In the rapidly evolving software infrastructure sector, Palantir Technologies Inc. and Informatica Inc. stand out as key players driving innovation in data management and analytics. Palantir excels in advanced data integration for intelligence and operations, while Informatica focuses on AI-powered enterprise data unification across cloud environments. This article will explore their strategies, market positions, and growth potential to help you decide which company deserves a place in your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Palantir Technologies Inc. and Informatica Inc. by providing an overview of these two companies and their main differences.

Palantir Technologies Inc. Overview

Palantir Technologies Inc. specializes in building and deploying advanced software platforms for intelligence and operational use, primarily focusing on counterterrorism and data analysis. Headquartered in Denver, Colorado, Palantir offers solutions like Gotham and Foundry, which enable users to analyze and integrate large datasets for actionable insights. The company serves government and commercial clients, positioning itself as a leader in data-driven decision-making.

Informatica Inc. Overview

Informatica Inc. develops an AI-powered platform designed to manage, unify, and govern data across multi-cloud and hybrid environments at enterprise scale. Based in Redwood City, California, its suite includes data integration, API management, data quality, and governance products, aiming to provide comprehensive data solutions. Informatica focuses on helping businesses achieve accurate, consistent, and compliant data management for analytics and operational needs.

Key similarities and differences

Both Palantir and Informatica operate in the Software – Infrastructure industry, providing data-centric platforms that support complex enterprise needs. Palantir emphasizes intelligence and operational software with a focus on pattern recognition and actionable insights, while Informatica concentrates on data integration, quality, and governance across cloud and hybrid systems. Their business models differ in target markets and software applications, with Palantir leaning towards government and security sectors and Informatica focusing on enterprise data management.

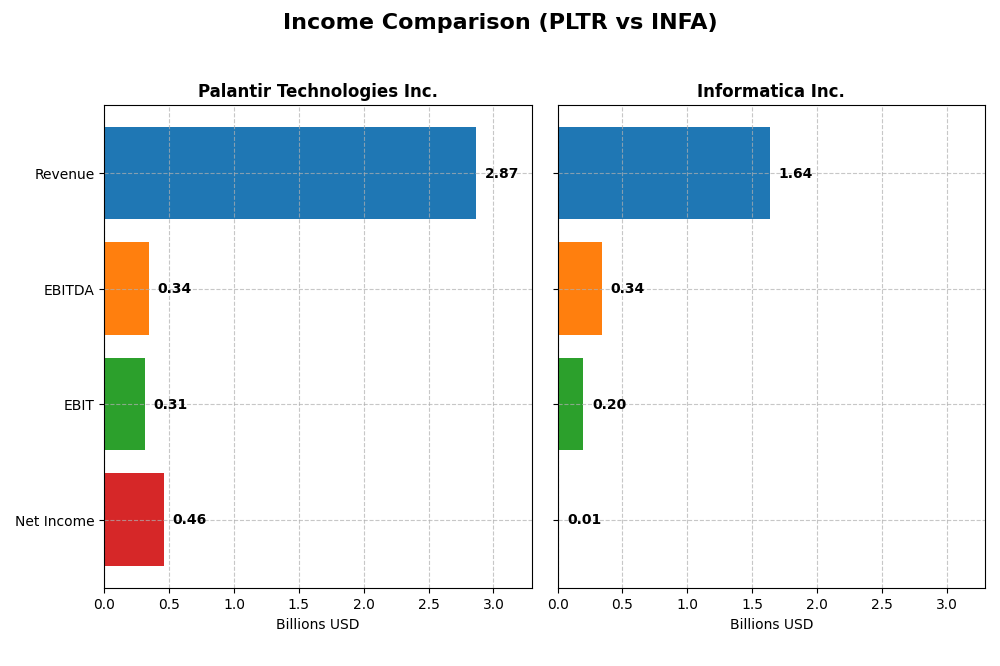

Income Statement Comparison

The table below presents a side-by-side comparison of the key income statement metrics for Palantir Technologies Inc. and Informatica Inc. for the fiscal year 2024.

| Metric | Palantir Technologies Inc. (PLTR) | Informatica Inc. (INFA) |

|---|---|---|

| Market Cap | 390.5B | 7.5B |

| Revenue | 2.87B | 1.64B |

| EBITDA | 342M | 339M |

| EBIT | 310M | 199M |

| Net Income | 462M | 9.9M |

| EPS | 0.21 | 0.033 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Palantir Technologies Inc.

Palantir showed strong growth from 2020 to 2024, with revenue rising from 1.09B to 2.87B and net income improving from a 1.17B loss to 462M profit. Margins notably improved, with a gross margin above 80% and net margin reaching 16.13% in 2024. The latest year saw a revenue increase of 28.8% and net income growth of 71%, signaling accelerating profitability.

Informatica Inc.

Informatica’s revenue grew steadily from 1.32B in 2020 to 1.64B in 2024, while net income turned positive in 2024 at 9.9M after losses in prior years. Gross margin remained stable near 80%, but net margin was low at 0.61%. Revenue growth slowed to 2.8% in 2024; however, EBIT and net margin improvements suggest operational leverage is improving despite moderate top-line gains.

Which one has the stronger fundamentals?

Palantir exhibits stronger fundamentals with robust revenue and net income growth, high and improving margins, and zero interest expense, reflecting efficient cost management. Informatica shows positive trends but has a much lower net margin and slower revenue growth, with some neutral and unfavorable margin aspects. Overall, Palantir’s financials appear more favorable based on recent income statement performance.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for Palantir Technologies Inc. and Informatica Inc. based on their most recent fiscal year data ending 2024.

| Ratios | Palantir Technologies Inc. (PLTR) | Informatica Inc. (INFA) |

|---|---|---|

| ROE | 9.24% | 0.43% |

| ROIC | 5.51% | 0.56% |

| P/E | 368.2 | 787.9 |

| P/B | 34.01 | 3.39 |

| Current Ratio | 5.96 | 1.82 |

| Quick Ratio | 5.96 | 1.82 |

| D/E (Debt to Equity Ratio) | 0.048 | 0.81 |

| Debt-to-Assets | 3.77% | 35.2% |

| Interest Coverage | 0 | 0.87 |

| Asset Turnover | 0.45 | 0.31 |

| Fixed Asset Turnover | 11.92 | 8.75 |

| Payout ratio | 0% | 0.12% |

| Dividend yield | 0% | 0.00015% |

Interpretation of the Ratios

Palantir Technologies Inc.

Palantir’s 2024 ratios reveal strengths in debt management and interest coverage, with a low debt-to-equity of 0.05 and infinite interest coverage. However, valuation multiples like PE at 368.2 and PB at 34.01 appear stretched, alongside a high current ratio of 5.96 that may indicate inefficient asset use. The dividend yield is zero, reflecting no payouts as the company likely prioritizes reinvestment in growth and R&D.

Informatica Inc.

No ratio data is available for Informatica, preventing a detailed financial ratio analysis. The absence of dividends follows from missing financial disclosures, suggesting limited information on shareholder returns or payout policy. This lack of data restricts any meaningful comparison or evaluation of its financial health and operational efficiency.

Which one has the best ratios?

Palantir exhibits a mixed financial profile with several favorable metrics, particularly in leverage and interest coverage, but also faces concerns around valuation and asset turnover. Informatica’s missing data prevents any ratio-based assessment. Hence, based solely on available information, Palantir presents a more analyzable set of ratios despite some unfavorable signals.

Strategic Positioning

This section compares the strategic positioning of Palantir Technologies Inc. and Informatica Inc. across market position, key segments, and exposure to technological disruption:

Palantir Technologies Inc.

- Leading software infrastructure provider with significant government and commercial contracts, facing moderate competition.

- Revenue driven by government operating segment and growing commercial business focused on data integration and intelligence platforms.

- Develops advanced AI platforms and software for data analysis, with strong integration of large language models and virtual deployment.

Informatica Inc.

- Established software infrastructure firm focused on enterprise data management, operating with moderate competitive pressure.

- Key business drivers include AI-powered data management, subscription services, and professional services in multi-cloud environments.

- Focuses on AI-powered data unification and governance tools, addressing cloud and hybrid system complexities.

Palantir Technologies Inc. vs Informatica Inc. Positioning

Palantir exhibits a more diversified segment focus between government and commercial markets, while Informatica concentrates on enterprise data management with a subscription-heavy model. Palantir’s government contracts offer stability; Informatica emphasizes multi-cloud AI integration, each with distinct market advantages and challenges.

Which has the best competitive advantage?

Based on MOAT evaluation, Palantir currently shows a slightly unfavorable position with value destruction despite improving profitability. Informatica lacks sufficient data for MOAT assessment, making Palantir’s competitive advantage clearer but still cautious.

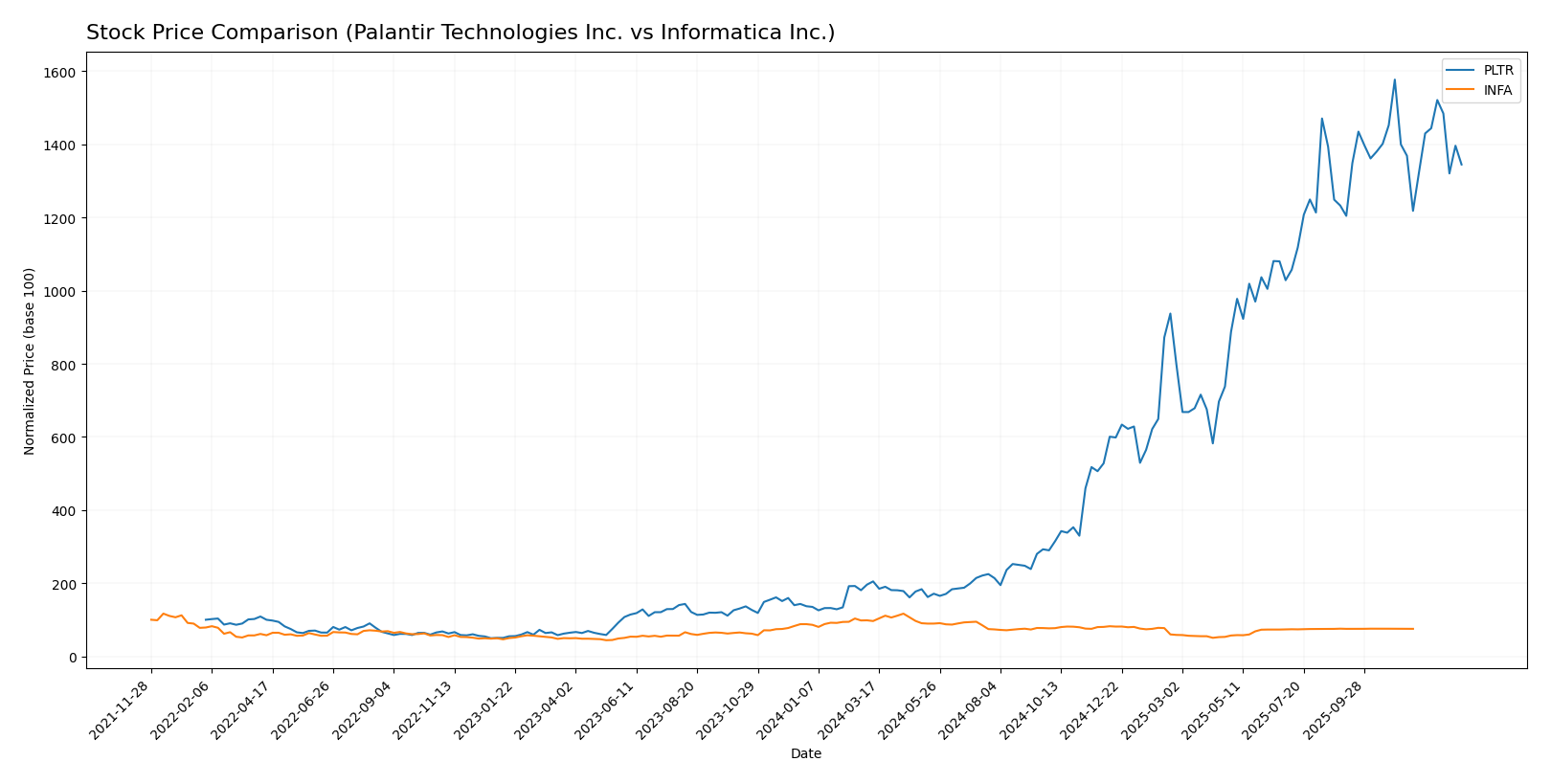

Stock Comparison

The stock price chart highlights significant price movements and contrasting trading dynamics for Palantir Technologies Inc. and Informatica Inc. over the past year, reflecting divergent market sentiment and volume trends.

Trend Analysis

Palantir Technologies Inc. exhibited a strong bullish trend over the past 12 months with a 644.28% price increase, though the trend shows deceleration. The stock experienced high volatility, ranging from 20.47 to 200.47, with recent short-term weakness.

Informatica Inc. displayed a bearish trend over the same period, with a 12.68% price decline accompanied by accelerating downward momentum. The stock had lower volatility, fluctuating between 16.67 and 38.48, with a recent neutral short-term trend.

Comparing both stocks, Palantir Technologies Inc. delivered the highest market performance with a substantial positive price change, while Informatica Inc. faced a negative price trend in the last year.

Target Prices

The current analyst consensus reveals optimistic price targets for both Palantir Technologies Inc. and Informatica Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Palantir Technologies Inc. | 223 | 160 | 198.33 |

| Informatica Inc. | 27 | 27 | 27 |

Analysts expect Palantir’s stock to appreciate from the current price of 170.96 USD toward an average target near 198 USD, while Informatica’s price target aligns closely with its current price of 24.79 USD, suggesting a more stable outlook.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Palantir Technologies Inc. and Informatica Inc.:

Rating Comparison

Palantir Technologies Inc. Rating

- Rating: B, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 2, indicating a moderate valuation.

- ROE Score: 4, showing favorable profitability efficiency.

- ROA Score: 5, reflecting very favorable asset utilization.

- Debt To Equity Score: 4, suggesting favorable financial risk.

- Overall Score: 3, considered moderate overall financial health.

Informatica Inc. Rating

- No rating data available.

- No data available.

- No data available.

- No data available.

- No data available.

- No data available.

Which one is the best rated?

Based strictly on the available data, Palantir holds a clear advantage with a “B” rating and several favorable to very favorable financial scores. Informatica lacks any rating or score information for comparison.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Palantir Technologies Inc. and Informatica Inc.:

PLTR Scores

- Altman Z-Score: 172.6, indicating a safe zone status.

- Piotroski Score: 7, classified as strong financial health.

INFA Scores

- Altman Z-Score: 1.94, indicating a grey zone status.

- Piotroski Score: 6, classified as average financial health.

Which company has the best scores?

Palantir (PLTR) shows a significantly higher Altman Z-Score, placing it in the safe zone, and a stronger Piotroski Score than Informatica (INFA), which is in the grey zone with average strength. Based strictly on these scores, PLTR displays better financial health.

Grades Comparison

Here is a comparison of recent grades assigned by reputable grading companies for the two companies:

Palantir Technologies Inc. Grades

The table below displays recent grades from established financial institutions for Palantir Technologies Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2026-01-12 |

| RBC Capital | Maintain | Underperform | 2025-11-04 |

| Baird | Maintain | Neutral | 2025-11-04 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-04 |

| Goldman Sachs | Maintain | Neutral | 2025-11-04 |

| Mizuho | Maintain | Neutral | 2025-11-04 |

| UBS | Maintain | Neutral | 2025-11-04 |

| Piper Sandler | Maintain | Overweight | 2025-11-04 |

| DA Davidson | Maintain | Neutral | 2025-11-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

The overall trend for Palantir is mostly neutral grades with one recent upgrade to buy and a stable overweight rating, showing cautious optimism.

Informatica Inc. Grades

The table below presents recent grades from recognized financial institutions for Informatica Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Downgrade | Neutral | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-05-28 |

| JP Morgan | Downgrade | Neutral | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | Downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-28 |

| Truist Securities | Downgrade | Hold | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-27 |

| UBS | Maintain | Neutral | 2025-05-16 |

Informatica shows a pattern of downgrades and mostly neutral or sector perform ratings, indicating a cautious stance from analysts.

Which company has the best grades?

Palantir Technologies Inc. has received comparatively stronger grades, including a recent upgrade to a Buy from Citigroup and an Overweight rating from Piper Sandler, whereas Informatica Inc. has experienced multiple downgrades to Neutral or Hold. This suggests Palantir may currently be viewed more favorably, potentially implying better near-term prospects for investors.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Palantir Technologies Inc. (PLTR) and Informatica Inc. (INFA), based on the most recent available data.

| Criterion | Palantir Technologies Inc. (PLTR) | Informatica Inc. (INFA) |

|---|---|---|

| Diversification | Moderate: Revenue split between Commercial (~1.3B) and Government (~1.57B) segments, showing balanced exposure. | Moderate: Revenue mainly from Subscription (~1.1B) and Professional Services (~78M), focused on data management. |

| Profitability | Mixed: Net margin favorable at 16.13%, but ROIC (5.51%) below WACC (11.11%), indicating value destruction. | Data unavailable for evaluation. |

| Innovation | Strong track record of growing ROIC trend (+110%), indicating improving operational efficiency and innovation. | Data unavailable for evaluation. |

| Global presence | Significant government contracts and commercial clients suggest broad geographic reach. | Data unavailable for evaluation. |

| Market Share | Growing commercial revenue indicates expanding market share in data analytics and software. | Data unavailable for evaluation. |

Key takeaways: Palantir shows a promising growth trajectory in profitability and innovation despite current value destruction. Informatica’s data limitations restrict detailed assessment, but its subscription-based model suggests stable recurring revenues. Caution is warranted, especially given Palantir’s high valuation multiples and mixed financial ratios.

Risk Analysis

Below is a comparative table of key risks for Palantir Technologies Inc. (PLTR) and Informatica Inc. (INFA) based on the most recent available data from 2024 and 2025.

| Metric | Palantir Technologies Inc. (PLTR) | Informatica Inc. (INFA) |

|---|---|---|

| Market Risk | High beta of 1.545 indicates elevated sensitivity to market fluctuations. | Moderate beta of 1.135 suggests less volatility but still exposed to market changes. |

| Debt Level | Very low debt-to-equity ratio of 0.05 and debt-to-assets 3.77%, indicating low leverage risk. | Data unavailable; caution advised due to lack of transparency. |

| Regulatory Risk | Moderate, given involvement with intelligence and government contracts, sensitive to policy shifts. | Moderate, operating in data governance and privacy, affected by evolving data regulations. |

| Operational Risk | Moderate; relies heavily on complex software platforms and AI deployment, possible tech execution risks. | Moderate; dependency on cloud and hybrid data integration platforms subject to technical and security challenges. |

| Environmental Risk | Low; software sector with limited direct environmental impact. | Low; similarly limited environmental footprint. |

| Geopolitical Risk | Moderate to high; international operations and government contracts expose it to geopolitical tensions. | Moderate; primarily US-based but influenced by global data privacy laws and trade policies. |

The most impactful risks for Palantir are market volatility and geopolitical exposure due to its sensitive government contract base. For Informatica, operational and regulatory risks tied to data privacy and cloud solutions are most significant. Palantir’s very low debt mitigates financial risk, whereas Informatica’s financial leverage is unclear, warranting cautious consideration.

Which Stock to Choose?

Palantir Technologies Inc. has shown strong income growth with a 28.79% revenue increase in 2024 and favorable profitability metrics, including a 16.13% net margin. Its financial ratios are mixed, with strengths in debt management and quick ratio, but weaknesses in valuation multiples. The company maintains very low debt and carries a very favorable rating of B.

Informatica Inc. presents a more modest income evolution, with a 2.81% revenue growth in 2024 and a net margin of 0.61%, considered neutral. Data on its financial ratios is incomplete, but its Altman Z-score places it in a grey zone for financial distress risk, and its Piotroski score is average, indicating moderate financial strength.

Investors seeking growth might find Palantir’s strong income growth and favorable rating appealing, while those more cautious about valuation and financial stability could interpret Informatica’s profile as more conservative despite limited data. The choice could thus depend on an investor’s tolerance for risk and preference for growth versus stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Palantir Technologies Inc. and Informatica Inc. to enhance your investment decisions: