In the dynamic world of household and personal products, The Clorox Company and Inter Parfums, Inc. stand out as prominent players with distinct market approaches. Clorox is a diversified leader in cleaning and wellness, while Inter Parfums specializes in luxury fragrances with a global reach. Both companies showcase innovation and resilience, making them compelling choices. This article will help you decide which one holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between The Clorox Company and Inter Parfums, Inc. by providing an overview of these two companies and their main differences.

The Clorox Company Overview

The Clorox Company manufactures and markets consumer and professional products worldwide, focusing on health and wellness, household, lifestyle, and international segments. Its product portfolio includes cleaning, personal care, and food-related brands such as Clorox, Glad, Brita, and Burt’s Bees. Founded in 1913 and headquartered in Oakland, California, Clorox serves diverse retail channels including mass retailers and e-commerce.

Inter Parfums, Inc. Overview

Inter Parfums, Inc. produces, markets, and distributes fragrances and fragrance-related products globally under prestigious brand names like Coach, Jimmy Choo, and Lanvin. Operating through European and U.S. segments, the company sells primarily to department stores, specialty shops, and online retailers. Established in 1982 and based in New York City, Inter Parfums focuses exclusively on the fragrance and cosmetics market.

Key similarities and differences

Both companies operate in the household and personal products industry within the consumer defensive sector, but Clorox has a broader product range including cleaning, food, and personal care, while Inter Parfums specializes in fragrances and cosmetics. Clorox’s business is diversified across several segments and retail channels, contrasting with Inter Parfums’ focus on luxury fragrance distribution and a smaller employee base. Their market caps also differ significantly, reflecting scale and scope variations.

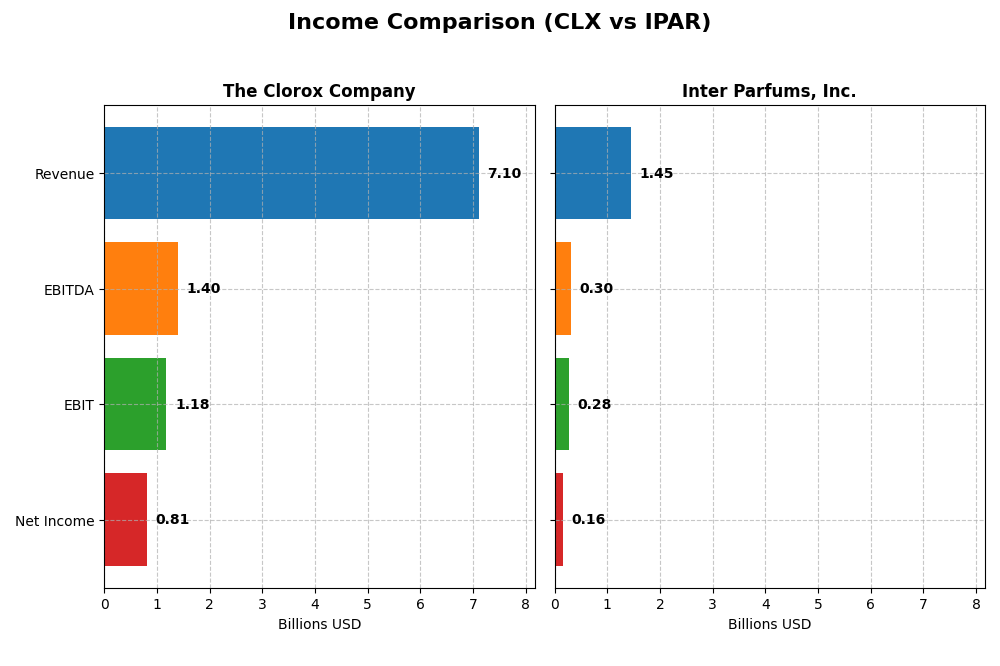

Income Statement Comparison

This table compares key income statement metrics for The Clorox Company and Inter Parfums, Inc. for their most recent fiscal years.

| Metric | The Clorox Company (CLX) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| Market Cap | 13.0B | 2.9B |

| Revenue | 7.1B | 1.45B |

| EBITDA | 1.40B | 305M |

| EBIT | 1.18B | 276M |

| Net Income | 810M | 164M |

| EPS | 6.56 | 5.13 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

The Clorox Company

From 2021 to 2025, The Clorox Company’s revenue remained relatively stable, fluctuating around 7.1B to 7.4B, with a slight decline overall. Net income, however, showed strong improvement, rising from 149M in 2023 to 810M in 2025. Margins improved notably, with the net margin increasing to 11.4% in 2025. The latest year saw earnings growth accelerate despite flat revenue, reflecting enhanced operational efficiency and margin expansion.

Inter Parfums, Inc.

Inter Parfums demonstrated robust revenue growth from 539M in 2020 to 1.45B in 2024, a 169% increase over the period. Net income followed suit, surging over 330% to 164M in 2024. Margins showed strong profitability with a gross margin of 63.85% and a net margin near 11.3%. The most recent fiscal year experienced solid top-line growth of 10.22%, although net margin slightly contracted, suggesting rising operating expenses impacted profitability.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement fundamentals, with strong margins and net income growth. The Clorox Company shows stability in revenue with significant margin improvement and net income acceleration in 2025. Inter Parfums boasts impressive revenue and net income growth over five years but faced a slight net margin dip recently. The choice between them depends on preference for steady margin gains versus high growth dynamics.

Financial Ratios Comparison

Below is a comparison of key financial ratios for The Clorox Company (CLX) and Inter Parfums, Inc. (IPAR), based on their most recent fiscal year data.

| Ratios | The Clorox Company (CLX) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| ROE | 2.52% | 22.07% |

| ROIC | 24.14% | 18.62% |

| P/E | 18.31 | 25.63 |

| P/B | 46.20 | 5.66 |

| Current Ratio | 0.84 | 2.75 |

| Quick Ratio | 0.57 | 1.63 |

| D/E (Debt-to-Equity) | 8.97 | 0.26 |

| Debt-to-Assets | 51.79% | 13.62% |

| Interest Coverage | 11.67 | 35.63 |

| Asset Turnover | 1.28 | 1.03 |

| Fixed Asset Turnover | 4.44 | 8.14 |

| Payout Ratio | 74.32% | 58.42% |

| Dividend Yield | 4.06% | 2.28% |

Interpretation of the Ratios

The Clorox Company

The Clorox Company presents a generally favorable financial profile with strong net margin (11.4%), exceptional return on equity (252.34%), and solid return on invested capital (24.14%). However, liquidity ratios like current (0.84) and quick ratios (0.57) are weak, alongside a high debt-to-equity ratio (8.97) and debt-to-assets at 51.79%, indicating leverage concerns. The company offers a healthy dividend yield of 4.06%, supported by consistent dividends and share buybacks, though leverage risks should be monitored.

Inter Parfums, Inc.

Inter Parfums shows a very favorable ratio set with strong net margin (11.32%), return on equity (22.07%), and return on invested capital (18.62%). Liquidity is excellent with a current ratio of 2.75 and quick ratio of 1.63, alongside low debt-to-equity (0.26) and debt-to-assets (13.62%), reflecting conservative leverage. The dividend yield stands at 2.28%, supported by stable payouts and manageable financial risk, enhancing shareholder returns prudently.

Which one has the best ratios?

Inter Parfums’ ratios appear more robust overall, combining strong profitability, excellent liquidity, and low leverage, which contributes to its very favorable global evaluation. The Clorox Company also shows high profitability but is burdened by weaker liquidity and higher debt levels. Thus, Inter Parfums offers a more balanced financial profile based strictly on ratio analysis.

Strategic Positioning

This section compares the strategic positioning of The Clorox Company and Inter Parfums, Inc., focusing on market position, key segments, and exposure to technological disruption:

The Clorox Company

- Large market cap of 13B with diversified consumer product portfolio facing moderate competitive pressure.

- Operates through four segments: Health and Wellness, Household, Lifestyle, and International.

- Limited explicit exposure to technological disruption mentioned in product or distribution strategies.

Inter Parfums, Inc.

- Smaller market cap of 2.9B, operating in fragrance segment with competitive pressure on NASDAQ.

- Operates two segments: European Based and United States Based Operations focused on fragrances.

- No specific technological disruption exposure indicated in fragrance and cosmetics distribution.

The Clorox Company vs Inter Parfums, Inc. Positioning

The Clorox Company demonstrates a diversified strategic approach across multiple product categories globally, while Inter Parfums focuses on a concentrated fragrance business. Diversification offers risk spreading; concentration allows focused brand management but may increase vulnerability.

Which has the best competitive advantage?

Both companies show a very favorable moat with growing ROIC above WACC, indicating durable competitive advantages and efficient capital use. Clorox’s larger scale contrasts with Inter Parfums’ focused niche, reflecting different but strong competitive moats.

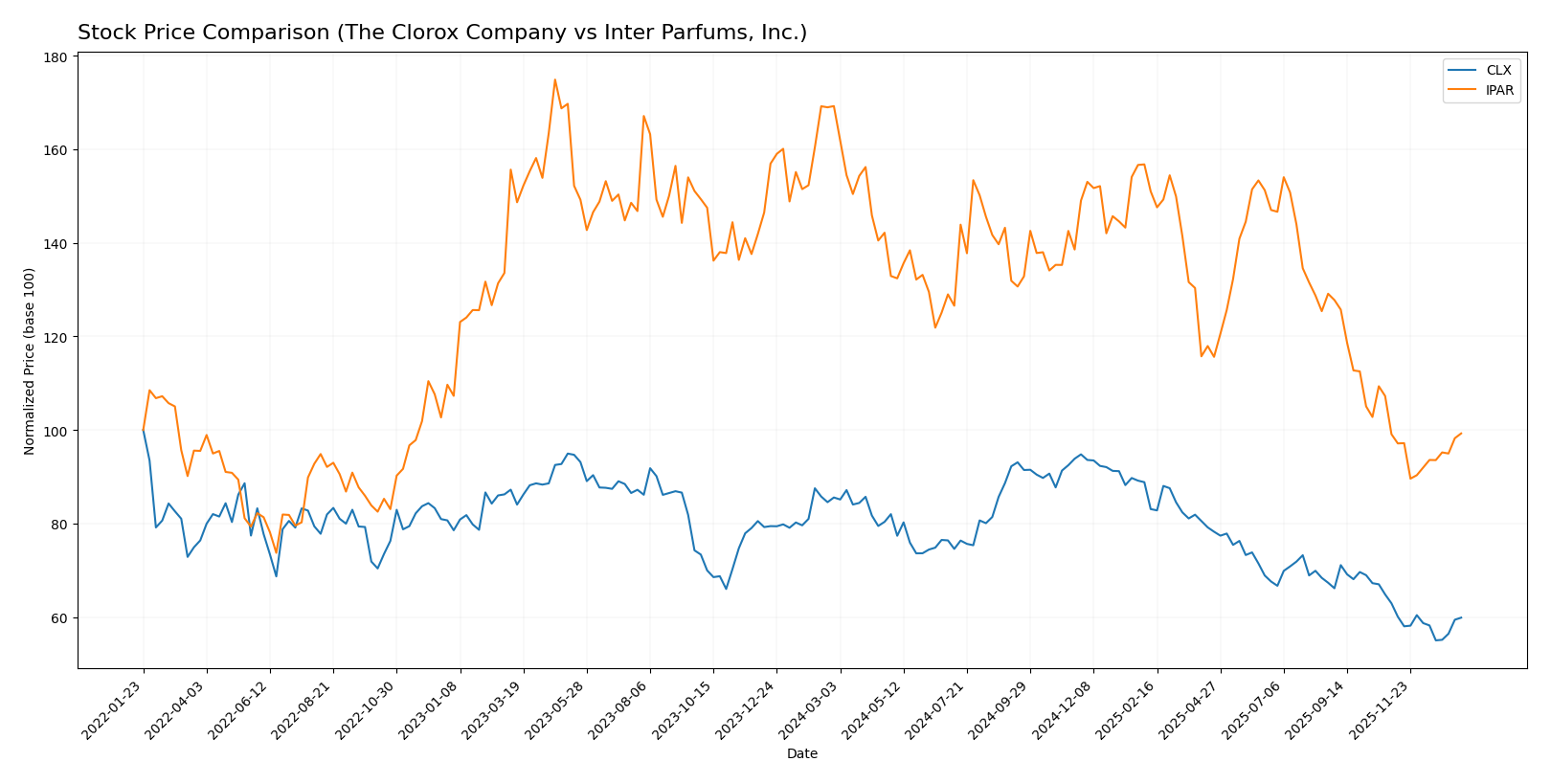

Stock Comparison

The stock prices of The Clorox Company (CLX) and Inter Parfums, Inc. (IPAR) have both exhibited notable bearish trends over the past 12 months, with varying degrees of decline and differing recent trading behaviors.

Trend Analysis

The Clorox Company’s stock declined by 30.01% over the past year, showing a bearish trend with deceleration in the downward movement. It reached a high of 169.3 and a low of 98.31, with significant volatility (std deviation 19.09).

Inter Parfums, Inc. experienced a larger price drop of 41.33% over the same period, also bearish but with accelerating decline. Its highest price was 152.22 and lowest 80.61, with volatility slightly lower than CLX (std deviation 17.11).

Comparing the two, CLX delivered a smaller loss and thus a better market performance than IPAR over the past year, despite both showing bearish trends.

Target Prices

The current analyst consensus for target prices indicates moderate upside potential for both The Clorox Company and Inter Parfums, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Clorox Company | 152 | 94 | 118.33 |

| Inter Parfums, Inc. | 125 | 103 | 114 |

Analysts expect The Clorox Company’s stock, trading at $106.98, to rise toward a consensus target of $118.33. Inter Parfums, currently at $89.30, shows a higher consensus target of $114, suggesting potential appreciation.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for The Clorox Company and Inter Parfums, Inc.:

Rating Comparison

The Clorox Company Rating

- Rating: B-, considered very favorable overall

- Discounted Cash Flow Score: 5, very favorable

- ROE Score: 1, very unfavorable

- ROA Score: 5, very favorable

- Debt To Equity Score: 1, very unfavorable

- Overall Score: 3, moderate

Inter Parfums, Inc. Rating

- Rating: B+, also considered very favorable overall

- Discounted Cash Flow Score: 3, moderate

- ROE Score: 5, very favorable

- ROA Score: 5, very favorable

- Debt To Equity Score: 3, moderate

- Overall Score: 3, moderate

Which one is the best rated?

Inter Parfums holds a higher overall rating (B+) compared to Clorox’s B-. While both share a moderate overall score of 3, Inter Parfums scores better on ROE and debt management, whereas Clorox excels on discounted cash flow and ROA.

Scores Comparison

Here is a comparison of the financial health scores for The Clorox Company and Inter Parfums, Inc.:

CLX Scores

- Altman Z-Score: 3.27, indicating a safe financial zone

- Piotroski Score: 5, reflecting average financial strength

IPAR Scores

- Altman Z-Score: 6.12, indicating a safe financial zone

- Piotroski Score: 5, reflecting average financial strength

Which company has the best scores?

Both companies are in the safe zone based on Altman Z-Scores, with IPAR having a notably higher score. Their Piotroski Scores are identical at an average level, showing similar financial strength on that metric.

Grades Comparison

Below is the comparison of the latest available grades for The Clorox Company and Inter Parfums, Inc.:

The Clorox Company Grades

This table summarizes recent analyst grades from recognized grading companies for The Clorox Company.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2026-01-08 |

| Goldman Sachs | Maintain | Sell | 2026-01-07 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

| JP Morgan | Maintain | Neutral | 2025-11-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-04 |

| Citigroup | Maintain | Neutral | 2025-11-04 |

| JP Morgan | Maintain | Neutral | 2025-10-10 |

| Citigroup | Maintain | Neutral | 2025-10-09 |

The overall trend for The Clorox Company grades is neutral to hold, indicating a cautious stance from analysts with no significant upgrades or downgrades recently.

Inter Parfums, Inc. Grades

This table summarizes recent analyst grades from recognized grading companies for Inter Parfums, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BWS Financial | Downgrade | Neutral | 2025-11-21 |

| Canaccord Genuity | Maintain | Buy | 2025-11-19 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Jefferies | Maintain | Buy | 2025-10-28 |

| BWS Financial | Maintain | Buy | 2025-10-22 |

| Canaccord Genuity | Maintain | Buy | 2025-10-21 |

| BWS Financial | Maintain | Buy | 2025-05-07 |

| Piper Sandler | Maintain | Overweight | 2025-04-24 |

| DA Davidson | Maintain | Buy | 2025-03-25 |

| BWS Financial | Maintain | Buy | 2025-03-17 |

Inter Parfums shows a strong buying consensus with mostly buy and overweight recommendations, despite a recent downgrade to neutral by BWS Financial.

Which company has the best grades?

Inter Parfums, Inc. holds a stronger consensus with predominant buy and overweight grades, compared to The Clorox Company’s mostly neutral and hold recommendations. This suggests Inter Parfums may be viewed more favorably by analysts, potentially influencing investors toward higher expected growth or value.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for The Clorox Company (CLX) and Inter Parfums, Inc. (IPAR) based on the most recent financial and operational data.

| Criterion | The Clorox Company (CLX) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| Diversification | Highly diversified with multiple segments: Health & Wellness (2.7B), Household (2.0B), International (1.1B), Lifestyle (1.3B) | Limited diversification, primarily focused on FranceMember segment (37.6M) |

| Profitability | Strong profitability with net margin 11.4%, ROIC 24.14%, and ROE 252.34% | Solid profitability: net margin 11.32%, ROIC 18.62%, ROE 22.07% |

| Innovation | Moderate innovation with steady revenue growth in lifestyle and health segments | High ROIC growth (178%), indicating strong innovation and efficient capital use |

| Global presence | Significant international revenue (1.1B) contributing to global footprint | Limited global presence, mainly France-focused with smaller sales volume |

| Market Share | Large market share in consumer goods with durable competitive advantage (Very Favorable MOAT) | Smaller market share but with a durable competitive advantage and very favorable MOAT |

Key takeaways: The Clorox Company benefits from broad diversification across product lines and geographies, delivering strong profitability and a very favorable competitive moat. Inter Parfums, while less diversified and smaller in scale, shows impressive return on invested capital growth and maintains a very favorable moat, reflecting efficient management and innovation in its niche market.

Risk Analysis

Below is a table summarizing key risks for The Clorox Company (CLX) and Inter Parfums, Inc. (IPAR) based on the most recent data available:

| Metric | The Clorox Company (CLX) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| Market Risk | Low beta (0.575) indicates lower volatility, but consumer staples sector exposure limits growth potential | Higher beta (1.243) means more sensitivity to market swings, increasing volatility risk |

| Debt level | High debt-to-assets ratio (51.79%) and high debt/equity (8.97), indicating elevated leverage and financial risk | Low debt-to-assets (13.62%) and low debt/equity (0.26), reflecting conservative leverage |

| Regulatory Risk | Moderate, due to global operations and product safety regulations | Moderate, with regulations on cosmetics and fragrances internationally |

| Operational Risk | Diversified product portfolio reduces risk, but supply chain disruptions can impact | Dependence on brand licensing and retail channels poses risk if relationships sour |

| Environmental Risk | Increasing pressure for sustainable packaging and chemical usage; potential cost implications | Sustainability initiatives in sourcing and packaging needed to meet market expectations |

| Geopolitical Risk | Moderate, with international sales sensitive to trade policies and currency fluctuations | Moderate, exposure to international markets with some geopolitical uncertainties |

Clorox’s key risks stem from its high leverage and exposure to regulatory and environmental pressures, which could impact costs. Inter Parfums faces higher market volatility but benefits from low debt and strong operational focus, though brand dependency is a concern. Investors should monitor leverage and regulatory developments closely.

Which Stock to Choose?

The Clorox Company (CLX) shows a mostly favorable income evolution with a modest 0.16% revenue growth in the last year but a -3.23% decline over five years. Its profitability metrics, including an 11.4% net margin and strong ROIC of 24.14%, suggest efficient capital use despite some unfavorable liquidity and leverage ratios. The company holds a very favorable overall rating of B- with a moderate score on financial stability and a safe zone Altman Z-Score.

Inter Parfums, Inc. (IPAR) demonstrates a favorable income trajectory with a 10.22% revenue growth last year and a robust 169.44% increase over the longer term. Profitability is solid, with an 11.32% net margin and a very favorable rating of B+, supported by strong liquidity, low debt levels, and a very favorable ROIC. Its financial health is also affirmed by a safe zone Altman Z-Score and a very favorable global ratios evaluation.

For investors prioritizing durable competitive advantages and efficient capital use, both companies exhibit very favorable moats with growing ROICs. Growth-oriented investors might find IPAR’s robust revenue and net income expansion more appealing, while those valuing stability and strong cash flow generation could lean towards CLX’s consistent profitability and dividend yield. The choice could therefore depend on whether one favors higher growth potential or financial steadiness.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Clorox Company and Inter Parfums, Inc. to enhance your investment decisions: