In the dynamic realm of software infrastructure, Zscaler, Inc. and Informatica Inc. stand out as key innovators shaping cloud security and data management. Both companies operate within the technology sector, targeting enterprise needs with cutting-edge platforms that address evolving digital challenges. Their overlapping markets and distinct innovation strategies make this comparison particularly insightful. Join me as I analyze these firms to uncover which presents the most compelling opportunity for investors today.

Table of contents

Companies Overview

I will begin the comparison between Zscaler and Informatica by providing an overview of these two companies and their main differences.

Zscaler Overview

Zscaler, Inc. operates as a cloud security company worldwide, offering solutions that secure access to applications and measure digital experience across enterprises. Its platform includes modules for internet access, private access, and workload segmentation to reduce risks and prevent data breaches. Headquartered in San Jose, California, Zscaler serves a diverse range of industries with a focus on software infrastructure.

Informatica Overview

Informatica Inc. develops an AI-powered platform designed to connect, manage, and unify data across multi-cloud and hybrid environments at enterprise scale. The company provides a suite of data management products including data integration, API management, data quality, master data management, and governance tools. Based in Redwood City, California, Informatica targets businesses seeking comprehensive data solutions for analytics and compliance.

Key similarities and differences

Both Zscaler and Informatica operate in the software infrastructure sector, focusing on enterprise technology solutions. While Zscaler specializes in cloud security and access management, Informatica emphasizes data integration and governance powered by artificial intelligence. Their business models revolve around delivering cloud-based platforms, but they address distinct enterprise needs—security versus data management and analytics.

Income Statement Comparison

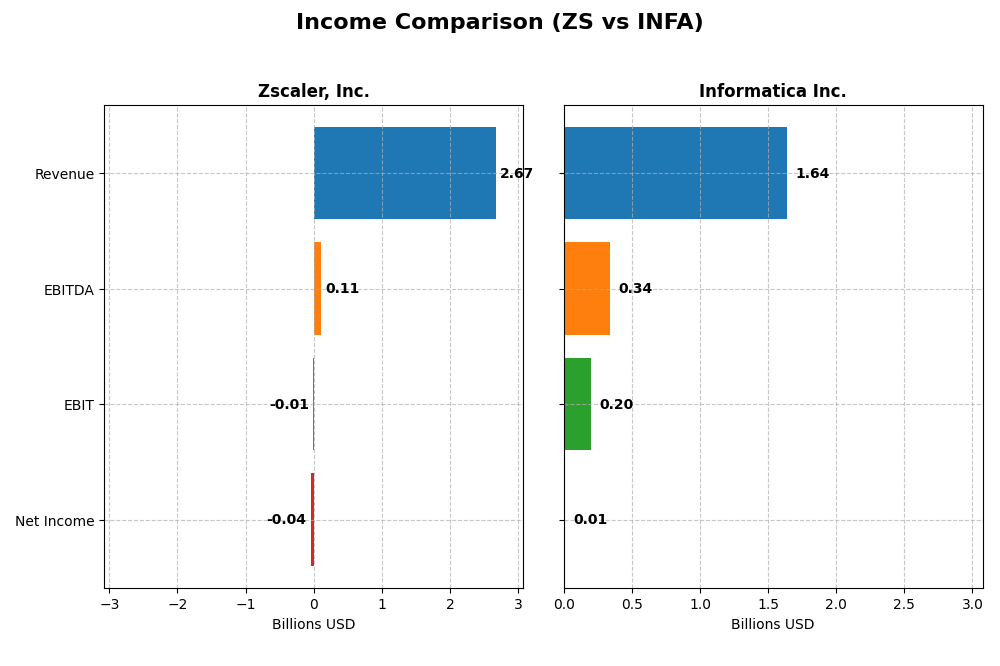

This table presents the latest available fiscal year income statement figures for Zscaler, Inc. and Informatica Inc., highlighting key financial metrics in USD.

| Metric | Zscaler, Inc. (ZS) | Informatica Inc. (INFA) |

|---|---|---|

| Market Cap | 34.1B | 7.5B |

| Revenue | 2.67B | 1.64B |

| EBITDA | 112M | 339M |

| EBIT | -8.8M | 199M |

| Net Income | -41.5M | 9.9M |

| EPS | -0.27 | 0.033 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Zscaler, Inc.

Zscaler, Inc. experienced strong revenue growth from 2021 to 2025, with a 297% increase over the period. Despite persistent net losses, net income improved by 84%. The company maintained a favorable gross margin near 77%, though EBIT and net margins remained negative. In 2025, revenue grew 23.3% year-over-year, with improved EBIT and net margin growth indicating operational progress.

Informatica Inc.

Informatica Inc. showed steady revenue growth of nearly 24% from 2020 to 2024, but only a modest 2.8% increase in the most recent year. Gross margin was strong at 80%, with positive EBIT and a slight net margin of 0.6%. Recent years saw significant EBIT and net margin improvements, with net income turning positive in 2024 after previous losses, signaling improving profitability.

Which one has the stronger fundamentals?

Zscaler exhibits rapid revenue expansion and improving margins but continues to post net losses and negative EBIT margin. Informatica demonstrates stable revenue growth with positive EBIT and a slight net profit in 2024, though with slower recent revenue growth. Both companies show favorable income statement trends, but Informatica’s profitability metrics suggest relatively stronger current fundamentals.

Financial Ratios Comparison

The table below presents a side-by-side comparison of the most recent key financial ratios for Zscaler, Inc. and Informatica Inc. as of their latest fiscal years.

| Ratios | Zscaler, Inc. (ZS) FY 2025 | Informatica Inc. (INFA) FY 2024 |

|---|---|---|

| ROE | -2.31% | 0.43% |

| ROIC | -3.18% | 0.56% |

| P/E | -1063 | 788 |

| P/B | 24.51 | 3.39 |

| Current Ratio | 2.01 | 1.82 |

| Quick Ratio | 2.01 | 1.82 |

| D/E (Debt-to-Equity) | 1.00 | 0.81 |

| Debt-to-Assets | 28.0% | 35.2% |

| Interest Coverage | -13.49 | 0.87 |

| Asset Turnover | 0.42 | 0.31 |

| Fixed Asset Turnover | 4.22 | 8.75 |

| Payout ratio | 0 | 0.12% |

| Dividend yield | 0 | 0.00015% |

Interpretation of the Ratios

Zscaler, Inc.

Zscaler shows a mixed ratio profile with 35.71% favorable and 50% unfavorable ratios, suggesting slightly unfavorable financial health. Strong liquidity is noted with current and quick ratios at 2.01, while profitability metrics such as net margin (-1.55%) and ROE (-2.31%) are unfavorable. The company does not pay dividends, likely due to ongoing investments and negative returns. No dividend yield or payout risks apply.

Informatica Inc.

No ratio data or key financial metrics are available for Informatica Inc., preventing a detailed assessment. This lack of information limits insight into the company’s profitability, liquidity, leverage, or shareholder returns. Without dividend data, it is unclear whether the company pays dividends or focuses on reinvestment or growth strategies.

Which one has the best ratios?

Based on available data, Zscaler’s ratios are slightly unfavorable but offer some strengths like liquidity and fixed asset turnover. Informatica’s evaluation is not possible due to missing data, so no definitive comparison can be made. Investors should consider the incomplete information when assessing these companies.

Strategic Positioning

This section compares the strategic positioning of Zscaler, Inc. and Informatica Inc., focusing on Market position, Key segments, and Exposure to technological disruption:

Zscaler, Inc.

- Market leader in cloud security with $2.67B revenue, facing moderate competitive pressure.

- Key segments include cloud security, workload segmentation, and digital experience solutions.

- Exposure to disruption through cloud security innovation and SaaS application protection.

Informatica Inc.

- Focuses on AI-powered data management with $1.1B subscription revenue, competitive in data integration.

- Key drivers are data integration, API management, data quality, and governance platforms.

- Exposure centered on multi-cloud and hybrid data management, driven by AI-enabled platform evolution.

Zscaler, Inc. vs Informatica Inc. Positioning

Zscaler adopts a concentrated approach in cloud security solutions, leveraging workload segmentation and digital experience tools. Informatica pursues a diversified strategy around AI-powered data integration and management, spanning multiple interoperable products. Both face distinct competitive challenges within their niches.

Which has the best competitive advantage?

Zscaler’s MOAT evaluation indicates a slightly unfavorable status due to value destruction despite improving ROIC, while Informatica lacks sufficient data for MOAT assessment. Thus, Zscaler’s competitive advantage is currently limited but improving.

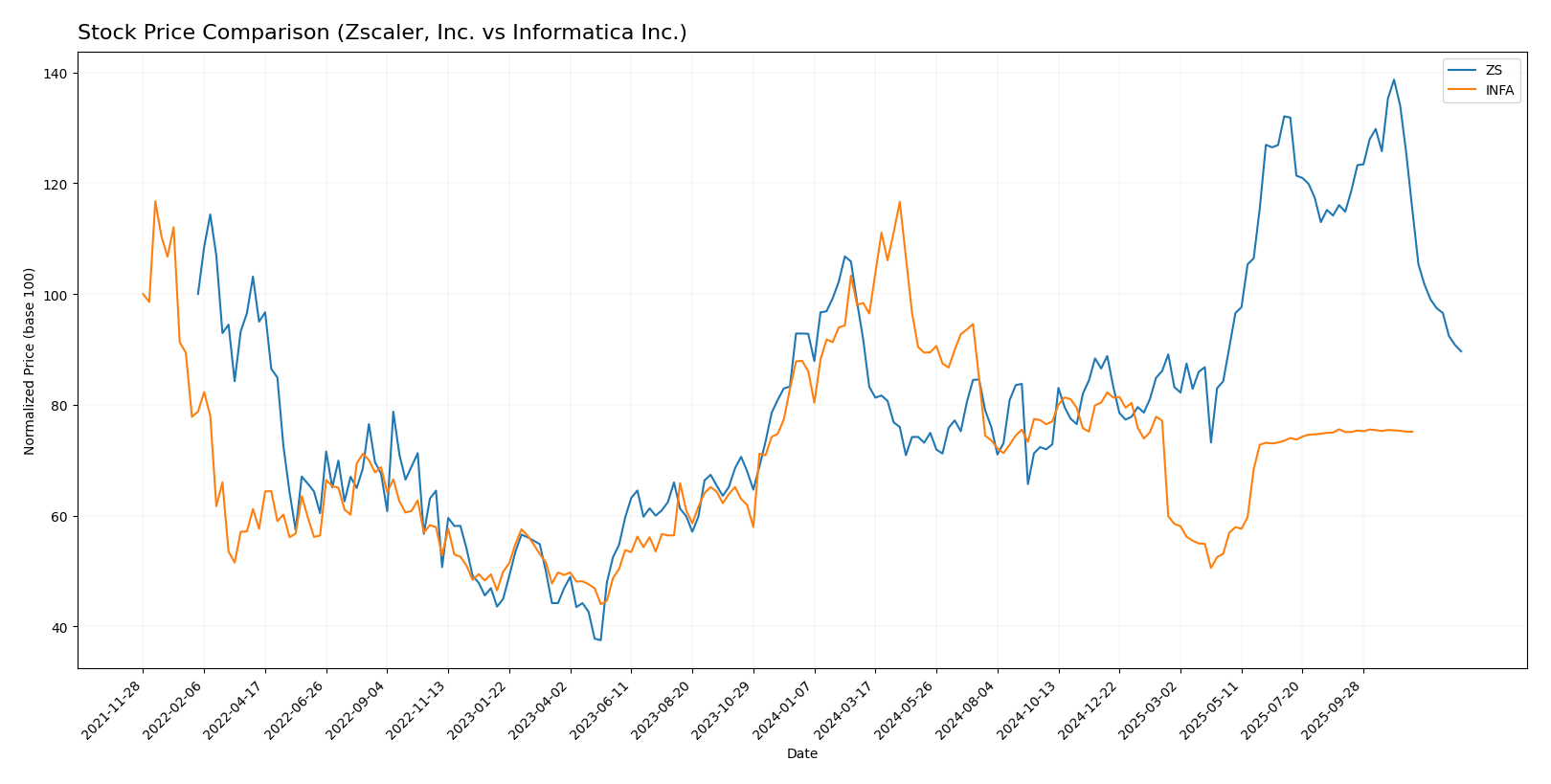

Stock Comparison

The stock price movements of Zscaler, Inc. and Informatica Inc. over the past 12 months reveal contrasting bearish trends with varying degrees of acceleration and volatility, highlighting different trading dynamics and market responses.

Trend Analysis

Zscaler, Inc. (ZS) experienced a -9.03% price decline over the past year, indicating a bearish trend with deceleration and high volatility (std deviation 47.11). The stock ranged between 331.14 and 156.78.

Informatica Inc. (INFA) showed a -12.68% decline over the same period, also bearish but with acceleration and much lower volatility (std deviation 4.46). Its price fluctuated between 38.48 and 16.67.

Comparing both, Zscaler’s stock exhibited a smaller overall loss but higher volatility, while Informatica’s trend was more accelerated downward. Zscaler delivered relatively better market performance during this timeframe.

Target Prices

Analysts present a clear consensus on target prices for Zscaler, Inc. and Informatica Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Zscaler, Inc. | 360 | 260 | 311.41 |

| Informatica Inc. | 27 | 27 | 27 |

The target consensus for Zscaler at 311.41 suggests significant upside potential from its current 213.98 price. Informatica’s consensus target of 27 is slightly above its current 24.79 price, indicating modest expected growth.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Zscaler, Inc. and Informatica Inc.:

Rating Comparison

ZS Rating

- Rating: C- with a “Very Favorable” status from the rating evaluation.

- Discounted Cash Flow Score: 4, indicating a “Favorable” valuation based on future cash flows.

- ROE Score: 1, marked as “Very Unfavorable” for profitability from equity.

- ROA Score: 1, considered “Very Unfavorable” for asset efficiency.

- Debt To Equity Score: 1, rated “Very Unfavorable” for financial risk.

- Overall Score: 1, classified as “Very Unfavorable” in overall financial standing.

INFA Rating

- No rating data available.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

Which one is the best rated?

Based strictly on the data, Zscaler, Inc. has a complete set of ratings, including a “Very Favorable” overall rating but low scores on profitability and financial risk metrics. Informatica Inc. lacks any rating data, so Zscaler is better rated by default.

Scores Comparison

The scores comparison between Zscaler, Inc. and Informatica Inc. highlights their financial health and bankruptcy risk:

ZS Scores

- Altman Z-Score: 4.89, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

INFA Scores

- Altman Z-Score: 1.94, in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

Which company has the best scores?

ZS shows a stronger Altman Z-Score indicating better bankruptcy safety, while INFA has a higher Piotroski Score reflecting relatively stronger financial health. Each company leads in different score categories based on the provided data.

Grades Comparison

Here is a summary of the recent grades from reputable financial institutions for both companies:

Zscaler, Inc. Grades

The following table shows recent analyst grades from major grading companies for Zscaler, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Mizuho | Upgrade | Outperform | 2025-12-16 |

| Bernstein | Downgrade | Market Perform | 2025-12-01 |

| Citigroup | Maintain | Buy | 2025-12-01 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Baird | Maintain | Outperform | 2025-11-26 |

| BTIG | Maintain | Buy | 2025-11-26 |

Overall, Zscaler’s grades indicate a predominantly positive outlook with several Buy and Outperform ratings, alongside some Neutral and Market Perform assessments.

Informatica Inc. Grades

The following table shows recent analyst grades from major grading companies for Informatica Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Downgrade | Neutral | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-05-28 |

| JP Morgan | Downgrade | Neutral | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | Downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-28 |

| Truist Securities | Downgrade | Hold | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-27 |

| UBS | Maintain | Neutral | 2025-05-16 |

Informatica’s grades reflect a more cautious or neutral stance, with multiple downgrades and a majority of Neutral, Hold, or Sector Perform ratings.

Which company has the best grades?

Zscaler, Inc. has received stronger and more positive grades compared to Informatica Inc., with several Buy and Outperform ratings versus Informatica’s neutral and hold designations. This suggests Zscaler may currently be viewed more favorably by analysts, potentially influencing investor sentiment and portfolio allocation.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Zscaler, Inc. (ZS) and Informatica Inc. (INFA) based on the most recent available data.

| Criterion | Zscaler, Inc. (ZS) | Informatica Inc. (INFA) |

|---|---|---|

| Diversification | Limited product diversification; mainly cloud security | Moderate diversification with cloud, subscription, and professional services |

| Profitability | Negative net margin (-1.55%), negative ROIC (-3.18%) | Data unavailable for precise evaluation |

| Innovation | Growing ROIC trend suggests improving profitability | Data unavailable, but product mix indicates focus on cloud and subscription innovation |

| Global presence | Strong global cloud security footprint | Established presence with varied revenue streams |

| Market Share | Significant in cloud security niche | Competitive in data management and integration markets |

Key takeaways: Zscaler shows improving profitability trends despite current value destruction, reflecting potential for turnaround. Informatica’s diversification across services and subscription revenue streams is a strength, though lack of recent financial details limits thorough assessment. Caution and ongoing monitoring are advised for both.

Risk Analysis

Below is a comparative table highlighting key risks for Zscaler, Inc. (ZS) and Informatica Inc. (INFA) as of 2026:

| Metric | Zscaler, Inc. (ZS) | Informatica Inc. (INFA) |

|---|---|---|

| Market Risk | Moderate (Beta 1.02, tech sector volatility) | Moderate-High (Beta 1.14, less trading activity) |

| Debt level | Moderate (Debt-to-assets 28%, DE ratio 1.0) | Unknown (data unavailable) |

| Regulatory Risk | Moderate (Cloud security regulations) | Moderate (Data privacy and AI regulations) |

| Operational Risk | Moderate (complex cloud security platform) | Moderate (AI-powered data integration complexity) |

| Environmental Risk | Low (Software sector, limited direct impact) | Low (Software sector, limited direct impact) |

| Geopolitical Risk | Moderate (Global cloud service exposure) | Moderate (Global data regulations and trade impacts) |

Zscaler faces moderate market and operational risks due to its cloud security focus and recent unfavorable profitability ratios. Informatica’s risks are harder to fully assess due to missing financial data but carry moderate regulatory and market exposure given its AI-driven data management platform. The most impactful risk remains regulatory changes and operational complexity in both firms.

Which Stock to Choose?

Zscaler, Inc. (ZS) has shown strong revenue growth of 297% over 2021-2025, with favorable income statement trends despite negative profitability ratios such as ROE (-2.31%) and net margin (-1.55%). Its debt levels are moderate with a current ratio above 2.0, but the company is still shedding value as ROIC remains below WACC. The overall rating is very favorable (C-), although many financial ratios are unfavorable, indicating mixed financial health.

Informatica Inc. (INFA) presents a more stable profitability profile with a positive EBIT margin of 12.15% and a modest net margin of 0.61%. Income growth is slower, around 24% over the last five years, with mixed cash flow results and a net debt to EBITDA ratio indicating higher leverage. Its Altman Z-score places it in the grey zone, signaling moderate financial risk, while the Piotroski score suggests average financial strength. However, detailed ratio data and ratings are unavailable.

For investors prioritizing strong growth and improving profitability despite current value destruction, Zscaler might appear more attractive. Conversely, those favoring stability and a better current profitability profile could find Informatica’s performance more aligned with risk-averse or income-focused strategies. The choice might depend heavily on the investor’s tolerance for risk and investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Zscaler, Inc. and Informatica Inc. to enhance your investment decisions: