In the dynamic world of household and personal products, The Estée Lauder Companies Inc. (EL) and Inter Parfums, Inc. (IPAR) stand out as influential players. Both headquartered in New York and operating globally, they excel in innovative fragrance and skincare solutions with overlapping market presence. This article will dissect their strategies and performance to help you identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between The Estée Lauder Companies Inc. and Inter Parfums, Inc. by providing an overview of these two companies and their main differences.

The Estée Lauder Companies Inc. Overview

The Estée Lauder Companies Inc. is a major player in the household and personal products industry, focused on manufacturing, marketing, and selling a broad portfolio of skin care, makeup, fragrance, and hair care products worldwide. The company operates numerous well-known brands and distributes through various channels including department stores, specialty retailers, and online platforms. Headquartered in New York City, it employs over 44K people and maintains a strong market presence with a market cap of approximately 40.7B USD.

Inter Parfums, Inc. Overview

Inter Parfums, Inc. manufactures and distributes fragrances and fragrance-related products under multiple prestigious brands, serving both U.S. and international markets. The company operates through European and U.S. segments, selling via department stores, specialty stores, duty-free shops, and e-commerce. Based in New York City and employing around 650 people, Inter Parfums has a market capitalization near 2.9B USD, reflecting a smaller scale compared to larger competitors.

Key similarities and differences

Both companies operate in the consumer defensive sector within household and personal products, focusing on fragrance offerings as part of their product range. Estée Lauder has a diversified portfolio including skin care and makeup, while Inter Parfums specializes more narrowly in fragrance products. Estée Lauder’s extensive brand portfolio and global reach contrast with Inter Parfums’ more focused brand strategy and smaller workforce, highlighting differences in scale and market positioning.

Income Statement Comparison

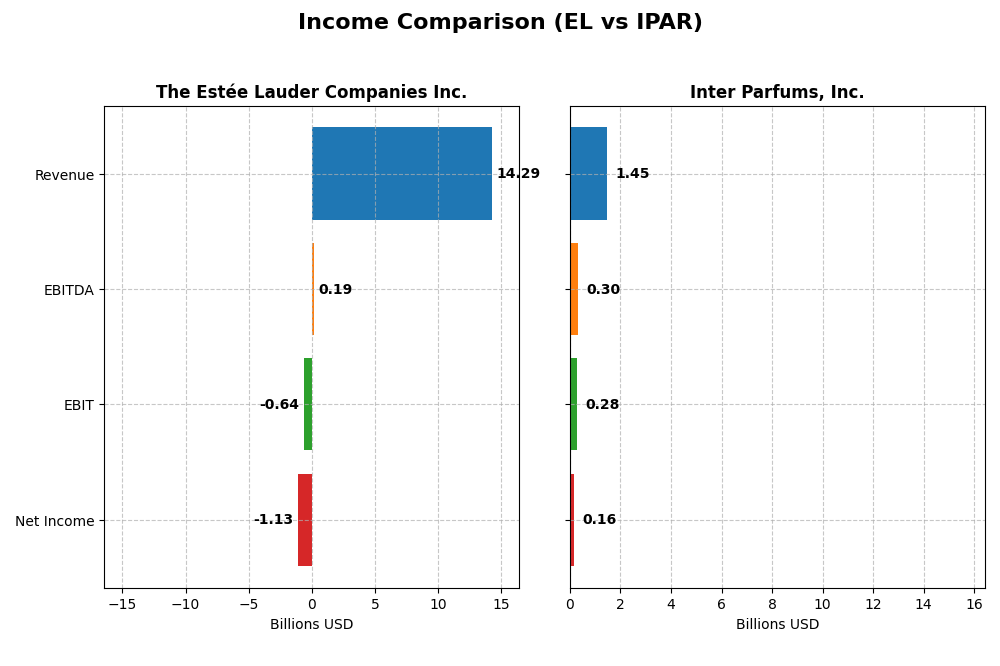

The following table presents a side-by-side comparison of the most recent fiscal year income statement metrics for The Estée Lauder Companies Inc. and Inter Parfums, Inc.

| Metric | The Estée Lauder Companies Inc. | Inter Parfums, Inc. |

|---|---|---|

| Market Cap | 40.7B | 2.87B |

| Revenue | 14.29B | 1.45B |

| EBITDA | 193M | 305M |

| EBIT | -636M | 276M |

| Net Income | -1.13B | 164M |

| EPS | -3.15 | 5.13 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

The Estée Lauder Companies Inc.

Over the 2021-2025 period, Estée Lauder’s revenue declined by approximately 12%, with net income dropping sharply by nearly 140%. Gross margins remained relatively stable at around 74%, but EBIT and net margins turned negative in the latest year. The 2025 fiscal year showed a decline in revenue and profitability, with a net loss of $1.13B, reflecting deteriorated operational efficiency and margin compression.

Inter Parfums, Inc.

Inter Parfums experienced robust revenue growth of 169% from 2020 to 2024, with net income surging over 330%. Gross margin stayed strong near 64%, while EBIT and net margins improved to 19% and 11%, respectively. The most recent year, 2024, saw a 10% revenue increase and a 6% EBIT rise, though net margin slightly contracted, signaling healthy expansion tempered by rising operating expenses.

Which one has the stronger fundamentals?

Inter Parfums displays stronger fundamentals with consistent revenue and net income growth, favorable margins, and effective cost management over the period. Conversely, Estée Lauder shows declining revenue and net income, with negative EBIT and net margins in the latest year, indicating operational challenges. Thus, Inter Parfums presents a more favorable income statement profile based solely on this data.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for The Estée Lauder Companies Inc. (EL) and Inter Parfums, Inc. (IPAR) based on their most recent fiscal year data.

| Ratios | The Estée Lauder Companies Inc. (EL) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| ROE | -29.3% | 22.1% |

| ROIC | 6.4% | 18.6% |

| P/E | -25.7 | 25.6 |

| P/B | 7.53 | 5.66 |

| Current Ratio | 1.30 | 2.75 |

| Quick Ratio | 0.92 | 1.63 |

| D/E (Debt-to-Equity) | 2.44 | 0.26 |

| Debt-to-Assets | 47.5% | 13.6% |

| Interest Coverage | 2.37 | 35.6 |

| Asset Turnover | 0.72 | 1.03 |

| Fixed Asset Turnover | 2.79 | 8.14 |

| Payout Ratio | -54.5% | 58.4% |

| Dividend Yield | 2.12% | 2.28% |

Interpretation of the Ratios

The Estée Lauder Companies Inc.

The Estée Lauder shows a mixed financial profile with several unfavorable ratios, including a negative net margin of -7.93% and a return on equity (ROE) of -29.31%, signaling profitability concerns. Neutral ratings on return on invested capital (6.44%) and liquidity ratios (current ratio 1.3) suggest moderate operational stability. The company offers a dividend yield of 2.12%, indicating ongoing shareholder returns despite profitability challenges.

Inter Parfums, Inc.

Inter Parfums displays a strong ratio set with favorable net margin at 11.32% and ROE of 22.07%, reflecting solid profitability. The company’s return on invested capital (18.62%) and liquidity ratios, including a current ratio of 2.75, are also favorable, suggesting efficient asset use and good solvency. A dividend yield of 2.28% complements the robust financial performance and shareholder returns.

Which one has the best ratios?

Inter Parfums holds the advantage with predominantly favorable ratios, showing strong profitability, liquidity, and asset turnover compared to Estée Lauder’s mixed and somewhat unfavorable metrics. Estée Lauder’s negative profitability and high debt-to-equity ratio weaken its financial stance. Overall, Inter Parfums’ ratios indicate a more solid financial position.

Strategic Positioning

This section compares the strategic positioning of The Estée Lauder Companies Inc. (EL) and Inter Parfums, Inc. (IPAR) regarding market position, key segments, and exposure to technological disruption:

The Estée Lauder Companies Inc.

- Large market cap of 40.7B with significant competitive pressure in household & personal products sector.

- Diversified product portfolio including skin care (6.96B), makeup (4.21B), fragrance (2.49B), and hair care (565M).

- No explicit data on technological disruption exposure; operates through traditional retail and e-commerce channels.

Inter Parfums, Inc.

- Smaller market cap of 2.9B, operating in a competitive fragrance segment with a focused market presence.

- Primarily focused on fragrances with European and U.S. based operations, selling multiple licensed brands.

- No explicit data on technological disruption exposure; sales through department stores and e-commerce.

EL vs IPAR Positioning

EL pursues a highly diversified business model across multiple beauty segments, providing broad revenue streams but facing intense competition. IPAR has a concentrated focus on fragrances, leveraging licensed brands and regional operations, with a smaller scale but specialized approach.

Which has the best competitive advantage?

IPAR shows a very favorable moat with growing ROIC and value creation, indicating a durable competitive advantage. EL exhibits a very unfavorable moat with declining ROIC, signaling value destruction and weakening competitive positioning.

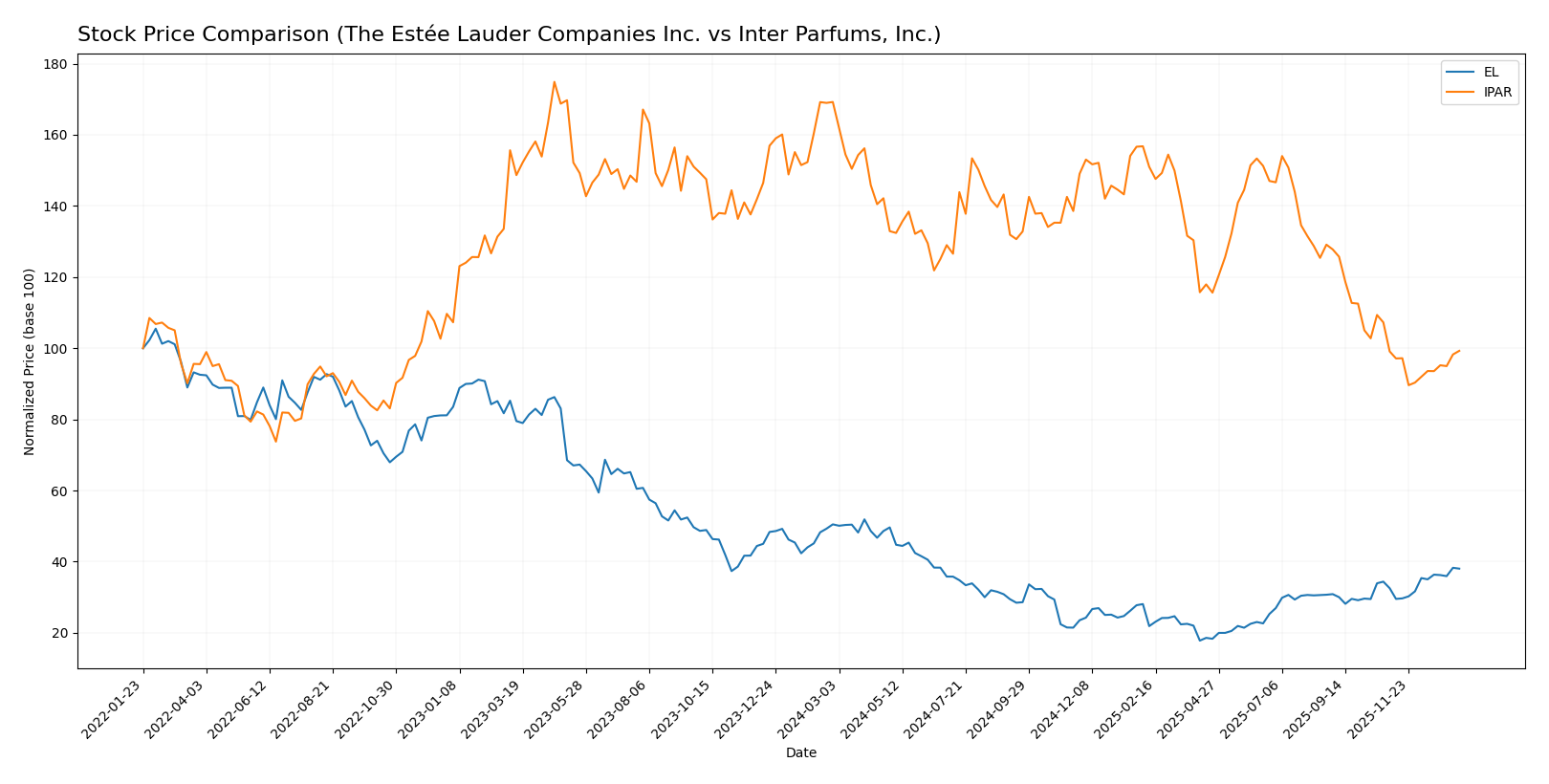

Stock Comparison

The stock price chart reveals significant bearish trends for both The Estée Lauder Companies Inc. and Inter Parfums, Inc. over the past 12 months, with recent recovery signs more pronounced in Estée Lauder’s trading dynamics.

Trend Analysis

The Estée Lauder Companies Inc. experienced a -24.65% price decline over the past year, marking a bearish trend with accelerating downward momentum and high volatility (std deviation 25.16). A notable recovery occurred recently with a +16.89% gain.

Inter Parfums, Inc.’s stock decreased by -41.33% over the same period, also bearish with acceleration and moderate volatility (std deviation 17.11). Its recent trend is nearly flat, showing a marginal +0.17% increase.

Comparing both, The Estée Lauder Companies Inc. delivered the highest market performance with a less severe decline and stronger recent recovery compared to Inter Parfums, Inc.

Target Prices

The current analyst consensus on target prices reflects a moderately optimistic outlook for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Estée Lauder Companies Inc. | 130 | 70 | 106.67 |

| Inter Parfums, Inc. | 125 | 103 | 114 |

Analysts expect Inter Parfums to have a higher upside relative to its current price of 89.3 USD, suggesting potential growth. Estée Lauder’s consensus target of 106.67 USD is slightly below its current price of 113.02 USD, indicating a more cautious stance.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for The Estée Lauder Companies Inc. (EL) and Inter Parfums, Inc. (IPAR):

Rating Comparison

EL Rating

- Rating: D+ with a very favorable status.

- Discounted Cash Flow Score: 2, indicating a moderate valuation outlook.

- ROE Score: 1, reflecting very unfavorable efficiency in generating profits.

- ROA Score: 1, showing very unfavorable asset utilization.

- Debt To Equity Score: 1, indicating very unfavorable financial risk.

- Overall Score: 1, classified as very unfavorable.

IPAR Rating

- Rating: B+ with a very favorable status.

- Discounted Cash Flow Score: 3, indicating a moderate valuation outlook.

- ROE Score: 5, reflecting very favorable efficiency in generating profits.

- ROA Score: 5, showing very favorable asset utilization.

- Debt To Equity Score: 3, indicating moderate financial risk.

- Overall Score: 3, classified as moderate.

Which one is the best rated?

Based strictly on the data, IPAR is better rated than EL, with higher overall, ROE, ROA, and debt-to-equity scores. EL shows mostly very unfavorable scores except for a moderate DCF score.

Scores Comparison

The comparison of scores for The Estée Lauder Companies Inc. and Inter Parfums, Inc. is as follows:

EL Scores

- Altman Z-Score: 3.11, in the safe zone, indicating low bankruptcy risk.

- Piotroski Score: 5, rated average, showing moderate financial strength.

IPAR Scores

- Altman Z-Score: 6.12, in the safe zone, indicating very low bankruptcy risk.

- Piotroski Score: 5, rated average, showing moderate financial strength.

Which company has the best scores?

Based on the data, IPAR has a higher Altman Z-Score than EL, suggesting a stronger financial stability. Both have the same Piotroski Score, indicating similar financial strength in that regard.

Grades Comparison

The following tables summarize the recent grades assigned to The Estée Lauder Companies Inc. and Inter Parfums, Inc.:

The Estée Lauder Companies Inc. Grades

This table details the latest grades and actions given by reputable financial institutions for EL.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-05 |

| Raymond James | Upgrade | Strong Buy | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-17 |

| Evercore ISI Group | Maintain | Outperform | 2025-12-16 |

| Rothschild & Co | Downgrade | Sell | 2025-11-25 |

| Argus Research | Upgrade | Buy | 2025-11-11 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Telsey Advisory Group | Maintain | Market Perform | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

Overall, EL’s grades show a mixed trend with several upgrades to buy and outperform, but also a notable downgrade to sell, reflecting some divergent analyst views.

Inter Parfums, Inc. Grades

This table presents the recent grades and actions for IPAR from recognized financial firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BWS Financial | Downgrade | Neutral | 2025-11-21 |

| Canaccord Genuity | Maintain | Buy | 2025-11-19 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Jefferies | Maintain | Buy | 2025-10-28 |

| BWS Financial | Maintain | Buy | 2025-10-22 |

| Canaccord Genuity | Maintain | Buy | 2025-10-21 |

| BWS Financial | Maintain | Buy | 2025-05-07 |

| Piper Sandler | Maintain | Overweight | 2025-04-24 |

| DA Davidson | Maintain | Buy | 2025-03-25 |

| BWS Financial | Maintain | Buy | 2025-03-17 |

IPAR’s grades largely reflect consistent buy ratings with a single downgrade to neutral, indicating generally positive analyst sentiment.

Which company has the best grades?

Inter Parfums, Inc. has received predominantly buy ratings, signaling strong analyst confidence, while The Estée Lauder Companies Inc. shows more mixed opinions with some downgrades. This difference may influence investor perceptions of risk and growth potential.

Strengths and Weaknesses

Below is a comparative table summarizing the key strengths and weaknesses of The Estée Lauder Companies Inc. (EL) and Inter Parfums, Inc. (IPAR) based on the latest available data:

| Criterion | The Estée Lauder Companies Inc. (EL) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| Diversification | Highly diversified product portfolio including Skin Care (6.96B), Makeup (4.21B), Fragrance (2.49B), and Hair Care (0.57B) | Limited product range focused mainly on fragrances, smaller scale |

| Profitability | Negative net margin (-7.93%) and ROE (-29.31%), ROIC slightly below WACC (6.44% vs 8.08%), value destroying | Strong profitability with net margin 11.32%, ROE 22.07%, ROIC 18.62%, creating value |

| Innovation | Moderate innovation with stable product segments but declining ROIC trend (-51%) indicates challenges | Demonstrates a durable competitive advantage with growing ROIC (+178%), indicating successful innovation |

| Global presence | Strong global footprint with substantial revenues across multiple segments | More niche global presence, smaller revenue base but efficient capital use |

| Market Share | Large market share in premium beauty and skincare sectors but facing profitability pressure | Smaller market share but improving profitability and operational efficiency |

Key takeaways: Estée Lauder offers strong diversification and global reach but is currently challenged by declining profitability and value destruction. Inter Parfums, while smaller and less diversified, shows robust profitability growth and efficient capital deployment, making it a more favorable value creator in the current environment.

Risk Analysis

Below is a comparative table highlighting key risk factors for The Estée Lauder Companies Inc. (EL) and Inter Parfums, Inc. (IPAR) based on the most recent data from 2025 and 2024 respectively:

| Metric | The Estée Lauder Companies Inc. (EL) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| Market Risk | Beta 1.146; moderate market volatility exposure | Beta 1.243; slightly higher market volatility exposure |

| Debt level | Debt-to-Equity 2.44 (unfavorable); High leverage risk | Debt-to-Equity 0.26 (favorable); low leverage risk |

| Regulatory Risk | Moderate; global operations subject to consumer product regulations | Moderate; similar regulatory environment but smaller scale |

| Operational Risk | Large scale, 44K employees; complexity adds operational risk | Smaller scale, 647 employees; lower operational risk |

| Environmental Risk | Moderate; industry pressure on sustainability practices | Moderate; similar industry exposure |

| Geopolitical Risk | Exposure through global supply chains and markets | Exposure through international markets but less extensive |

The most likely and impactful risks stem from The Estée Lauder Companies’ elevated debt levels and operational complexity, increasing financial and execution risks. Inter Parfums benefits from a stronger balance sheet and more favorable leverage but faces similar market and regulatory risks. Investors should weigh EL’s financial vulnerabilities against IPAR’s operational scale when managing risk exposure.

Which Stock to Choose?

The Estée Lauder Companies Inc. (EL) has experienced declining income with negative net margin and return on equity in 2025. Its financial ratios reveal a slightly unfavorable profile, marked by high debt and weak profitability, despite a favorable dividend yield. The company’s value creation analysis indicates it is shedding value with a very unfavorable moat rating and declining ROIC trend, while its credit risk scores place it in a safe zone with average financial strength.

Inter Parfums, Inc. (IPAR) shows a favorable income evolution with positive margins and strong returns on equity and invested capital in 2024. Its financial ratios are very favorable overall, reflecting low debt, solid liquidity, and efficient asset utilization. The company demonstrates a very favorable moat with increasing ROIC and value creation, supported by safe credit risk scores and average Piotroski strength, despite a moderate rating on price-to-book valuation.

For investors prioritizing growth and proven value creation, IPAR’s strong profitability and very favorable financial ratios may appear attractive. Conversely, those focused on dividend yield and navigating transitional phases might find EL’s profile worth monitoring, given its unfavorable financials but safe credit status. Ultimately, the choice could depend on an investor’s risk tolerance and strategy emphasis.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Estée Lauder Companies Inc. and Inter Parfums, Inc. to enhance your investment decisions: