Investors often seek opportunities within the industrial machinery sector, where innovation and market presence play crucial roles. Illinois Tool Works Inc. (ITW) is a well-established industrial giant with a diverse product range and global footprint. In contrast, Nano Nuclear Energy Inc. (NNE) is a nimble innovator focused on advanced microreactor technology. By comparing these two companies, we aim to uncover which offers the most compelling potential for your investment portfolio in 2026.

Table of contents

Companies Overview

I will begin the comparison between Illinois Tool Works Inc. and Nano Nuclear Energy Inc by providing an overview of these two companies and their main differences.

Illinois Tool Works Inc. Overview

Illinois Tool Works Inc. manufactures and sells industrial products and equipment worldwide through seven segments, including Automotive OEM, Food Equipment, and Welding. Founded in 1912 and based in Glenview, Illinois, ITW serves diverse markets such as automotive, commercial food equipment, construction, and general industry. It operates with 44K employees and a market cap of approximately 74.7B USD.

Nano Nuclear Energy Inc Overview

Nano Nuclear Energy Inc. is a microreactor technology company developing solid-core and low-pressure coolant nuclear reactors, alongside a uranium fuel fabrication facility. Founded in 2021 and based in New York City, NNE is a much smaller company with 5 employees and a market cap around 1.33B USD. It focuses on advancing nuclear fuel supply and consultation services.

Key similarities and differences

Both companies operate within the industrial sector and machinery industry, yet their business models differ vastly. ITW is a diversified industrial manufacturer with broad product segments and established markets, while NNE specializes in innovative nuclear microreactor technology and fuel supply. ITW’s scale and market presence contrast with NNE’s niche technological focus and early-stage development.

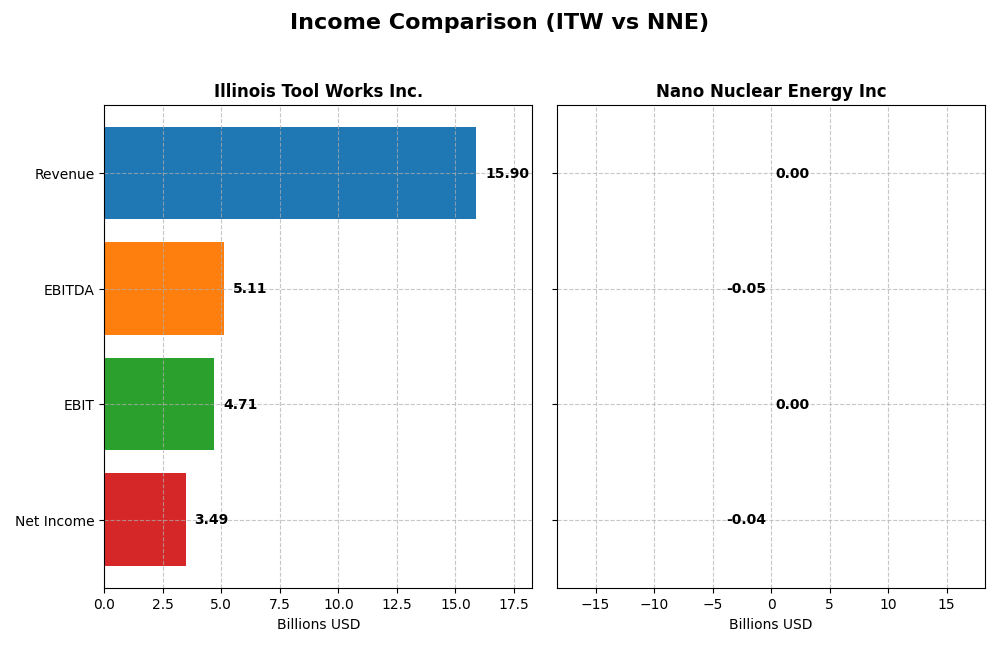

Income Statement Comparison

This table provides a side-by-side comparison of the most recent full fiscal year income statement metrics for Illinois Tool Works Inc. and Nano Nuclear Energy Inc.

| Metric | Illinois Tool Works Inc. (ITW) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| Market Cap | 74.7B | 1.3B |

| Revenue | 15.9B | 0 |

| EBITDA | 5.11B | -46.2M |

| EBIT | 4.71B | 0 |

| Net Income | 3.49B | -40.1M |

| EPS | 11.75 | -1.06 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Illinois Tool Works Inc.

Illinois Tool Works (ITW) showed a steady revenue increase of 26.44% from 2020 to 2024, though revenue slightly declined by 1.3% in 2024. Net income notably grew 65.39% over the period, with a 19.51% margin improvement in the last year. The 2024 performance highlights stronger profitability, with EBITDA and EPS growth exceeding 15%, reflecting efficient cost management.

Nano Nuclear Energy Inc

Nano Nuclear Energy (NNE) reported zero revenue from 2022 through 2025, reflecting its developmental stage. Net losses widened substantially, with net income decreasing by over 3700% across the period. Despite negative margins, NNE’s one-year gross profit and EBIT growth were favorable at 100%, tied to increased research and development expenses, though overall income statement trends remain unfavorable.

Which one has the stronger fundamentals?

Illinois Tool Works presents stronger fundamentals supported by solid revenue growth, stable and improving margins, and consistent profitability gains. Conversely, Nano Nuclear Energy’s income statement is marked by ongoing losses and no revenue generation, reflecting early-stage risks. The contrasting financial profiles highlight ITW’s established earnings quality versus NNE’s developmental financial challenges.

Financial Ratios Comparison

Below is a comparison of the most recent financial ratios for Illinois Tool Works Inc. (ITW) and Nano Nuclear Energy Inc (NNE), reflecting their fiscal year 2024 and 2025 data respectively.

| Ratios | Illinois Tool Works Inc. (ITW) 2024 | Nano Nuclear Energy Inc (NNE) 2025 |

|---|---|---|

| ROE | 105.16% | -18.00% |

| ROIC | 27.19% | -20.51% |

| P/E | 21.58 | -0.04 |

| P/B | 22.69 | 0.007 |

| Current Ratio | 1.36 | 53.48 |

| Quick Ratio | 0.99 | 53.48 |

| D/E (Debt-to-Equity) | 2.44 | 0.013 |

| Debt-to-Assets | 53.61% | 1.22% |

| Interest Coverage | 15.07 | 0 |

| Asset Turnover | 1.06 | 0 |

| Fixed Asset Turnover | 6.91 | 0 |

| Payout Ratio | 48.60% | 0 |

| Dividend Yield | 2.25% | 0 |

Interpretation of the Ratios

Illinois Tool Works Inc.

Illinois Tool Works Inc. shows a balanced ratio profile with half of its metrics favorable, particularly strong returns on equity (105.16%) and invested capital (27.19%). However, some caution is warranted due to unfavorable debt-to-equity (2.44) and debt-to-assets (53.61%) ratios. The company pays dividends, offering a 2.25% yield supported by a stable payout and solid free cash flow coverage, though leverage risks persist.

Nano Nuclear Energy Inc

Nano Nuclear Energy Inc. presents predominantly unfavorable ratios, including negative returns on equity (-18.0%) and invested capital (-20.51%), and an elevated weighted average cost of capital (14.46%). Its liquidity ratios are mixed, with an extremely high current ratio but zero interest coverage. The firm does not pay dividends, likely reflecting its early development stage and focus on R&D and capital investment.

Which one has the best ratios?

Comparing both companies, Illinois Tool Works Inc. has a stronger and more favorable ratio set, with robust profitability and dividend support despite some leverage concerns. Nano Nuclear Energy Inc. faces significant financial challenges typical of a nascent firm, resulting in an overall unfavorable ratio assessment. Thus, Illinois Tool Works demonstrates comparatively better financial stability and performance.

Strategic Positioning

This section compares the strategic positioning of ITW and NNE, focusing on market position, key segments, and exposure to technological disruption:

ITW

- Large industrial machinery firm with $74.7B market cap facing moderate competitive pressure.

- Diverse segments including automotive OEM, food equipment, welding, construction, and specialty products.

- Operates in traditional industrial machinery with limited direct exposure to rapid technological disruption.

NNE

- Small microreactor technology company with $1.3B market cap and high beta.

- Focused on microreactor technology, nuclear fuel fabrication, and consulting.

- Developing innovative nuclear reactor technologies with potential industry disruption.

ITW vs NNE Positioning

ITW pursues a diversified industrial product strategy across multiple mature segments, providing stability but limited rapid innovation. NNE concentrates on emerging nuclear technologies, implying higher risk and growth potential, though with a smaller scale and workforce.

Which has the best competitive advantage?

ITW shows a very favorable moat with a strong and growing ROIC above WACC, indicating durable competitive advantage. NNE has a slightly unfavorable moat, shedding value despite improving profitability, reflecting weaker competitive positioning.

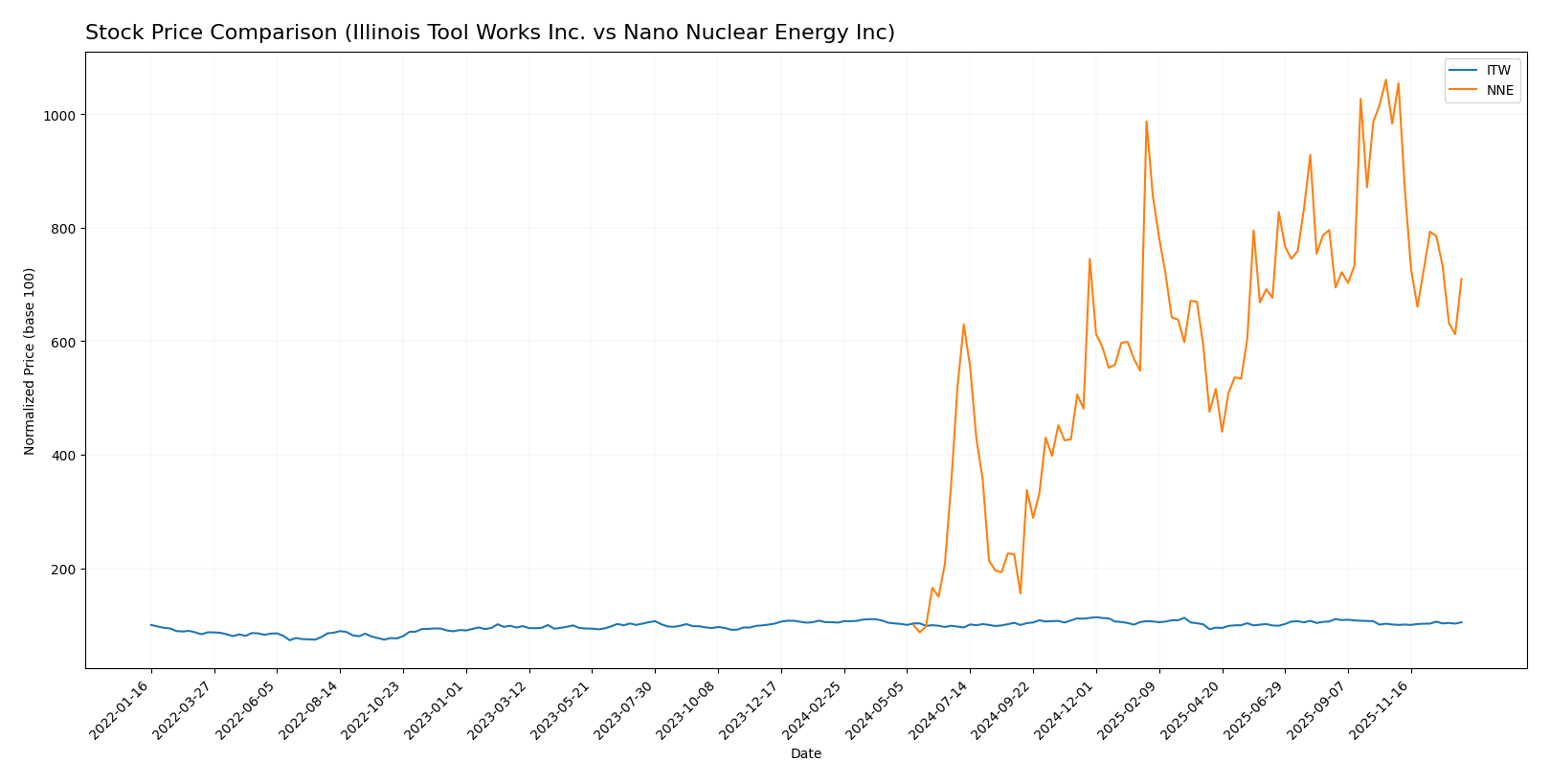

Stock Comparison

The past year has seen contrasting stock movements for Illinois Tool Works Inc. and Nano Nuclear Energy Inc., with ITW showing modest gains and NNE experiencing dramatic growth followed by recent declines.

Trend Analysis

Illinois Tool Works Inc. (ITW) exhibited a slight bullish trend over the past 12 months with a 0.47% price increase and acceleration in price movement, fluctuating between 225.57 and 277.52. Recent months show a stronger 3.81% rise with reduced volatility.

Nano Nuclear Energy Inc. (NNE) delivered a substantial 609.76% bullish price increase over the past year but with deceleration. However, the recent period reveals a 27.81% decline and seller dominance, indicating short-term bearish pressure.

Comparing both, NNE outperformed ITW in overall market performance despite recent setbacks, showing much higher gains, while ITW maintained steady but limited upward momentum.

Target Prices

The current analyst consensus reflects moderate upside potential for Illinois Tool Works Inc. and a firm valuation for Nano Nuclear Energy Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Illinois Tool Works Inc. | 275 | 230 | 254 |

| Nano Nuclear Energy Inc | 50 | 50 | 50 |

Analysts expect Illinois Tool Works to trade slightly above the current price of 255.12 USD, indicating modest growth potential. Nano Nuclear Energy’s target price at 50 USD suggests a significant premium over its current 32.01 USD price, reflecting higher risk and growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Illinois Tool Works Inc. (ITW) and Nano Nuclear Energy Inc (NNE):

Rating Comparison

ITW Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate, value of 3.

- ROE Score: Very favorable, highest score of 5.

- ROA Score: Very favorable, highest score of 5.

- Debt To Equity Score: Very unfavorable, low score of 1.

- Overall Score: Moderate, value of 3.

NNE Rating

- Rating: C, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate, value of 2.

- ROE Score: Very unfavorable, lowest score of 1.

- ROA Score: Very unfavorable, lowest score of 1.

- Debt To Equity Score: Very favorable, high score of 5.

- Overall Score: Moderate, value of 2.

Which one is the best rated?

Based strictly on the data, ITW holds a better overall rating with a “B” and stronger ROE and ROA scores compared to NNE’s “C” rating and weaker profitability metrics, despite NNE’s advantage in debt-to-equity score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Illinois Tool Works Inc. and Nano Nuclear Energy Inc.:

ITW Scores

- Altman Z-Score: 7.93, indicating a safe zone for bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

NNE Scores

- Altman Z-Score: 143.56, indicating a safe zone for bankruptcy risk.

- Piotroski Score: 2, classified as very weak financial health.

Which company has the best scores?

Based on the provided data, NNE has a much higher Altman Z-Score, suggesting lower bankruptcy risk, while ITW has a significantly stronger Piotroski Score, indicating better overall financial health.

Grades Comparison

Here is a comparison of the latest available grades for Illinois Tool Works Inc. and Nano Nuclear Energy Inc.:

Illinois Tool Works Inc. Grades

The table below summarizes recent grades assigned by reputable financial institutions to Illinois Tool Works Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Underweight | 2026-01-07 |

| Goldman Sachs | Downgrade | Sell | 2025-12-16 |

| B of A Securities | Upgrade | Neutral | 2025-11-18 |

| Barclays | Maintain | Underweight | 2025-10-27 |

| Truist Securities | Maintain | Hold | 2025-10-27 |

| Wells Fargo | Maintain | Underweight | 2025-10-27 |

| Truist Securities | Maintain | Hold | 2025-10-08 |

| Barclays | Downgrade | Underweight | 2025-08-14 |

| Barclays | Maintain | Equal Weight | 2025-08-04 |

| UBS | Maintain | Neutral | 2025-07-31 |

Overall, Illinois Tool Works has predominantly received hold to sell-oriented grades, with several downgrades and no strong buy ratings.

Nano Nuclear Energy Inc. Grades

The table below shows recent grades from recognized grading companies for Nano Nuclear Energy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-08-19 |

| Ladenburg Thalmann | Downgrade | Sell | 2025-08-18 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-15 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-01-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-27 |

| Benchmark | Maintain | Buy | 2024-11-07 |

| Benchmark | Maintain | Buy | 2024-07-15 |

| Benchmark | Maintain | Buy | 2024-06-25 |

Nano Nuclear Energy’s grades are mainly buy recommendations, with one notable downgrade to sell.

Which company has the best grades?

Nano Nuclear Energy Inc. has received generally more favorable grades, mostly buy recommendations, while Illinois Tool Works Inc. has more cautious to negative grades. This discrepancy may influence investors’ perception of growth potential and risk profile between the two companies.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses between Illinois Tool Works Inc. (ITW) and Nano Nuclear Energy Inc. (NNE) based on the latest financial and operational data.

| Criterion | Illinois Tool Works Inc. (ITW) | Nano Nuclear Energy Inc. (NNE) |

|---|---|---|

| Diversification | Highly diversified across 7 major segments with stable revenues ranging from $1.7B to $3.2B per segment in 2024 | Limited diversification; primarily focused on nuclear energy technology development |

| Profitability | Strong profitability: Net margin 21.94%, ROIC 27.19%, ROE 105.16% (2024) | Negative profitability: Net margin 0%, ROIC -20.51%, ROE -18% (2025) |

| Innovation | Consistent investment in R&D across specialty products and test & measurement segments | Emerging technology focus with growing ROIC trend but currently value-destroying |

| Global presence | Established global footprint with multiple industrial segments worldwide | Early-stage company with limited global reach |

| Market Share | Large industrial market share with durable competitive advantage and very favorable economic moat | Small market share with unfavorable moat status but improving profitability trend |

Key takeaways: Illinois Tool Works demonstrates a robust and diversified business model with strong profitability and a durable competitive moat. In contrast, Nano Nuclear Energy is still developing its market position and technology, currently operating at a loss but showing promising improvements in profitability trends. Investors should weigh ITW’s stability against NNE’s growth potential with caution.

Risk Analysis

Below is a comparison of key risk factors for Illinois Tool Works Inc. (ITW) and Nano Nuclear Energy Inc. (NNE) based on the most recent data.

| Metric | Illinois Tool Works Inc. (ITW) | Nano Nuclear Energy Inc. (NNE) |

|---|---|---|

| Market Risk | Beta 1.17 – Moderate market volatility exposure | Beta 7.49 – Highly volatile and speculative stock |

| Debt Level | Debt-to-Equity 2.44 (unfavorable) – significant leverage | Debt-to-Equity 0.01 (favorable) – very low leverage |

| Regulatory Risk | Moderate – industrial regulations, global trade policies | High – nuclear energy regulations and licensing challenges |

| Operational Risk | Established operations with diverse segments; moderate risk | High – early-stage technology development and scale-up risks |

| Environmental Risk | Moderate – manufacturing emissions and waste management | High – nuclear safety and waste disposal concerns |

| Geopolitical Risk | Moderate – global supply chains sensitive to trade tensions | High – geopolitical risks related to nuclear technology and fuel supply |

The most impactful and likely risks differ between these companies. ITW faces moderate market and regulatory risks with notable debt leverage, but benefits from operational diversity and strong financial stability. NNE, a microreactor startup, carries elevated market volatility, regulatory hurdles, and environmental concerns inherent to nuclear technology, alongside operational risks from its nascent stage. Investors should weigh ITW’s steady industrial profile against NNE’s high-risk, high-reward innovation potential.

Which Stock to Choose?

Illinois Tool Works Inc. (ITW) shows a favorable income evolution with strong profitability and a very favorable rating. Despite a slight revenue decline in 2024, it maintains high returns on equity (105%) and invested capital (27%), moderate debt levels with net debt-to-EBITDA at 1.4, and a robust financial moat indicating durable competitive advantage.

Nano Nuclear Energy Inc. (NNE) exhibits unfavorable income metrics with negative returns on equity (-18%) and invested capital (-20%), but benefits from a very favorable rating driven by low debt ratios. Its financial moat is slightly unfavorable, signaling value destruction despite growing profitability, and income growth is weak with high volatility in cash flows.

For investors prioritizing stable profitability and a proven competitive moat, ITW might appear more favorable, while those with a tolerance for higher risk and interest in potential turnaround or growth opportunities could consider NNE, acknowledging its financial challenges and volatility.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Illinois Tool Works Inc. and Nano Nuclear Energy Inc to enhance your investment decisions: