Home > Comparison > Real Estate > WELL vs DOC

The strategic rivalry between Welltower Inc. and Healthpeak Properties shapes the healthcare real estate sector’s evolution. Welltower operates as a capital-intensive REIT, focusing on seniors housing and post-acute communities across high-growth markets. In contrast, Healthpeak integrates ownership with active operations in healthcare discovery and delivery properties. This head-to-head pits scale and specialization against integrated development. This analysis aims to identify which business model offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

Welltower Inc. and Healthpeak Properties, Inc. shape the healthcare REIT landscape with distinct market approaches.

Welltower Inc.: Leader in Seniors Housing Infrastructure

Welltower Inc. dominates the healthcare real estate sector by investing in seniors housing and post-acute care facilities across the US, Canada, and the UK. Its core revenue stems from leasing these properties to leading care operators. In 2026, the company emphasizes scaling innovative care delivery models, reinforcing its role in transforming healthcare infrastructure.

Healthpeak Properties, Inc.: Integrated Healthcare Real Estate Developer

Healthpeak Properties integrates ownership, operation, and development of healthcare real estate, focusing on high-quality facilities for healthcare discovery and delivery. It generates income through leasing and managing these assets. The firm’s 2026 strategy centers on maintaining a diversified portfolio that supports cutting-edge healthcare services and operational excellence.

Strategic Collision: Similarities & Divergences

Both companies compete in the healthcare REIT space but diverge in approach: Welltower prioritizes partnerships to scale care models, while Healthpeak emphasizes integrated development and operations. Their battleground lies in securing premium healthcare property tenants. Welltower’s broad geographic footprint contrasts with Healthpeak’s focused operational model, offering distinct risk and growth profiles for investors.

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Welltower Inc. (WELL) | Healthpeak Properties, Inc. (DOC) |

|---|---|---|

| Revenue | 7.85B | 2.70B |

| Cost of Revenue | 4.83B | 1.07B |

| Operating Expenses | 1.88B | 1.15B |

| Gross Profit | 3.02B | 1.63B |

| EBITDA | 2.78B | 1.61B |

| EBIT | 1.10B | 554M |

| Interest Expense | 574M | 280M |

| Net Income | 952M | 242M |

| EPS | 1.58 | 0.36 |

| Fiscal Year | 2024 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable operation amid evolving market challenges.

Welltower Inc. Analysis

Welltower’s revenue surged from 4.6B in 2020 to 7.9B in 2024, reflecting robust growth momentum. Net income fluctuated, peaking near 953M in 2024 but with a slight overall decline since 2020. The company maintains healthy gross margins at 38.5%, with net margins over 12%, signaling strong cost control and operational efficiency in the latest year.

Healthpeak Properties, Inc. Analysis

Healthpeak’s revenue grew steadily from 1.9B in 2021 to 2.8B in 2025, but net income plunged dramatically to 71M in 2025 from over 500M in prior years. Gross margins remain favorable at 22.5%, but net margins compressed to just 2.5%, reflecting increasing interest expenses and weakening profitability. The recent decline in earnings warns of operational or financial stress.

Margin Strength vs. Earnings Durability

Welltower clearly outperforms Healthpeak with superior revenue growth and consistently stronger margins. Despite a slight dip in net income over the period, Welltower’s operational efficiency and margin expansion demonstrate resilience. Healthpeak’s sharp profit decline and thin net margins expose vulnerability to interest costs and market pressures. Welltower’s profile offers a more attractive combination of scale and profitability for investors prioritizing durable earnings.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Welltower Inc. (WELL) | Healthpeak Properties, Inc. (DOC) |

|---|---|---|

| ROE | 3.0% | 9.5% |

| ROIC | 2.3% | 21.4% |

| P/E | 79.9 | 156.9 |

| P/B | 2.38 | 1.49 |

| Current Ratio | 5.28 | 1.09 |

| Quick Ratio | 5.28 | 1.09 |

| D/E | 0.52 | 1.39 |

| Debt-to-Assets | 32.8% | 51.3% |

| Interest Coverage | 2.00 | 1.78 |

| Asset Turnover | 0.15 | 0.14 |

| Fixed Asset Turnover | 6.54 | 6.85 |

| Payout ratio | 162.4% | 1190.1% |

| Dividend yield | 2.03% | 7.59% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence that shape investor decisions in subtle but crucial ways.

Welltower Inc.

Welltower posts a modest 3% ROE and 12.1% net margin, indicating restrained profitability against a lofty P/E of nearly 80 that signals an expensive valuation. Its dividend yield of 2.03% reflects a shareholder-friendly return, supported by a solid quick ratio. However, low returns on capital and stretched asset turnover suggest operational challenges.

Healthpeak Properties, Inc.

Healthpeak shows a weaker 0.95% ROE and a slim 2.5% net margin, yet exhibits robust 21.4% ROIC that outpaces its 6.34% WACC, highlighting effective capital deployment. The stock trades at a high P/E of 157, marking it as highly stretched. A generous 7.59% dividend yield offers strong income, offsetting other valuation concerns.

Premium Valuation vs. Operational Safety

Welltower’s higher profitability and moderate dividend contrast with Healthpeak’s superior capital efficiency but stretched valuation. Welltower balances risk and reward for investors seeking stability, while Healthpeak suits those prioritizing capital returns despite elevated price risk. Investors should align choice with their risk appetite.

Which one offers the Superior Shareholder Reward?

I observe Welltower Inc. (WELL) delivers a modest 2.03% dividend yield with a payout ratio of 1.62x, signaling a slightly aggressive dividend policy relative to free cash flow. WELL supplements income with steady buybacks, supporting total returns. Healthpeak Properties, Inc. (DOC) offers a higher 7.59% dividend yield but with an unsustainably high payout ratio near 11.9x, risking future cuts. DOC’s buybacks are less intense, emphasizing income over capital return. I see WELL’s balanced mix of dividends and buybacks as more sustainable, providing superior total shareholder reward in 2026.

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Welltower Inc. and Healthpeak Properties, Inc.:

Welltower shows strength in return on assets (score 3) and debt-to-equity management (score 3), indicating balanced operational efficiency and moderate leverage. Healthpeak leads in discounted cash flow (score 4), signaling better future cash flow prospects but suffers from high leverage risk (debt-to-equity score 1). Both struggle with valuation metrics (P/E and P/B scores of 1 or 2), reflecting market skepticism. Overall, Welltower offers a more balanced profile, while Healthpeak depends on its DCF advantage amid financial risk.

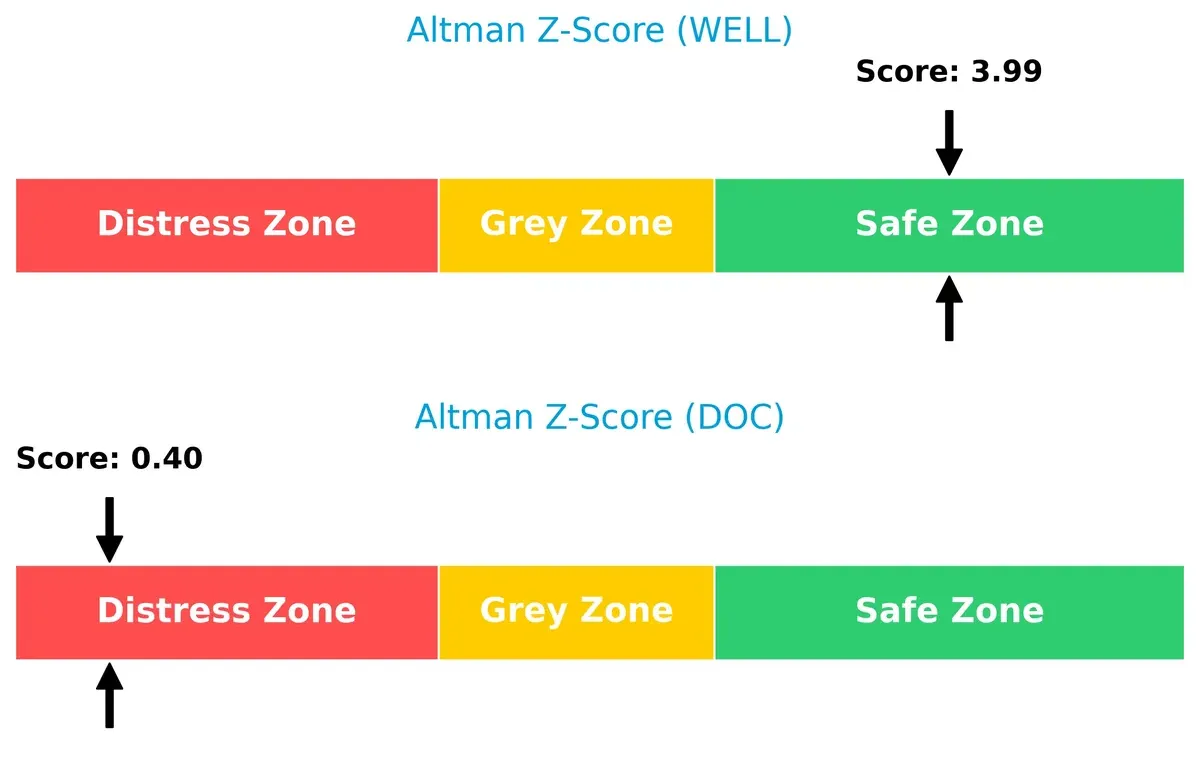

Bankruptcy Risk: Solvency Showdown

Welltower’s Altman Z-Score at 3.99 places it firmly in the safe zone, signaling strong long-term survival prospects. Healthpeak’s 0.40 lies deep in the distress zone, warning of high bankruptcy risk in this cycle:

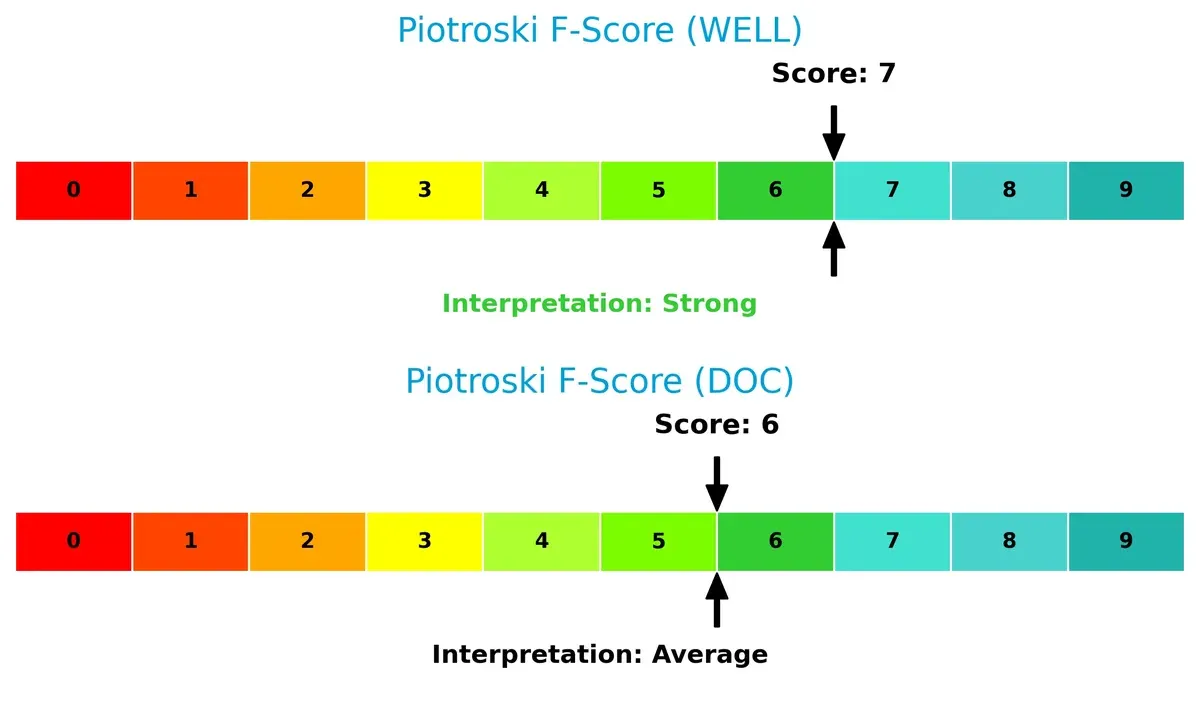

Financial Health: Quality of Operations

Welltower’s Piotroski F-Score of 7 reflects solid financial health and operational quality. Healthpeak’s score of 6 is decent but flags some internal weaknesses relative to Welltower:

How are the two companies positioned?

This section dissects WELL and DOC’s operational DNA by comparing revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to reveal which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This comparison dissects how Welltower Inc. and Healthpeak Properties, Inc. diversify their income streams and where their primary sector bets lie:

Welltower leans heavily on Senior Housing – Operating at $6.0B, anchoring its revenue with additional smaller streams like Outpatient Medical ($802M) and Triple Net ($789M). Healthpeak presents a more balanced spread with Outpatient Medical Buildings leading at $1.27B, followed by Lab ($860M) and Senior Housing ($604M). Welltower’s concentration risks contrast with Healthpeak’s diversified approach, which mitigates sector volatility and leverages multiple healthcare infrastructure pillars.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Welltower Inc. and Healthpeak Properties, Inc.:

Welltower Inc. Strengths

- Diverse revenue streams including Senior Housing and Outpatient Medical

- Strong quick ratio at 5.28 indicating liquidity

- Favorable fixed asset turnover at 6.54

- Moderate debt-to-assets ratio at 32.83%

- Dividend yield at 2.03% supports income investors

Healthpeak Properties, Inc. Strengths

- High ROIC at 21.39% well above WACC at 6.34%

- Favorable price-to-book at 1.49 signals valuation support

- Solid quick ratio at 1.09

- Favorable fixed asset turnover at 6.85

- Higher dividend yield neutral at 7.59%

Welltower Inc. Weaknesses

- Low ROE at 2.98% below sector benchmarks

- Net margin stronger but PE at 79.85 is elevated

- Current ratio at 5.28 unusually high, may signal inefficient asset use

- Interest coverage low at 1.91 raises debt servicing concerns

- Asset turnover low at 0.15

Healthpeak Properties, Inc. Weaknesses

- Net margin very weak at 2.53%

- ROE at 0.95% indicates poor profitability

- High debt-to-equity at 1.39 and debt-to-assets at 51.34% increase financial risk

- Interest coverage low at 1.78

- PE extremely high at 156.87 raises valuation risk

- Asset turnover low at 0.14

Both companies show slightly unfavorable overall ratio profiles. Welltower’s strengths in liquidity and moderate leverage contrast with Healthpeak’s superior capital efficiency and valuation metrics. Each faces profitability and debt servicing challenges that must inform their strategic priorities.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield protecting long-term profits from relentless competitive erosion in healthcare REITs:

Welltower Inc.: Geographic Reach and Strategic Partnerships

Welltower’s moat relies on diversified, high-growth markets in the US, UK, and Canada. It shows stable margins but struggles with value destruction, signaling risks in capital allocation. New care delivery models could deepen this moat if executed well.

Healthpeak Properties, Inc.: Operational Efficiency and Focused Asset Mix

Healthpeak’s moat centers on efficient capital use and a focused portfolio across labs, outpatient, and senior housing. Unlike Welltower, it creates strong value with growing ROIC, indicating superior competitive positioning and expansion potential despite margin pressures.

Geographic Diversification vs. Capital Efficiency: Which Moat Holds Stronger?

Healthpeak’s wide moat, fueled by 15%+ ROIC above WACC and a steep growth trend, outperforms Welltower’s geographic scale with negative value creation. Healthpeak is better equipped to defend and grow market share amid sector challenges.

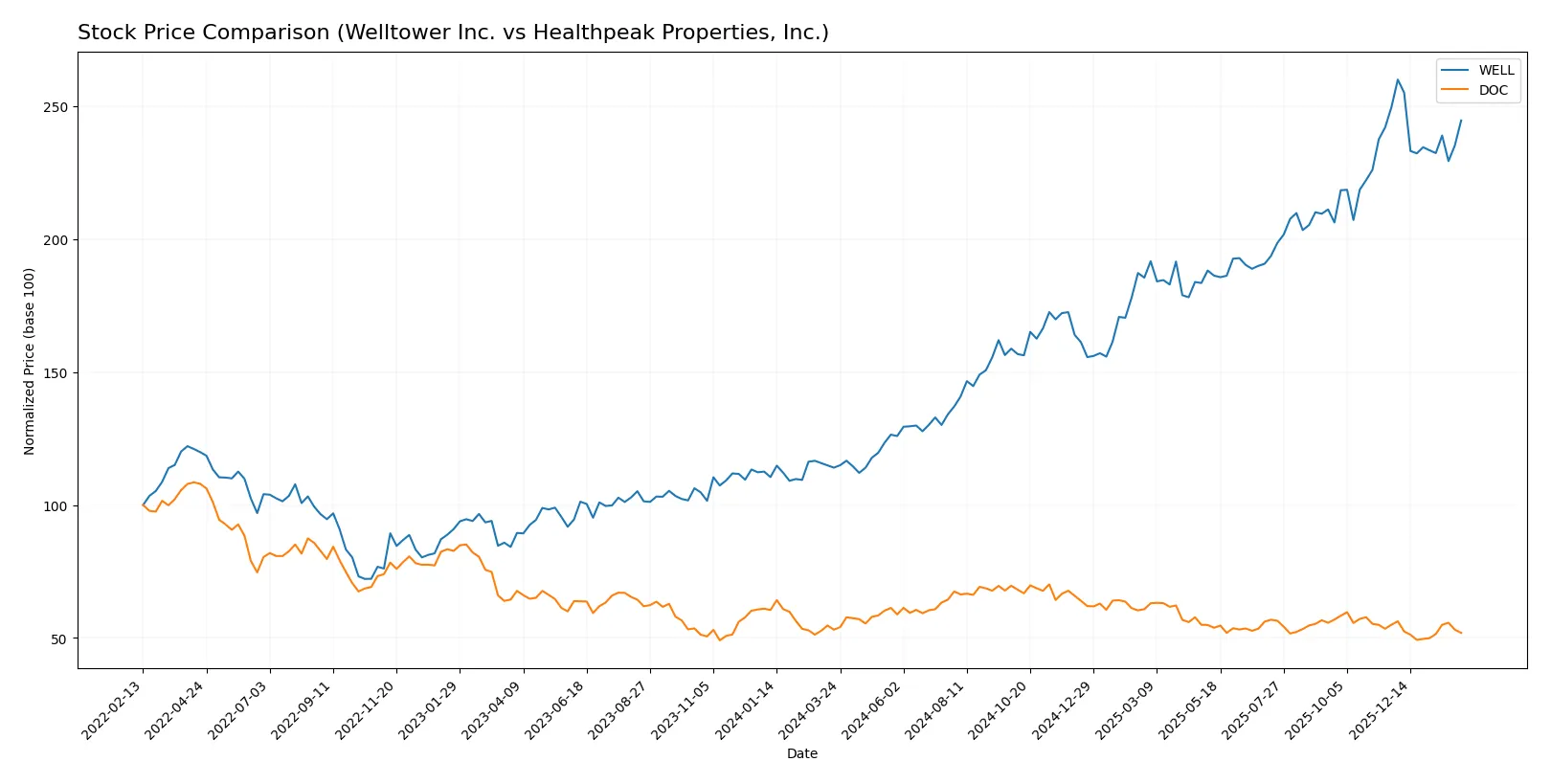

Which stock offers better returns?

The past year’s stock performance reveals stark contrasts: Welltower Inc. surged with strong gains but slowing momentum, while Healthpeak Properties, Inc. faced a steady decline with accelerating losses.

Trend Comparison

Welltower Inc. shows a bullish trend over the past 12 months, with a 114.47% price increase and decelerating upward momentum. The stock reached a high of 208.22 and a low of 89.79.

Healthpeak Properties, Inc. exhibits a bearish trend with a 2.26% price decline over the same period. The downward trend accelerates, with a high of 22.76 and a low of 15.99.

Comparing both, Welltower Inc. delivered the highest market performance, outperforming Healthpeak Properties, Inc. by a wide margin.

Target Prices

Analysts present a clear consensus on target prices for Welltower Inc. and Healthpeak Properties, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Welltower Inc. | 182 | 246 | 212.56 |

| Healthpeak Properties, Inc. | 17 | 21 | 18.71 |

The consensus targets for WELL imply upside potential from the current price of $195.92, suggesting moderate growth expectations. DOC’s target prices also indicate upside from its $16.85 level, reflecting analyst confidence in its healthcare real estate niche.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Welltower Inc. Grades

This table shows recent grades assigned by reputable financial institutions for Welltower Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Downgrade | Equal Weight | 2024-10-01 |

| Scotiabank | Maintain | Sector Outperform | 2024-09-23 |

| Evercore ISI Group | Maintain | In Line | 2024-09-16 |

| Evercore ISI Group | Maintain | In Line | 2024-08-28 |

| Deutsche Bank | Maintain | Buy | 2024-08-21 |

| RBC Capital | Maintain | Sector Perform | 2024-08-09 |

| Scotiabank | Maintain | Sector Outperform | 2024-08-07 |

| Wedbush | Maintain | Neutral | 2024-08-05 |

| Evercore ISI Group | Maintain | In Line | 2024-07-16 |

| Morgan Stanley | Maintain | Overweight | 2024-07-11 |

Healthpeak Properties, Inc. Grades

This table shows recent grades from established grading firms for Healthpeak Properties, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Downgrade | Hold | 2026-02-05 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-04 |

| Wells Fargo | Maintain | Equal Weight | 2026-02-02 |

| Jefferies | Downgrade | Hold | 2025-12-16 |

| Evercore ISI Group | Maintain | Outperform | 2025-12-15 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-25 |

| Baird | Maintain | Outperform | 2025-11-12 |

| Raymond James | Upgrade | Outperform | 2025-09-15 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-27 |

| Morgan Stanley | Maintain | Overweight | 2025-08-22 |

Which company has the best grades?

Welltower Inc. holds a mix from Buy to Equal Weight, with several Sector Outperform ratings sustained. Healthpeak Properties, Inc. also shows mostly Outperform and Equal Weight grades but includes recent downgrades to Hold. Welltower’s more consistent positive outlook may suggest stronger institutional confidence, potentially influencing investor sentiment and market demand.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Welltower Inc.

- Welltower operates in high-growth markets with strong partnerships but faces intense seniors housing competition.

Healthpeak Properties, Inc.

- Healthpeak focuses on healthcare discovery real estate, confronting fierce competition and slower growth in certain segments.

2. Capital Structure & Debt

Welltower Inc.

- Moderate debt-to-equity ratio (0.52) with neutral risk; interest coverage is weak at 1.91x, signaling potential strain.

Healthpeak Properties, Inc.

- High leverage with debt-to-equity of 1.39 and poor interest coverage (1.78x), creating elevated financial risk.

3. Stock Volatility

Welltower Inc.

- Lower beta (0.832) indicates less volatility and reduced market risk exposure.

Healthpeak Properties, Inc.

- Higher beta (1.107) suggests greater stock price fluctuations and higher investor risk.

4. Regulatory & Legal

Welltower Inc.

- Faces regulatory scrutiny typical of large REITs but benefits from diversified geographic footprint.

Healthpeak Properties, Inc.

- Similar regulatory challenges with added exposure to healthcare discovery properties, which may face evolving compliance demands.

5. Supply Chain & Operations

Welltower Inc.

- Operations concentrated in seniors housing and outpatient facilities, vulnerable to labor shortages and operational disruptions.

Healthpeak Properties, Inc.

- Broader real estate portfolio includes healthcare discovery, facing risks from construction delays and tenant solvency issues.

6. ESG & Climate Transition

Welltower Inc.

- Moderate ESG risks; must accelerate climate transition efforts to meet investor expectations in healthcare infrastructure.

Healthpeak Properties, Inc.

- ESG challenges are more pronounced due to medical real estate exposure, requiring aggressive sustainability initiatives.

7. Geopolitical Exposure

Welltower Inc.

- Geographic concentration in US, Canada, UK reduces extreme geopolitical risks but remains sensitive to North American policies.

Healthpeak Properties, Inc.

- Primarily US-focused, with limited international diversification, increasing vulnerability to domestic policy shifts.

Which company shows a better risk-adjusted profile?

Welltower’s moderate leverage and lower stock volatility offer a more balanced risk profile. Healthpeak’s high debt and distress-level Altman Z-score raise red flags. Welltower’s strong Altman Z-score (3.99) contrasts sharply with Healthpeak’s distress zone (0.40), signaling greater financial stability. However, Welltower’s low ROIC versus WACC and weak interest coverage remain concerns. Healthpeak’s high leverage and unfavorable debt ratios expose it to refinancing risks, amplified by a rising interest rate environment in 2026. Overall, Welltower demonstrates a better risk-adjusted position despite some operational challenges.

Final Verdict: Which stock to choose?

Welltower Inc. (WELL) excels as a cash-generating powerhouse with a bullish price momentum and strong operational cash flow. Its key point of vigilance lies in value destruction indicated by ROIC below WACC. WELL suits investors seeking aggressive growth with an appetite for cyclical sector risks.

Healthpeak Properties, Inc. (DOC) boasts a robust economic moat, evidenced by a ROIC well above WACC and a growing trend, signaling efficient capital use and competitive advantage. Despite a weaker recent price trend and higher leverage, DOC offers better stability for GARP (Growth at a Reasonable Price) investors prioritizing value creation.

If you prioritize dynamic cash flow growth and can tolerate valuation premium and capital inefficiency risks, WELL is the compelling choice due to its operational strength and momentum. However, if you seek a sustainable competitive advantage with disciplined capital allocation and greater financial stability, DOC outshines as the prudent pick. Both demand careful risk assessment aligned with portfolio strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Welltower Inc. and Healthpeak Properties, Inc. to enhance your investment decisions: