The Clorox Company (CLX) and Helen of Troy Limited (HELE) are two prominent players in the Household & Personal Products industry, each with distinct market approaches and innovation strategies. Clorox focuses on a broad portfolio spanning cleaning, wellness, and lifestyle brands, while Helen of Troy emphasizes diversified consumer products across health, beauty, and home segments. This comparison will help investors identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between The Clorox Company and Helen of Troy Limited by providing an overview of these two companies and their main differences.

The Clorox Company Overview

The Clorox Company is a global manufacturer and marketer of consumer and professional products, operating through four segments: Health and Wellness, Household, Lifestyle, and International. Its portfolio includes cleaning products, cat litter, bags and wraps, natural personal care, and food products. Founded in 1913 and headquartered in Oakland, California, Clorox primarily sells through mass retailers, grocery outlets, and e-commerce channels, positioning itself as a leader in household and personal products.

Helen of Troy Limited Overview

Helen of Troy Limited provides consumer products across Home & Outdoor, Health & Wellness, and Beauty segments, including food preparation tools, health monitoring devices, water filtration systems, and grooming products. Incorporated in 1968 and based in El Paso, Texas, Helen of Troy distributes through mass merchandisers, drugstores, warehouse clubs, and e-commerce retailers under diverse brands like OXO, Hydro Flask, Vicks, and Revlon, serving markets worldwide.

Key similarities and differences

Both companies operate in the Household & Personal Products industry and serve global markets with diversified product ranges spanning health, wellness, and household categories. Clorox emphasizes cleaning, personal care, and food products with a strong international presence, while Helen of Troy focuses on home, health, and beauty products with a brand-driven portfolio. Clorox is larger by market cap and employee count, reflecting broader scale and distribution channels compared to Helen of Troy’s more specialized brand segmentation.

Income Statement Comparison

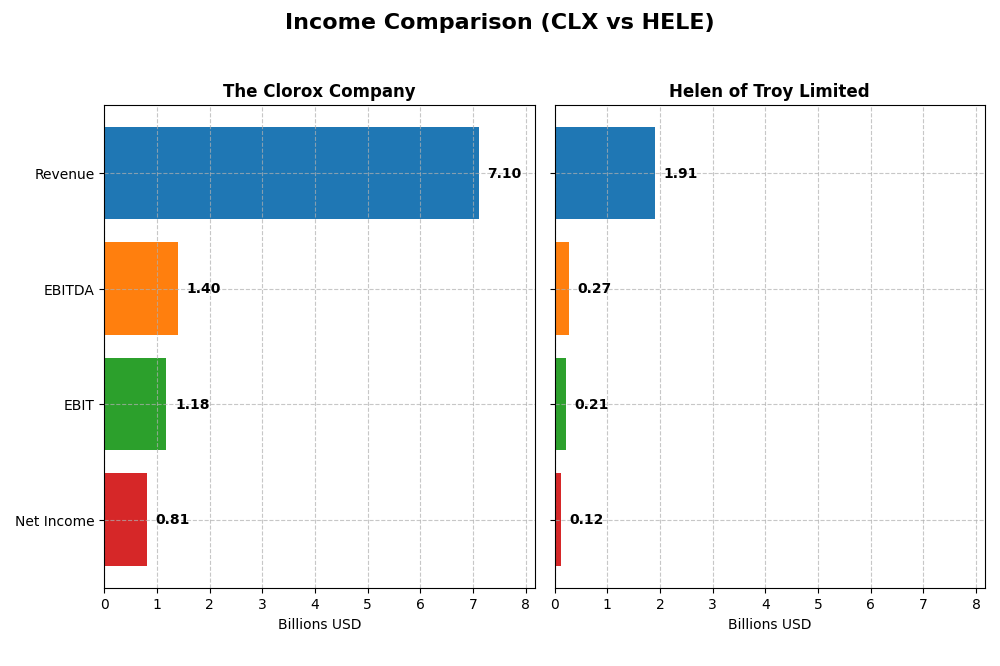

This table compares key income statement metrics for The Clorox Company and Helen of Troy Limited for the most recent fiscal year available.

| Metric | The Clorox Company (CLX) | Helen of Troy Limited (HELE) |

|---|---|---|

| Market Cap | 13.0B | 431M |

| Revenue | 7.10B | 1.91B |

| EBITDA | 1.40B | 269M |

| EBIT | 1.18B | 214M |

| Net Income | 810M | 124M |

| EPS | 6.56 | 5.38 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

The Clorox Company

The Clorox Company’s revenue showed minor fluctuations, slightly declining by 3.23% over 2021-2025, while net income grew 14.08%. Margins improved overall, with gross margin at 44.96% and net margin rising to 11.4% in 2025. The latest fiscal year saw marginal revenue growth of 0.16%, but substantial increases in EBIT and net margin indicate enhanced profitability and operational efficiency.

Helen of Troy Limited

Helen of Troy Limited experienced a revenue decline of 9.11% over the five-year span, with net income shrinking by over 51%. Despite maintaining a favorable gross margin near 48%, EBIT and net margins fell to 11.19% and 6.49% respectively in 2025. The most recent year reflected declines across revenue, gross profit, EBIT, and net margin, indicating contraction and reduced profitability.

Which one has the stronger fundamentals?

The Clorox Company demonstrates stronger fundamentals with mostly favorable margin improvements, net income growth, and operational efficiency gains despite slight revenue stagnation. Conversely, Helen of Troy shows unfavorable trends, with declining revenue, shrinking net income, and deteriorating margins. Clorox’s income statement profile appears more resilient and profitable over the reviewed period.

Financial Ratios Comparison

The table below compares key financial ratios for The Clorox Company (CLX) and Helen of Troy Limited (HELE) based on their most recent fiscal year data for 2025.

| Ratios | The Clorox Company (CLX) | Helen of Troy Limited (HELE) |

|---|---|---|

| ROE | 2.52% | 7.35% |

| ROIC | 24.14% | 5.32% |

| P/E | 18.31 | 10.25 |

| P/B | 46.20 | 0.75 |

| Current Ratio | 0.84 | 2.00 |

| Quick Ratio | 0.57 | 1.03 |

| D/E | 8.97 | 0.57 |

| Debt-to-Assets | 51.79% | 30.74% |

| Interest Coverage | 11.67 | 2.75 |

| Asset Turnover | 1.28 | 0.61 |

| Fixed Asset Turnover | 4.44 | 5.23 |

| Payout Ratio | 74.32% | 0% |

| Dividend Yield | 4.06% | 0% |

Interpretation of the Ratios

The Clorox Company

The Clorox Company shows mostly favorable financial ratios, with strong net margin at 11.4% and impressive returns on equity (252.34%) and invested capital (24.14%). However, liquidity ratios are weak, with a current ratio of 0.84 and high debt-to-equity at 8.97, posing potential solvency concerns. Dividend yield is solid at 4.06%, supported by consistent payouts and share buyback programs, though coverage by free cash flow is negative, indicating distribution risks.

Helen of Troy Limited

Helen of Troy presents mixed ratios: moderate net margin at 6.49%, but weak return on equity of 7.35%. Liquidity is strong with a current ratio of 2.0 and a quick ratio above 1.0, while debt levels are moderate. The company does not pay dividends, likely prioritizing reinvestment or growth strategies. Share buybacks are not mentioned, reflecting a conservative capital return approach given the absence of dividend yield.

Which one has the best ratios?

The Clorox Company holds the advantage with a higher proportion of favorable ratios (57.14%) and superior profitability metrics, despite some solvency and liquidity weaknesses. Helen of Troy has fewer favorable ratios (42.86%) and weaker returns, though it maintains better liquidity. Overall, Clorox’s profitability and dividend yield weigh more positively against Helen of Troy’s mixed performance.

Strategic Positioning

This section compares the strategic positioning of The Clorox Company and Helen of Troy Limited, including market position, key segments, and exposure to technological disruption:

The Clorox Company

- Large market cap of 13B with moderate competitive pressure in household products sector.

- Operates through four segments: Health & Wellness, Household, Lifestyle, International.

- Exposure to disruption is moderate with focus on traditional cleaning, personal care, and international markets.

Helen of Troy Limited

- Smaller market cap of 431M, competing in diverse consumer products markets.

- Operates three segments: Home & Outdoor, Health & Wellness, and Beauty.

- Faces exposure due to diverse product categories including health devices and beauty appliances.

The Clorox Company vs Helen of Troy Limited Positioning

Clorox shows a diversified segment approach with global reach and established brands, while Helen of Troy has a more concentrated segment focus with health, beauty, and home products. Clorox’s scale offers broad market coverage, Helen of Troy targets niche consumer categories.

Which has the best competitive advantage?

The Clorox Company demonstrates a very favorable moat with growing ROIC and value creation, indicating a durable competitive advantage. Helen of Troy shows very unfavorable moat metrics with declining ROIC, suggesting value destruction and weaker competitive positioning.

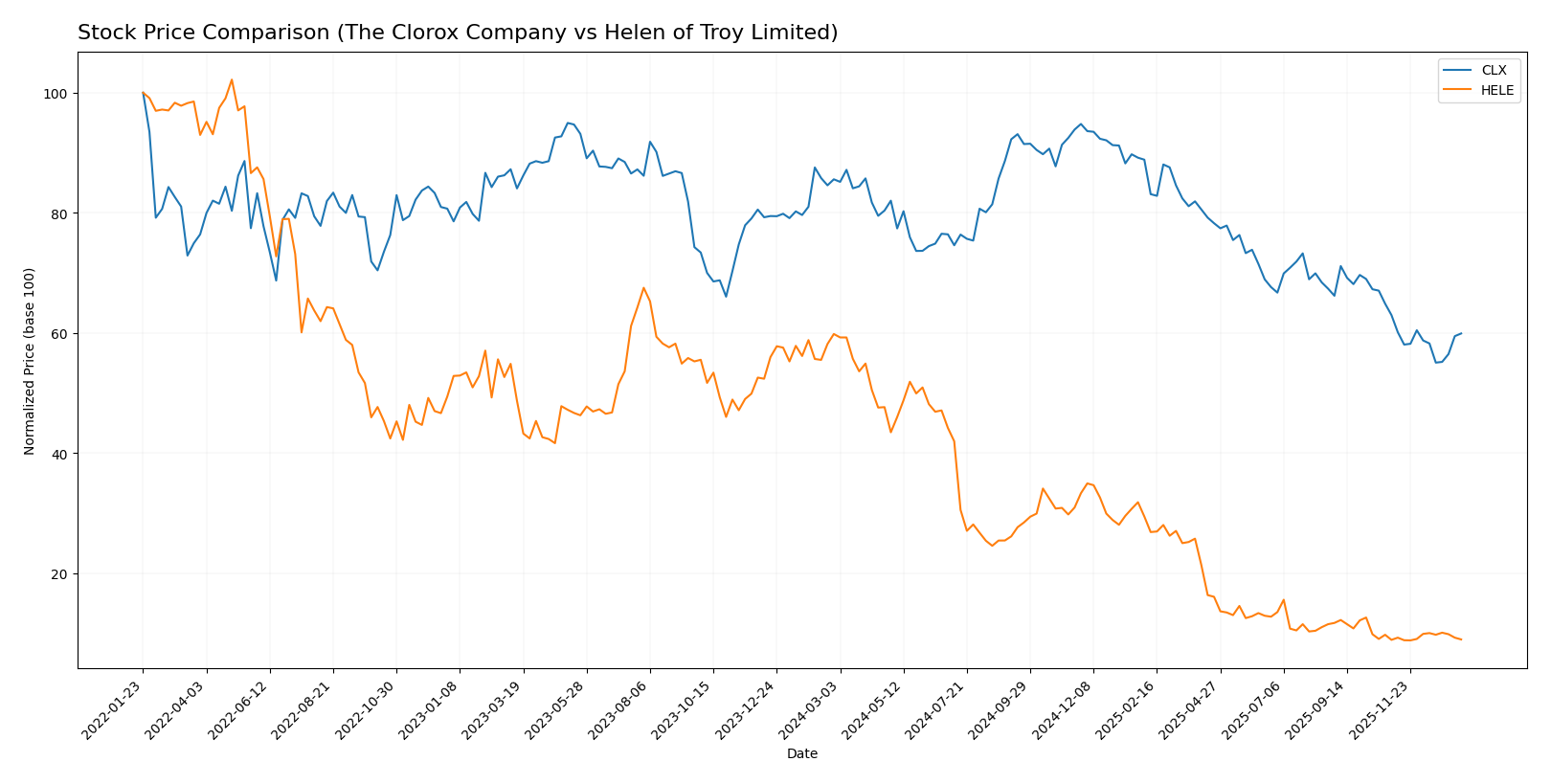

Stock Comparison

The past year showed significant bearish trends for both The Clorox Company and Helen of Troy Limited, with notable price declines and varying volume dynamics shaping their trading patterns.

Trend Analysis

The Clorox Company (CLX) experienced a -30.01% price decline over the past 12 months, indicating a bearish trend with deceleration. Price volatility was elevated with a 19.09 std deviation, peaking at 169.3 and bottoming at 98.31.

Helen of Troy Limited (HELE) faced a sharper -85.04% drop over the same period, confirming a bearish trend with accelerating decline. Volatility was higher at a 31.1 std deviation, with prices ranging from 125.57 to 18.45.

Comparatively, both stocks were bearish, but CLX’s performance was relatively stronger than HELE’s, delivering a less severe market decline over the last year.

Target Prices

The current consensus among analysts shows clear target price ranges for both The Clorox Company and Helen of Troy Limited.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Clorox Company | 152 | 94 | 118.33 |

| Helen of Troy Limited | 22 | 22 | 22 |

Analysts expect The Clorox Company’s stock to trade moderately higher than its current price of 106.98 USD, while Helen of Troy’s target consensus aligns exactly with its current price of 18.78 USD, indicating limited upside.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for The Clorox Company and Helen of Troy Limited:

Rating Comparison

CLX Rating

- Rating: B- indicating a very favorable overall status

- Discounted Cash Flow Score: 5, rated very favorable

- ROE Score: 1, rated very unfavorable

- ROA Score: 5, rated very favorable

- Debt To Equity Score: 1, rated very unfavorable

- Overall Score: 3, rated moderate

HELE Rating

- Rating: B indicating a very favorable overall status

- Discounted Cash Flow Score: 5, rated very favorable

- ROE Score: 1, rated very unfavorable

- ROA Score: 1, rated very unfavorable

- Debt To Equity Score: 4, rated favorable

- Overall Score: 3, rated moderate

Which one is the best rated?

Helen of Troy holds a slightly better rating (B) compared to Clorox (B-). Although both share similar overall scores and unfavorable ROE scores, Helen of Troy’s stronger debt-to-equity score improves its financial stability rating.

Scores Comparison

The comparison of scores between The Clorox Company and Helen of Troy Limited is as follows:

CLX Scores

- Altman Z-Score: 3.27, indicating financial safety in the safe zone.

- Piotroski Score: 5, representing an average financial strength.

HELE Scores

- Altman Z-Score: 1.10, indicating financial distress in the distress zone.

- Piotroski Score: 3, representing very weak financial strength.

Which company has the best scores?

Based on the provided data, The Clorox Company has higher Altman Z-Score and Piotroski Score values, indicating stronger financial stability and health compared to Helen of Troy Limited.

Grades Comparison

Here is the comparison of recent reliable grades for The Clorox Company and Helen of Troy Limited:

The Clorox Company Grades

The following table summarizes recent grades from major financial institutions for The Clorox Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2026-01-08 |

| Goldman Sachs | Maintain | Sell | 2026-01-07 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

| JP Morgan | Maintain | Neutral | 2025-11-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-04 |

| Citigroup | Maintain | Neutral | 2025-11-04 |

| JP Morgan | Maintain | Neutral | 2025-10-10 |

| Citigroup | Maintain | Neutral | 2025-10-09 |

The overall trend for The Clorox Company shows a consistent hold or neutral stance, with no upgrades or downgrades across multiple reputable firms.

Helen of Troy Limited Grades

Below are recent grades issued by recognized financial analysts for Helen of Troy Limited:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-09 |

| Canaccord Genuity | Maintain | Hold | 2026-01-09 |

| Canaccord Genuity | Maintain | Hold | 2026-01-06 |

| UBS | Maintain | Neutral | 2025-10-10 |

| Canaccord Genuity | Maintain | Hold | 2025-10-10 |

| UBS | Maintain | Neutral | 2025-10-02 |

| Canaccord Genuity | Downgrade | Hold | 2025-07-11 |

| UBS | Maintain | Neutral | 2025-07-11 |

| Canaccord Genuity | Maintain | Buy | 2025-07-07 |

| Canaccord Genuity | Maintain | Buy | 2025-04-25 |

Helen of Troy Limited’s grades show a mostly stable hold or neutral rating, with occasional buy ratings and one downgrade from buy to hold.

Which company has the best grades?

Both companies predominantly receive hold or neutral grades, but Helen of Troy Limited has shown sporadic buy ratings compared to The Clorox Company’s consistent hold/neutral stance. This may indicate slightly more optimism from analysts towards Helen of Troy, which could influence investor sentiment differently.

Strengths and Weaknesses

Below is a comparative overview of The Clorox Company (CLX) and Helen of Troy Limited (HELE) based on key investment criteria:

| Criterion | The Clorox Company (CLX) | Helen of Troy Limited (HELE) |

|---|---|---|

| Diversification | Broad product portfolio across Health, Household, International, Lifestyle segments totaling over $8.7B revenue in 2025; well spread risk | Focused mainly on Beauty & Wellness and Home & Outdoor segments with approx. $1.9B revenue in 2025; less diversified |

| Profitability | Strong profitability with 11.4% net margin, ROIC 24.14%, and favorable ROE of 252.34%; consistent value creation | Moderate profitability: 6.49% net margin, ROIC 5.32%, and low ROE 7.35%; currently value destructive |

| Innovation | Demonstrates durable competitive advantage and growing ROIC trend, indicating effective innovation and efficiency | Declining ROIC and negative value creation suggest innovation challenges and weaker competitive edge |

| Global presence | Solid international revenue (~$1.1B) within diversified segments, supporting global footprint | Limited international exposure; mainly North American focus |

| Market Share | Strong market presence with stable asset turnover (1.28) and fixed asset turnover (4.44) | Lower asset turnover (0.61) but favorable fixed asset turnover (5.23), indicating operational focus |

Key takeaways: The Clorox Company shows a robust and diversified business with strong profitability and a durable moat, making it a safer investment choice. Helen of Troy faces profitability and growth challenges, signaling higher risk despite some operational strengths.

Risk Analysis

Below is a comparative risk table for The Clorox Company (CLX) and Helen of Troy Limited (HELE) based on the latest 2025 data:

| Metric | The Clorox Company (CLX) | Helen of Troy Limited (HELE) |

|---|---|---|

| Market Risk | Low (Beta 0.575 indicates lower volatility) | Moderate (Beta 0.78 suggests moderate volatility) |

| Debt level | High (Debt to assets 51.79%, D/E 8.97 unfavorable) | Moderate (Debt to assets 30.74%, D/E 0.57 neutral) |

| Regulatory Risk | Moderate (Consumer products market, some exposure) | Moderate (Global consumer markets, regulatory complexity) |

| Operational Risk | Moderate (Global supply chain and brand portfolio complexity) | Moderate (Diverse product lines and geographic exposure) |

| Environmental Risk | Moderate (Household products with potential environmental concerns) | Low to Moderate (Less exposure to chemicals, more focus on consumer devices) |

| Geopolitical Risk | Moderate (International sales present some geopolitical exposure) | Moderate (Global sales with emerging market exposure) |

The Clorox Company faces its most impactful risk from its high debt levels, which could affect financial flexibility despite strong profitability and liquidity challenges. Helen of Troy’s highest risk lies in its financial distress signals, including a low Altman Z-Score and very weak Piotroski score, indicating vulnerability despite lower leverage. Market risk for both is moderate to low due to their consumer defensive sector positioning. Investors should weigh Clorox’s leverage risk against Helen of Troy’s financial health concerns when considering risk management.

Which Stock to Choose?

The Clorox Company (CLX) shows a mixed income evolution with slight revenue decline but strong profitability improvements, including a favorable net margin of 11.4%. Its financial ratios are predominantly favorable, notably ROE at 252% and ROIC at 24.14%, despite elevated debt indicators and liquidity concerns. The company holds a very favorable rating and demonstrates a very favorable moat with growing ROIC exceeding WACC.

Helen of Troy Limited (HELE) experienced overall unfavorable income trends with declining revenue and profitability, reflected in a moderate net margin of 6.49%. Its financial ratios present a slightly favorable profile with strong liquidity and valuation metrics, yet low returns and weakening profitability. HELE’s rating is also very favorable, but its moat evaluation is very unfavorable due to declining ROIC below WACC.

Investors focused on value creation and financial durability may find CLX’s strong moat and profitability metrics more appealing, while those prioritizing liquidity and lower valuation multiples might see HELE as potentially suitable. The choice could depend on tolerance for financial leverage and performance consistency.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Clorox Company and Helen of Troy Limited to enhance your investment decisions: