In the dynamic world of household and personal products, e.l.f. Beauty, Inc. (ELF) and Inter Parfums, Inc. (IPAR) stand out as influential players with distinct approaches to innovation and market reach. While ELF emphasizes accessible cosmetics and skincare with a strong e-commerce presence, IPAR excels in luxury fragrances and brand partnerships. This article will help you identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between e.l.f. Beauty, Inc. and Inter Parfums, Inc. by providing an overview of these two companies and their main differences.

e.l.f. Beauty, Inc. Overview

e.l.f. Beauty, Inc. operates in the household and personal products industry, offering cosmetic and skin care products globally under several brand names including e.l.f. Cosmetics and Well People. Founded in 2004 and headquartered in Oakland, California, the company sells through retailers and direct-to-consumer channels, including e-commerce platforms. e.l.f. focuses on accessible beauty products with a market cap of approximately 4.9B USD.

Inter Parfums, Inc. Overview

Inter Parfums, Inc. manufactures, markets, and distributes fragrances and related products worldwide, operating primarily through two segments: European and U.S. Based Operations. Founded in 1982 and based in New York City, it offers products under numerous high-profile brand names such as Coach, Jimmy Choo, and Lanvin. The company sells via department stores, specialty retailers, and e-commerce, with a market cap near 2.9B USD.

Key similarities and differences

Both companies operate in the consumer defensive sector within household and personal products, focusing on beauty and fragrance markets. While e.l.f. emphasizes cosmetics and skin care with a direct-to-consumer approach, Inter Parfums centers on luxury fragrances distributed through wholesale and specialty stores. e.l.f. has a higher market capitalization and younger brand portfolio, whereas Inter Parfums has a longer history with diversified brand licensing.

Income Statement Comparison

Below is a side-by-side comparison of the key income statement metrics for e.l.f. Beauty, Inc. and Inter Parfums, Inc. for their most recent fiscal years.

| Metric | e.l.f. Beauty, Inc. (ELF) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| Market Cap | 4.92B | 2.87B |

| Revenue | 1.31B | 1.45B |

| EBITDA | 206M | 305M |

| EBIT | 162M | 276M |

| Net Income | 112M | 164M |

| EPS | 1.99 | 5.13 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

e.l.f. Beauty, Inc.

Over 2021-2025, e.l.f. Beauty saw robust revenue growth from $318M to $1.31B and net income surged from $6.2M to $112M. Gross and EBIT margins remained favorable at 71.24% and 12.34%, respectively. However, in the most recent year, net margin and EPS declined, signaling some pressure despite 28.3% revenue growth.

Inter Parfums, Inc.

Inter Parfums’ revenue grew steadily from $539M in 2020 to $1.45B in 2024, with net income rising to $164M from $38M. Margins are solid, with a 63.85% gross margin and 19.02% EBIT margin. In 2024, revenue increased 10.2%, EPS improved 7.8%, but net margin slightly dipped by 2.3%, reflecting mixed operational dynamics.

Which one has the stronger fundamentals?

Both companies demonstrate favorable income statement trends with strong revenue and net income growth. e.l.f. Beauty shows higher margin expansion and sharper overall growth but recent margin and EPS declines. Inter Parfums exhibits steadier margin stability and consistent EPS gains, suggesting a more balanced income profile over the period.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for e.l.f. Beauty, Inc. and Inter Parfums, Inc. based on their most recent fiscal year data.

| Ratios | e.l.f. Beauty, Inc. (ELF) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| ROE | 14.73% | 22.07% |

| ROIC | 11.21% | 18.62% |

| P/E | 31.49 | 25.63 |

| P/B | 4.64 | 5.66 |

| Current Ratio | 3.05 | 2.75 |

| Quick Ratio | 2.00 | 1.63 |

| D/E (Debt-to-Equity) | 0.41 | 0.26 |

| Debt-to-Assets | 25.08% | 13.62% |

| Interest Coverage | 9.20 | 35.63 |

| Asset Turnover | 1.05 | 1.03 |

| Fixed Asset Turnover | 45.63 | 8.14 |

| Payout Ratio | 0% | 58.42% |

| Dividend Yield | 0% | 2.28% |

Interpretation of the Ratios

e.l.f. Beauty, Inc.

The financial ratios for e.l.f. Beauty show a mixed picture, with 42.86% favorable and 42.86% unfavorable ratings, leading to a neutral overall assessment. The company’s return on equity is moderate at 14.73%, but its return on invested capital and valuation multiples like P/E and P/B are unfavorable. e.l.f. Beauty does not pay dividends, likely prioritizing reinvestment and growth.

Inter Parfums, Inc.

Inter Parfums exhibits predominantly strong financial ratios, with 78.57% favorable and only 14.29% unfavorable, resulting in a very favorable global opinion. Key metrics such as net margin (11.32%), ROE (22.07%), and ROIC (18.62%) are robust. The company pays dividends, supported by a 2.28% yield, and maintains a healthy payout structure with solid coverage from operating cash flow.

Which one has the best ratios?

Inter Parfums clearly demonstrates superior financial health with a larger proportion of favorable ratios, stronger profitability measures, and dividend payments, compared to the more balanced but neutral profile of e.l.f. Beauty. The latter’s mix of weaknesses in valuation and capital returns contrasts with Inter Parfums’ consistent strengths, suggesting it has the better ratio profile overall.

Strategic Positioning

This section compares the strategic positioning of e.l.f. Beauty, Inc. and Inter Parfums, Inc., focusing on market position, key segments, and exposure to technological disruption:

e.l.f. Beauty, Inc.

- Mid-cap with higher beta, faces competitive pressure in personal products market.

- Offers cosmetics and skin care under multiple brands, sells through retail and e-commerce.

- No explicit mention of technological disruption exposure in provided data.

Inter Parfums, Inc.

- Smaller market cap, moderate beta, competes in fragrances and cosmetics globally.

- Focuses on fragrances and cosmetics with numerous luxury brands, sells via specialty and department stores plus e-commerce.

- No explicit mention of technological disruption exposure in provided data.

e.l.f. Beauty, Inc. vs Inter Parfums, Inc. Positioning

e.l.f. Beauty pursues a diversified cosmetic and skin care product strategy with multiple brands and channels, while Inter Parfums concentrates on fragrances and luxury brands, targeting department and specialty stores. Diversification versus focused brand portfolio defines their strategic approaches.

Which has the best competitive advantage?

Inter Parfums demonstrates a very favorable moat with strong ROIC exceeding WACC and growing profitability, suggesting a durable competitive advantage. e.l.f. Beauty shows slightly unfavorable moat status, with value destruction despite improving ROIC trends.

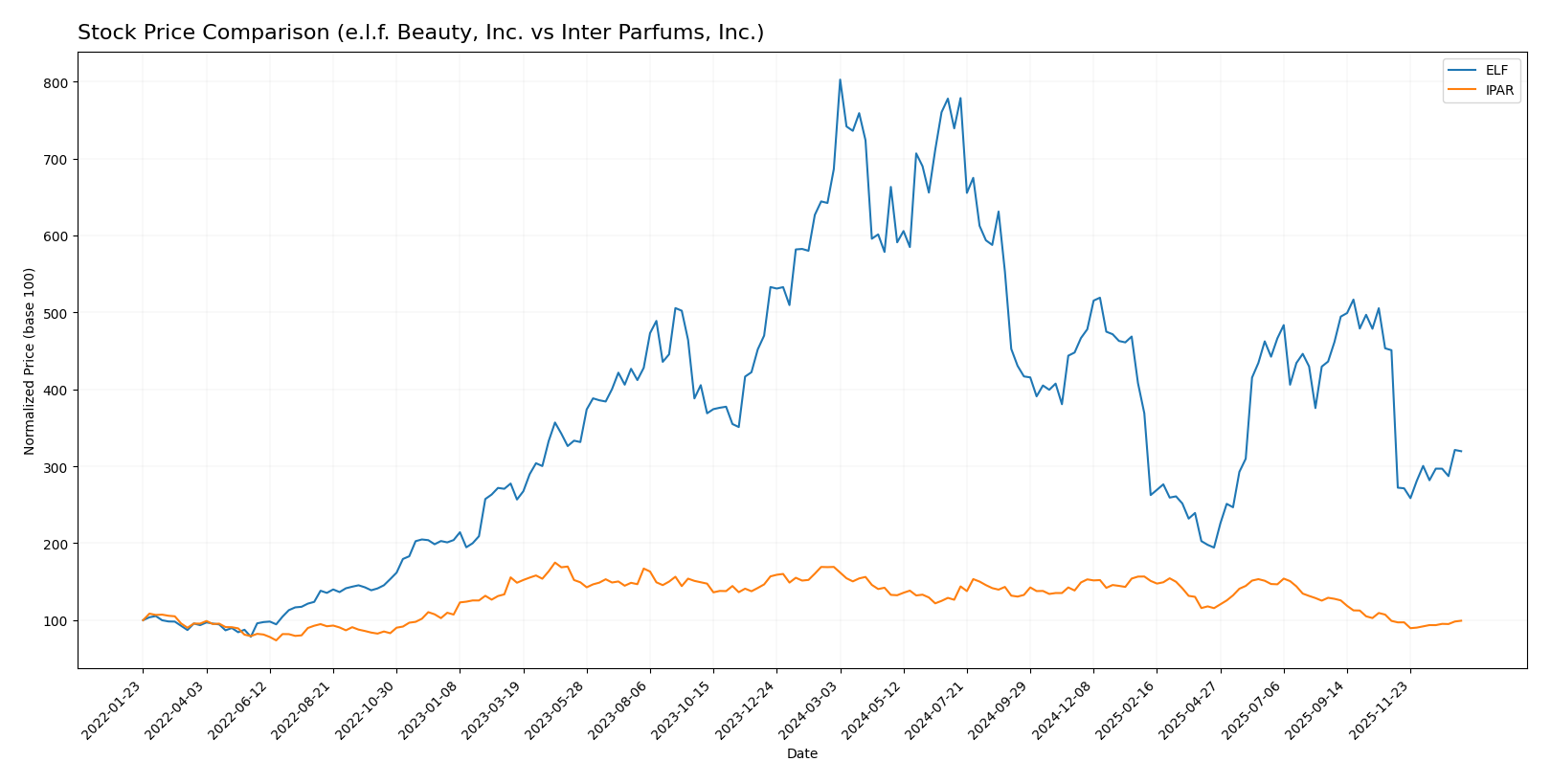

Stock Comparison

The stock prices of e.l.f. Beauty, Inc. and Inter Parfums, Inc. have exhibited significant bearish trends over the past 12 months, with e.l.f. Beauty showing greater price decline and volatility compared to Inter Parfums.

Trend Analysis

e.l.f. Beauty, Inc. (ELF) experienced a 53.44% price decline over the past year, indicating a bearish trend with accelerating downward momentum. The stock’s volatility is high, with a standard deviation of 43.02, and it reached a peak price of 217.4 before dropping to a low of 52.65.

Inter Parfums, Inc. (IPAR) also showed a bearish trend over the past 12 months with a 41.33% price decrease and accelerating decline. Its volatility is lower than ELF’s at 17.11 standard deviation, with a high of 152.22 and a low of 80.61. Recently, IPAR’s price trend was almost neutral with a slight 0.17% increase.

Comparing both stocks, e.l.f. Beauty had the larger negative price change and higher volatility, while Inter Parfums delivered the relatively better market performance, especially during the recent period with stabilizing prices.

Target Prices

Analysts present a clear target price consensus for both e.l.f. Beauty, Inc. and Inter Parfums, Inc., indicating expected upside potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| e.l.f. Beauty, Inc. | 165 | 85 | 128.17 |

| Inter Parfums, Inc. | 125 | 103 | 114 |

The consensus targets for e.l.f. Beauty suggest a significant upside from the current price of $86.58, while Inter Parfums’ target consensus of $114 also indicates room for appreciation from its current $89.30 level. Analysts generally expect positive price movement for both stocks.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for e.l.f. Beauty, Inc. and Inter Parfums, Inc.:

Rating Comparison

ELF Rating

- Rating: C+, evaluated as Very Favorable

- Discounted Cash Flow Score: 3, interpreted as Moderate

- ROE Score: 3, interpreted as Moderate

- ROA Score: 3, interpreted as Moderate

- Debt To Equity Score: 2, interpreted as Moderate

- Overall Score: 2, interpreted as Moderate

IPAR Rating

- Rating: B+, evaluated as Very Favorable

- Discounted Cash Flow Score: 3, interpreted as Moderate

- ROE Score: 5, interpreted as Very Favorable

- ROA Score: 5, interpreted as Very Favorable

- Debt To Equity Score: 3, interpreted as Moderate

- Overall Score: 3, interpreted as Moderate

Which one is the best rated?

Based strictly on the provided data, Inter Parfums (IPAR) holds a higher rating (B+) and superior ROE and ROA scores compared to e.l.f. Beauty (ELF), which has a lower overall score and rating (C+). IPAR is better rated overall.

Scores Comparison

The comparison of the Altman Z-Score and Piotroski Score for e.l.f. Beauty, Inc. and Inter Parfums, Inc. is as follows:

ELF Scores

- Altman Z-Score: 3.44, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength.

IPAR Scores

- Altman Z-Score: 6.12, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength.

Which company has the best scores?

Based on the provided data, IPAR has a higher Altman Z-Score than ELF, suggesting stronger financial stability. Both companies share the same average Piotroski Score, indicating comparable financial strength.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to e.l.f. Beauty, Inc. and Inter Parfums, Inc.:

e.l.f. Beauty, Inc. Grades

This table summarizes recent grades assigned to e.l.f. Beauty, Inc. by reputable grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2025-12-22 |

| JP Morgan | Maintain | Overweight | 2025-12-18 |

| Goldman Sachs | Maintain | Buy | 2025-11-07 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Jefferies | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Downgrade | Neutral | 2025-11-06 |

| UBS | Maintain | Neutral | 2025-11-06 |

| Canaccord Genuity | Maintain | Buy | 2025-11-06 |

| JP Morgan | Maintain | Overweight | 2025-11-06 |

| Jefferies | Maintain | Buy | 2025-10-28 |

The overall trend for e.l.f. Beauty, Inc. shows a majority of buy and overweight ratings with some recent downgrades to neutral, indicating cautious optimism.

Inter Parfums, Inc. Grades

This table presents recent grades for Inter Parfums, Inc. from verified grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BWS Financial | Downgrade | Neutral | 2025-11-21 |

| Canaccord Genuity | Maintain | Buy | 2025-11-19 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Jefferies | Maintain | Buy | 2025-10-28 |

| BWS Financial | Maintain | Buy | 2025-10-22 |

| Canaccord Genuity | Maintain | Buy | 2025-10-21 |

| BWS Financial | Maintain | Buy | 2025-05-07 |

| Piper Sandler | Maintain | Overweight | 2025-04-24 |

| DA Davidson | Maintain | Buy | 2025-03-25 |

| BWS Financial | Maintain | Buy | 2025-03-17 |

Inter Parfums, Inc. exhibits predominantly buy ratings with one recent downgrade to neutral, reflecting a generally positive but cautious outlook.

Which company has the best grades?

Both e.l.f. Beauty, Inc. and Inter Parfums, Inc. have received mostly buy and overweight grades from reputable firms, though e.l.f. Beauty, Inc. shows a slightly broader range including outperform ratings. Investors might perceive e.l.f. Beauty as having marginally stronger analyst support, which could influence confidence and portfolio decisions.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of e.l.f. Beauty, Inc. (ELF) and Inter Parfums, Inc. (IPAR) based on recent financial and strategic data:

| Criterion | e.l.f. Beauty, Inc. (ELF) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| Diversification | Limited product diversification | Moderate diversification with fragrance focus and international reach |

| Profitability | Neutral net margin (8.53%), ROIC below WACC (11.21% < 11.49%) indicating value destruction | Strong profitability: net margin 11.32%, ROIC 18.62% well above WACC (9.18%), creating value |

| Innovation | Growing ROIC trend suggests improving efficiency and innovation | Growing ROIC trend supports durable competitive advantage and innovation |

| Global presence | Primarily US-focused, limited global footprint | Solid global presence including France market (37.6M USD in 2020) |

| Market Share | Moderate with competitive pressures | Stronger market share supported by profitability and financial health |

In summary, IPAR demonstrates a very favorable overall financial and strategic position with strong profitability, a durable moat, and global presence. ELF shows improving profitability trends but currently struggles with value creation, suggesting cautious monitoring and potential risk for investors.

Risk Analysis

Below is a comparative table of key risks for e.l.f. Beauty, Inc. (ELF) and Inter Parfums, Inc. (IPAR) based on the most recent data from 2025 and 2024 respectively.

| Metric | e.l.f. Beauty, Inc. (ELF) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| Market Risk | High beta of 1.72 indicates elevated volatility | Moderate beta of 1.24 indicates moderate volatility |

| Debt level | Moderate debt-to-equity at 0.41, favorable coverage ratio | Lower debt-to-equity at 0.26 with strong interest coverage |

| Regulatory Risk | Moderate, typical for cosmetics industry | Moderate, cosmetics and fragrance regulations globally |

| Operational Risk | Moderate, reliance on retail and e-commerce channels | Moderate, dependency on department stores and specialty retailers |

| Environmental Risk | Emerging risk in sustainability practices | Increasing focus on eco-friendly production, moderate risk |

| Geopolitical Risk | Moderate, global distribution exposes to trade tensions | Moderate, international presence exposes to geopolitical shifts |

The most impactful and likely risks are market volatility for ELF due to its higher beta, and regulatory changes affecting both companies in the cosmetics and fragrance sectors. Additionally, ELF’s higher leverage compared to IPAR warrants cautious monitoring of financial stability. Both companies face operational risks linked to distribution channels and evolving environmental standards.

Which Stock to Choose?

e.l.f. Beauty, Inc. (ELF) shows favorable income growth with a 312.91% revenue increase over five years and solid profitability metrics, but mixed financial ratios indicate a neutral overall position. Its debt metrics are favorable, yet its ROIC is slightly below WACC, suggesting value erosion despite improving profitability. The company holds a moderate rating (C+), with strengths in asset turnover and interest coverage but weaknesses in valuation multiples.

Inter Parfums, Inc. (IPAR) demonstrates steady income growth and profitability, with an 85.71% favorable global income statement opinion. Its financial ratios are mostly favorable (78.57%), reflecting strong return measures and low leverage, supported by a very favorable moat evaluation where ROIC exceeds WACC. IPAR holds a higher rating (B+) with strong returns on equity and assets, though some valuation multiples remain unfavorable.

For investors prioritizing companies with a durable competitive advantage and strong financial stability, IPAR’s very favorable rating and moat status might appear more attractive. Conversely, investors seeking rapid revenue growth and improving profitability amid some valuation concerns may find ELF’s profile suggestive of potential opportunities, acknowledging its slightly unfavorable moat and mixed ratios. Each profile could interpret these signals differently depending on risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of e.l.f. Beauty, Inc. and Inter Parfums, Inc. to enhance your investment decisions: