Informatica Inc. and StoneCo Ltd. are two prominent players in the software infrastructure industry, each driving innovation in data management and financial technology, respectively. Informatica excels in AI-powered data integration for enterprises, while StoneCo focuses on fintech solutions for merchants in Brazil. Their market overlap and distinct innovation strategies make this comparison compelling. Let’s explore which company presents the most attractive opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Informatica Inc. and StoneCo Ltd. by providing an overview of these two companies and their main differences.

Informatica Inc. Overview

Informatica Inc. focuses on developing an AI-powered platform that connects, manages, and unifies data across multi-cloud and hybrid systems at enterprise scale in the US. Its suite includes data integration, API management, data quality, master data management, and governance products, targeting large organizations seeking to improve data accuracy and compliance. Founded in 1993, it operates in the Software – Infrastructure industry with around 5,200 employees.

StoneCo Ltd. Overview

StoneCo Ltd. offers financial technology solutions enabling electronic commerce across in-store, online, and mobile channels primarily in Brazil. It distributes its products through proprietary Stone Hubs and sales teams, serving about 1.77M clients including SMBs and digital merchants. Founded in 2000, it functions under HR Holdings, LLC, operates in the Software – Infrastructure sector, and employs approximately 7,200 people from its base in the Cayman Islands.

Key similarities and differences

Both companies operate in the Software – Infrastructure industry, leveraging technology to serve business clients. Informatica emphasizes data management and integration solutions primarily in the US enterprise market, while StoneCo focuses on fintech services for merchants in Brazil. Informatica’s business centers on software products for data governance and analytics, contrasting with StoneCo’s payment processing and financial solutions platform tailored to commerce.

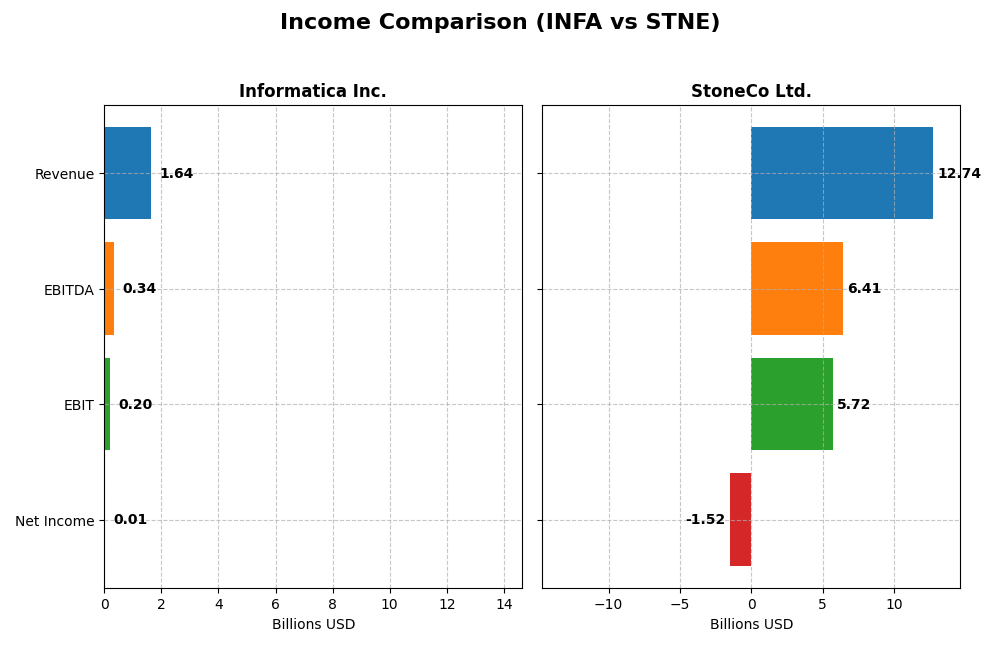

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Informatica Inc. and StoneCo Ltd. for the fiscal year 2024.

| Metric | Informatica Inc. (INFA) | StoneCo Ltd. (STNE) |

|---|---|---|

| Market Cap | 7.5B USD | 3.9B USD |

| Revenue | 1.64B USD | 12.7B BRL |

| EBITDA | 339M USD | 6.41B BRL |

| EBIT | 199M USD | 5.72B BRL |

| Net Income | 9.9M USD | -1.52B BRL |

| EPS | 0.03 USD | -5.02 BRL |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Informatica Inc.

Informatica’s revenue showed steady growth, rising from 1.32B in 2020 to 1.64B in 2024, with net income turning positive in 2024 after several years of losses. Gross margin remained strong at 80.11%, while EBIT margin improved to 12.15%. The 2024 performance saw a slight slowdown in revenue growth (2.81%) but significant EBIT and net margin expansion, signaling improving profitability.

StoneCo Ltd.

StoneCo’s revenue surged notably, growing from 3.17B BRL in 2020 to 12.7B BRL in 2024, but net income remained negative, reaching -1.52B BRL in 2024. Gross margin stayed healthy at 73.4%, and EBIT margin was robust at 44.86%. Despite solid revenue growth (12.1% in 2024), net margin declined further, reflecting challenges in converting sales growth into net profits.

Which one has the stronger fundamentals?

Informatica exhibits stronger fundamentals with consistent revenue growth, positive margin trends, and recent net income recovery. StoneCo shows impressive top-line expansion but ongoing net losses and deteriorating net margins. Informatica’s balanced margin improvement and positive net income contrast with StoneCo’s profitability struggles despite robust revenue gains.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Informatica Inc. (INFA) and StoneCo Ltd. (STNE) based on their most recent fiscal year data for 2024.

| Ratios | Informatica Inc. (INFA) | StoneCo Ltd. (STNE) |

|---|---|---|

| ROE | 0.43% | -12.87% |

| ROIC | 0.56% | 22.41% |

| P/E | 788 | -9.84 |

| P/B | 3.39 | 1.27 |

| Current Ratio | 1.82 | 1.37 |

| Quick Ratio | 1.82 | 1.37 |

| D/E | 0.81 | 1.10 |

| Debt-to-Assets | 35.2% | 23.5% |

| Interest Coverage | 0.87 | 5.57 |

| Asset Turnover | 0.31 | 0.23 |

| Fixed Asset Turnover | 8.75 | 6.95 |

| Payout ratio | 0.12% | 0% |

| Dividend yield | 0.00015% | 0% |

Interpretation of the Ratios

Informatica Inc.

Informatica’s financial ratios show mixed signals, with a current ratio at 1.82 indicating a decent short-term liquidity position. However, returns on assets (0.19%) and equity (0.43%) are very low, suggesting weak profitability and efficiency. The company does not pay dividends, which aligns with its likely reinvestment strategy to support growth and R&D priorities.

StoneCo Ltd.

StoneCo presents a slightly favorable overall ratio profile, with a strong return on invested capital (22.41%) and good interest coverage (5.41), indicating efficient capital use and manageable debt costs. Yet, negative net margin (-11.89%) and return on equity (-12.87%) highlight ongoing profitability challenges. StoneCo does not issue dividends, possibly reflecting reinvestment needs or growth focus.

Which one has the best ratios?

StoneCo edges out Informatica with a higher proportion of favorable ratios (50% vs. unclear for Informatica) and robust capital returns despite profitability issues. Informatica shows liquidity strength but struggles with profitability and cash flow, limiting its ratio attractiveness. Overall, StoneCo’s performance appears more balanced given the available data.

Strategic Positioning

This section compares the strategic positioning of Informatica Inc. and StoneCo Ltd., focusing on market position, key segments, and exposure to technological disruption:

Informatica Inc.

- Leading US software infrastructure player with moderate beta, facing competitive tech sector pressure.

- Focuses on AI-powered data management platform, subscription and professional services drive revenue.

- Platform relies on enterprise cloud and AI integration, potentially vulnerable to rapid tech shifts.

StoneCo Ltd.

- Brazilian fintech with smaller market cap, higher beta, competing in dynamic electronic commerce market.

- Provides financial technology solutions to merchants, emphasizing local sales and digital channels.

- Operates in fintech with evolving payment technologies, facing disruption risks from innovation cycles.

Informatica Inc. vs StoneCo Ltd. Positioning

Informatica pursues a diversified enterprise data management strategy emphasizing AI and cloud, while StoneCo concentrates on fintech solutions for Brazilian merchants, leveraging hyper-local sales. Informatica’s broad platform contrasts with StoneCo’s focused regional fintech approach.

Which has the best competitive advantage?

StoneCo shows a very favorable moat with growing ROIC and value creation, indicating a durable competitive advantage. Informatica lacks sufficient data for moat evaluation, limiting direct comparison on competitive strength.

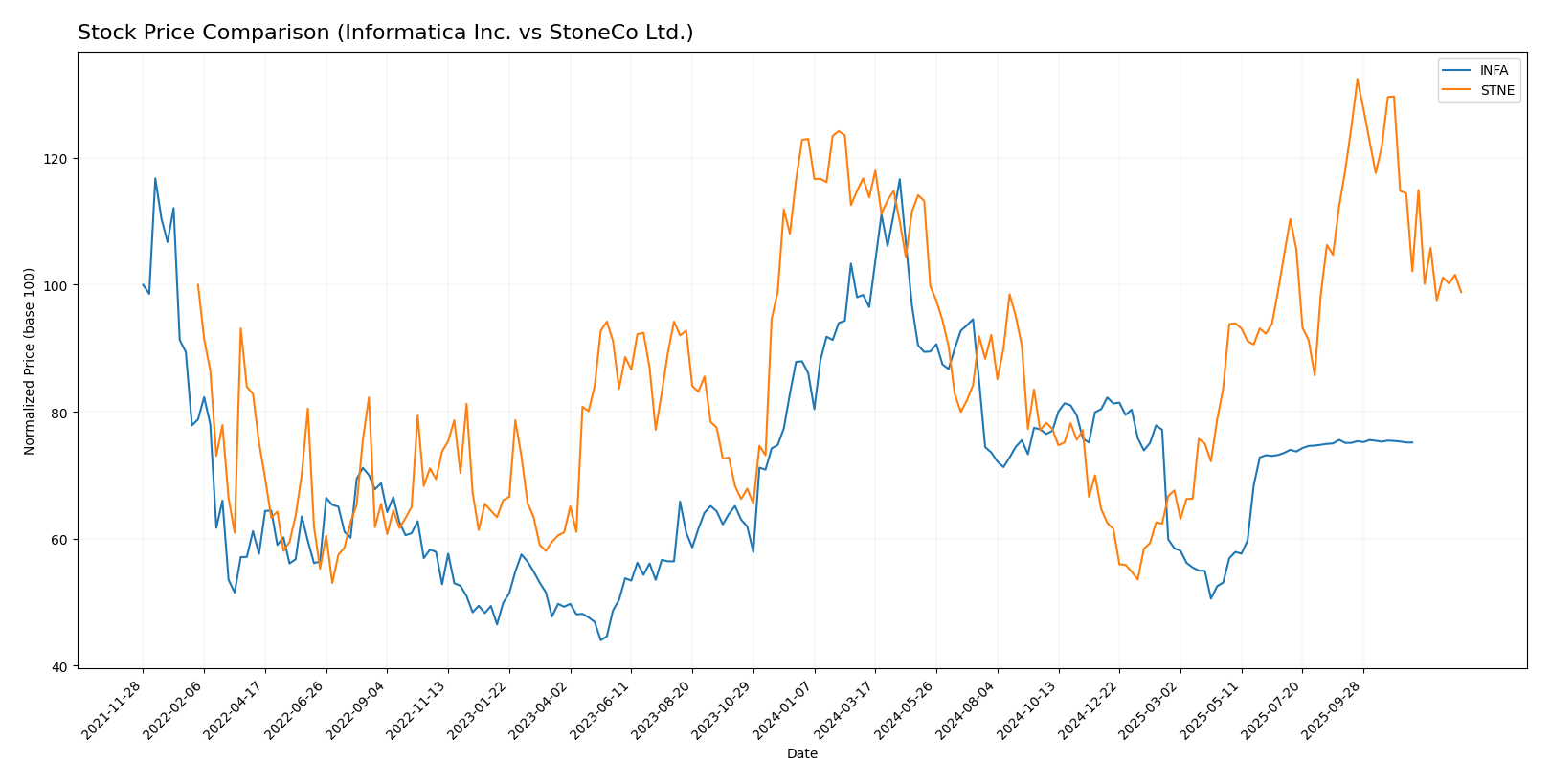

Stock Comparison

The stock price movements of Informatica Inc. and StoneCo Ltd. over the past 12 months reveal notable bearish trends with distinct trading volume dynamics and recent variations in momentum.

Trend Analysis

Informatica Inc. experienced a 12.68% price decline over the past year, marking a bearish trend with accelerating downward momentum and a high volatility level at 4.46 std deviation. The stock ranged between 16.67 and 38.48.

StoneCo Ltd.’s stock price fell by 13.9% over the same period, also bearish but showing deceleration in the downtrend and lower volatility at 2.92 std deviation, with prices fluctuating from 7.85 to 19.4.

Comparing both stocks, Informatica Inc. showed a slightly smaller loss and accelerating trend, while StoneCo Ltd. had a larger decline with decelerating bearish momentum, resulting in Informatica delivering the relatively better market performance.

Target Prices

The current analyst consensus presents clear target prices for Informatica Inc. and StoneCo Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Informatica Inc. | 27 | 27 | 27 |

| StoneCo Ltd. | 20 | 20 | 20 |

Analysts expect Informatica’s stock to appreciate modestly from $24.79 to $27, while StoneCo’s consensus target of $20 suggests significant upside from the current $14.49 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Informatica Inc. and StoneCo Ltd.:

Rating Comparison

INFA Rating

- No rating information available for INFA.

- No discounted cash flow score available for INFA.

- No ROE score available for INFA.

- No ROA score available for INFA.

- No Debt To Equity score available for INFA.

- No overall score available for INFA.

STNE Rating

- Overall rating is C, considered Very Favorable.

- Discounted Cash Flow Score is 3, rated Moderate.

- Return on Equity Score is 1, rated Very Unfavorable.

- Return on Assets Score is 1, rated Very Unfavorable.

- Debt To Equity Score is 1, rated Very Unfavorable.

- Overall Score is 2, rated Moderate.

Which one is the best rated?

Based on the available data, StoneCo Ltd. has a complete rating profile with an overall “C” rating and mixed scores. Informatica Inc. lacks any rating or financial score data, so StoneCo is better rated strictly by the information provided.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

INFA Scores

- Altman Z-Score: 1.94, indicating a grey zone risk.

- Piotroski Score: 6, reflecting average financial strength.

STNE Scores

- Altman Z-Score: 1.02, indicating distress zone risk.

- Piotroski Score: 5, reflecting average financial strength.

Which company has the best scores?

INFA has a higher Altman Z-Score (1.94 vs 1.02) placing it in the grey zone, whereas STNE is in the distress zone. Both have average Piotroski Scores, with INFA slightly higher at 6 versus 5.

Grades Comparison

The following section presents the latest grading data from reputable financial institutions for Informatica Inc. and StoneCo Ltd.:

Informatica Inc. Grades

Here are the most recent grades assigned by recognized grading companies for Informatica Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Downgrade | Neutral | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-05-28 |

| JP Morgan | Downgrade | Neutral | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | Downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-28 |

| Truist Securities | Downgrade | Hold | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-27 |

| UBS | Maintain | Neutral | 2025-05-16 |

The overall trend for Informatica indicates a shift towards more cautious ratings, with multiple downgrades and a consensus rating of Hold.

StoneCo Ltd. Grades

The table below details the latest ratings given by established grading firms for StoneCo Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Maintain | Buy | 2025-10-14 |

| B of A Securities | Maintain | Buy | 2025-09-09 |

| UBS | Maintain | Buy | 2025-08-29 |

| JP Morgan | Maintain | Overweight | 2025-07-16 |

| Barclays | Maintain | Equal Weight | 2025-05-12 |

| Barclays | Maintain | Equal Weight | 2025-04-23 |

| Citigroup | Upgrade | Buy | 2025-04-22 |

| Barclays | Maintain | Equal Weight | 2025-03-21 |

| Morgan Stanley | Maintain | Underweight | 2025-03-21 |

| Goldman Sachs | Maintain | Buy | 2025-02-06 |

StoneCo’s ratings mainly reflect positive sentiment, with a consensus Buy rating and multiple Buy recommendations from top firms.

Which company has the best grades?

StoneCo Ltd. has received generally stronger grades compared to Informatica Inc., with more Buy ratings and a Buy consensus versus Informatica’s Hold consensus. This suggests StoneCo might be viewed more favorably by analysts, potentially impacting investor confidence and portfolio inclusion.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Informatica Inc. (INFA) and StoneCo Ltd. (STNE) based on the most recent available data.

| Criterion | Informatica Inc. (INFA) | StoneCo Ltd. (STNE) |

|---|---|---|

| Diversification | Moderate – Revenue mainly from subscription and professional services, limited product segments. | Moderate – Focused on financial technology; limited diversification across industries. |

| Profitability | Data unavailable for recent profitability metrics. | Mixed – Strong ROIC at 22.4% (favorable), but negative net margin (-11.9%) and ROE (-12.9%) indicate operational challenges. |

| Innovation | Strong subscription growth suggests ongoing product evolution and cloud focus. | Strong – Demonstrates durable competitive advantage with very favorable moat and growing ROIC. |

| Global presence | Established global player in data management and integration software. | Primarily focused on Brazil and Latin America markets, limiting global reach. |

| Market Share | Leader in enterprise data integration and cloud solutions. | Growing fintech market share regionally, but still developing internationally. |

Key takeaways: StoneCo exhibits a durable competitive advantage with growing returns on invested capital, though profitability issues require caution. Informatica’s strong subscription growth indicates innovation, but lack of recent financial data limits a full assessment. Risk management favors monitoring StoneCo’s operational efficiency and seeking updated Informatica metrics.

Risk Analysis

Below is a comparative overview of key risks for Informatica Inc. (INFA) and StoneCo Ltd. (STNE) based on the most recent data available for 2026:

| Metric | Informatica Inc. (INFA) | StoneCo Ltd. (STNE) |

|---|---|---|

| Market Risk | Moderate (Beta 1.14, tech sector volatility) | High (Beta 1.84, emerging market exposure) |

| Debt level | Data not available; cautious approach needed | Moderate to high (Debt/Equity 1.1, some financial leverage risk) |

| Regulatory Risk | Moderate (US data governance laws) | High (Brazilian fintech regulations and cross-border compliance) |

| Operational Risk | Moderate (complex AI platform integration) | Moderate to high (payment processing infrastructure) |

| Environmental Risk | Low (software industry impact limited) | Low (digital payments, minor environmental footprint) |

| Geopolitical Risk | Low (US-based, stable environment) | High (Brazil and Cayman Islands exposure) |

Informatica’s main risk lies in market volatility and regulatory compliance in the US tech space, whereas StoneCo faces higher geopolitical and regulatory risks coupled with financial leverage concerns. StoneCo’s Altman Z-score in the distress zone and negative profitability metrics highlight elevated bankruptcy risk, making its risk profile more concerning. Investors should weigh these factors carefully.

Which Stock to Choose?

Informatica Inc. (INFA) shows a favorable income statement with high gross and EBIT margins and strong growth in net margin and EPS over the 2020-2024 period. Financial ratios and profitability are mixed, with a moderate net debt to EBITDA of 2.8 and average financial health scores indicating some caution.

StoneCo Ltd. (STNE) has a slightly favorable overall financial ratio evaluation, supported by a very favorable moat due to a growing ROIC well above WACC, indicating value creation. However, it faces unfavorable net margin and ROE ratios, with some distress signals in Altman Z-Score and moderate Piotroski scores.

Investors focused on quality and competitive advantage might find StoneCo’s strong economic moat appealing despite profitability challenges, while those prioritizing consistent income growth and moderate risk could interpret Informatica’s improving margins and stable debt levels as favorable. Risk-tolerant investors may weigh StoneCo’s value creation against its earnings volatility.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Informatica Inc. and StoneCo Ltd. to enhance your investment decisions: