Linde plc and International Flavors & Fragrances Inc. both operate within the specialty chemicals industry, yet they serve distinct yet overlapping markets with innovative approaches. Linde focuses on industrial and process gases essential for manufacturing and healthcare, while IFF specializes in natural ingredients for flavors, fragrances, and personal care products. This comparison explores which company offers the most compelling investment potential in today’s evolving market landscape. Let’s find out which deserves a place in your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Linde plc and International Flavors & Fragrances Inc. by providing an overview of these two companies and their main differences.

Linde plc Overview

Linde plc is an industrial gas and engineering company operating globally across North and South America, Europe, the Middle East, Africa, and Asia Pacific. It supplies atmospheric and process gases like oxygen, nitrogen, and hydrogen, and designs turnkey process plants for various industries including healthcare, energy, and manufacturing. Founded in 1879, Linde is headquartered in Woking, UK, and has a market cap of 205B USD.

International Flavors & Fragrances Inc. Overview

International Flavors & Fragrances Inc. produces cosmetic actives and natural health ingredients used in consumer products worldwide, including Europe, North America, and Asia. Operating through segments such as Nourish and Scent, it serves industries from perfumes and personal care to food and pharmaceuticals. Founded in 1833 and based in New York City, IFF’s market cap stands at 17.5B USD with 22.4K employees.

Key similarities and differences

Both companies operate within the specialty chemicals sector but target distinct markets: Linde focuses on industrial gases and engineering solutions, while IFF specializes in flavors, fragrances, and biosciences for consumer products. Linde’s business model emphasizes large-scale industrial applications and plant construction, contrasting with IFF’s ingredient manufacturing for personal care and food industries. Linde is significantly larger by market cap and employee count.

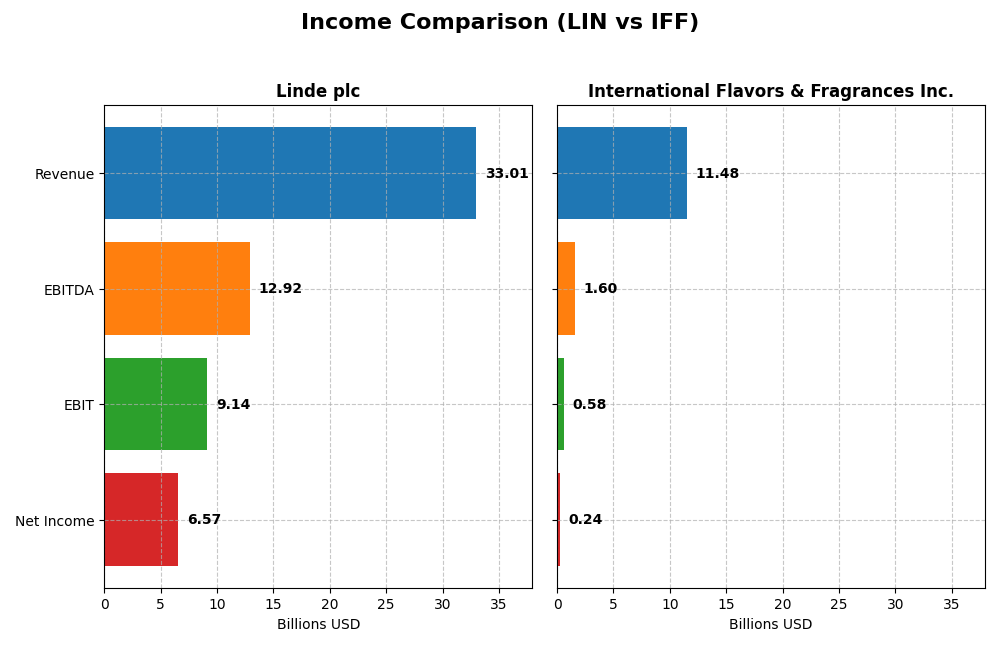

Income Statement Comparison

Below is a side-by-side comparison of key income statement metrics for Linde plc and International Flavors & Fragrances Inc. for the fiscal year 2024.

| Metric | Linde plc (LIN) | International Flavors & Fragrances Inc. (IFF) |

|---|---|---|

| Market Cap | 205B | 17.5B |

| Revenue | 33B | 11.5B |

| EBITDA | 12.9B | 1.6B |

| EBIT | 9.1B | 583M |

| Net Income | 6.6B | 243M |

| EPS | 13.71 | 0.95 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Linde plc

Linde plc’s revenue grew steadily from $27.2B in 2020 to $33B in 2024, with net income rising impressively from $2.5B to $6.6B over the same period. Margins improved consistently, with gross margin at 36.6% and net margin at 19.9% in 2024. The latest year showed moderate revenue growth of 0.46%, but notable EBIT and net margin increases, reflecting solid profitability enhancements.

International Flavors & Fragrances Inc.

IFF’s revenue expanded significantly from $5.1B in 2020 to $11.5B in 2024, but net income declined from $365M to $243M, showing profitability challenges. Gross margin remained favorable at 35.9%, while EBIT and net margins were lower, with EBIT margin at 5.1% in 2024. The recent year saw flat revenue growth, yet EBIT and net margin improved sharply, indicating operational recovery.

Which one has the stronger fundamentals?

Linde exhibits stronger fundamentals with consistent revenue and substantial net income growth, supported by robust margins and favorable interest expense ratios. IFF shows impressive revenue growth but struggles with net income declines and weaker margins, despite recent operational improvements. Overall, Linde’s income statement portrays greater stability and profitability over the period.

Financial Ratios Comparison

This table presents a side-by-side comparison of key financial ratios for Linde plc and International Flavors & Fragrances Inc. based on their latest full-year 2024 data.

| Ratios | Linde plc (LIN) | International Flavors & Fragrances Inc. (IFF) |

|---|---|---|

| ROE | 17.23% | 1.75% |

| ROIC | 9.19% | 2.63% |

| P/E | 30.53 | 89.07 |

| P/B | 5.26 | 1.56 |

| Current Ratio | 0.89 | 1.84 |

| Quick Ratio | 0.76 | 1.32 |

| D/E | 0.59 | 0.69 |

| Debt-to-Assets | 28.21% | 33.56% |

| Interest Coverage | 15.03 | 2.51 |

| Asset Turnover | 0.41 | 0.40 |

| Fixed Asset Turnover | 1.28 | 2.65 |

| Payout Ratio | 40.44% | 211.52% |

| Dividend Yield | 1.32% | 2.37% |

Interpretation of the Ratios

Linde plc

Linde shows strong profitability with a favorable net margin of 19.89% and robust ROE at 17.23%, though its PE and PB ratios are unfavorable, indicating a potentially high valuation. Liquidity ratios are weak, with a current ratio below 1. The company pays dividends, yielding 1.32%, reflecting a neutral stance supported by manageable payout risks and moderate coverage by free cash flow.

International Flavors & Fragrances Inc.

IFF’s financial ratios reveal weaknesses, including a low net margin of 2.12% and ROE of 1.75%, both unfavorable. Its debt management is neutral, but interest coverage is concerningly low at 1.91. Liquidity ratios are favorable, supporting short-term stability. The dividend yield is 2.37%, supported by a cautious payout, though overall returns are pressured by weak profitability.

Which one has the best ratios?

Linde presents a more balanced ratio profile with strong profitability and manageable debt, despite valuation and liquidity concerns. Conversely, IFF struggles with profitability and interest coverage despite better liquidity and dividend yield. Overall, Linde’s ratios suggest a stronger financial position, while IFF’s remain slightly unfavorable due to persistent operational challenges.

Strategic Positioning

This section compares the strategic positioning of Linde plc and International Flavors & Fragrances Inc., focusing on Market position, Key segments, and Exposure to technological disruption:

Linde plc

- Leading industrial gas and engineering company facing competitive pressure globally.

- Diverse segments: Americas, EMEA, APAC, and Engineering, driving broad revenue streams.

- Operates in established industrial gases sector with limited exposure to rapid disruption.

International Flavors & Fragrances Inc.

- Specialty chemicals firm in flavors and fragrances with moderate competitive challenges.

- Concentrated segments: Nourish, Scent, Health & Biosciences, Pharma Solutions.

- Focus on natural ingredients and biotech, facing moderate technological disruption risks.

Linde plc vs International Flavors & Fragrances Inc. Positioning

Linde pursues a diversified global approach across multiple industrial and geographic segments, supporting stable revenue. IFF concentrates on specialty flavors and biosciences, which may offer focused innovation but higher segment concentration risk.

Which has the best competitive advantage?

Linde shows a slightly favorable moat with growing profitability, indicating improving competitive strength. IFF faces a very unfavorable moat due to declining returns and value destruction, suggesting weaker competitive advantage.

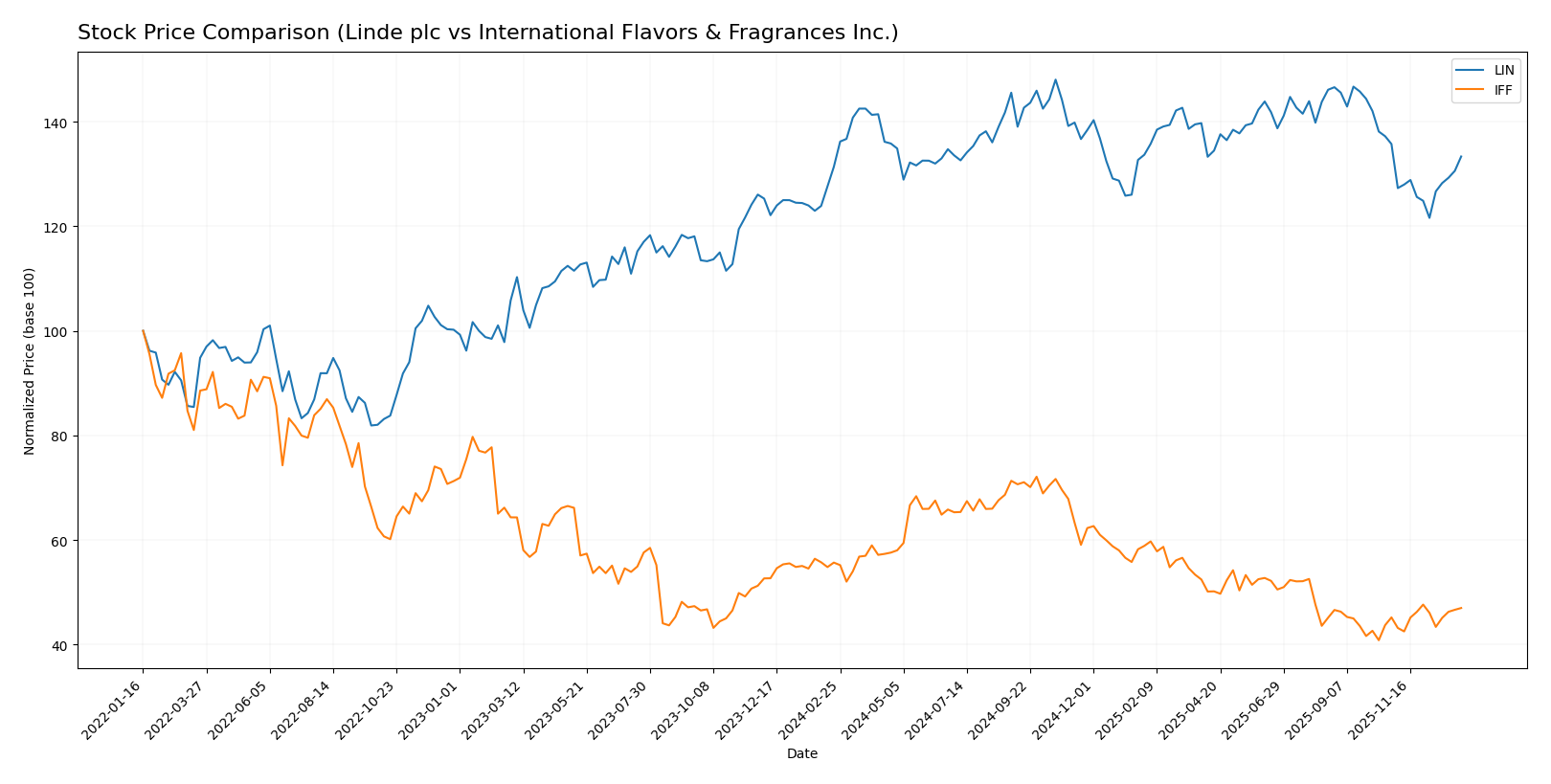

Stock Comparison

The past year showed varied price movements and trading dynamics for Linde plc and International Flavors & Fragrances Inc., with Linde displaying modest growth amid accelerating trends, while IFF experienced a significant decline before recent recovery.

Trend Analysis

Linde plc’s stock exhibited a 1.51% price increase over the past 12 months, indicating a bullish trend with acceleration, reaching a high of 486.45 and a low of 399.57, despite a mild recent downturn of -1.76%.

International Flavors & Fragrances Inc. showed a -15.6% price change over the past year, marking a bearish trend with acceleration; however, it gained 3.97% recently, suggesting a short-term recovery phase.

Comparing trends, Linde plc delivered the highest market performance over the full year, maintaining a positive overall price change versus IFF’s substantial decline.

Target Prices

The consensus target prices for Linde plc and International Flavors & Fragrances Inc. indicate positive analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Linde plc | 516 | 490 | 500.33 |

| International Flavors & Fragrances Inc. | 89 | 66 | 76.67 |

Analysts expect Linde’s stock to rise significantly above its current price of 438.21 USD, while IFF’s consensus target suggests a moderate upside from its current 68.52 USD level.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Linde plc and International Flavors & Fragrances Inc.:

Rating Comparison

Linde plc Rating

- Rating: B, considered very favorable by analysts

- Discounted Cash Flow Score: 4, indicating favorable value

- ROE Score: 5, reflecting very favorable profitability

- ROA Score: 5, showing very favorable asset utilization

- Debt To Equity Score: 1, indicating very unfavorable risk

- Overall Score: 3, rated as moderate

International Flavors & Fragrances Inc. Rating

- Rating: C+, also considered very favorable by analysts

- Discounted Cash Flow Score: 5, indicating very favorable value

- ROE Score: 1, reflecting very unfavorable profitability

- ROA Score: 1, showing very unfavorable asset utilization

- Debt To Equity Score: 1, indicating very unfavorable risk

- Overall Score: 2, rated as moderate

Which one is the best rated?

Based strictly on the provided data, Linde plc holds a higher overall rating (B) compared to International Flavors & Fragrances Inc. (C+). Linde shows stronger profitability scores while both share very unfavorable debt-to-equity scores.

Scores Comparison

Here is a comparison of the key financial scores for Linde plc and International Flavors & Fragrances Inc.:

Linde plc Scores

- Altman Z-Score: 3.54, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength.

International Flavors & Fragrances Inc. Scores

- Altman Z-Score: 1.20, indicating distress zone, high bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength.

Which company has the best scores?

Linde plc shows a stronger Altman Z-Score, placing it in the safe zone, while IFF falls into the distress zone. Both companies have an identical average Piotroski Score of 5, indicating similar financial strength.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Linde plc and International Flavors & Fragrances Inc.:

Linde plc Grades

This table lists recent grades and rating actions from established financial institutions for Linde plc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Outperform | 2025-12-12 |

| UBS | Upgrade | Buy | 2025-11-11 |

| RBC Capital | Maintain | Outperform | 2025-11-06 |

| Seaport Global | Upgrade | Buy | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| B of A Securities | Maintain | Buy | 2025-11-03 |

| JP Morgan | Maintain | Overweight | 2025-11-03 |

| UBS | Maintain | Neutral | 2025-10-06 |

| Citigroup | Maintain | Buy | 2025-10-06 |

| JP Morgan | Maintain | Overweight | 2025-08-04 |

The overall trend for Linde plc shows predominantly “Buy,” “Outperform,” and “Overweight” recommendations, indicating a positive market sentiment with several upgrades recently.

International Flavors & Fragrances Inc. Grades

This table summarizes recent grading actions by recognized financial firms for International Flavors & Fragrances Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-07 |

| UBS | Maintain | Neutral | 2025-11-06 |

| B of A Securities | Maintain | Buy | 2025-10-14 |

| Argus Research | Maintain | Buy | 2025-10-07 |

| UBS | Maintain | Neutral | 2025-10-06 |

| Citigroup | Maintain | Buy | 2025-10-06 |

| Mizuho | Maintain | Outperform | 2025-10-03 |

| Morgan Stanley | Maintain | Overweight | 2025-09-22 |

| Wolfe Research | Upgrade | Peer Perform | 2025-09-08 |

| Tigress Financial | Maintain | Buy | 2025-08-26 |

The grades for International Flavors & Fragrances Inc. are mostly “Buy,” “Outperform,” and “Overweight,” with a single upgrade from “Underperform” to “Peer Perform,” reflecting stable to positive analyst sentiment.

Which company has the best grades?

Both Linde plc and International Flavors & Fragrances Inc. maintain strong “Buy” and “Outperform” ratings from multiple reputable sources. However, Linde plc has a slightly higher number of recent upgrades and consistently strong “Outperform” grades, which may suggest a marginally more favorable outlook in analyst consensus. This can influence investor perception by indicating potentially stronger near-term growth or stability.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses of Linde plc and International Flavors & Fragrances Inc. based on their recent financial and operational data.

| Criterion | Linde plc | International Flavors & Fragrances Inc. |

|---|---|---|

| Diversification | Strong global diversification across Americas (14.4B), EMEA (8.4B), APAC (6.6B), and Engineering segments (2.3B) | Diversified product portfolio with Nourish (5.9B), Scent (2.4B), Health & Biosciences (2.1B), Pharma Solutions (0.96B) |

| Profitability | High net margin (19.9%) and ROE (17.2%); neutral ROIC (9.2%) with slightly favorable moat | Low net margin (2.1%) and ROE (1.8%), unfavorable ROIC (2.6%) with very unfavorable moat status |

| Innovation | Moderate innovation reflected in growing ROIC trend (+146%) but no strong moat yet | Declining ROIC trend (-31%), indicating challenges in sustaining competitive advantage |

| Global presence | Well-established in multiple regions with strong revenue in Americas and EMEA | Global presence but less dominant, with concentrated revenues in Nourish and Scent segments |

| Market Share | Large market share in industrial gases with balanced regional revenues | Significant market share in flavors and fragrances but profitability and growth are concerns |

Key takeaways: Linde plc demonstrates robust diversification and improving profitability with a growing ROIC, suggesting potential value creation despite a modest moat. In contrast, International Flavors & Fragrances faces profitability challenges and a declining ROIC, signaling value destruction and increased investment risk.

Risk Analysis

Below is a comparative table summarizing key risks for Linde plc (LIN) and International Flavors & Fragrances Inc. (IFF) based on the latest 2024 financial and operational data:

| Metric | Linde plc (LIN) | International Flavors & Fragrances Inc. (IFF) |

|---|---|---|

| Market Risk | Moderate (Beta 0.855, stable sectors) | Slightly higher (Beta 1.056, consumer-driven) |

| Debt level | Moderate (D/E 0.59, favorable debt-to-assets 28%) | Moderate to high (D/E 0.69, neutral debt-to-assets 33.6%) |

| Regulatory Risk | Medium (global industrial gas regulations) | Medium (stringent regulations in cosmetics, food) |

| Operational Risk | Moderate (complex global operations, plant construction) | Moderate (supply chain and product safety concerns) |

| Environmental Risk | Moderate (industrial emissions, energy use) | Moderate (sustainability pressures in ingredients sourcing) |

| Geopolitical Risk | Medium (exposure across multiple continents) | Medium (diversified global markets, US-based) |

Linde faces moderate market and operational risks but benefits from solid financial stability and a safe Altman Z-score, indicating low bankruptcy risk. IFF exhibits higher financial vulnerability with a distress-level Altman Z-score and unfavorable profitability metrics, making debt and market risks more impactful. Investors should weigh Linde’s balanced risk profile against IFF’s financial fragility and sector-specific challenges.

Which Stock to Choose?

Linde plc (LIN) shows a favorable income evolution with strong profitability metrics including a 19.89% net margin and 17.23% ROE. Its debt levels are moderate with a net debt to EBITDA of 1.37, and its overall rating is very favorable, though some valuation ratios like P/E and P/B appear high.

International Flavors & Fragrances Inc. (IFF) presents a mixed income profile with a low 2.12% net margin and weak profitability ratios such as 1.75% ROE. It carries higher leverage with net debt to EBITDA of 5.73, and despite a very favorable rating, many financial ratios, including interest coverage and P/E, are unfavorable.

For investors, Linde’s favorable rating and improving income statement could suggest attractiveness for those seeking quality and moderate risk. Conversely, IFF’s profile with higher debt and weaker profitability might appeal to risk-tolerant investors focusing on potential turnaround or growth opportunities, as its valuation and recent price trends might signal recovery potential.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Linde plc and International Flavors & Fragrances Inc. to enhance your investment decisions: