Home > Comparison > Healthcare > WST vs HOLX

The strategic rivalry between West Pharmaceutical Services, Inc. and Hologic, Inc. shapes the dynamics of the healthcare instruments and supplies sector. West operates as a capital-intensive manufacturer specializing in injectable drug delivery systems, while Hologic focuses on high-margin diagnostics and surgical products for women’s health. This head-to-head contrasts manufacturing scale against specialized innovation. This analysis will determine which company presents the superior risk-adjusted profile for inclusion in a diversified healthcare portfolio.

Table of contents

Companies Overview

West Pharmaceutical Services and Hologic stand as key innovators within the medical instruments and supplies sector.

West Pharmaceutical Services, Inc.: Leader in Injectable Drug Delivery Systems

West Pharmaceutical Services dominates as a provider of containment and delivery systems for injectable drugs worldwide. It generates revenue primarily through proprietary products like stoppers, seals, and self-injection devices, alongside contract manufacturing for pharmaceutical and medical device firms. In 2026, West focuses strategically on advancing its drug containment solutions and broadening its integrated service offerings to enhance product safety and quality.

Hologic, Inc.: Pioneer in Women’s Health Diagnostics and Surgical Products

Hologic positions itself as a specialist in diagnostics and surgical technologies for women’s health. Its revenue stems from four segments, including molecular assays, breast imaging, and minimally invasive surgical systems. The company’s 2026 strategic emphasis lies in expanding its diagnostic capabilities and surgical product portfolio to improve early detection and treatment outcomes for women’s health globally.

Strategic Collision: Similarities & Divergences

Both companies excel in the medical instruments and supplies industry, yet West targets drug delivery systems with a manufacturing-centric model, while Hologic pursues a tech-driven approach in diagnostics and surgery. Their primary competition unfolds in healthcare innovation, where West leans on product containment expertise and Hologic on clinical diagnostics. This contrast shapes distinct investment profiles: West offers stability through proprietary manufacturing, and Hologic promises growth via cutting-edge medical technology.

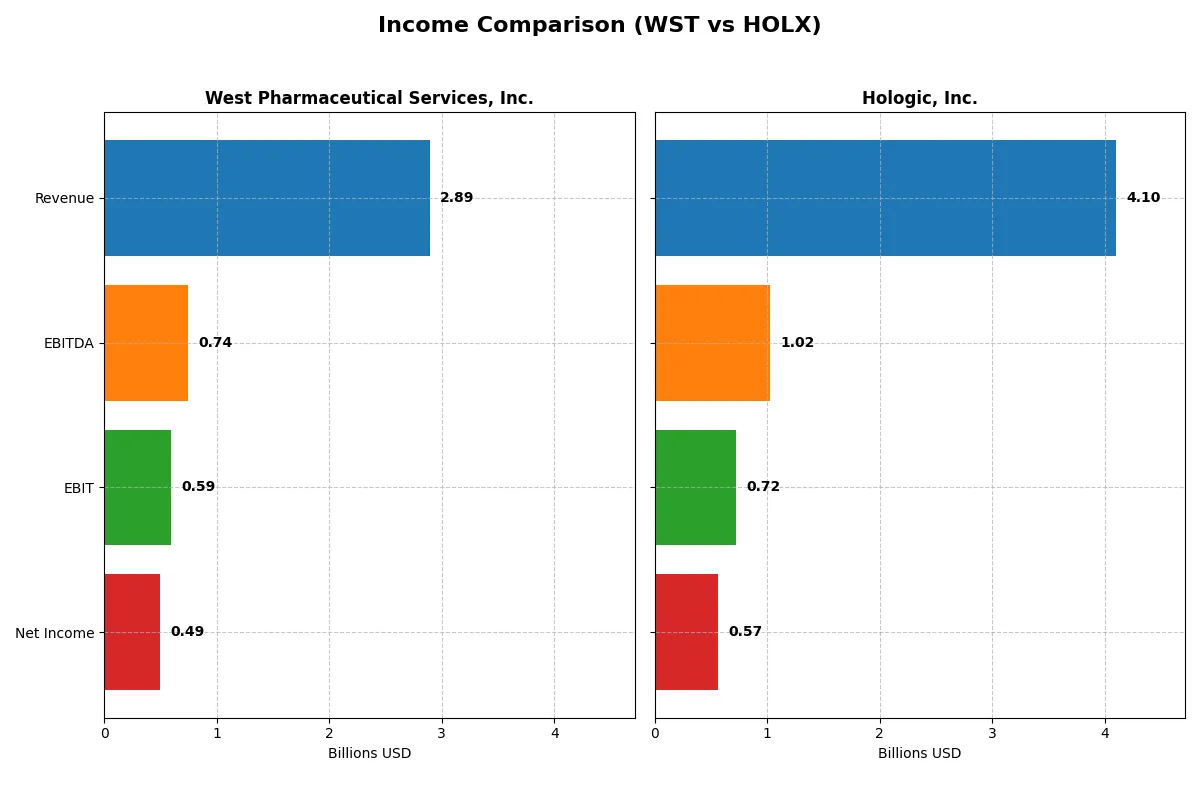

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | West Pharmaceutical Services, Inc. (WST) | Hologic, Inc. (HOLX) |

|---|---|---|

| Revenue | 2.89B | 4.10B |

| Cost of Revenue | 1.89B | 1.60B |

| Operating Expenses | 408M | 1.79B |

| Gross Profit | 1.00B | 2.50B |

| EBITDA | 744M | 1.02B |

| EBIT | 588M | 724M |

| Interest Expense | 2.9M | 42.7M |

| Net Income | 493M | 566M |

| EPS | 6.75 | 2.50 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates its business more efficiently and generates sustainable profits.

West Pharmaceutical Services, Inc. Analysis

West Pharmaceutical’s revenue shows moderate growth over five years, peaking near 3B USD with a slight 2% dip in 2024. Net income follows a similar trend, with a 17% net margin reflecting strong profitability. Despite recent pressure on revenue and earnings, its gross margin remains healthy at 34.65%, signaling solid cost control and operational efficiency.

Hologic, Inc. Analysis

Hologic’s revenue peaked at 5.6B USD in 2021 but declined 27% over the period, stabilizing around 4.1B USD in 2025. Net income contracted sharply by nearly 70%, dragging net margins to 13.8%. While its gross margin is robust at 61%, significant margin compression and a steep EBIT decline indicate challenges in sustaining profitability momentum.

Margin Strength vs. Revenue Resilience

West Pharmaceutical demonstrates steadier revenue and profit growth, supported by a consistent net margin near 17%. Hologic shows higher gross margins but suffers from declining revenue and net income, eroding its bottom-line strength. For investors prioritizing stable earnings growth and margin resilience, West’s profile currently proves more attractive.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | West Pharmaceutical Services, Inc. (WST) | Hologic, Inc. (HOLX) |

|---|---|---|

| ROE | 18.4% (2024) | 11.2% (2025) |

| ROIC | 15.7% (2024) | 7.3% (2025) |

| P/E | 48.5 (2024) | 27.0 (2025) |

| P/B | 8.91 (2024) | 3.02 (2025) |

| Current Ratio | 2.79 (2024) | 3.75 (2025) |

| Quick Ratio | 2.11 (2024) | 3.06 (2025) |

| D/E | 0.11 (2024) | 0.52 (2025) |

| Debt-to-Assets | 8.4% (2024) | 29.1% (2025) |

| Interest Coverage | 205.0 (2024) | 16.7 (2025) |

| Asset Turnover | 0.79 (2024) | 0.45 (2025) |

| Fixed Asset Turnover | 1.72 (2024) | 6.27 (2025) |

| Payout ratio | 12.0% (2024) | 0% (2025) |

| Dividend yield | 0.25% (2024) | 0% (2025) |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, unveiling hidden risks and operational excellence beyond surface-level financials.

West Pharmaceutical Services, Inc.

West Pharmaceutical shows strong profitability with an 18.37% ROE and a 17.03% net margin, indicating efficient operations. However, its valuation appears stretched, with a high P/E of 48.53 and P/B of 8.91. Shareholders receive a modest 0.25% dividend yield, reflecting limited cash returns but solid reinvestment in R&D and growth.

Hologic, Inc.

Hologic operates with moderate profitability, posting an 11.21% ROE and 13.8% net margin, suggesting steady but less robust efficiency. The stock trades at a lower P/E of 26.99 and P/B of 3.02, though these remain elevated. It pays no dividend, signaling a focus on reinvesting cash flow to fuel growth and innovation.

Operational Efficiency vs. Valuation Stretch

West Pharmaceutical delivers higher profitability but at a premium valuation, raising risk on price. Hologic offers a more moderate outlook with less efficiency but a comparatively lower valuation. Investors seeking growth might favor West’s strong returns; those preferring valuation discipline may lean toward Hologic’s cautious profile.

Which one offers the Superior Shareholder Reward?

West Pharmaceutical Services, Inc. (WST) pays a modest dividend yield around 0.25%, with a conservative payout ratio near 12%. It balances dividends with steady buybacks, supporting sustainable shareholder returns. Hologic, Inc. (HOLX) forgoes dividends, reinvesting heavily in R&D and growth, while executing robust buybacks to boost equity value. HOLX’s free cash flow supports aggressive buybacks (free cash flow/operating cash flow ratio ~0.87–0.94), fueling capital appreciation. WST’s dividend and buyback combo suits income-focused investors, but HOLX’s growth and buyback strategy offers a superior total return potential in 2026, given its efficient capital allocation and strong cash flow reinvestment. I favor HOLX for long-term shareholders seeking higher total rewards.

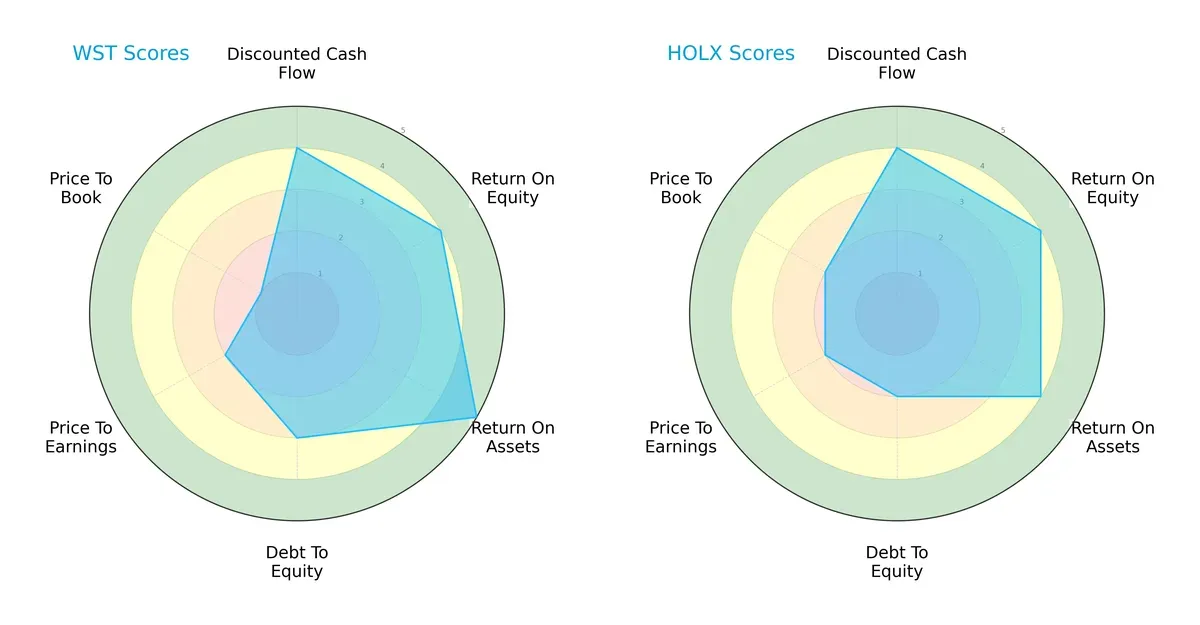

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of West Pharmaceutical Services and Hologic, highlighting their core financial strengths and weaknesses:

West Pharmaceutical shows a more balanced operational efficiency with a higher ROA score (5 vs. 4) and a moderate debt-to-equity position (3 vs. 2). Hologic leans on a slightly stronger valuation profile with better price-to-book metrics (2 vs. 1). Both companies share similar DCF and ROE scores, but West’s lower P/B score flags potential market overvaluation risks. Overall, West excels in asset utilization, while Hologic offers a steadier valuation balance.

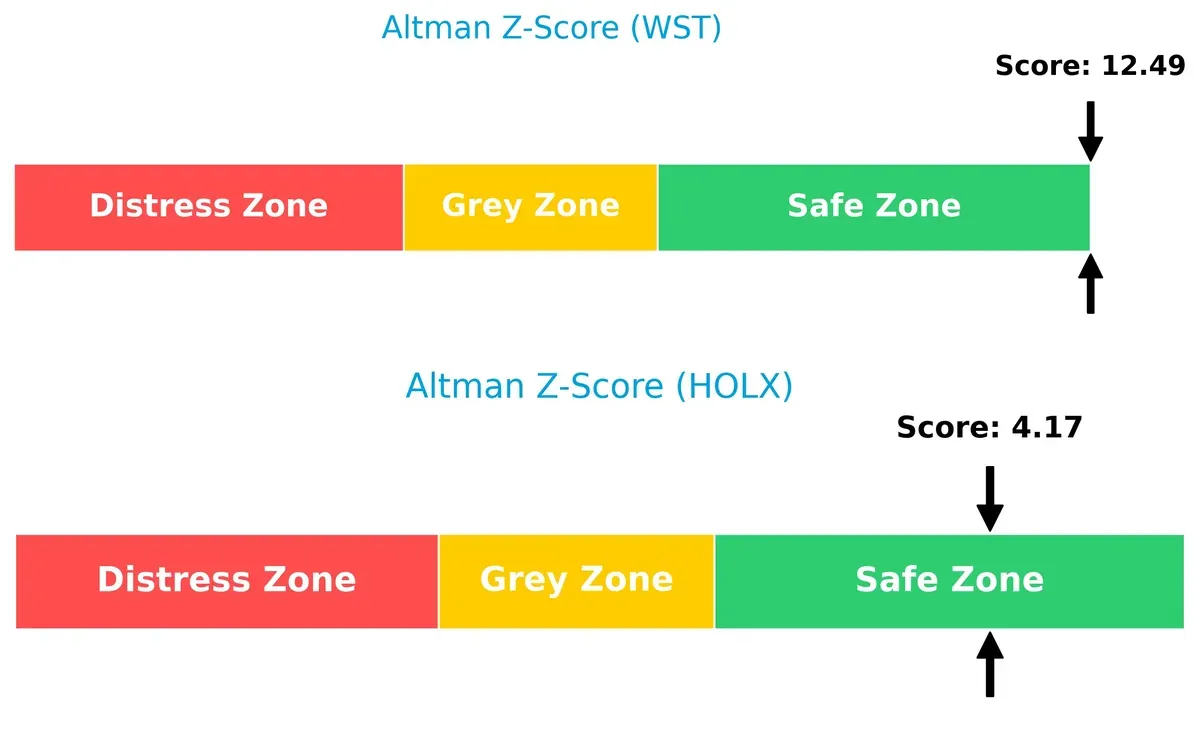

Bankruptcy Risk: Solvency Showdown

West Pharmaceutical’s Altman Z-Score of 12.5 far exceeds Hologic’s 4.2, both safely above the distress threshold, signaling superior long-term solvency for West in this cycle:

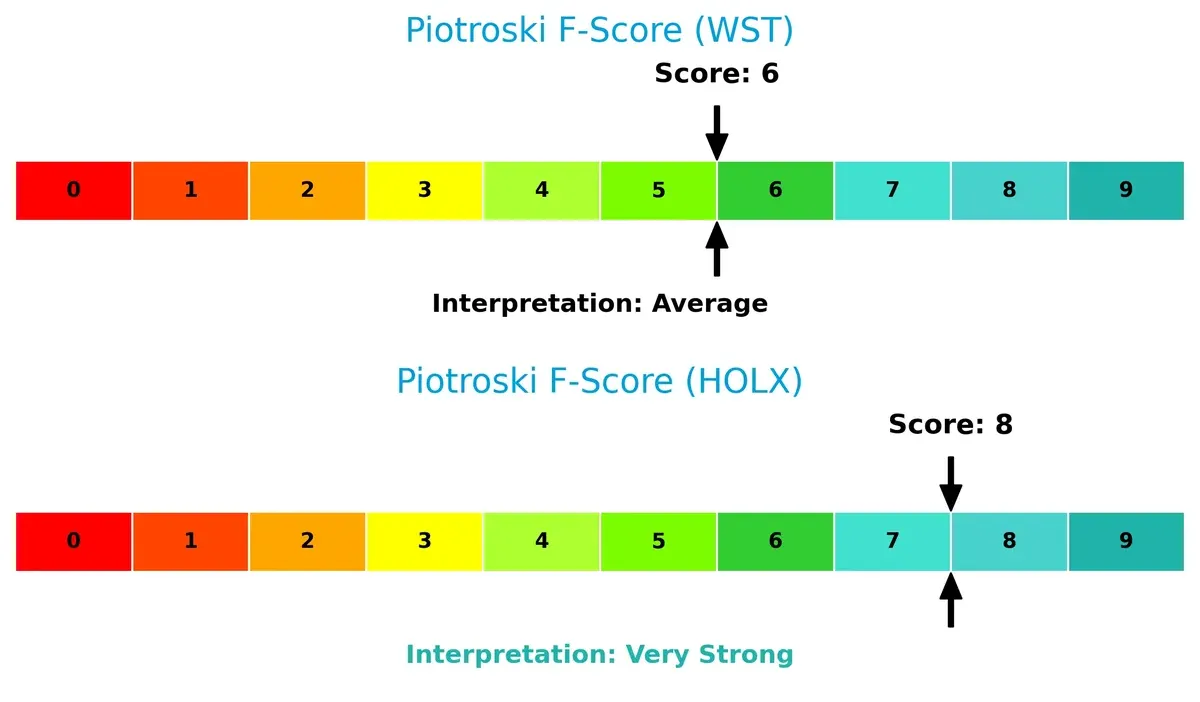

Financial Health: Quality of Operations

Hologic’s Piotroski F-Score of 8 indicates very strong internal financial health, outperforming West’s average score of 6, which suggests room for improvement in operational efficiency and risk management:

How are the two companies positioned?

This section dissects the operational DNA of West Pharmaceutical Services and Hologic by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to identify which model offers the most resilient and sustainable competitive advantage today.

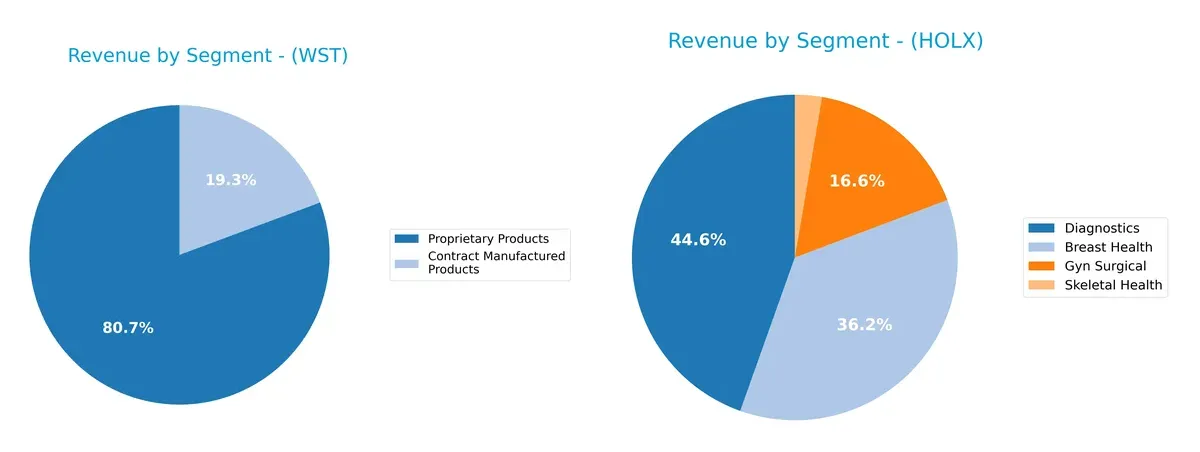

Revenue Segmentation: The Strategic Mix

This comparison dissects how West Pharmaceutical Services and Hologic diversify their income streams and reveals where their primary sector bets lie:

West Pharmaceutical Services anchors its revenue with $2.33B in Proprietary Products, dwarfing its $559M Contract Manufactured segment, showing a concentrated but stable product moat. Hologic displays a more diversified mix, with Diagnostics leading at $1.78B, followed by Breast Health at $1.52B, Gyn Surgical at $641M, and Skeletal Health at $84M. Hologic’s spread mitigates concentration risk, while West’s reliance on proprietary products signals ecosystem dominance but higher segment risk.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of West Pharmaceutical Services, Inc. and Hologic, Inc.:

WST Strengths

- Strong profitability with 17% net margin and 18% ROE

- Low debt levels with 0.11 debt-to-equity and 8.38% debt-to-assets

- Favorable liquidity ratios with 2.79 current and 2.11 quick ratios

- Balanced revenue streams from proprietary ($2.33B) and contract manufactured products ($559M)

- Solid global diversification across US, Europe, and other countries

HOLX Strengths

- Favorable cost of capital with 6.54% WACC below ROIC

- Diverse product segments including diagnostics ($1.83B) and breast health ($1.48B)

- Strong fixed asset turnover at 6.27 indicating efficient asset use

- Geographic reach with $3B US revenue and sizable Europe and Asia-Pacific sales

- Positive interest coverage at 16.95 supports debt servicing

WST Weaknesses

- High valuation multiples with PE at 48.53 and PB at 8.91, which may pressure returns

- Moderate asset turnover at 0.79 and fixed asset turnover neutral at 1.72

- Low dividend yield of 0.25% may deter income-focused investors

- Neutral WACC at 9.19% limits capital efficiency gains

HOLX Weaknesses

- Moderate profitability with 13.8% net margin and neutral ROE at 11.21%

- Elevated debt-to-equity at 0.52 and mixed current ratio at 3.75 (unfavorable)

- Lower asset turnover at 0.45 reflects less efficient asset use

- Unfavorable PE (27) and PB (3.02) ratios indicate potential overvaluation

- Zero dividend yield reduces income appeal

Both companies show diversified revenue bases and solid global presence. WST’s stronger profitability and conservative leverage contrast with HOLX’s more efficient asset utilization but higher debt and valuation risks. These factors shape their strategic priorities in balancing growth and financial discipline.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only shield preserving long-term profits from relentless competitive erosion. Here’s how West Pharmaceutical and Hologic compare:

West Pharmaceutical Services, Inc.: Precision Engineering Moat

West’s moat hinges on proprietary drug containment systems and custom injectable components. It boasts a very favorable ROIC trending upward, reflecting strong value creation. New delivery technologies in 2026 could deepen this moat.

Hologic, Inc.: Diagnostic Innovation Moat

Hologic’s strength lies in specialized women’s health diagnostics and imaging, contrasting West’s focus on drug delivery. However, its ROIC is declining with value erosion evident. Expansion into emerging markets offers some upside but also risks disruption.

Durable Engineering vs. Innovation in Decline

West holds the wider and deeper moat with consistent value creation and margin stability. Hologic’s eroding profitability flags a weaker moat. West is better positioned to defend and grow its market share in 2026.

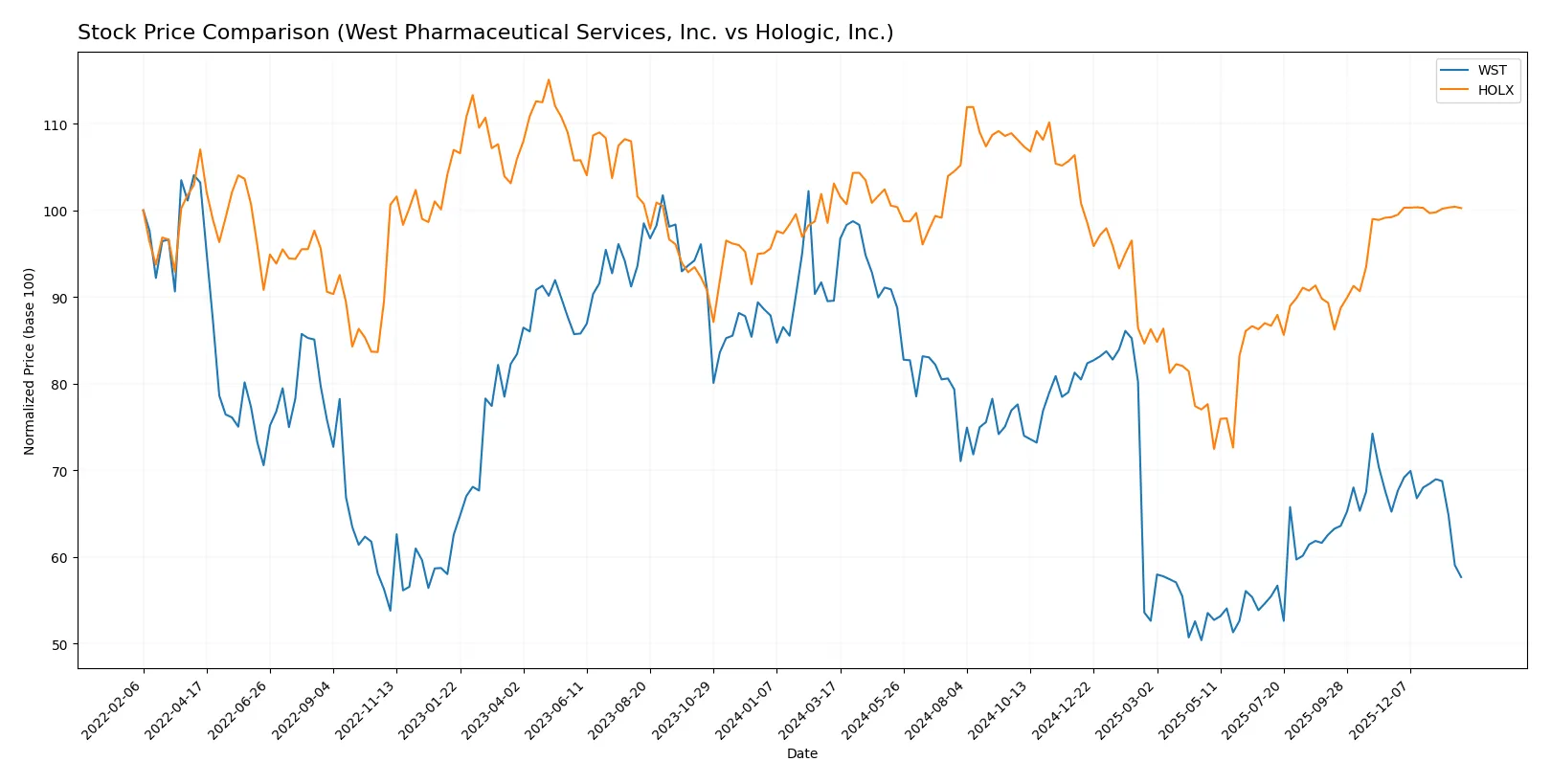

Which stock offers better returns?

The past year shows contrasting stock price dynamics: West Pharmaceutical Services, Inc. suffered a significant decline with decelerating losses, while Hologic, Inc. faced a mild downtrend but recently stabilized with slight upward momentum.

Trend Comparison

West Pharmaceutical Services, Inc. experienced a bearish trend over the past 12 months, with a sharp price decline of -35.61% and decelerating losses. The stock reached a high of 395.71 and a low of 201.9.

Hologic, Inc. also showed a bearish trend with a -2.75% drop over the year but demonstrated acceleration in losses. Recently, the stock price edged up by 1.05%, indicating near-neutral short-term momentum.

Comparing the two, Hologic, Inc. delivered the higher market performance, suffering a smaller loss and showing recent price stability compared to West Pharmaceutical’s steep and persistent decline.

Target Prices

Analysts show a bullish consensus for both West Pharmaceutical Services, Inc. and Hologic, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| West Pharmaceutical Services, Inc. | 285 | 390 | 335.17 |

| Hologic, Inc. | 76 | 79 | 77.8 |

The target consensus for West Pharmaceutical Services is 45% above its current price, signaling strong growth expectations. Hologic’s consensus is slightly above its current price, suggesting modest upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

I review the most recent institutional grades for both companies below:

West Pharmaceutical Services, Inc. Grades

This table summarizes the latest grades from top financial institutions for West Pharmaceutical Services, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2025-10-27 |

| Keybanc | Maintain | Overweight | 2025-10-24 |

| UBS | Maintain | Buy | 2025-10-24 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-23 |

| Barclays | Maintain | Equal Weight | 2025-10-02 |

| Barclays | Maintain | Equal Weight | 2025-07-25 |

| UBS | Maintain | Buy | 2025-07-25 |

| Evercore ISI Group | Maintain | Outperform | 2025-07-25 |

| Keybanc | Maintain | Overweight | 2025-02-14 |

| B of A Securities | Maintain | Buy | 2024-12-13 |

Hologic, Inc. Grades

This table presents recent institutional grades for Hologic, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Downgrade | Hold | 2026-01-12 |

| Evercore ISI Group | Downgrade | In Line | 2026-01-05 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-11 |

| Mizuho | Downgrade | Neutral | 2025-10-23 |

| JP Morgan | Downgrade | Neutral | 2025-10-22 |

| Stephens & Co. | Downgrade | Equal Weight | 2025-10-22 |

| Raymond James | Downgrade | Market Perform | 2025-10-22 |

| Leerink Partners | Maintain | Market Perform | 2025-10-21 |

| Needham | Maintain | Hold | 2025-10-21 |

| BTIG | Maintain | Neutral | 2025-10-21 |

Which company has the best grades?

West Pharmaceutical Services consistently receives higher grades, including multiple Buy and Outperform ratings. Hologic, Inc. faces several downgrades and more Hold or Neutral ratings. Investors may view West’s stronger grades as signaling better growth or stability prospects.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

West Pharmaceutical Services, Inc. (WST)

- Operates in a niche injectable drug delivery market with moderate competition and strong proprietary products.

Hologic, Inc. (HOLX)

- Faces intense competition in women’s health diagnostics and imaging, requiring constant innovation.

2. Capital Structure & Debt

West Pharmaceutical Services, Inc. (WST)

- Low debt-to-equity ratio (0.11) and strong interest coverage (202.9) signal conservative leverage and financial stability.

Hologic, Inc. (HOLX)

- Higher debt-to-equity (0.52) but manageable interest coverage (16.95); moderate leverage raises caution.

3. Stock Volatility

West Pharmaceutical Services, Inc. (WST)

- Beta of 1.167 indicates slightly above-market volatility, reflecting sensitivity to healthcare cycles.

Hologic, Inc. (HOLX)

- Lower beta of 0.697 suggests more defensive positioning with less price fluctuation versus the broader market.

4. Regulatory & Legal

West Pharmaceutical Services, Inc. (WST)

- Subject to global pharmaceutical packaging regulations; lower risk due to diversified geographic presence.

Hologic, Inc. (HOLX)

- Faces regulatory scrutiny in diagnostics and medical devices, with ongoing compliance costs and litigation risks.

5. Supply Chain & Operations

West Pharmaceutical Services, Inc. (WST)

- Complex manufacturing for injectable systems; supply chain disruptions could impact delivery timelines.

Hologic, Inc. (HOLX)

- Reliant on advanced manufacturing for diagnostic equipment; potential exposure to component shortages.

6. ESG & Climate Transition

West Pharmaceutical Services, Inc. (WST)

- Increasing pressure to reduce polymer waste and improve sustainability in packaging materials.

Hologic, Inc. (HOLX)

- ESG focus on reducing energy consumption in imaging systems and ensuring ethical sourcing of materials.

7. Geopolitical Exposure

West Pharmaceutical Services, Inc. (WST)

- Global operations spread risk but exposed to trade tensions and regulatory shifts in emerging markets.

Hologic, Inc. (HOLX)

- International sales expose it to currency fluctuations and geopolitical risks in key markets like Europe and Asia.

Which company shows a better risk-adjusted profile?

West Pharmaceutical Services faces its most significant risk in supply chain complexity, which could disrupt critical injectable drug delivery components. Hologic’s primary risk lies in regulatory and legal pressures from stringent compliance and potential litigation. Despite WST’s higher beta, its low leverage and strong interest coverage enhance its financial resilience. HOLX, though more stable in stock volatility, carries moderate debt and regulatory exposure. WST’s Altman Z-Score of 12.5 versus HOLX’s 4.2 signals a safer financial zone. Thus, West Pharmaceutical Services offers a better risk-adjusted profile supported by robust capital structure and liquidity.

Final Verdict: Which stock to choose?

West Pharmaceutical Services (WST) stands out for its durable competitive advantage, consistently generating strong returns on invested capital well above its cost of capital. This company operates as a reliable value creator with efficient capital allocation. Its main point of vigilance is the recent slowdown in revenue and earnings growth, which could pressure momentum. WST suits an aggressive growth portfolio seeking long-term value.

Hologic (HOLX) boasts a strategic moat in its recurring revenue streams and market presence in medical diagnostics. It offers a safer profile with stronger liquidity but reveals declining profitability and shrinking returns on invested capital. HOLX may appeal to investors seeking growth at a reasonable price, balancing moderate risk with stability.

If you prioritize durable profitability and value creation, WST is the compelling choice due to its strong ROIC and economic moat. However, if you seek relative safety and steady cash flow with less emphasis on growth acceleration, HOLX offers better stability despite its challenges. Each fits distinct investor profiles; prudent diversification should consider these analytical scenarios carefully.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of West Pharmaceutical Services, Inc. and Hologic, Inc. to enhance your investment decisions: