In the dynamic world of technology infrastructure software, Synopsys, Inc. (SNPS) and Informatica Inc. (INFA) stand out as influential players. Both companies drive innovation in software solutions that support critical enterprise operations, from electronic design automation to AI-powered data management. Given their overlapping markets and distinct approaches to innovation, comparing them offers valuable insight. Join me as we explore which company presents a more compelling opportunity for investors in 2026.

Table of contents

Companies Overview

I will begin the comparison between Synopsys and Informatica by providing an overview of these two companies and their main differences.

Synopsys Overview

Synopsys, Inc. specializes in electronic design automation software, enabling the design and testing of integrated circuits. Its product portfolio includes platforms for digital design, verification, FPGA design, and intellectual property solutions covering USB, PCI Express, and other protocols. Founded in 1986 and based in Mountain View, California, Synopsys serves diverse sectors such as electronics, automotive, and finance with a workforce of 20,000 employees.

Informatica Overview

Informatica Inc. develops an AI-powered data management platform that integrates and governs enterprise data across multi-cloud and hybrid environments. Its offerings include data integration, API management, data quality, master data management, and governance products. Founded in 1993 and headquartered in Redwood City, California, Informatica employs approximately 5,200 staff members and focuses on enabling accurate and consistent data for analytics and compliance.

Key similarities and differences

Both Synopsys and Informatica operate in the software infrastructure industry, with strong technology-driven solutions. Synopsys focuses on hardware design automation and verification tools, while Informatica specializes in enterprise data management and integration software. Additionally, Synopsys has a significantly larger market capitalization and workforce compared to Informatica, reflecting their differing scales and market positions.

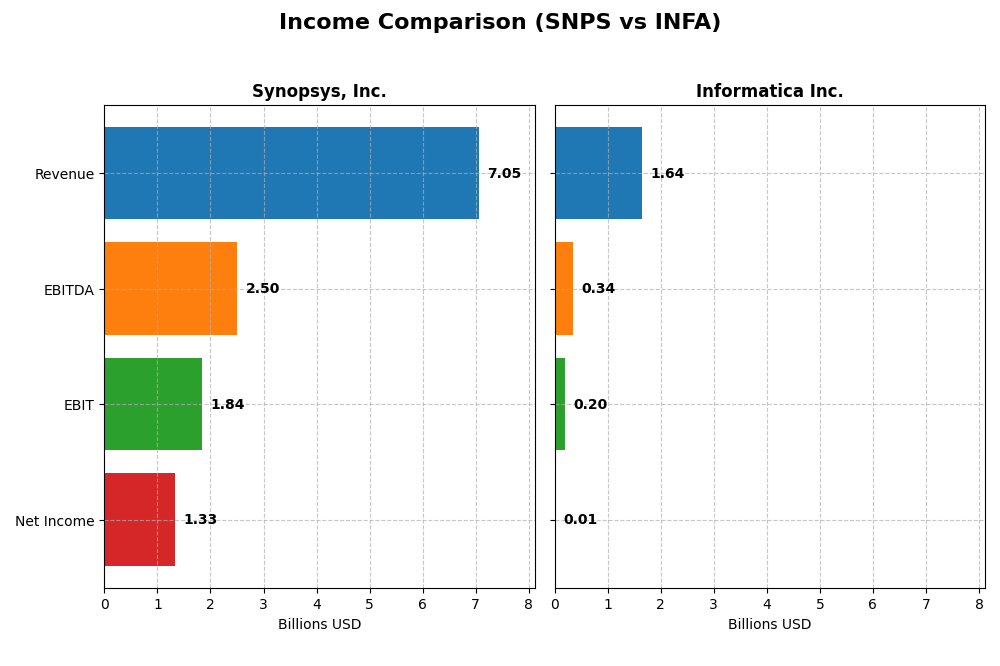

Income Statement Comparison

The following table compares key income statement metrics for Synopsys, Inc. and Informatica Inc. for their most recent fiscal years.

| Metric | Synopsys, Inc. (SNPS) | Informatica Inc. (INFA) |

|---|---|---|

| Market Cap | 98.8B | 7.5B |

| Revenue | 7.05B | 1.64B |

| EBITDA | 2.50B | 339M |

| EBIT | 1.84B | 199M |

| Net Income | 1.33B | 9.93M |

| EPS | 8.13 | 0.033 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Synopsys, Inc.

Synopsys displayed consistent revenue growth from 2021 to 2025, reaching $7.05B in 2025. Net income increased overall but fell in 2025 to $1.33B from $2.26B in 2024. Margins remained strong with a 76.98% gross margin and 18.89% net margin. The latest year saw revenue growth slow to 15.12%, while net margin and EPS declined notably.

Informatica Inc.

Informatica’s revenue grew modestly to $1.64B in 2024, up from $1.32B in 2020. The company returned to profitability in 2024 with a net income of $9.93M, reversing prior losses. Margins reflected stability with an 80.11% gross margin and a neutral 0.61% net margin. Recent performance showed slow revenue growth but strong improvement in net margin and EPS.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement trends, with Synopsys showing robust revenue and net income growth over five years, albeit with margin pressure in 2025. Informatica demonstrates resilience by recovering net income and improving margins despite slower revenue gains. Synopsys’s higher profitability contrasts with Informatica’s margin stabilization, suggesting differing fundamental strengths.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Synopsys, Inc. (SNPS) and Informatica Inc. (INFA) as of their latest fiscal years, offering a snapshot for comparative analysis.

| Ratios | Synopsys, Inc. (2025) | Informatica Inc. (2024) |

|---|---|---|

| ROE | 4.72% | 0.43% |

| ROIC | 1.97% | 0.56% |

| P/E | 54.36 | 787.95 |

| P/B | 2.57 | 3.39 |

| Current Ratio | 1.62 | 1.82 |

| Quick Ratio | 1.52 | 1.82 |

| D/E (Debt to Equity) | 0.50 | 0.81 |

| Debt-to-Assets | 29.6% | 35.2% |

| Interest Coverage | 2.05 | 0.87 |

| Asset Turnover | 0.15 | 0.31 |

| Fixed Asset Turnover | 5.04 | 8.75 |

| Payout ratio | 0 | 0.12% |

| Dividend yield | 0% | 0.00015% |

Interpretation of the Ratios

Synopsys, Inc.

Synopsys presents a mixed ratio profile with a strong net margin of 18.96% and favorable liquidity ratios (current ratio 1.62, quick ratio 1.52), indicating good operational efficiency and short-term financial health. However, the return on equity (4.72%), return on invested capital (1.97%), and price-to-earnings ratio (54.36) are unfavorable, signaling potential concerns on profitability and valuation. Synopsys does not pay dividends, reflecting a possible reinvestment strategy or growth focus.

Informatica Inc.

No financial ratios data is available for Informatica, preventing a thorough ratio analysis. The absence of dividend payments might be linked to incomplete data or strategic factors such as reinvestment in R&D or acquisitions. Without key metrics or cash flow information, assessing profitability, liquidity, or shareholder returns for Informatica is not feasible.

Which one has the best ratios?

Based on the available data, Synopsys offers a clearer picture with several favorable liquidity and profitability ratios but also notable weaknesses in returns and valuation multiples. Informatica’s lack of ratio data precludes a direct comparison, making Synopsys the only company with analyzable financial ratios at this time, resulting in a neutral overall evaluation.

Strategic Positioning

This section compares the strategic positioning of Synopsys and Informatica, focusing on Market position, Key segments, and Exposure to disruption:

Synopsys, Inc.

- Leading provider in electronic design automation with strong competitive pressure in semiconductor software.

- Key segments include License and Maintenance, Technology Services, and FPGA design products.

- Exposure to disruption through innovation in virtual prototyping, security IP, and SoC infrastructure IP.

Informatica Inc.

- Focused on AI-powered data management platform amid competitive cloud and data integration markets.

- Key drivers are subscription services, professional services, and multi-cloud data integration products.

- Faces technological disruption from evolving AI data platforms and cloud integration demands.

Synopsys, Inc. vs Informatica Inc. Positioning

Synopsys exhibits a diversified portfolio in electronic design automation and IP solutions, while Informatica concentrates on AI-driven data management and integration. Synopsys benefits from broad industry applications; Informatica focuses on enterprise-scale cloud data challenges.

Which has the best competitive advantage?

Based on MOAT evaluation, Synopsys shows very unfavorable value creation with declining ROIC, indicating value destruction. Informatica lacks sufficient data for MOAT assessment, so Synopsys’s competitive advantage appears weaker by this measure.

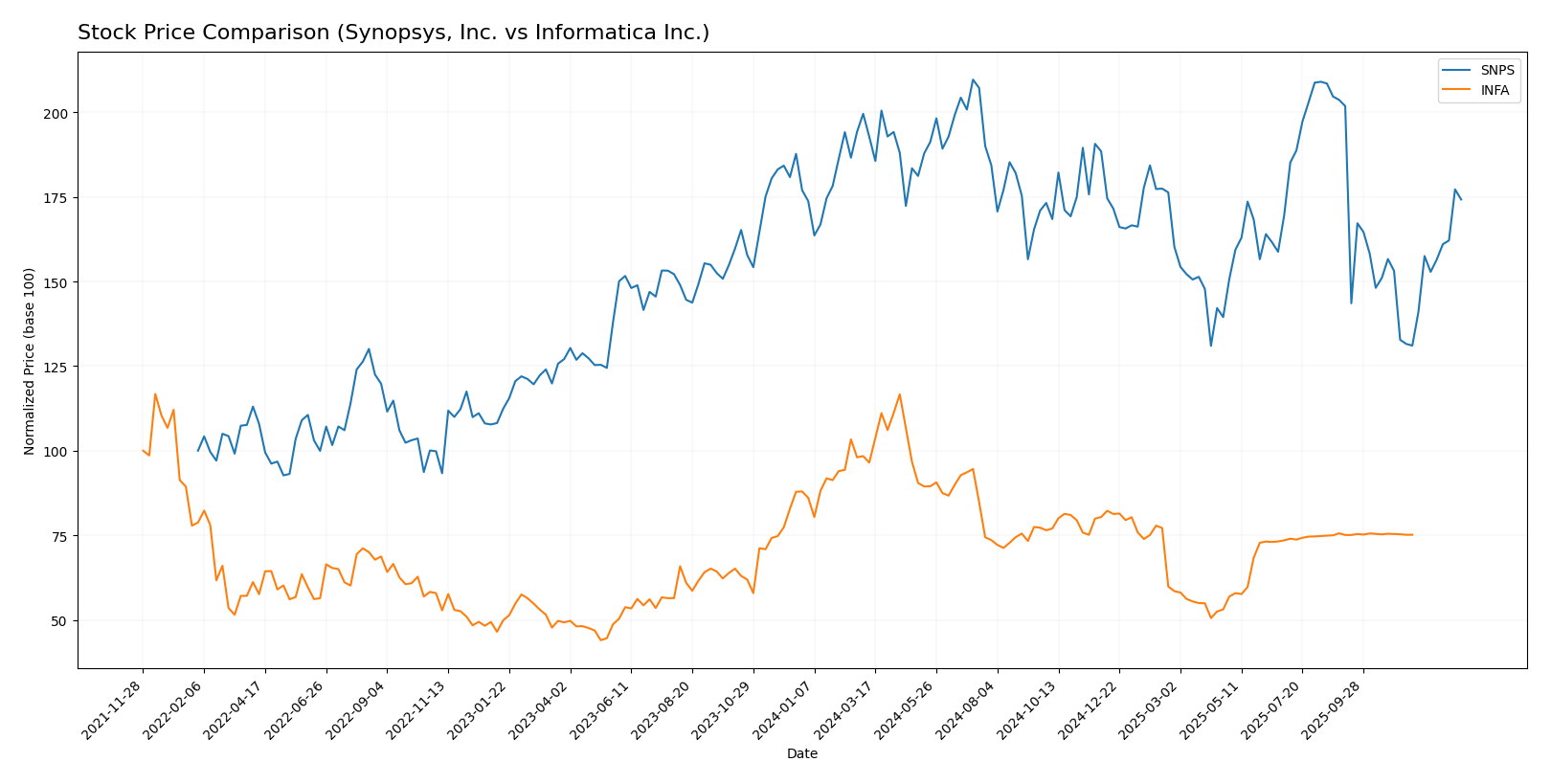

Stock Comparison

The stock price dynamics over the past 12 months reveal contrasting trajectories for Synopsys, Inc. and Informatica Inc., with both exhibiting notable volatility and accelerating bearish trends followed by recent shifts in momentum.

Trend Analysis

Synopsys, Inc. experienced a 10.31% price decline over the past year, marking a bearish trend with accelerating downward momentum. The stock showed high volatility, with prices ranging from 388.13 to 621.3 and a recent rebound of 13.77% in the last two and a half months.

Informatica Inc. also faced a bearish trend, with a 12.68% price decrease over the year and accelerating decline. Volatility was much lower, with prices between 16.67 and 38.48, and a near-neutral trend recently, showing a slight 0.08% increase over two and a half months.

Comparing both, Synopsys’s stock has delivered a better recent recovery despite the steeper overall drop. Informatica’s consistent but less volatile decline placed it behind Synopsys in market performance over the full year.

Target Prices

The current analyst consensus for target prices reflects moderate optimism for Synopsys, Inc. and a stable outlook for Informatica Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Synopsys, Inc. | 600 | 425 | 530 |

| Informatica Inc. | 27 | 27 | 27 |

For Synopsys, the consensus target price of 530 USD is slightly above the current price of 516.31 USD, suggesting potential moderate upside. Informatica’s target price matches its current price at 24.79 USD, indicating a neutral outlook from analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Synopsys, Inc. and Informatica Inc.:

Rating Comparison

SNPS Rating

- Rating: B-, classified as Very Favorable.

- Discounted Cash Flow Score: 3, indicating Moderate.

- ROE Score: 3, Moderate rating on profitability.

- ROA Score: 3, Moderate efficiency in asset use.

- Debt To Equity Score: 2, Moderate financial risk.

- Overall Score: 3, Moderate overall financial health.

INFA Rating

- No rating data available.

- No DCF score available.

- No ROE score available.

- No ROA score available.

- No debt to equity score available.

- No overall score available.

Which one is the best rated?

Based solely on the provided data, Synopsys holds a complete set of moderate scores and a Very Favorable B- rating, while Informatica lacks any rating or scores. Therefore, Synopsys is better rated in this comparison.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Synopsys and Informatica:

Synopsys Scores

- Altman Z-Score: 3.54, in the safe zone, low bankruptcy risk.

- Piotroski Score: 4, average financial strength.

Informatica Scores

- Altman Z-Score: 1.94, in the grey zone, moderate bankruptcy risk.

- Piotroski Score: 6, average financial strength.

Which company has the best scores?

Synopsys has a stronger Altman Z-Score indicating lower bankruptcy risk, while Informatica scores higher on the Piotroski scale, both showing average financial strength.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Synopsys, Inc. and Informatica Inc.:

Synopsys, Inc. Grades

The table below summarizes recent actionable grades from reputable grading companies for Synopsys, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Morgan Stanley | Maintain | Overweight | 2025-12-12 |

| Rosenblatt | Maintain | Buy | 2025-12-11 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| Piper Sandler | Maintain | Overweight | 2025-12-11 |

| Needham | Maintain | Buy | 2025-12-11 |

| B of A Securities | Upgrade | Buy | 2025-12-11 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-11 |

| Rosenblatt | Upgrade | Buy | 2025-12-09 |

Synopsys has predominantly received “Buy” and “Overweight” ratings, with a recent downgrade from Piper Sandler to “Neutral.” The overall trend shows mostly positive sentiment with some caution.

Informatica Inc. Grades

The table below summarizes recent actionable grades from reputable grading companies for Informatica Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Downgrade | Neutral | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-05-28 |

| JP Morgan | Downgrade | Neutral | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | Downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-28 |

| Truist Securities | Downgrade | Hold | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-27 |

| UBS | Maintain | Neutral | 2025-05-16 |

Informatica’s grades mostly range from “Hold” to “Neutral” and “Sector Perform,” with several downgrades, indicating a cautious or neutral stance from analysts.

Which company has the best grades?

Synopsys, Inc. holds stronger and more positive grades with numerous “Buy” and “Overweight” ratings compared to Informatica Inc.’s predominantly “Hold” and “Neutral” grades. This suggests Synopsys may currently be viewed more favorably by analysts, potentially influencing investor sentiment toward higher expected performance.

Strengths and Weaknesses

Below is a comparative overview of Synopsys, Inc. (SNPS) and Informatica Inc. (INFA) based on their recent financial and operational data.

| Criterion | Synopsys, Inc. (SNPS) | Informatica Inc. (INFA) |

|---|---|---|

| Diversification | High product diversification with licensing, maintenance, and technology services generating multi-billion revenues. | Moderate diversification focused on subscription and professional services with smaller total revenue scale. |

| Profitability | Moderate profitability: net margin is favorable at 19%, but ROIC is low at 1.97% and below WACC, indicating value destruction. | Data insufficient to evaluate profitability metrics accurately. |

| Innovation | Strong investment in technology services and fixed asset efficiency (fixed asset turnover favorable). | Data insufficient to assess innovation capacity. |

| Global presence | Established global footprint with consistent license growth and service offerings worldwide. | Growing subscription revenue suggests expanding market reach but less global scale than SNPS. |

| Market Share | Significant market share in electronic design automation with stable license revenues above $2B. | Niche market presence with subscription revenues around $1.1B, smaller scale compared to SNPS. |

Key takeaways: Synopsys shows strong diversification and solid revenue streams but struggles with declining returns on invested capital, signaling risk. Informatica’s data gaps limit full assessment, but its growth in subscription services hints at a focused, evolving business model. Investors should weigh Synopsys’ scale against its profitability challenges and seek updated data on Informatica before making decisions.

Risk Analysis

Below is a comparative table of key risks for Synopsys, Inc. (SNPS) and Informatica Inc. (INFA) based on the most recent data from 2025.

| Metric | Synopsys, Inc. (SNPS) | Informatica Inc. (INFA) |

|---|---|---|

| Market Risk | Moderate beta at 1.12; tech sector volatility | Moderate beta at 1.14; emerging tech exposure |

| Debt Level | Moderate debt-to-assets: 29.6%, debt/equity 0.5 (neutral) | Limited data; Altman Z-Score in grey zone suggests caution |

| Regulatory Risk | Moderate, US tech regulations impact | Moderate, data privacy laws impact |

| Operational Risk | Complex software solutions; integration challenges | AI-powered platform complexity; integration risk |

| Environmental Risk | Low, software sector with limited direct exposure | Low, primarily cloud-based services |

| Geopolitical Risk | Moderate, US-China tech tensions may affect supply chain | Moderate, reliance on global cloud infrastructure |

Synopsys carries moderate market and operational risks but maintains a healthy financial position with a safe Altman Z-Score (3.54). Informatica shows a moderate risk profile with a grey zone Altman Z-Score (1.94), signaling some financial vulnerability, especially given missing detailed financial ratios. Market volatility and regulatory changes remain the most impactful risks for both companies.

Which Stock to Choose?

Synopsys, Inc. (SNPS) shows favorable income evolution with 67.8% revenue growth and 75.9% net income growth over 2021-2025. Its profitability is strong, reflected in an 18.9% net margin, though some ratios like ROE and ROIC are unfavorable. Debt levels are moderate, with a neutral debt-to-equity ratio and a very favorable overall rating of B-.

Informatica Inc. (INFA) presents a mixed income evolution with modest revenue growth of 23.9% over 2020-2024 and a low net margin of 0.61%. Its financial ratios and key metrics data are missing, but available scores show a grey zone Altman Z-Score indicating moderate bankruptcy risk, and an average Piotroski score, suggesting moderate financial strength. Debt appears higher relative to earnings.

For risk-tolerant investors seeking growth, SNPS’s strong income growth and favorable margins might appear more attractive, despite some valuation and profitability concerns. Conversely, those with a cautious approach might view INFA’s more moderate growth and financial scores as signaling a different risk profile, though incomplete data limits full assessment. Overall, the choice could depend on investors’ appetite for growth versus caution amid distinct financial profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Synopsys, Inc. and Informatica Inc. to enhance your investment decisions: