Investors seeking stable opportunities in the packaged foods sector often weigh The Kraft Heinz Company (KHC) against Hormel Foods Corporation (HRL). Both giants share a strong market presence, producing a diverse range of consumer staples with global reach. Their innovation strategies and product portfolios overlap, making their comparison essential for portfolio diversification. In this article, I will analyze these companies to identify which represents the most compelling investment choice for you.

Table of contents

Companies Overview

I will begin the comparison between The Kraft Heinz Company and Hormel Foods Corporation by providing an overview of these two companies and their main differences.

The Kraft Heinz Company Overview

The Kraft Heinz Company operates in the packaged foods industry, manufacturing and marketing a wide range of food and beverage products across the US, Canada, the UK, and internationally. Its portfolio includes condiments, dairy, meats, snacks, and beverages. The company distributes products through various channels, including grocery stores, convenience outlets, foodservice distributors, and e-commerce platforms. It is headquartered in Pittsburgh, Pennsylvania, with a market capitalization of approximately 27.7B USD.

Hormel Foods Corporation Overview

Hormel Foods Corporation develops, processes, and distributes meat, nuts, and various food products primarily in the US and internationally. Its diverse product range includes fresh and frozen meats, refrigerated meals, canned goods, and snack items under multiple well-known brands. The company serves retail, foodservice, deli, and commercial customers. Headquartered in Austin, Minnesota, Hormel Foods has a market cap of about 12.6B USD and operates through four business segments.

Key similarities and differences

Both companies operate in the consumer defensive sector within the packaged foods industry, offering diverse food products and leveraging multi-channel distribution networks including retail and foodservice. Kraft Heinz has a larger market capitalization and broader geographic coverage, while Hormel Foods focuses more on meat and protein products with multiple specialized segments. Both actively trade on major US exchanges with stable dividend payouts, but differ in scale and product specialization.

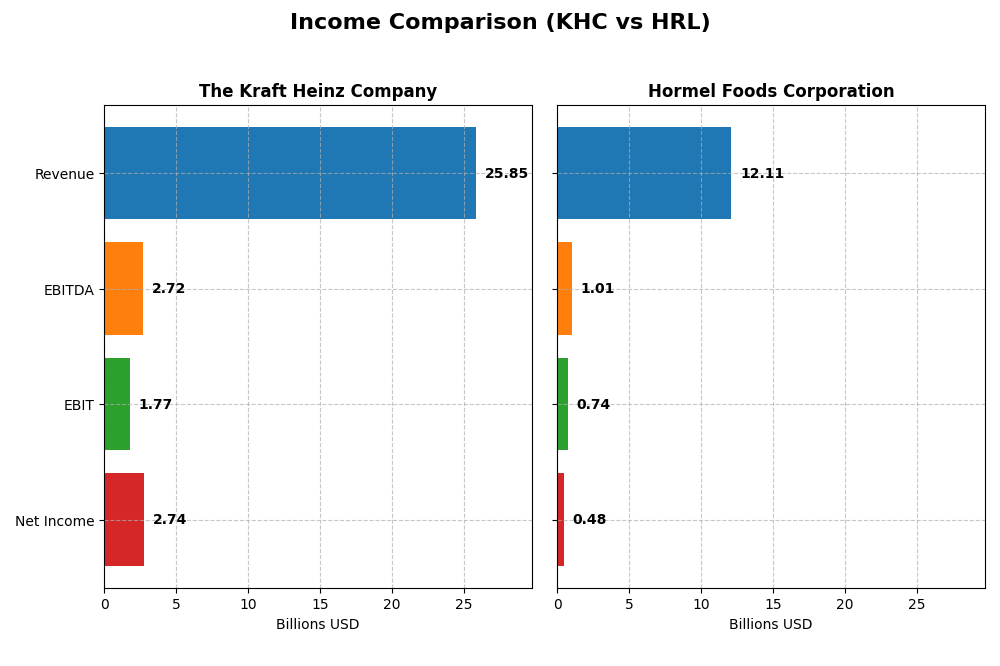

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for The Kraft Heinz Company and Hormel Foods Corporation for their most recent fiscal years.

| Metric | The Kraft Heinz Company (KHC) | Hormel Foods Corporation (HRL) |

|---|---|---|

| Market Cap | 27.7B | 12.6B |

| Revenue | 25.8B | 12.1B |

| EBITDA | 2.72B | 1.01B |

| EBIT | 1.77B | 742M |

| Net Income | 2.74B | 478M |

| EPS | 2.27 | 0.87 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

The Kraft Heinz Company

From 2020 to 2024, Kraft Heinz’s revenue showed a slight overall decline, falling by about 1.3%, while net income grew substantially by over 670%, reflecting improved profitability. Gross margin remained favorable at 34.7%, with a stable ebit margin around 6.8%. In 2024, revenue decreased nearly 3%, and ebit dropped sharply by 61%, signaling some operational challenges despite a steady gross profit.

Hormel Foods Corporation

Hormel Foods experienced modest revenue growth of 6.3% from 2021 to 2025 but faced a nearly 47% decline in net income during this period. Margins were generally neutral, with a gross margin near 15.5% and ebit margin around 6.1%. In 2025, revenue rose slightly by 1.5% but gross profit fell by 7.5%, accompanied by a significant 41.5% drop in net margin, indicating margin pressure and weaker earnings.

Which one has the stronger fundamentals?

Kraft Heinz presents favorable trends in net income growth and margin improvements over the longer term, despite recent revenue and ebit declines. In contrast, Hormel shows neutral revenue expansion but suffers from significant net income and margin contractions. Overall, Kraft Heinz’s income statement fundamentals appear stronger based on profitability and margin stability, while Hormel’s financials suggest more pronounced earnings challenges.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for The Kraft Heinz Company (KHC) and Hormel Foods Corporation (HRL) based on their most recent fiscal year data.

| Ratios | The Kraft Heinz Company (2024) | Hormel Foods Corporation (2025) |

|---|---|---|

| ROE | 5.58% | 6.04% |

| ROIC | 6.61% | 4.31% |

| P/E | 13.53 | 24.84 |

| P/B | 0.75 | 1.50 |

| Current Ratio | 1.06 | 2.47 |

| Quick Ratio | 0.59 | 1.20 |

| D/E (Debt-to-Equity) | 0.40 | 0.36 |

| Debt-to-Assets | 22.5% | 21.3% |

| Interest Coverage | 1.85 | 9.21 |

| Asset Turnover | 0.29 | 0.90 |

| Fixed Asset Turnover | 3.61 | 5.41 |

| Payout Ratio | 70.4% | 132.4% |

| Dividend Yield | 5.20% | 5.33% |

Interpretation of the Ratios

The Kraft Heinz Company

KHC shows a mixed ratio profile with favorable net margin (10.62%) and valuation metrics (PE 13.53, PB 0.75), but weaker profitability ratios such as ROE (5.58%) and asset turnover (0.29). Liquidity is borderline, with a current ratio of 1.06 but a low quick ratio of 0.59. Dividend yield is moderate at 5.2%, supported by steady payouts, though coverage by free cash flow is a concern due to recent negative free cash flow to equity.

Hormel Foods Corporation

HRL presents a generally solid liquidity position, with strong current (2.47) and quick ratios (1.2), and excellent interest coverage (9.51). Profitability ratios like ROE (6.04%) and net margin (3.95%) are weaker, and valuation multiples are higher with a PE of 24.84. Dividend yield stands at 5.33%, reflecting consistent shareholder returns, with manageable leverage and operational efficiency indicated by fixed asset turnover of 5.41.

Which one has the best ratios?

Both KHC and HRL have half their ratios rated as favorable, but KHC’s stronger profitability margins and valuation appeal contrast with HRL’s superior liquidity and interest coverage. KHC’s weaker asset efficiency and coverage ratios balance HRL’s higher valuation and lower profitability, leading to a closely matched but differently shaped financial ratio landscape.

Strategic Positioning

This section compares the strategic positioning of Kraft Heinz and Hormel Foods, including Market position, Key segments, and exposure to disruption:

Kraft Heinz

- Large market cap of 27.7B with low beta, facing typical packaged foods competitive pressure

- Diverse product portfolio including condiments, dairy, meals, meats, beverages, and snacks

- No explicit data on technological disruption exposure

Hormel Foods

- Smaller market cap of 12.6B, moderate beta, competes in packaged foods sector

- Focus on meat, nuts, grocery, refrigerated, and international food segments

- No explicit data on technological disruption exposure

Kraft Heinz vs Hormel Foods Positioning

Kraft Heinz pursues a diversified product approach across multiple food categories, while Hormel emphasizes segmented meat and grocery business lines. Kraft Heinz’s broader portfolio may offer wider market coverage, whereas Hormel’s focus could yield specialized expertise but potentially less diversification.

Which has the best competitive advantage?

Kraft Heinz demonstrates a very favorable moat with growing ROIC exceeding WACC, indicating durable competitive advantage. Hormel shows a very unfavorable moat with declining ROIC below WACC, signaling value destruction and weaker competitive positioning.

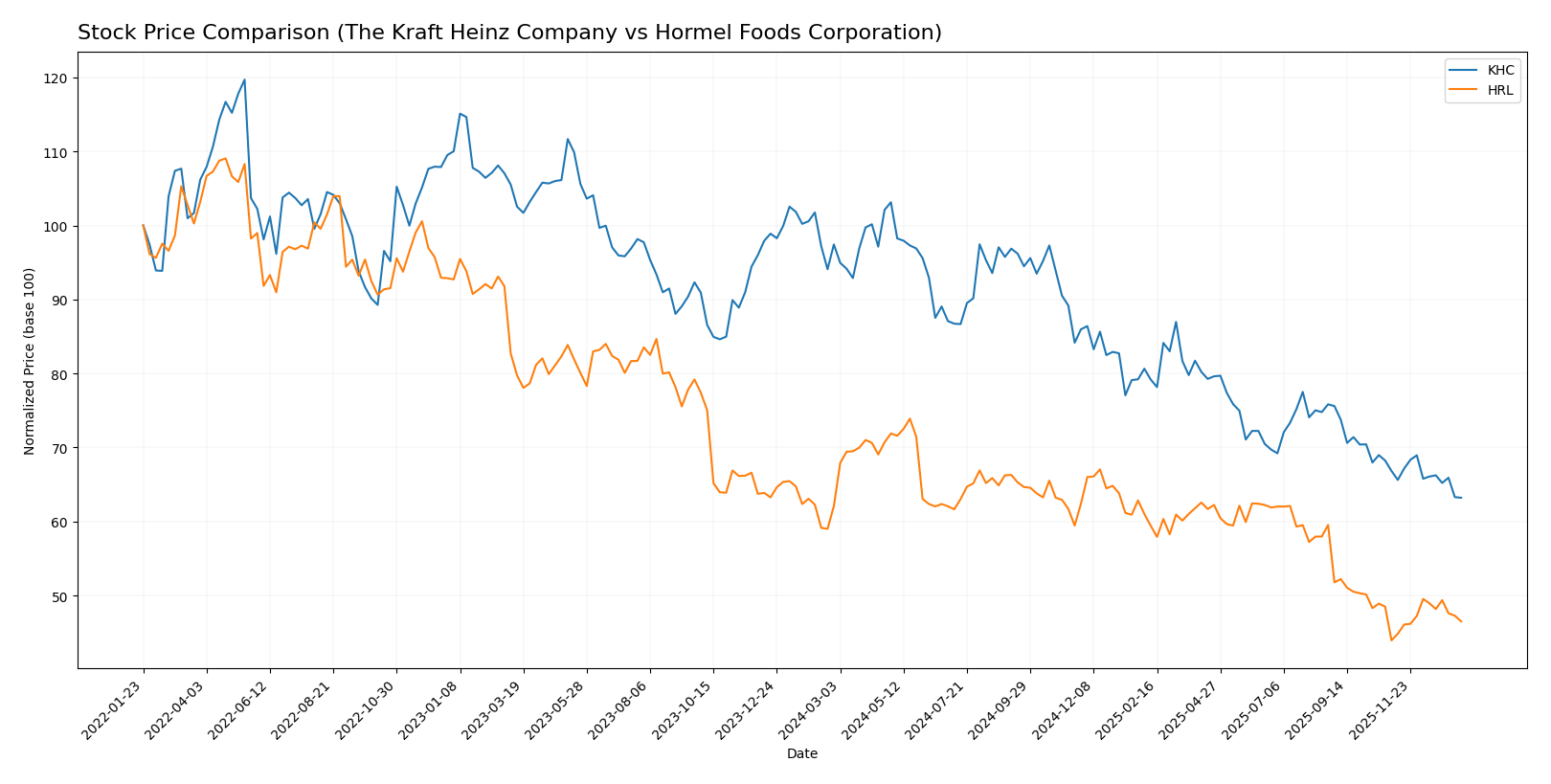

Stock Comparison

The stock price movements of The Kraft Heinz Company (KHC) and Hormel Foods Corporation (HRL) over the past 12 months show significant bearish trends for both, with notable price declines and varying recent momentum patterns.

Trend Analysis

The Kraft Heinz Company (KHC) experienced a bearish trend over the past year with a -35.12% price change, showing acceleration in the decline and a high volatility level with a 4.13 standard deviation. The stock reached a high of 38.16 and a low of 23.39.

Hormel Foods Corporation (HRL) also exhibited a bearish trend over the last 12 months, falling by -25.11% with accelerating downward momentum and a 3.52 standard deviation. Its price ranged between 36.31 at the peak and 21.59 at the lowest point.

Comparing the two, HRL outperformed KHC in market performance over the past year, as KHC faced a steeper price decline despite both stocks showing bearish trends overall.

Target Prices

The consensus target prices for The Kraft Heinz Company and Hormel Foods Corporation indicate moderate upside potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Kraft Heinz Company | 28 | 24 | 26.29 |

| Hormel Foods Corporation | 30 | 26 | 27.75 |

Analysts expect The Kraft Heinz Company’s stock to rise from its current price of 23.39 USD, while Hormel Foods Corporation shows a similar potential upside from 22.85 USD. Both stocks have target consensus prices comfortably above current levels.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for The Kraft Heinz Company and Hormel Foods Corporation:

Rating Comparison

KHC Rating

- Rating: B- indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 5, very favorable, suggests strong future cash flow projections.

- ROE Score: 1, very unfavorable, reflecting low efficiency in generating profit from equity.

- ROA Score: 1, very unfavorable, weak asset utilization to generate earnings.

- Debt To Equity Score: 3, moderate, showing average financial risk.

- Overall Score: 3, moderate, reflecting balanced but not strong financial health.

HRL Rating

- Rating: B indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 4, favorable, indicating solid future cash flow prospects.

- ROE Score: 2, moderate, showing better profit generation efficiency than KHC.

- ROA Score: 3, moderate, indicating more effective asset use compared to KHC.

- Debt To Equity Score: 3, moderate, similar financial risk level as KHC.

- Overall Score: 3, moderate, indicating comparable overall financial standing.

Which one is the best rated?

Based strictly on the data, HRL holds a slightly better rating (B vs. B-) with more moderate scores in ROE and ROA, indicating better profitability and asset efficiency. Both share the same overall and debt-to-equity scores.

Scores Comparison

Here is a comparison of the financial scores for KHC and HRL:

KHC Scores

- Altman Z-Score: 0.44, indicating financial distress zone risk.

- Piotroski Score: 6, classified as average financial strength.

HRL Scores

- Altman Z-Score: 5.17, indicating a safe financial zone.

- Piotroski Score: 7, classified as strong financial strength.

Which company has the best scores?

HRL has the best scores, with a safe zone Altman Z-Score of 5.17 and a strong Piotroski Score of 7, compared to KHC’s distress zone and average scores.

Grades Comparison

Here is a comparison of recent grades assigned to The Kraft Heinz Company and Hormel Foods Corporation by established grading firms:

The Kraft Heinz Company Grades

This table summarizes the latest grades given by notable financial institutions for KHC:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-10-31 |

| JP Morgan | Maintain | Neutral | 2025-10-30 |

| UBS | Maintain | Neutral | 2025-10-30 |

| TD Cowen | Maintain | Hold | 2025-10-30 |

| Evercore ISI Group | Maintain | In Line | 2025-10-30 |

| Piper Sandler | Maintain | Neutral | 2025-10-30 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-30 |

| Mizuho | Maintain | Neutral | 2025-10-28 |

| UBS | Maintain | Neutral | 2025-10-08 |

The Kraft Heinz Company’s grades consistently reflect a neutral to hold stance, indicating a cautious outlook among analysts.

Hormel Foods Corporation Grades

Below is a detailed table of recent grades for HRL from reputable grading agencies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-12-09 |

| JP Morgan | Maintain | Overweight | 2025-12-05 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

| Piper Sandler | Maintain | Neutral | 2025-12-05 |

| JP Morgan | Maintain | Overweight | 2025-11-21 |

| Piper Sandler | Maintain | Neutral | 2025-11-06 |

| Goldman Sachs | Maintain | Buy | 2025-10-30 |

| Goldman Sachs | Maintain | Buy | 2025-08-29 |

| B of A Securities | Maintain | Neutral | 2025-08-29 |

| Barclays | Maintain | Overweight | 2025-08-29 |

Hormel Foods Corporation generally receives more positive grades, with several overweight and buy recommendations suggesting confidence in its prospects.

Which company has the best grades?

Hormel Foods Corporation has received higher grades overall, including multiple overweight and buy ratings, compared to Kraft Heinz’s predominantly neutral and hold grades. This differential may affect investor sentiment and portfolio allocation decisions by signaling relatively stronger analyst confidence in Hormel Foods.

Strengths and Weaknesses

The following table summarizes the key strengths and weaknesses of The Kraft Heinz Company (KHC) and Hormel Foods Corporation (HRL) based on recent financial performance, market position, and innovation capacity.

| Criterion | The Kraft Heinz Company (KHC) | Hormel Foods Corporation (HRL) |

|---|---|---|

| Diversification | Broad product portfolio including cheese, dairy, coffee, ready meals, and snacks; well-diversified revenue streams | Diversified segments: Foodservice, Retail, International; strong presence in perishable meats and shelf-stable products |

| Profitability | Net margin 10.62% (favorable); ROIC 6.61% (neutral); growing ROIC trend; company creating value | Net margin 3.95% (unfavorable); ROIC 4.31% (unfavorable); declining ROIC trend; company shedding value |

| Innovation | Moderate innovation focus with stable product categories and some growth in new product segments | Moderate innovation with focus on specialty and refrigerated foods; adjusting to changing consumer trends |

| Global presence | Strong global footprint with significant revenues from Taste Elevation categories | Expanding international segment but less global reach than KHC |

| Market Share | Large market share in condiment and snack categories; efficient asset utilization (fixed asset turnover favorable) | Strong market share in meat and refrigerated foods; higher current and quick ratios indicate liquidity strength |

In summary, Kraft Heinz demonstrates a durable competitive advantage with improving profitability and a well-diversified product base, while Hormel faces profitability challenges and a declining return on capital despite solid liquidity and segment diversification. Investors should weigh Kraft Heinz’s value-creating profile against Hormel’s current value erosion risk.

Risk Analysis

Below is a comparative table outlining key risks for The Kraft Heinz Company (KHC) and Hormel Foods Corporation (HRL) based on the most recent data from 2025-2026.

| Metric | The Kraft Heinz Company (KHC) | Hormel Foods Corporation (HRL) |

|---|---|---|

| Market Risk | Low beta (0.065) indicates low market volatility exposure. | Moderate beta (0.324) suggests moderate market sensitivity. |

| Debt level | Moderate debt-to-equity ratio (0.40), favorable but interest coverage (1.94) is low, signaling some risk. | Similar debt-to-equity (0.36) with strong interest coverage (9.51), indicating lower financial risk. |

| Regulatory Risk | Moderate, given global food industry regulations and labeling laws. | Similar regulatory exposure with diversified product lines. |

| Operational Risk | Lower asset turnover (0.29) and quick ratio (0.59) unfavorable, possible efficiency concerns. | Better operational metrics, including higher asset turnover (0.9) and liquidity ratios. |

| Environmental Risk | Exposure to supply chain disruptions and sustainability pressures in food production. | Similar risks, mitigated by diversified sourcing and product range. |

| Geopolitical Risk | Global presence subjects KHC to trade and tariff risks. | Also exposed internationally but less so due to more US-centric operations. |

Kraft Heinz faces higher operational and financial risks due to weaker liquidity and interest coverage, despite low market volatility. Hormel shows stronger financial health and operational efficiency, reducing its risk profile. Investors should weigh Kraft Heinz’s moderate leverage and weaker profitability against Hormel’s steadier fundamentals.

Which Stock to Choose?

The Kraft Heinz Company (KHC) shows a mixed income evolution with a net margin of 10.62% rated favorable, yet recent revenue growth is negative. Its financial ratios are slightly favorable overall, supported by a low debt ratio, though some efficiency metrics are unfavorable. KHC’s profitability is moderate with a return on equity of 5.58%, and its debt level remains manageable. The company holds a very favorable rating despite some weak scores, and its durable competitive advantage is reflected in a very favorable moat evaluation.

Hormel Foods Corporation (HRL) has a neutral to unfavorable income evolution, marked by declining net income and margins over the overall period. Its financial ratios are slightly favorable overall, with strengths in liquidity and interest coverage, but profitability ratios remain modest. HRL’s return on equity is slightly higher at 6.04%, with a similarly moderate debt profile. It carries a very favorable rating with generally moderate financial scores, but its moat evaluation is very unfavorable, signaling declining profitability and value destruction.

Investors seeking a durable competitive advantage and value creation might find The Kraft Heinz Company more aligned with their profile, given its very favorable moat and stable rating. Conversely, those favoring stronger liquidity and moderate profitability with a stable credit profile could view Hormel Foods Corporation as fitting, despite its unfavorable moat and income trends. The choice could depend on an investor’s tolerance for value stability versus operational durability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Kraft Heinz Company and Hormel Foods Corporation to enhance your investment decisions: