Investors seeking robust opportunities in the industrial machinery sector will find Howmet Aerospace Inc. (HWM) and Nordson Corporation (NDSN) compelling candidates. Both companies operate globally with a focus on advanced engineered solutions and precision dispensing systems, respectively, serving diverse markets from aerospace to manufacturing. Their innovation strategies and market overlap make them worthy of comparison. In this article, I will help you identify which company offers the most promising investment potential in 2026.

Table of contents

Companies Overview

I will begin the comparison between Howmet Aerospace Inc. and Nordson Corporation by providing an overview of these two companies and their main differences.

Howmet Aerospace Inc. Overview

Howmet Aerospace Inc. delivers advanced engineered solutions primarily for the aerospace and transportation industries globally. Operating through four segments—Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels—it specializes in aircraft engine components, aerospace fastening systems, titanium and aluminum forgings, and forged wheels for heavy-duty trucks. Founded in 1888 and based in Pittsburgh, the company holds a strong position in industrial machinery with a market capitalization of $87.9B.

Nordson Corporation Overview

Nordson Corporation engineers and manufactures precision dispensing and coating systems globally, serving various industries including packaged goods, semiconductor, and medical devices. It operates through Industrial Precision Solutions and Advanced Technology Solutions segments, offering automated and manual systems to apply adhesives, coatings, and fluids. Founded in 1935 and based in Westlake, Ohio, Nordson is a smaller player in industrial machinery with a market cap of $14.5B and a focus on specialized fluid control technologies.

Key similarities and differences

Both Howmet Aerospace and Nordson operate in the industrial machinery sector and serve global markets with engineered solutions. Howmet focuses on aerospace and transportation components, emphasizing heavy manufacturing and structural parts, while Nordson specializes in fluid dispensing and coating technologies across diverse industries. Howmet’s business model leans heavily on aerospace parts manufacturing, contrasting with Nordson’s precision systems for adhesives and coatings, reflecting distinct market niches and product applications.

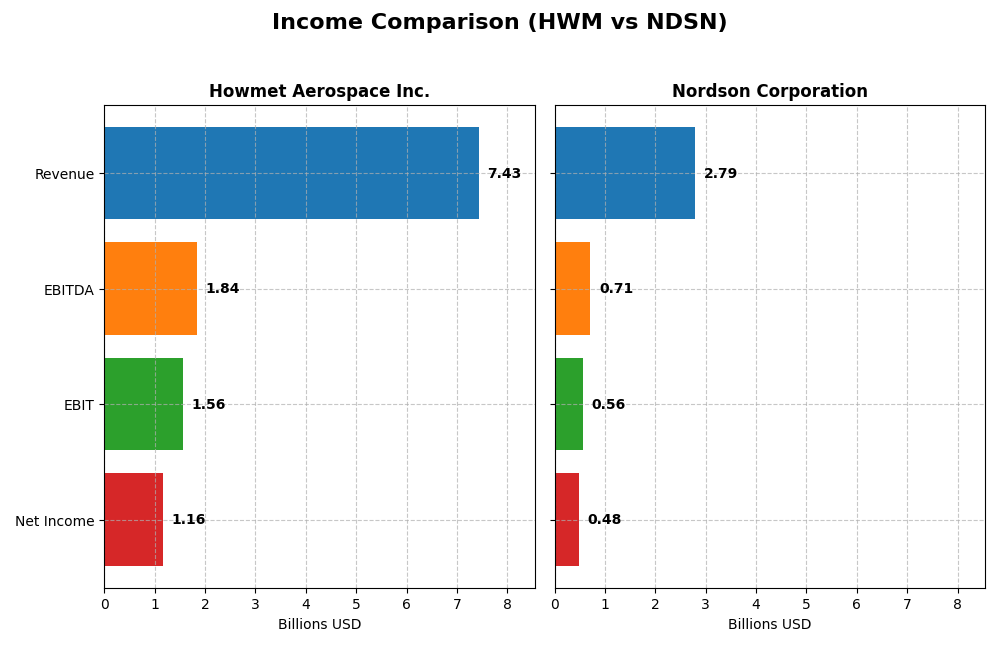

Income Statement Comparison

This table compares the most recent fiscal year income statement figures of Howmet Aerospace Inc. and Nordson Corporation, providing a clear view of their financial performance.

| Metric | Howmet Aerospace Inc. (HWM) | Nordson Corporation (NDSN) |

|---|---|---|

| Market Cap | 87.9B | 14.5B |

| Revenue | 7.43B | 2.79B |

| EBITDA | 1.84B | 712M |

| EBIT | 1.57B | 561M |

| Net Income | 1.16B | 484M |

| EPS | 2.83 | 8.56 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Howmet Aerospace Inc.

Howmet Aerospace’s revenue grew steadily from $5.25B in 2020 to $7.43B in 2024, with net income rising sharply from $209M to $1.16B. Margins improved consistently, with a gross margin of 27.62% and net margin of 15.55% in 2024. The latest year showed strong growth acceleration, especially in net income and EPS, reflecting solid operational leverage.

Nordson Corporation

Nordson’s revenues increased moderately from $2.36B in 2021 to $2.79B in 2025, with net income rising from $454M to $484M. Gross margin remained high at 55.16%, though EBIT margin declined slightly to 20.1%, and net margin to 17.35%. The most recent year showed slowed revenue growth and decreased EBIT, signaling margin pressure despite stable EPS improvement.

Which one has the stronger fundamentals?

Howmet Aerospace demonstrates stronger fundamentals with significant revenue and net income growth, alongside improving margins over the period, indicating effective cost management and operational efficiency. Nordson, while maintaining a solid gross margin and steady revenues, faced a recent decline in EBIT and net margin, suggesting some headwinds. Overall, Howmet’s consistent margin expansion and robust income growth highlight a more favorable income statement profile.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Howmet Aerospace Inc. (HWM) and Nordson Corporation (NDSN) based on their most recent fiscal year data.

| Ratios | Howmet Aerospace Inc. (2024) | Nordson Corporation (2025) |

|---|---|---|

| ROE | 25.4% | 15.9% |

| ROIC | 15.5% | 10.5% |

| P/E | 38.6 | 27.1 |

| P/B | 9.80 | 4.31 |

| Current Ratio | 2.17 | 1.64 |

| Quick Ratio | 0.98 | 1.05 |

| D/E (Debt-to-Equity) | 0.76 | 0.69 |

| Debt-to-Assets | 33.0% | 35.4% |

| Interest Coverage | 9.19 | 7.04 |

| Asset Turnover | 0.71 | 0.47 |

| Fixed Asset Turnover | 2.92 | 4.70 |

| Payout Ratio | 9.4% | 37.0% |

| Dividend Yield | 0.24% | 1.36% |

Interpretation of the Ratios

Howmet Aerospace Inc.

Howmet Aerospace shows a generally solid financial profile with favorable net margin (15.55%), ROE (25.36%), and ROIC (15.49%), indicating efficient profitability and capital use. However, valuation ratios like P/E (38.63) and P/B (9.8) appear stretched, posing potential valuation concerns. The dividend yield is low at 0.24%, suggesting modest shareholder returns supported by conservative payouts.

Nordson Corporation

Nordson displays a favorable overall ratio set with a strong net margin of 17.35%, solid ROE at 15.92%, and attractive WACC at 7.99%. While P/E (27.1) and P/B (4.31) are somewhat elevated, the company maintains a reasonable dividend yield of 1.36%, reflecting balanced shareholder returns without excessive risk. Liquidity ratios are also healthy, supporting operational stability.

Which one has the best ratios?

Nordson Corporation holds a more favorable ratio profile overall, with a higher proportion of favorable metrics (57.14%) compared to Howmet Aerospace’s 35.71%. Although both face valuation challenges, Nordson’s stronger liquidity, lower cost of capital, and better dividend yield contribute to a more balanced financial standing relative to Howmet Aerospace.

Strategic Positioning

This section compares the strategic positioning of Howmet Aerospace Inc. and Nordson Corporation, focusing on Market position, Key segments, and Exposure to technological disruption:

Howmet Aerospace Inc.

- Large market cap of 88B with diversified aerospace and transport industrial segments facing moderate competitive pressure.

- Key segments include Engine Products, Fastening Systems, and Engineered Structures with strong aerospace and transportation demand drivers.

- Exposure to aerospace manufacturing technology but no explicit mention of disruption risks in provided data.

Nordson Corporation

- Smaller market cap of 14.5B with niche focus in precision dispensing and coating systems under moderate competitive pressure.

- Operates Industrial Precision Solutions and Advanced Technology Solutions serving adhesives, coatings, and medical fluid markets.

- Exposure to advanced dispensing and coating technologies with potential impact from automation and precision innovations.

Howmet Aerospace Inc. vs Nordson Corporation Positioning

Howmet Aerospace has a diversified industrial profile with multiple aerospace and transportation segments, providing broad revenue streams. Nordson is more concentrated in precision dispensing and coating technologies, focusing on specialized markets, which may limit diversification but allows targeted expertise.

Which has the best competitive advantage?

Howmet Aerospace shows a very favorable moat with growing ROIC surpassing WACC by 5.85%, indicating durable competitive advantage and efficient capital use. Nordson’s moat is slightly favorable with declining ROIC, reflecting value creation but weakening profitability.

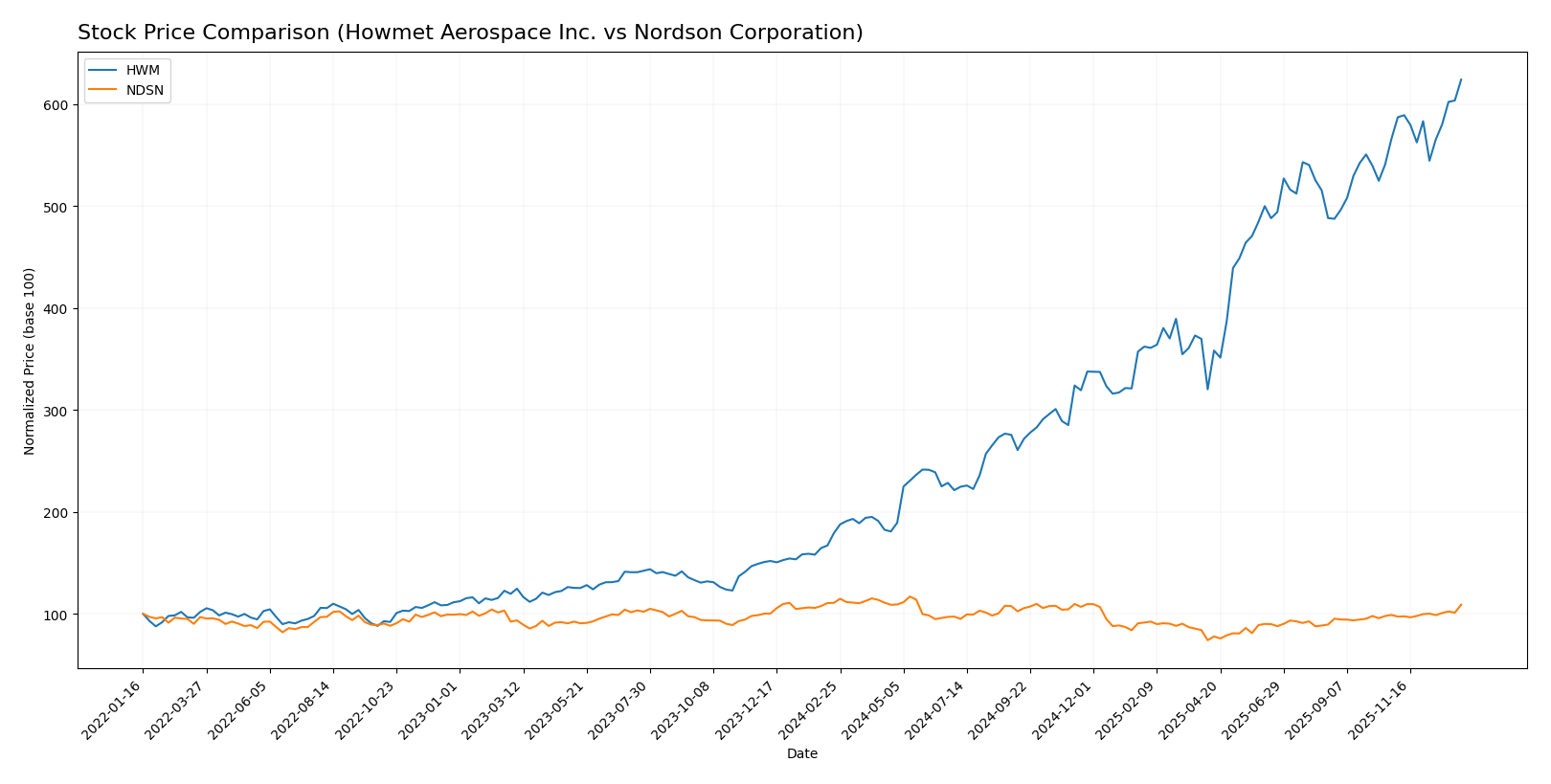

Stock Comparison

The past year shows Howmet Aerospace Inc. (HWM) with a strong bullish trend marked by substantial price gains and high volatility, while Nordson Corporation (NDSN) experienced a slight bearish trend despite recent positive momentum.

Trend Analysis

Howmet Aerospace Inc. (HWM) displayed a 248.45% price increase over the past 12 months, indicating a bullish trend with deceleration in momentum. The stock fluctuated between $62.82 and $218.9, with a high volatility measured by a 47.02 standard deviation.

Nordson Corporation (NDSN) showed a -1.58% price change over the same period, reflecting a bearish trend with accelerating movement. Its price ranged from $176.73 to $278.89, with moderate volatility indicated by a 23.43 standard deviation.

Comparing the two, HWM significantly outperformed NDSN in market performance over the past year, delivering the highest price appreciation despite decelerating trend momentum.

Target Prices

The current analyst consensus presents optimistic target prices for both Howmet Aerospace Inc. and Nordson Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Howmet Aerospace Inc. | 258 | 205 | 231.75 |

| Nordson Corporation | 295 | 240 | 274.17 |

Analysts expect Howmet Aerospace’s price to rise moderately above the current 218.47 USD, while Nordson’s consensus target suggests a potential gain from its current 260.43 USD price. Both stocks show promising upside potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Howmet Aerospace Inc. (HWM) and Nordson Corporation (NDSN):

Rating Comparison

HWM Rating

- Rating: B, classified as Very Favorable overall rating.

- Discounted Cash Flow Score: 2, indicating moderate valuation based on cash flow.

- ROE Score: 5, very favorable efficiency in generating profit from equity.

- ROA Score: 5, very favorable asset utilization to generate earnings.

- Debt To Equity Score: 2, moderate financial risk with average leverage.

- Overall Score: 3, moderate overall financial standing.

NDSN Rating

- Rating: B, classified as Very Favorable overall rating.

- Discounted Cash Flow Score: 3, indicating moderate valuation based on cash flow.

- ROE Score: 4, favorable efficiency in generating profit from equity.

- ROA Score: 4, favorable asset utilization to generate earnings.

- Debt To Equity Score: 2, moderate financial risk with average leverage.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Both HWM and NDSN share the same overall rating of B and a moderate overall score of 3. HWM outperforms NDSN in ROE and ROA scores, while NDSN has a slightly better discounted cash flow score. Debt to equity scores are equal.

Scores Comparison

Here is the comparison of the Altman Z-Score and Piotroski Score for Howmet Aerospace Inc. and Nordson Corporation:

HWM Scores

- Altman Z-Score: 10.43, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 9, classified as very strong financial health.

NDSN Scores

- Altman Z-Score: 4.90, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Which company has the best scores?

Based strictly on the provided data, Howmet Aerospace (HWM) has higher scores on both the Altman Z-Score and Piotroski Score, indicating comparatively stronger financial health than Nordson Corporation (NDSN).

Grades Comparison

The following section compares the recent grades assigned to Howmet Aerospace Inc. and Nordson Corporation by reputable grading companies:

Howmet Aerospace Inc. Grades

This table summarizes recent analyst grades for Howmet Aerospace Inc. from verified grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2025-11-14 |

| JP Morgan | Maintain | Overweight | 2025-11-10 |

| Goldman Sachs | Maintain | Buy | 2025-11-03 |

| BTIG | Maintain | Buy | 2025-11-03 |

| UBS | Maintain | Neutral | 2025-10-31 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

| Truist Securities | Maintain | Buy | 2025-10-15 |

| Susquehanna | Maintain | Positive | 2025-10-09 |

| B of A Securities | Maintain | Buy | 2025-08-05 |

Overall, Howmet Aerospace shows a strong consensus toward Buy or Outperform ratings, with consistent maintenance of positive grades across multiple firms.

Nordson Corporation Grades

This table presents the recent grading actions from recognized financial analysts for Nordson Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Buy | 2025-12-12 |

| Baird | Maintain | Neutral | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-12-11 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| Oppenheimer | Maintain | Outperform | 2025-08-25 |

| Baird | Maintain | Neutral | 2025-08-22 |

| Keybanc | Maintain | Overweight | 2025-07-15 |

| Baird | Maintain | Neutral | 2025-05-30 |

| Oppenheimer | Upgrade | Outperform | 2025-05-30 |

| Keybanc | Maintain | Overweight | 2025-04-08 |

Nordson Corporation exhibits a mix of Buy, Overweight, and Neutral ratings, with some recent upgrades and a solid presence of Outperform grades.

Which company has the best grades?

Howmet Aerospace Inc. generally receives more consistent Buy and Outperform grades, while Nordson Corporation shows a wider spread including Neutral ratings. This suggests Howmet’s analyst sentiment is somewhat stronger, potentially impacting investor confidence differently for each company.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Howmet Aerospace Inc. (HWM) and Nordson Corporation (NDSN) based on their latest financial and operational data.

| Criterion | Howmet Aerospace Inc. (HWM) | Nordson Corporation (NDSN) |

|---|---|---|

| Diversification | Moderate: Revenue spread across Engine Products, Fastening Systems, and Structure Systems segments | High: Diverse segments including Industrial Precision, Medical & Fluid, and Advanced Technology Systems |

| Profitability | Strong: Net margin 15.55%, ROE 25.36%, ROIC 15.49% | Solid: Net margin 17.35%, ROE 15.92%, ROIC 10.49% |

| Innovation | High: Demonstrates durable competitive advantage with growing ROIC (86% increase over 5 years) | Moderate: Creating value but ROIC declining by 27%, indicating challenges in sustaining profitability |

| Global presence | Strong aerospace market presence with multiple product lines | Strong in industrial and medical sectors with global reach |

| Market Share | Significant in aerospace components, steady growth in Engine Products segment | Leading in precision systems and fluid solutions, with a focus on technology integration |

Key takeaways: Howmet Aerospace shows a very favorable moat with strong profitability growth and solid diversification in aerospace products. Nordson maintains favorable profitability but faces declining ROIC, signaling pressure on its innovation and competitive edge despite good diversification and global presence. Risk management favors careful monitoring of Nordson’s profitability trend.

Risk Analysis

Below is a comparative table of key risks for Howmet Aerospace Inc. (HWM) and Nordson Corporation (NDSN) based on the most recent data from 2025-2026:

| Metric | Howmet Aerospace Inc. (HWM) | Nordson Corporation (NDSN) |

|---|---|---|

| Market Risk | Beta 1.29 indicates moderate volatility and sensitivity to market swings. | Beta 1.03 suggests slightly lower market volatility risk. |

| Debt level | Debt-to-Equity ratio ~0.76, Debt to Assets 33% – moderate leverage, manageable interest coverage ratio of 8.6. | Debt-to-Equity ratio ~0.69, Debt to Assets 35%, interest coverage 5.55, moderate leverage but slightly lower coverage than HWM. |

| Regulatory Risk | Aerospace and defense sectors face evolving regulations and export controls, especially internationally. | Industrial machinery with exposure to environmental and safety regulations globally. |

| Operational Risk | Complex manufacturing across multiple continents; supply chain disruptions or production delays could impact results. | Precision dispensing and coatings require high quality control; disruption in manufacturing or supply chain may affect sales. |

| Environmental Risk | Exposure to environmental regulations due to aerospace materials and manufacturing processes. | Environmental compliance critical for chemical and coating applications; risks from stricter emission laws. |

| Geopolitical Risk | Significant international operations including China and Europe; geopolitical tensions could affect trade and supply chains. | Global footprint but more concentrated in US and select markets, lower geopolitical risk than HWM. |

In summary, the most impactful risks for Howmet Aerospace are geopolitical tensions and regulatory changes due to its global aerospace footprint, while Nordson faces operational and environmental risks inherent in its specialized manufacturing and chemical handling. Both companies maintain moderate debt levels with adequate coverage, but market volatility remains a factor to monitor.

Which Stock to Choose?

Howmet Aerospace Inc. (HWM) shows a strong income evolution with 41.28% revenue growth over 2020-2024 and highly favorable profitability metrics, including a 15.55% net margin and 25.36% ROE. Its debt is moderate with a net debt to EBITDA of 1.58, and its overall rating is very favorable, supported by a very favorable moat indicating durable competitive advantage.

Nordson Corporation (NDSN) presents moderate income growth of 18.18% over 2021-2025, with a favorable 17.35% net margin but some recent declines in EBIT and net margin growth. Debt levels are similar to HWM with net debt to EBITDA at 2.79. Its rating is also very favorable, although the moat is slightly favorable with a declining ROIC trend, indicating some erosion in profitability.

For investors prioritizing strong and growing profitability with a durable competitive advantage, Howmet Aerospace might appear more favorable. Conversely, those valuing steadier income profiles with a slightly better free cash flow yield and moderate risk might find Nordson’s profile more aligned with their goals due to its favorable rating despite a declining moat.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Howmet Aerospace Inc. and Nordson Corporation to enhance your investment decisions: