Howmet Aerospace Inc. (HWM) and Nano Nuclear Energy Inc. (NNE) are two prominent players within the industrial machinery sector, yet they operate in distinct niches with innovative approaches. Howmet Aerospace is a well-established leader in aerospace engineered solutions, while Nano Nuclear Energy pioneers microreactor technology for the evolving nuclear energy landscape. This comparison explores their market overlap and innovation strategies to identify which company offers a more compelling investment opportunity for you.

Table of contents

Companies Overview

I will begin the comparison between Howmet Aerospace Inc. and Nano Nuclear Energy Inc by providing an overview of these two companies and their main differences.

Howmet Aerospace Inc. Overview

Howmet Aerospace Inc. provides advanced engineered solutions for aerospace and transportation industries worldwide, operating through four segments: Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels. Founded in 1888 and based in Pittsburgh, PA, Howmet holds a strong market position with a focus on manufacturing components for aircraft engines, industrial turbines, and commercial transportation.

Nano Nuclear Energy Inc Overview

Nano Nuclear Energy Inc. is a microreactor technology company developing solid-core and low-pressure coolant reactors, along with a uranium fabrication facility and nuclear fuel services. Founded in 2021 and based in New York City, NNE is a smaller, emerging player focused on innovative nuclear energy solutions, with a significantly smaller workforce and market capitalization compared to established industrial firms.

Key similarities and differences

Both companies operate in the industrial machinery sector but serve distinct markets—Howmet Aerospace specializes in aerospace and transportation components, while Nano Nuclear Energy focuses on nuclear microreactor technology and fuel supply. Howmet has a broad global presence and a diversified product portfolio, whereas NNE is a niche, high-beta startup with concentrated activity in nuclear innovation and development.

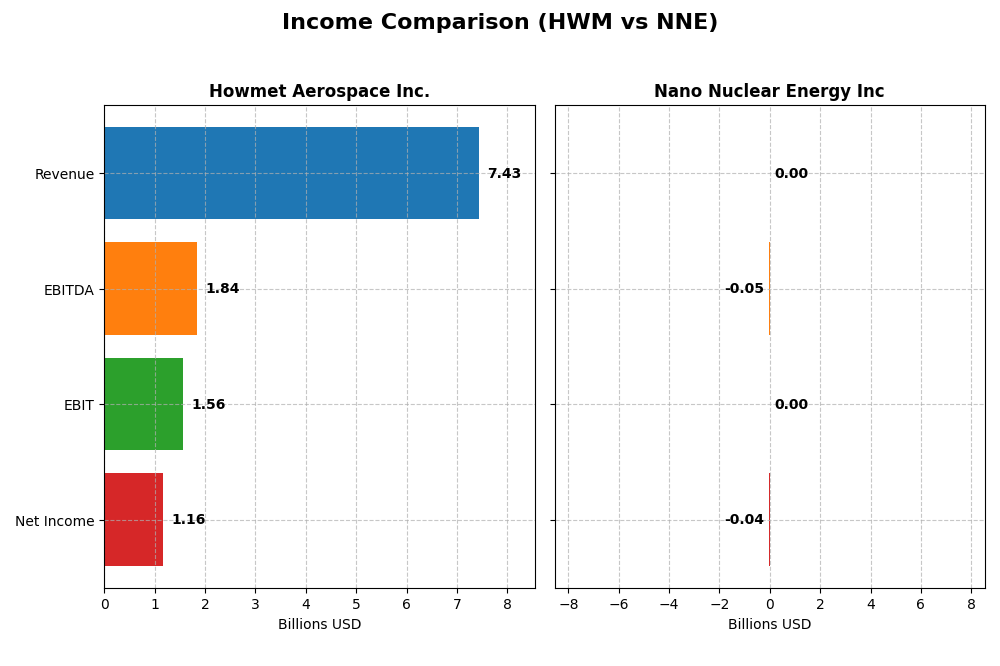

Income Statement Comparison

The table below presents a factual comparison of key income statement metrics for Howmet Aerospace Inc. and Nano Nuclear Energy Inc. for their most recent fiscal years.

| Metric | Howmet Aerospace Inc. (HWM) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| Market Cap | 87.8B | 1.33B |

| Revenue | 7.43B | 0 |

| EBITDA | 1.84B | -46.2M |

| EBIT | 1.57B | 0 |

| Net Income | 1.16B | -40.1M |

| EPS | 2.83 | -1.06 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Howmet Aerospace Inc.

Howmet Aerospace demonstrated strong and consistent revenue growth from 2020 to 2024, increasing from $5.26B to $7.43B. Net income surged significantly, reaching $1.16B in 2024, with net margins expanding to 15.55%. The latest year showed robust margin improvements and a 11.9% revenue growth, coupled with a 34.93% net margin increase, reflecting solid operational leverage.

Nano Nuclear Energy Inc

Nano Nuclear Energy has reported no revenue over the recent years through 2025, with continuous net losses reaching -$40M in 2025. Margins remain unfavorable, with zero gross and net margins and an operating loss of -$46M in 2025. Despite some improvement in EBIT and EPS growth rates, the company’s income statement reflects ongoing development-stage costs without commercial revenue generation.

Which one has the stronger fundamentals?

Howmet Aerospace clearly exhibits stronger fundamentals with favorable growth, margin expansion, and profitability over the period. In contrast, Nano Nuclear Energy’s income statement shows persistent losses and no revenue, reflecting early-stage risk and negative margin trends. The favorable income metrics of Howmet Aerospace indicate a more stable and growing business model compared to Nano Nuclear Energy’s developmental phase challenges.

Financial Ratios Comparison

The table below compares key financial ratios for Howmet Aerospace Inc. (HWM) and Nano Nuclear Energy Inc (NNE) based on their most recent reported fiscal year data.

| Ratios | Howmet Aerospace Inc. (HWM) 2024 | Nano Nuclear Energy Inc (NNE) 2025 |

|---|---|---|

| ROE | 25.36% | -18.00% |

| ROIC | 15.49% | -20.51% |

| P/E | 38.63 | -0.04 |

| P/B | 9.80 | 0.007 |

| Current Ratio | 2.17 | 53.48 |

| Quick Ratio | 0.98 | 53.48 |

| D/E (Debt-to-Equity) | 0.76 | 0.01 |

| Debt-to-Assets | 33.00% | 1.22% |

| Interest Coverage | 9.19 | 0 |

| Asset Turnover | 0.71 | 0 |

| Fixed Asset Turnover | 2.92 | 0 |

| Payout Ratio | 9.44% | 0 |

| Dividend Yield | 0.24% | 0 |

Interpretation of the Ratios

Howmet Aerospace Inc.

Howmet Aerospace presents mostly favorable financial ratios, including a strong net margin of 15.55% and a robust return on equity of 25.36%. However, valuation metrics like PE at 38.63 and PB at 9.8 appear elevated, indicating potential overvaluation concerns. The company pays dividends, with a modest yield of 0.24%, but the payout ratio and free cash flow coverage suggest caution due to limited dividend yield and distribution sustainability.

Nano Nuclear Energy Inc

Nano Nuclear Energy shows predominantly unfavorable ratios, such as negative returns on equity (-18%) and invested capital (-20.51%), along with a high weighted average cost of capital at 14.43%. Its current ratio is extremely high at 53.48, possibly indicating inefficient asset utilization. The company does not pay dividends, likely due to its negative earnings and focus on development and reinvestment in its nascent microreactor technology.

Which one has the best ratios?

Howmet Aerospace’s ratios are generally stronger, with several favorable profitability and coverage metrics, despite some valuation concerns. In contrast, Nano Nuclear Energy exhibits mostly unfavorable financial performance ratios and no dividend payouts, reflecting its early-stage development status. Overall, Howmet Aerospace displays a slightly favorable ratio profile compared to the unfavorable profile of Nano Nuclear Energy.

Strategic Positioning

This section compares the strategic positioning of Howmet Aerospace Inc. and Nano Nuclear Energy Inc. across Market position, Key segments, and Exposure to technological disruption:

Howmet Aerospace Inc.

- Large industrial machinery player with $87.8B market cap, facing moderate competition.

- Diversified segments: Engine Products, Fastening Systems, and Engineered Structures drive revenues.

- Operates in established aerospace and transportation industries; disruption risk moderate from tech advances.

Nano Nuclear Energy Inc

- Small microreactor tech firm with $1.3B market cap, high volatility and competition.

- Focused on microreactor development and nuclear fuel fabrication, with limited business scope.

- Engaged in emerging nuclear tech innovation; high exposure to technological disruption and development risks.

Howmet Aerospace Inc. vs Nano Nuclear Energy Inc. Positioning

Howmet Aerospace presents a diversified industrial portfolio with stable segments, benefiting from scale and established markets. Nano Nuclear Energy is concentrated in cutting-edge nuclear microreactors, exposing it to higher innovation risks but potential growth in a nascent sector.

Which has the best competitive advantage?

Howmet Aerospace holds a very favorable moat with increasing ROIC and value creation, indicating a durable competitive advantage. Nano Nuclear Energy shows a slightly unfavorable moat, shedding value despite improving profitability.

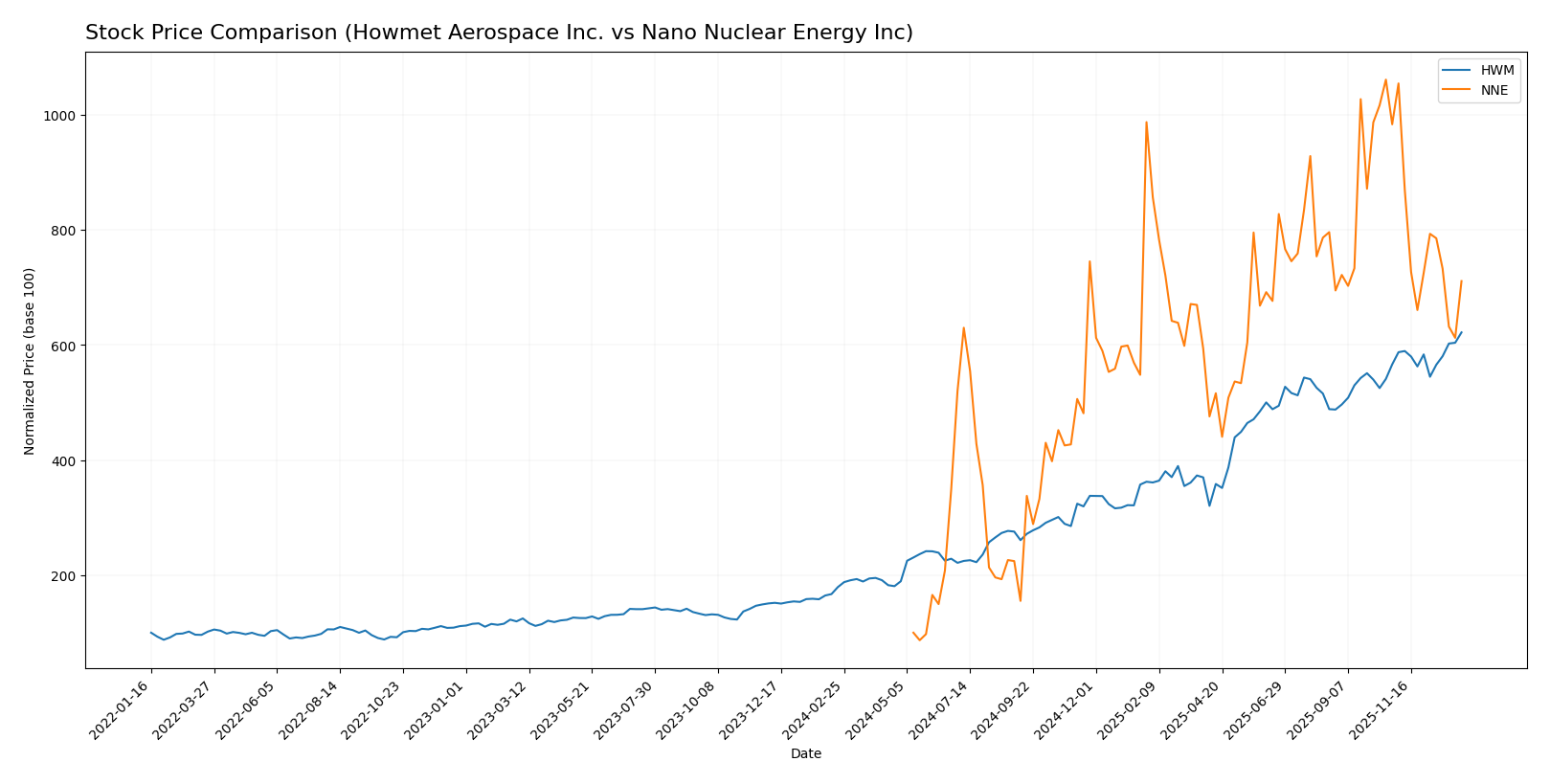

Stock Comparison

The stock price movements of Howmet Aerospace Inc. (HWM) and Nano Nuclear Energy Inc. (NNE) over the past year reveal significant gains with contrasting recent dynamics, highlighting varied investor sentiment and trading volumes.

Trend Analysis

Howmet Aerospace Inc. (HWM) experienced a strong bullish trend over the past 12 months with a 247.04% price increase, albeit with decelerating momentum and notable volatility marked by a 47.0 standard deviation. The recent quarter shows a moderate 9.82% gain with a stable upward slope.

Nano Nuclear Energy Inc. (NNE) delivered an even more pronounced bullish trend over the past year, gaining 610.78%, but also with deceleration and lower volatility at 10.81 standard deviation. Recently, however, the stock declined by 27.7%, reflecting a negative short-term slope and seller dominance.

Comparing both, NNE showed the highest market performance over the full 12 months, despite its recent downward movement, whereas HWM maintained steady recent gains with strong buyer dominance.

Target Prices

The current analyst consensus reflects positive outlooks for Howmet Aerospace Inc. and Nano Nuclear Energy Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Howmet Aerospace Inc. | 258 | 205 | 231.75 |

| Nano Nuclear Energy Inc | 50 | 50 | 50 |

Analysts expect Howmet Aerospace’s price to rise moderately above its current 218.07 USD, while Nano Nuclear Energy shows a strong target at 50 USD, significantly above its present 31.95 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Howmet Aerospace Inc. and Nano Nuclear Energy Inc:

Rating Comparison

Howmet Aerospace Inc. Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: 2, indicating moderate valuation status.

- ROE Score: 5, reflecting very favorable profit generation efficiency.

- ROA Score: 5, showing very favorable asset utilization.

- Debt To Equity Score: 2, suggesting moderate financial risk.

- Overall Score: 3, rated moderate overall financial standing.

Nano Nuclear Energy Inc Rating

- Rating: C, also marked very favorable despite lower scores.

- Discounted Cash Flow Score: 2, indicating moderate valuation status.

- ROE Score: 1, showing very unfavorable profit generation efficiency.

- ROA Score: 1, indicating very unfavorable asset utilization.

- Debt To Equity Score: 5, indicating very favorable financial risk.

- Overall Score: 2, rated moderate overall financial standing.

Which one is the best rated?

Based on the provided data, Howmet Aerospace Inc. holds a higher overall rating (B vs. C) and superior profitability and asset utilization scores. Nano Nuclear Energy Inc. scores better on debt management but has weaker profitability metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Howmet Aerospace Inc. and Nano Nuclear Energy Inc.:

HWM Scores

- Altman Z-Score: 10.43, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 9, classified as very strong financial health.

NNE Scores

- Altman Z-Score: 143.56, indicating a safe zone, very low bankruptcy risk.

- Piotroski Score: 2, classified as very weak financial health.

Which company has the best scores?

Based on the provided data, NNE has a much higher Altman Z-Score indicating extremely low bankruptcy risk, while HWM has a markedly stronger Piotroski Score reflecting better overall financial strength.

Grades Comparison

Here is a comparison of the latest reliable grades assigned to Howmet Aerospace Inc. and Nano Nuclear Energy Inc.:

Howmet Aerospace Inc. Grades

The following table lists recent grades from established grading companies for Howmet Aerospace Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2025-11-14 |

| JP Morgan | Maintain | Overweight | 2025-11-10 |

| Goldman Sachs | Maintain | Buy | 2025-11-03 |

| BTIG | Maintain | Buy | 2025-11-03 |

| UBS | Maintain | Neutral | 2025-10-31 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

| Truist Securities | Maintain | Buy | 2025-10-15 |

| Susquehanna | Maintain | Positive | 2025-10-09 |

| B of A Securities | Maintain | Buy | 2025-08-05 |

The overall grades for Howmet Aerospace Inc. show a strong consensus for Buy ratings, with a few Neutral and Outperform ratings, indicating general confidence from analysts.

Nano Nuclear Energy Inc. Grades

The following table presents recent grades from recognized grading companies for Nano Nuclear Energy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-08-19 |

| Ladenburg Thalmann | Downgrade | Sell | 2025-08-18 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-15 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-01-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-27 |

| Benchmark | Maintain | Buy | 2024-11-07 |

| Benchmark | Maintain | Buy | 2024-07-15 |

| Benchmark | Maintain | Buy | 2024-06-25 |

Grades for Nano Nuclear Energy Inc. show a general Buy consensus, but include a recent Sell downgrade, suggesting some analyst caution.

Which company has the best grades?

Howmet Aerospace Inc. holds a stronger and more consistent Buy consensus from multiple reputable firms compared to Nano Nuclear Energy Inc., which has a notable Sell downgrade amid mostly Buy ratings. This difference may affect investor confidence and perceived risk levels.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Howmet Aerospace Inc. (HWM) and Nano Nuclear Energy Inc. (NNE) based on the most recent financial and operational data:

| Criterion | Howmet Aerospace Inc. (HWM) | Nano Nuclear Energy Inc. (NNE) |

|---|---|---|

| Diversification | Well-diversified across Engine Products, Fastening, and Structure Systems segments with $6.0B+ revenue mix | Limited diversification; emerging company with narrower focus |

| Profitability | Strong profitability: 15.55% net margin, 25.36% ROE, positive ROIC (15.49%) | Negative profitability: 0% net margin, -18% ROE, negative ROIC (-20.51%) |

| Innovation | Established aerospace technology with durable competitive advantage and growing ROIC | Early-stage tech with growing ROIC but still value-destroying overall |

| Global presence | Significant global footprint in aerospace components manufacturing | Limited global presence due to size and development phase |

| Market Share | Large market share in aerospace components with steady revenue growth | Minimal current market share, operating in a nascent sector |

Key takeaways: Howmet Aerospace demonstrates a strong and diversified business model with robust profitability and a durable competitive moat. In contrast, Nano Nuclear Energy is still in early growth stages with unfavorable financial metrics despite improving profitability trends, indicating higher investment risk.

Risk Analysis

Below is a table summarizing key risks for Howmet Aerospace Inc. (HWM) and Nano Nuclear Energy Inc. (NNE) based on their latest financial and operational data for 2025-2026.

| Metric | Howmet Aerospace Inc. (HWM) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| Market Risk | Moderate beta 1.29, cyclical aerospace sector exposure | High beta 7.49, emerging tech with volatile market price |

| Debt level | Moderate debt-to-equity 0.76, interest coverage strong | Very low debt 0.01, minimal financial leverage |

| Regulatory Risk | Exposure to aerospace and defense regulations globally | High due to nuclear energy sector and evolving regulations |

| Operational Risk | Established operations with diversified segments | High operational risk; early-stage tech development and small team (5 employees) |

| Environmental Risk | Moderate, aerospace manufacturing impact | Elevated due to nuclear energy and fuel fabrication activities |

| Geopolitical Risk | Global supply chain exposure including China, Europe | Significant given nuclear industry sensitivity and geopolitical factors |

In summary, NNE faces the most impactful and likely risks due to its nascent stage, high market volatility, and regulatory challenges in the nuclear sector. HWM, while exposed to cyclical aerospace markets and moderate debt, benefits from scale and diversified operations, lowering its relative risk profile. Investors should weigh NNE’s innovation potential against its elevated operational and regulatory uncertainties.

Which Stock to Choose?

Howmet Aerospace Inc. (HWM) exhibits a favorable income evolution with robust revenue and net income growth over 2020-2024. Its financial ratios show a slightly favorable profile, highlighting strong profitability and manageable debt levels, supported by a very favorable B rating and a very strong financial health score.

Nano Nuclear Energy Inc (NNE) shows an unfavorable income trend with negative returns and net income declines over 2022-2025. Its financial ratios are generally unfavorable despite low debt, reflected in a very favorable C rating contrasted by weak profitability and a very weak financial health score.

For investors, HWM might appear more suitable for those seeking quality and stable profitability with a durable competitive advantage, while NNE could be of interest to risk-tolerant investors focusing on potential turnaround growth despite current financial weaknesses.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Howmet Aerospace Inc. and Nano Nuclear Energy Inc to enhance your investment decisions: