Informatica Inc. and Strategy Inc. are two prominent players in the technology sector, each carving a unique niche within the software industry. Informatica specializes in AI-driven data infrastructure solutions, while Strategy focuses on enterprise analytics software combined with bitcoin treasury management. Their innovative approaches and overlapping market interests make them compelling candidates for comparison. In this article, I will help you identify which company presents the most attractive investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Informatica Inc. and Strategy Inc. by providing an overview of these two companies and their main differences.

Informatica Inc. Overview

Informatica Inc. develops an AI-powered platform that connects, manages, and unifies data across multi-cloud and hybrid systems at enterprise scale. The company offers data integration, API management, data quality, master data management, data catalog, and governance products. Founded in 1993 and headquartered in Redwood City, California, Informatica positions itself as a leader in software infrastructure focused on comprehensive data management solutions.

Strategy Inc. Overview

Strategy Inc operates as a bitcoin treasury company and a provider of AI-powered enterprise analytics software. It offers securities providing exposure to Bitcoin and analytics platforms like Strategy One and Strategy Mosaic for data governance and decision-making. Established in 1989 and based in Tysons Corner, Virginia, the firm is positioned within the software application sector with a focus on both digital assets and enterprise intelligence.

Key similarities and differences

Both companies operate in the technology sector and leverage AI in their software offerings, but they differ in focus and market approach. Informatica specializes in data infrastructure and integration for enterprises, while Strategy combines bitcoin treasury services with enterprise analytics applications. Informatica has a larger workforce and operates primarily in data management, whereas Strategy’s business model integrates digital assets with AI-driven analytics solutions.

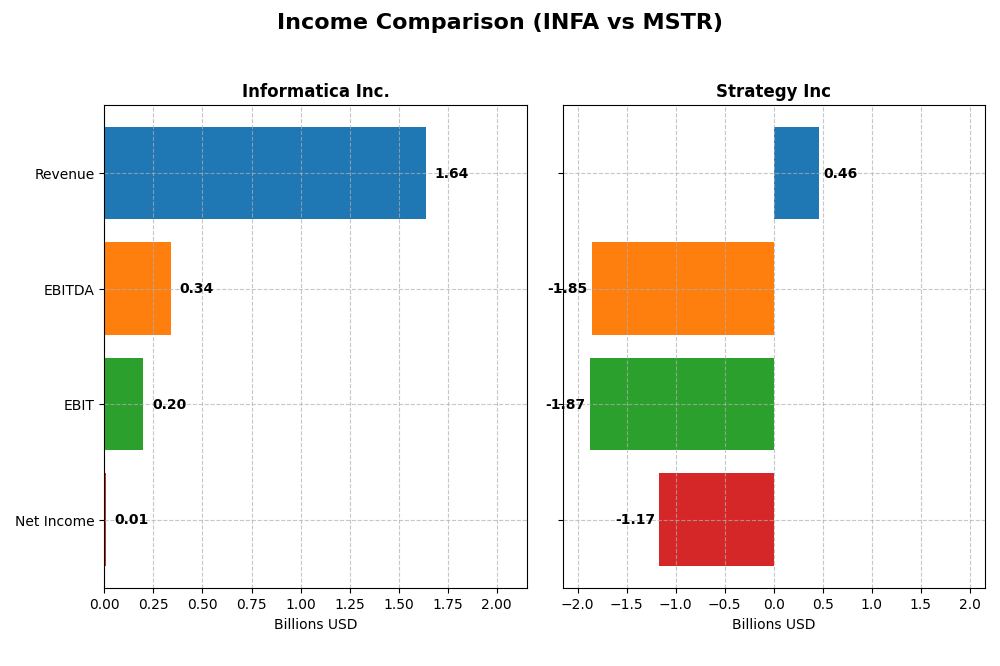

Income Statement Comparison

Below is the income statement comparison for Informatica Inc. and Strategy Inc for the fiscal year 2024, highlighting key financial metrics side by side.

| Metric | Informatica Inc. (INFA) | Strategy Inc (MSTR) |

|---|---|---|

| Market Cap | 7.54B | 45.14B |

| Revenue | 1.64B | 463M |

| EBITDA | 339M | -1.85B |

| EBIT | 199M | -1.87B |

| Net Income | 9.93M | -1.17B |

| EPS | 0.03 | -6.06 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Informatica Inc.

Informatica Inc. demonstrated steady revenue growth from $1.32B in 2020 to $1.64B in 2024, with net income improving from a loss of $168M to a slight profit of $9.9M in 2024. Margins showed stability, with gross margin around 80% and EBIT margin improving to 12.15%. The 2024 year marked a notable EBIT increase of 168% despite a modest 2.8% revenue growth, indicating margin enhancement.

Strategy Inc

Strategy Inc experienced declining revenue from $480M in 2020 to $463M in 2024 and reported a significant net loss reaching $1.17B in 2024. Margins deteriorated, with gross margin at 72%, but EBIT margin deeply negative at -404%, and net margin also unfavorable. The latest year showed worsening EBIT and net margin, reflecting operational and financial challenges with increased interest expenses.

Which one has the stronger fundamentals?

Based on income statement analysis, Informatica Inc. exhibits stronger fundamentals, with consistent revenue growth, improved profitability, and favorable margin trends. In contrast, Strategy Inc faces severe margin pressure, substantial losses, and negative growth across key metrics. Informatica’s positive earnings trajectory and margin stability present a more favorable income profile compared to Strategy’s unfavorable financial performance.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for Informatica Inc. and Strategy Inc, based on their most recent fiscal year data from 2024.

| Ratios | Informatica Inc. (INFA) | Strategy Inc (MSTR) |

|---|---|---|

| ROE | 0.43% | -6.40% |

| ROIC | 0.56% | -4.38% |

| P/E | 788 | -47.80 |

| P/B | 3.39 | 3.06 |

| Current Ratio | 1.82 | 0.71 |

| Quick Ratio | 1.82 | 0.71 |

| D/E | 0.81 | 0.40 |

| Debt-to-Assets | 35.2% | 28.1% |

| Interest Coverage | 0.87 | -29.9 |

| Asset Turnover | 0.31 | 0.018 |

| Fixed Asset Turnover | 8.75 | 5.73 |

| Payout ratio | 0.12% | 0% |

| Dividend yield | 0.00015% | 0% |

Interpretation of the Ratios

Informatica Inc.

Informatica’s financial ratios show mixed signals, with moderate leverage (netDebtToEBITDA around 2.8) and a current ratio above 1.8, indicating reasonable liquidity. However, returns on assets and equity remain very low, close to zero, suggesting limited profitability. The company does not pay dividends, likely prioritizing reinvestment in R&D, as reflected by nearly 19% revenue spent in this area, and no share buyback is noted.

Strategy Inc

Strategy Inc exhibits predominantly weak ratios, including negative returns on equity and invested capital, and a low current ratio of 0.71 indicating liquidity concerns. Despite a favorable debt-to-equity ratio of 0.4, most profitability and efficiency metrics are unfavorable. The company does not pay dividends, consistent with its high-risk bitcoin treasury focus and reinvestment in technology and growth initiatives without share repurchases.

Which one has the best ratios?

Between the two, Informatica Inc. presents relatively stronger liquidity and more stable leverage metrics, albeit with weak profitability. Strategy Inc’s ratios are generally less favorable, with greater liquidity and profitability challenges driven by its volatile business model. Overall, Informatica’s ratios appear less risky and more balanced compared to Strategy’s predominantly unfavorable profile.

Strategic Positioning

This section compares the strategic positioning of Informatica Inc. and Strategy Inc, including their market position, key segments, and exposure to technological disruption:

Informatica Inc.

- Mid-cap software infrastructure firm facing moderate competition in data management.

- Focuses on AI-powered data integration, governance, and cloud subscription services.

- Positioned in enterprise data platforms; potential tech disruption from evolving cloud and AI trends.

Strategy Inc

- Large-cap software application company with high beta, volatile market presence.

- Focuses on bitcoin treasury operations and AI-powered enterprise analytics software.

- Exposure to blockchain and AI innovations; high volatility suggests greater disruption risk.

Informatica Inc. vs Strategy Inc Positioning

Informatica Inc. pursues a diversified data management platform strategy emphasizing enterprise cloud and AI services. Strategy Inc concentrates on bitcoin treasury and AI analytics, reflecting a more niche and volatile approach with exposure to cryptocurrency markets.

Which has the best competitive advantage?

Based on MOAT evaluation data, Strategy Inc shows a very unfavorable moat with declining ROIC and value destruction. No MOAT data is available for Informatica Inc., preventing a definitive competitive advantage assessment.

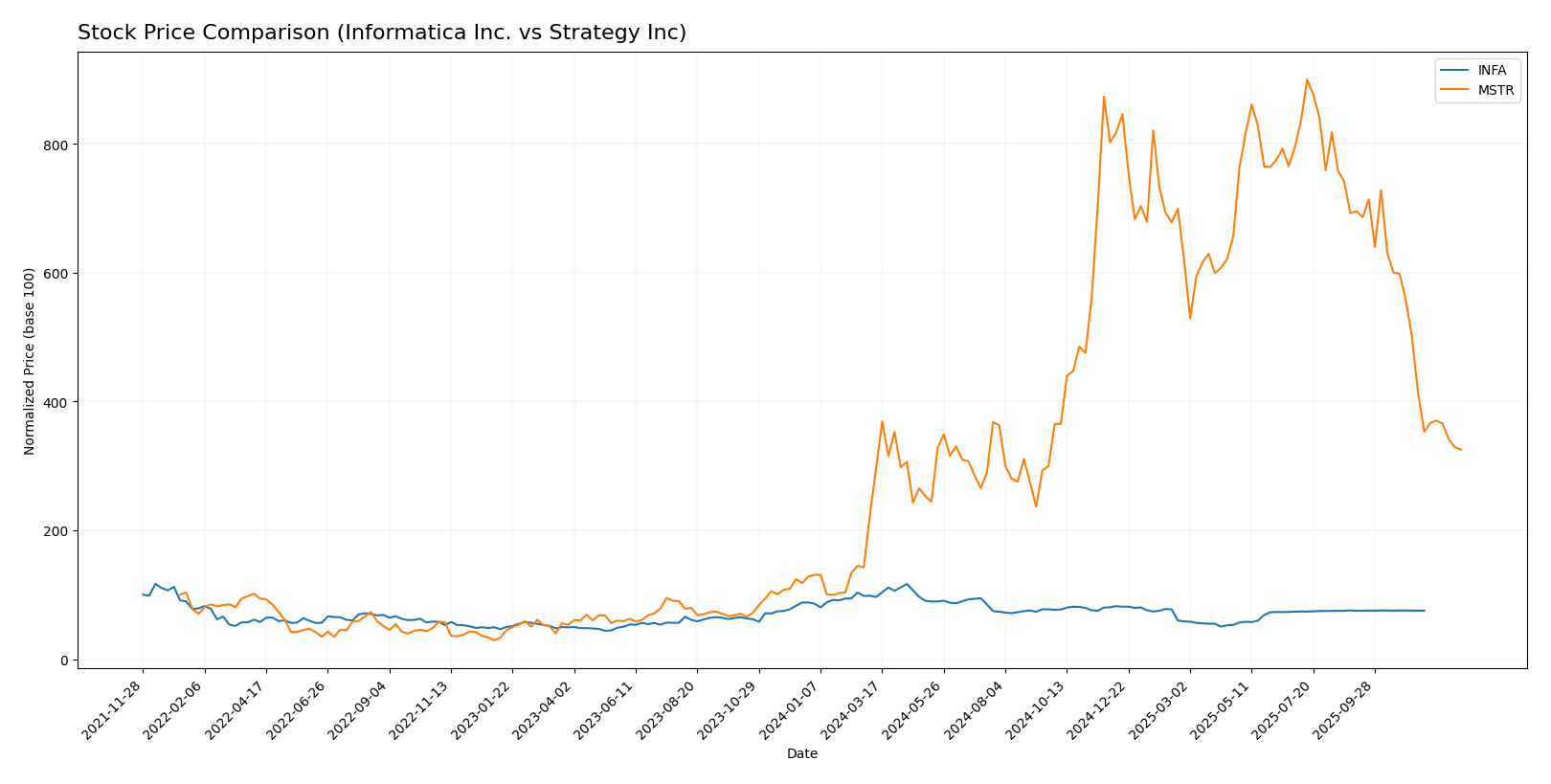

Stock Comparison

The stock price movements of Informatica Inc. and Strategy Inc. over the past year reveal contrasting dynamics, with one showing a significant upward trajectory while the other experienced a decline, both punctuated by distinct trading volume patterns.

Trend Analysis

Informatica Inc. exhibited a bearish trend over the past 12 months with a price decline of 12.68%, accompanied by accelerating downward momentum and moderate volatility indicated by a standard deviation of 4.46. The stock reached a high of 38.48 and a low of 16.67.

Strategy Inc. showed a strong bullish trend with a 143.17% price increase over the same period, although this growth is decelerating. The stock’s price volatility was high, with a standard deviation of 105.72, hitting a peak of 434.58 and a low of 64.63.

Comparing both, Strategy Inc. delivered the highest market performance with a substantial positive price change, contrasting with Informatica Inc.’s notable decline over the past year.

Target Prices

The current analyst consensus for target prices shows mixed expectations between Informatica Inc. and Strategy Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Informatica Inc. | 27 | 27 | 27 |

| Strategy Inc | 705 | 175 | 472.8 |

Informatica’s target price of $27 is modestly above its current price of $24.79, suggesting limited upside. Strategy Inc’s consensus target of $472.8 significantly exceeds its current price of $157.16, indicating strong potential growth according to analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Informatica Inc. and Strategy Inc.:

Rating Comparison

INFA Rating

- No rating data available for Informatica.

- No Discounted Cash Flow Score provided.

- No Return on Equity Score available.

- No Return on Assets Score available.

- No Debt To Equity Score available.

- No Overall Score provided.

MSTR Rating

- Rating of A- considered Very Favorable by analysts.

- Discounted Cash Flow Score is 1, indicating a Very Unfavorable valuation based on future cash flow projections.

- Return on Equity Score is 4, rated Favorable for efficient profit generation from equity.

- Return on Assets Score is 5, rated Very Favorable for effective asset utilization.

- Debt To Equity Score is 3, considered Moderate financial risk.

- Overall Score is 4, rated Favorable reflecting good financial standing.

Which one is the best rated?

Based strictly on the available data, Strategy Inc. (MSTR) has a complete rating profile with an A- rating and favorable overall and efficiency scores, while Informatica Inc. (INFA) lacks rating information. Therefore, MSTR is better rated.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Informatica Inc. and Strategy Inc.:

INFA Scores

- Altman Z-Score: 1.94, indicating moderate risk in the grey zone.

- Piotroski Score: 6, reflecting average financial strength.

MSTR Scores

- Altman Z-Score: 2.59, also in the grey zone with moderate risk.

- Piotroski Score: 4, indicating average but weaker financial strength.

Which company has the best scores?

Based on the provided data, Strategy Inc. has a higher Altman Z-Score, suggesting somewhat lower bankruptcy risk, while Informatica Inc. has a stronger Piotroski Score, indicating better overall financial health.

Grades Comparison

The following is a comparison of recent grades assigned to Informatica Inc. and Strategy Inc.:

Informatica Inc. Grades

This table shows recent grade updates from various reputable grading companies for Informatica Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Downgrade | Neutral | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-05-28 |

| JP Morgan | Downgrade | Neutral | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | Downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-28 |

| Truist Securities | Downgrade | Hold | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-27 |

| UBS | Maintain | Neutral | 2025-05-16 |

Grades for Informatica Inc. generally show a recent downgrading trend from several firms, moving toward Neutral or Hold ratings, with others maintaining Sector Perform and Equal Weight grades.

Strategy Inc Grades

This table presents recent grades from established grading companies for Strategy Inc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-12-22 |

| Bernstein | Maintain | Outperform | 2025-12-08 |

| Monness, Crespi, Hardt | Upgrade | Neutral | 2025-11-10 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-03 |

| Canaccord Genuity | Maintain | Buy | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-31 |

| BTIG | Maintain | Buy | 2025-10-31 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

| Wells Fargo | Downgrade | Equal Weight | 2025-09-30 |

| TD Cowen | Maintain | Buy | 2025-09-16 |

Strategy Inc’s grades predominantly reflect Buy and Outperform ratings, with most grading companies maintaining positive recommendations despite one recent downgrade to Equal Weight.

Which company has the best grades?

Strategy Inc has received consistently stronger grades, mostly Buy and Outperform, compared to Informatica Inc., which shows a trend toward Neutral and Hold ratings. This suggests Strategy Inc may be viewed more favorably by analysts, potentially affecting investor perceptions of growth and risk.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Informatica Inc. (INFA) and Strategy Inc. (MSTR) based on the most recent available data.

| Criterion | Informatica Inc. (INFA) | Strategy Inc. (MSTR) |

|---|---|---|

| Diversification | Strong subscription and professional services mix with over $1.1B in subscription revenue (2024) | Revenue concentrated in license and maintenance; less diversified with ~$107M subscription (2024) |

| Profitability | Data unavailable; pending further financial details | Negative profitability: net margin -252%, ROIC -4.38%, declining profitability |

| Innovation | Leading cloud and subscription support segment growth | Limited data but declining ROIC suggests challenges in innovation impact |

| Global presence | Established global software provider with diversified service lines | Smaller scale with less evidence of global expansion |

| Market Share | Significant player in data management software | Market share appears limited; struggling with value creation |

Key takeaways: Informatica shows strong diversification and growth in subscription revenues, indicating resilience and innovation. Strategy Inc. faces significant profitability challenges with declining returns, signaling caution for investors despite some favorable debt metrics.

Risk Analysis

Below is a summary table of key risks for Informatica Inc. and Strategy Inc. based on the most recent data from 2026:

| Metric | Informatica Inc. | Strategy Inc |

|---|---|---|

| Market Risk | Moderate (Beta 1.14) | High (Beta 3.41) |

| Debt level | Data unavailable | Moderate (D/E 0.4) |

| Regulatory Risk | Moderate (data governance focus) | Elevated (crypto exposure) |

| Operational Risk | Moderate (complex AI platform) | Moderate (crypto and software) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Low | Moderate (global crypto markets) |

Informatica faces moderate market and operational risks due to its AI-driven data platform, with some uncertainty from missing financial ratios. Strategy Inc. has a higher market risk driven by volatile bitcoin exposure and unfavorable financial ratios, including a negative net margin and liquidity constraints, raising caution for investors.

Which Stock to Choose?

Informatica Inc. (INFA) shows a generally favorable income statement with a 23.95% revenue growth over 2020-2024 and improving profitability metrics such as EBIT and net margin growth. However, it carries a moderate debt level with a net debt to EBITDA of 2.8 and an Altman Z-score placing it in the grey zone, indicating some financial caution.

Strategy Inc (MSTR) exhibits unfavorable income trends, including a -3.59% revenue decline over five years and negative net margin at -251.73%. Its financial ratios are mostly unfavorable, despite a very favorable overall rating of A- and a grey zone Altman Z-score. The company is shedding value with declining ROIC compared to WACC.

Considering ratings and financial evaluations, MSTR’s high rating contrasts with its income and ratio weaknesses, suggesting it may appeal to risk-tolerant investors seeking potential turnaround opportunities. Conversely, INFA’s stable income growth and moderate financial health could be preferable for those favoring steady or quality investments.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Informatica Inc. and Strategy Inc to enhance your investment decisions: