Home > Comparison > Healthcare > HCA vs SOLV

The strategic rivalry between HCA Healthcare, Inc. and Solventum Corporation shapes the healthcare sector’s evolution. HCA operates as a capital-intensive hospital network delivering broad inpatient and outpatient services. In contrast, Solventum pursues a diversified, innovation-driven model spanning medical supplies, dental products, and health IT solutions. This head-to-head pits traditional care delivery against integrated healthcare solutions. This analysis will identify which corporate approach offers superior risk-adjusted returns for a diversified portfolio in 2026.

Table of contents

Companies Overview

HCA Healthcare and Solventum Corporation both anchor vital niches in the US healthcare sector with distinct operational scopes and market impacts.

HCA Healthcare, Inc.: Premier Healthcare Service Provider

HCA Healthcare dominates the US healthcare facilities market with a sprawling network of 182 hospitals and over 125 surgery centers. Its core revenue stems from inpatient and outpatient medical services spanning acute care, emergency, and specialized psychiatric treatment. In 2021, HCA intensified its focus on expanding acute care capacity and enhancing outpatient services, leveraging scale to improve patient access and operational efficiency.

Solventum Corporation: Innovative Medical Solutions Developer

Solventum Corporation excels in developing diversified healthcare technologies across med-surg, dental, health IT, and purification segments. Its revenue engine relies on commercializing advanced wound care products, dental appliances, and software platforms. Founded in 2023, Solventum’s strategic priority in 2026 centers on scaling its product portfolio and penetrating new markets with integrated healthcare solutions that address evolving clinical needs.

Strategic Collision: Similarities & Divergences

HCA Healthcare focuses on delivering comprehensive care through physical healthcare infrastructure, whereas Solventum builds a technology-driven ecosystem of healthcare products and software. Their competition unfolds in overlapping medical device and care delivery innovation arenas. HCA’s scale and facility ownership contrast sharply with Solventum’s lean, product-centric model, creating distinct investment profiles shaped by asset intensity versus innovation agility.

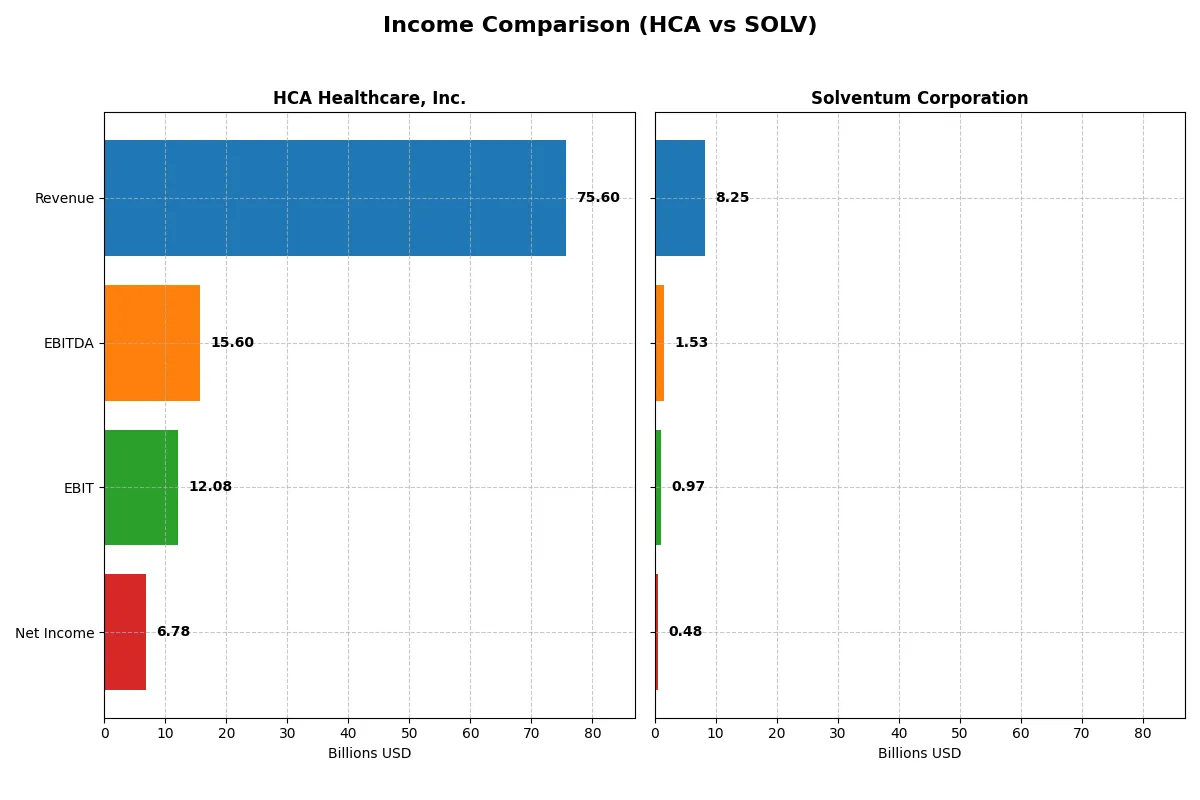

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | HCA Healthcare, Inc. (HCA) | Solventum Corporation (SOLV) |

|---|---|---|

| Revenue | 75.6B | 8.25B |

| Cost of Revenue | 44.2B | 3.66B |

| Operating Expenses | 19.4B | 3.56B |

| Gross Profit | 31.4B | 4.59B |

| EBITDA | 15.6B | 1.53B |

| EBIT | 12.1B | 972M |

| Interest Expense | 2.25B | 367M |

| Net Income | 6.78B | 479M |

| EPS | 28.62 | 2.77 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes each company’s operational efficiency and profitability through recent financial performance.

HCA Healthcare, Inc. Analysis

HCA’s revenue grew steadily from 58.7B in 2021 to 75.6B in 2025, demonstrating solid top-line momentum. Its gross margin remains strong at 41.5%, and net margin improved to 8.97% in 2025, reflecting disciplined cost control. The 2025 net income of 6.8B underscores efficient capital allocation amidst rising operating expenses.

Solventum Corporation Analysis

Solventum’s revenue increased modestly from 7.3B in 2020 to 8.3B in 2024, showing limited growth traction. It maintains a higher gross margin of 55.65%, but net margin lags at 5.8% due to increased operating expenses. The 2024 net income plunged to 479M, signaling deteriorating profitability and operational challenges.

Verdict: Margin Resilience vs. Profitability Decline

HCA Healthcare showcases robust revenue growth paired with improving net margins, outpacing Solventum’s stagnant sales and steep profit contraction. HCA’s ability to expand earnings while managing costs positions it as the stronger fundamental performer. For investors, HCA’s profile offers greater stability and growth potential compared to Solventum’s eroding profitability.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | HCA Healthcare, Inc. (HCA) | Solventum Corporation (SOLV) |

|---|---|---|

| ROE | -1.13% | 16.19% |

| ROIC | 18.53% | 6.85% |

| P/E | 15.88 | 23.89 |

| P/B | -17.87 | 3.87 |

| Current Ratio | 0.83 | 1.20 |

| Quick Ratio | 0.73 | 0.84 |

| D/E | -8.33 | 2.71 |

| Debt-to-Assets | 82.67% | 55.41% |

| Interest Coverage | 5.32 | 2.82 |

| Asset Turnover | 1.25 | 0.57 |

| Fixed Asset Turnover | 2.43 | 5.09 |

| Payout ratio | 10.01% | 0% |

| Dividend yield | 0.63% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden operational strengths and risks that shape investment outcomes.

HCA Healthcare, Inc.

HCA shows mixed signals with a neutral P/E of 15.9 and a strong ROIC at 18.5%, indicating operational efficiency. However, a deeply negative ROE at -112.6% signals shareholder value erosion. The stock pays a low 0.63% dividend, reflecting weak direct returns and a strained balance sheet with a current ratio below 1.

Solventum Corporation

Solventum trades at a higher P/E of 23.9 with a modest 5.8% net margin and a favorable 16.2% ROE, indicating better profitability alignment. Its ROIC is moderate at 6.9%, and the company does not pay dividends, instead investing heavily in R&D. The current ratio is stable at 1.2, supporting operational liquidity.

Premium Valuation vs. Operational Safety

HCA’s valuation appears reasonable with efficient capital use but suffers from poor equity returns and liquidity risks. Solventum carries a higher valuation with stronger ROE and healthier liquidity but lower capital efficiency. Investors seeking operational safety might prefer Solventum, while those focused on capital efficiency may lean toward HCA’s profile.

Which one offers the Superior Shareholder Reward?

I compare HCA Healthcare and Solventum’s shareholder rewards through dividends and buybacks. HCA yields 0.63% to 0.90% with payout ratios around 10-12%, backed by strong free cash flow coverage above 50%. It also maintains steady buybacks, enhancing total returns. Solventum pays no dividends but reinvests heavily in growth, with high free cash flow conversion near 85% and consistent capex below 25% of operating cash flow. Solventum’s low payout supports a robust reinvestment strategy, but its higher debt-to-equity (~2.7) adds risk. I find HCA’s balanced distribution—modest dividends plus buybacks—more sustainable and attractive for 2026 investors seeking total returns grounded in cash flow strength and shareholder distributions.

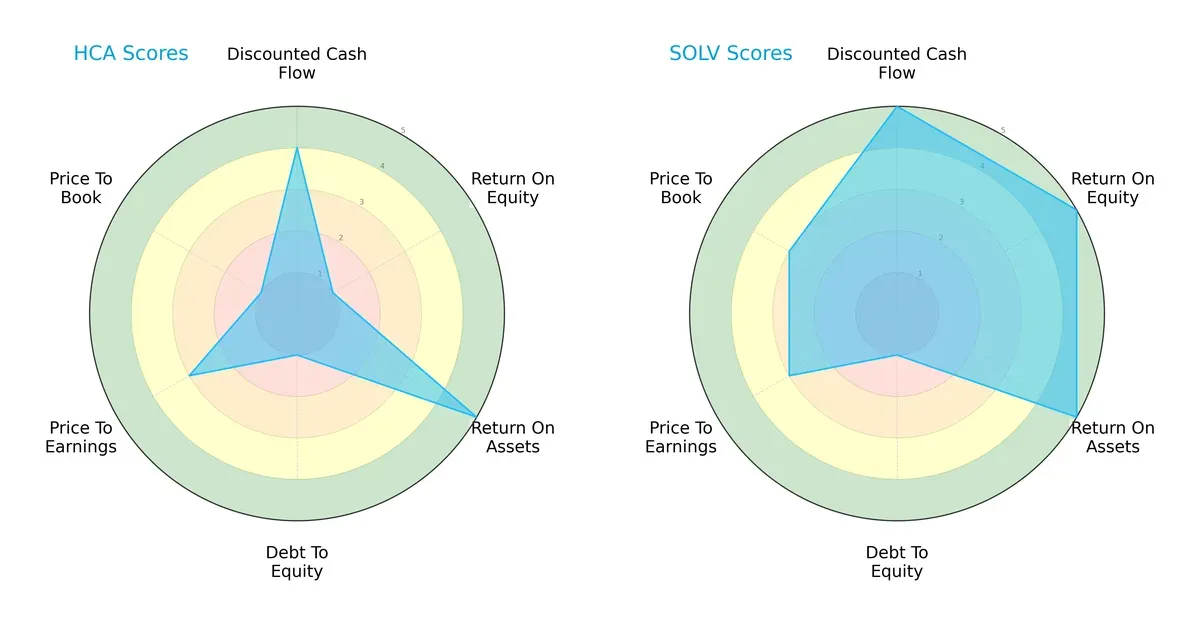

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of HCA Healthcare, Inc. and Solventum Corporation:

Solventum leads with a more balanced and robust financial profile, excelling in DCF, ROE, and ROA. HCA Healthcare shows strength in asset utilization but suffers from poor equity returns and high leverage. Both struggle with debt, yet Solventum maintains a stronger valuation discipline overall.

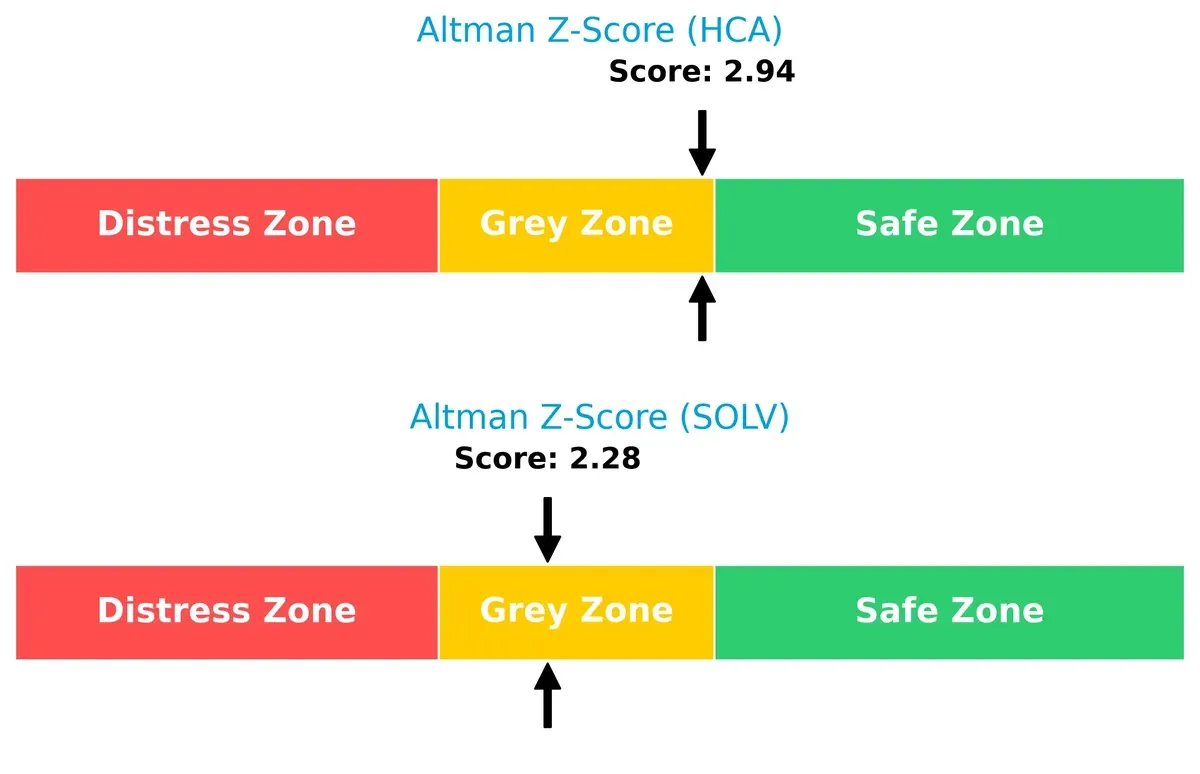

Bankruptcy Risk: Solvency Showdown

Solventum’s Altman Z-Score at 2.28 versus HCA’s 2.94 places both firms in the grey zone, signaling moderate bankruptcy risk amid economic fluctuations:

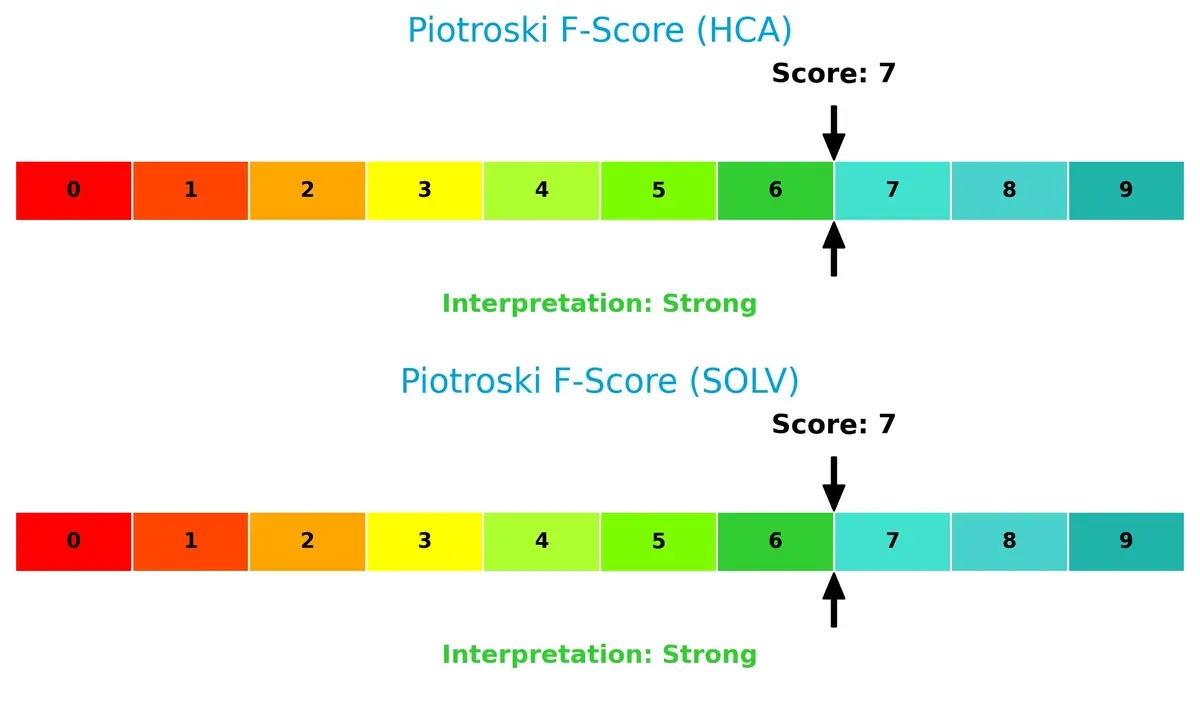

Financial Health: Quality of Operations

Both companies score a solid 7 on the Piotroski F-Score, indicating strong operational quality and financial health without glaring red flags:

How are the two companies positioned?

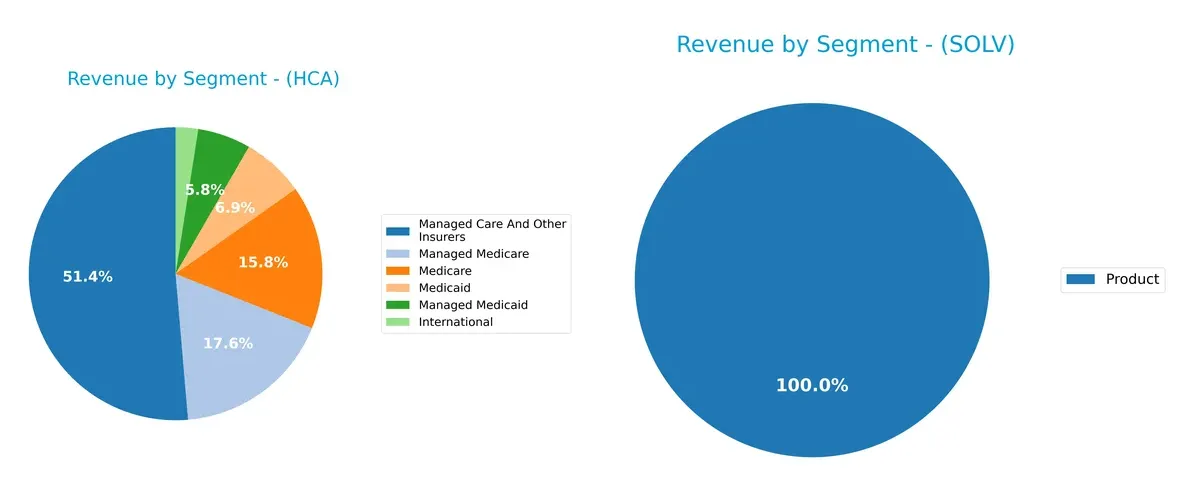

This section dissects the operational DNA of HCA and Solventum by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify which model offers the most resilient competitive advantage.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how both firms diversify their income streams and where their primary sector bets lie:

HCA Healthcare anchors its revenue heavily in “Managed Care And Other Insurers” at $34.95B, complemented by sizeable Medicare and Medicaid segments, reflecting a broad healthcare payer ecosystem. In contrast, Solventum Corporation’s revenue pivots solely on its “Product” segment at $6.35B, signaling concentration risk but potentially strong product specialization. HCA’s diversified mix reduces dependence on a single stream, while Solventum’s focus demands vigilance on product lifecycle and market shifts.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of HCA Healthcare, Inc. and Solventum Corporation:

HCA Strengths

- Diversified revenue streams across multiple insurance and government payers

- Strong global presence with significant US and international sales

- Favorable ROIC well above WACC indicates efficient capital allocation

- Solid asset turnover reflecting operational efficiency

SOLV Strengths

- Favorable ROE indicates strong profitability on equity

- Lower WACC suggests cheaper capital costs

- High fixed asset turnover signals efficient use of long-term assets

- Balanced geographic presence between US and non-US markets

HCA Weaknesses

- Unfavorable ROE points to equity returns issues

- High debt-to-assets ratio (82.67%) signals leverage risk

- Low current and quick ratios reflect liquidity constraints

- Negative PB ratio may indicate valuation or accounting concerns

SOLV Weaknesses

- Unfavorable PB ratio suggests potential overvaluation

- Moderate debt-to-assets ratio (55.41%) still a risk factor

- Neutral interest coverage implies limited buffer on debt payments

- Zero dividend yield may deter income-focused investors

HCA’s strengths lie in diversification and capital efficiency but face liquidity and leverage risks. SOLV shows profitability strengths but carries moderate financial risks and lacks dividend income, shaping strategic priorities differently.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from relentless competition erosion. Only a durable competitive advantage guarantees sustainable returns:

HCA Healthcare, Inc.: Scale and Network Effects in Healthcare Delivery

HCA’s moat stems from extensive hospital networks and brand trust, reflected in a strong 10.5% ROIC premium over WACC. Its stable 16% EBIT margin underpins margin resilience. Expansion into outpatient and psychiatric services in 2026 could deepen this moat amid rising healthcare demands.

Solventum Corporation: Innovation and Product Diversification

Solventum relies on intellectual property and diversified medical solutions, contrasting HCA’s scale. However, its ROIC barely exceeds WACC by 1.6%, signaling value erosion. Innovation in digital health and filtration technology offers growth prospects but faces execution risks and industry incumbents.

Verdict: Scale and Network Effects vs. Innovation Edge

HCA commands a wider, more durable moat through scale and network effects that stabilize profits and shield market share. Solventum’s narrower moat and negative margin trends expose it to competitive pressures. HCA stands better poised to defend and expand its healthcare footprint in 2026.

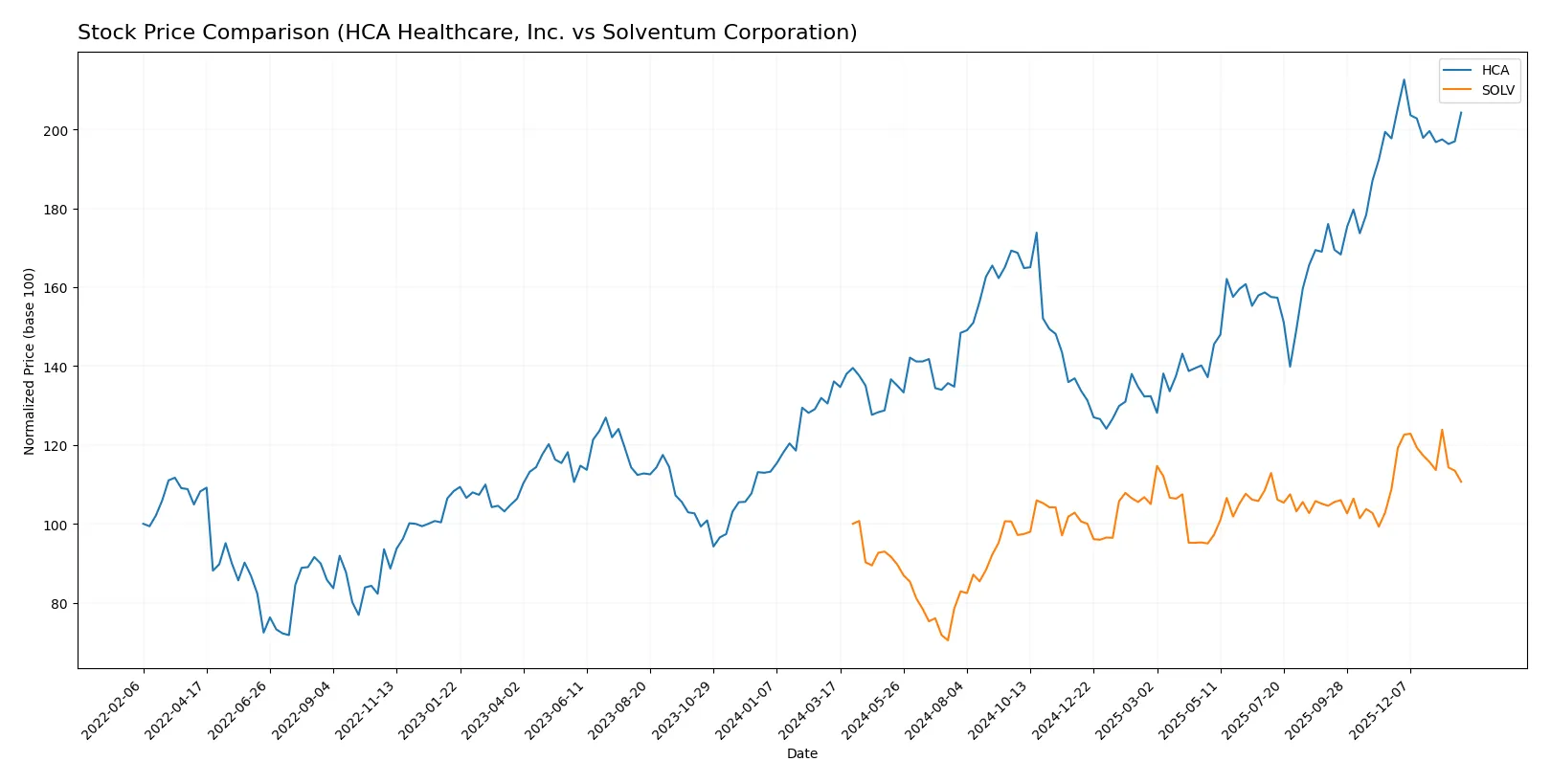

Which stock offers better returns?

Over the past year, HCA Healthcare, Inc. and Solventum Corporation exhibited distinct bullish trends with notable price appreciation and shifting trading dynamics.

Trend Comparison

HCA Healthcare, Inc. posted a strong 50.07% price gain over 12 months, marking a bullish but decelerating trend with high volatility and a peak price of 508.29.

Solventum Corporation gained 10.67% over the same period, reflecting a bullish yet decelerating trend with lower volatility and a highest price of 86.14.

HCA outperformed Solventum, delivering substantially higher returns despite greater price fluctuations and a recent slight downward momentum.

Target Prices

Analyst consensus forecasts moderate upside potential for both HCA Healthcare and Solventum Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| HCA Healthcare, Inc. | 425 | 598 | 516.62 |

| Solventum Corporation | 77 | 105 | 95.8 |

HCA’s consensus target of 517 surpasses its current price of 488, implying upside. Solventum’s target near 96 also suggests room to grow above its 77 current price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a summary of recent grades given to HCA Healthcare, Inc. and Solventum Corporation by leading financial institutions:

HCA Healthcare, Inc. Grades

The latest institutional grades for HCA Healthcare, Inc. are as follows:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-30 |

| Deutsche Bank | Maintain | Buy | 2026-01-28 |

| Keybanc | Maintain | Overweight | 2026-01-28 |

| Oppenheimer | Maintain | Outperform | 2026-01-28 |

| Jefferies | Maintain | Buy | 2026-01-28 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-28 |

| Truist Securities | Maintain | Buy | 2026-01-28 |

| RBC Capital | Maintain | Outperform | 2026-01-28 |

| Barclays | Maintain | Overweight | 2026-01-28 |

| UBS | Maintain | Buy | 2026-01-28 |

Solventum Corporation Grades

The most recent institutional grades for Solventum Corporation are displayed below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Upgrade | Overweight | 2026-01-26 |

| Mizuho | Upgrade | Outperform | 2026-01-20 |

| Stifel | Maintain | Buy | 2026-01-07 |

| BTIG | Upgrade | Buy | 2025-12-02 |

| UBS | Maintain | Neutral | 2025-11-10 |

| Piper Sandler | Maintain | Overweight | 2025-11-07 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-15 |

| Piper Sandler | Maintain | Overweight | 2025-08-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-08 |

| Morgan Stanley | Upgrade | Overweight | 2025-07-15 |

Which company has the best grades?

HCA Healthcare, Inc. holds a consistently strong consensus with multiple “Buy,” “Overweight,” and “Outperform” ratings maintained in January 2026. Solventum Corporation shows positive momentum with recent upgrades to “Overweight” and “Outperform,” but some ratings remain neutral. Investors might view HCA’s stable and broad institutional support as a sign of confidence, while Solventum’s upgrades indicate improving outlook but with more variability in sentiment.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

HCA Healthcare, Inc.

- Faces intense competition in acute care hospitals and outpatient services; pricing pressures from insurers remain high.

Solventum Corporation

- Competes in diversified healthcare solutions with rapid innovation; faces pressure from larger medtech and software firms.

2. Capital Structure & Debt

HCA Healthcare, Inc.

- High debt-to-assets at 82.7% signals leverage risk despite solid interest coverage at 5.37x.

Solventum Corporation

- Moderate leverage with 55.4% debt-to-assets but weaker interest coverage at 2.65x may constrain flexibility.

3. Stock Volatility

HCA Healthcare, Inc.

- Beta of 1.37 indicates higher sensitivity to market swings, implying elevated volatility risk.

Solventum Corporation

- Beta of 0.51 suggests lower volatility and defensive characteristics in turbulent markets.

4. Regulatory & Legal

HCA Healthcare, Inc.

- Subject to extensive healthcare regulations and reimbursement changes impacting revenue stability.

Solventum Corporation

- Faces compliance risks across multiple segments, including medical devices and health IT regulations.

5. Supply Chain & Operations

HCA Healthcare, Inc.

- Hospital operations vulnerable to labor shortages and rising input costs, affecting service delivery.

Solventum Corporation

- Diverse product lines depend on complex supply chains, with potential disruptions in manufacturing and distribution.

6. ESG & Climate Transition

HCA Healthcare, Inc.

- Pressure to reduce carbon footprint in hospital operations; social responsibility demands growing.

Solventum Corporation

- Faces ESG scrutiny in manufacturing processes and product lifecycle management; climate transition costs may rise.

7. Geopolitical Exposure

HCA Healthcare, Inc.

- Primarily US-focused with limited international exposure, reducing geopolitical risk.

Solventum Corporation

- US-based but with global supply chain links, exposing it to trade tensions and regulatory shifts abroad.

Which company shows a better risk-adjusted profile?

HCA’s most impactful risk is its elevated leverage, with debt-to-assets over 80% posing financial strain despite solid interest coverage. Solventum’s key risk lies in moderate debt combined with thinner interest coverage and operational complexity. Despite higher volatility, HCA shows a stronger operational moat and favorable ROIC over WACC. Solventum’s lower beta offers defensive traits, but its financial leverage and narrower margins weigh on resilience. The recent data reveal HCA’s balance sheet stress as a red flag, while Solventum’s diversified but debt-laden model demands caution. Overall, HCA exhibits a cautiously better risk-adjusted profile given its scale and cash flow strength.

Final Verdict: Which stock to choose?

HCA Healthcare stands out with its robust capital efficiency and strong cash generation, marking it as a disciplined value creator in healthcare. Its main point of vigilance is the strained liquidity position, which calls for close monitoring. This stock suits investors targeting aggressive growth with a tolerance for operational risks.

Solventum Corporation’s strategic moat lies in its innovative edge and steady asset utilization, supported by a favorable return on equity. It offers a safer investment profile compared to HCA, though with more moderate profitability and higher debt concerns. Solventum fits well for those seeking growth at a reasonable price and longer-term stability.

If you prioritize capital efficiency and cash flow strength, HCA Healthcare is the compelling choice due to its clear value creation and sector resilience. However, if you seek a steadier growth trajectory with a focus on innovation and balance sheet caution, Solventum offers better stability despite its challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of HCA Healthcare, Inc. and Solventum Corporation to enhance your investment decisions: