In the competitive world of household and personal products, Inter Parfums, Inc. (IPAR) and Spectrum Brands Holdings, Inc. (SPB) stand out with distinct yet overlapping market footprints. While Inter Parfums focuses on luxury fragrances and cosmetics, Spectrum Brands offers a diverse portfolio spanning personal care, pet care, and home products. This article will analyze both companies’ strategies and performance to help you decide which stock could best enhance your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Inter Parfums, Inc. and Spectrum Brands Holdings, Inc. by providing an overview of these two companies and their main differences.

Inter Parfums, Inc. Overview

Inter Parfums, Inc. manufactures and markets fragrances and related products globally. Its portfolio includes luxury brands such as Coach, Jimmy Choo, and Montblanc. Operating through European and U.S. segments, the company distributes products to department stores, specialty retailers, and online platforms. Headquartered in New York, Inter Parfums has a market cap of approximately 2.87B USD and employs around 647 people.

Spectrum Brands Holdings, Inc. Overview

Spectrum Brands Holdings, Inc. is a diversified consumer products company with three segments: Home and Personal Care, Global Pet Care, and Home and Garden. It markets brands like Black & Decker, Remington, and Tetra. The company sells through retailers, wholesalers, and e-commerce channels worldwide. Based in Middleton, Wisconsin, Spectrum Brands has a market cap near 1.53B USD and employs about 3,100 people.

Key similarities and differences

Both companies operate within the household and personal products industry, serving global markets through multiple sales channels including e-commerce. Inter Parfums focuses on fragrances and cosmetics with a luxury brand portfolio, while Spectrum Brands offers a broader product range across home care, pet care, and garden segments. Spectrum’s workforce is significantly larger, reflecting its diversified business model compared to Inter Parfums’ specialized product focus.

Income Statement Comparison

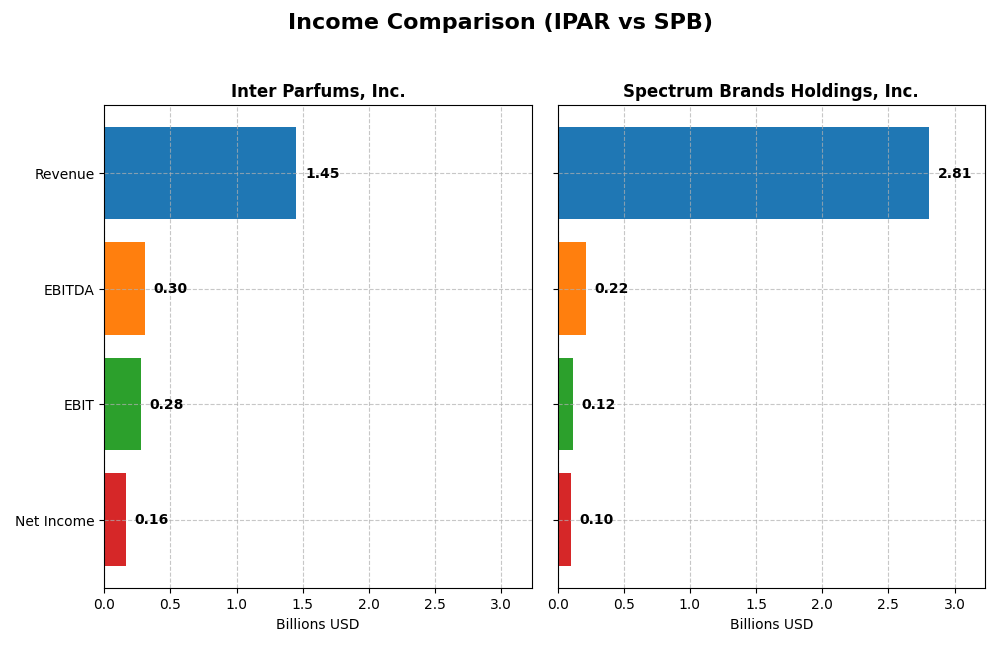

The table below presents the latest fiscal year income statement data for Inter Parfums, Inc. and Spectrum Brands Holdings, Inc., enabling a straightforward financial comparison.

| Metric | Inter Parfums, Inc. (IPAR) | Spectrum Brands Holdings, Inc. (SPB) |

|---|---|---|

| Market Cap | 2.87B | 1.53B |

| Revenue | 1.45B | 2.81B |

| EBITDA | 305M | 215M |

| EBIT | 276M | 117M |

| Net Income | 164M | 100M |

| EPS | 5.13 | 3.88 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Inter Parfums, Inc.

Inter Parfums has demonstrated strong growth in revenue and net income from 2020 to 2024, with revenue rising from $539M to $1.45B and net income increasing from $38M to $164M. Margins remain robust, with a gross margin of 63.85% and net margin at 11.32% in 2024. The latest year saw revenue growth slow slightly to 10.22%, while earnings per share rose 7.79%, indicating margin improvements despite a minor net margin decline.

Spectrum Brands Holdings, Inc.

Spectrum Brands experienced declining revenue and net income over the 2021-2025 period, with revenue dropping from $3.0B to $2.81B and net income falling from $190M to $100M. Gross margin remains moderate at 36.74%, but EBIT and net margins are low at 4.17% and 3.56%, respectively. The most recent year showed a 5.23% revenue decrease and a 15.54% net margin decline, reflecting ongoing operational challenges and margin pressure.

Which one has the stronger fundamentals?

Inter Parfums exhibits stronger fundamentals with consistent revenue and net income growth, high and stable margins, and a favorable income statement evaluation covering 85.71% positive indicators. In contrast, Spectrum Brands shows unfavorable trends in revenue, net income, and margin growth, with only 14.29% favorable income indicators. The divergent trajectories highlight Inter Parfums’ comparatively better financial health and performance stability.

Financial Ratios Comparison

This table presents a side-by-side comparison of key financial ratios for Inter Parfums, Inc. (IPAR) and Spectrum Brands Holdings, Inc. (SPB) based on the most recent full fiscal year data available.

| Ratios | Inter Parfums, Inc. (2024) | Spectrum Brands Holdings, Inc. (2025) |

|---|---|---|

| ROE | 22.1% | 5.2% |

| ROIC | 18.6% | 4.9% |

| P/E | 25.6 | 13.5 |

| P/B | 5.7 | 0.7 |

| Current Ratio | 2.75 | 2.26 |

| Quick Ratio | 1.63 | 1.41 |

| D/E (Debt-to-Equity) | 0.26 | 0.34 |

| Debt-to-Assets | 13.6% | 19.4% |

| Interest Coverage | 35.6 | 4.2 |

| Asset Turnover | 1.03 | 0.83 |

| Fixed Asset Turnover | 8.14 | 8.55 |

| Payout Ratio | 58.4% | 48.2% |

| Dividend Yield | 2.28% | 3.57% |

Interpretation of the Ratios

Inter Parfums, Inc.

Inter Parfums shows predominantly strong financial ratios with favorable net margin at 11.32%, ROE at 22.07%, and ROIC at 18.62%, indicating efficient profitability and capital use. Its current and quick ratios suggest solid liquidity, while debt levels and interest coverage are also favorable, confirming prudent leverage management. The company pays a dividend with a 2.28% yield, supported by stable free cash flow, reflecting sustainable shareholder returns.

Spectrum Brands Holdings, Inc.

Spectrum Brands presents mixed ratios with unfavorable profitability metrics: net margin at 3.56%, ROE at 5.23%, and ROIC at 4.95%, suggesting weaker earnings efficiency. Liquidity and leverage ratios remain favorable, with a low debt-to-assets ratio and current ratio above 2. The dividend yield is higher at 3.57%, but interest coverage is neutral, pointing to moderate risk in meeting interest obligations. The payout appears balanced yet warrants monitoring due to modest profitability.

Which one has the best ratios?

Inter Parfums exhibits a higher proportion of favorable ratios, especially in profitability and return measures, compared to Spectrum Brands’ weaker earnings performance and moderate risk indicators. While both companies maintain sound liquidity and manageable debt, Inter Parfums’ stronger operational efficiency and sustainable dividend coverage suggest it holds the superior ratio profile overall.

Strategic Positioning

This section compares the strategic positioning of Inter Parfums, Inc. and Spectrum Brands Holdings, Inc. in terms of market position, key segments, and exposure to technological disruption:

Inter Parfums, Inc.

- Mid-cap player in household products facing moderate competition on NASDAQ.

- Operates two segments focusing on fragrances marketed globally under many luxury brands.

- Limited information on technological disruption exposure.

Spectrum Brands Holdings, Inc.

- Smaller market cap on NYSE with lower beta, facing diverse competition.

- Three diversified segments: Home & Personal Care, Pet Supplies, Home & Garden.

- No explicit details on technological disruption exposure provided.

Inter Parfums, Inc. vs Spectrum Brands Holdings, Inc. Positioning

Inter Parfums is concentrated in fragrance products with global luxury branding, while Spectrum Brands has a diversified portfolio across household, pet, and garden products. Inter Parfums’ niche focus contrasts with Spectrum’s broad market approach, each with distinct scale and segment specialization.

Which has the best competitive advantage?

Inter Parfums demonstrates a very favorable moat with strong value creation and growing ROIC, indicating durable competitive advantage. Spectrum Brands shows slightly unfavorable moat status with negative value creation despite improving profitability.

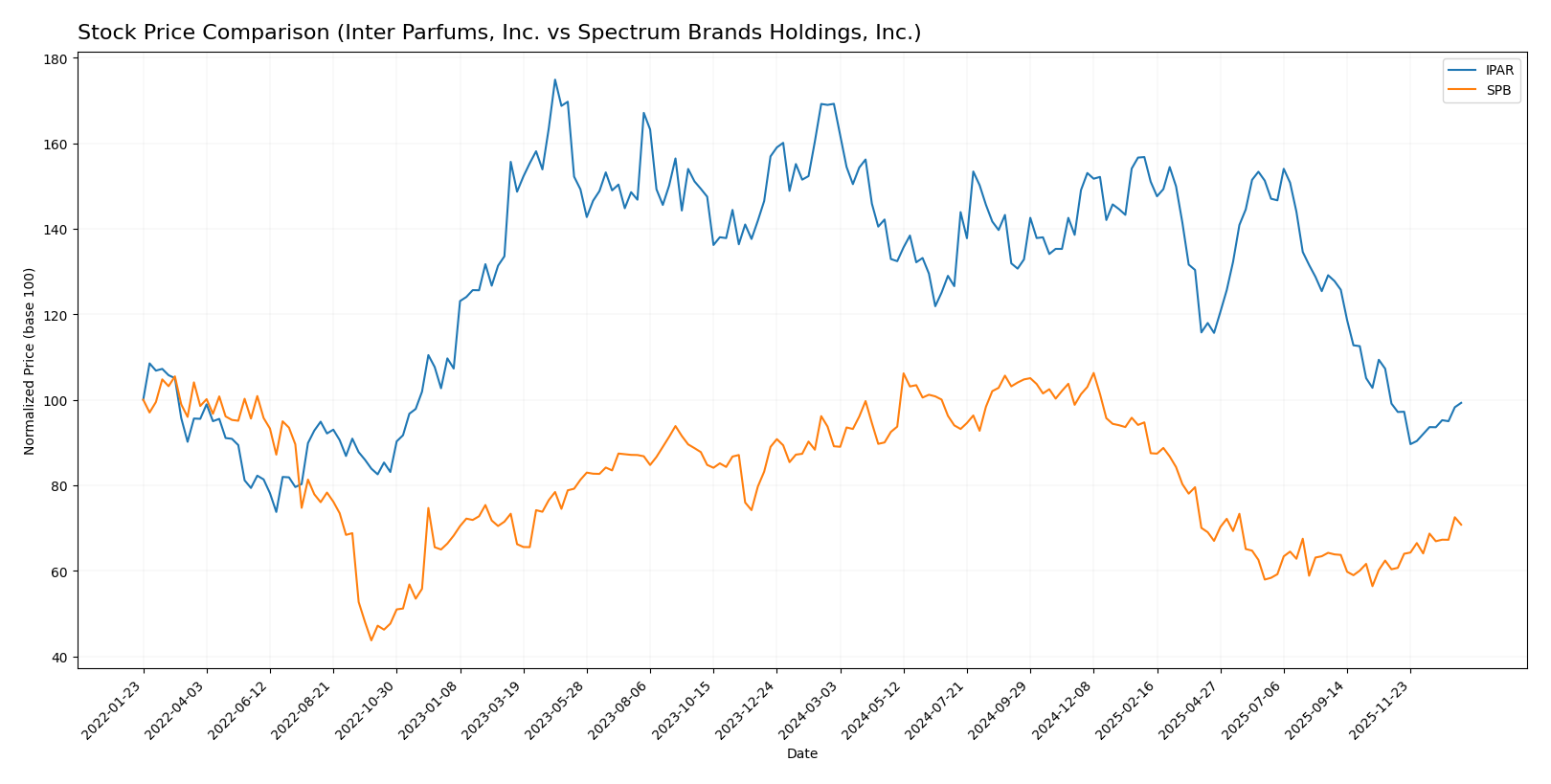

Stock Comparison

The stock price movements of Inter Parfums, Inc. (IPAR) and Spectrum Brands Holdings, Inc. (SPB) over the past 12 months reveal distinct bearish trends with accelerating declines, while recent months show contrasting momentum shifts in their trading dynamics.

Trend Analysis

Inter Parfums, Inc. (IPAR) experienced a significant bearish trend over the past year, with a price decline of 41.33%, marked by accelerating downward momentum and high volatility (std deviation 17.11). The stock hit a high of 152.22 and a low of 80.61.

Spectrum Brands Holdings, Inc. (SPB) also faced a bearish trend over the same period, showing a 20.57% price decline with accelerating losses and notable volatility (std deviation 15.02). The stock ranged between 94.88 at its peak and 50.35 at its lowest point.

Comparing the two, SPB delivered the higher market performance over the past year with a smaller percentage decline than IPAR, while recent trends show SPB gaining positive momentum unlike the near-neutral recent trend of IPAR.

Target Prices

Analysts present a clear target consensus for Inter Parfums, Inc. and Spectrum Brands Holdings, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Inter Parfums, Inc. | 125 | 103 | 114 |

| Spectrum Brands Holdings, Inc. | 75 | 75 | 75 |

For Inter Parfums, the consensus target price of 114 suggests potential upside from the current price of 89.3. Spectrum Brands’ target price of 75 also indicates room for growth compared to its current price of 63.2. Overall, analysts expect moderate appreciation for both stocks.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Inter Parfums, Inc. and Spectrum Brands Holdings, Inc.:

Rating Comparison

IPAR Rating

- Rating: B+ with a very favorable status

- Discounted Cash Flow Score: 3, moderate valuation

- ROE Score: 5, very favorable efficiency

- ROA Score: 5, very favorable asset utilization

- Debt To Equity Score: 3, moderate financial risk

- Overall Score: 3, moderate overall assessment

SPB Rating

- Rating: B with a very favorable status

- Discounted Cash Flow Score: 1, very unfavorable value

- ROE Score: 2, moderate efficiency

- ROA Score: 3, moderate asset utilization

- Debt To Equity Score: 3, moderate financial risk

- Overall Score: 3, moderate overall assessment

Which one is the best rated?

Based on provided data, IPAR holds a slightly higher rating (B+ vs. B) with stronger ROE and ROA scores, indicating better profitability and asset use. Both companies share the same overall and debt-to-equity scores, but SPB’s DCF score is notably weaker.

Scores Comparison

The scores comparison between Inter Parfums, Inc. and Spectrum Brands Holdings, Inc. is as follows:

IPAR Scores

- Altman Z-Score: 6.12, safe zone, indicating low bankruptcy risk

- Piotroski Score: 5, average financial strength

SPB Scores

- Altman Z-Score: 1.77, distress zone, indicating high bankruptcy risk

- Piotroski Score: 6, average financial strength

Which company has the best scores?

Based on the provided data, IPAR has a significantly higher Altman Z-Score, placing it in the safe zone, while SPB is in the distress zone. Both have average Piotroski Scores, with SPB slightly higher. Overall, IPAR’s scores indicate stronger financial stability.

Grades Comparison

Here is a comparison of the recent grades assigned to Inter Parfums, Inc. and Spectrum Brands Holdings, Inc.:

Inter Parfums, Inc. Grades

The table below shows recent grades and rating actions from reputable grading companies for Inter Parfums, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BWS Financial | Downgrade | Neutral | 2025-11-21 |

| Canaccord Genuity | Maintain | Buy | 2025-11-19 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Jefferies | Maintain | Buy | 2025-10-28 |

| BWS Financial | Maintain | Buy | 2025-10-22 |

| Canaccord Genuity | Maintain | Buy | 2025-10-21 |

| BWS Financial | Maintain | Buy | 2025-05-07 |

| Piper Sandler | Maintain | Overweight | 2025-04-24 |

| DA Davidson | Maintain | Buy | 2025-03-25 |

| BWS Financial | Maintain | Buy | 2025-03-17 |

Overall, Inter Parfums mostly maintains a “Buy” grade with a recent slight downgrade to “Neutral” by one firm, indicating a generally positive but cautious sentiment.

Spectrum Brands Holdings, Inc. Grades

The table below shows recent grades and rating actions from reputable grading companies for Spectrum Brands Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Canaccord Genuity | Maintain | Buy | 2025-11-17 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-14 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-25 |

| Canaccord Genuity | Maintain | Buy | 2025-08-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-07-09 |

| Canaccord Genuity | Maintain | Buy | 2025-06-25 |

| UBS | Maintain | Buy | 2025-05-09 |

| UBS | Maintain | Buy | 2025-04-17 |

| Wells Fargo | Maintain | Equal Weight | 2025-04-16 |

| Wells Fargo | Maintain | Equal Weight | 2025-04-02 |

Spectrum Brands shows consistent “Buy” and “Equal Weight” ratings, reflecting a balanced but positive outlook from analysts.

Which company has the best grades?

Both companies hold a consensus “Buy” rating, but Inter Parfums, Inc. shows a stronger bias toward “Buy” grades with minimal downgrades, whereas Spectrum Brands Holdings, Inc. has a mix of “Buy” and “Equal Weight” ratings. This suggests investors may perceive Inter Parfums as having slightly higher conviction from analysts, potentially impacting portfolio positioning and risk appetite.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Inter Parfums, Inc. (IPAR) and Spectrum Brands Holdings, Inc. (SPB) based on their latest available data:

| Criterion | Inter Parfums, Inc. (IPAR) | Spectrum Brands Holdings, Inc. (SPB) |

|---|---|---|

| Diversification | Narrow focus on fragrances and perfumes, limiting diversification | Broad product portfolio: pet supplies, home & personal care, home & garden |

| Profitability | High net margin (11.32%), ROIC 18.62%, strong value creation | Low net margin (3.56%), ROIC 4.95%, currently shedding value |

| Innovation | Demonstrates durable competitive advantage with growing ROIC | Improving ROIC trend but still below cost of capital |

| Global presence | Solid presence, but more niche and specialized | Extensive global exposure across multiple consumer segments |

| Market Share | Strong in luxury fragrance niche | Market share spread across diverse consumer goods markets |

In summary, IPAR shows strong profitability and a durable moat within its niche fragrance market, making it a value creator with efficient capital use. SPB has a more diversified business and global reach but struggles with profitability and value creation despite improving returns. Investors should weigh IPAR’s focused strength against SPB’s broader but currently less profitable portfolio.

Risk Analysis

Below is a comparative table summarizing key risks for Inter Parfums, Inc. (IPAR) and Spectrum Brands Holdings, Inc. (SPB) based on the most recent data from 2025-2026:

| Metric | Inter Parfums, Inc. (IPAR) | Spectrum Brands Holdings, Inc. (SPB) |

|---|---|---|

| Market Risk | Beta 1.24 indicates moderate volatility; PE ratio high at 25.6, suggesting sensitivity to market sentiment | Beta 0.68 reflects lower volatility; PE ratio 13.5 more attractive, but recent stock price decline (-2.4%) increases market risk |

| Debt level | Low debt-to-equity ratio (0.26), strong interest coverage (35.3x) indicates low financial leverage risk | Moderate debt-to-equity (0.34) with weaker interest coverage (3.9x) signals higher debt servicing risk |

| Regulatory Risk | Operating internationally with luxury brands, exposure to changing trade policies and cosmetics regulations | Diverse global product lines increase regulatory complexity, especially in pet care and pesticides |

| Operational Risk | Concentrated on fragrance segment with strong brand portfolio but reliant on department and specialty store sales | Broader segments (Home, Pet Care, Garden) diversify operational risks but require complex supply chain management |

| Environmental Risk | Moderate, given cosmetic industry scrutiny on sustainability and packaging waste | Higher risk due to chemical products and pesticides with stricter environmental regulations |

| Geopolitical Risk | Exposure to European and US markets; moderate risk from trade tensions and currency fluctuations | Similar exposure with added risk from global supply chain disruptions impacting multiple segments |

The most significant risks for IPAR include market volatility influenced by premium valuation and regulatory compliance in cosmetics abroad. For SPB, debt levels combined with environmental regulatory pressures and recent stock volatility pose the greatest challenges. Both companies require vigilance on geopolitical factors affecting international operations.

Which Stock to Choose?

Inter Parfums, Inc. (IPAR) shows strong income growth with a 10.22% revenue increase in 2024 and favorable profitability metrics, including an 11.32% net margin and 22.07% ROE. Its debt levels are low with a net debt to EBITDA of 0.22, and it holds a very favorable overall rating of B+.

Spectrum Brands Holdings, Inc. (SPB) reports declining income with a -5.23% revenue drop in 2025 and weaker profitability, as seen in its 3.56% net margin and 5.23% ROE. The company carries higher leverage, with net debt to EBITDA at 2.47, but maintains a favorable rating of B.

For investors prioritizing financial strength and durable competitive advantage, IPAR’s very favorable rating, superior income growth, and strong financial ratios could be seen as more attractive. Conversely, SPB might appeal to those valuing current valuation metrics and dividend yield despite its unfavorable income trends and higher debt. The choice may depend on whether an investor favors growth and quality or looks for different risk and value profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Inter Parfums, Inc. and Spectrum Brands Holdings, Inc. to enhance your investment decisions: