In the rapidly evolving technology sector, indie Semiconductor, Inc. (INDI) and MicroVision, Inc. (MVIS) stand out as innovators driving advancements in automotive and sensing technologies. Both companies target overlapping markets with cutting-edge solutions—INDI focuses on automotive semiconductors and software, while MVIS specializes in lidar sensors and micro-display technologies. This analysis will help you uncover which company presents a more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between indie Semiconductor and MicroVision by providing an overview of these two companies and their main differences.

indie Semiconductor Overview

indie Semiconductor, Inc. focuses on automotive semiconductors and software solutions aimed at advanced driver assistance systems, connected cars, and electrification applications. The company serves various automotive needs including parking assistance, in-cabin wireless charging, infotainment, and telematics. Headquartered in Aliso Viejo, California, indie operates in the semiconductor industry with a market cap of approximately 750M USD and employs around 920 full-time staff.

MicroVision Overview

MicroVision, Inc. develops lidar sensors primarily for automotive safety and autonomous driving, utilizing laser beam scanning technology. It also designs micro-displays for augmented reality headsets and interactive display modules for smart devices. Based in Redmond, Washington, MicroVision operates in hardware and equipment, with a market cap near 272M USD and a workforce of 185 employees. The company targets original equipment and design manufacturers.

Key similarities and differences

Both indie Semiconductor and MicroVision operate within the technology sector focusing on automotive applications, but their core products differ. indie Semiconductor provides a broad range of automotive semiconductors and software enhancing vehicle connectivity and user experience. In contrast, MicroVision specializes in lidar and scanning technologies for autonomous driving and augmented reality. indie is larger in market cap and staff size, while MicroVision has a narrower product scope with a strong emphasis on sensor technology.

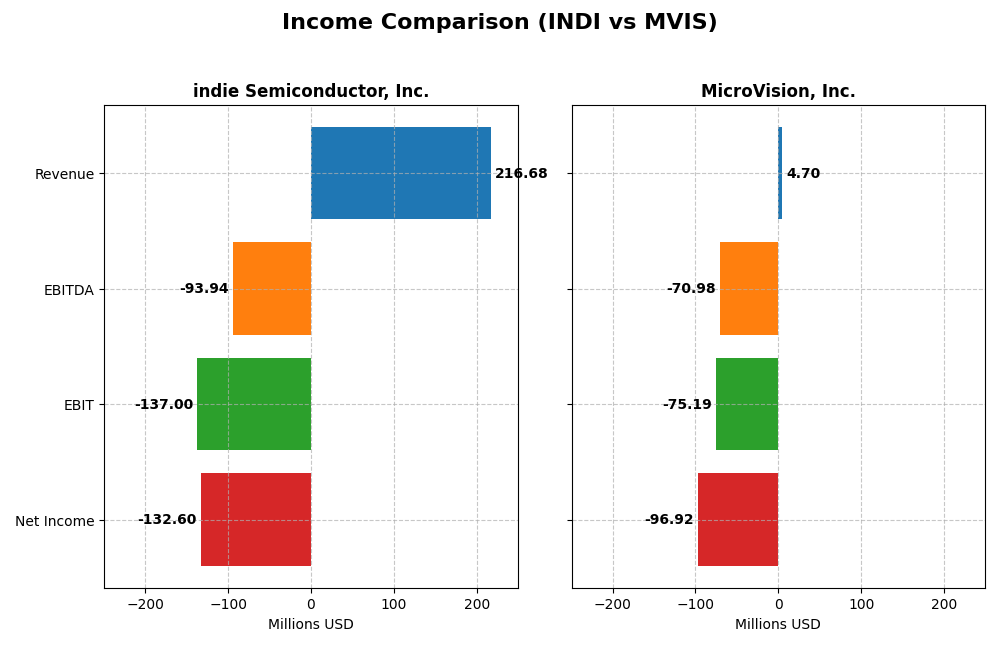

Income Statement Comparison

This table compares key income statement metrics for indie Semiconductor, Inc. and MicroVision, Inc. for the fiscal year 2024, highlighting their financial performance.

| Metric | indie Semiconductor, Inc. | MicroVision, Inc. |

|---|---|---|

| Market Cap | 750M | 272M |

| Revenue | 217M | 4.7M |

| EBITDA | -94M | -71M |

| EBIT | -137M | -75M |

| Net Income | -133M | -97M |

| EPS | -0.76 | -0.46 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

indie Semiconductor, Inc.

Indie Semiconductor saw revenue grow significantly over 2020-2024, reaching $217M in 2024, though it declined slightly by 2.9% in the last year. Gross margin improved to a favorable 41.7%, but net margin remained deeply negative at -61.2%. The latest year showed gross profit recovery, but operating and net income stayed under pressure, reflecting ongoing losses.

MicroVision, Inc.

MicroVision’s revenue increased by about 52% over the five-year span but dropped 35.3% in 2024 to $4.7M. Gross margin remained negative at -60.4%, and net margin deteriorated further to -2063.8%. Despite a slight EBIT improvement last year, overall profitability and margins remain unfavorable, with heavy interest expenses impacting net results.

Which one has the stronger fundamentals?

Comparing fundamentals, indie Semiconductor demonstrates healthier margin improvements and a more stable gross profit trend despite net losses. MicroVision faces severe margin pressures and a worsening net income trajectory. While both companies operate at losses, indie Semiconductor’s partial margin recovery and lower interest burden present relatively stronger income statement fundamentals.

Financial Ratios Comparison

The table below presents key financial ratios for indie Semiconductor, Inc. (INDI) and MicroVision, Inc. (MVIS) based on their most recent fiscal year data (2024), enabling a straightforward side-by-side analysis.

| Ratios | indie Semiconductor, Inc. (INDI) | MicroVision, Inc. (MVIS) |

|---|---|---|

| ROE | -31.7% | -198.7% |

| ROIC | -19.3% | -83.7% |

| P/E | -5.35 | -2.83 |

| P/B | 1.70 | 5.63 |

| Current Ratio | 4.82 | 1.79 |

| Quick Ratio | 4.23 | 1.74 |

| D/E (Debt-to-Equity) | 0.95 | 1.06 |

| Debt-to-Assets | 42.3% | 42.6% |

| Interest Coverage | -18.4 | -19.2 |

| Asset Turnover | 0.23 | 0.039 |

| Fixed Asset Turnover | 4.30 | 0.20 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

indie Semiconductor, Inc.

Indie Semiconductor shows predominantly unfavorable financial ratios with a net margin of -61.2% and ROE at -31.73%, indicating profitability challenges. However, a favorable PE ratio of -5.35 and strong quick ratio at 4.23 offer some stability. The company does not pay dividends, likely due to negative earnings and a focus on reinvestment and R&D, as reflected in high expenditure ratios.

MicroVision, Inc.

MicroVision’s ratios reveal significant weaknesses, including a net margin of -2063.78% and ROE of -198.72%, signaling severe losses. The PE ratio is favorable at -2.83, but asset turnover and fixed asset turnover are very low. No dividends are paid, consistent with its negative earnings and priority on R&D investment, evident from its high research to revenue ratio and cash flow deficits.

Which one has the best ratios?

Both companies face considerable financial difficulties with predominantly unfavorable ratios. Indie Semiconductor displays a slightly better asset turnover and fixed asset turnover, while MicroVision struggles with much higher losses and weaker asset efficiency. Overall, neither company presents a distinctly favorable financial profile, as both have substantial risks and no dividend return.

Strategic Positioning

This section compares the strategic positioning of indie Semiconductor, Inc. and MicroVision, Inc., including Market position, Key segments, and Exposure to technological disruption:

indie Semiconductor, Inc.

- Mid-sized semiconductor company facing competition in automotive tech.

- Automotive semiconductors for ADAS, connected car, and electrification.

- Exposure mainly through automotive and photonic technology innovation.

MicroVision, Inc.

- Smaller hardware and equipment firm focused on niche lidar market.

- Lidar sensors, micro-displays, AR headsets, and scanning tech.

- Exposure via lidar and scanning tech in automotive and consumer devices.

indie Semiconductor, Inc. vs MicroVision, Inc. Positioning

indie Semiconductor pursues diversified automotive semiconductor and software solutions, leveraging multiple automotive applications. MicroVision concentrates on lidar and AR technologies, targeting OEMs with specialized scanning and sensor products, reflecting a more focused business approach.

Which has the best competitive advantage?

Both companies are shedding value with ROIC below WACC; indie Semiconductor shows declining profitability, while MicroVision has a growing ROIC trend, indicating slightly better potential to improve competitive advantage.

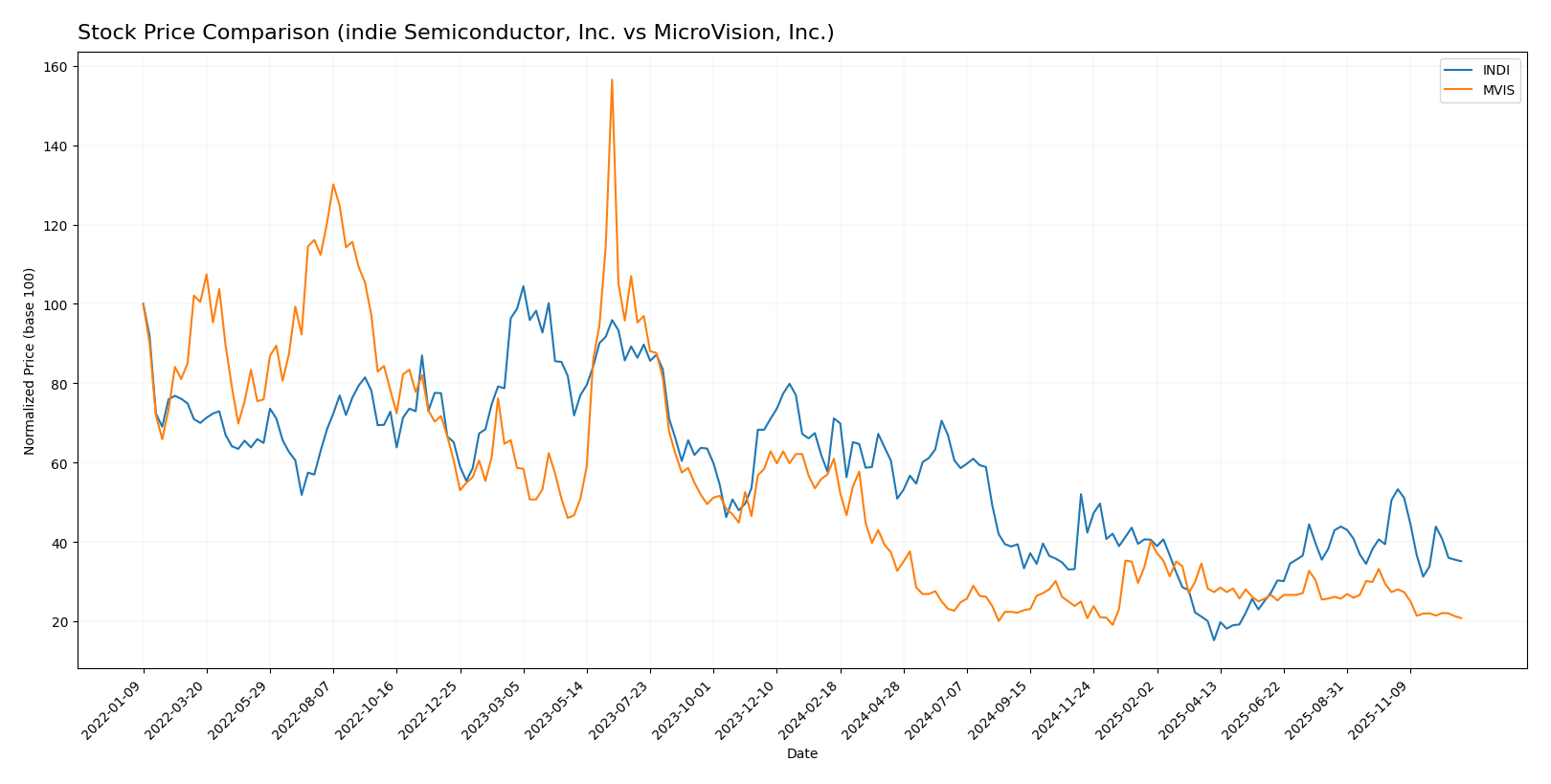

Stock Comparison

The stock prices of indie Semiconductor, Inc. (INDI) and MicroVision, Inc. (MVIS) have both exhibited significant declines over the past year, reflecting bearish trends with decelerating momentum and varying degrees of seller dominance in recent trading activity.

Trend Analysis

Indie Semiconductor, Inc. (INDI) experienced a bearish trend with a 50.6% decrease over the past 12 months, showing deceleration and a price range from 7.49 to 1.6. Recent activity confirms continued decline with a -30.45% change.

MicroVision, Inc. (MVIS) also showed a bearish trend, with a sharper 65.91% decline over the past year, decelerating and trading between 2.61 and 0.82. The recent trend shows a -23.96% decrease, indicating persistent downward pressure.

Comparing both, INDI has outperformed MVIS over the past 12 months, delivering a smaller percentage loss and less severe recent declines, despite both stocks remaining in bearish territory.

Target Prices

Analysts present a clear consensus on target prices for indie Semiconductor, Inc. and MicroVision, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| indie Semiconductor, Inc. | 8 | 8 | 8 |

| MicroVision, Inc. | 5 | 5 | 5 |

The target consensus for indie Semiconductor at $8 suggests significant upside from its current price of $3.7, while MicroVision’s $5 target indicates strong growth potential from $0.89. Analysts expect both stocks to appreciate notably.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for indie Semiconductor, Inc. and MicroVision, Inc.:

Rating Comparison

INDI Rating

- Rating: C, considered very favorable by analysts.

- Discounted Cash Flow Score: 1, rated very unfavorable.

- ROE Score: 1, very unfavorable efficiency in profit generation.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 3, moderate financial risk.

- Overall Score: 2, moderate overall financial standing.

MVIS Rating

- Rating: C-, also considered very favorable by analysts.

- Discounted Cash Flow Score: 1, rated very unfavorable.

- ROE Score: 1, very unfavorable efficiency in profit generation.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 2, moderate financial risk but higher than INDI.

- Overall Score: 1, very unfavorable overall financial standing.

Which one is the best rated?

Based strictly on the provided data, indie Semiconductor (INDI) holds a higher overall score of 2 compared to MicroVision’s (MVIS) score of 1, indicating INDI is better rated overall despite similar unfavorable scores in cash flow and profitability metrics.

Scores Comparison

The scores comparison between indie Semiconductor, Inc. and MicroVision, Inc. is as follows:

INDI Scores

- Altman Z-Score: 0.14, in distress zone, high risk of bankruptcy

- Piotroski Score: 3, very weak financial strength

MVIS Scores

- Altman Z-Score: -6.63, in distress zone, very high risk of bankruptcy

- Piotroski Score: 1, very weak financial strength

Which company has the best scores?

Based on the provided data, INDI has a higher Altman Z-Score and Piotroski Score than MVIS, indicating relatively better financial stability and strength, though both are in distress and very weak categories.

Grades Comparison

The following presents the latest available grades from recognized grading companies for both indie Semiconductor, Inc. and MicroVision, Inc.:

indie Semiconductor, Inc. Grades

This table shows the recent grades assigned by established financial institutions for indie Semiconductor, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

Overall, indie Semiconductor’s grades predominantly reflect a strong buy consensus with some overweight ratings and one neutral from UBS, indicating consistent confidence among analysts.

MicroVision, Inc. Grades

The following table summarizes recent grades given by reputable grading companies for MicroVision, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| D. Boral Capital | Maintain | Buy | 2025-12-16 |

| D. Boral Capital | Maintain | Buy | 2025-11-12 |

| WestPark Capital | Maintain | Buy | 2025-10-21 |

| WestPark Capital | Maintain | Buy | 2025-09-05 |

| D. Boral Capital | Maintain | Buy | 2025-09-02 |

| WestPark Capital | Maintain | Buy | 2025-08-27 |

| D. Boral Capital | Maintain | Buy | 2025-08-11 |

| D. Boral Capital | Maintain | Buy | 2025-05-21 |

| D. Boral Capital | Maintain | Buy | 2025-05-13 |

| WestPark Capital | Maintain | Buy | 2025-03-27 |

MicroVision’s grades consistently indicate strong buy ratings from both D. Boral Capital and WestPark Capital, demonstrating unanimous analyst optimism.

Which company has the best grades?

Both indie Semiconductor, Inc. and MicroVision, Inc. show predominantly buy ratings, but MicroVision’s grades are uniformly buy with no neutral or overweight qualifiers, reflecting slightly stronger analyst enthusiasm. This may suggest a more bullish consensus impacting investor sentiment.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for indie Semiconductor, Inc. (INDI) and MicroVision, Inc. (MVIS) based on the most recent data.

| Criterion | indie Semiconductor, Inc. (INDI) | MicroVision, Inc. (MVIS) |

|---|---|---|

| Diversification | Moderate: Mainly products (202.7M) with smaller services (14M) | Low: Primarily product revenue (4.12M) with some contract and license revenues |

| Profitability | Very weak: Negative net margin (-61.2%) and ROIC (-19.25%) | Very weak: Extremely negative net margin (-2063.8%) and ROIC (-83.7%) |

| Innovation | Moderate: R&D focus implied by product turnover and fixed asset turnover (4.3 favorable) | Low: Limited innovation reflected by low asset turnover (0.04) and poor profitability |

| Global presence | Neutral: No explicit data but reasonable current ratio (4.82) suggests stable operations | Neutral: Current ratio 1.79 suggests liquidity but limited scale |

| Market Share | Moderate: Product revenue growth indicates some market traction | Low: Revenue highly volatile and dependent on licensing agreements |

Key takeaways: Both companies face significant profitability challenges with negative returns on capital. INDI shows better product revenue scale and asset efficiency, while MVIS has a growing ROIC trend but remains deeply unprofitable. Investors should exercise caution and monitor improvements in profitability and diversification before considering these stocks.

Risk Analysis

Below is a comparative table summarizing key risks for indie Semiconductor, Inc. (INDI) and MicroVision, Inc. (MVIS) based on their latest 2024 data:

| Metric | indie Semiconductor, Inc. (INDI) | MicroVision, Inc. (MVIS) |

|---|---|---|

| Market Risk | High beta (2.59) indicates high volatility | Beta 1.56, moderately volatile |

| Debt level | Debt-to-Equity ~0.95 (neutral) | Debt-to-Equity ~1.06 (moderate risk) |

| Regulatory Risk | Moderate, automotive semiconductor regulations | Moderate, lidar and AR tech regulations |

| Operational Risk | Negative margins and ROE signal operational challenges | Severe losses and negative ROE indicate operational strain |

| Environmental Risk | Moderate, automotive industry impact | Moderate, tech hardware environmental concerns |

| Geopolitical Risk | Moderate, US-based with global supply chain exposure | Moderate, US-based with global markets |

The most impactful risks for both companies are operational and market risks. INDI faces significant operational losses with a -61.2% net margin and high volatility, while MVIS exhibits extreme operational distress with a net margin below -2000% and a negative Altman Z-Score, signaling high bankruptcy risk. Debt levels remain moderate but warrant caution as both companies show weak profitability and financial stability.

Which Stock to Choose?

Indie Semiconductor, Inc. (INDI) shows a mixed income evolution with strong revenue growth overall but negative net margin and declining profitability. Its financial ratios are mostly unfavorable, including negative returns on equity and invested capital, though some liquidity ratios appear favorable. Debt levels are moderate, and the company holds a very favorable rating despite challenges in profitability and cash flow.

MicroVision, Inc. (MVIS) reveals a generally unfavorable income statement with steep net losses and negative margins, alongside a declining revenue trend. Financial ratios largely indicate risk with poor profitability metrics and high debt-to-equity levels. Liquidity ratios are favorable, yet the rating is very favorable overall, reflecting some potential despite financial difficulties.

For investors, the choice could depend on risk tolerance and investment strategy. Those focused on growth might see potential in Indie’s higher revenue growth and moderate debt, while risk-averse or value-oriented investors might perceive MicroVision’s improving ROIC trend and liquidity as important, despite its financial challenges. Each stock may appear more suitable depending on the investor’s profile and emphasis on stability versus growth.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of indie Semiconductor, Inc. and MicroVision, Inc. to enhance your investment decisions: