Medtronic plc and Insulet Corporation are two prominent players in the medical devices industry, each shaping healthcare innovation in distinct ways. Medtronic, a global giant with a diversified portfolio, contrasts with Insulet’s focused approach on insulin delivery systems. Their overlapping markets and commitment to cutting-edge technology make this comparison particularly relevant. Join me as we explore which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Medtronic plc and Insulet Corporation by providing an overview of these two companies and their main differences.

Medtronic plc Overview

Medtronic plc, headquartered in Dublin, Ireland, develops, manufactures, and sells device-based medical therapies globally. It serves healthcare systems and specialists with a diverse portfolio including cardiovascular devices, surgical instruments, neuroscience products, and diabetes management solutions. Established in 1949, Medtronic operates across multiple medical segments and employs approximately 95,000 people.

Insulet Corporation Overview

Insulet Corporation, based in Acton, Massachusetts, focuses on insulin delivery systems for insulin-dependent diabetes patients. Its flagship product, the Omnipod System, is a tubeless, self-adhesive insulin pump worn up to three days, complemented by a wireless personal diabetes manager. Founded in 2000, Insulet markets its products mainly through distributors and pharmacies across the US, Canada, Europe, the Middle East, and Australia.

Key similarities and differences

Both Medtronic and Insulet operate in the medical devices industry, specializing in healthcare solutions for chronic conditions. Medtronic has a broader product range across cardiovascular, surgical, neuroscience, and diabetes segments, while Insulet concentrates exclusively on insulin delivery systems. Medtronic’s scale and workforce significantly exceed Insulet’s, reflecting its diversified business model versus Insulet’s focused approach.

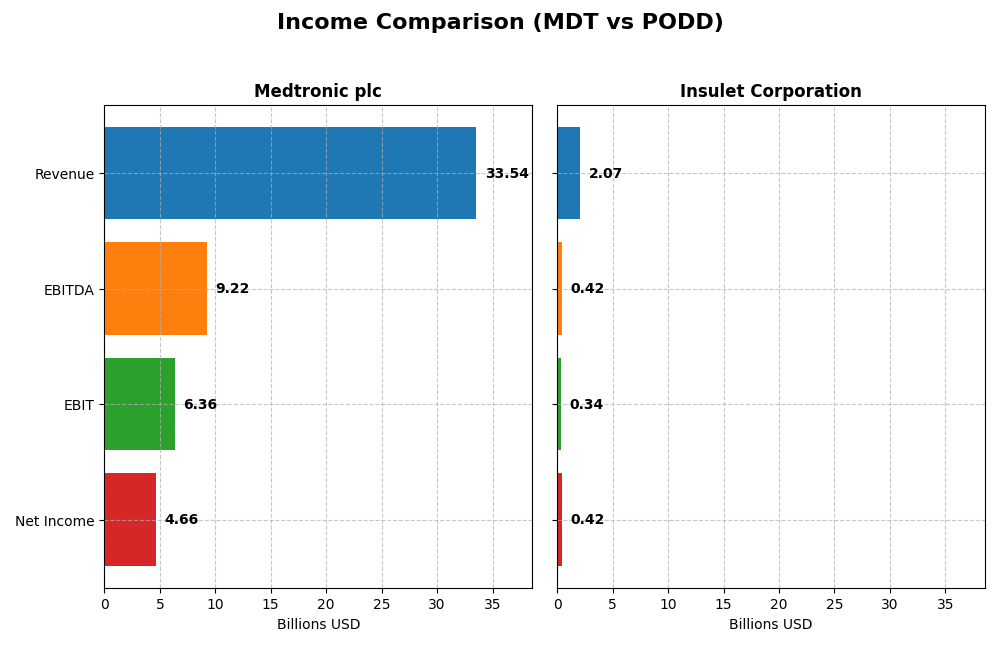

Income Statement Comparison

Below is a side-by-side comparison of the most recent fiscal year income statement metrics for Medtronic plc and Insulet Corporation, reflecting their financial performance in 2025 and 2024 respectively.

| Metric | Medtronic plc (MDT) | Insulet Corporation (PODD) |

|---|---|---|

| Market Cap | 125B | 20B |

| Revenue | 33.5B | 2.07B |

| EBITDA | 9.22B | 424M |

| EBIT | 6.36B | 343M |

| Net Income | 4.66B | 418M |

| EPS | 3.63 | 5.97 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Medtronic plc

Medtronic’s revenue steadily increased from $30.1B in 2021 to $33.5B in 2025, reflecting an 11.36% growth over five years. Net income grew by 29.28% during this period, reaching $4.66B in 2025. Margins improved favorably, with a notable net margin rise to 13.9% in 2025. The latest year showed moderate revenue growth but strong margin and earnings per share expansion.

Insulet Corporation

Insulet’s revenue surged from $904M in 2020 to $2.07B in 2024, marking a robust 129.06% increase. Net income skyrocketed by over 6000%, reaching $418M in 2024, with net margin expanding to 20.19%. Margins consistently improved, and the most recent year demonstrated strong double-digit growth in revenue, profit, and EPS, indicating accelerating profitability.

Which one has the stronger fundamentals?

Both companies present favorable income statements with growing revenues and improving margins. Medtronic shows steady, moderate growth with strong profitability and disciplined cost management. Insulet exhibits exceptional growth rates and expanding margins, reflecting rapid scaling. The choice of stronger fundamentals depends on preference for steady maturity versus high-growth dynamics.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Medtronic plc (MDT) and Insulet Corporation (PODD) based on their most recent fiscal year data.

| Ratios | Medtronic plc (MDT) FY 2025 | Insulet Corporation (PODD) FY 2024 |

|---|---|---|

| ROE | 9.71% | 34.52% |

| ROIC | 6.08% | 16.27% |

| P/E | 23.37 | 43.74 |

| P/B | 2.27 | 15.10 |

| Current Ratio | 1.85 | 3.54 |

| Quick Ratio | 1.42 | 2.73 |

| D/E (Debt-to-Equity) | 0.59 | 1.17 |

| Debt-to-Assets | 31.10% | 46.05% |

| Interest Coverage | 8.17 | 7.23 |

| Asset Turnover | 0.37 | 0.67 |

| Fixed Asset Turnover | 4.91 | 2.73 |

| Payout Ratio | 77.0% | 0% |

| Dividend Yield | 3.29% | 0% |

Interpretation of the Ratios

Medtronic plc

Medtronic’s ratios show a generally solid financial position with favorable net margin at 13.9% and strong interest coverage at 8.72, but moderate concerns arise from a lower return on equity at 9.71% and an unfavorable asset turnover of 0.37. The company pays dividends with a favorable 3.29% yield, supported by steady payout coverage, though investors should monitor cash flow consistency.

Insulet Corporation

Insulet exhibits strong profitability with a favorable net margin of 20.19% and an impressive return on equity of 34.52%. However, its high price-to-earnings ratio of 43.74 and price-to-book of 15.1 indicate expensive valuation. The company does not pay dividends, reflecting its reinvestment strategy during growth, with a solid quick ratio of 2.73 but elevated debt levels.

Which one has the best ratios?

Medtronic’s profile is slightly favorable with balanced ratios and dividend payments, while Insulet presents a neutral stance due to its mixed valuation and leverage metrics despite high profitability. Medtronic’s more consistent financial health contrasts with Insulet’s growth-oriented but riskier profile, highlighting differing risk-return trade-offs in their ratios.

Strategic Positioning

This section compares the strategic positioning of Medtronic plc and Insulet Corporation including their market position, key segments, and exposure to technological disruption:

Medtronic plc

- Large market cap of 125B with diversified medical device offerings facing moderate competitive pressure.

- Diverse revenue streams from cardiac, neuroscience, medical surgical, and diabetes segments.

- Exposure to disruption through advanced surgical AI, robotics, and continuous glucose monitoring.

Insulet Corporation

- Smaller market cap of 20B focused on insulin delivery devices, facing competitive pressures in diabetes care.

- Concentrated revenue primarily from the Omnipod insulin delivery system and drug delivery segment.

- Focus on innovative tubeless insulin delivery, with wireless management enhancing technological edge.

Medtronic plc vs Insulet Corporation Positioning

Medtronic’s broad diversification across multiple medical device sectors contrasts with Insulet’s concentrated focus on insulin delivery. Medtronic benefits from varied revenue streams but faces complex market dynamics, while Insulet’s specialization offers innovation-driven growth but limited segment exposure.

Which has the best competitive advantage?

Based on MOAT evaluation, Insulet shows a very favorable position with strong value creation and growing ROIC, indicating a durable competitive advantage. Medtronic’s slightly unfavorable status signals value destruction despite improved profitability.

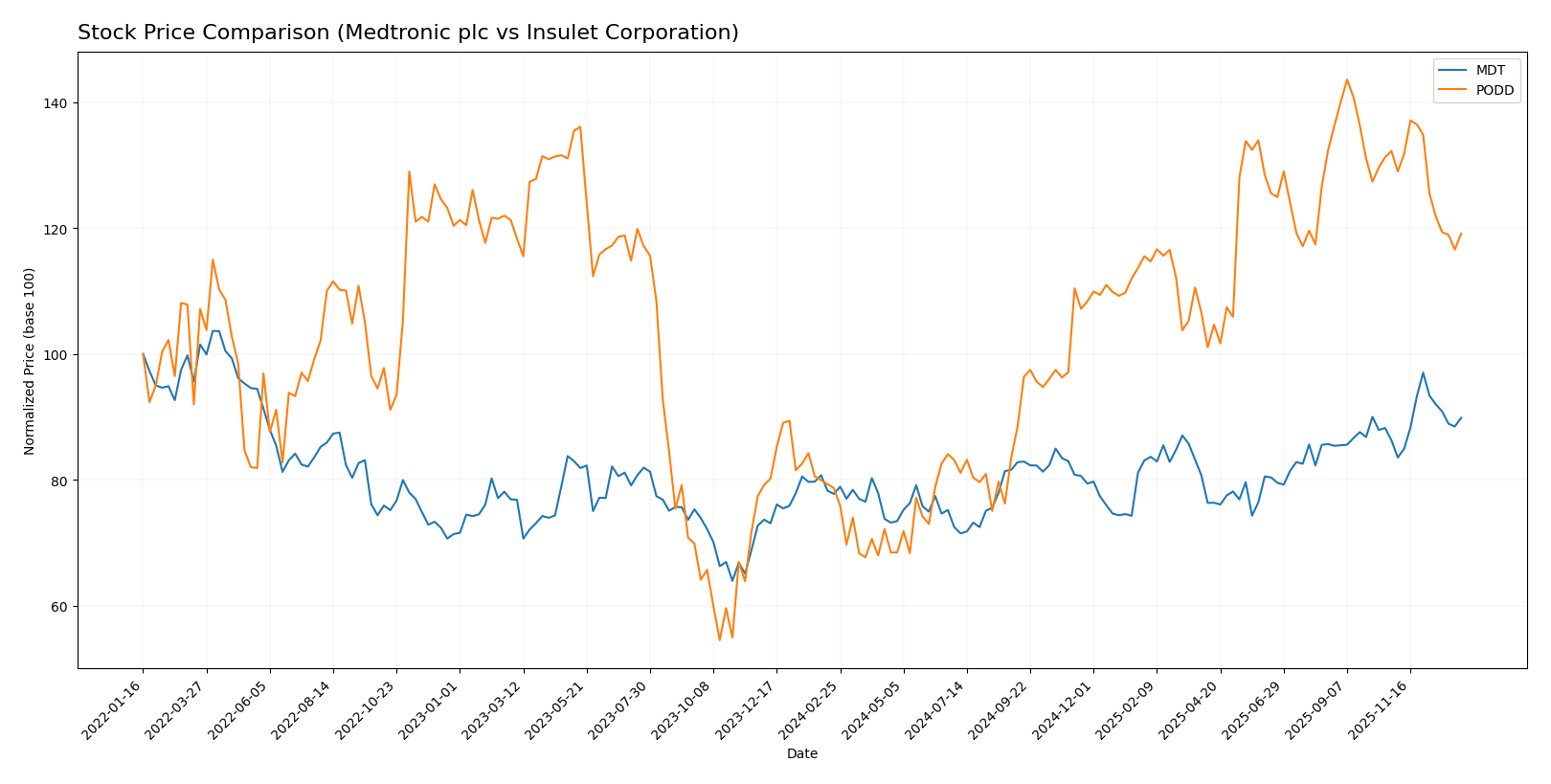

Stock Comparison

The stock price chart highlights significant bullish momentum for Medtronic plc (MDT) and Insulet Corporation (PODD) over the past 12 months, with notable divergences in recent quarterly trends and trading volumes.

Trend Analysis

Medtronic plc (MDT) showed a 15.53% price increase over the past year, indicating a bullish trend with acceleration. The stock ranged between 77.61 and 105.33, with a recent upward trend of 4.12%.

Insulet Corporation (PODD) experienced a 51.32% gain over the past 12 months, also bullish but with deceleration. Volatility was high (std deviation 54.06), and recent months showed a -9.93% decline with seller dominance.

Comparing both, PODD delivered the highest market performance over the year despite recent weakness, while MDT maintained steadier growth and increasing volume trends.

Target Prices

Analysts present a clear target price consensus for Medtronic plc and Insulet Corporation, reflecting optimistic outlooks.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Medtronic plc | 120 | 103 | 111.67 |

| Insulet Corporation | 450 | 301 | 381.6 |

The target consensus for Medtronic is significantly above its current price of 97.53 USD, suggesting potential upside. Similarly, Insulet’s consensus target of 381.6 USD strongly exceeds its current price of 289.04 USD, indicating favorable analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Medtronic plc and Insulet Corporation:

Rating Comparison

MDT Rating

- Rating: B, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 4, a Favorable indicator of valuation.

- ROE Score: 3, a Moderate measure of profitability from shareholders’ equity.

- ROA Score: 4, Favorable, showing effective asset utilization.

- Debt To Equity Score: 1, Very Unfavorable, indicating higher financial risk.

- Overall Score: 3, Moderate overall financial standing.

PODD Rating

- Rating: B-, also considered Very Favorable by analysts.

- Discounted Cash Flow Score: 1, marked as Very Unfavorable for valuation.

- ROE Score: 4, a Favorable measure of profitability from shareholders’ equity.

- ROA Score: 4, Favorable, showing effective asset utilization.

- Debt To Equity Score: 3, Moderate, indicating balanced financial leverage.

- Overall Score: 2, Moderate overall financial standing.

Which one is the best rated?

Medtronic plc holds a slightly higher overall rating (B vs. B-) and a better discounted cash flow score, but has a weaker debt-to-equity score. Insulet excels in profitability scores but scores lower on valuation metrics. Overall, Medtronic is better rated based on the provided data.

Scores Comparison

The scores comparison between Medtronic plc and Insulet Corporation provides insight into their financial health and risk profiles:

MDT Scores

- Altman Z-Score: 3.20, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial strength.

PODD Scores

- Altman Z-Score: 9.99, well within the safe zone showing very low bankruptcy risk.

- Piotroski Score: 7, also indicating strong financial strength.

Which company has the best scores?

Based on the provided data, PODD has a higher Altman Z-Score than MDT, indicating a stronger safety margin from bankruptcy risk, while both have the same Piotroski Score of 7, reflecting equally strong financial strength.

Grades Comparison

Here is a comparison of the recent grades assigned to Medtronic plc and Insulet Corporation by leading financial analysts:

Medtronic plc Grades

The following table summarizes recent grades from reputable grading companies for Medtronic plc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | maintain | Outperform | 2026-01-09 |

| Barclays | maintain | Overweight | 2026-01-08 |

| William Blair | upgrade | Outperform | 2026-01-06 |

| Truist Securities | maintain | Hold | 2025-12-18 |

| Truist Securities | maintain | Hold | 2025-11-20 |

| Barclays | maintain | Overweight | 2025-11-20 |

| UBS | maintain | Neutral | 2025-11-19 |

| Morgan Stanley | maintain | Overweight | 2025-11-19 |

| Goldman Sachs | upgrade | Neutral | 2025-11-19 |

| Wells Fargo | maintain | Overweight | 2025-11-19 |

Medtronic’s grades generally range between Hold and Outperform, with several upgrades and consistent Overweight ratings indicating moderate optimism.

Insulet Corporation Grades

The following table presents recent grades from recognized grading companies for Insulet Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | maintain | Outperform | 2026-01-09 |

| Truist Securities | maintain | Buy | 2025-12-18 |

| Canaccord Genuity | maintain | Buy | 2025-12-17 |

| Canaccord Genuity | maintain | Buy | 2025-11-24 |

| Truist Securities | maintain | Buy | 2025-11-21 |

| BTIG | maintain | Buy | 2025-11-21 |

| RBC Capital | maintain | Outperform | 2025-11-21 |

| UBS | upgrade | Buy | 2025-11-19 |

| BTIG | maintain | Buy | 2025-11-13 |

| UBS | maintain | Neutral | 2025-11-07 |

Insulet’s grades mainly show Buy and Outperform ratings with multiple maintains and upgrades, reflecting a stronger positive consensus.

Which company has the best grades?

Insulet Corporation has received consistently higher grades, predominantly Buy and Outperform, compared to Medtronic’s mix of Hold to Outperform. This stronger grade profile may indicate greater analyst confidence, potentially influencing investor sentiment and portfolio decisions.

Strengths and Weaknesses

Below is a summary table highlighting key strengths and weaknesses of Medtronic plc (MDT) and Insulet Corporation (PODD) based on recent financial and operational data.

| Criterion | Medtronic plc (MDT) | Insulet Corporation (PODD) |

|---|---|---|

| Diversification | Highly diversified across cardiac, diabetes, medical surgical, and neuroscience segments with revenues over $12B, $2.75B, $8.4B, and $9.8B respectively in 2025 | Less diversified, primarily focused on drug delivery and international Omnipod products, with $2.03B revenue in Omnipod segment in 2024 |

| Profitability | Moderate profitability: net margin 13.9%, ROIC 6.08% slightly below WACC, indicating slight value destruction but improving | Strong profitability: net margin 20.2%, ROIC 16.3% well above WACC, demonstrating solid value creation |

| Innovation | Continuous innovation in multiple therapy areas but slower ROIC growth | Rapid innovation reflected in 660% ROIC growth trend, strong competitive advantage |

| Global presence | Established global footprint with a broad product range | Growing international sales but concentrated in specific product lines |

| Market Share | Large market share in multiple medical device sectors | Niche leadership in insulin pump market with expanding footprint |

Key takeaways: Medtronic offers broad diversification and steady revenue streams but faces challenges in consistently creating value above its cost of capital. Insulet presents a compelling growth story with strong profitability and innovation but carries concentration risk. Investors should weigh stability versus growth potential aligned with their risk tolerance.

Risk Analysis

Below is a comparative risk table for Medtronic plc (MDT) and Insulet Corporation (PODD) based on the most recent data from 2025 and 2024 respectively:

| Metric | Medtronic plc (MDT) | Insulet Corporation (PODD) |

|---|---|---|

| Market Risk | Beta 0.73 (lower volatility) | Beta 1.4 (higher volatility) |

| Debt level | Debt/Equity 0.59 (neutral) | Debt/Equity 1.17 (unfavorable) |

| Regulatory Risk | Moderate, global healthcare regulations | Moderate, diabetes device regulations |

| Operational Risk | Large scale with 95K employees, complexity | Smaller scale, 3.9K employees, niche market |

| Environmental Risk | Moderate, manufacturing impact | Moderate, device disposal concerns |

| Geopolitical Risk | Exposure due to global presence (Ireland HQ) | Primarily US-based, limited exposure |

The most significant risks are Insulet’s higher market volatility and elevated debt-to-equity ratio, which increase financial and market risk. Medtronic’s large global footprint exposes it to geopolitical uncertainties but benefits from lower volatility and stronger liquidity. Both companies carry moderate regulatory and environmental risks typical of medical device firms. Investors should weigh these risks carefully against growth potential and financial stability.

Which Stock to Choose?

Medtronic plc (MDT) shows a steady income evolution with favorable margins and profitability, supported by a solid current ratio and interest coverage. Its debt levels are moderate, but ROE remains slightly unfavorable, with an overall slightly favorable rating and a slightly unfavorable moat due to value destruction despite growing profitability.

Insulet Corporation (PODD) exhibits strong income growth and profitability with excellent margins and ROE, though its valuation ratios and debt-to-equity are less favorable. The company benefits from a very favorable moat and strong financial scores, indicating durable competitive advantages despite moderate rating concerns.

For investors prioritizing stable income and moderate valuation, MDT’s slightly favorable rating and stable financials might appear more suitable, while those seeking high growth and value creation with higher volatility could find PODD’s very favorable moat and strong profitability more appealing. The choice may depend on one’s risk tolerance and investment focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Medtronic plc and Insulet Corporation to enhance your investment decisions: