Home > Comparison > Real Estate > VTR vs DOC

The strategic rivalry between Ventas, Inc. and Healthpeak Properties, Inc. defines the current trajectory of the healthcare real estate sector. Ventas operates a diversified, capital-intensive portfolio of healthcare properties, while Healthpeak focuses on integrated real estate solutions for healthcare discovery and delivery. This analysis explores their contrasting operational models and investment profiles to determine which offers a superior risk-adjusted return for a diversified portfolio.

Table of contents

Companies Overview

Ventas, Inc. and Healthpeak Properties, Inc. stand as key players in the specialized REIT healthcare facilities market.

Ventas, Inc.: Healthcare Real Estate Powerhouse

Ventas, Inc. is a leading REIT focused on healthcare facilities. It generates revenue by owning and managing a diversified portfolio of over 1,200 properties, partnering with top healthcare providers. Its 2020 strategy emphasized leveraging capital strength and partnerships to drive consistent cash flow and superior returns amid demographic tailwinds.

Healthpeak Properties, Inc.: Integrated Healthcare REIT

Healthpeak Properties, Inc. operates as a fully integrated healthcare real estate investment trust. It earns income through ownership, operation, and development of high-quality healthcare real estate focused on discovery and delivery. The company’s recent focus has been on expanding its portfolio with quality assets that support innovative healthcare services.

Strategic Collision: Similarities & Divergences

Both companies compete in the niche healthcare REIT sector but differ in portfolio scope and operational style. Ventas emphasizes diversified partnerships and capital management, while Healthpeak integrates ownership with active development. Their battleground is the evolving healthcare infrastructure market, with Ventas offering stability and Healthpeak pursuing growth through development. These distinctions shape contrasting risk and growth investment profiles.

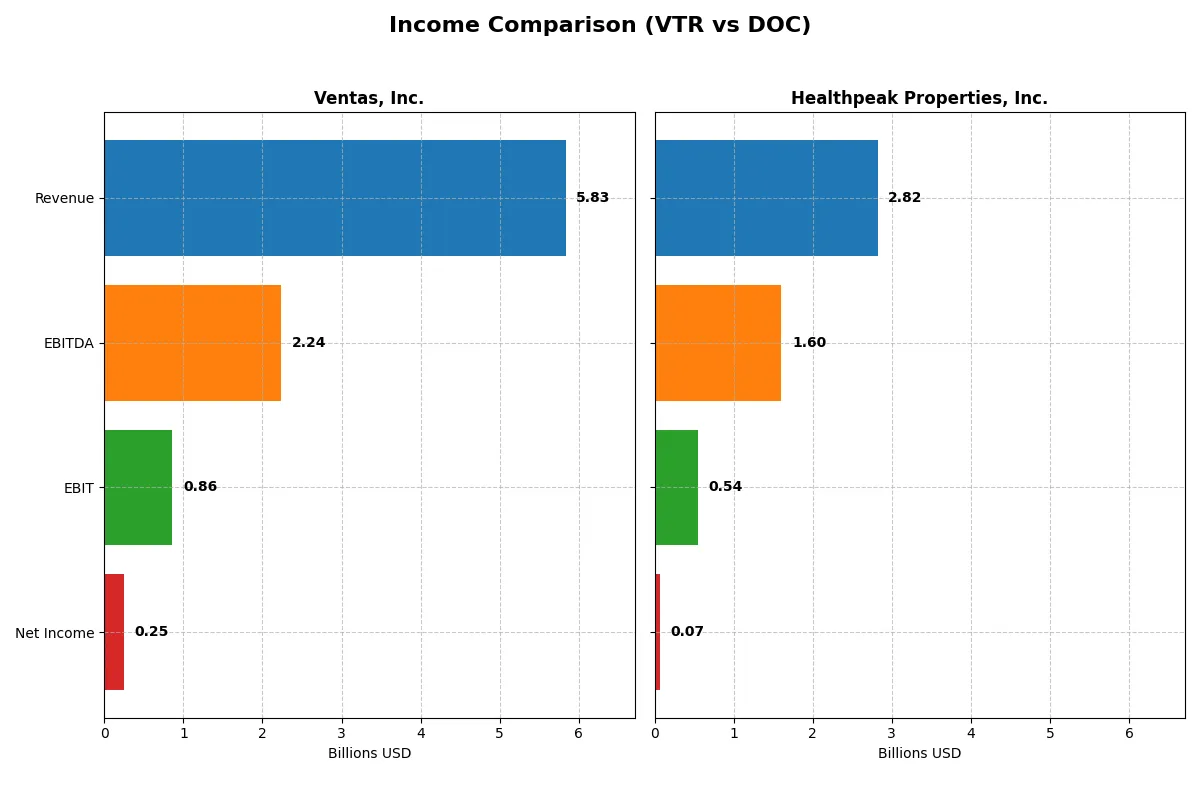

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line in the most recent fiscal year:

| Metric | Ventas, Inc. (VTR) | Healthpeak Properties, Inc. (DOC) |

|---|---|---|

| Revenue | 5.83B | 2.82B |

| Cost of Revenue | 6.18B | 2.19B |

| Operating Expenses | -1.17B | 90.4M |

| Gross Profit | -344.2M | 634.5M |

| EBITDA | 2.24B | 1.60B |

| EBIT | 860M | 544.1M |

| Interest Expense | 612.2M | 305.2M |

| Net Income | 251.4M | 71.3M |

| EPS | 0.55 | 0.10 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability trajectory of two major real estate investment trusts.

Ventas, Inc. Analysis

Ventas’s revenue grew 18.5% in 2025, rising to $5.83B, while net income surged to $251M, recovering from prior losses. Despite a negative gross margin of -5.9%, Ventas’s EBIT margin improved to 14.7%, reflecting better operational control. The company’s net margin of 4.3% signals cautious profitability momentum after a turbulent period.

Healthpeak Properties, Inc. Analysis

Healthpeak’s revenue advanced modestly by 4.5% to $2.82B in 2025, but net income dropped sharply to $71M, down from $243M the previous year. The firm maintains a solid gross margin of 22.5% and a strong EBIT margin of 19.3%, yet net margin fell to 2.5%. Earnings contraction points to challenges in translating top-line strength into bottom-line growth.

Margin Recovery vs. Earnings Stability

Ventas demonstrates stronger income growth and margin recovery, boasting a 161% net margin increase last year and over 400% net income growth over five years. Healthpeak, despite steadier gross margins, suffers declining net income and shrinking margins overall. For investors prioritizing earnings resilience and upward momentum, Ventas’s turnaround profile appears more compelling.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Ventas, Inc. (VTR) | Healthpeak Properties, Inc. (DOC) |

|---|---|---|

| ROE | 2.0% | 9.5% |

| ROIC | 21.6% | 21.4% |

| P/E | 140.1 | 156.9 |

| P/B | 2.81 | 1.49 |

| Current Ratio | 5.04 | 1.09 |

| Quick Ratio | 5.04 | 1.09 |

| D/E (Debt-to-Equity) | 1.07 | 1.39 |

| Debt-to-Assets | 48.7% | 51.3% |

| Interest Coverage | 1.35 | 1.78 |

| Asset Turnover | 0.21 | 0.14 |

| Fixed Asset Turnover | 0 | 6.85 |

| Payout ratio | 342.2% | 11.9% |

| Dividend yield | 2.44% | 7.59% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios serve as a company’s DNA, uncovering hidden risks and operational strengths that raw financials alone can’t reveal.

Ventas, Inc.

Ventas posts a modest 2.01% ROE and a net margin of 4.31%, signaling limited profitability despite a strong 21.6% ROIC surpassing its 6.57% WACC. Its P/E of 140.08 suggests an expensive valuation. Ventas delivers a 2.44% dividend yield, favoring shareholder returns through steady income rather than aggressive growth reinvestment.

Healthpeak Properties, Inc.

Healthpeak shows even weaker profitability with a 0.95% ROE and 2.53% net margin, though its 21.39% ROIC remains robust against a 6.34% WACC. The stock trades at a stretched P/E of 156.87 but maintains a reasonable P/B of 1.49. Its 7.59% dividend yield reflects a yield-focused strategy, balancing payout with moderate reinvestment.

Premium Valuation vs. Operational Safety

Both companies face stretched valuations with sky-high P/Es, but Ventas offers a better ROE and a more balanced debt profile. Healthpeak’s higher dividend yield may attract income seekers, but Ventas provides a safer operational footing. Investors prioritizing stability may lean toward Ventas, while yield hunters might prefer Healthpeak’s income profile.

Which one offers the Superior Shareholder Reward?

I see Ventas, Inc. (VTR) yields 2.44%, with a payout ratio over 340%, signaling dividend coverage risk despite stable buybacks. Healthpeak Properties, Inc. (DOC) offers a 7.59% yield, with a conservative 12% payout ratio and robust free cash flow supporting strong dividends plus share repurchases. DOC’s distribution is more sustainable, balancing income and capital return. For 2026 investors, DOC delivers a superior total return profile given its prudent capital allocation and higher, well-covered yield.

Comparative Score Analysis: The Strategic Profile

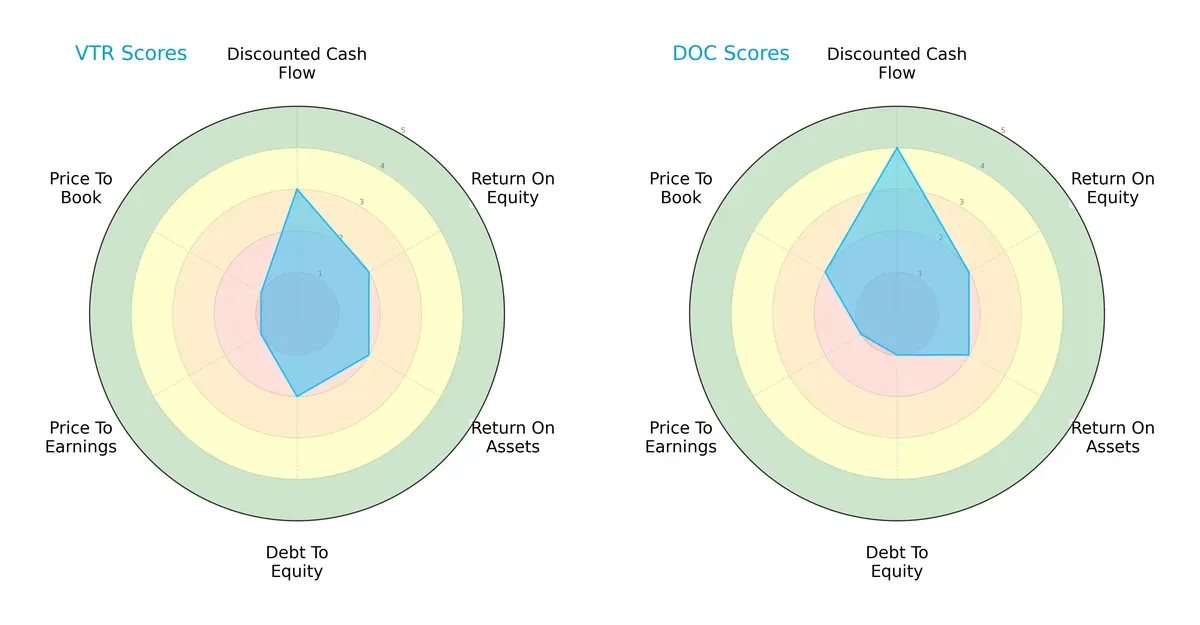

The radar chart reveals the fundamental DNA and trade-offs of Ventas, Inc. and Healthpeak Properties, Inc., highlighting their financial strengths and weaknesses:

Ventas and Healthpeak share similar overall scores, but their profiles diverge. Healthpeak leads in discounted cash flow with a favorable score of 4 versus Ventas’ moderate 3. Both lag in return on equity and assets, scoring 2. Ventas maintains a slightly better debt-to-equity position at 2 against Healthpeak’s weaker 1. Valuation metrics favor neither strongly, both scoring low. Ventas presents a more balanced risk profile, while Healthpeak relies on superior cash flow projections.

Bankruptcy Risk: Solvency Showdown

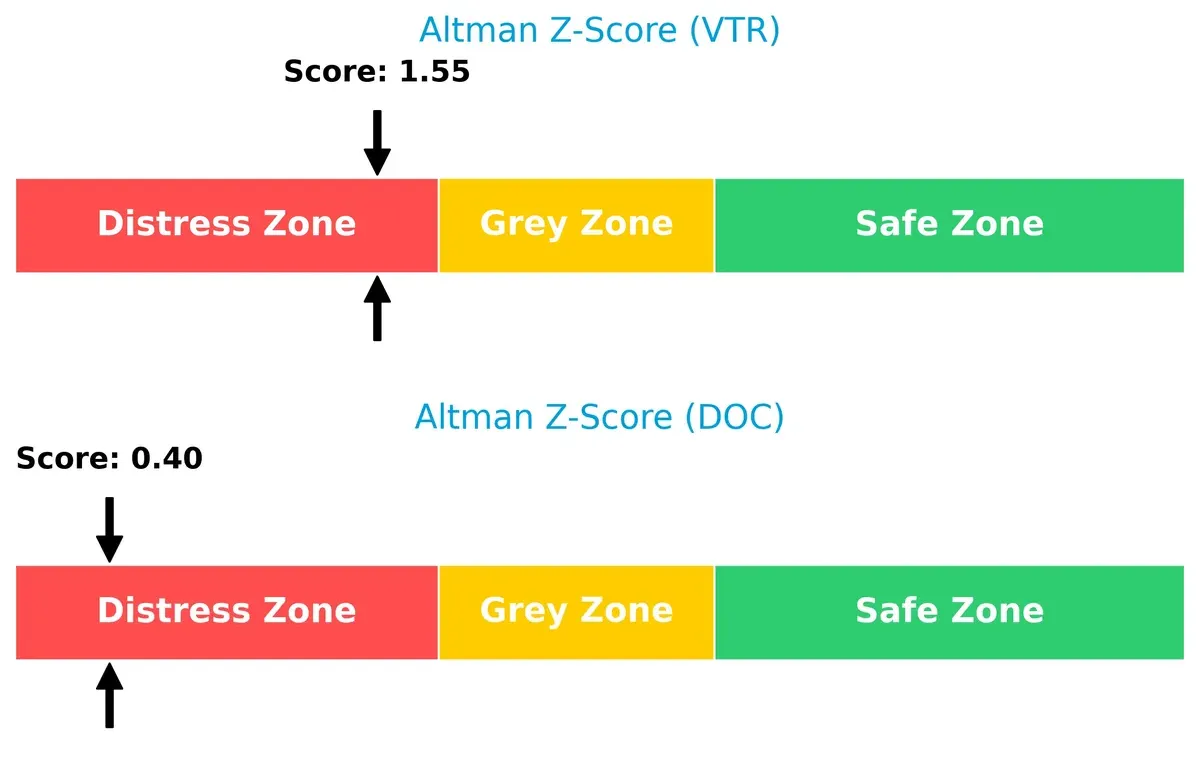

Ventas’ Altman Z-Score of 1.55 versus Healthpeak’s 0.40 signals differing distress levels:

Both companies reside in the distress zone, but Ventas stands closer to the grey area threshold. This suggests Ventas has a marginally stronger solvency outlook, while Healthpeak faces heightened bankruptcy risk in the current cycle.

Financial Health: Quality of Operations

Ventas scores 7 on the Piotroski scale, outperforming Healthpeak’s 6, indicating superior financial health:

Ventas demonstrates stronger internal financial metrics and operational quality. Healthpeak’s average score hints at potential red flags in profitability or liquidity, warranting caution.

How are the two companies positioned?

This section dissects Ventas and Healthpeak’s operational DNA by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to reveal the more resilient, sustainable competitive advantage today.

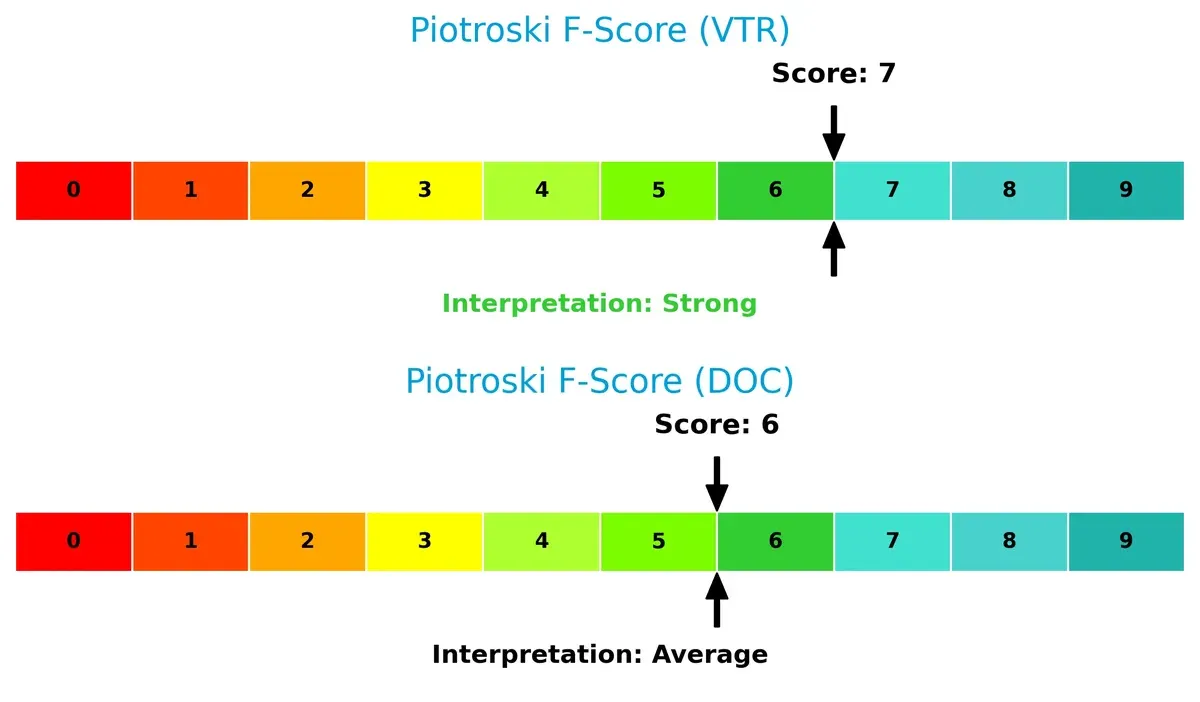

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Ventas, Inc. and Healthpeak Properties, Inc. diversify their income streams and where their primary sector bets lie:

Ventas anchors 4.3B in Senior Living Operations, dwarfing its other segments like Outpatient Medical (898M) and Triple Net Leased Properties (602M). Healthpeak shows a more balanced mix with Outpatient Medical Buildings at 1.27B, Lab at 860M, and Senior Housing at 604M. Ventas’ heavy reliance on senior living signals concentration risk, while Healthpeak’s spread suggests strategic flexibility across healthcare real estate niches.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Ventas, Inc. and Healthpeak Properties, Inc.:

Ventas, Inc. Strengths

- Diversified revenue from senior living, outpatient medical, and triple net leased properties

- Strong ROIC of 21.6% exceeding WACC of 6.57%

- High quick ratio of 5.04 suggesting liquidity

- Established global presence with significant US and Canadian revenue

Healthpeak Properties, Inc. Strengths

- Diversified revenue across lab, outpatient medical buildings, and senior housing

- ROIC of 21.39% above WACC of 6.34%

- Favorable PB ratio at 1.49 indicating undervaluation

- High fixed asset turnover of 6.85 reflecting efficient asset use

Ventas, Inc. Weaknesses

- Low net margin (4.31%) and ROE (2.01%) indicate weak profitability

- High PE ratio (140.08) suggests overvaluation risk

- Unfavorable debt-to-equity of 1.07 and low interest coverage (1.4) imply financial leverage concerns

- Low asset turnover (0.21) signals operational inefficiency

Healthpeak Properties, Inc. Weaknesses

- Lower net margin (2.53%) and ROE (0.95%) reflect modest profitability

- Elevated PE ratio (156.87) indicates potential overvaluation

- Higher debt-to-equity (1.39) and debt-to-assets (51.34%) increase financial risk

- Interest coverage of 1.78 remains weak despite better asset turnover

Both companies show strong capital efficiency with ROIC well above WACC, which supports value creation. However, profitability metrics and leverage ratios highlight financial risks that could impact strategic flexibility. Investors should consider these factors in light of sector benchmarks and market conditions.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable barrier protecting long-term profits from relentless competitive erosion in dynamic markets:

Ventas, Inc.: Diversified Portfolio & Partner Network Moat

Ventas leverages strong intangible assets and partner relationships in healthcare real estate. This manifests in a very favorable ROIC growing 12x faster than WACC. Expanding into aging population markets deepens its moat in 2026.

Healthpeak Properties, Inc.: Specialized Asset Focus Moat

Healthpeak’s moat stems from focused asset specialization in labs and outpatient facilities, contrasting Ventas’ diversification. It creates value with a similarly strong ROIC growth trend. Opportunities lie in innovation-driven healthcare real estate expansion.

Diversification vs. Specialization: The Healthcare REIT Moat Battle

Both companies maintain very favorable moats with ROIC exceeding WACC by ~15%. Ventas’ broader portfolio and partner ecosystem create a wider moat. It is better positioned to defend market share amid evolving healthcare demands.

Which stock offers better returns?

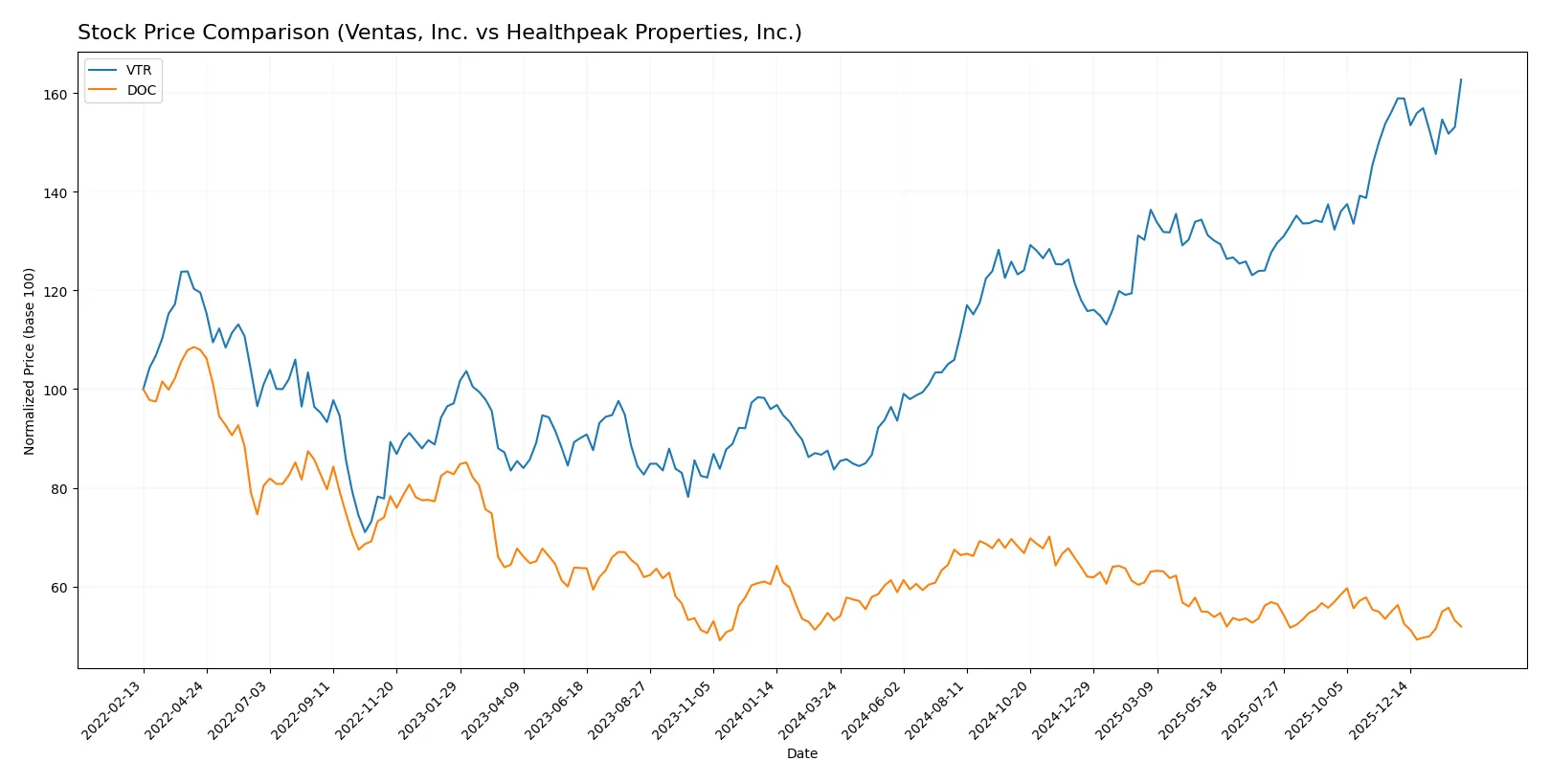

Both Ventas, Inc. and Healthpeak Properties, Inc. showed distinct price movements over the past year, with Ventas exhibiting strong gains and Healthpeak facing a moderate decline.

Trend Comparison

Ventas, Inc. shows a bullish trend over 12 months with a 94.33% price increase and decelerating momentum. The stock peaked at 82.55 and bottomed at 42.48, with a relatively high volatility (std dev 9.67).

Healthpeak Properties, Inc. reveals a bearish trend with a 2.26% price drop over the year, despite accelerating negative momentum. The stock ranged between 15.99 and 22.76, with lower volatility (std dev 1.81).

Ventas outperformed Healthpeak in market returns, delivering strong positive growth versus Healthpeak’s modest loss in the past year.

Target Prices

Analysts present a moderate upside for Ventas, Inc. and Healthpeak Properties, Inc., reflecting cautious optimism in healthcare REITs.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Ventas, Inc. | 73 | 94 | 84.75 |

| Healthpeak Properties, Inc. | 17 | 21 | 18.71 |

The target consensus for Ventas sits about 2.7% above its current price of $82.55, signaling modest appreciation potential. Healthpeak’s consensus target exceeds its current $16.85 price by roughly 11%, suggesting greater relative upside.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Ventas, Inc. Grades

This table summarizes recent analyst grades for Ventas, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2025-12-04 |

| Wells Fargo | Maintain | Overweight | 2025-11-25 |

| Scotiabank | Maintain | Sector Perform | 2025-11-13 |

| Citigroup | Maintain | Buy | 2025-11-11 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-31 |

| Wells Fargo | Maintain | Overweight | 2025-10-21 |

| Evercore ISI Group | Maintain | Outperform | 2025-09-15 |

| Scotiabank | Maintain | Sector Perform | 2025-08-28 |

| Argus Research | Maintain | Buy | 2025-08-26 |

| JP Morgan | Maintain | Overweight | 2025-08-26 |

Healthpeak Properties, Inc. Grades

This table presents the latest analyst updates for Healthpeak Properties, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Downgrade | Hold | 2026-02-05 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-04 |

| Wells Fargo | Maintain | Equal Weight | 2026-02-02 |

| Jefferies | Downgrade | Hold | 2025-12-16 |

| Evercore ISI Group | Maintain | Outperform | 2025-12-15 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-25 |

| Baird | Maintain | Outperform | 2025-11-12 |

| Raymond James | Upgrade | Outperform | 2025-09-15 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-27 |

| Morgan Stanley | Maintain | Overweight | 2025-08-22 |

Which company has the best grades?

Ventas, Inc. consistently holds positive grades such as Overweight, Buy, and Outperform. Healthpeak Properties, Inc. shows mixed signals with recent downgrades to Hold and several Equal Weight ratings despite some Outperform grades. Ventas, Inc.’s stronger consensus may appeal to investors seeking more confident analyst support.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Ventas, Inc.

- Operates a highly diversified portfolio with strong partners, but faces intense competition in healthcare real estate.

Healthpeak Properties, Inc.

- Focuses on integrated healthcare real estate with development risk, encountering fierce sector rivalry and evolving tenant needs.

2. Capital Structure & Debt

Ventas, Inc.

- Debt-to-equity ratio of 1.07 and interest coverage ratio of 1.4 signal moderate leverage but strained debt servicing capacity.

Healthpeak Properties, Inc.

- Higher debt-to-equity at 1.39 and better interest coverage at 1.78 reflect heavier leverage with slightly improved serviceability.

3. Stock Volatility

Ventas, Inc.

- Beta of 0.772 indicates lower volatility and defensive positioning relative to the market.

Healthpeak Properties, Inc.

- Beta of 1.107 shows greater price sensitivity and higher market volatility risk.

4. Regulatory & Legal

Ventas, Inc.

- Subject to healthcare and real estate regulations; stable compliance history but exposed to policy changes impacting reimbursement.

Healthpeak Properties, Inc.

- Faces similar regulatory risks with additional scrutiny on healthcare delivery properties and development approvals.

5. Supply Chain & Operations

Ventas, Inc.

- Strong operational focus on managing a large property portfolio; risks from construction delays and tenant turnover persist.

Healthpeak Properties, Inc.

- Operational risks include development pipeline execution and tenant concentration, which may affect cash flow stability.

6. ESG & Climate Transition

Ventas, Inc.

- ESG initiatives align with industry norms; exposure to climate risks in property locations necessitates ongoing adaptation.

Healthpeak Properties, Inc.

- Increasing ESG commitments but faces challenges in retrofitting older assets and integrating sustainability into new developments.

7. Geopolitical Exposure

Ventas, Inc.

- Primarily US-focused, limiting direct geopolitical risk but sensitive to domestic policy shifts and economic cycles.

Healthpeak Properties, Inc.

- Also US-centric with limited international exposure, but regional economic disruptions and healthcare policy shifts remain concerns.

Which company shows a better risk-adjusted profile?

Ventas faces its greatest risk in capital structure, with stretched interest coverage signaling financial vulnerability. Healthpeak’s main risk lies in elevated leverage combined with operational development risks. Ventas shows a better risk-adjusted profile due to lower stock volatility and a stronger liquidity position, despite some financial strain. Notably, Ventas’s current ratio of 5.04 contrasts with Healthpeak’s leaner 1.09, underscoring superior short-term resilience.

Final Verdict: Which stock to choose?

Ventas, Inc. (VTR) stands out as a cash-generating powerhouse with a very favorable moat, driven by its robust ROIC exceeding WACC and a history of growing profitability. Its point of vigilance lies in its stretched balance sheet and interest coverage, which could pressure financial flexibility. VTR suits investors targeting aggressive growth with a tolerance for leverage risk.

Healthpeak Properties, Inc. (DOC) offers a strong strategic moat grounded in consistent value creation and efficient capital use, highlighted by its favorable fixed asset turnover and higher free cash flow yield. Compared to VTR, DOC provides a somewhat safer profile with a more moderate balance sheet risk but struggles with recent income volatility. It fits well within a GARP portfolio seeking stability with growth potential.

If you prioritize aggressive growth backed by a sustainable competitive advantage, Ventas outshines due to its accelerating profitability despite financial leverage risks. However, if you seek steadier capital allocation with better balance sheet stability and a more conservative risk profile, Healthpeak offers better stability, though it commands caution amid recent earnings headwinds.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Ventas, Inc. and Healthpeak Properties, Inc. to enhance your investment decisions: