Home > Comparison > Basic Materials > PPG vs IFF

The strategic rivalry between PPG Industries, Inc. and International Flavors & Fragrances Inc. shapes the specialty chemicals landscape. PPG operates as a capital-intensive coatings and materials manufacturer, while IFF leads with high-margin, innovation-driven flavor and fragrance solutions. This head-to-head reflects a contrast between asset-heavy industrial production and agile specialty ingredient innovation. This analysis will identify which business model delivers a superior risk-adjusted return for a diversified portfolio.

Table of contents

Companies Overview

PPG Industries and International Flavors & Fragrances both hold significant positions in the specialty chemicals sector.

PPG Industries, Inc.: Global Coatings Powerhouse

PPG Industries dominates the specialty coatings market with a diverse portfolio spanning automotive, industrial, and protective coatings. Its core revenue derives from manufacturing paints, coatings, and specialty materials for sectors like aerospace, construction, and transportation. In 2026, PPG focuses on expanding its performance coatings segment and enhancing sustainable product offerings.

International Flavors & Fragrances Inc.: Sensory Ingredient Innovator

International Flavors & Fragrances leads in flavor and fragrance solutions, producing natural ingredients for food, cosmetics, and pharmaceuticals. It generates revenue through segments like Nourish and Scent, targeting consumer goods and personal care producers worldwide. Its 2026 strategy emphasizes innovation in natural and plant-based compounds and growth in health and biosciences.

Strategic Collision: Similarities & Divergences

Both companies excel in specialty chemicals but pursue contrasting philosophies. PPG builds on a broad industrial coatings portfolio, while IFF specializes in sensory and natural ingredients. Their primary battleground lies in sustainability-driven innovation across diverse end markets. PPG’s industrial scale contrasts with IFF’s ingredient-driven niche, resulting in distinct investment profiles shaped by their focused competitive moats.

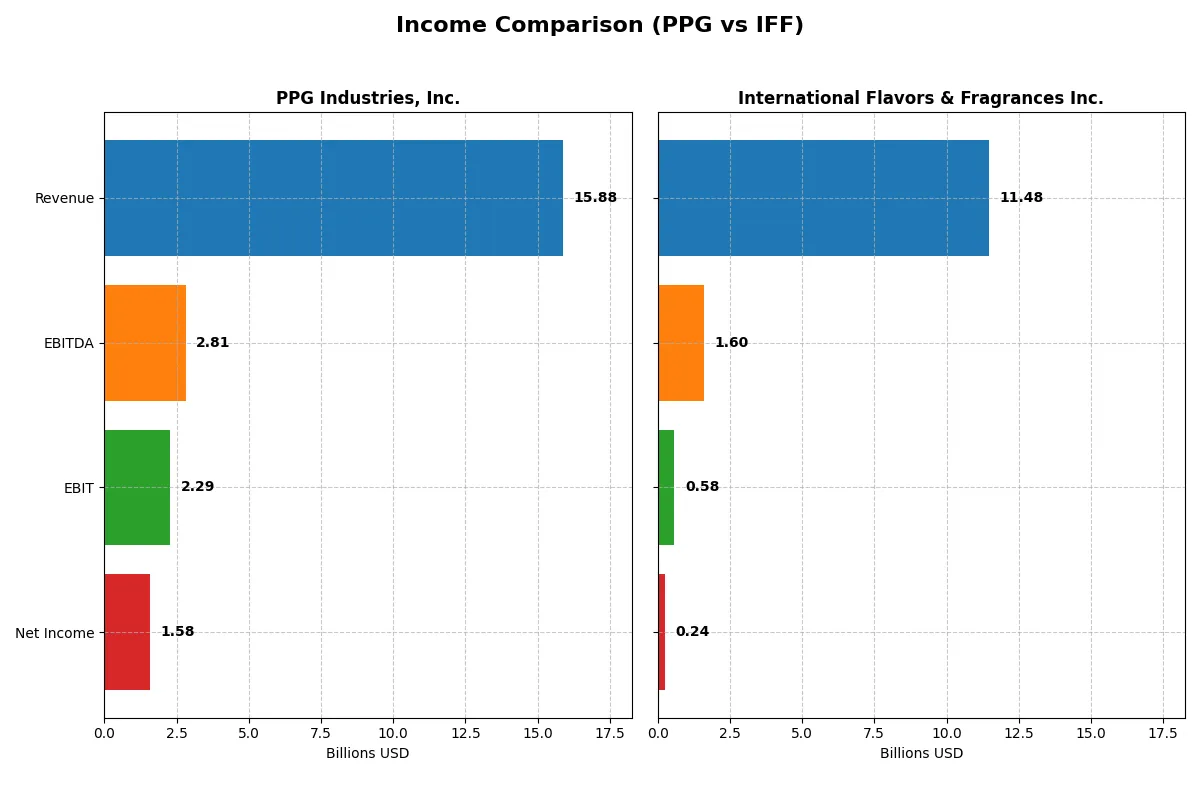

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | PPG Industries, Inc. (PPG) | International Flavors & Fragrances Inc. (IFF) |

|---|---|---|

| Revenue | 15.9B | 11.5B |

| Cost of Revenue | 9.8B | 7.4B |

| Operating Expenses | 3.9B | 3.4B |

| Gross Profit | 6.0B | 4.1B |

| EBITDA | 2.8B | 1.6B |

| EBIT | 2.3B | 583M |

| Interest Expense | 241M | 305M |

| Net Income | 1.6B | 243M |

| EPS | 6.96 | 0.95 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how effectively each company converts sales into profit and manages expenses amid market cycles.

PPG Industries, Inc. Analysis

PPG’s revenue held steady near 15.9B in 2025, with net income climbing sharply to 1.58B. Its gross margin contracts slightly but remains robust at 38%. Net margin expands to nearly 10%, reflecting operational efficiency and disciplined cost control. The company’s rising EPS signals strong momentum despite modest revenue growth.

International Flavors & Fragrances Inc. Analysis

IFF’s revenue stalled around 11.5B in 2024, yet net income rebounded to 243M from a deep loss the prior year. Gross margin improved to 36%, and EBIT margin edged above 5%, showing recovering profitability. However, net margin remains slim at just over 2%, highlighting ongoing challenges in expense management and scale.

Margin Strength vs. Profitability Recovery

PPG clearly outperforms IFF in profitability and margin stability, delivering consistent net income growth and higher returns on sales. IFF shows promising recovery momentum but struggles with thin net margins and volatile earnings. For investors, PPG’s profile offers dependable earnings power, while IFF presents a riskier turnaround story with uncertain margin leverage.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | PPG Industries, Inc. (PPG) | International Flavors & Fragrances Inc. (IFF) |

|---|---|---|

| ROE | -44.5% | 1.75% |

| ROIC | 43.1% | 2.63% |

| P/E | 14.7 | 89.1 |

| P/B | -6.54 | 1.56 |

| Current Ratio | 1.62 | 1.84 |

| Quick Ratio | 1.22 | 1.32 |

| D/E (Debt-to-Equity) | -2.10 | 0.69 |

| Debt-to-Assets | 93.6% | 33.6% |

| Interest Coverage | 9.0 | 2.51 |

| Asset Turnover | 1.99 | 0.40 |

| Fixed Asset Turnover | 0.0 | 2.65 |

| Payout ratio | 39.8% | 211.5% |

| Dividend yield | 2.71% | 2.37% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, unmasking hidden risks and operational strengths crucial for investment decisions.

PPG Industries, Inc.

PPG shows mixed signals with a negative ROE at -44.48% but a strong ROIC of 43.13%, signaling efficient capital use despite weak shareholder equity returns. Its P/E ratio of 14.71 suggests the stock remains reasonably valued. A 2.71% dividend yield provides steady shareholder returns, balancing growth and income.

International Flavors & Fragrances Inc.

IFF posts low profitability with a 1.75% ROE and 2.63% ROIC, indicating operational challenges. The stock trades at a stretched P/E of 89.07, reflecting high market expectations. IFF offers a 2.37% dividend yield, but its modest returns and high valuation signal riskier shareholder payback sustainability.

Premium Valuation vs. Operational Efficiency

PPG balances reasonable valuation with strong capital returns and a solid dividend yield, presenting a more stable risk-reward profile. IFF’s elevated P/E and weak profitability highlight valuation risks despite dividend income. Investors seeking operational efficiency and valuation discipline may prefer PPG, while those betting on growth might consider IFF’s profile.

Which one offers the Superior Shareholder Reward?

I see PPG Industries offers a balanced distribution with a 2.7% dividend yield and a sustainable 40% payout ratio, supported by stable free cash flow. Its buyback program is modest but consistent. Conversely, International Flavors & Fragrances (IFF) yields 2.37%, but with a payout ratio above 200%, signaling unsustainable dividends. IFF relies more on reinvestment and acquisitions for growth, with weaker buyback activity. Given PPG’s prudent capital allocation and healthier cash flow coverage, I judge PPG offers the superior total return profile for 2026 investors.

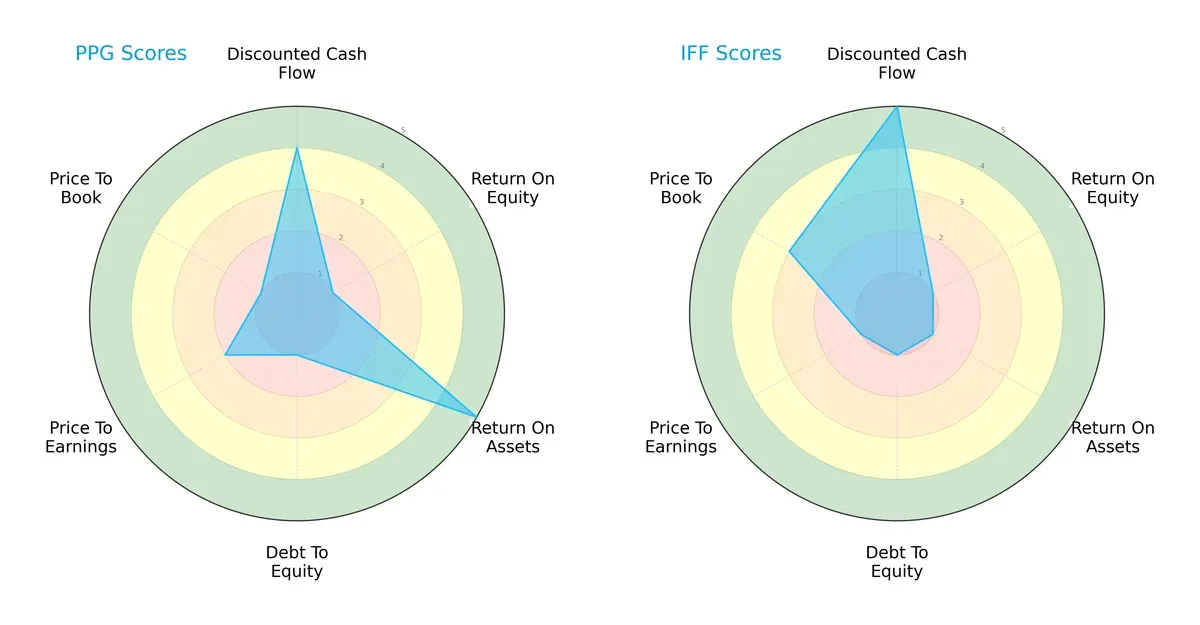

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of PPG Industries, Inc. and International Flavors & Fragrances Inc., highlighting their core financial strengths and weaknesses:

PPG shows strength in discounted cash flow (DCF) and return on assets (ROA), but weak returns on equity (ROE) and high debt levels. IFF excels in DCF but lags in profitability and leverage metrics. PPG’s profile is more balanced, while IFF relies heavily on cash flow valuation.

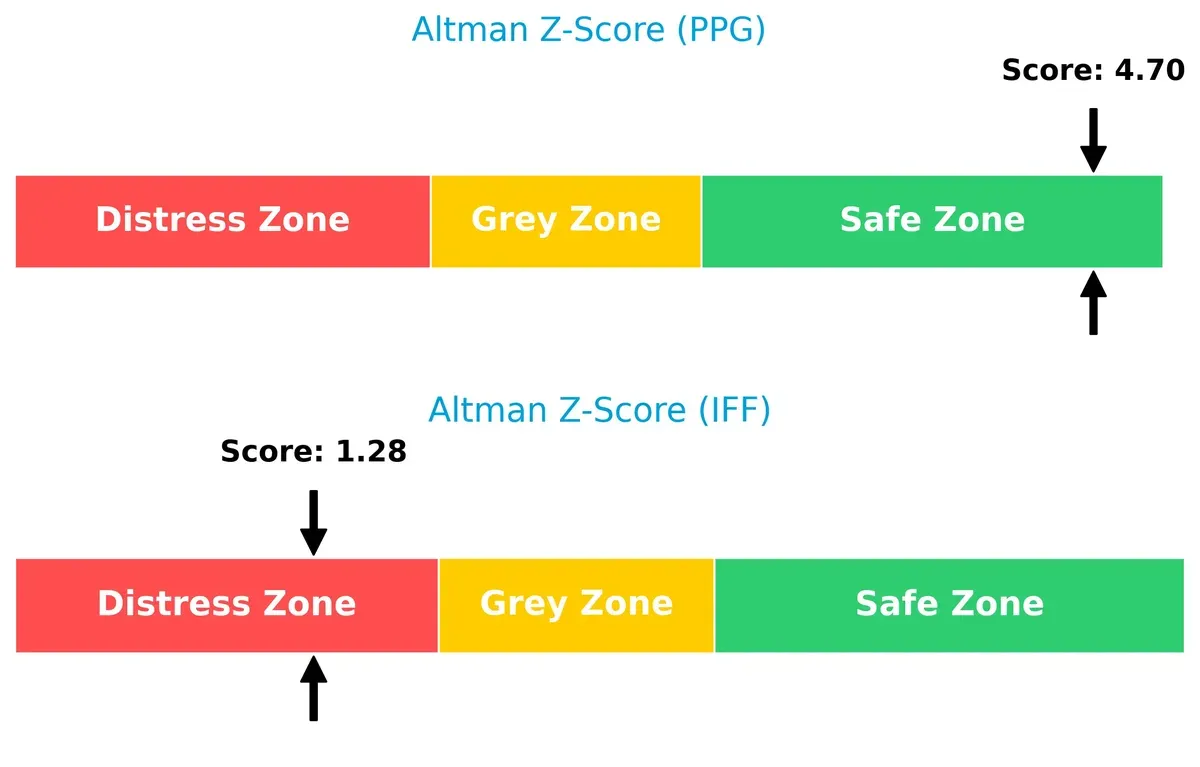

Bankruptcy Risk: Solvency Showdown

PPG’s Altman Z-Score of 4.7 places it securely in the safe zone, signaling strong financial stability. IFF’s 1.3 score falls into the distress zone, indicating elevated bankruptcy risk in this cycle:

Financial Health: Quality of Operations

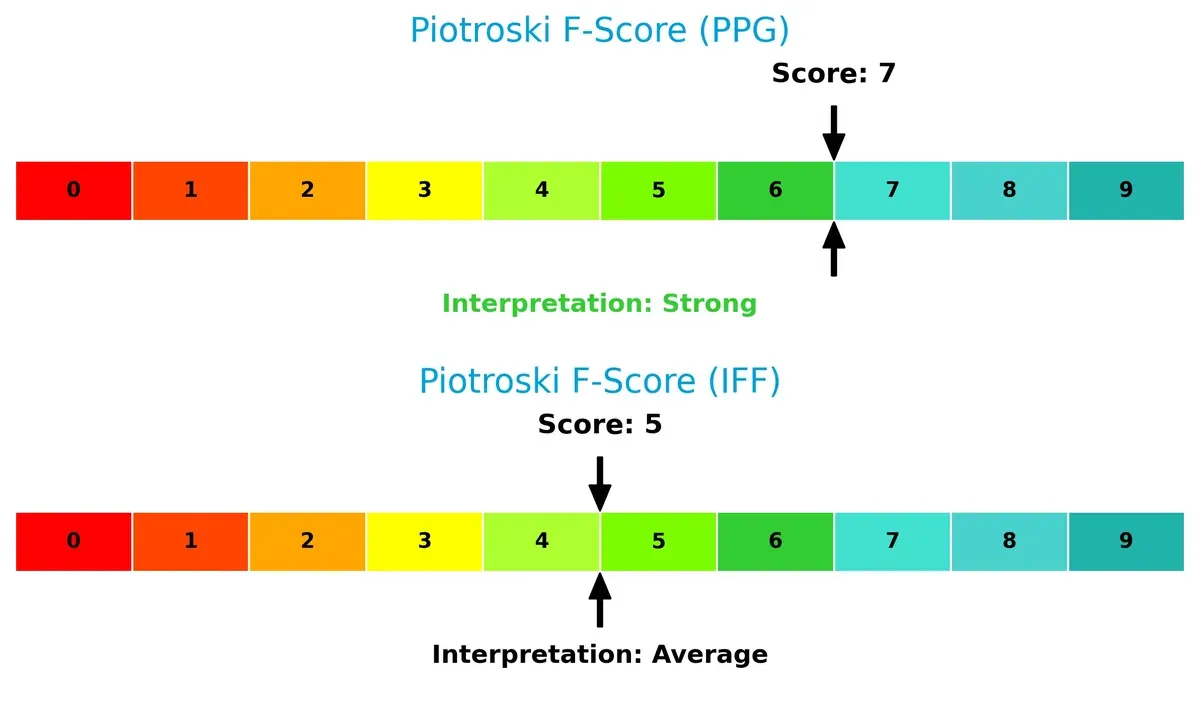

PPG’s Piotroski F-Score of 7 reflects strong operational quality and financial health. IFF’s score of 5 suggests average strength with potential internal weaknesses:

How are the two companies positioned?

This section dissects the operational DNA of PPG and IFF by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

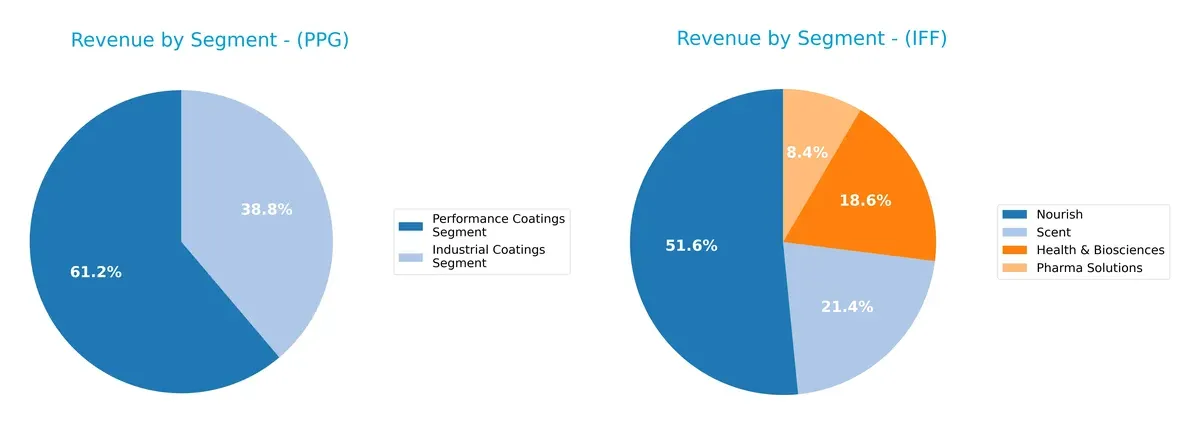

This visual comparison dissects how PPG Industries and International Flavors & Fragrances diversify their income streams and where their primary sector bets lie:

PPG anchors its revenue in two strong segments: Performance Coatings at $11.16B and Industrial Coatings at $7.08B, showing moderate diversification. IFF presents a broader mix with Nourish leading at $5.87B, supported by Scent ($2.44B), Health & Biosciences ($2.11B), and Pharma Solutions ($961M). PPG’s focus suggests infrastructure dominance, while IFF’s spread reduces concentration risk but demands precise capital allocation across diverse markets.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of PPG Industries, Inc. and International Flavors & Fragrances Inc.:

PPG Strengths

- Strong profitability with 43.13% ROIC above 7.85% WACC

- Favorable liquidity ratios with current 1.62 and quick 1.22

- Diverse revenue from Industrial and Performance Coatings segments

- Significant global presence across North America, EMEA, Asia Pacific, and Latin America

- Dividend yield of 2.71% supports shareholder returns

IFF Strengths

- Favorable capital cost with 6.89% WACC

- Good liquidity with current ratio 1.84 and quick ratio 1.32

- Diversified product lines including Nourish, Health & Biosciences, and Scent

- Presence across Asia, EMEA, North America, and Latin America

- Dividend yield of 2.37% indicates shareholder distributions

PPG Weaknesses

- Negative and unfavorable ROE at -44.48% signals poor equity returns

- High debt-to-assets at 93.55% raises leverage concerns

- Unfavorable fixed asset turnover at 0 restricts asset efficiency

- Negative price-to-book ratio at -6.54 questions valuation

- Net margin at 9.93% only neutral compared to peers

IFF Weaknesses

- Low profitability with net margin 2.12% and ROIC 2.63% below WACC

- Unfavorable ROE at 1.75% limits equity gains

- High PE of 89.07 suggests expensive valuation

- Weak interest coverage of 1.91 signals risk in debt servicing

- Asset turnover at 0.4 indicates low operational efficiency

PPG shows robust operational efficiency and strong capital returns but carries risk from high leverage and weak equity profitability. IFF’s strength lies in liquidity and diversification, yet faces challenges in profitability and valuation metrics. These factors shape each company’s strategic priorities and risk exposures.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields a company’s long-term profits from relentless competitive pressure. Here’s how PPG Industries and International Flavors & Fragrances stack up:

PPG Industries, Inc.: Durable Cost and Innovation Moat

PPG leverages a cost advantage and proprietary coatings technology, reflected in a robust ROIC well above WACC. Stable margins and rising profitability signal a moat deepening through new specialty materials in 2026.

International Flavors & Fragrances Inc.: Eroding Intangible Asset Moat

IFF depends on intangible assets like brand and formulation expertise but suffers declining ROIC below WACC. Despite recent margin improvements, its competitive edge weakens amid evolving consumer preferences and innovation challenges.

Verdict: Cost Efficiency vs. Intangible Asset Vulnerability

PPG’s wide economic moat from cost leadership and innovation outmatches IFF’s shrinking intangible asset moat. PPG is better positioned to defend market share and sustain value creation long term.

Which stock offers better returns?

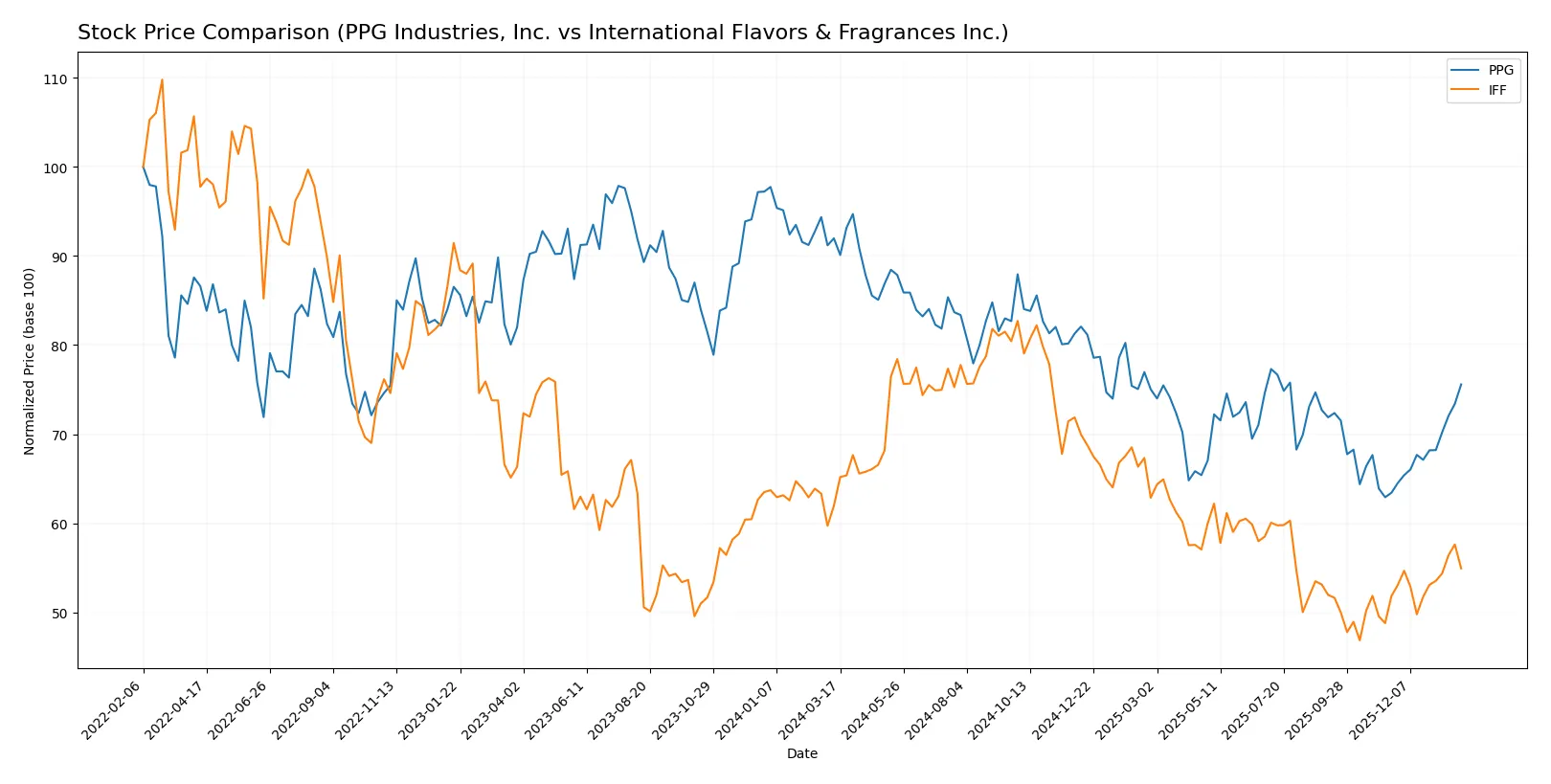

The past year shows both PPG Industries and International Flavors & Fragrances enduring bearish trends with accelerating declines. Recent months reveal contrasting short-term rebounds and strong buyer dominance in trading volumes.

Trend Comparison

PPG Industries exhibits a 17.84% price decline over the last 12 months, marking a bearish trend with accelerating losses. The stock hit a high of 144.9 and a low of 96.25, with a recent rebound of 19.17% since November 2025.

International Flavors & Fragrances declined 11.35% over the same period, also bearish with accelerating losses. Its price ranged between 59.55 and 105.12 and showed a milder recent recovery of 5.97% since November 2025.

PPG’s steeper overall decline contrasts with a stronger recent rebound compared to IFF. PPG delivered the lowest market performance over the full year, despite outpacing IFF in short-term gains.

Target Prices

Analysts present a confident target price consensus for both PPG Industries, Inc. and International Flavors & Fragrances Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| PPG Industries, Inc. | 115 | 135 | 126 |

| International Flavors & Fragrances Inc. | 71 | 89 | 78.6 |

PPG’s target consensus sits about 9% above its current price of $115.63, indicating modest upside. IFF’s consensus target exceeds its $69.81 price by roughly 12.5%, suggesting room for appreciation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the recent institutional grades for PPG Industries, Inc. and International Flavors & Fragrances Inc.:

PPG Industries, Inc. Grades

The table below shows PPG Industries’ current grades from major financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2026-01-29 |

| Goldman Sachs | Maintain | Buy | 2026-01-29 |

| Wells Fargo | Maintain | Overweight | 2026-01-29 |

| Citigroup | Maintain | Buy | 2026-01-29 |

| RBC Capital | Maintain | Sector Perform | 2026-01-29 |

| UBS | Maintain | Neutral | 2026-01-29 |

| Jefferies | Maintain | Hold | 2026-01-29 |

| Mizuho | Maintain | Outperform | 2026-01-28 |

International Flavors & Fragrances Inc. Grades

Below are the most recent grades for International Flavors & Fragrances Inc. from key analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Maintain | Buy | 2026-01-22 |

| Citigroup | Maintain | Buy | 2026-01-21 |

| UBS | Maintain | Neutral | 2026-01-12 |

| Barclays | Maintain | Overweight | 2025-11-07 |

| B of A Securities | Maintain | Buy | 2025-10-14 |

| Mizuho | Maintain | Outperform | 2025-10-03 |

Which company has the best grades?

PPG Industries consistently holds strong Buy and Overweight ratings from top-tier analysts, indicating broad confidence. IFF also receives Buy and Outperform grades but has more Neutral ratings. Investors may perceive PPG as having slightly stronger endorsement momentum.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

PPG Industries, Inc.

- Operates in specialty chemicals with broad industrial coatings and materials demand; faces intense competition from diversified chemical firms.

International Flavors & Fragrances Inc.

- Focuses on flavor, fragrance, and biosciences markets; competes with niche ingredient and specialty chemical providers.

2. Capital Structure & Debt

PPG Industries, Inc.

- High debt-to-assets ratio at 93.55% is a significant red flag, increasing financial risk despite strong interest coverage.

International Flavors & Fragrances Inc.

- Moderate leverage with 33.56% debt-to-assets and lower interest coverage signals manageable but cautious debt profile.

3. Stock Volatility

PPG Industries, Inc.

- Beta of 1.164 indicates slightly above-market volatility, reflecting sensitivity to economic cycles and sector shifts.

International Flavors & Fragrances Inc.

- Beta of 1.056 suggests volatility close to the market average, providing somewhat more stability to investors.

4. Regulatory & Legal

PPG Industries, Inc.

- Subject to environmental and safety regulations due to chemical manufacturing; compliance costs and litigation risks persist.

International Flavors & Fragrances Inc.

- Faces regulatory scrutiny relating to food safety, cosmetics, and pharmaceutical ingredients; moderate legal exposure.

5. Supply Chain & Operations

PPG Industries, Inc.

- Complex global supply chain for raw materials and coatings; disruptions could impact production and delivery schedules.

International Flavors & Fragrances Inc.

- Relies on specialty natural and synthetic inputs; supply chain disruptions in botanical sourcing are a vulnerability.

6. ESG & Climate Transition

PPG Industries, Inc.

- Increasing pressure to reduce carbon footprint in heavy chemical operations; transition risks may affect costs and reputation.

International Flavors & Fragrances Inc.

- Growing demand for sustainable and natural ingredients aligns with ESG trends but requires ongoing innovation and compliance.

7. Geopolitical Exposure

PPG Industries, Inc.

- Global footprint exposes it to trade tensions and tariffs, especially in industrial and military segments.

International Flavors & Fragrances Inc.

- Diverse international markets bring exposure to regional instability and currency fluctuations.

Which company shows a better risk-adjusted profile?

PPG’s most impactful risk is its elevated leverage, which heightens financial vulnerability despite operational strengths. IFF’s chief risk lies in weak profitability and financial distress signals, as reflected by its low Altman Z-score. Overall, PPG shows a stronger risk-adjusted profile, supported by a safe-zone Altman Z-score of 4.7 and favorable return on invested capital. Meanwhile, IFF’s distress-zone score near 1.3 and unfavorable profitability metrics raise caution. These contrasts highlight PPG’s superior capital structure resilience versus IFF’s ongoing financial challenges.

Final Verdict: Which stock to choose?

PPG Industries stands out as a cash-generating powerhouse with a very favorable moat, consistently delivering returns well above its cost of capital. Its discipline in capital allocation fuels durable competitive advantages. A point of vigilance remains its elevated debt levels, which could amplify risk in downturns. This stock fits well in an aggressive growth portfolio seeking value creation.

International Flavors & Fragrances offers a strategic moat rooted in its niche market presence and recurring revenue streams. While it lacks PPG’s efficiency and shows weaker profitability metrics, its lower leverage and steadier working capital provide a more conservative safety profile. It suits a GARP (Growth at a Reasonable Price) portfolio focused on steady income with moderate growth.

If you prioritize durable value creation and operational efficiency, PPG outshines due to its strong ROIC and robust free cash flow generation. However, if you seek a more stable balance sheet with exposure to niche markets, IFF offers better stability despite its weaker profitability. Both present analytical scenarios tailored to distinct investor risk tolerances and return expectations.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of PPG Industries, Inc. and International Flavors & Fragrances Inc. to enhance your investment decisions: