Kenvue Inc. and Inter Parfums, Inc. are two prominent players in the Household & Personal Products industry, yet they serve distinct niches—from consumer health to luxury fragrances. Kenvue focuses on broad-based health and beauty essentials, while Inter Parfums excels in high-end fragrance markets with global reach. This comparison explores their innovation strategies and market positions to help you decide which company offers the most promising investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Kenvue Inc. and Inter Parfums, Inc. by providing an overview of these two companies and their main differences.

Kenvue Overview

Kenvue Inc. is a global consumer health company operating through three segments: Self Care, Skin Health and Beauty, and Essential Health. It offers well-known brands such as Tylenol, Neutrogena, and Band-Aid. Headquartered in Skillman, New Jersey, Kenvue is a subsidiary of Johnson & Johnson and focuses on household and personal products within the consumer defensive sector. The company employs 22,000 people and was incorporated in 2022.

Inter Parfums Overview

Inter Parfums, Inc. manufactures and distributes fragrances and related products globally, operating through European and U.S.-based segments. Its portfolio includes luxury brands like Coach, Jimmy Choo, and Lanvin. Founded in 1982 and headquartered in New York City, Inter Parfums serves department stores, specialty shops, and e-commerce. It employs 647 people and is listed on the NASDAQ under the consumer defensive sector.

Key similarities and differences

Both companies operate in the household and personal products industry within the consumer defensive sector in the U.S. However, Kenvue is focused on health and beauty products spanning multiple segments and operates as a large subsidiary of Johnson & Johnson, while Inter Parfums specializes in luxury fragrances with a smaller workforce. Kenvue has a lower stock beta, indicating less volatility compared to Inter Parfums, reflecting differences in market positioning and business models.

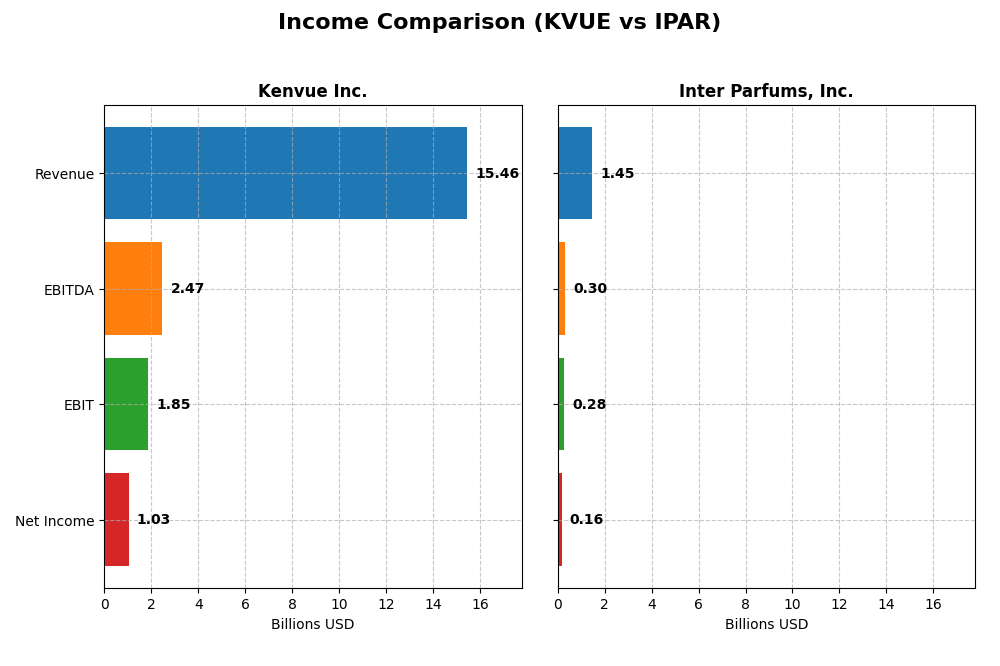

Income Statement Comparison

The table below compares key income statement metrics for Kenvue Inc. and Inter Parfums, Inc. for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | Kenvue Inc. (KVUE) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| Market Cap | 32.6B | 2.87B |

| Revenue | 15.5B | 1.45B |

| EBITDA | 2.47B | 305M |

| EBIT | 1.85B | 276M |

| Net Income | 1.03B | 164M |

| EPS | 0.54 | 5.13 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Kenvue Inc.

Kenvue’s revenue showed modest growth from $14.5B in 2020 to $15.45B in 2024, with net income recovering from a loss in 2020 to $1.03B in 2024. Margins remained favorable overall, though net margin and EBIT margin declined sharply in 2024. The most recent year saw slowed revenue growth and a significant drop in profitability metrics, signaling margin pressure.

Inter Parfums, Inc.

Inter Parfums experienced strong revenue growth from $539M in 2020 to $1.45B in 2024, with net income rising steadily to $164M. Margins improved, maintaining a favorable gross margin near 64% and an EBIT margin above 19%. In 2024, revenue and EBIT both grew, although net margin slightly contracted, reflecting mixed cost efficiencies despite top-line strength.

Which one has the stronger fundamentals?

Inter Parfums exhibits stronger fundamentals with consistently favorable margin improvements, higher revenue and net income growth, and better profitability ratios. Kenvue, while showing overall income growth since 2020, faced margin deterioration and earnings decline in the latest year. Inter Parfums’ superior margin stability and growth metrics suggest comparatively more robust income statement fundamentals.

Financial Ratios Comparison

This table presents the most recent financial ratios for Kenvue Inc. and Inter Parfums, Inc., offering a side-by-side view of their key performance indicators as of fiscal year 2024.

| Ratios | Kenvue Inc. (KVUE) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| ROE | 10.7% | 22.1% |

| ROIC | 6.2% | 18.6% |

| P/E | 39.4 | 25.6 |

| P/B | 4.20 | 5.66 |

| Current Ratio | 0.96 | 2.75 |

| Quick Ratio | 0.69 | 1.63 |

| D/E (Debt-to-Equity) | 0.90 | 0.26 |

| Debt-to-Assets | 34.1% | 13.6% |

| Interest Coverage | 4.27 | 35.6 |

| Asset Turnover | 0.60 | 1.03 |

| Fixed Asset Turnover | 8.36 | 8.14 |

| Payout Ratio | 151% | 58.4% |

| Dividend Yield | 3.83% | 2.28% |

Interpretation of the Ratios

Kenvue Inc.

Kenvue shows a mixed ratio profile with a slightly unfavorable global opinion. Key concerns include a high price-to-earnings ratio of 39.38 and weak liquidity indicated by a current ratio below 1. Dividend yield is favorable at 3.83%, suggesting solid shareholder returns, yet payout sustainability should be monitored given some unfavorable financial leverage and valuation metrics.

Inter Parfums, Inc.

Inter Parfums exhibits strong financial ratios, with favorable returns on equity (22.07%) and invested capital (18.62%). Liquidity ratios are robust, and interest coverage is high at 35.3, indicating good debt management. Dividend yield stands at 2.28%, supported by solid free cash flow, reflecting prudent shareholder return policies and financial health.

Which one has the best ratios?

Inter Parfums holds the advantage with broadly favorable ratios spanning profitability, liquidity, and solvency, contributing to a very favorable overall assessment. Kenvue’s ratios are more mixed, with noteworthy liquidity and valuation concerns, resulting in a slightly unfavorable view. Thus, Inter Parfums shows stronger financial health based on these metrics.

Strategic Positioning

This section compares the strategic positioning of Kenvue Inc. and Inter Parfums, Inc., including market position, key segments, and exposure to disruption:

Kenvue Inc.

- Large market cap (32.6B), lower beta (0.55), faces broad consumer defensive competition.

- Diversified segments: Self Care, Skin Health & Beauty, Essential Health driving revenues.

- Operates in consumer health; limited explicit exposure to tech disruption indicated.

Inter Parfums, Inc.

- Smaller market cap (2.9B), higher beta (1.24), competes in niche fragrance segment with global reach.

- Concentrated in fragrances and cosmetics, operating mainly through US and European segments.

- Focuses on fragrance products; no direct technological disruption mentioned.

Kenvue Inc. vs Inter Parfums, Inc. Positioning

Kenvue has a diversified portfolio across multiple health and personal care segments, providing broad exposure but potential complexity. Inter Parfums is concentrated in fragrances, offering focused market presence but higher segment risk. Both operate in consumer defensive industries.

Which has the best competitive advantage?

Inter Parfums shows a very favorable moat with value creation and growing ROIC, indicating a durable competitive advantage. Kenvue’s moat is slightly favorable with growing profitability but currently shedding value relative to capital costs.

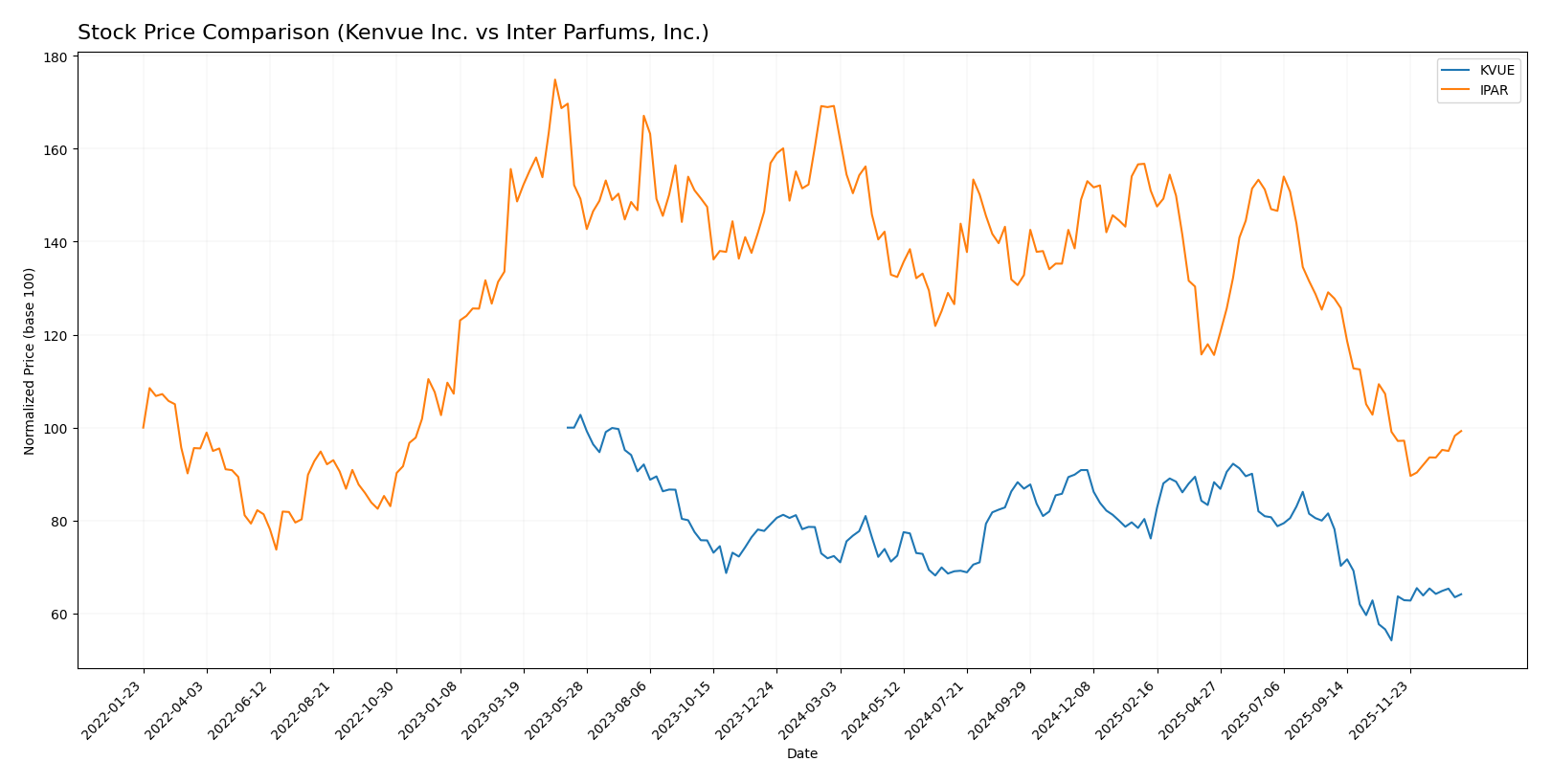

Stock Comparison

The stock price movements of Kenvue Inc. and Inter Parfums, Inc. over the past 12 months reveal significant bearish trends with notable price fluctuations and distinct recent trading dynamics.

Trend Analysis

Kenvue Inc. experienced an overall bearish trend with an 11.37% price decline over the past year, showing acceleration and moderate volatility with a standard deviation of 2.47. Its recent trend reversed positively by 18.3% from November 2025 to January 2026.

Inter Parfums, Inc. faced a sharper bearish trend, with a 41.33% price drop and higher volatility marked by a standard deviation of 17.11 over the last 12 months. Its recent trend remained nearly flat with a 0.17% increase and moderate volatility.

Comparing the two, Kenvue Inc. outperformed Inter Parfums with a smaller annual decline and a stronger recent recovery, delivering higher market performance during the analyzed periods.

Target Prices

Analysts provide a clear target price consensus for Kenvue Inc. and Inter Parfums, Inc., indicating expected price ranges and averages.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Kenvue Inc. | 23 | 15 | 18.57 |

| Inter Parfums, Inc. | 125 | 103 | 114 |

For Kenvue Inc., the consensus target price of 18.57 is slightly above the current stock price of 17, suggesting moderate upside potential. Inter Parfums shows a stronger upside, with a consensus target of 114 well above its current price of 89.3.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Kenvue Inc. and Inter Parfums, Inc.:

Rating Comparison

Kenvue Inc. Rating

- Rating: B+, considered Very Favorable

- Discounted Cash Flow Score: 4, indicating Favorable DCF

- ROE Score: 4, Favorable return on equity performance

- ROA Score: 4, Favorable asset utilization

- Debt To Equity Score: 2, Moderate financial leverage

- Overall Score: 3, Moderate overall financial standing

Inter Parfums, Inc. Rating

- Rating: B+, considered Very Favorable

- Discounted Cash Flow Score: 3, indicating Moderate DCF

- ROE Score: 5, Very Favorable return on equity performance

- ROA Score: 5, Very Favorable asset utilization

- Debt To Equity Score: 3, Moderate financial leverage

- Overall Score: 3, Moderate overall financial standing

Which one is the best rated?

Both Kenvue and Inter Parfums share the same overall rating of B+ and a moderate overall score of 3. Inter Parfums scores higher in ROE and ROA, while Kenvue leads in discounted cash flow and has a slightly better debt-to-equity score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Kenvue Inc. and Inter Parfums, Inc.:

Kenvue Scores

- Altman Z-Score: 1.95, in the grey zone, indicating moderate bankruptcy risk.

- Piotroski Score: 5, an average financial strength score.

Inter Parfums Scores

- Altman Z-Score: 6.12, in the safe zone, indicating low bankruptcy risk.

- Piotroski Score: 5, an average financial strength score.

Which company has the best scores?

Inter Parfums has a clearly stronger Altman Z-Score indicating better financial stability, while both companies share the same average Piotroski Score. Based on these scores, Inter Parfums shows a lower risk profile.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Kenvue Inc. and Inter Parfums, Inc.:

Kenvue Inc. Grades

The following table summarizes recent grades from reputable financial institutions for Kenvue Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2025-11-10 |

| Canaccord Genuity | Downgrade | Hold | 2025-10-29 |

| Jefferies | Maintain | Buy | 2025-10-27 |

| JP Morgan | Maintain | Overweight | 2025-10-10 |

| Citigroup | Maintain | Neutral | 2025-10-09 |

| B of A Securities | Maintain | Buy | 2025-10-08 |

| UBS | Maintain | Neutral | 2025-10-08 |

| Goldman Sachs | Maintain | Neutral | 2025-10-02 |

| Barclays | Maintain | Equal Weight | 2025-10-01 |

| Rothschild & Co | Upgrade | Buy | 2025-09-26 |

Kenvue’s grades show a mixed but generally moderate outlook, with several institutions maintaining hold or neutral positions and a few upgrades to buy.

Inter Parfums, Inc. Grades

The following table summarizes recent grades from reputable financial institutions for Inter Parfums, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BWS Financial | Downgrade | Neutral | 2025-11-21 |

| Canaccord Genuity | Maintain | Buy | 2025-11-19 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Jefferies | Maintain | Buy | 2025-10-28 |

| BWS Financial | Maintain | Buy | 2025-10-22 |

| Canaccord Genuity | Maintain | Buy | 2025-10-21 |

| BWS Financial | Maintain | Buy | 2025-05-07 |

| Piper Sandler | Maintain | Overweight | 2025-04-24 |

| DA Davidson | Maintain | Buy | 2025-03-25 |

| BWS Financial | Maintain | Buy | 2025-03-17 |

Inter Parfums maintains predominantly buy ratings, with only a single recent downgrade to neutral, reflecting a broadly positive consensus.

Which company has the best grades?

Inter Parfums, Inc. has received generally stronger and more consistent buy and overweight grades compared to Kenvue Inc., which shows more hold and neutral ratings. This disparity may influence investors’ confidence, with Inter Parfums potentially viewed as having a more favorable outlook.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Kenvue Inc. (KVUE) and Inter Parfums, Inc. (IPAR) based on their latest financial and strategic metrics.

| Criterion | Kenvue Inc. (KVUE) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| Diversification | Well-diversified product portfolio with Essential Health (4.69B), Self Care (6.53B), Skin Health & Beauty (4.24B) segments | Limited product diversification, focused primarily on fragrance products |

| Profitability | Moderate profitability: net margin 6.66%, ROIC 6.25%, with slightly unfavorable ratio profile | Strong profitability: net margin 11.32%, ROIC 18.62%, very favorable financial ratios |

| Innovation | Growing ROIC indicates improving efficiency but no strong moat yet | Durable competitive advantage reflected in very favorable moat status and strong ROIC growth |

| Global presence | Presence in multiple health and beauty markets globally | More niche, concentrated market presence but with solid financial health |

| Market Share | Large market segments but faces strong competition and moderate valuation metrics | Smaller scale but robust financial health and high operational efficiency |

Kenvue benefits from diversification and improving profitability but shows only a slight competitive advantage with some financial metric weaknesses. Inter Parfums demonstrates a durable competitive moat, higher profitability, and stronger financial ratios, making it a potentially more stable investment with less risk.

Risk Analysis

Below is a comparative table outlining key risks for Kenvue Inc. (KVUE) and Inter Parfums, Inc. (IPAR) based on the most recent 2024 data:

| Metric | Kenvue Inc. (KVUE) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| Market Risk | Low beta (0.55) suggests lower volatility vs. market | Higher beta (1.24) indicates greater sensitivity to market swings |

| Debt level | Moderate debt-to-equity (0.9), debt-to-assets 34% | Low debt-to-equity (0.26), debt-to-assets 14% |

| Regulatory Risk | Moderate, as a consumer healthcare company faces standard FDA and consumer product regulations | Moderate, influenced by international trade and cosmetics regulations |

| Operational Risk | Medium, with large global operations and supply chain dependencies | Medium, smaller scale but reliant on brand licensing and international distribution |

| Environmental Risk | Moderate, typical for consumer product manufacturing but with growing focus on sustainability | Moderate, cosmetics manufacturing environmental impact and sourcing challenges |

| Geopolitical Risk | Moderate exposure due to global operations including supply chain and market access | Moderate, exposure from international operations and trade policies |

Kenvue faces moderate financial and operational risks, with a grey zone Altman Z-score indicating some caution on financial distress probability. Inter Parfums shows stronger financial health with a safe zone Altman Z-score and lower leverage but higher market volatility risk. The most impactful risks are Kenvue’s debt level and moderate operational complexity, and Inter Parfums’ market sensitivity and dependence on international regulations. Investors should weigh these factors carefully in risk management decisions.

Which Stock to Choose?

Kenvue Inc. (KVUE) shows a favorable income statement with solid gross and EBIT margins, but recent one-year growth in revenue and net margin is unfavorable. Financial ratios are slightly unfavorable overall, with a neutral return on equity of 10.65% and moderate debt levels. The company’s MOAT rating is slightly favorable, indicating growing profitability but no strong competitive advantage yet. KVUE holds a very favorable overall rating of B+ but displays some liquidity concerns with a current ratio below 1.

Inter Parfums, Inc. (IPAR) demonstrates favorable income growth, including strong revenue and net income increases over the period, though net margin growth dipped slightly last year. Financial ratios are very favorable, featuring a high return on equity of 22.07%, low debt, and strong liquidity with a current ratio above 2. IPAR’s MOAT evaluation is very favorable, reflecting a durable competitive advantage and increasing profitability. The company’s rating is also B+, supported by very favorable ROE and ROA scores, though price-to-book metrics are less attractive.

For investors prioritizing growth and a durable competitive advantage, IPAR’s strong income growth and very favorable financial ratios might appear more attractive. Conversely, those focused on established profitability with moderate risk exposure could view KVUE’s stable income quality and improving MOAT as positive signs. Ultimately, the relative appeal of these stocks may depend on individual risk tolerance and investment strategy preferences.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Kenvue Inc. and Inter Parfums, Inc. to enhance your investment decisions: