In the fast-evolving software infrastructure sector, MongoDB, Inc. and Informatica Inc. stand out as key players driving innovation in data management. Both companies offer advanced solutions to handle complex data environments, targeting enterprises aiming to optimize data integration and cloud capabilities. Comparing their market positions and growth strategies reveals insights crucial for investors. Join me as we explore which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between MongoDB and Informatica by providing an overview of these two companies and their main differences.

MongoDB Overview

MongoDB, Inc. is a technology company specializing in software infrastructure, offering a general-purpose database platform globally. Its products include MongoDB Enterprise Advanced for enterprises, MongoDB Atlas for cloud database services, and a free Community Server. Founded in 2007 and headquartered in New York City, MongoDB aims to provide versatile database solutions for cloud, on-premise, and hybrid environments.

Informatica Overview

Informatica Inc. develops an AI-powered platform for data management across multi-cloud and hybrid systems at an enterprise scale. The company offers a comprehensive suite of interoperable products including data integration, API management, data quality, master data management, and governance tools. Founded in 1993 and based in Redwood City, California, Informatica focuses on unifying and governing enterprise data to support analytics, compliance, and operational efficiency.

Key similarities and differences

Both MongoDB and Informatica operate in the software infrastructure sector, serving enterprise clients with advanced data solutions. MongoDB centers on database platforms suitable for diverse deployment environments, while Informatica provides broad data management and integration services powered by artificial intelligence. Their business models overlap in targeting enterprise data needs but differ in product scope—database technology versus comprehensive data management ecosystems.

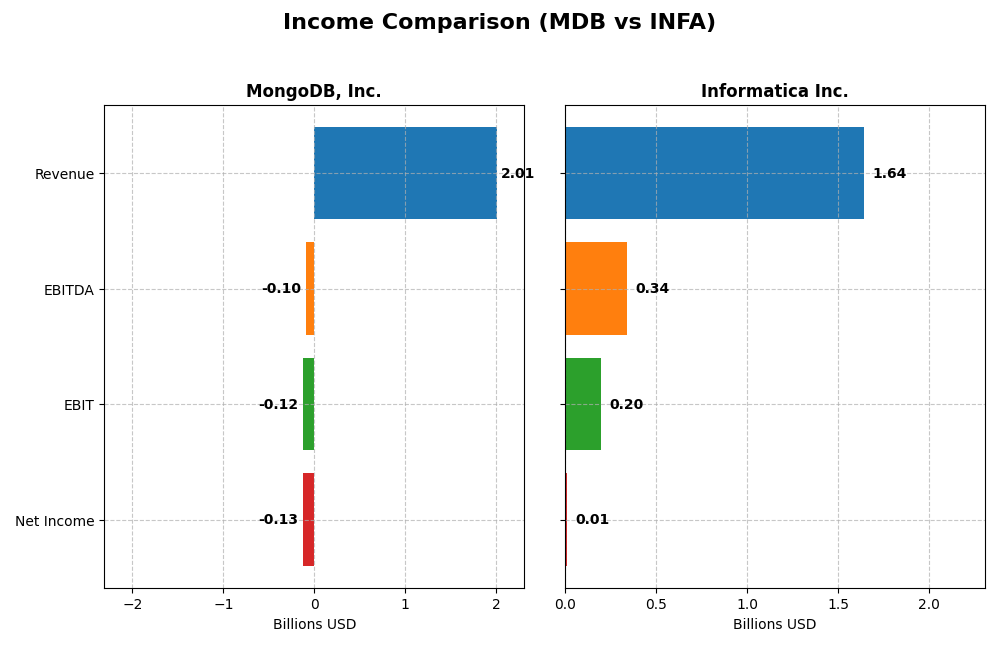

Income Statement Comparison

The table below compares the most recent full fiscal year income statement metrics of MongoDB, Inc. and Informatica Inc., highlighting key financial figures for 2025 and 2024 respectively.

| Metric | MongoDB, Inc. (MDB) | Informatica Inc. (INFA) |

|---|---|---|

| Market Cap | 32.5B | 7.5B |

| Revenue | 2.01B | 1.64B |

| EBITDA | -97M | 339M |

| EBIT | -124M | 199M |

| Net Income | -129M | 10M |

| EPS | -1.73 | 0.0329 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

MongoDB, Inc.

MongoDB showed strong revenue growth from $590M in 2021 to $2.01B in 2025, a 240% increase overall. Net income losses narrowed over the period, improving from -$267M in 2022 to -$129M in 2025. Gross margin remained favorable at 73.3%, while net margin stayed negative at -6.4%. The latest year saw solid revenue and net margin improvements, signaling operational progress despite ongoing losses.

Informatica Inc.

Informatica’s revenue rose steadily from $1.32B in 2020 to $1.64B in 2024, a 24% increase overall, with net income shifting from significant losses to a slight profit of $9.9M in 2024. Gross margin was strong at 80.1%, and EBIT margin improved to 12.2%. Although revenue growth slowed to 2.8% recently, profitability metrics showed marked improvement, reflecting better cost control and margin expansion.

Which one has the stronger fundamentals?

Both firms have favorable income statement trends, but MongoDB’s rapid revenue growth and improving net margin contrast with Informatica’s slower revenue gains but positive EBIT and net margins. MongoDB’s high gross margin and expanding scale are offset by persistent losses, whereas Informatica’s profitability and margin stability provide a different profile. Each exhibits strengths depending on growth versus profitability focus.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for MongoDB, Inc. (MDB) and Informatica Inc. (INFA) based on their most recent fiscal year data available.

| Ratios | MongoDB, Inc. (2025) | Informatica Inc. (2024) |

|---|---|---|

| ROE | -4.64% | 0.43% |

| ROIC | -7.36% | 0.56% |

| P/E | -157.88 | 787.95 |

| P/B | 7.32 | 3.39 |

| Current Ratio | 5.20 | 1.82 |

| Quick Ratio | 5.20 | 1.82 |

| D/E | 0.0131 | 0.81 |

| Debt-to-Assets | 1.06% | 35.24% |

| Interest Coverage | -26.70 | 0.87 |

| Asset Turnover | 0.58 | 0.31 |

| Fixed Asset Turnover | 24.78 | 8.75 |

| Payout ratio | 0 | 0.12% |

| Dividend yield | 0% | 0.00015% |

Interpretation of the Ratios

MongoDB, Inc.

MongoDB shows several unfavorable ratios, including negative net margin (-6.43%), return on equity (-4.64%), and return on invested capital (-7.36%), indicating profitability challenges. The current ratio is high at 5.2 but flagged unfavorable, while the quick ratio and low debt metrics are favorable. The company does not pay dividends, reflecting a reinvestment focus likely tied to its growth and operating losses.

Informatica Inc.

There is no available ratio data for Informatica, preventing a detailed analysis of its financial strength or weaknesses. Without key metrics, dividend information, or other financial indicators, it is unclear how the company manages profitability, liquidity, or shareholder returns. Dividend status and shareholder return strategies cannot be assessed due to missing data.

Which one has the best ratios?

Based on the available information, only MongoDB’s ratios can be evaluated, revealing a predominance of unfavorable financial metrics despite some strengths in liquidity and low leverage. Informatica’s lack of data means no ratio comparison is possible, making MongoDB the only company with a measurable ratio profile, which is overall unfavorable.

Strategic Positioning

This section compares the strategic positioning of MongoDB, Inc. and Informatica Inc., focusing on Market position, Key segments, and Exposure to technological disruption:

MongoDB, Inc.

- Positioned as a leading general purpose database platform facing competition in software infrastructure.

- Revenue driven mainly by MongoDB Atlas multi-cloud service and subscriptions; smaller professional services.

- Exposure through cloud database innovation with hybrid and multi-cloud deployment capabilities.

Informatica Inc.

- Focuses on AI-powered data management platform amid competitive software infrastructure market.

- Revenue from subscription, licenses, and professional services covering data integration, quality, and governance.

- Exposure via AI-driven data unification and API management across multi-cloud and hybrid systems.

MongoDB vs Informatica Positioning

MongoDB emphasizes a concentrated cloud database platform with strong Atlas growth, while Informatica offers a diversified AI-based data management suite. MongoDB’s focus is on database services, whereas Informatica covers broader enterprise data integration and governance.

Which has the best competitive advantage?

Only MongoDB’s MOAT evaluation is available, showing a slightly unfavorable status due to value destruction despite growing profitability. Informatica’s competitive advantage cannot be assessed due to missing data.

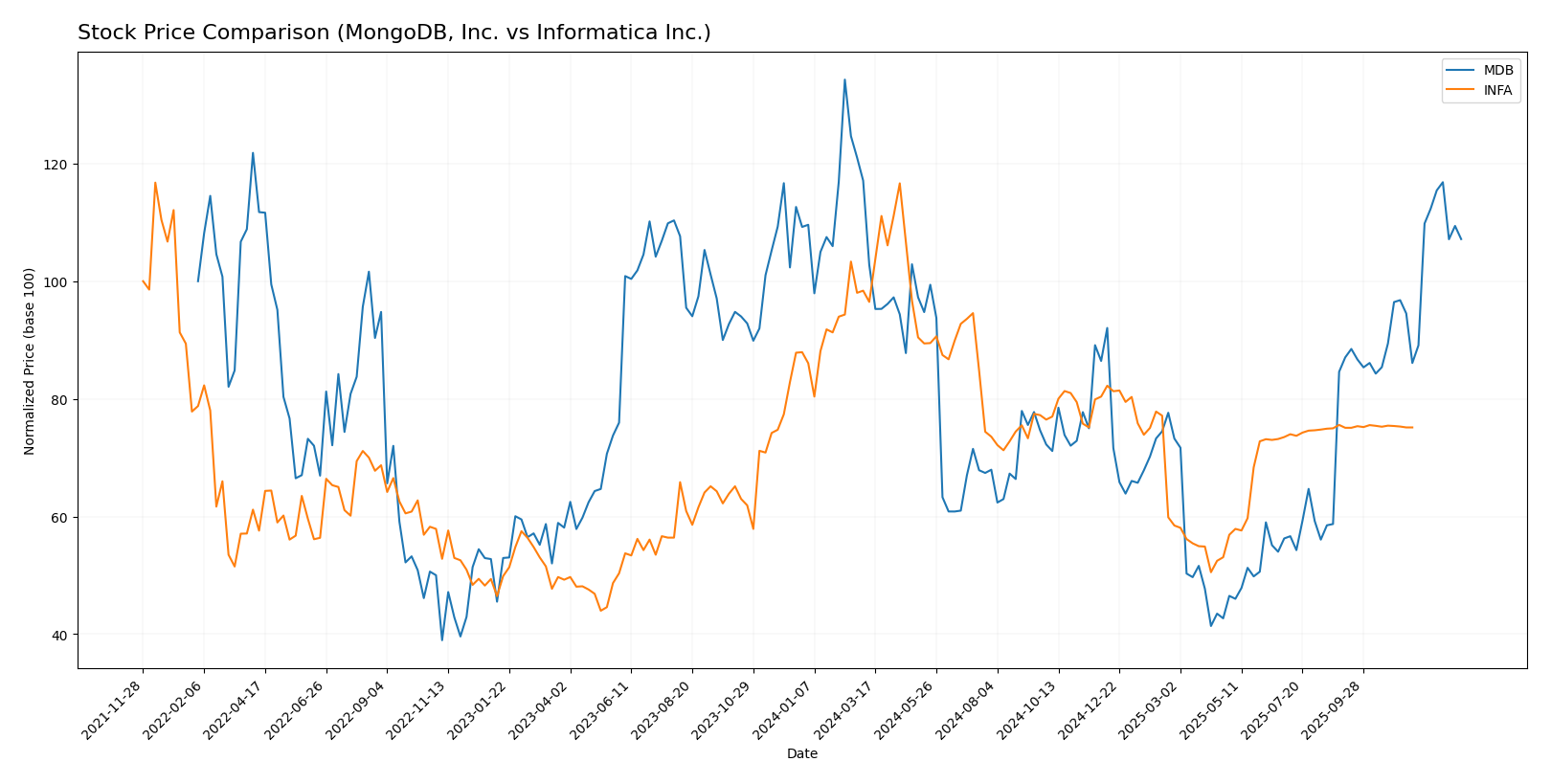

Stock Comparison

The stock price movements of MongoDB, Inc. (MDB) and Informatica Inc. (INFA) over the past 12 months reveal bearish trends with accelerating downward momentum, alongside notable shifts in recent trading dynamics.

Trend Analysis

MongoDB, Inc. (MDB) experienced a -11.46% price change over the past year, indicating a bearish trend with accelerating decline. The stock showed high volatility with a standard deviation of 72.49 and prices ranging from 154.39 to 451.52. Recently, MDB reversed with an 11.1% gain and strong buyer dominance.

Informatica Inc. (INFA) also showed a bearish trend with a -12.68% price drop over the last 12 months and accelerating negative momentum. Volatility was low at 4.46 standard deviation, with price extremes between 16.67 and 38.48. Recently, the stock’s price was nearly flat at +0.08%, accompanied by seller dominance.

Comparing both, MDB and INFA delivered similar bearish trends over the year, but MDB outperformed recently with a strong price rebound and buyer dominance, resulting in higher market performance in the latest period.

Target Prices

The current analyst consensus suggests optimistic target prices for MongoDB, Inc. and Informatica Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MongoDB, Inc. | 500 | 375 | 445.2 |

| Informatica Inc. | 27 | 27 | 27 |

For MongoDB, the consensus target price of 445.2 USD is approximately 11% above the current price of 399.76 USD, indicating moderate upside potential. Informatica’s target price of 27 USD is about 9% above its current price of 24.79 USD, reflecting a modest expected appreciation.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MongoDB, Inc. (MDB) and Informatica Inc. (INFA):

Rating Comparison

MDB Rating

- Rating: C, considered Very Favorable by evaluators.

- Discounted Cash Flow Score: 2, assessed as Moderate, indicating average valuation outlook.

- ROE Score: 1, marked Very Unfavorable, showing weak profit generation from equity.

- ROA Score: 1, also Very Unfavorable, reflecting poor asset utilization.

- Debt To Equity Score: 4, rated Favorable, suggesting strong financial stability with low leverage.

- Overall Score: 2, Moderate overall financial standing according to analysts.

INFA Rating

- No rating data available.

- No data available.

- No data available.

- No data available.

- No data available.

- No data available.

Which one is the best rated?

Based strictly on the available data, MDB holds a “Very Favorable” rating with detailed scores, while INFA lacks any rating or score information, making MDB the better-rated company by default.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for MongoDB, Inc. and Informatica Inc.:

MDB Scores

- Altman Z-Score: 30.24, indicating a safe zone status.

- Piotroski Score: 4, classified as average financial strength.

INFA Scores

- Altman Z-Score: 1.94, indicating a grey zone status.

- Piotroski Score: 6, classified as average financial strength.

Which company has the best scores?

MongoDB shows a much higher Altman Z-Score, placing it clearly in the safe zone, while Informatica is in the grey zone. Both companies have average Piotroski scores, with Informatica slightly higher.

Grades Comparison

The following presents a detailed comparison of the latest available grades for MongoDB, Inc. and Informatica Inc.:

MongoDB, Inc. Grades

This table summarizes recent grades assigned to MongoDB, Inc. by reputable grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| Needham | Maintain | Buy | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Piper Sandler | Maintain | Overweight | 2025-12-02 |

MongoDB, Inc. has consistently received strong buy and overweight ratings from multiple credible firms, reflecting a positive consensus.

Informatica Inc. Grades

This table summarizes recent grades assigned to Informatica Inc. by reputable grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Downgrade | Neutral | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-05-28 |

| JP Morgan | Downgrade | Neutral | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | Downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-28 |

| Truist Securities | Downgrade | Hold | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-27 |

| UBS | Maintain | Neutral | 2025-05-16 |

Informatica Inc.’s ratings are predominantly neutral or hold, with several downgrades noted, indicating a more cautious outlook.

Which company has the best grades?

MongoDB, Inc. has received predominantly buy and outperform ratings, while Informatica Inc. has mainly neutral and hold grades with multiple downgrades. This contrast suggests MongoDB currently enjoys a more favorable analyst sentiment, which may influence investor confidence and portfolio positioning.

Strengths and Weaknesses

Below is a summary table comparing key strengths and weaknesses of MongoDB, Inc. (MDB) and Informatica Inc. (INFA) based on the latest available data.

| Criterion | MongoDB, Inc. (MDB) | Informatica Inc. (INFA) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from MongoDB Atlas (1.41B) and subscriptions (539M) | Moderate to High: Diverse revenue streams from subscriptions (1.1B) and professional services (78M) |

| Profitability | Weak: Negative net margin (-6.43%), ROIC (-7.36%), and ROE (-4.64%) | Data unavailable to assess profitability |

| Innovation | High: Rapid revenue growth in cloud-based Atlas service; strong product innovation | Data unavailable for innovation assessment |

| Global presence | Strong: Cloud services with global reach | Strong: Established enterprise software global footprint |

| Market Share | Growing in cloud database market | Established player in data integration market |

Key takeaways: MongoDB shows strong innovation and growing cloud revenue but struggles with profitability and value creation. Informatica’s detailed financials are unavailable, but its diversified revenue and market position suggest stability. Investors should weigh MongoDB’s growth potential against its current financial challenges.

Risk Analysis

Below is a comparative table summarizing key risk metrics for MongoDB, Inc. (MDB) and Informatica Inc. (INFA) as of 2025:

| Metric | MongoDB, Inc. (MDB) | Informatica Inc. (INFA) |

|---|---|---|

| Market Risk | Beta 1.38, high volatility | Beta 1.14, moderate volatility |

| Debt level | Very low debt-to-equity (0.01) | Data unavailable |

| Regulatory Risk | Moderate, subject to US tech laws | Moderate, US data privacy focus |

| Operational Risk | Negative profitability ratios | Data unavailable |

| Environmental Risk | Low direct impact | Low direct impact |

| Geopolitical Risk | US-based, exposed to trade policies | US-based, similar exposure |

The most impactful risk for MongoDB is its operational weakness, reflected in negative net margin (-6.43%) and unfavorable return on equity (-4.64%), which could pressure future profitability despite a strong balance sheet and low debt. Informatica’s financial data is limited, but its Altman Z-score in the grey zone (1.94) signals moderate bankruptcy risk, suggesting caution. Both firms face typical technology sector market and regulatory risks, but MongoDB’s profitability challenges represent the most immediate concern.

Which Stock to Choose?

MongoDB, Inc. (MDB) shows strong income growth with a 239.86% revenue increase over five years and favorable profitability trends despite negative net margin and ROE. Its financial ratios are mostly unfavorable, but low debt and a very favorable rating suggest cautious resilience.

Informatica Inc. (INFA) reports stable profitability with a positive EBIT margin of 12.15% and neutral net margin, alongside moderate revenue growth of 23.95% over five years. However, missing key ratio data and a grey zone Altman Z-score indicate some financial uncertainty.

Investors seeking growth might view MDB’s rising income and improving profitability as appealing despite current financial weaknesses. Conversely, those preferring stability may find INFA’s consistent profitability and moderate growth more aligned with lower risk tolerance, though data gaps advise prudence.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MongoDB, Inc. and Informatica Inc. to enhance your investment decisions: