Investors seeking opportunities in the industrial machinery sector often face the choice between established leaders and innovative newcomers. IDEX Corporation (IEX) offers a diversified portfolio of fluidics and safety products, while Nano Nuclear Energy Inc (NNE) pioneers microreactor technology with cutting-edge nuclear solutions. This comparison highlights their market positions and innovation strategies to help you decide which company may best enhance your investment portfolio. Let’s explore which stock holds the most promise for your wallet.

Table of contents

Companies Overview

I will begin the comparison between IDEX Corporation and Nano Nuclear Energy Inc by providing an overview of these two companies and their main differences.

IDEX Corporation Overview

IDEX Corporation operates globally, offering applied solutions through three segments: Fluid & Metering Technologies, Health & Science Technologies, and Fire & Safety/Diversified Products. It serves diverse industries including food, chemical, pharmaceutical, and defense, focusing on fluid-handling pumps, precision fluidics, firefighting equipment, and more. Founded in 1987 and headquartered in Northbrook, Illinois, IDEX is a well-established player in industrial machinery with nearly 9,000 employees.

Nano Nuclear Energy Inc Overview

Nano Nuclear Energy is a microreactor technology company developing solid-core and low-pressure coolant reactors, alongside fuel fabrication and nuclear consultation services. Founded in 2021 and based in New York City, it operates in a niche segment of the industrial machinery sector with a very small workforce of 5 employees. The company aims to innovate in nuclear energy with its ZEUS and ODIN reactor projects.

Key similarities and differences

Both IDEX and Nano Nuclear Energy operate within the industrial machinery sector in the U.S. However, IDEX is a diversified industrial solutions provider with a broad product portfolio and established market presence, while Nano Nuclear Energy focuses narrowly on advanced nuclear microreactors and related fuel services. IDEX has a substantial workforce and market cap of about 13.9B, contrasting with Nano Nuclear’s small team and 1.3B market cap, reflecting different scales and stages of development.

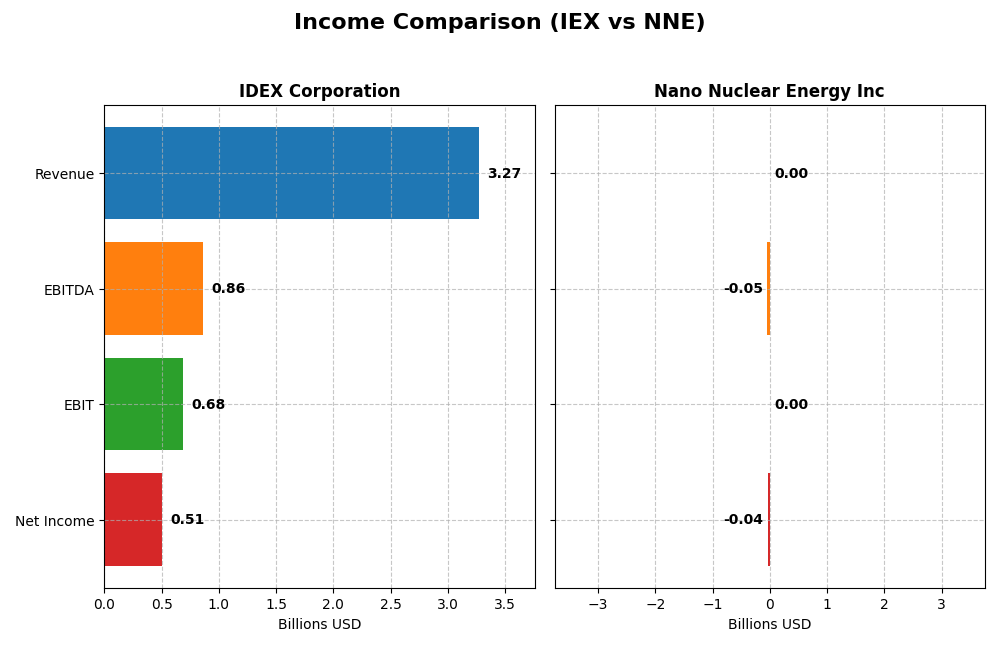

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for IDEX Corporation and Nano Nuclear Energy Inc for their most recent fiscal years.

| Metric | IDEX Corporation (IEX) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| Market Cap | 13.9B | 1.33B |

| Revenue | 3.27B | 0 |

| EBITDA | 859M | -46M |

| EBIT | 684M | 0 |

| Net Income | 505M | -40M |

| EPS | 6.67 | -1.06 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

IDEX Corporation

IDEX Corporation has shown steady revenue growth of 39% over five years, with net income increasing 33.7%. Margins remain strong with a gross margin of 46.4% and net margin of 15.45%, although the latest year saw a slight decline in revenue (-0.16%) and net income (-15.15%). Despite these recent decreases, the company maintains favorable profitability and solid operational efficiency.

Nano Nuclear Energy Inc

Nano Nuclear Energy has reported no revenue throughout the analyzed period, reflecting its early stage and development focus. The company consistently posted net losses, with net income deteriorating significantly over the years. Margins are zero or negative, and although some yearly improvements in EPS and EBIT growth appeared, overall fundamentals remain unfavorable due to the lack of operating income and persistent expenses.

Which one has the stronger fundamentals?

IDEX Corporation clearly exhibits stronger fundamentals, supported by consistent revenue and net income growth, solid margins, and positive profitability metrics. In contrast, Nano Nuclear Energy’s absence of revenue and ongoing losses weigh heavily on its income statement profile. The overall income statement evaluations favor IDEX, indicating a more stable and financially sustainable business model.

Financial Ratios Comparison

This table presents the most recent key financial ratios for IDEX Corporation and Nano Nuclear Energy Inc, reflecting their fiscal year 2024 and 2025 performances respectively.

| Ratios | IDEX Corporation (2024) | Nano Nuclear Energy Inc (2025) |

|---|---|---|

| ROE | 13.31% | -18.00% |

| ROIC | 8.81% | -20.51% |

| P/E | 31.37 | -0.04 |

| P/B | 4.18 | 0.01 |

| Current Ratio | 2.53 | 53.48 |

| Quick Ratio | 1.85 | 53.48 |

| D/E (Debt-to-Equity) | 0.52 | 0.01 |

| Debt-to-Assets | 29.45% | 1.22% |

| Interest Coverage | 15.66 | 0 |

| Asset Turnover | 0.48 | 0 |

| Fixed Asset Turnover | 7.10 | 0 |

| Payout Ratio | 40.65% | 0 |

| Dividend Yield | 1.30% | 0 |

Interpretation of the Ratios

IDEX Corporation

IDEX Corporation shows a slightly favorable overall ratio profile with strong liquidity indicated by a current ratio of 2.53 and quick ratio of 1.85. Profitability is solid with a net margin of 15.45% but some valuation concerns arise from a high PE of 31.37 and PB of 4.18. The company pays dividends with a stable yield of 1.3%, supported by consistent free cash flow, though payout sustainability should be monitored.

Nano Nuclear Energy Inc

Nano Nuclear Energy’s financial ratios reflect challenges, with unfavorable profitability metrics including negative ROE (-18%) and ROIC (-20.51%). The company has a very high current ratio of 53.48, which signals potential inefficiency, and a zero dividend yield as it does not pay dividends. This likely reflects its early-stage development focus, reinvesting earnings into R&D and capital expenditures rather than shareholder returns.

Which one has the best ratios?

Comparing the two, IDEX Corporation presents a more balanced and slightly favorable set of financial ratios, combining profitability and liquidity with dividend payments. In contrast, Nano Nuclear Energy’s ratios are mostly unfavorable with negative returns and no dividend, consistent with a high-risk, early-stage profile. Thus, IDEX’s ratios appear stronger and more stable based on the available data.

Strategic Positioning

This section compares the strategic positioning of IDEX Corporation and Nano Nuclear Energy Inc, focusing on market position, key segments, and exposure to technological disruption:

IDEX Corporation

- Well-established with $13.9B market cap facing moderate competition in industrial machinery.

- Operates diversified segments: Fluid & Metering, Health & Science, Fire & Safety, driving steady revenues.

- Moderate exposure to technological disruption, mainly incremental innovation in fluidics and safety equipment.

Nano Nuclear Energy Inc

- Smaller player with $1.3B market cap in emerging microreactor technology sector, high volatility.

- Focused on developing microreactors and fuel fabrication, concentrated in nuclear energy innovation.

- High exposure to disruption with advanced microreactor and fuel technologies under development.

IDEX Corporation vs Nano Nuclear Energy Inc Positioning

IEX leverages a diversified portfolio across multiple industrial segments, providing revenue stability but less focus on cutting-edge technology. NNE concentrates on nuclear microreactors, offering innovation potential but higher market and technological risks due to niche focus and early stage.

Which has the best competitive advantage?

Both companies are rated slightly unfavorable in MOAT evaluations, with IEX showing declining profitability and NNE shedding value but improving ROIC. Neither currently demonstrates a strong sustainable competitive advantage based on capital efficiency.

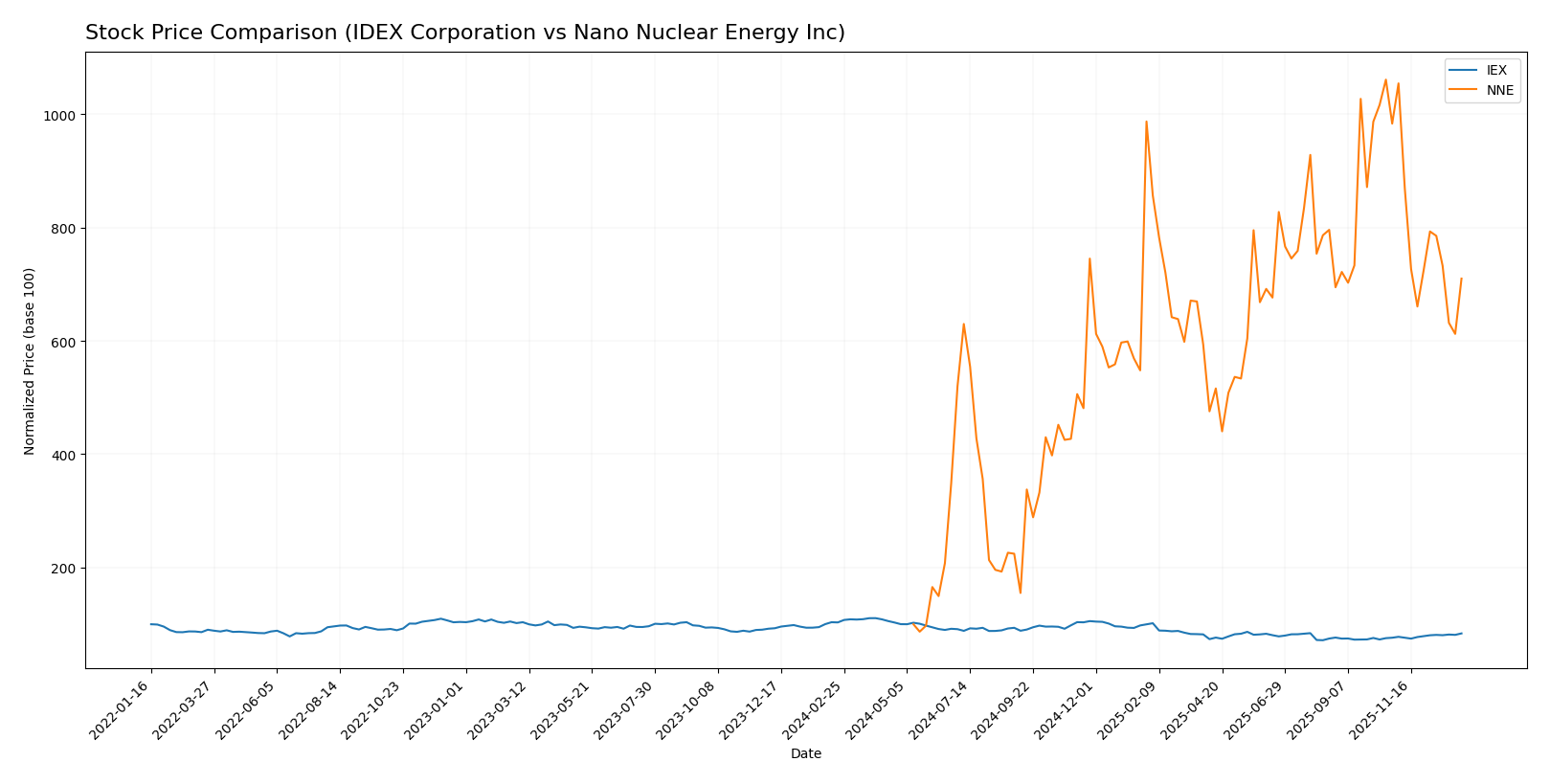

Stock Comparison

The stock prices of IDEX Corporation (IEX) and Nano Nuclear Energy Inc (NNE) have shown contrasting dynamics over the past 12 months, with IEX experiencing a significant bearish trend and NNE a strong bullish run, though recent months reveal shifts in momentum.

Trend Analysis

IDEX Corporation’s stock declined by 18.8% over the past year, indicating a bearish trend with accelerating downward momentum. The stock showed high volatility, ranging between 158.26 and 244.02, with a recent short-term rebound of 9.98%.

Nano Nuclear Energy Inc’s stock surged 609.76% over the last 12 months, reflecting a bullish trend with decelerating growth. Its price ranged from 3.92 to 47.84, but recent months show a reversal with a 27.81% decline.

Comparing both, Nano Nuclear Energy Inc delivered the highest market performance over the year despite recent weakness, while IDEX showed a prolonged bearish trend with a late-term recovery.

Target Prices

Here is the consensus target price overview from verified analysts for the selected companies:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| IDEX Corporation | 210 | 180 | 194 |

| Nano Nuclear Energy Inc | 50 | 50 | 50 |

Analysts expect IDEX Corporation’s stock to appreciate moderately above its current price of $184.71, suggesting a potential upside. Nano Nuclear Energy’s target is well above its current price of $32.01, indicating strong growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for IDEX Corporation and Nano Nuclear Energy Inc:

Rating Comparison

IEX Rating

- Rated B+, evaluated as Very Favorable overall.

- Discounted Cash Flow Score of 4, indicating a Favorable outlook on cash flows.

- Return on Equity Score of 4, signaling strong efficiency in generating profits.

- Return on Assets Score of 4, showing effective asset utilization.

- Debt To Equity Score of 2, showing a Moderate level of financial risk.

- Overall Score of 3, assessed as Moderate.

NNE Rating

- Rated C, evaluated as Very Favorable overall.

- Discounted Cash Flow Score of 2, reflecting a Moderate outlook on cash flows.

- Return on Equity Score of 1, indicating a Very Unfavorable efficiency.

- Return on Assets Score of 1, indicating Very Unfavorable asset use.

- Debt To Equity Score of 5, indicating Very Favorable financial stability.

- Overall Score of 2, assessed as Moderate.

Which one is the best rated?

Based strictly on the provided data, IEX holds a higher overall rating (B+) and stronger scores in discounted cash flow, ROE, and ROA, while NNE scores better only on debt to equity. Thus, IEX is better rated overall.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for IDEX Corporation and Nano Nuclear Energy Inc:

IEX Scores

- Altman Z-Score: 4.48, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

NNE Scores

- Altman Z-Score: 143.56, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 2, classified as very weak financial health.

Which company has the best scores?

Based on the provided data, NNE has a much higher Altman Z-Score than IEX, indicating very low bankruptcy risk. However, IEX’s Piotroski Score is significantly stronger than NNE’s, suggesting better overall financial strength.

Grades Comparison

Here is a comparison of the latest grades assigned to IDEX Corporation and Nano Nuclear Energy Inc by recognized grading companies:

IDEX Corporation Grades

This table summarizes the recent grades from major financial institutions for IDEX Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-12-08 |

| RBC Capital | Maintain | Outperform | 2025-10-30 |

| Stifel | Maintain | Buy | 2025-10-20 |

| Oppenheimer | Maintain | Outperform | 2025-10-07 |

| DA Davidson | Maintain | Neutral | 2025-08-04 |

| Stifel | Maintain | Buy | 2025-07-31 |

| RBC Capital | Maintain | Outperform | 2025-07-31 |

| Oppenheimer | Maintain | Outperform | 2025-07-31 |

| Stifel | Maintain | Buy | 2025-07-21 |

| Citigroup | Maintain | Buy | 2025-07-14 |

The grades for IDEX Corporation show a consistent pattern of buy and outperform ratings, with only one neutral rating, indicating generally positive sentiment.

Nano Nuclear Energy Inc Grades

This table presents the latest available grades from recognized firms for Nano Nuclear Energy Inc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-08-19 |

| Ladenburg Thalmann | Downgrade | Sell | 2025-08-18 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-15 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-01-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-27 |

| Benchmark | Maintain | Buy | 2024-11-07 |

| Benchmark | Maintain | Buy | 2024-07-15 |

| Benchmark | Maintain | Buy | 2024-06-25 |

Nano Nuclear Energy Inc has mostly buy ratings, but one notable recent downgrade to sell from Ladenburg Thalmann, indicating some divergence in analyst views.

Which company has the best grades?

IDEX Corporation holds predominantly buy and outperform grades with no sell recommendations, while Nano Nuclear Energy Inc shows mostly buy ratings but includes a recent sell downgrade. This suggests IDEX’s grades are comparatively stronger and more stable, potentially reflecting lower perceived risk for investors.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for IDEX Corporation (IEX) and Nano Nuclear Energy Inc (NNE) based on their latest financial and operational data.

| Criterion | IDEX Corporation (IEX) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| Diversification | Strong product diversification across three main segments with steady revenue streams: Health & Science Technologies ($1.3B), Fluid & Metering Technologies ($1.23B), Fire & Safety Products ($744M) | Limited diversification; primarily focused on nuclear energy with no reported segment revenue diversification |

| Profitability | Moderate profitability with net margin 15.45%, ROIC 8.81%, slightly favorable overall ratios | Currently unprofitable with negative net margin (0%), ROIC (-20.5%), and unfavorable financial ratios |

| Innovation | Established technology and innovation in industrial products, but ROIC trend declining (-17.6%) | High innovation potential in nuclear energy with rapidly growing ROIC (+59.2%), though still value destroying |

| Global presence | Global footprint with diversified markets in industrial, health, and safety sectors | Smaller scale, less global presence, focusing on emerging nuclear tech markets |

| Market Share | Strong market presence in industrial and safety products sectors | Emerging player with limited market share and early-stage development |

Key takeaway: IDEX Corporation offers a well-diversified business with moderate profitability but faces challenges from declining ROIC trends. In contrast, Nano Nuclear Energy shows promise with improving profitability trends but currently suffers from significant value destruction and financial instability, reflecting its developmental stage. Investors should weigh stability versus growth potential carefully.

Risk Analysis

Below is a comparative overview of key risks for IDEX Corporation (IEX) and Nano Nuclear Energy Inc (NNE) based on the most recent data from 2025-2026:

| Metric | IDEX Corporation (IEX) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| Market Risk | Moderate (Beta ~1.0) | Very High (Beta ~7.5) |

| Debt Level | Moderate (D/E 0.52, favorable) | Very Low (D/E 0.01, very favorable) |

| Regulatory Risk | Moderate (Industrial sector) | High (Nuclear energy regulations) |

| Operational Risk | Moderate (Established operations) | High (Early-stage tech, 5 employees) |

| Environmental Risk | Moderate (Industrial machinery) | High (Nuclear technology impact) |

| Geopolitical Risk | Moderate (US-based, global sales) | High (Nuclear fuel and tech sensitive) |

The most likely and impactful risks are market volatility for NNE due to its extremely high beta and regulatory challenges in the nuclear sector. IEX shows balanced risk with moderate debt and stable operations, but its industrial exposure carries typical sector risks. Investors should weigh NNE’s high growth potential against regulatory and operational uncertainties.

Which Stock to Choose?

IDEX Corporation (IEX) shows a generally favorable income statement with solid profitability metrics, a slightly favorable financial ratios profile, and a very favorable rating of B+. Despite a recent decline in revenue and earnings growth, it maintains strong margins and manageable debt levels. However, its economic moat appears slightly unfavorable due to declining ROIC relative to WACC.

Nano Nuclear Energy Inc (NNE) presents an unfavorable income statement with negative profitability and high volatility in financial performance. While some valuation ratios look attractive, overall financial ratios and ratings are unfavorable, reflecting significant value destruction. Its economic moat remains slightly unfavorable despite improving ROIC trends, indicating ongoing challenges in creating value.

For investors prioritizing financial stability and consistent profitability, IEX might appear more favorable given its stronger rating and more balanced income and ratio evaluations. Conversely, those with a higher risk tolerance focusing on growth potential might see NNE’s recent bullish price trend and improving ROIC as suggestive of possible opportunities, albeit with considerable risk.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of IDEX Corporation and Nano Nuclear Energy Inc to enhance your investment decisions: