Hillenbrand, Inc. and Columbus McKinnon Corporation are two established players in the industrial machinery sector, each with distinct but overlapping market niches. Hillenbrand offers diversified process and molding solutions, while Columbus McKinnon specializes in intelligent motion and lifting equipment. Their innovation strategies and market reach make them compelling peers. In this article, I will help you decide which company presents the most attractive investment opportunity in 2025.

Table of contents

Companies Overview

I will begin the comparison between Hillenbrand, Inc. and Columbus McKinnon Corporation by providing an overview of these two companies and their main differences.

Hillenbrand, Inc. Overview

Hillenbrand, Inc. is a diversified industrial company operating primarily in the United States and internationally. It focuses on three segments: Advanced Process Solutions, Molding Technology Solutions, and Batesville, which provides funeral services products. The company serves various industries, including plastics, food, pharmaceuticals, automotive, and consumer goods, positioning itself as a multi-industry equipment and services provider.

Columbus McKinnon Corporation Overview

Columbus McKinnon Corporation designs and manufactures intelligent motion solutions for material handling worldwide. Its products include hoists, crane systems, rigging equipment, and power and motion technology products. Serving diverse markets such as industrial automation, construction, food and beverage, and e-commerce, Columbus McKinnon targets ergonomic and efficient material movement across many sectors with a broad product portfolio.

Key similarities and differences

Both companies operate within the industrial sector with a focus on machinery and equipment, yet Hillenbrand emphasizes process and molding technologies alongside funeral services, while Columbus McKinnon specializes in motion and material handling solutions. Hillenbrand’s operations are more diversified across industries, whereas Columbus McKinnon focuses on motion control and lifting equipment. Their customer bases overlap in industrial markets but differ in product specialization and end-use applications.

Income Statement Comparison

The table below presents the most recent fiscal year income statement metrics for Hillenbrand, Inc. and Columbus McKinnon Corporation, allowing a straightforward financial comparison.

| Metric | Hillenbrand, Inc. (HI) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Market Cap | 2.23B | 497M |

| Revenue | 2.67B | 963M |

| EBITDA | 231M | 75M |

| EBIT | 92M | 27M |

| Net Income | 43M | -5.1M |

| EPS | 0.74 | -0.18 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Hillenbrand, Inc. experienced a revenue decline of nearly 16% from 2024 to 2025, with net income recovering to $43M after a significant loss the previous year. Gross margin remained stable at around 34%, while EBIT margin hovered near 3.4%, showing a remarkable EBIT growth of over 600%. The latest year’s results indicate margin improvement despite lower top-line figures.

Columbus McKinnon Corporation saw a slight revenue decrease of 5% from 2023 to 2024, accompanied by a 13% drop in gross profit. EBIT margin held steady at 2.8%, but EBIT declined sharply by 73%. Net margin and EPS both turned negative, reflecting unfavorable profitability trends in the most recent fiscal year after a period of moderate growth.

Which one has the stronger fundamentals?

Based on the income statement evaluations, Hillenbrand displays stronger fundamentals with half of its metrics favorable, including improved EBIT and net margin growth. In contrast, Columbus McKinnon shows predominantly unfavorable trends, including declines in profitability and earnings per share. Hillenbrand’s margin resilience and earnings recovery provide a comparatively more favorable income statement profile.

Financial Ratios Comparison

The table below presents key financial ratios for Hillenbrand, Inc. and Columbus McKinnon Corporation based on their most recent fiscal year data, enabling a straightforward side-by-side comparison.

| Ratios | Hillenbrand, Inc. (2025) | Columbus McKinnon Corp. (2024) |

|---|---|---|

| ROE | 3.66% | -0.58% |

| ROIC | -32.60% | 3.30% |

| P/E | 36.69 | -94.69 |

| P/B | 1.34 | 0.55 |

| Current Ratio | 1.22 | 1.81 |

| Quick Ratio | 0.88 | 1.04 |

| D/E (Debt-to-Equity) | 1.12 | 0.61 |

| Debt-to-Assets | 35.86% | 31.09% |

| Interest Coverage | 0.55 | 1.68 |

| Asset Turnover | 0.60 | 0.55 |

| Fixed Asset Turnover | 7.80 | 9.07 |

| Payout Ratio | 121.69% | -156.52% |

| Dividend Yield | 3.32% | 1.65% |

Interpretation of the Ratios

Hillenbrand, Inc. shows a mixed ratio profile with several unfavorable indicators such as low net margin (1.95%), weak return on equity (3.66%), and a negative return on invested capital (-32.6%), signaling profitability and capital efficiency challenges. The company’s payout appears sustainable with a dividend yield of 3.32%, supported by moderate valuation metrics and stable liquidity ratios, though debt and interest coverage raise some concerns.

Columbus McKinnon Corporation presents a more favorable overall ratio evaluation despite a negative net margin (-0.53%) and return on equity (-0.58%), reflecting operational difficulties. Its balance sheet strength is reflected in strong current (1.81) and quick ratios (1.04), and conservative leverage (debt to equity 0.61). The dividend yield is a modest 1.65%, consistent with a cautious shareholder return approach amid reinvestment priorities.

Which one has the best ratios?

Columbus McKinnon’s ratios are generally more favorable, with better liquidity, lower leverage, and a more conservative payout reflected in its valuation and coverage metrics. Hillenbrand’s profitability and capital return ratios are weaker, and although it offers a higher dividend yield, its debt levels and interest coverage ratios are less supportive. Overall, Columbus McKinnon demonstrates stronger financial stability based on these key ratios.

Strategic Positioning

I will now compare Hillenbrand and Columbus McKinnon’s positioning to understand their respective business strategies better.

Hillenbrand Positioning

Hillenbrand operates in diversified industrial machinery with key segments: Process Equipment Group and Milacron, generating $2.07B and $604M in 2025, respectively. The company faces technological disruption but maintains steady segment contributions. Recent year revenue shows Process Equipment growth slowing and a notable Milacron decline, indicating margin and concentration risks.

Columbus McKinnon Positioning

Columbus McKinnon, focused on agricultural machinery and motion solutions, sees Hoists as the largest revenue driver at $480M in 2024, supported by High Precision Conveyors and Digital Power Control segments. The firm’s product range faces competitive pressure and technological shifts. Recent performance shows slight revenue decline in key segments, signaling cautious market dynamics and margin pressures.

Hillenbrand vs Columbus McKinnon Positioning

Hillenbrand presents a diversified portfolio across industrial sectors with three major segments, balancing risks and growth, while Columbus McKinnon offers a more concentrated product range focused on motion and lifting solutions, benefiting from specialization but potentially more exposed to market volatility.

Stock Comparison

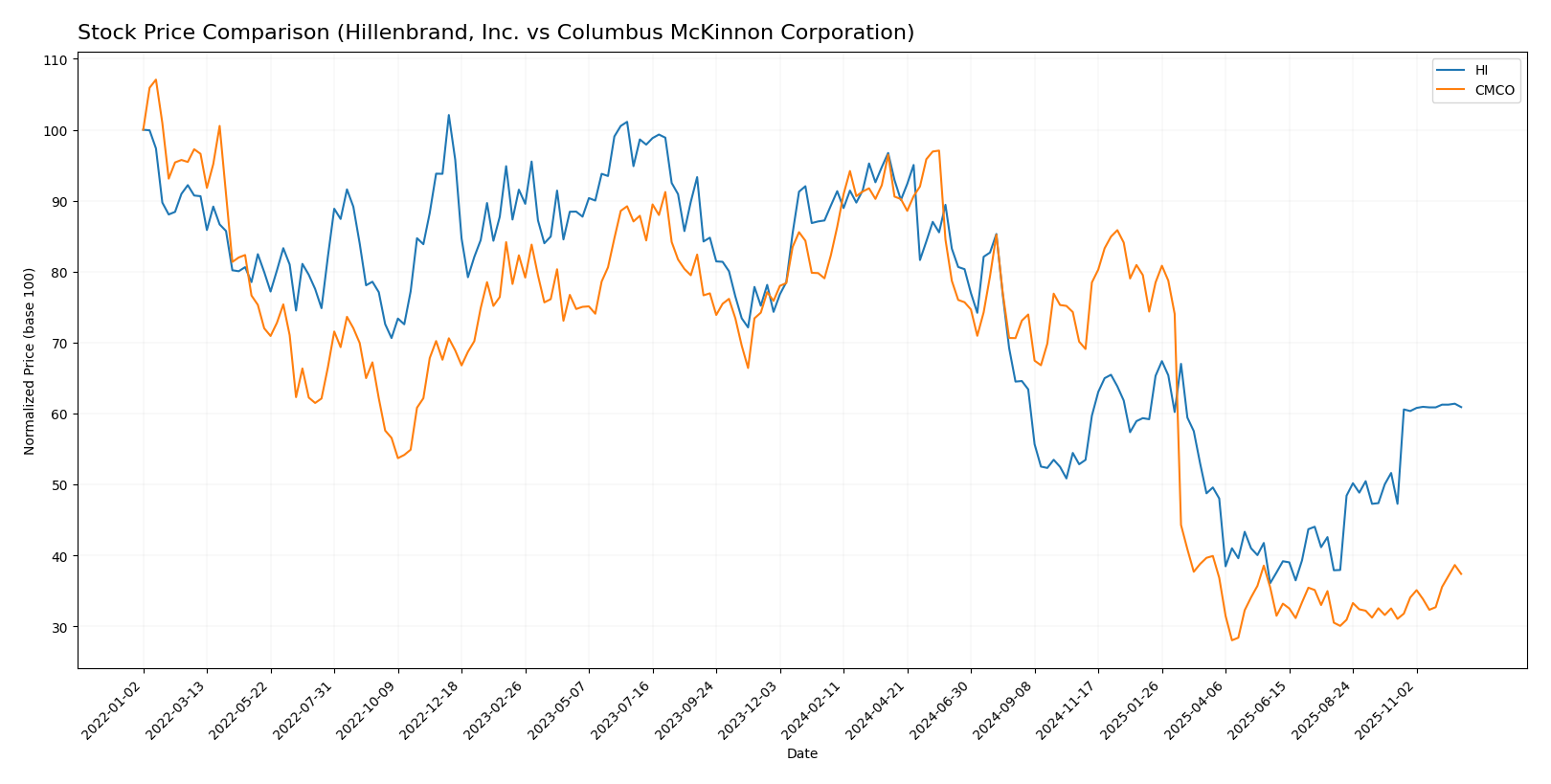

The past year saw significant price declines for both Hillenbrand, Inc. and Columbus McKinnon Corporation, followed by recent partial recoveries indicating shifting trading dynamics.

Trend Analysis

Hillenbrand, Inc. experienced a bearish trend over the past 12 months with a price drop of 31.81% and accelerating decline, hitting a low of 18.75 before a recent 18.0% rebound since October 2025.

Columbus McKinnon Corporation also faced a bearish trend with a sharper 54.58% fall and accelerating losses, reaching a 12.96 low, then posting a 14.96% recovery in the recent two-and-a-half-month period.

Comparing trends, Hillenbrand, Inc. delivered the highest market performance with a smaller overall decline and a stronger recent rebound than Columbus McKinnon Corporation.

Analyst Opinions Comparison

I will now compare Hillenbrand and Columbus McKinnon’s ratings, grades, and price targets to gauge analysts’ opinions.

Hillenbrand Rating

Hillenbrand holds a B+ rating with an overall score of 3, scoring high on return on assets (5) but low on debt to equity (1) and price to earnings (2).

Columbus McKinnon Rating

Columbus McKinnon also has a B+ rating and overall score of 3, excelling in discounted cash flow (5) and price to book (5) but scoring lower in price to earnings (1) and return on assets (3).

Which one is the best rated?

Both companies share the same B+ rating and overall score of 3, but their strengths differ, with Hillenbrand leading in return on assets and Columbus McKinnon in discounted cash flow and price to book.

Hillenbrand, Inc. Grades

The following table shows recent stock grades assigned by reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Neutral | 2025-11-20 |

| DA Davidson | Maintain | Neutral | 2025-10-16 |

| CJS Securities | Downgrade | Market Perform | 2025-10-16 |

| Keybanc | Downgrade | Sector Weight | 2025-05-08 |

| DA Davidson | Maintain | Neutral | 2025-05-01 |

| DA Davidson | Maintain | Neutral | 2024-11-15 |

| Keybanc | Maintain | Overweight | 2024-11-14 |

| DA Davidson | Downgrade | Neutral | 2024-08-12 |

Overall, Hillenbrand, Inc. has experienced a general downgrade trend from “Buy” and “Overweight” positions to “Neutral” and “Sector Weight,” reflecting more cautious sentiment.

Columbus McKinnon Corporation Grades

Below is a summary of recent stock grades from established grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Downgrade | Neutral | 2025-02-11 |

| DA Davidson | Maintain | Buy | 2024-02-05 |

| DA Davidson | Maintain | Buy | 2022-10-04 |

| DA Davidson | Maintain | Buy | 2022-10-03 |

| Barrington Research | Maintain | Outperform | 2022-07-29 |

| Barrington Research | Maintain | Outperform | 2022-07-28 |

| JP Morgan | Downgrade | Neutral | 2022-05-26 |

| Barrington Research | Maintain | Outperform | 2022-05-26 |

| Barrington Research | Maintain | Outperform | 2022-05-25 |

| JP Morgan | Downgrade | Neutral | 2022-05-25 |

Columbus McKinnon Corporation’s ratings show a mixed but overall cautious trend, with downgrades from “Buy” and “Overweight” to “Neutral,” while some firms maintain “Outperform” ratings.

Grades Comparison of Hillenbrand, Inc. and Columbus McKinnon Corporation

Comparing grades, Columbus McKinnon has received more “Buy” and “Outperform” ratings historically, while Hillenbrand’s ratings have largely settled at “Neutral.” This difference may influence investors’ perception of relative growth potential and risk profile between the two stocks.

Target Prices

The current target price consensus for Hillenbrand, Inc. and Columbus McKinnon Corporation reflects moderate upside potential based on analyst estimates.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Hillenbrand, Inc. | 32 | 32 | 32 |

| Columbus McKinnon Corporation | 50 | 48 | 49 |

Analysts expect Hillenbrand, Inc.’s stock price to hover around $32, slightly above its current price of $31.66. Columbus McKinnon Corporation shows a more significant target upside with consensus near $49, well above its current $17.29 price, indicating potential growth expectations.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Hillenbrand, Inc. (HI) and Columbus McKinnon Corporation (CMCO) based on the most recent financial and operational data.

| Criterion | Hillenbrand, Inc. (HI) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Diversification | Highly diversified industrial segments including process solutions, molding, and funeral products | Focused on intelligent motion and material handling solutions |

| Profitability | Moderate net profit margin (~1.95%), showing recent recovery from losses | Slightly negative net profit margin (-0.53%), fluctuating profitability |

| Innovation | Offers advanced process and molding technology solutions for diverse industries | Provides a broad range of motion solutions and automation products, emphasizing intelligent systems |

| Global presence | Operates internationally with strong US base | Global reach but smaller scale and narrower industry focus |

| Market Share | Market cap ~2.2B USD with broad industrial footprint | Smaller market cap ~0.5B USD, niche market specialization |

| Debt level | Higher leverage (debt/equity ~1.12), debt to market cap ~0.84, moderate solvency | Lower leverage (debt/equity ~0.61), debt to market cap ~0.94, better working capital position |

Key takeaways: Hillenbrand stands out for its diversification and larger market presence but carries higher debt levels with moderate profitability. Columbus McKinnon has a focused product range and better financial leverage but faces challenges in profitability and scale. Investors should weigh diversification against financial risk and market position when choosing between these industrial plays.

Risk Analysis

Below is a comparison of key risk factors for Hillenbrand, Inc. (HI) and Columbus McKinnon Corporation (CMCO) as of 2025.

| Metric | Hillenbrand, Inc. (HI) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Market Risk | High beta (1.40) indicates higher volatility; market cap of 2.23B USD. | Moderate beta (1.29); smaller market cap of 497M USD. |

| Regulatory Risk | Exposure to multiple industrial sectors may face diverse regulations. | Industrial and agricultural machinery subject to safety and environmental rules. |

| Operational Risk | Complex multi-segment operations increase execution complexity. | Focused on motion solutions; operational efficiency critical. |

| Environmental Risk | Moderate due to manufacturing and industrial processes. | Moderate, with emphasis on material handling equipment manufacturing. |

| Geopolitical Risk | Global operations expose it to trade and geopolitical uncertainties. | Primarily US-based but vulnerable to supply chain disruptions. |

The most impactful risks for HI are market volatility and operational complexity given its diversified segments and global footprint. CMCO faces moderate market and regulatory risks with tighter operational focus but lower scale. Investors should carefully monitor HI’s debt levels and CMCO’s interest coverage as financial leverage could amplify these risks.

Which Stock to Choose?

Hillenbrand, Inc. shows a declining income with a -16% revenue growth but favorable EBIT growth of 615% and net margin improvement. Its financial ratios are globally unfavorable, marked by low profitability, high debt, and a B+ rating with concerns on debt-to-equity and interest coverage.

Columbus McKinnon Corporation presents a modest revenue decline of -5%, unfavorable EBIT contraction of -73%, and negative net margin. Its financial ratios appear globally favorable with better liquidity and lower leverage, though profitability remains weak. It holds a B+ rating with stronger discounted cash flow and price-to-book scores.

Investors seeking growth might find Hillenbrand’s improving income metrics attractive despite its financial ratio weaknesses, while those favoring financial stability and better liquidity could view Columbus McKinnon as more favorable. The ratings suggest both companies have moderate appeal but differ in risk and profitability profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Hillenbrand, Inc. and Columbus McKinnon Corporation to enhance your investment decisions: