Home > Comparison > Technology > NOK vs HPE

The strategic rivalry between Nokia Oyj and Hewlett Packard Enterprise Company shapes the technology sector’s communication equipment landscape. Nokia operates as a global leader in mobile and fixed network infrastructure, emphasizing cloud and virtualization services. In contrast, Hewlett Packard Enterprise specializes in multi-workload servers and intelligent edge solutions with a strong focus on IT consumption models. This analysis evaluates which company’s business model offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

Nokia Oyj and Hewlett Packard Enterprise Company both shape the global communication equipment landscape with distinct market approaches.

Nokia Oyj: Global Network Infrastructure Leader

Nokia dominates as a provider of mobile, fixed, and cloud network solutions worldwide. Its revenue stems from segments including Mobile Networks and Cloud Services. In 2026, Nokia focuses strategically on expanding 5G radio access and optical networks, targeting communications providers and hyperscalers with cutting-edge infrastructure.

Hewlett Packard Enterprise Company: Enterprise IT Solutions Specialist

HPE leads in integrated IT infrastructure and intelligent edge solutions with servers, storage, and network hardware. Its core revenue comes from hardware sales and cloud-managed services. In 2026, HPE prioritizes innovation in cloud-based network management and as-a-service offerings, serving commercial enterprises with flexible technology deployment.

Strategic Collision: Similarities & Divergences

Nokia pursues a broad infrastructure play emphasizing network equipment, while HPE integrates hardware with cloud and edge computing services. Both vie for dominance in enterprise and service provider markets, but Nokia’s focus on communications infrastructure contrasts with HPE’s edge-to-cloud IT platform. Their investment profiles reflect Nokia’s infrastructure moat versus HPE’s diversified technology stack and service model.

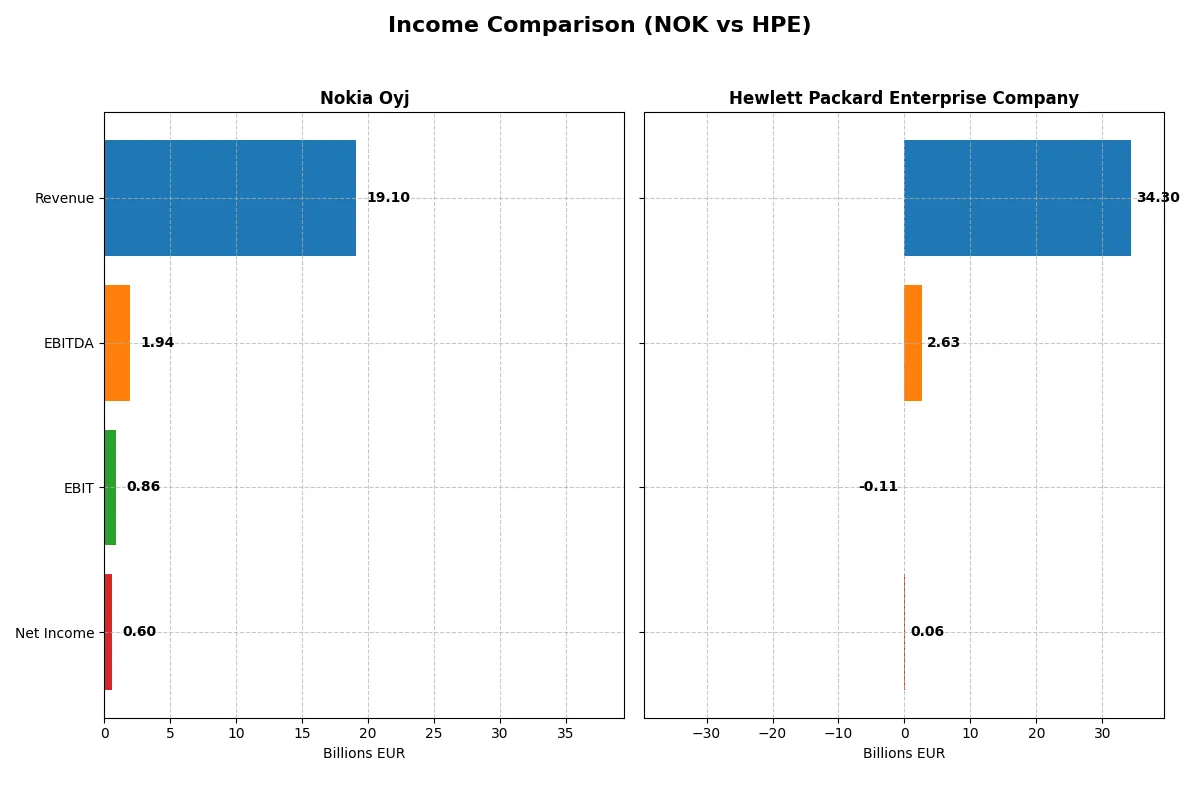

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Nokia Oyj (NOK) | Hewlett Packard Enterprise Company (HPE) |

|---|---|---|

| Revenue | 19.1B EUR | 34.3B USD |

| Cost of Revenue | 11.1B EUR | 24.4B USD |

| Operating Expenses | 6.5B EUR | 8.2B USD |

| Gross Profit | 8.0B EUR | 9.9B USD |

| EBITDA | 1.9B EUR | 2.6B USD |

| EBIT | 862M EUR | -110M USD |

| Interest Expense | 0 EUR | 175M USD |

| Net Income | 604M EUR | 57M USD |

| EPS | 0.11 EUR | -0.045 USD |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison will reveal which company runs a more efficient and profitable corporate engine in the current market context.

Nokia Oyj Analysis

Nokia’s revenue declined 0.6% to 19.1B EUR in 2025, with net income shrinking 52.4% to 604M EUR. Its gross margin remains healthy at 42.1%, but net margin slipped to 3.2%. The sharp EBIT drop signals weakening operating momentum, despite stable interest expense and controlled operating costs.

Hewlett Packard Enterprise Company Analysis

HPE grew revenue 14.1% to 34.3B USD in 2025, yet net income collapsed 98.1% to just 57M USD. Gross margin held at 28.8%, but EBIT margin turned negative at -0.3%. Rising operating expenses outpaced revenue gains, eroding profitability despite solid top-line growth.

Margin Strength vs. Revenue Growth

Nokia exhibits stronger margin stability but suffers from declining revenue and profits. HPE delivers robust revenue growth but faces severe profitability deterioration. Nokia’s more consistent margin profile offers a clearer fundamental advantage for investors focused on earnings quality.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose underlying fiscal health, valuation premiums, and capital efficiency for the companies compared below:

| Ratios | Nokia Oyj (NOK) | Hewlett Packard Enterprise Company (HPE) |

|---|---|---|

| ROE | 2.88% | 0.23% |

| ROIC | 3.82% | -0.59% |

| P/E | 49.36 | 567.23 |

| P/B | 1.42 | 1.31 |

| Current Ratio | 1.58 | 1.01 |

| Quick Ratio | 1.36 | 0.76 |

| D/E | 0.25 | 0.91 |

| Debt-to-Assets | 13.86% | 29.46% |

| Interest Coverage | 5.55 | 9.39 |

| Asset Turnover | 0.51 | 0.45 |

| Fixed Asset Turnover | 7.68 | 5.71 |

| Payout ratio | 120% | 13,965% |

| Dividend yield | 2.43% | 2.46% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and operational strengths that shape investor decisions.

Nokia Oyj

Nokia posts a modest ROE of 2.88% and a low net margin of 3.16%, signaling weak profitability. The stock’s P/E ratio of 49.36 appears stretched versus sector norms, yet a solid dividend yield of 2.43% offers shareholder returns. The firm prioritizes R&D, reinvesting heavily with a 23.2% R&D-to-revenue ratio, supporting future growth.

Hewlett Packard Enterprise Company

HPE reports a negligible ROE of 0.23% and a near break-even net margin of 0.17%, reflecting operational struggles. Its P/E ratio surges to 567, marking the stock as highly expensive. Despite this, HPE maintains a dividend yield of 2.46%. Capital allocation leans modestly towards R&D at 7.3%, though free cash flow is negative, raising caution.

Risk-Return Balance: Conservative Growth vs. Stretched Valuation

Nokia shows a more balanced profile with favorable liquidity and manageable debt, albeit low profitability and a stretched valuation. HPE’s metrics reveal significant operational challenges and extreme valuation multiples, despite shareholder dividends. Investors seeking conservative risk exposure might prefer Nokia’s steadier fundamentals, while HPE suits those tolerating volatility for potential turnaround gains.

Which one offers the Superior Shareholder Reward?

Nokia offers a more balanced distribution strategy with a 3.1% dividend yield and a moderate 57% payout ratio, supported by solid free cash flow coverage near 81%. Its buyback intensity appears limited but sustainable. Hewlett Packard Enterprise pays a similar 2.6% yield but with a higher payout ratio above 26%, yet weaker free cash flow coverage around 45%, signaling potential strain. HPE’s aggressive buybacks boost total return but increase financial leverage and risk. Historically, Nokia’s conservative payout and healthier coverage ratios suggest a more sustainable shareholder reward. In 2026, I favor Nokia for superior total return stability and risk-adjusted value creation.

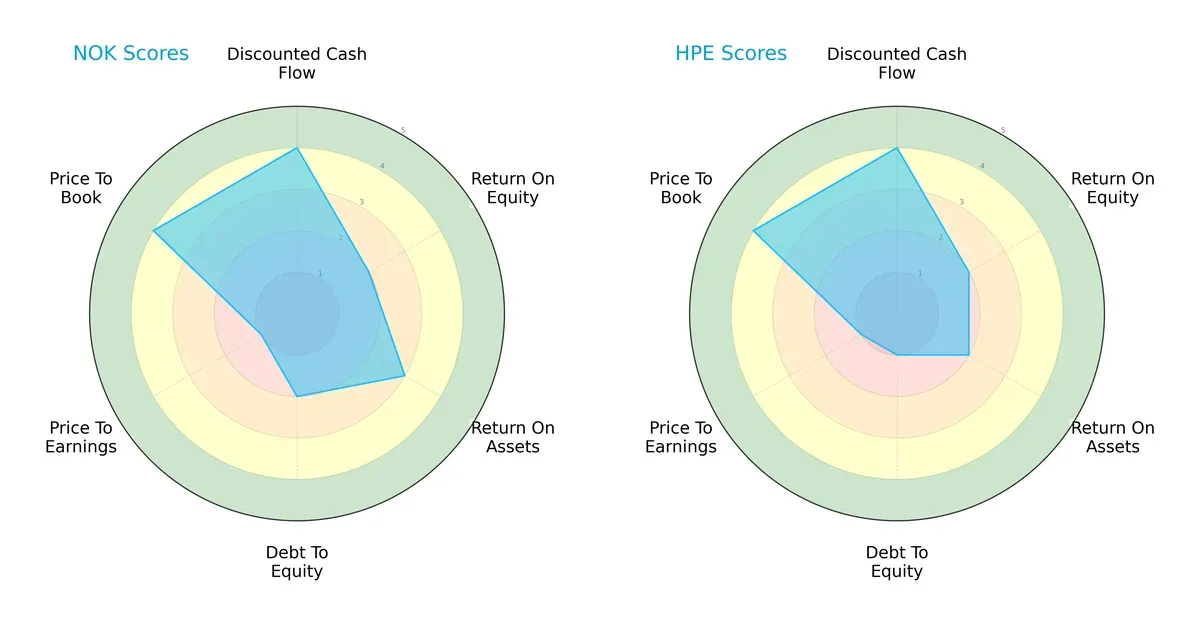

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Nokia Oyj and Hewlett Packard Enterprise Company:

Nokia exhibits a more balanced profile, scoring moderately across ROE (2) and ROA (3), with a favorable DCF (4) and P/B (4). HPE matches Nokia’s DCF but lags in ROA (2) and shows a very unfavorable debt-to-equity score (1), signaling higher financial risk. Both suffer from weak P/E scores (1). Nokia’s strength lies in asset utilization and conservative leverage; HPE relies heavily on cash flow but carries more debt risk.

Bankruptcy Risk: Solvency Showdown

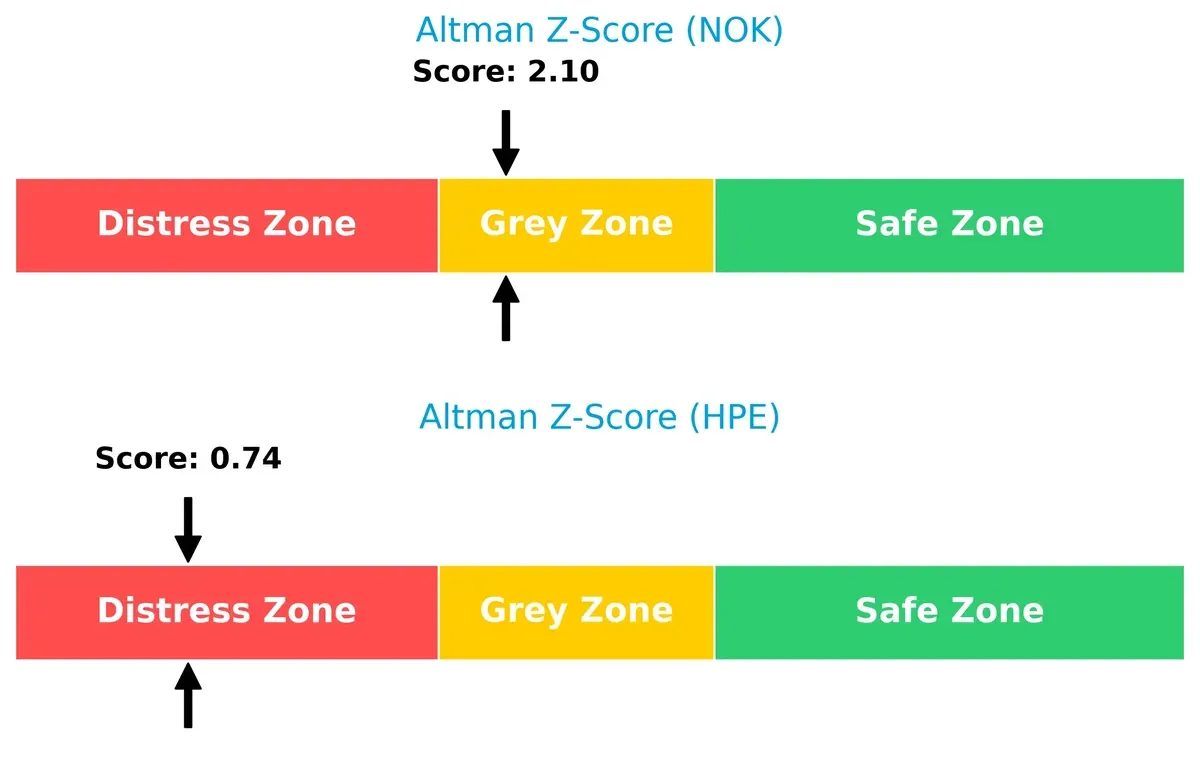

The Altman Z-Score delta highlights Nokia’s safer position versus HPE’s distress signal:

Nokia’s Z-Score at 2.10 places it in the grey zone, indicating moderate bankruptcy risk but relative stability. HPE’s 0.74 score signals significant distress, raising red flags about its long-term survival amid current market volatility.

Financial Health: Quality of Operations

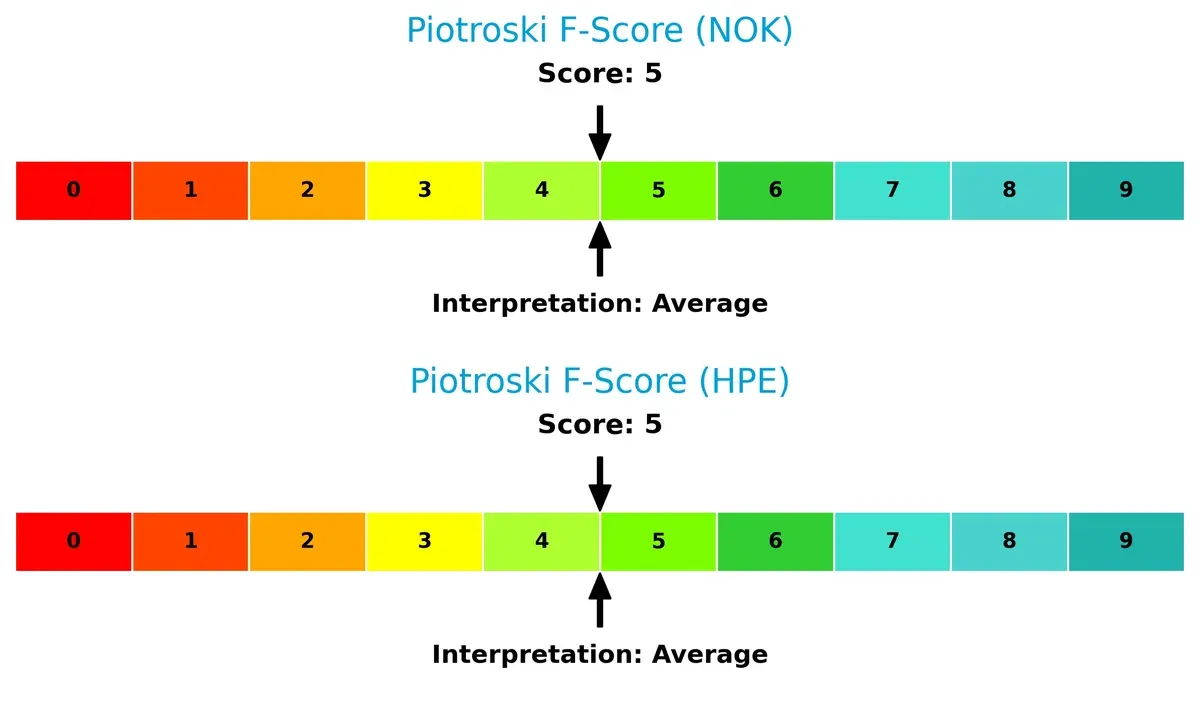

Both firms share identical Piotroski F-Scores, reflecting average financial health:

With a score of 5, Nokia and HPE demonstrate moderate operational quality. Neither firm displays peak financial strength, but no immediate red flags emerge. Investors should monitor internal metrics closely, especially given HPE’s higher leverage risks.

How are the two companies positioned?

This section dissects Nokia and HPE’s operational DNA by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to identify which business model offers the most resilient competitive advantage today.

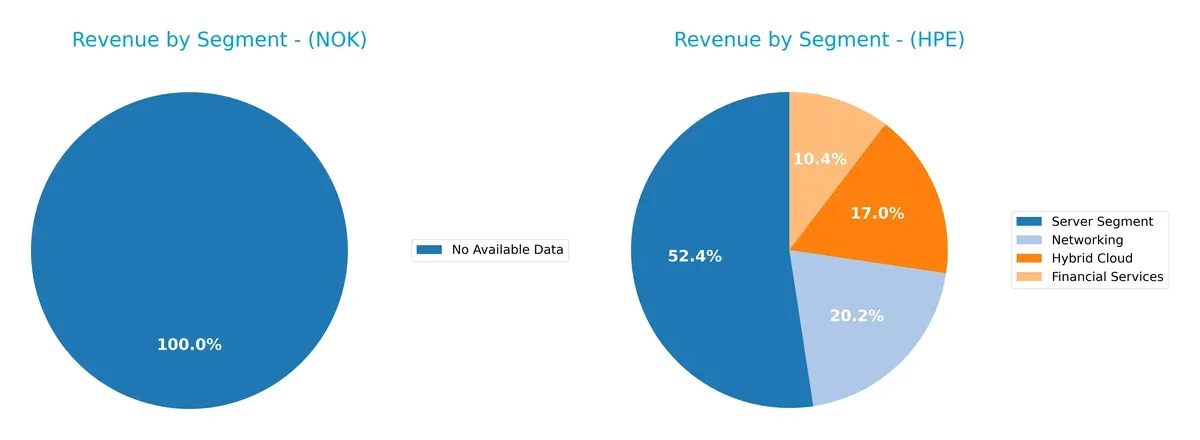

Revenue Segmentation: The Strategic Mix

This comparison dissects how Nokia Oyj and Hewlett Packard Enterprise Company diversify income streams and where their primary sector bets lie:

Nokia Oyj lacks available segmentation data, so I cannot evaluate its revenue mix. Hewlett Packard Enterprise pivots strongly on the Server Segment, which anchors $17.7B in 2025 revenue, dwarfing Financial Services ($3.5B) and Hybrid Cloud ($5.8B). HPE’s focus signals infrastructure dominance but also concentration risk, with less diversified streams compared to a typical diversified tech firm. This bet prioritizes compute power and data center ecosystems, shaping HPE’s competitive moat.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Nokia Oyj and Hewlett Packard Enterprise Company:

Nokia Oyj Strengths

- Favorable WACC and PB ratios support cost-effective capital use

- Strong current and quick ratios ensure liquidity

- Low debt-to-assets ratio and infinite interest coverage reduce financial risk

- High fixed asset turnover indicates efficient asset use

- Stable dividend yield shows shareholder returns

Hewlett Packard Enterprise Company Strengths

- Diverse revenue streams across Financial Services, Hybrid Cloud, Networking, and Servers

- Favorable WACC and PB ratios aid capital efficiency

- Growing revenues in Americas, Asia Pacific, and EMEA reflect global presence

- Favorable fixed asset turnover and dividend yield support operational efficiency and shareholder returns

Nokia Oyj Weaknesses

- Unfavorable net margin, ROE, and ROIC indicate weak profitability

- High P/E suggests overvaluation risk

- Neutral asset turnover may limit revenue generation

- Limited explicit product diversification data

Hewlett Packard Enterprise Company Weaknesses

- Very low net margin, ROE, and negative ROIC reflect profitability challenges

- Extremely high P/E ratio signals valuation concerns

- Low quick ratio and interest coverage show liquidity and solvency risks

- Unfavorable asset turnover may impair efficient use of assets

Nokia displays solid financial stability with conservative leverage and good liquidity but struggles with profitability metrics. HPE benefits from broad product diversification and global reach but faces significant profitability and liquidity weaknesses, which could constrain strategic flexibility.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true barrier protecting long-term profits from relentless competition erosion. Let’s dissect these two tech giants’ moats:

Nokia Oyj: Intangible Assets and Network Legacy

Nokia’s moat hinges on its vast patent portfolio and established 5G infrastructure. This yields stable margins, yet declining ROIC signals weakening capital efficiency. New cloud and virtualization services could rekindle moat strength in 2026.

Hewlett Packard Enterprise Company: Cost Advantage with Hybrid IT Focus

HPE leverages scale and integrated IT solutions, contrasting Nokia’s intangible asset focus. Despite revenue growth, its negative ROIC trend highlights value erosion. Expansion in intelligent edge and as-a-service models offers disruption potential.

Moat Clash: Intellectual Property vs. Cost Leadership

Both firms suffer shrinking ROICs, signaling value destruction. Nokia’s intangible asset moat is deeper but under pressure. HPE’s cost advantage faces tougher headwinds. Nokia is better positioned to defend market share amid tech evolution.

Which stock offers better returns?

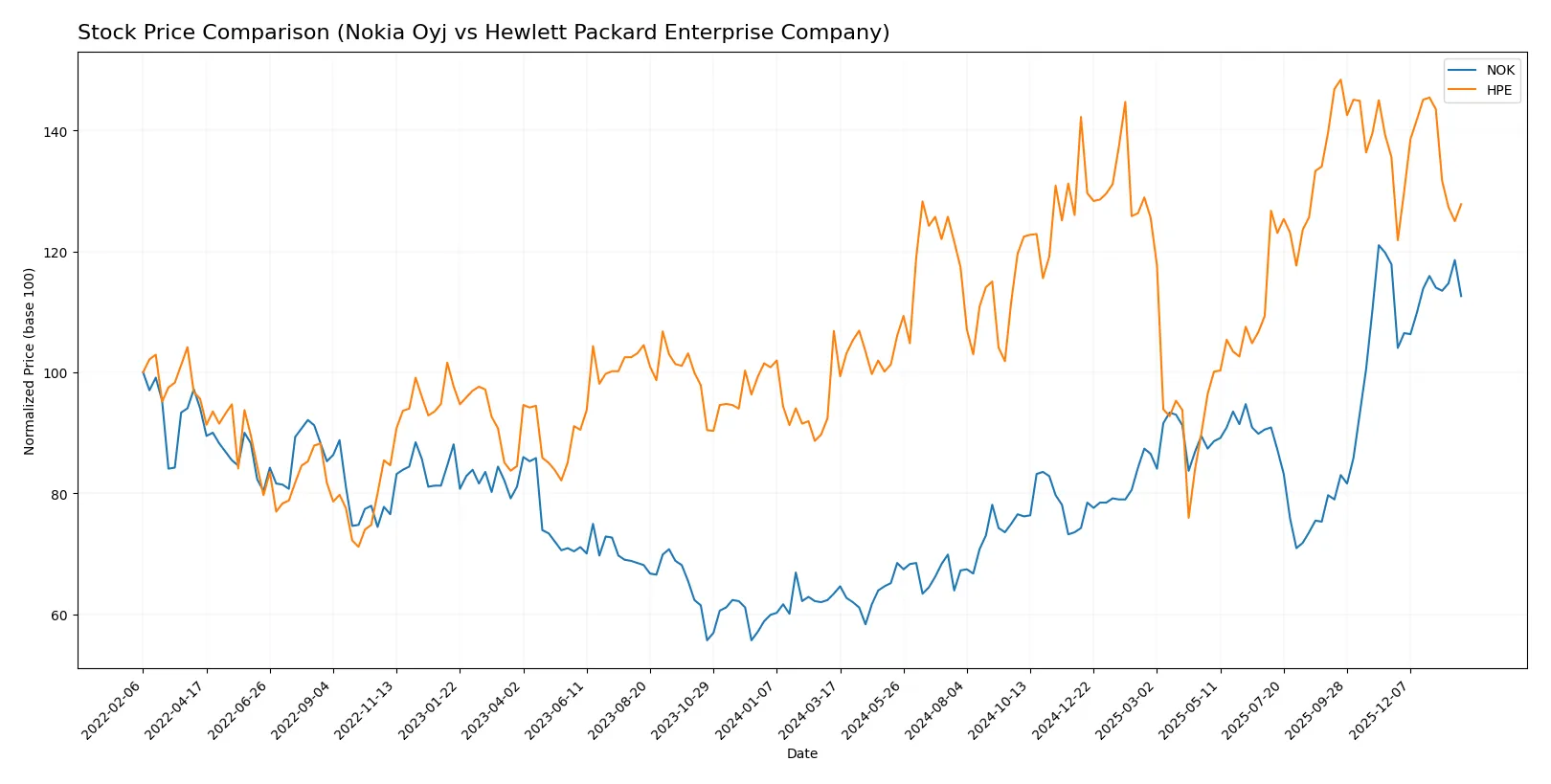

The past year shows stark price gains for Nokia, while Hewlett Packard Enterprise advances moderately amid shifting buyer dynamics.

Trend Comparison

Nokia Oyj’s stock rose 77.62% over 12 months, reflecting a bullish trend with accelerating momentum and a low volatility of 0.9. The price ranged from 3.33 to 6.91, showing strong upward movement.

Hewlett Packard Enterprise’s stock gained 19.62% over the same period, a bullish but decelerating trend. The price fluctuated between 12.79 and 24.99, with higher volatility at 2.72, indicating less stable gains.

Nokia delivered significantly higher returns with acceleration in its trend, outperforming Hewlett Packard Enterprise’s more moderate and decelerating price appreciation.

Target Prices

Analysts present a clear consensus on target prices for Nokia Oyj and Hewlett Packard Enterprise Company.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Nokia Oyj | 5 | 8.5 | 6.69 |

| Hewlett Packard Enterprise Company | 21 | 31 | 27.25 |

Analysts expect Nokia to trade modestly above its current price of 6.43, indicating moderate upside. Hewlett Packard Enterprise’s consensus target suggests a significant premium over its 21.54 stock price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize the latest institutional grades for Nokia Oyj and Hewlett Packard Enterprise Company:

Nokia Oyj Grades

This table details recent grade actions from major financial institutions covering Nokia Oyj.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-12-01 |

| Jefferies | Upgrade | Buy | 2025-10-28 |

| JP Morgan | Maintain | Overweight | 2025-10-24 |

| JP Morgan | Maintain | Overweight | 2025-07-29 |

| JP Morgan | Maintain | Overweight | 2025-02-21 |

| Craig-Hallum | Maintain | Buy | 2025-01-06 |

| JP Morgan | Upgrade | Overweight | 2024-12-09 |

| JP Morgan | Maintain | Neutral | 2024-10-21 |

| Northland Capital Markets | Maintain | Outperform | 2024-10-18 |

| Northland Capital Markets | Maintain | Outperform | 2024-09-04 |

Hewlett Packard Enterprise Company Grades

This table lists recent institutional ratings and changes for Hewlett Packard Enterprise Company.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Maintain | Buy | 2025-12-10 |

| BWG Global | Upgrade | Positive | 2025-11-24 |

| Morgan Stanley | Downgrade | Equal Weight | 2025-11-17 |

| Goldman Sachs | Maintain | Neutral | 2025-10-16 |

| Barclays | Maintain | Overweight | 2025-10-16 |

| UBS | Maintain | Neutral | 2025-10-16 |

| Citigroup | Maintain | Buy | 2025-10-06 |

| Goldman Sachs | Maintain | Neutral | 2025-10-02 |

| Citigroup | Maintain | Buy | 2025-09-04 |

| Goldman Sachs | Maintain | Neutral | 2025-09-04 |

Which company has the best grades?

Nokia Oyj generally holds stronger and more consistent upgrades toward Overweight and Buy ratings. Hewlett Packard Enterprise shows a mix of Neutral and Buy, with a recent downgrade from Morgan Stanley. Investors might interpret Nokia’s grades as more positive signals for potential outperformance.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Nokia Oyj

- Faces intense rivalry in 5G and cloud network solutions, with pressure on margins and innovation pace.

Hewlett Packard Enterprise Company

- Competes in diverse IT infrastructure and edge computing markets, struggling with slower growth and commoditization.

2. Capital Structure & Debt

Nokia Oyj

- Maintains low debt-to-equity ratio (0.25), favorable interest coverage, indicating strong financial stability.

Hewlett Packard Enterprise Company

- Higher leverage (D/E 0.91) and negative interest coverage reflect elevated financial risk and refinancing challenges.

3. Stock Volatility

Nokia Oyj

- Low beta (0.51) implies limited stock volatility and defensive positioning in tech sector.

Hewlett Packard Enterprise Company

- High beta (1.33) signals elevated market sensitivity and higher risk from macroeconomic swings.

4. Regulatory & Legal

Nokia Oyj

- Exposure to global telecom regulations and IP licensing disputes, with moderate compliance costs.

Hewlett Packard Enterprise Company

- Faces complex IT security, data privacy regulations, plus ongoing legal scrutiny in multiple jurisdictions.

5. Supply Chain & Operations

Nokia Oyj

- Global supply chain risks from semiconductor shortages and geopolitical tensions affecting network equipment.

Hewlett Packard Enterprise Company

- Operational risks from component sourcing and logistics disruptions impact server and storage product delivery.

6. ESG & Climate Transition

Nokia Oyj

- Committed to sustainable networks and reducing carbon footprint, but faces pressure on resource efficiency.

Hewlett Packard Enterprise Company

- ESG efforts underway, yet struggles to fully integrate sustainability in complex IT hardware lifecycle management.

7. Geopolitical Exposure

Nokia Oyj

- Significant exposure to EU and Asia-Pacific markets, vulnerable to trade disputes and regulatory shifts.

Hewlett Packard Enterprise Company

- US-based but global footprint exposes it to trade tensions, sanctions, and foreign policy risks.

Which company shows a better risk-adjusted profile?

Nokia’s strongest risk is fierce market competition in 5G and cloud, yet it benefits from solid capital structure and low volatility. HPE’s critical risk lies in financial leverage and operational vulnerabilities amid market sensitivity. Nokia shows a better risk-adjusted profile, supported by its lower beta and robust interest coverage. HPE’s Altman Z-score in the distress zone and negative interest coverage flag real financial distress concerns.

Final Verdict: Which stock to choose?

Nokia Oyj wields a robust balance sheet and solid cash conversion that underpin its operational resilience. Its superpower lies in financial stability and favorable liquidity ratios. The point of vigilance is its declining profitability and negative ROIC trend, signaling challenges ahead. Nokia suits portfolios focused on steady income with moderate risk tolerance.

Hewlett Packard Enterprise Company boasts a strategic moat centered on recurring revenue streams from enterprise clients. Its moat is less durable, with weaker cash flow and profitability metrics, but it offers a growth narrative supported by revenue expansion. Relative to Nokia, HPE carries higher financial risk, fitting better in a GARP (Growth at a Reasonable Price) portfolio seeking potential turnaround plays.

If you prioritize financial stability and value preservation, Nokia outshines with stronger liquidity and moderate valuation despite profitability pressures. However, if you seek growth potential and can tolerate financial volatility, HPE offers a compelling case with its enterprise focus and revenue momentum. Both stocks require cautious monitoring of their profitability and capital efficiency trajectories.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Nokia Oyj and Hewlett Packard Enterprise Company to enhance your investment decisions: