Insulet Corporation (PODD) and Zimmer Biomet Holdings, Inc. (ZBH) are two prominent players in the medical devices industry, each specializing in innovative healthcare solutions. While Insulet focuses on insulin delivery systems for diabetes management, Zimmer Biomet excels in orthopedic and musculoskeletal products. Their overlapping presence in medical technology and differing innovation strategies make this comparison compelling. Join me as we analyze which company presents a more attractive investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Insulet Corporation and Zimmer Biomet Holdings, Inc. by providing an overview of these two companies and their main differences.

Insulet Corporation Overview

Insulet Corporation develops, manufactures, and sells insulin delivery systems for insulin-dependent diabetes patients. Its flagship product is the Omnipod System, a tubeless, self-adhesive device worn up to three days, paired with a wireless personal diabetes manager. Insulet operates primarily through independent distributors and pharmacy channels across the US, Canada, Europe, the Middle East, and Australia, positioning itself as a specialized leader in diabetes care technology.

Zimmer Biomet Holdings, Inc. Overview

Zimmer Biomet Holdings operates in musculoskeletal healthcare, designing and marketing orthopaedic reconstructive products including knee and hip implants, spine devices, and dental reconstructive solutions. Serving multiple regions globally, the company targets orthopedic surgeons, dentists, hospitals, and healthcare distributors with a broad portfolio addressing bone, joint, and soft tissue injuries. Founded in 1927, it is a longstanding player in the medical devices industry.

Key similarities and differences

Both companies operate within the healthcare sector focusing on medical devices, but their product lines and target markets differ significantly. Insulet specializes in insulin delivery systems for diabetes management, emphasizing wearable technology, while Zimmer Biomet offers a diversified range of orthopaedic and reconstructive implants and surgical products. Insulet’s distribution is more patient-centric, whereas Zimmer Biomet serves medical professionals and institutions across broader musculoskeletal healthcare needs.

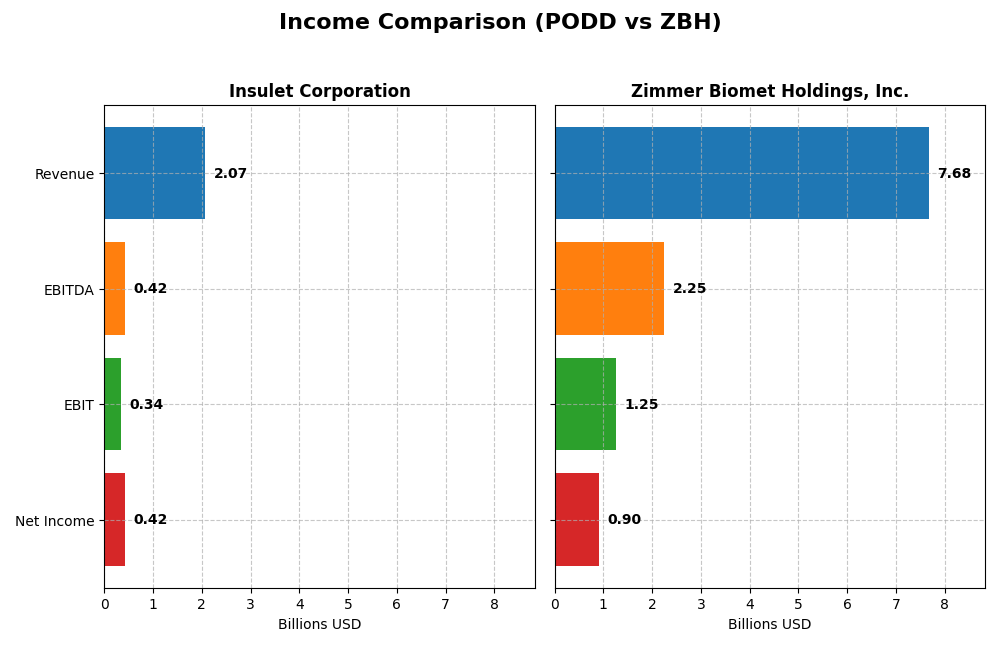

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Insulet Corporation and Zimmer Biomet Holdings, Inc. for the fiscal year 2024.

| Metric | Insulet Corporation (PODD) | Zimmer Biomet Holdings, Inc. (ZBH) |

|---|---|---|

| Market Cap | 20.3B | 18.4B |

| Revenue | 2.07B | 7.68B |

| EBITDA | 424M | 2.25B |

| EBIT | 343M | 1.25B |

| Net Income | 418M | 904M |

| EPS | 5.97 | 4.45 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Insulet Corporation

Insulet has demonstrated strong growth in revenue and net income from 2020 to 2024, with revenue nearly doubling to $2.07B and net income surging to $418M. Margins have improved significantly, with a favorable gross margin of 69.79% and net margin of 20.19%. The 2024 fiscal year showed accelerated growth, with revenue up 22.07% and net margin expanding by 66.11%.

Zimmer Biomet Holdings, Inc.

Zimmer Biomet’s revenue increased moderately by 25.31% over the period, reaching $7.68B in 2024, while net income rose to $904M. Margins remain stable with a gross margin of 71.46% and net margin of 11.77%. However, 2024 growth slowed, with revenue up only 3.85% and net margin declining by 15.01%, indicating some pressure on profitability.

Which one has the stronger fundamentals?

Insulet exhibits more robust growth and margin expansion, with all income statement metrics rated favorable and a net income growth exceeding 6000% over five years. Zimmer Biomet maintains solid margins but faces slower growth and some unfavorable margin trends in 2024. Both show favorable fundamentals, yet Insulet’s recent performance indicates stronger momentum.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Insulet Corporation (PODD) and Zimmer Biomet Holdings, Inc. (ZBH) based on their most recent fiscal year data (2024).

| Ratios | Insulet Corporation (PODD) | Zimmer Biomet Holdings, Inc. (ZBH) |

|---|---|---|

| ROE | 34.5% | 7.2% |

| ROIC | 16.3% | 5.7% |

| P/E | 43.7 | 23.7 |

| P/B | 15.1 | 1.72 |

| Current Ratio | 3.54 | 1.91 |

| Quick Ratio | 2.73 | 0.99 |

| D/E (Debt-to-Equity) | 1.17 | 0.50 |

| Debt-to-Assets | 46.1% | 29.0% |

| Interest Coverage | 7.23 | 5.90 |

| Asset Turnover | 0.67 | 0.36 |

| Fixed Asset Turnover | 2.73 | 3.75 |

| Payout Ratio | 0% | 21.7% |

| Dividend Yield | 0% | 0.91% |

Interpretation of the Ratios

Insulet Corporation

Insulet shows strong profitability ratios with a net margin of 20.19% and a high return on equity at 34.52%, indicating efficient management of equity capital. However, its valuation ratios like P/E at 43.74 and P/B at 15.1 appear stretched, raising valuation concerns. The company does not pay dividends, likely reinvesting earnings for growth and innovation, reflecting a prioritization of R&D over shareholder payouts.

Zimmer Biomet Holdings, Inc.

Zimmer Biomet exhibits moderate profitability with a net margin of 11.77% but a relatively low ROE of 7.25%, which may be a concern for investors seeking high equity returns. Its debt ratios and liquidity are favorable, supporting financial stability. The company pays a dividend with a yield near 0.91%, suggesting some shareholder return, though its payout ratio and buyback details are not provided.

Which one has the best ratios?

Zimmer Biomet presents a more balanced ratio profile with half of its ratios favorable and better debt management, while Insulet has stronger profitability but faces valuation and liquidity challenges. Zimmer’s dividend payments add a layer of shareholder return, contrasting with Insulet’s reinvestment strategy. Overall, Zimmer’s ratios are slightly more favorable, reflecting financial stability and shareholder orientation.

Strategic Positioning

This section compares the strategic positioning of Insulet Corporation and Zimmer Biomet Holdings, including Market position, Key segments, and disruption:

Insulet Corporation

- Mid-sized market cap of 20.3B in insulin delivery, facing typical device industry pressures.

- Focus on insulin delivery systems, mainly Omnipod, with strong international sales growth.

- Exposure to technological disruption centered on wireless, disposable insulin devices.

Zimmer Biomet Holdings, Inc.

- Slightly smaller market cap of 18.4B in musculoskeletal devices, with moderate competitive pressure.

- Diverse orthopedic products: hips, knees, sports medicine, spine, and dental implants.

- Exposure through innovation in robotic, surgical, and bone cement products in orthopedics.

Insulet Corporation vs Zimmer Biomet Holdings Positioning

Insulet is concentrated in insulin delivery with a growing international footprint, while Zimmer Biomet has a diversified orthopedic portfolio spanning multiple product categories. Insulet’s focus may bring specialization benefits, contrasting with Zimmer Biomet’s broader market reach and product variety.

Which has the best competitive advantage?

Insulet demonstrates a very favorable moat with ROIC exceeding WACC by 6.37% and growing profitability, indicating a durable competitive advantage. Zimmer Biomet shows a slightly unfavorable moat, shedding value despite improving ROIC trends.

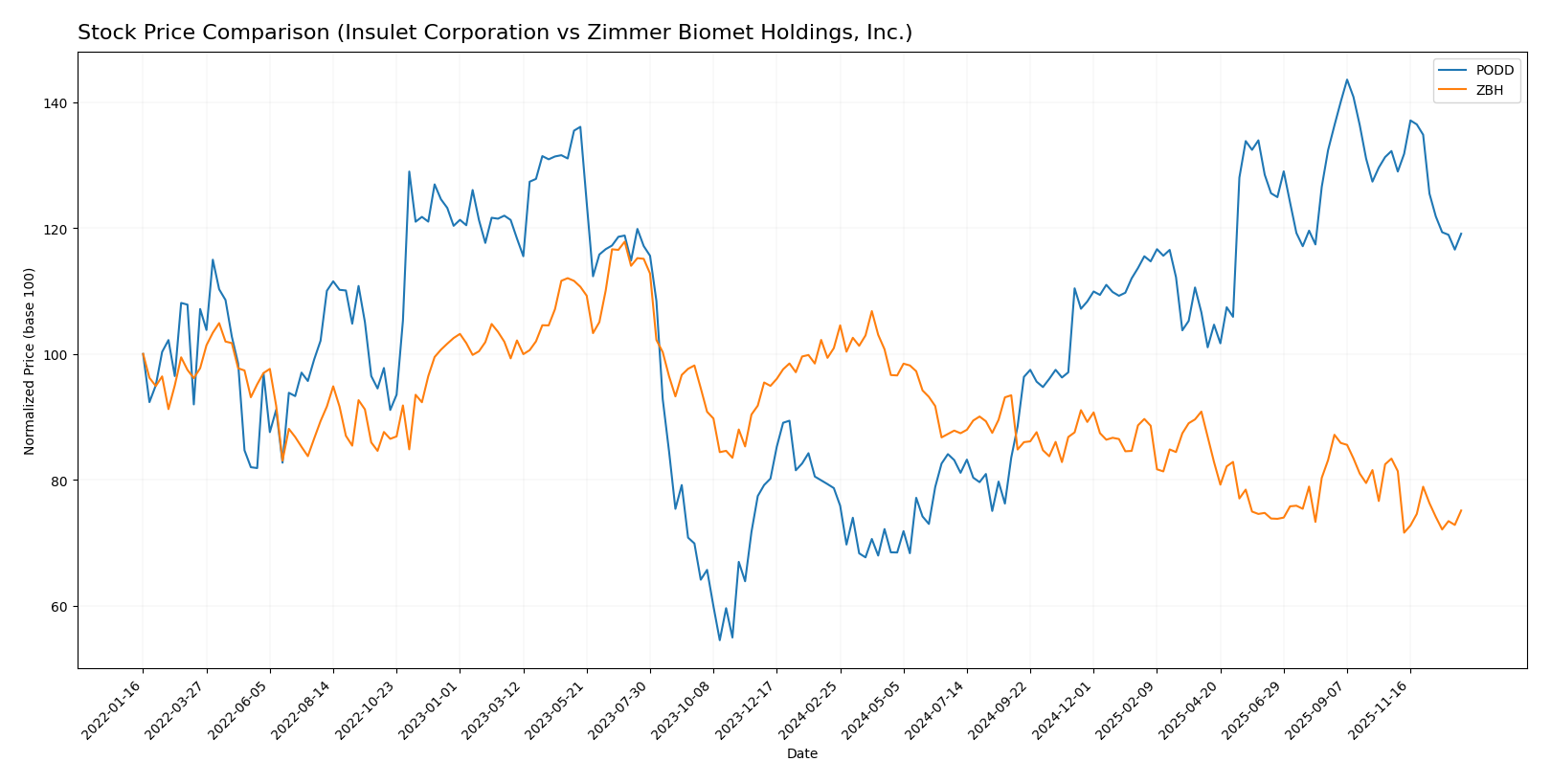

Stock Comparison

The stock price movements of Insulet Corporation (PODD) and Zimmer Biomet Holdings, Inc. (ZBH) over the past 12 months reveal contrasting trends, with PODD showing significant gains and ZBH experiencing a notable decline amid varying trading volumes and momentum shifts.

Trend Analysis

Insulet Corporation’s stock exhibited a strong bullish trend over the past 12 months with a 51.32% price increase, though momentum decelerated recently with a 9.93% decline in the last two and a half months. Volatility remains high with a 54.06 standard deviation.

Zimmer Biomet’s stock showed a bearish trend over the same 12-month period, dropping 25.55% with decelerating downward momentum. The recent period recorded a 9.88% decline, accompanied by lower volatility at a 10.3 standard deviation.

Comparing both stocks, Insulet Corporation outperformed Zimmer Biomet significantly in market performance over the past year, delivering positive returns versus Zimmer Biomet’s marked losses.

Target Prices

The current analyst consensus suggests upside potential for both Insulet Corporation and Zimmer Biomet Holdings, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Insulet Corporation | 450 | 301 | 381.6 |

| Zimmer Biomet Holdings, Inc. | 130 | 93 | 108.91 |

Analysts expect Insulet’s stock to rise significantly above its current price of 289.04 USD, while Zimmer Biomet’s consensus target also indicates moderate upside from its present 92.85 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Insulet Corporation and Zimmer Biomet Holdings, Inc.:

Rating Comparison

PODD Rating

- Rating: B- indicating a very favorable overall assessment.

- Discounted Cash Flow Score: 1, rated very unfavorable, suggesting potential overvaluation concerns.

- ROE Score: 4, favorable, showing efficient profit generation from equity.

- ROA Score: 4, favorable, demonstrating effective asset utilization.

- Debt To Equity Score: 3, moderate, reflecting balanced financial risk.

- Overall Score: 2, moderate, showing average financial standing.

ZBH Rating

- Rating: B+ indicating a very favorable overall assessment.

- Discounted Cash Flow Score: 5, rated very favorable, indicating strong future cash flow projections.

- ROE Score: 3, moderate, showing average efficiency in generating profit from equity.

- ROA Score: 3, moderate, indicating average effectiveness in utilizing assets.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk due to debt levels.

- Overall Score: 3, moderate, reflecting slightly better overall financial health.

Which one is the best rated?

Zimmer Biomet (ZBH) holds a higher rating (B+) and stronger discounted cash flow score compared to Insulet (PODD). However, ZBH’s debt-to-equity score is less favorable, balancing its overall moderate scores against PODD’s mixed profile.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

PODD Scores

- Altman Z-Score: 9.99, in the safe zone, indicating low bankruptcy risk.

- Piotroski Score: 7, categorized as strong financial health.

ZBH Scores

- Altman Z-Score: 1.84, in the grey zone, indicating moderate bankruptcy risk.

- Piotroski Score: 8, categorized as very strong financial health.

Which company has the best scores?

PODD shows a much safer Altman Z-Score indicating lower bankruptcy risk, while ZBH has a higher Piotroski Score indicating stronger financial health. Each company leads in one score category based on the data provided.

Grades Comparison

The following presents a detailed comparison of the recent grades assigned to Insulet Corporation and Zimmer Biomet Holdings, Inc.:

Insulet Corporation Grades

Below is a summary of the latest grades from reputable grading companies for Insulet Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Truist Securities | Maintain | Buy | 2025-12-18 |

| Canaccord Genuity | Maintain | Buy | 2025-12-17 |

| Canaccord Genuity | Maintain | Buy | 2025-11-24 |

| Truist Securities | Maintain | Buy | 2025-11-21 |

| BTIG | Maintain | Buy | 2025-11-21 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| UBS | Upgrade | Buy | 2025-11-19 |

| BTIG | Maintain | Buy | 2025-11-13 |

| UBS | Maintain | Neutral | 2025-11-07 |

Insulet Corporation’s grades consistently show a strong buy or outperform consensus, with only one neutral rating maintained recently.

Zimmer Biomet Holdings, Inc. Grades

Presented here are the latest grades from recognized grading firms for Zimmer Biomet Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Market Perform | 2026-01-09 |

| BTIG | Maintain | Buy | 2026-01-08 |

| Evercore ISI Group | Upgrade | Outperform | 2026-01-05 |

| Baird | Downgrade | Neutral | 2025-12-16 |

| Citigroup | Maintain | Neutral | 2025-12-11 |

| Canaccord Genuity | Maintain | Hold | 2025-11-10 |

| UBS | Maintain | Sell | 2025-11-06 |

| RBC Capital | Maintain | Outperform | 2025-11-06 |

| Barclays | Maintain | Underweight | 2025-11-06 |

| JP Morgan | Downgrade | Neutral | 2025-11-06 |

Zimmer Biomet’s grades show a more mixed pattern, ranging from buy and outperform to sell and underweight, reflecting a varied analyst outlook.

Which company has the best grades?

Insulet Corporation has received predominantly buy and outperform grades, indicating stronger analyst confidence compared to Zimmer Biomet, whose grades vary widely from buy to sell. This disparity suggests that investors might perceive Insulet as a more favorable option based on current analyst sentiment, potentially influencing portfolio decisions accordingly.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of Insulet Corporation (PODD) and Zimmer Biomet Holdings, Inc. (ZBH) based on diversification, profitability, innovation, global presence, and market share.

| Criterion | Insulet Corporation (PODD) | Zimmer Biomet Holdings, Inc. (ZBH) |

|---|---|---|

| Diversification | Limited product range focused mainly on drug delivery and International Omnipod segment | Broad product portfolio across hips, knees, S E T, and other categories |

| Profitability | High net margin (20.19%), strong ROE (34.52%), ROIC (16.27%), favorable profitability ratios | Moderate net margin (11.77%), lower ROE (7.25%), ROIC neutral (5.68%), mixed profitability ratios |

| Innovation | Very favorable MOAT with growing ROIC, indicating strong innovation and competitive advantage | Slightly unfavorable MOAT despite growing ROIC, indicating some challenges in sustaining innovation |

| Global presence | Strong international sales growth, especially in Omnipod segment with $2.03B revenue in 2024 | Established global presence with diversified revenue streams totaling over $7.2B in major categories |

| Market Share | Focused niche market with high growth potential but smaller scale | Larger market share in orthopedic devices with diversified product sales |

Insulet shows robust profitability and innovation with a focused yet rapidly growing international presence, while Zimmer Biomet benefits from diversification and scale but faces challenges in profitability and maintaining a strong economic moat. Investors should weigh growth potential against stability and diversification.

Risk Analysis

Below is a comparison table of key risks affecting Insulet Corporation (PODD) and Zimmer Biomet Holdings, Inc. (ZBH) based on the latest available data from 2024 and 2026 market context:

| Metric | Insulet Corporation (PODD) | Zimmer Biomet Holdings, Inc. (ZBH) |

|---|---|---|

| Market Risk | High beta of 1.4 indicates higher volatility relative to the market. | Lower beta of 0.614 suggests more stable price movements. |

| Debt level | Debt-to-equity ratio at 1.17 (unfavorable), with 46% debt to assets (neutral). | Lower debt-to-equity at 0.5 (favorable), 29% debt to assets (favorable). |

| Regulatory Risk | Moderate, due to medical device approvals and compliance across multiple regions. | Moderate, with similar regulatory exposure in orthopedics and medical devices. |

| Operational Risk | Medium, dependent on innovation and supply chain for Omnipod delivery systems. | Medium, complex global supply chain and manufacturing for diverse product lines. |

| Environmental Risk | Moderate, medical device manufacturing has environmental standards to meet. | Moderate, with environmental impact from manufacturing and materials used. |

| Geopolitical Risk | Moderate, exposure in US, Canada, Europe, Middle East, Australia markets. | Moderate, with a broad global footprint including emerging markets. |

Synthesis: Insulet faces higher market volatility and leverage risks, raising caution despite strong profitability metrics. Zimmer Biomet has a safer debt profile and better stability but operates in a competitive, regulated global environment. Market risk and debt levels are the most impactful factors to monitor for both companies in 2026.

Which Stock to Choose?

Insulet Corporation (PODD) shows strong income growth with a 22.07% revenue increase in 2024 and highly favorable profitability ratios, including a 20.19% net margin and 34.52% ROE. Its debt level is moderate with a net debt to EBITDA of 1.11, and it holds a very favorable B- rating supported by a very favorable moat indicating durable competitive advantage.

Zimmer Biomet Holdings, Inc. (ZBH) presents modest income growth at 3.85% revenue increase in 2024, with favorable margins but lower profitability metrics such as 11.77% net margin and 7.25% ROE. The company maintains a lower debt level with net debt to EBITDA of 2.52 and a very favorable B+ rating, though its moat status is slightly unfavorable due to value destruction despite improving ROIC.

Investors focused on growth may find Insulet’s robust income evolution, strong profitability, and very favorable moat appealing, while those prioritizing stability might view Zimmer Biomet’s moderate growth and solid rating, despite its slightly unfavorable moat, as more suitable. The choice could therefore depend on one’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Insulet Corporation and Zimmer Biomet Holdings, Inc. to enhance your investment decisions: