Home > Comparison > Consumer Cyclical > IP vs PKG

The strategic rivalry between International Paper Company and Packaging Corporation of America defines the current trajectory of the packaging sector. International Paper operates as a capital-intensive industrial giant with a global footprint, while Packaging Corporation of America focuses on high-margin containerboard and corrugated packaging in the U.S. This analysis explores their contrasting growth and operational models to determine which offers superior risk-adjusted returns for a diversified portfolio in 2026.

Table of contents

Companies Overview

International Paper Company and Packaging Corporation of America stand as key players in the packaging industry, shaping supply chains across North America and beyond.

International Paper Company: Global Packaging & Cellulose Leader

International Paper dominates as a global packaging company with a broad industrial footprint. It generates revenue by manufacturing containerboards and cellulose fibers used in hygiene products and specialty applications. In 2026, its strategy focuses on optimizing its Industrial Packaging and Global Cellulose Fibers segments to enhance operational efficiency amid evolving market demands.

Packaging Corporation of America: U.S. Corrugated Packaging Specialist

Packaging Corporation of America excels as a U.S.-focused manufacturer of containerboard and corrugated packaging products. Its revenue stems mainly from shipping containers and retail packaging solutions. The company’s 2026 strategy emphasizes strengthening its Packaging and Paper segments through direct sales and marketing, catering to diverse industrial and consumer product packaging needs.

Strategic Collision: Similarities & Divergences

Both companies operate in packaging but diverge in geographic scope and product focus. International Paper pursues a global, diversified approach, while Packaging Corporation of America concentrates on the U.S. market with corrugated products. Their primary battleground is containerboard production and distribution. Investors face distinct profiles: International Paper offers scale and product breadth, whereas Packaging Corporation of America provides focused U.S. market exposure and specialized packaging solutions.

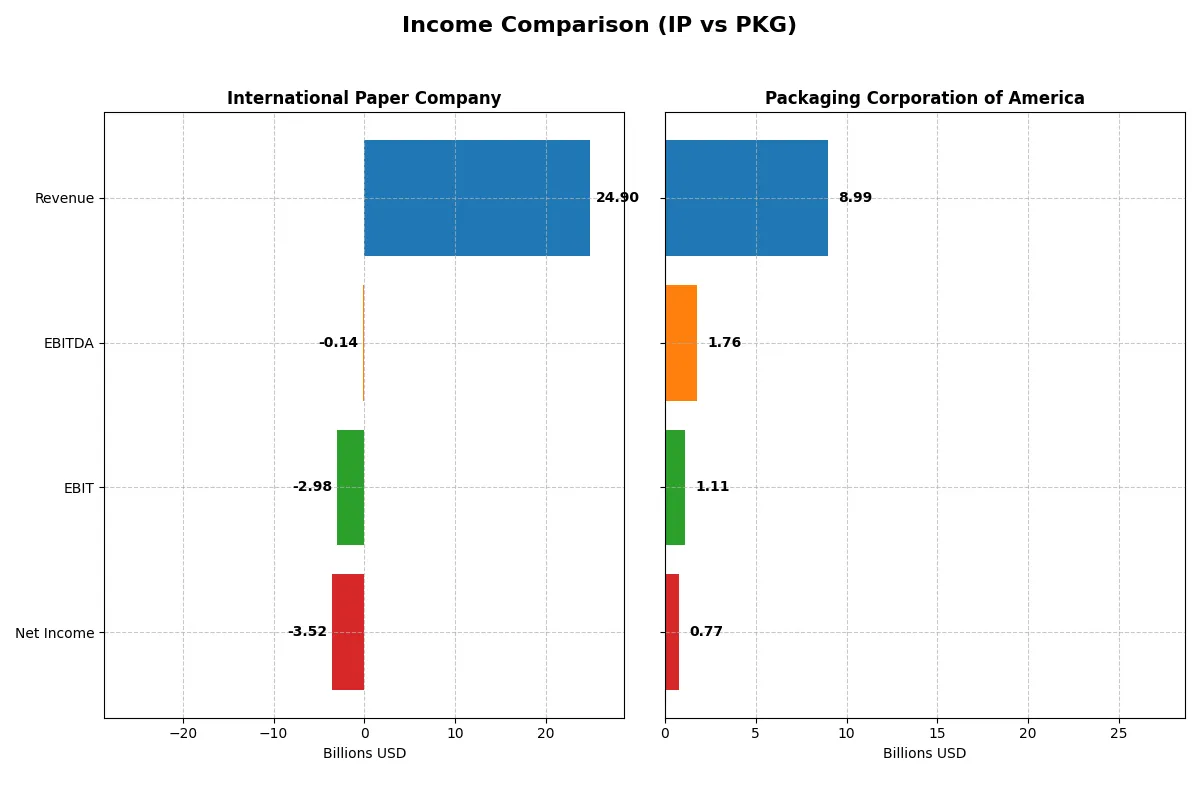

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | International Paper Company (IP) | Packaging Corporation of America (PKG) |

|---|---|---|

| Revenue | 24.9B | 8.99B |

| Cost of Revenue | 17.5B | 7.10B |

| Operating Expenses | 10.2B | 634M |

| Gross Profit | 7.35B | 1.89B |

| EBITDA | -138M | 1.76B |

| EBIT | -2.98B | 1.11B |

| Interest Expense | 372M | 79.1M |

| Net Income | -3.52B | 769M |

| EPS | -6.71 | 8.61 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability of each company’s core operations over recent years.

International Paper Company Analysis

International Paper’s revenue climbed sharply by 33.7% in 2025, reaching $24.9B, showing robust top-line momentum. However, the company swung to a net loss of $3.5B, reflecting operational inefficiencies and an unfavorable EBIT margin of -12%. Despite a strong gross margin near 30%, rising operating expenses eroded bottom-line profitability sharply in the latest year.

Packaging Corporation of America Analysis

Packaging Corp’s revenue grew modestly by 7.2% to $9B in 2025, with consistent gross margins around 21%. It sustained positive net income of $769M and an EBIT margin of 12.3%, indicating efficient cost control. While net margin dipped slightly, the company maintained overall profitability and stable operating leverage throughout the period.

Efficiency vs. Scale: Profitability in Focus

International Paper scales far larger, yet struggles with profitability, posting negative net margins and large net losses in 2025. Packaging Corp delivers smaller revenue but higher and stable profitability, with solid margins and positive net income. For investors, Packaging’s consistent earnings and margin discipline present a cleaner profit profile compared to International Paper’s challenging cost structure and volatility.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | International Paper Company (IP) | Packaging Corporation of America (PKG) |

|---|---|---|

| ROE | -23.7% (2025) | – (data unavailable) |

| ROIC | -7.6% (2025) | – (data unavailable) |

| P/E | -5.92 (2025) | 30.64 (2025) |

| P/B | 1.40 (2025) | – (data unavailable) |

| Current Ratio | 1.28 (2025) | 0 (2025) |

| Quick Ratio | 1.02 (2025) | 0 (2025) |

| D/E | 0.70 (2025) | 0 (2025) |

| Debt-to-Assets | 27.2% (2025) | 0 (2025) |

| Interest Coverage | -7.58 (2025) | 15.87 (2025) |

| Asset Turnover | 0.66 (2025) | 0 (2025) |

| Fixed Asset Turnover | 1.64 (2025) | 0 (2025) |

| Payout ratio | -27.8% (2025) | 74.3% (2025) |

| Dividend yield | 4.70% (2025) | 2.42% (2025) |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as the company’s DNA, revealing hidden risks and operational excellence that numbers alone fail to capture.

International Paper Company

International Paper registers deeply negative profitability with ROE at -23.7% and net margin at -14.1%, signaling operational distress. Valuation appears attractive with a P/E of -5.92 and a P/B of 1.4, suggesting market undervaluation. A 4.7% dividend yield provides steady shareholder returns amid weak reinvestment indicated by zero R&D spending.

Packaging Corporation of America

Packaging Corporation shows modest net margin at 8.5% but zero reported ROE and ROIC, raising questions on profitability quality. Its valuation is stretched with a P/E of 30.64, reflecting high market expectations. The company pays a 2.42% dividend yield, balancing moderate returns with limited reinvestment insight due to missing R&D data.

Valuation Appeal vs. Profitability Stability

International Paper offers a more favorable valuation with attractive dividends despite poor profitability. Packaging Corporation trades at a premium but lacks clear operational efficiency. Value-seeking investors may prefer International Paper’s pricing; growth-focused investors might lean toward Packaging’s stability profile.

Which one offers the Superior Shareholder Reward?

I compare International Paper Company (IP) and Packaging Corporation of America (PKG) on dividends and buybacks. IP yields 4.7% in 2025 but shows negative free cash flow (-0.3/share), raising sustainability concerns. Its payout ratio is negative due to losses in 2025, signaling risk. PKG pays a lower 2.4% yield but supports it with stronger free cash flow and a moderate 74% payout ratio, indicating more sustainable dividends. PKG’s robust operating margins and consistent buyback programs drive total returns. I conclude PKG offers a superior and more sustainable shareholder reward in 2026.

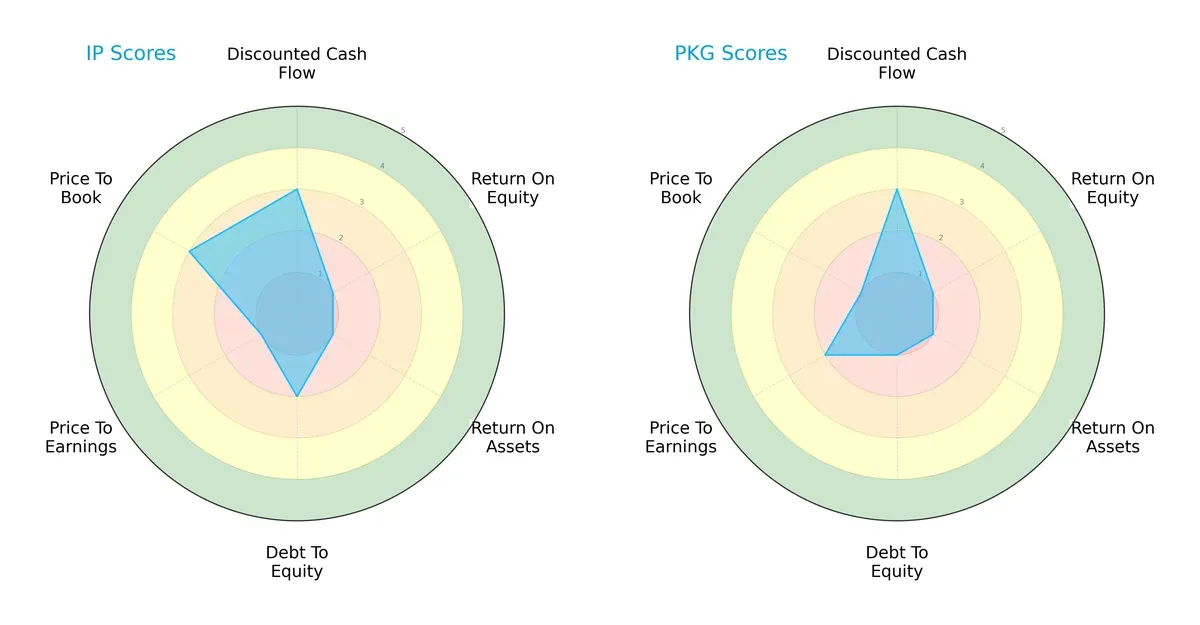

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of International Paper Company and Packaging Corporation of America:

International Paper shows a more balanced profile with moderate DCF (3) and debt-to-equity (2) scores, while Packaging Corporation relies heavily on a moderate DCF (3) but suffers from weak financial stability with very unfavorable debt-to-equity (1) and valuation scores. Both companies struggle with return on equity (1) and return on assets (1), but International Paper holds a stronger valuation edge with a price-to-book score of 3 versus Packaging’s 1.

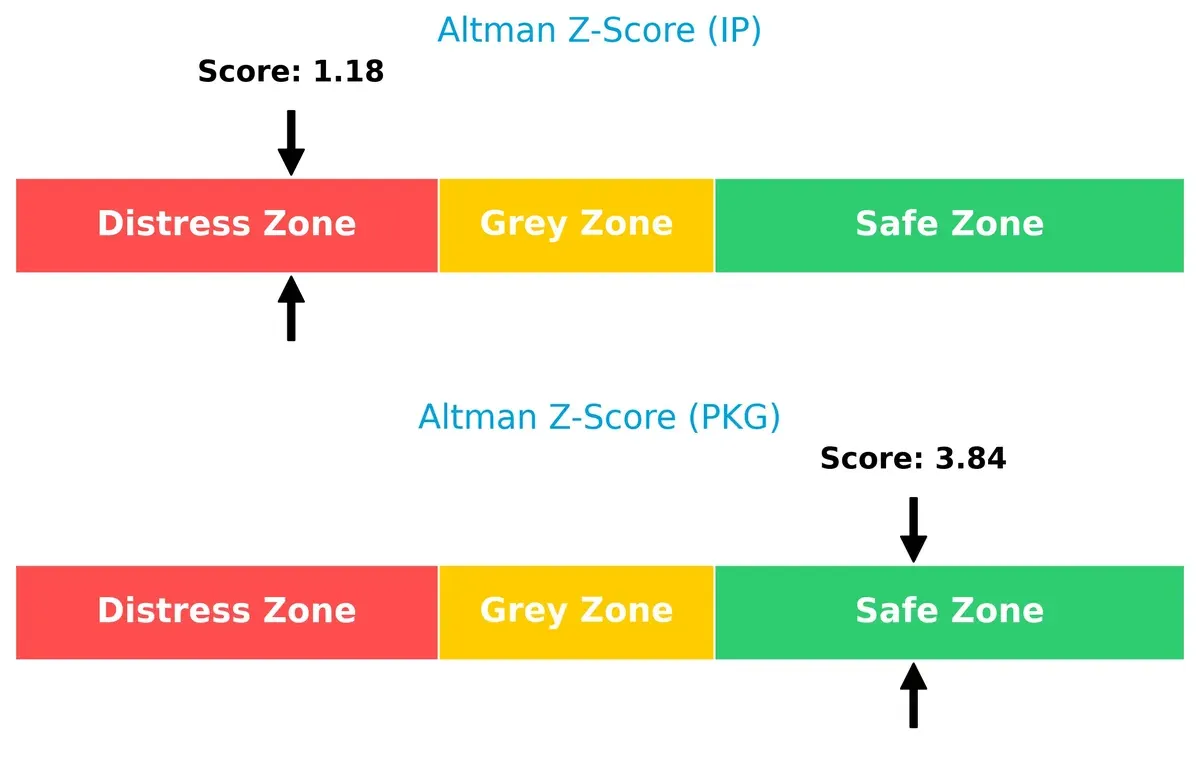

Bankruptcy Risk: Solvency Showdown

Packaging Corporation’s Altman Z-Score of 3.84 places it safely above distress, while International Paper’s 1.18 signals serious financial distress:

This stark contrast implies Packaging Corporation is well-positioned to endure long-term market pressures, whereas International Paper faces elevated bankruptcy risk in this cycle.

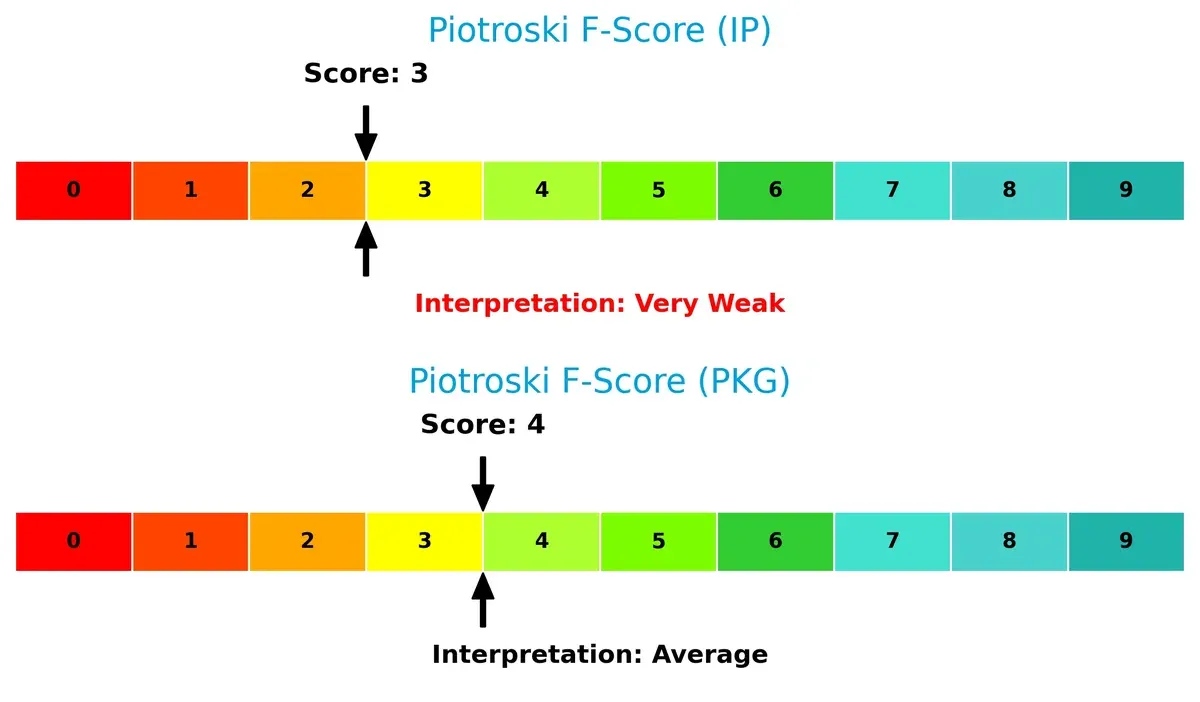

Financial Health: Quality of Operations

Packaging Corporation’s Piotroski F-Score of 4 slightly surpasses International Paper’s 3, indicating marginally better financial health:

Neither firm achieves strong operational quality, but International Paper’s very weak score raises red flags about its internal financial metrics compared to Packaging Corporation’s average standing.

How are the two companies positioned?

This section dissects IP and PKG’s operational DNA by comparing revenue distribution and internal dynamics. The objective is to confront their economic moats to reveal which model offers a more resilient, sustainable competitive advantage today.

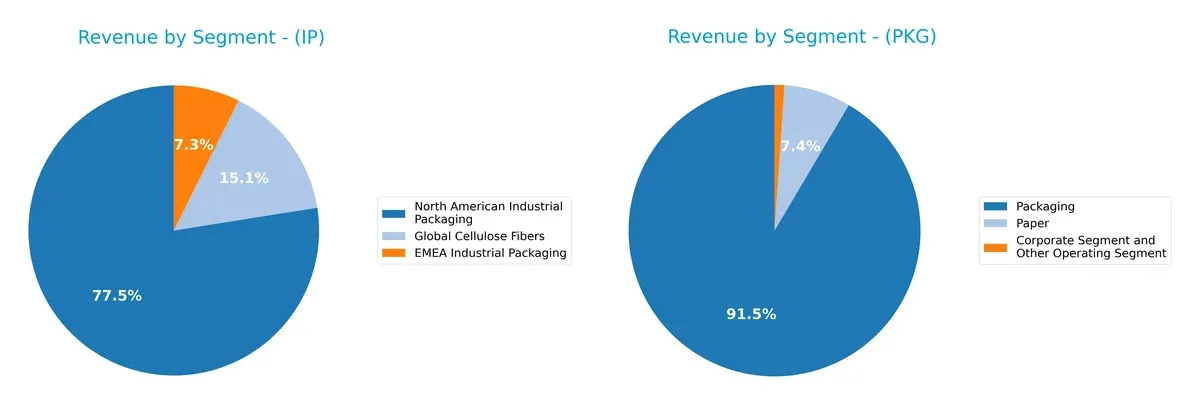

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how International Paper Company and Packaging Corporation of America diversify their income streams and where their primary sector bets lie:

International Paper anchors its revenue in North American Industrial Packaging with $14.3B, supplemented by $2.8B in Global Cellulose Fibers and $1.35B in EMEA Industrial Packaging. Packaging Corporation of America pivots on a single dominant Packaging segment at $7.7B, with a smaller $625M Paper segment. IP’s broader mix reduces concentration risk, while PKG’s heavy Packaging reliance exposes it to sector-specific cycles but may benefit from focused operational efficiencies.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of International Paper Company (IP) and Packaging Corporation of America (PKG):

IP Strengths

- Diversified revenue streams with Global Cellulose Fibers and Industrial Packaging

- Favorable WACC at 7.12% supports cost of capital

- Solid dividend yield of 4.7%

- Positive debt to assets ratio at 27.18% indicates controlled leverage

- Favorable price-to-book ratio at 1.4

- Quick ratio above 1.0 shows liquidity

PKG Strengths

- Favorable interest coverage of 13.99 indicates strong ability to service debt

- Favorable debt-to-equity and debt-to-assets ratios suggest low leverage

- Favorable price-to-book ratio supports valuation

- Positive dividend yield of 2.42%

- Neutral net margin at 8.55% reflects stable profitability

IP Weaknesses

- Negative net margin (-14.12%) signals operational losses

- Negative ROE (-23.71%) and ROIC (-7.64%) indicate poor capital returns

- Negative interest coverage (-8.01) shows difficulty covering interest expenses

- Neutral current ratio at 1.28 may indicate tight working capital

- Relatively low asset turnover at 0.66 may limit efficiency

PKG Weaknesses

- Unavailable WACC complicates cost of capital assessment

- Unfavorable ROE and ROIC at 0% indicate lack of profitability

- Unfavorable current and quick ratios at 0 show liquidity concerns

- Unfavorable price-to-earnings ratio at 30.64 suggests overvaluation

- Unfavorable asset and fixed asset turnover may limit operational efficiency

Overall, IP demonstrates strengths in diversification and controlled leverage but suffers from weak profitability and cash flow challenges. PKG shows financial conservatism and stable dividends but faces liquidity and capital return weaknesses. These differences highlight contrasting strategic and operational profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion:

International Paper Company: Cost Advantage with Scale and Diversification

International Paper leverages its vast scale and diversified product lines to sustain a cost advantage. Despite recent margin pressure and declining ROIC, new cellulose fiber innovations could bolster margin stability in 2026.

Packaging Corporation of America: Focused Efficiency and Market Niche

Packaging Corporation’s moat centers on operational efficiency and specialized containerboard products. Its consistent EBIT margin and stable revenue growth signal a resilient competitive position, with potential for niche expansion disrupting broader packaging markets.

Cost Leadership vs. Niche Efficiency in Packaging

International Paper’s broad scale grants a deeper moat but shrinking ROIC signals vulnerability. Packaging Corporation’s focused efficiency offers a narrower yet steadier moat. I see Packaging Corporation better equipped to defend market share amid industry headwinds.

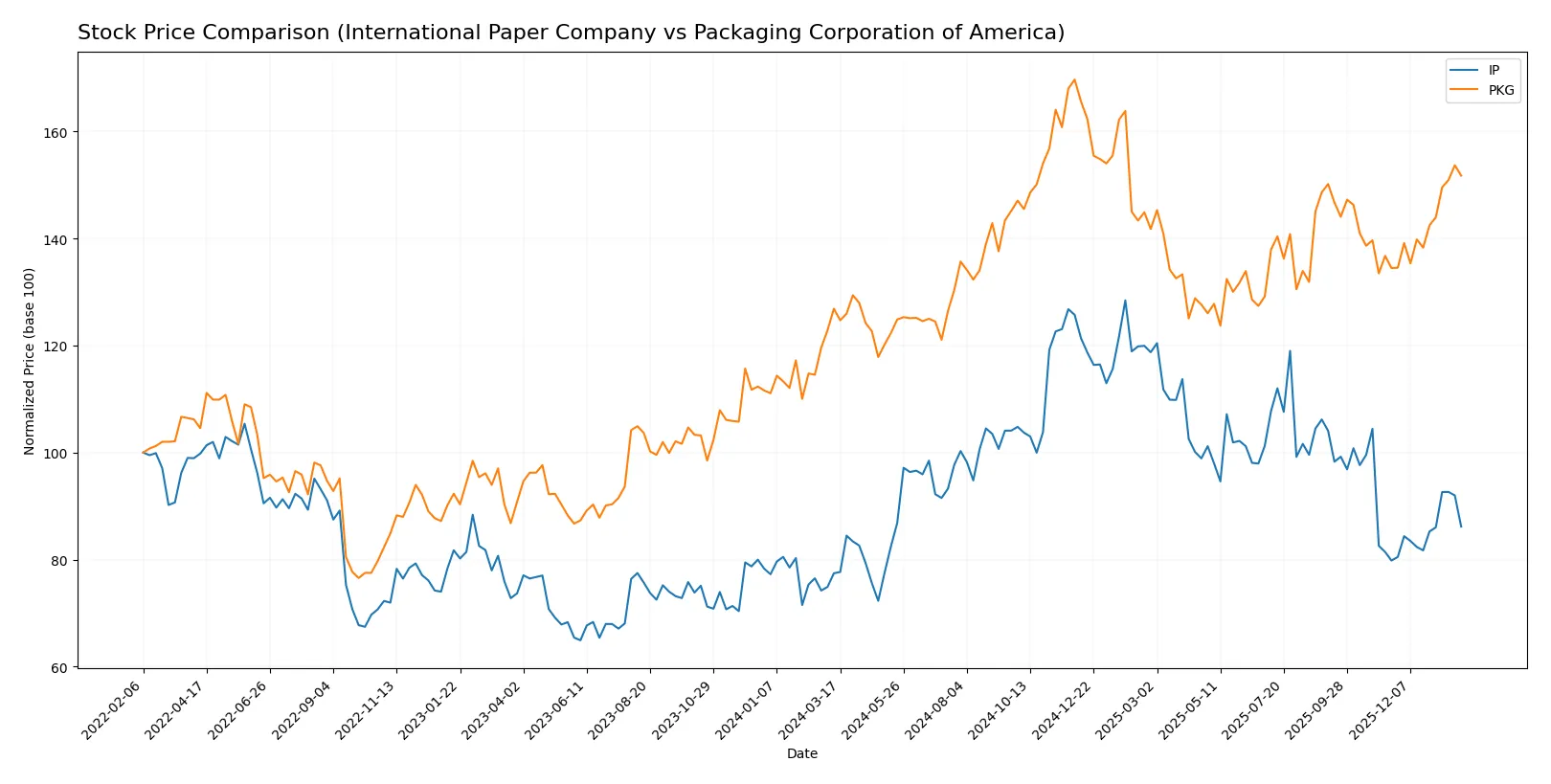

Which stock offers better returns?

Stock prices of International Paper Company and Packaging Corporation of America show distinct bullish trends over the past year, with notable acceleration and differing volatility profiles.

Trend Comparison

International Paper Company’s stock rose 11.26% over the past 12 months, reflecting a bullish trend with accelerating momentum. The price ranged from $33.83 to $60.09, with moderate volatility at 6.18%.

Packaging Corporation of America gained 19.6% over the same period, also bullish with acceleration. It showed higher volatility at 17.79%, trading between $172.85 and $248.85, indicating more pronounced price swings.

Packaging Corporation of America outperformed International Paper Company by delivering a higher total return with increased price appreciation despite greater volatility.

Target Prices

Analysts present a cautiously optimistic consensus for International Paper Company and Packaging Corporation of America.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| International Paper Company | 40.0 | 57.8 | 49.47 |

| Packaging Corporation of America | 233 | 270 | 246 |

The consensus target for International Paper sits about 23% above its current 40.32 price, signaling moderate upside. Packaging Corporation’s consensus target exceeds its 222.55 price by roughly 11%, reflecting steady growth expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the latest institutional grades for International Paper Company and Packaging Corporation of America:

International Paper Company Grades

This table summarizes recent grades assigned by established grading companies to International Paper Company.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Upgrade | Equal Weight | 2026-01-30 |

| RBC Capital | Maintain | Outperform | 2026-01-30 |

| UBS | Maintain | Buy | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-06 |

| Argus Research | Maintain | Buy | 2025-12-22 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| Citigroup | Maintain | Buy | 2025-11-03 |

Packaging Corporation of America Grades

This table details recent grades issued by reputable grading firms for Packaging Corporation of America.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-29 |

| Truist Securities | Maintain | Buy | 2026-01-29 |

| Citigroup | Maintain | Neutral | 2026-01-29 |

| UBS | Maintain | Neutral | 2026-01-12 |

| JP Morgan | Maintain | Overweight | 2025-12-05 |

Which company has the best grades?

International Paper Company holds multiple Buy and Outperform ratings, showing consistent institutional confidence. Packaging Corporation of America mostly receives Overweight and Buy grades but also several Neutral ratings. Investors may view IP’s stronger consensus as a signal of higher analyst conviction.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

International Paper Company

- Faces negative net margin and ROIC, signaling competitive challenges and margin pressure.

Packaging Corporation of America

- Maintains positive net margin but zero ROE and ROIC, indicating limited profitability improvement.

2. Capital Structure & Debt

International Paper Company

- Moderate debt-to-equity ratio at 0.7, with unfavorable interest coverage signaling refinancing risks.

Packaging Corporation of America

- Shows no reported debt, suggesting a strong balance sheet and lower financial risk.

3. Stock Volatility

International Paper Company

- Beta of 1.06 indicates volatility slightly above market average.

Packaging Corporation of America

- Beta of 0.894 implies lower volatility and relative stability versus market benchmarks.

4. Regulatory & Legal

International Paper Company

- Operates globally, exposing it to complex regulatory environments and trade policies.

Packaging Corporation of America

- Primarily US-focused, reducing exposure to international regulatory uncertainties.

5. Supply Chain & Operations

International Paper Company

- Global operations increase supply chain complexity and risk amid geopolitical tensions.

Packaging Corporation of America

- More concentrated US operations reduce supply chain risks but limit geographic diversification.

6. ESG & Climate Transition

International Paper Company

- Large workforce and global footprint may challenge rapid ESG adaptations.

Packaging Corporation of America

- Smaller scale and US focus may facilitate quicker climate transition initiatives.

7. Geopolitical Exposure

International Paper Company

- Exposure to Middle East, Europe, Asia, increasing vulnerability to geopolitical shocks.

Packaging Corporation of America

- US-centric operations limit direct geopolitical risks but may face domestic policy changes.

Which company shows a better risk-adjusted profile?

Packaging Corporation of America exhibits a stronger risk-adjusted profile overall. Its zero debt and safe Altman Z-score of 3.84 contrast sharply with International Paper’s leverage concerns and distress-zone Z-score of 1.18. However, International Paper’s global diversification could offer strategic opportunities if managed well.

The most impactful risk for International Paper is its weak liquidity and negative interest coverage, signaling potential financial distress despite a favorable WACC. For Packaging Corporation of America, the key risk lies in its profitability stagnation and elevated P/E ratio, which may pressure valuation. Packaging’s clean balance sheet and lower volatility justify its comparatively better risk stance.

Final Verdict: Which stock to choose?

International Paper Company’s superpower lies in its massive scale and ability to generate cash flow under challenging market conditions. However, its deteriorating profitability and negative returns on invested capital stand as a critical point of vigilance. It might suit portfolios seeking deep value turnaround plays with a tolerance for operational risks.

Packaging Corporation of America benefits from a strategic moat built on operational efficiency and robust cash flow generation, supported by a safer balance sheet and stronger financial stability. Compared to International Paper, it offers better risk management and could fit well in a GARP (Growth at a Reasonable Price) portfolio seeking moderate growth with defensive qualities.

If you prioritize a potential value recovery in a cyclical industry, International Paper commands attention despite its current struggles. However, if you seek more stability and operational resilience, Packaging Corporation offers better safety and steady cash generation, making it the more prudent choice for risk-conscious growth investors.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of International Paper Company and Packaging Corporation of America to enhance your investment decisions: