Home > Comparison > Consumer Cyclical > IP vs SW

The strategic rivalry between International Paper Company and Smurfit Westrock Plc defines the current trajectory of the global packaging sector. International Paper operates as a US-based industrial packaging and cellulose fiber producer, while Smurfit Westrock, headquartered in Ireland, focuses on diversified paper-based packaging with a strong international footprint. This analysis examines their contrasting operational models to identify which offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

International Paper and Smurfit Westrock stand as key players shaping the global packaging landscape.

International Paper Company: Packaging Powerhouse Rooted in Innovation

International Paper dominates the packaging sector primarily in the US and globally with a core focus on Industrial Packaging and Global Cellulose Fibers. Its revenue engine hinges on manufacturing containerboards and specialty pulps used across hygiene, construction, and other industries. In 2026, it sharpens its strategic focus on expanding sustainable fiber products to meet rising eco-conscious demand.

Smurfit Westrock Plc: Diversified Packaging Leader with Global Reach

Smurfit Westrock commands a strong position in paper-based packaging, producing containerboard, corrugated containers, and diverse paper products. It serves key sectors like food, e-commerce, and retail, leveraging a broad product portfolio and integrated supply chain. The company’s 2026 strategy emphasizes innovation in recycled packaging and machinery to capture evolving market needs.

Strategic Collision: Similarities & Divergences

Both companies share a commitment to containerboard and paper-based packaging but diverge in their operational footprints—International Paper with a fiber-driven approach versus Smurfit’s diversified packaging solutions and machinery integration. Their primary battleground is sustainable packaging innovation amid growing environmental regulations. These distinctions create contrasting investment profiles: one rooted in raw material leadership, the other in product and service breadth.

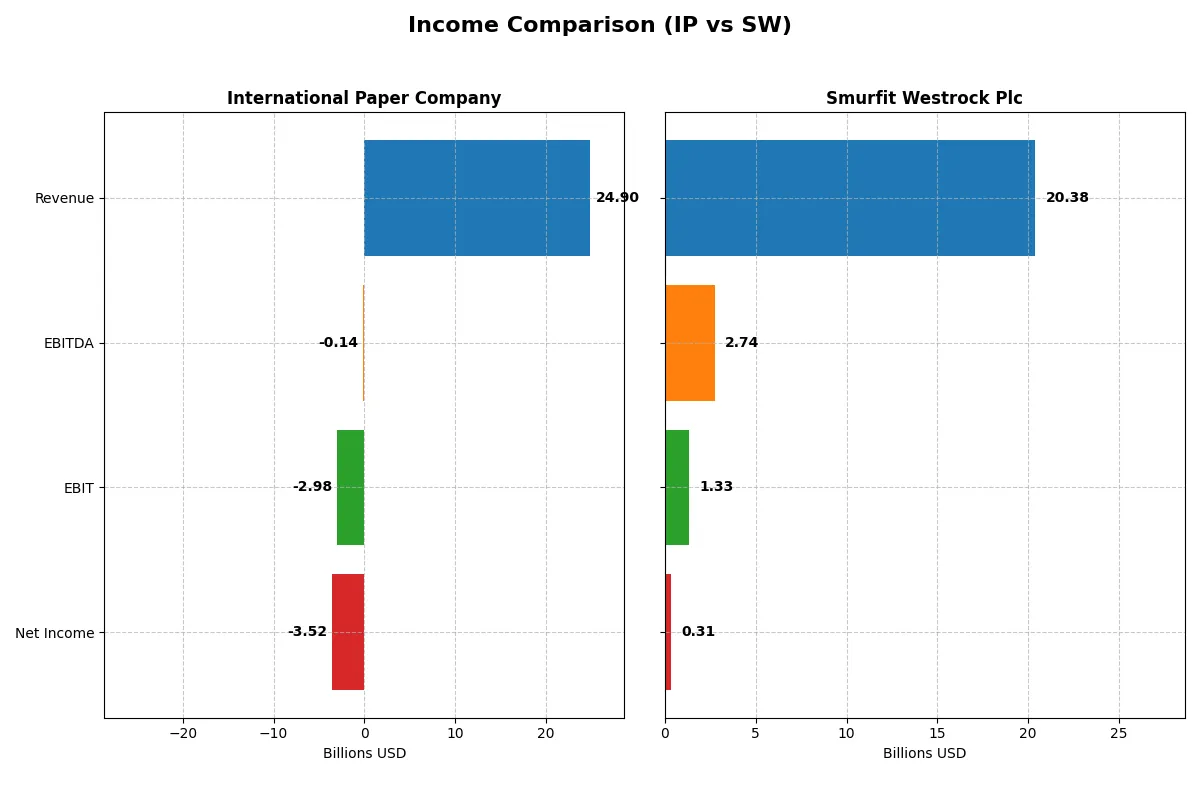

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | International Paper Company (IP) | Smurfit Westrock Plc (SW) |

|---|---|---|

| Revenue | 24.9B | 20.4B |

| Cost of Revenue | 17.5B | 16.3B |

| Operating Expenses | 10.2B | 3.1B |

| Gross Profit | 7.4B | 4.0B |

| EBITDA | -138M | 2.7B |

| EBIT | -3.0B | 1.3B |

| Interest Expense | 372M | 507M |

| Net Income | -3.5B | 308M |

| EPS | -6.71 | 0.80 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company converts its revenues into profit more efficiently and sustainably.

International Paper Company Analysis

International Paper’s revenue climbed 33.7% to 24.9B in 2025, yet it swung to a net loss of -3.5B from a 557M profit in 2024. Its gross margin remains strong at 29.5%, but the net margin fell sharply to -14.1%. Rising operating expenses and heavy other charges eroded operating income, signaling deteriorating efficiency and momentum.

Smurfit Westrock Plc Analysis

Smurfit Westrock doubled revenue to 20.4B in 2024, driven by an 86% surge. Gross margin holds at a moderate 19.9%, and EBIT margin improved slightly to 6.5%. Net income slipped to 308M from 747M in 2023, reflecting margin pressure despite top-line growth. Operating expenses grew in line with revenue, dampening profitability gains and momentum.

Revenue Growth vs. Margin Resilience

International Paper shows powerful revenue growth but deteriorating profitability with widening net losses, contrasting with Smurfit Westrock’s moderate margins and smaller net income declines. Smurfit’s steadier earnings and positive operating income mark it as the fundamental winner by operational efficiency. For investors, Smurfit represents a more resilient profit profile amid growth challenges.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | International Paper Company (IP) | Smurfit Westrock Plc (SW) |

|---|---|---|

| ROE | -23.7% (2025) | 1.8% (2024) |

| ROIC | -7.6% (2025) | 1.5% (2024) |

| P/E | -5.9 (2025) | 67.5 (2024) |

| P/B | 1.40 (2025) | 1.20 (2024) |

| Current Ratio | 1.28 (2025) | 1.37 (2024) |

| Quick Ratio | 1.02 (2025) | 0.89 (2024) |

| D/E | 0.70 (2025) | 0.78 (2024) |

| Debt-to-Assets | 27.2% (2025) | 31.1% (2024) |

| Interest Coverage | -7.6 (2025) | 1.9 (2024) |

| Asset Turnover | 0.66 (2025) | 0.47 (2024) |

| Fixed Asset Turnover | 1.64 (2025) | 0.90 (2024) |

| Payout ratio | -27.8% (2025) | 211.1% (2024) |

| Dividend yield | 4.70% (2025) | 3.13% (2024) |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios serve as a company’s financial DNA, uncovering hidden risks and measuring operational excellence in clear, quantifiable terms.

International Paper Company

International Paper reveals weak profitability with a negative ROE of -23.7% and net margin at -14.1%. Despite this, valuation metrics show a modest price-to-book of 1.4 and a favorable P/E ratio. The company rewards shareholders with a solid 4.7% dividend yield, signaling steady income rather than growth reinvestment.

Smurfit Westrock Plc

Smurfit Westrock posts low profitability with ROE at 1.8% and a slim net margin of 1.5%. The stock appears stretched with an elevated P/E of 67.5, indicating high expectations. Dividend yield stands at 3.1%, reflecting moderate shareholder returns amid restrained operational efficiency.

Premium Valuation vs. Operational Safety

International Paper balances a conservative valuation and a strong dividend against weak profitability, offering relative operational safety. Smurfit Westrock’s high valuation and low returns imply greater risk. Investors favoring income and stability may lean toward International Paper, while growth seekers might find Smurfit Westrock’s profile challenging.

Which one offers the Superior Shareholder Reward?

I compare International Paper Company (IP) and Smurfit Westrock Plc (SW) on dividends, payout ratios, and buybacks to judge total shareholder reward in 2026. IP yields 4.7% with a negative free cash flow coverage, signaling risk in dividend sustainability. SW pays a 3.1% yield but covers dividends better, supported by positive free cash flow and moderate payout ratios. IP’s dividend payout shows volatility and negative margins recently, undermining reliability. Both companies conduct share buybacks; however, IP’s weaker cash flow pressures its buyback program. SW’s consistent operating cash flow and prudent capital allocation support a more sustainable distribution policy. I favor Smurfit Westrock for superior long-term total return due to its balanced dividend and buyback strategy aligned with cash generation.

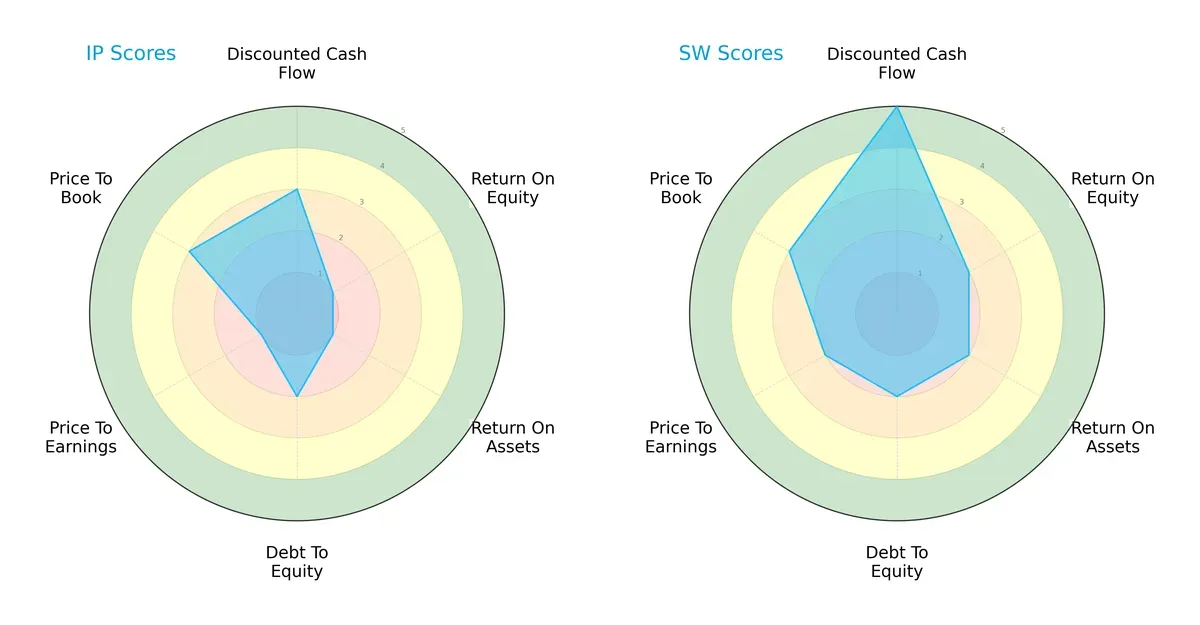

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and key trade-offs of International Paper Company and Smurfit Westrock Plc:

Smurfit Westrock leads with a more balanced profile, scoring very favorably on discounted cash flow (5) and moderately on ROE (2) and ROA (2). International Paper depends heavily on valuation metrics, showing moderate DCF (3) but very unfavorable returns on equity (1) and assets (1). Both show moderate debt management (2), yet IP’s low returns undermine its overall position. Smurfit Westrock clearly manages profitability and valuation better in this cycle.

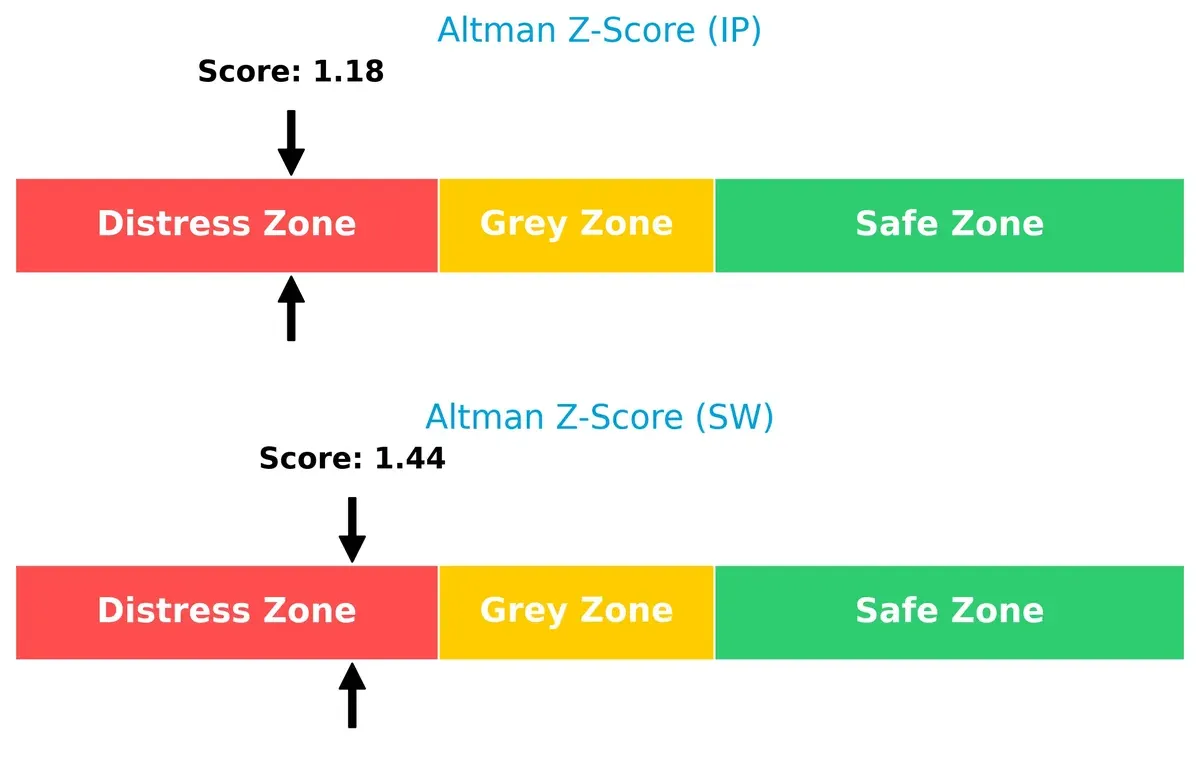

Bankruptcy Risk: Solvency Showdown

Both firms reside in the distress zone with Altman Z-Scores of 1.18 (IP) and 1.44 (SW), indicating elevated bankruptcy risk amid current market pressures:

Financial Health: Quality of Operations

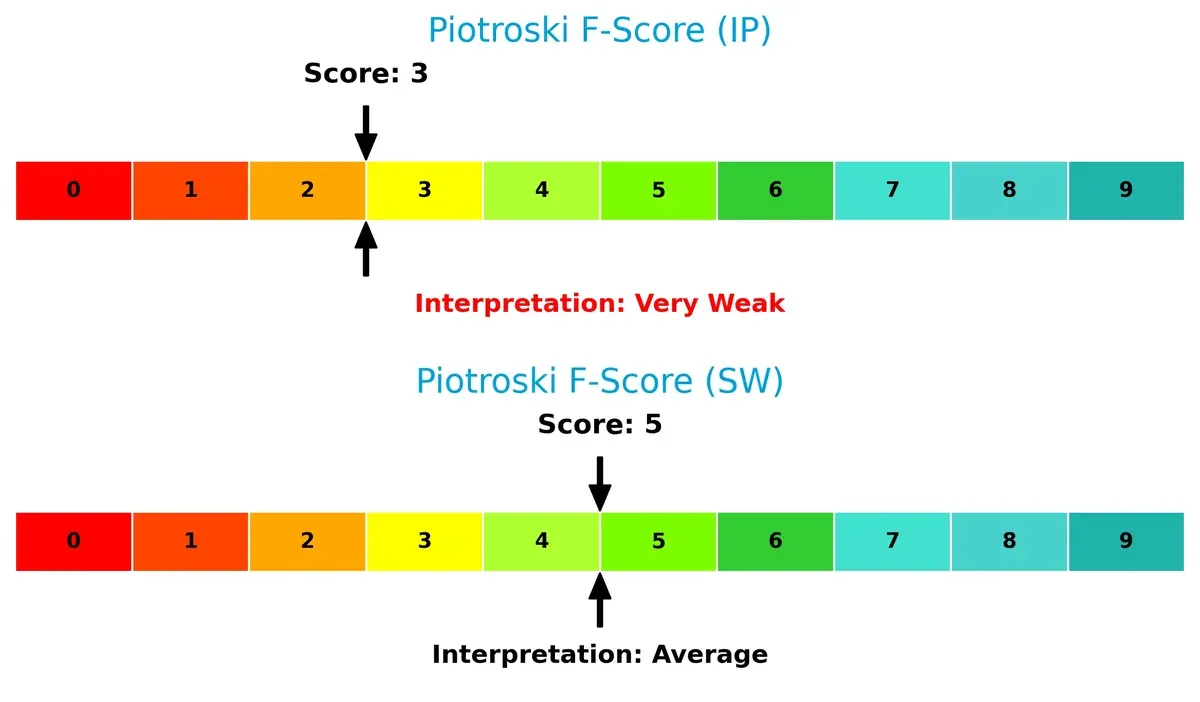

Piotroski F-Scores show Smurfit Westrock at 5 (average), outperforming International Paper’s 3, which signals very weak financial health and internal red flags:

How are the two companies positioned?

This section dissects the operational DNA of IP and SW by comparing their revenue distribution by segment and internal strengths and weaknesses. The goal is to confront their economic moats and identify which business model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

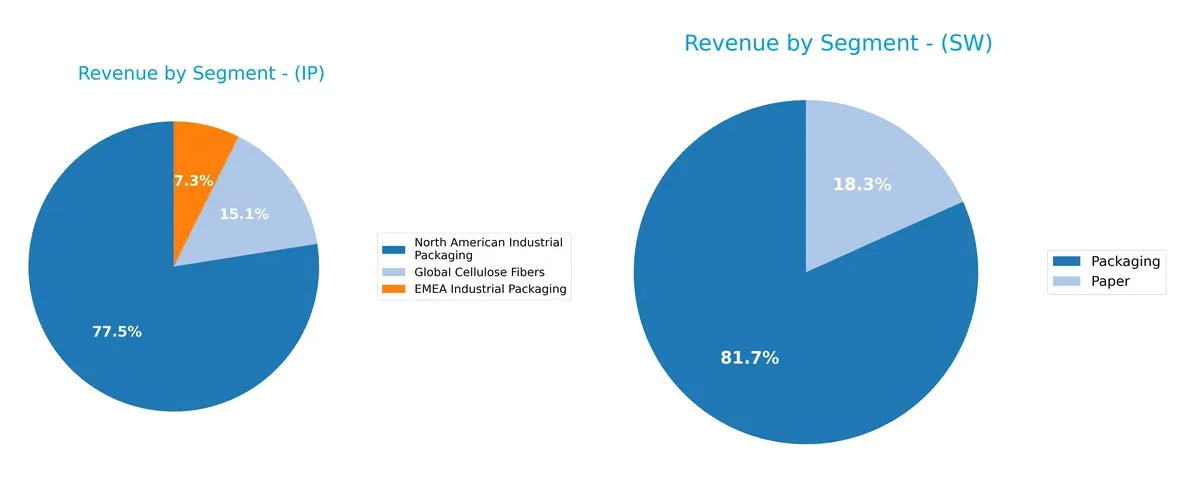

This visual comparison dissects how International Paper Company and Smurfit Westrock Plc diversify their income streams and where their primary sector bets lie:

International Paper pivots around North American Industrial Packaging with $14.3B, anchoring its revenue, complemented by $2.8B in Global Cellulose Fibers and $1.4B in EMEA Industrial Packaging. Smurfit Westrock shows a more balanced split with €17.3B in Packaging and €3.9B in Paper. IP’s concentration in industrial packaging signals strong infrastructure dominance but higher concentration risk. SW’s diversified mix reduces reliance on one segment, supporting resilience amid sector cycles.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of International Paper Company and Smurfit Westrock Plc:

International Paper Company Strengths

- Diverse product lines including cellulose fibers and industrial packaging

- Strong US market presence with $16.3B revenue

- Favorable debt to assets ratio at 27.18%

- Solid dividend yield of 4.7%

- Favorable WACC below ROIC, indicating cost-effective capital

Smurfit Westrock Plc Strengths

- Large packaging and paper segments with €17.3B and €3.9B revenue

- Balanced geographic exposure including US and Europe

- Favorable WACC supporting capital efficiency

- Favorable price-to-book at 1.2

- Dividend yield of 3.13% supports shareholder returns

International Paper Company Weaknesses

- Negative profitability metrics with net margin -14.12% and ROE -23.71%

- Negative interest coverage at -8.01 signals financial stress

- Neutral liquidity ratios may restrict flexibility

- Heavy reliance on US market limits global diversification

- PE ratio negative but marked favorable due to valuation context

Smurfit Westrock Plc Weaknesses

- Low profitability with net margin 1.51% and ROE 1.77%

- High PE ratio of 67.52 may indicate overvaluation risk

- Asset turnover ratios unfavorable, suggesting operational inefficiency

- Neutral debt to assets at 31.07% indicates moderate leverage

- Quick ratio below 1 signals weaker short-term liquidity

Both companies exhibit strengths in capital structure and dividend policy but face profitability challenges. IP’s strong US focus contrasts with SW’s broader geographic diversification, impacting their strategic flexibility differently.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole shield protecting long-term profits from relentless competition erosion. Let’s break down the moat strengths of these packaging giants:

International Paper Company: Scale and Intangible Asset Moat

International Paper’s moat stems from massive scale and established brand intangible assets that stabilize margins despite cyclical pressures. However, declining ROIC signals weakening capital efficiency in 2026, risking moat erosion.

Smurfit Westrock Plc: Diversified Product Range and Geographic Footprint

Smurfit Westrock’s competitive edge lies in its diverse product portfolio and broad geographic reach, contrasting IP’s U.S.-centric focus. Its margin stability and growth potential in emerging markets suggest a resilient but challenged moat.

Scale Dominance vs. Diversification Resilience

Both firms face declining ROIC, signaling value destruction. Yet, International Paper’s scale creates a wider moat, while Smurfit’s diversification offers depth. IP remains better positioned to defend market share despite headwinds.

Which stock offers better returns?

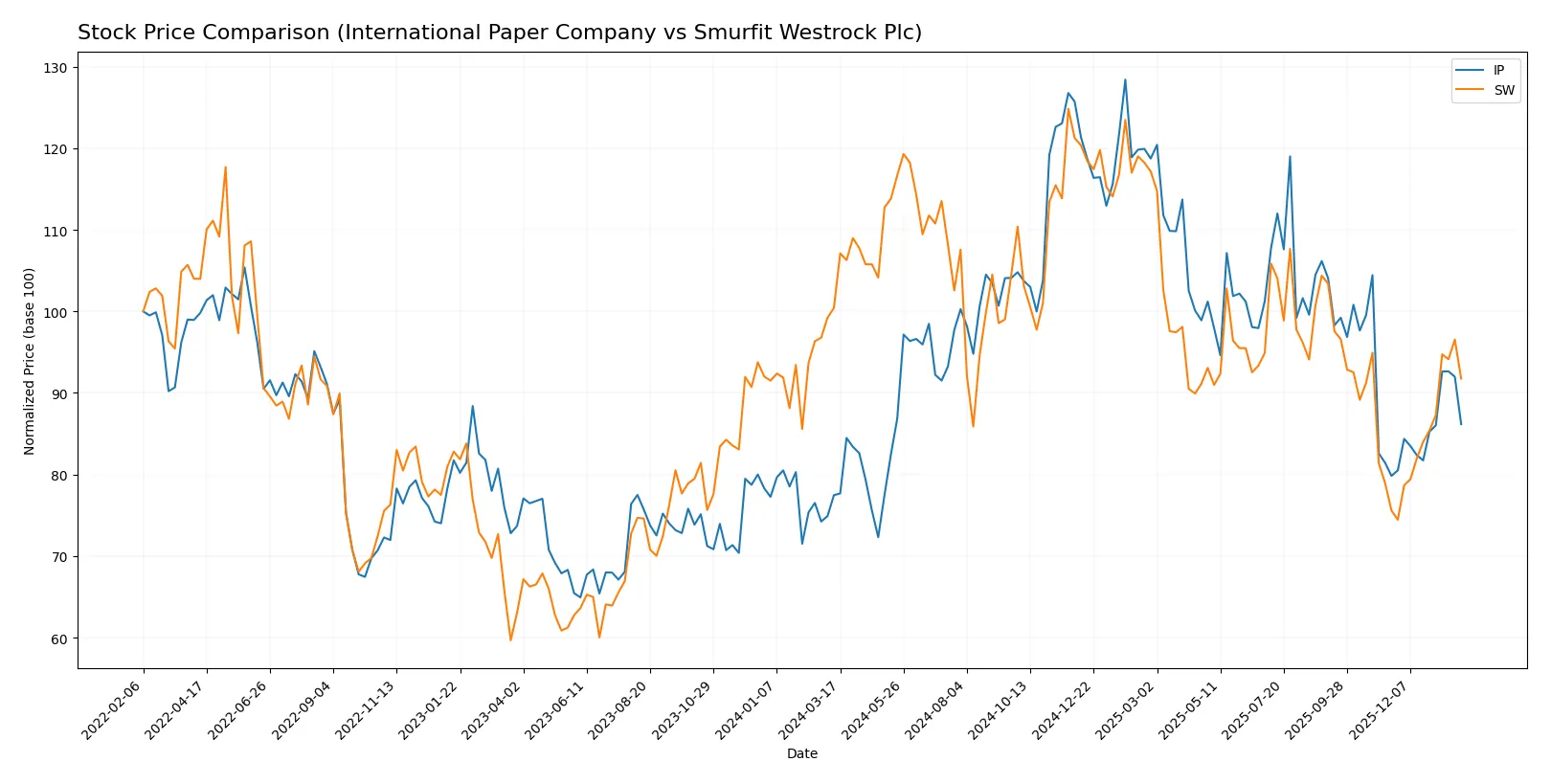

The chart captures key price movements and contrasting trading dynamics of International Paper Company and Smurfit Westrock Plc over the past year.

Trend Comparison

International Paper Company’s stock rose 11.26% over the past 12 months, showing a bullish trend with accelerating momentum. It hit a high of 60.09 and a low of 33.83, reflecting notable price swings.

Smurfit Westrock Plc’s stock declined 8.63% in the same period, marking a bearish trend despite accelerating movement. Its price ranged between 56.64 at peak and 33.78 at trough, indicating significant volatility.

Comparing both, International Paper Company delivered higher market performance with positive price growth, while Smurfit Westrock Plc lagged behind with a negative return.

Target Prices

Analysts provide a cautiously optimistic target consensus for both International Paper Company and Smurfit Westrock Plc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| International Paper Company | 40 | 57.8 | 49.47 |

| Smurfit Westrock Plc | 45 | 60 | 51 |

Targets for International Paper suggest a 23% upside from the current price of 40.32, while Smurfit Westrock shows a similar upside potential from 41.63 to a 51 consensus.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for International Paper Company and Smurfit Westrock Plc:

International Paper Company Grades

The latest grades from major financial institutions for International Paper Company are:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Upgrade | Equal Weight | 2026-01-30 |

| RBC Capital | Maintain | Outperform | 2026-01-30 |

| UBS | Maintain | Buy | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-06 |

| Argus Research | Maintain | Buy | 2025-12-22 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| Citigroup | Maintain | Buy | 2025-11-03 |

Smurfit Westrock Plc Grades

Recent institutional grades for Smurfit Westrock Plc are as follows:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-06 |

| Wells Fargo | Maintain | Overweight | 2026-01-06 |

| Truist Securities | Maintain | Buy | 2026-01-06 |

| Argus Research | Maintain | Buy | 2025-12-09 |

| Barclays | Maintain | Overweight | 2025-11-10 |

| RBC Capital | Maintain | Outperform | 2025-10-30 |

| Truist Securities | Maintain | Buy | 2025-10-30 |

| Wells Fargo | Maintain | Overweight | 2025-10-30 |

Which company has the best grades?

Smurfit Westrock Plc generally holds stronger grades, consistently rated as Buy or Overweight. International Paper shows a mix of Buy and Neutral ratings with fewer upgrades. This difference may influence investor confidence and portfolio allocation decisions.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing International Paper Company and Smurfit Westrock Plc in the 2026 market environment:

1. Market & Competition

International Paper Company

- Faces intense competition in global packaging with negative net margin signaling pricing pressure.

Smurfit Westrock Plc

- Competes globally but maintains positive net margin, indicating better market positioning amid competition.

2. Capital Structure & Debt

International Paper Company

- Moderate debt-to-equity ratio (0.7) with unfavorable interest coverage (-8.01), raising solvency concerns.

Smurfit Westrock Plc

- Slightly higher debt-to-equity (0.78) but positive interest coverage (2.62), suggesting better debt servicing capacity.

3. Stock Volatility

International Paper Company

- Beta 1.06 implies slightly higher volatility than the market, risking larger swings.

Smurfit Westrock Plc

- Beta 0.988 suggests volatility close to market average, offering relatively stable price movements.

4. Regulatory & Legal

International Paper Company

- Exposed to U.S. and international packaging regulations given diverse operations.

Smurfit Westrock Plc

- Faces EU and international regulatory regimes, with recent IPO adding scrutiny risks.

5. Supply Chain & Operations

International Paper Company

- Global footprint risks supply disruptions; asset turnover at 0.66 indicates moderate efficiency.

Smurfit Westrock Plc

- Larger workforce and lower asset turnover (0.47) signal operational inefficiencies amid supply chain complexity.

6. ESG & Climate Transition

International Paper Company

- Industry pressure to innovate sustainable packaging; negative ROIC (-7.64%) may limit ESG investments.

Smurfit Westrock Plc

- Moderate ROIC (1.48%) allows some ESG initiatives but below sector leaders, posing transition risks.

7. Geopolitical Exposure

International Paper Company

- Operations span volatile regions (Middle East, Asia), increasing geopolitical risks.

Smurfit Westrock Plc

- Primarily Europe-based with international reach, facing Brexit and EU regulatory uncertainties.

Which company shows a better risk-adjusted profile?

International Paper’s most impactful risk is its negative profitability and weak interest coverage, signaling financial distress. Smurfit Westrock’s key risk lies in operational inefficiencies and elevated valuation multiples. Despite distress-zone Altman Z-scores for both, Smurfit Westrock’s moderate Piotroski score and better debt coverage indicate a comparatively stronger risk-adjusted profile. The stark contrast in interest coverage and recent IPO-related volatility underscore my caution with International Paper.

Final Verdict: Which stock to choose?

International Paper Company’s superpower lies in its resilient operating scale and dividend yield, appealing to income-focused investors. Its point of vigilance is the ongoing value destruction indicated by declining returns on invested capital. IP suits portfolios seeking steady income with moderate risk tolerance.

Smurfit Westrock Plc commands a strategic moat through its significant invested capital and recent revenue growth acceleration. While its profitability metrics remain challenged, it offers better stability in interest coverage than IP. SW fits well with GARP portfolios aiming for growth tempered by cautious valuation.

If you prioritize income generation and dividend stability, International Paper is the compelling choice due to its solid market presence and shareholder returns. However, if you seek growth with a more favorable interest coverage profile, Smurfit Westrock offers better stability despite its valuation premium. Both carry risks linked to declining profitability, demanding careful risk management.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of International Paper Company and Smurfit Westrock Plc to enhance your investment decisions: