Illinois Tool Works Inc. (ITW) and IDEX Corporation (IEX) stand as prominent players in the industrial machinery sector, each driving innovation in specialized equipment and fluid technologies. While ITW boasts a diversified portfolio across automotive, construction, and food equipment markets, IEX focuses on precision fluidics and safety solutions. This comparison unveils their strategic strengths and market positions, helping you decide which company offers the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Illinois Tool Works Inc. and IDEX Corporation by providing an overview of these two companies and their main differences.

Illinois Tool Works Inc. Overview

Illinois Tool Works Inc. operates globally in the industrial machinery sector, manufacturing and selling a diverse range of industrial products and equipment. Founded in 1912 and based in Glenview, Illinois, ITW serves automotive OEMs, food equipment, construction, and general industrial markets through seven segments, including welding and polymers. The company distributes products directly and via independent distributors, positioning itself as a multifaceted industrial supplier with a market cap of approximately 74.7B USD.

IDEX Corporation Overview

IDEX Corporation, headquartered in Northbrook, Illinois, focuses on applied solutions across three main segments: Fluid & Metering Technologies, Health & Science Technologies, and Fire & Safety/Diversified Products. Incorporated in 1987, IEX designs and produces pumps, precision fluidics, and safety equipment for diverse industries including pharmaceutical, food, and fire rescue. With about 9K employees and a market cap near 13.9B USD, IDEX emphasizes specialized industrial and scientific equipment.

Key similarities and differences

Both ITW and IDEX operate within the industrial machinery sector and serve multiple industrial markets with specialized equipment, emphasizing innovation and applied technologies. However, ITW has a broader product portfolio spanning seven segments, including automotive and construction products, with a much larger workforce and market cap. In contrast, IDEX focuses on fluid handling, scientific technologies, and safety equipment with a leaner operation and a narrower but specialized product range.

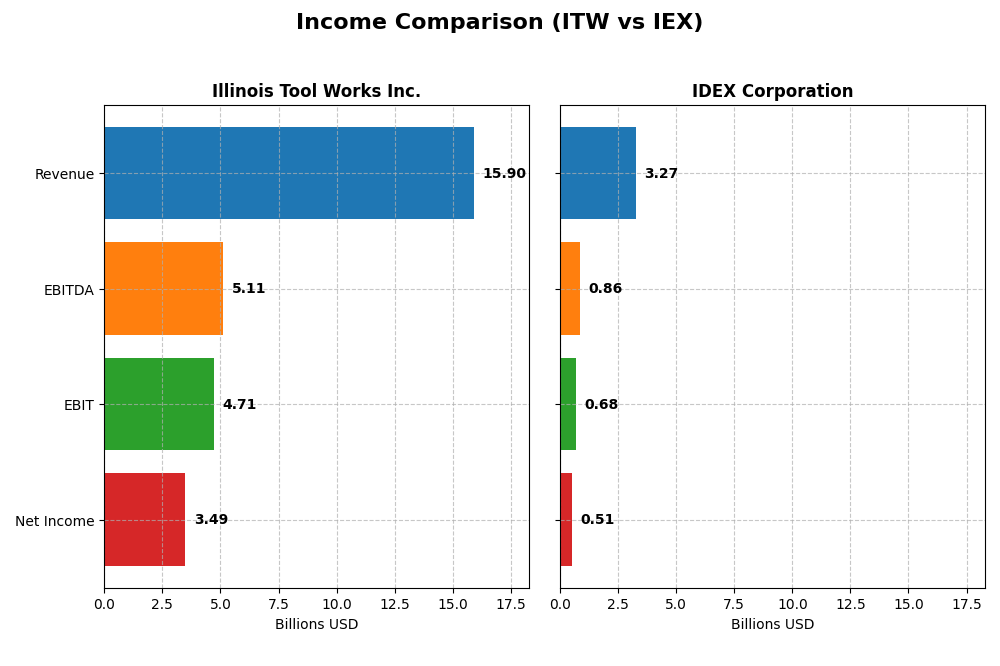

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Illinois Tool Works Inc. and IDEX Corporation for the fiscal year 2024.

| Metric | Illinois Tool Works Inc. (ITW) | IDEX Corporation (IEX) |

|---|---|---|

| Market Cap | 74.7B | 13.9B |

| Revenue | 15.9B | 3.3B |

| EBITDA | 5.11B | 859M |

| EBIT | 4.71B | 684M |

| Net Income | 3.49B | 505M |

| EPS | 11.75 | 6.67 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Illinois Tool Works Inc.

Illinois Tool Works (ITW) showed a 26.44% revenue growth and 65.39% net income growth over 2020-2024, reflecting strong fundamentals. Margins improved, with a gross margin of 43.65% and net margin of 21.94%, both favorable. Despite a slight 1.3% revenue decline in 2024, EBIT and net margin surged, indicating operational efficiency gains.

IDEX Corporation

IDEX Corporation (IEX) experienced a 39.0% revenue increase and 33.67% net income growth over the five years. Gross margin remained solid at 46.4%, but net margin declined by 3.84% overall. In 2024, revenue dropped marginally by 0.16%, with decreases in gross profit and EBIT, signaling challenges that impacted profitability and earnings per share.

Which one has the stronger fundamentals?

ITW demonstrates stronger fundamentals with higher margin stability, significant net income growth, and improved profitability metrics despite a minor revenue dip. IEX, while growing revenue faster overall, faces margin pressure and recent declines in profitability. The balance of favorable versus unfavorable trends suggests ITW maintains a more robust income statement profile.

Financial Ratios Comparison

This table presents a side-by-side comparison of key financial ratios for Illinois Tool Works Inc. (ITW) and IDEX Corporation (IEX) based on their latest fiscal year data (2024).

| Ratios | Illinois Tool Works Inc. (ITW) | IDEX Corporation (IEX) |

|---|---|---|

| ROE | 105.2% | 13.3% |

| ROIC | 27.2% | 8.8% |

| P/E | 21.6 | 31.4 |

| P/B | 22.7 | 4.18 |

| Current Ratio | 1.36 | 2.53 |

| Quick Ratio | 0.99 | 1.85 |

| D/E (Debt-to-Equity) | 2.44 | 0.52 |

| Debt-to-Assets | 53.6% | 29.4% |

| Interest Coverage | 15.1 | 15.7 |

| Asset Turnover | 1.06 | 0.48 |

| Fixed Asset Turnover | 6.91 | 7.10 |

| Payout Ratio | 48.6% | 40.7% |

| Dividend Yield | 2.25% | 1.30% |

Interpretation of the Ratios

Illinois Tool Works Inc.

Illinois Tool Works exhibits strong profitability with a net margin of 21.94% and an exceptional return on equity at 105.16%, indicating effective capital use. However, its high price-to-book ratio of 22.69 and elevated debt-to-equity at 2.44 raise concerns regarding valuation and financial leverage. The company pays dividends with a solid yield of 2.25%, supported by favorable coverage ratios, though debt levels warrant monitoring.

IDEX Corporation

IDEX Corporation shows a favorable net margin of 15.45% but more moderate returns on equity (13.31%) and invested capital (8.81%), reflecting steadier performance. Its balance sheet is healthier with a low debt-to-assets ratio of 29.45% and strong liquidity ratios above 2.5. Dividend yield is moderate at 1.3%, with a neutral stance on payout sustainability supported by consistent free cash flow.

Which one has the best ratios?

Both Illinois Tool Works and IDEX Corporation present a balanced mix of strengths and weaknesses, with half their ratios rated favorable and about 21% unfavorable. ITW’s higher profitability contrasts with its elevated leverage and valuation metrics, while IEX benefits from a stronger liquidity profile and lower debt but shows weaker asset turnover. Overall, both companies are slightly favorable, reflecting different financial risk-return profiles.

Strategic Positioning

This section compares the strategic positioning of Illinois Tool Works Inc. and IDEX Corporation, including their market position, key segments, and exposure to technological disruption:

Illinois Tool Works Inc. (ITW)

- Large industrial machinery firm with broad competitive pressure across multiple sectors.

- Diverse segments: automotive OEM, food equipment, welding, polymers, construction, specialty products.

- Moderate exposure through industrial and electronics equipment, incremental innovation likely.

IDEX Corporation (IEX)

- Mid-sized industrial machinery company facing moderate competitive pressure.

- Focused on fluid metering, health sciences, fire and safety with specialized solutions.

- Exposure via precision fluidics and safety technology, with niche applied solutions.

Illinois Tool Works Inc. vs IDEX Corporation Positioning

ITW pursues a diversified approach across seven industrial segments, spreading risk and revenue sources. IEX concentrates on three specialized segments, potentially enabling focused expertise but narrower market reach. ITW’s scale contrasts with IEX’s smaller employee base and segment count.

Which has the best competitive advantage?

ITW demonstrates a very favorable moat with growing ROIC above WACC, indicating durable competitive advantage. IEX shows a slightly unfavorable moat with declining ROIC below WACC, reflecting challenges in sustaining profitability.

Stock Comparison

The stock price movements of Illinois Tool Works Inc. (ITW) and IDEX Corporation (IEX) over the past 12 months reveal contrasting trends, with ITW showing modest gains and IEX experiencing a significant decline followed by recent recovery dynamics.

Trend Analysis

Illinois Tool Works Inc. (ITW) recorded a slight overall price increase of 0.47% over the past year, indicating a neutral to mildly bullish trend with accelerating momentum and a price range between 225.57 and 277.52. Recent weeks show a stronger 3.81% gain.

IDEX Corporation (IEX) showed a bearish trend with an 18.8% price decline over the past year despite an acceleration pattern. The stock hit a low of 158.26 but has rebounded recently with a 9.98% gain in the past few months.

Comparing both, ITW delivered a stable, modestly positive market performance, whereas IEX, despite a large yearly loss, has demonstrated a stronger short-term recovery in price and buyer dominance.

Target Prices

The current analyst consensus presents a positive outlook for both Illinois Tool Works Inc. and IDEX Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Illinois Tool Works Inc. | 275 | 230 | 254 |

| IDEX Corporation | 210 | 180 | 194 |

Analysts expect Illinois Tool Works to trade slightly below its current price of $255.12, while IDEX Corporation’s consensus target of $194 suggests potential upside from its current $184.71. Overall, targets indicate cautious optimism.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Illinois Tool Works Inc. (ITW) and IDEX Corporation (IEX):

Rating Comparison

ITW Rating

- Rating: B, considered very favorable overall.

- Discounted Cash Flow Score: Moderate at 3, indicating average valuation.

- ROE Score: Very favorable at 5, showing efficient profit generation.

- ROA Score: Very favorable at 5, indicating excellent asset utilization.

- Debt To Equity Score: Very unfavorable at 1, indicating high financial risk.

- Overall Score: Moderate at 3, reflecting balanced overall performance.

IEX Rating

- Rating: B+, considered very favorable overall.

- Discounted Cash Flow Score: Favorable at 4, suggesting better valuation assessment.

- ROE Score: Favorable at 4, reflecting strong but slightly lower profitability.

- ROA Score: Favorable at 4, showing good asset efficiency.

- Debt To Equity Score: Moderate at 2, showing lower financial leverage risk than ITW.

- Overall Score: Moderate at 3, indicating similar overall financial standing as ITW.

Which one is the best rated?

IEX holds a slightly better overall rating (B+) and stronger discounted cash flow, ROE, ROA, and debt-to-equity scores compared to ITW. However, both have the same moderate overall score of 3, signifying comparable financial standing with differing strengths.

Scores Comparison

The scores comparison between Illinois Tool Works Inc. and IDEX Corporation is as follows:

ITW Scores

- Altman Z-Score: 7.93, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

IEX Scores

- Altman Z-Score: 4.48, also in the safe zone with low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Which company has the best scores?

Both ITW and IEX are in the safe zone for Altman Z-Score and share the same Piotroski Score of 7, indicating strong financial health. ITW has a notably higher Altman Z-Score, suggesting comparatively lower bankruptcy risk.

Grades Comparison

The grades issued by several reputable firms for Illinois Tool Works Inc. and IDEX Corporation are summarized below:

Illinois Tool Works Inc. Grades

This table presents recent grades and actions from recognized grading companies for Illinois Tool Works Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Underweight | 2026-01-07 |

| Goldman Sachs | Downgrade | Sell | 2025-12-16 |

| B of A Securities | Upgrade | Neutral | 2025-11-18 |

| Barclays | Maintain | Underweight | 2025-10-27 |

| Truist Securities | Maintain | Hold | 2025-10-27 |

| Wells Fargo | Maintain | Underweight | 2025-10-27 |

| Truist Securities | Maintain | Hold | 2025-10-08 |

| Barclays | Downgrade | Underweight | 2025-08-14 |

| Barclays | Maintain | Equal Weight | 2025-08-04 |

| UBS | Maintain | Neutral | 2025-07-31 |

Overall, Illinois Tool Works shows a predominantly cautious to negative rating trend, with multiple underweight and sell grades reflecting a generally subdued outlook.

IDEX Corporation Grades

This table summarizes recent grades and actions from reputable grading firms for IDEX Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-12-08 |

| RBC Capital | Maintain | Outperform | 2025-10-30 |

| Stifel | Maintain | Buy | 2025-10-20 |

| Oppenheimer | Maintain | Outperform | 2025-10-07 |

| DA Davidson | Maintain | Neutral | 2025-08-04 |

| Stifel | Maintain | Buy | 2025-07-31 |

| RBC Capital | Maintain | Outperform | 2025-07-31 |

| Oppenheimer | Maintain | Outperform | 2025-07-31 |

| Stifel | Maintain | Buy | 2025-07-21 |

| Citigroup | Maintain | Buy | 2025-07-14 |

IDEX Corporation exhibits a strong positive rating pattern, with consistently maintained buy and outperform grades indicating favorable analyst sentiment.

Which company has the best grades?

IDEX Corporation has received generally stronger grades than Illinois Tool Works Inc., with more buy and outperform ratings versus ITW’s underweight and sell grades. This divergence suggests IDEX may be viewed as having better growth prospects or lower risk, factors investors often consider when managing portfolio exposure.

Strengths and Weaknesses

Here is a comparative overview of key strengths and weaknesses for Illinois Tool Works Inc. (ITW) and IDEX Corporation (IEX) based on recent financial and operational data.

| Criterion | Illinois Tool Works Inc. (ITW) | IDEX Corporation (IEX) |

|---|---|---|

| Diversification | Highly diversified across seven segments including Automotive OEM (3.19B), Food Equipment (2.65B), and Test & Measurement (2.82B) | Diversified in three segments with Health & Science Technologies leading (1.30B) |

| Profitability | Strong profitability: Net margin 21.94%, ROIC 27.19%, ROE 105.16% | Moderate profitability: Net margin 15.45%, ROIC 8.81%, ROE 13.31% |

| Innovation | Demonstrates durable competitive advantage with growing ROIC (+62%) | Declining ROIC (-17.6%) indicates challenges in sustaining profitability |

| Global presence | Large global footprint implied by broad segment reach and high revenues | Smaller scale with focused product lines and moderate global operations |

| Market Share | Leading market positions in industrial segments reflected by stable revenue growth | Niche market player with steady but slower revenue growth |

Key takeaways: ITW shows robust diversification and strong profitability with a durable competitive advantage, making it a value creator. IEX, while diversified, faces profitability pressure and declining returns on invested capital, signaling caution for investors.

Risk Analysis

Below is a comparison table outlining key risks for Illinois Tool Works Inc. (ITW) and IDEX Corporation (IEX) based on the latest available data from 2024-2026.

| Metric | Illinois Tool Works Inc. (ITW) | IDEX Corporation (IEX) |

|---|---|---|

| Market Risk | Beta 1.17 indicates moderate market volatility exposure | Beta ~1.00 shows market risk close to average |

| Debt Level | High leverage: Debt/Equity 2.44, Debt to Assets 53.6% (unfavorable) | Moderate leverage: Debt/Equity 0.52, Debt to Assets 29.5% (favorable) |

| Regulatory Risk | Moderate, industrial sector globally regulated but stable | Moderate, diversified industrial with some exposure to health and safety regulations |

| Operational Risk | Complex global operations with diverse segments; potential supply chain vulnerabilities | Diverse product lines but smaller scale, operationally less complex |

| Environmental Risk | Moderate: manufacturing footprint and fluid chemicals require compliance | Moderate: fluid handling and safety products require environmental compliance |

| Geopolitical Risk | Global footprint exposes ITW to trade and geopolitical tensions | Exposure to global markets but less extensive than ITW |

The most impactful risks include ITW’s high debt levels, which increase financial risk despite strong profitability metrics. Both companies face moderate regulatory and environmental risks typical for industrial manufacturers. ITW’s larger global scale slightly raises its geopolitical risk compared to IEX. Investors should weigh ITW’s leverage against its robust earnings and IEX’s more conservative balance sheet.

Which Stock to Choose?

Illinois Tool Works Inc. (ITW) shows a generally favorable income evolution with strong growth in net income and EPS over 2020–2024, supported by solid profitability margins. Its financial ratios reveal high returns on equity and invested capital, albeit with relatively high debt levels. The company holds a very favorable rating and demonstrates a very favorable moat with growing ROIC above WACC.

IDEX Corporation (IEX) presents mixed income trends, with overall revenue growth but recent declines in EBIT and margins. Its financial ratios are moderately favorable, showing decent profitability but lower returns compared to ITW, alongside lower debt and a slightly unfavorable moat due to declining ROIC. The rating remains very favorable but with more moderate financial scores.

For investors prioritizing durable competitive advantage and strong profitability, ITW’s very favorable moat and consistent income growth might appear more attractive. Conversely, those seeking companies with lower leverage and potential value in recent price trends could interpret IEX’s profile as fitting a different risk tolerance or growth strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Illinois Tool Works Inc. and IDEX Corporation to enhance your investment decisions: