In today’s evolving technology landscape, Zscaler, Inc. and GoDaddy Inc. stand out as influential players within the software infrastructure sector. Zscaler focuses on cutting-edge cloud security solutions, while GoDaddy specializes in cloud-based web services and digital identity management. Both companies target overlapping markets by enabling secure, scalable online experiences. In this article, I will analyze their strengths and strategies to help you decide which company offers the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Zscaler and GoDaddy by providing an overview of these two companies and their main differences.

Zscaler Overview

Zscaler, Inc. operates as a cloud security company providing solutions such as secure access to SaaS applications and internal managed applications, digital experience measurement, and workload segmentation to reduce risks and ensure compliance. Headquartered in San Jose, California, Zscaler serves diverse industries including financial services, healthcare, and telecommunications. The company is positioned as a key player in the software infrastructure sector with a market cap of 34.1B USD and employs approximately 7,348 people.

GoDaddy Overview

GoDaddy Inc. designs and develops cloud-based technology products focused on domain registration, website hosting, security, and digital marketing tools. Serving small businesses and individuals, GoDaddy offers a broad range of services including e-commerce, email, and payment facilitation. Based in Tempe, Arizona, GoDaddy operates in the software infrastructure industry with a market cap of 14.5B USD and a workforce of about 5,518 employees, targeting the foundational digital identity needs of its customers.

Key similarities and differences

Both Zscaler and GoDaddy operate within the technology sector focusing on software infrastructure, but their core business models differ significantly. Zscaler emphasizes cloud security and access management for enterprises and large organizations, while GoDaddy concentrates on enabling digital presence and online business tools for small businesses and individuals. Their market caps and employee counts reflect Zscaler’s larger scale and enterprise orientation compared to GoDaddy’s customer-centric service portfolio.

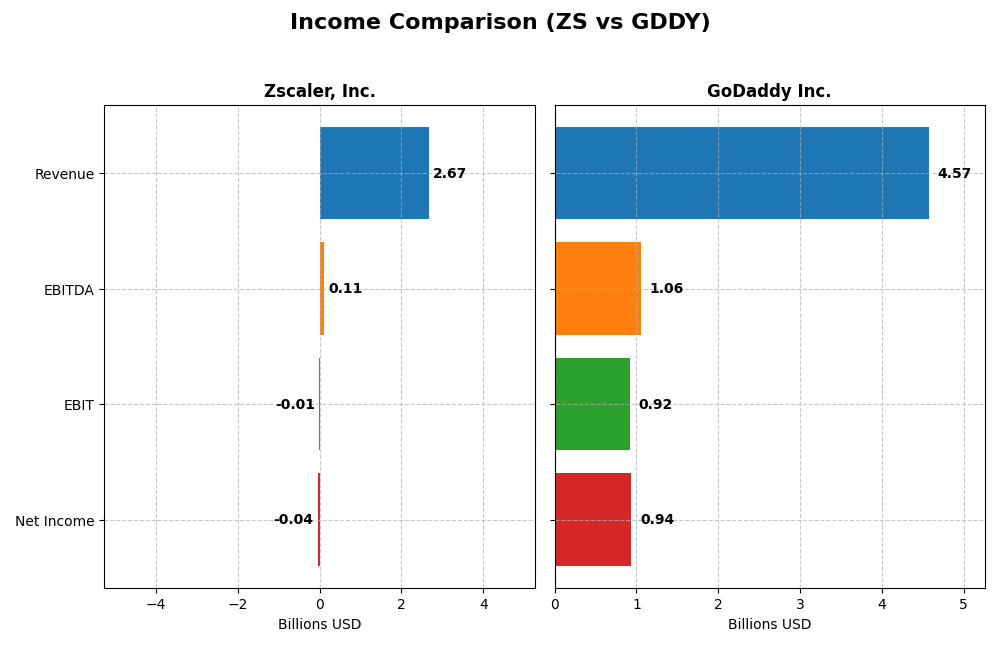

Income Statement Comparison

The following table contrasts the latest fiscal year income statement figures for Zscaler, Inc. and GoDaddy Inc., providing a snapshot of their financial performance.

| Metric | Zscaler, Inc. (ZS) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Cap | 34.1B | 14.5B |

| Revenue | 2.67B | 4.57B |

| EBITDA | 112M | 1.06B |

| EBIT | -8.8M | 924M |

| Net Income | -41.5M | 937M |

| EPS | -0.27 | 6.63 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Zscaler, Inc.

Zscaler, Inc. showed robust revenue growth from 2021 to 2025, increasing from $673M to $2.67B, with net losses narrowing from -$262M to -$41M. Gross margins remained strong around 77%, while EBIT and net margins stayed negative but improved in 2025. The latest fiscal year featured a 23% revenue increase and a 42% net margin improvement, signaling operational progress despite ongoing losses.

GoDaddy Inc.

GoDaddy Inc. experienced steady revenue growth from $3.32B in 2020 to $4.57B in 2024, with net income rising significantly to $937M in 2024 from earlier losses. Margins were healthy, with gross margin at 64% and net margin exceeding 20% in 2024. The most recent year showed a modest 7.5% revenue growth but a decline in net margin and EPS, indicating some margin pressure despite strong profitability.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement fundamentals, with Zscaler demonstrating rapid revenue expansion and improving margins but still operating at a loss. GoDaddy shows consistent profitability with higher net and EBIT margins, though recent margin and EPS declines warrant attention. Overall, GoDaddy’s positive net income and stable margins contrast with Zscaler’s growth-focused but loss-making profile.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Zscaler, Inc. (ZS) and GoDaddy Inc. (GDDY) based on their most recent fiscal year data.

| Ratios | Zscaler, Inc. (ZS) FY 2025 | GoDaddy Inc. (GDDY) FY 2024 |

|---|---|---|

| ROE | -2.31% | 135.37% |

| ROIC | -3.18% | 16.02% |

| P/E | -1063 | 29.76 |

| P/B | 24.51 | 40.28 |

| Current Ratio | 2.01 | 0.72 |

| Quick Ratio | 2.01 | 0.72 |

| D/E (Debt-to-Equity) | 1.00 | 5.63 |

| Debt-to-Assets | 28.0% | 47.3% |

| Interest Coverage | -13.5 | 5.64 |

| Asset Turnover | 0.42 | 0.56 |

| Fixed Asset Turnover | 4.22 | 22.22 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Zscaler, Inc.

Zscaler exhibits a mixed ratio profile with favorable liquidity ratios (current and quick ratios at 2.01) and strong fixed asset turnover (4.22), yet it faces challenges with negative net margin (-1.55%), return on equity (-2.31%), and return on invested capital (-3.18%). The company does not pay dividends, reflecting a reinvestment strategy possibly aimed at growth or R&D prioritization.

GoDaddy Inc.

GoDaddy shows strong profitability with a net margin of 20.49%, return on equity at 135.37%, and return on invested capital of 16.02%, indicating robust earnings generation. However, liquidity ratios are weak (current and quick ratios around 0.72), and leverage is high with debt-to-equity at 5.63. The firm does not pay dividends, likely focusing on reinvestment and growth initiatives.

Which one has the best ratios?

GoDaddy’s ratios indicate stronger profitability and efficient asset use, but weaker liquidity and higher leverage pose potential risks. Zscaler has better liquidity and asset efficiency but struggles with profitability and returns. Overall, GoDaddy presents a more favorable profitability profile, while Zscaler’s financial health shows cautionary signals.

Strategic Positioning

This section compares the strategic positioning of Zscaler, Inc. and GoDaddy Inc. in terms of market position, key segments, and exposure to technological disruption:

Zscaler, Inc.

- Operates globally in cloud security with a $34B market cap, facing competitive pressure in SaaS and cloud infrastructure security.

- Focuses on cloud security solutions including secure access, workload segmentation, and digital experience for diverse industries.

- Positioned in a fast-evolving cloud security sector with ongoing innovation to counter advanced cyber threats.

GoDaddy Inc.

- US and international cloud-based technology provider with a $14B market cap, competing mainly in domain and hosting markets.

- Offers domain registration, hosting, website building, marketing, and business applications targeting SMBs and individuals.

- Faces technological changes in cloud hosting, e-commerce, and security tools with continuous product development efforts.

Zscaler, Inc. vs GoDaddy Inc. Positioning

Zscaler maintains a concentrated focus on cloud security, serving varied industries, while GoDaddy offers a diversified portfolio spanning domains, hosting, marketing, and commerce. Zscaler’s specialization contrasts with GoDaddy’s broader digital presence services.

Which has the best competitive advantage?

GoDaddy shows a very favorable MOAT with value creation and growing ROIC, indicating a durable competitive advantage. Zscaler, despite growing profitability, currently sheds value, reflecting a slightly unfavorable MOAT position.

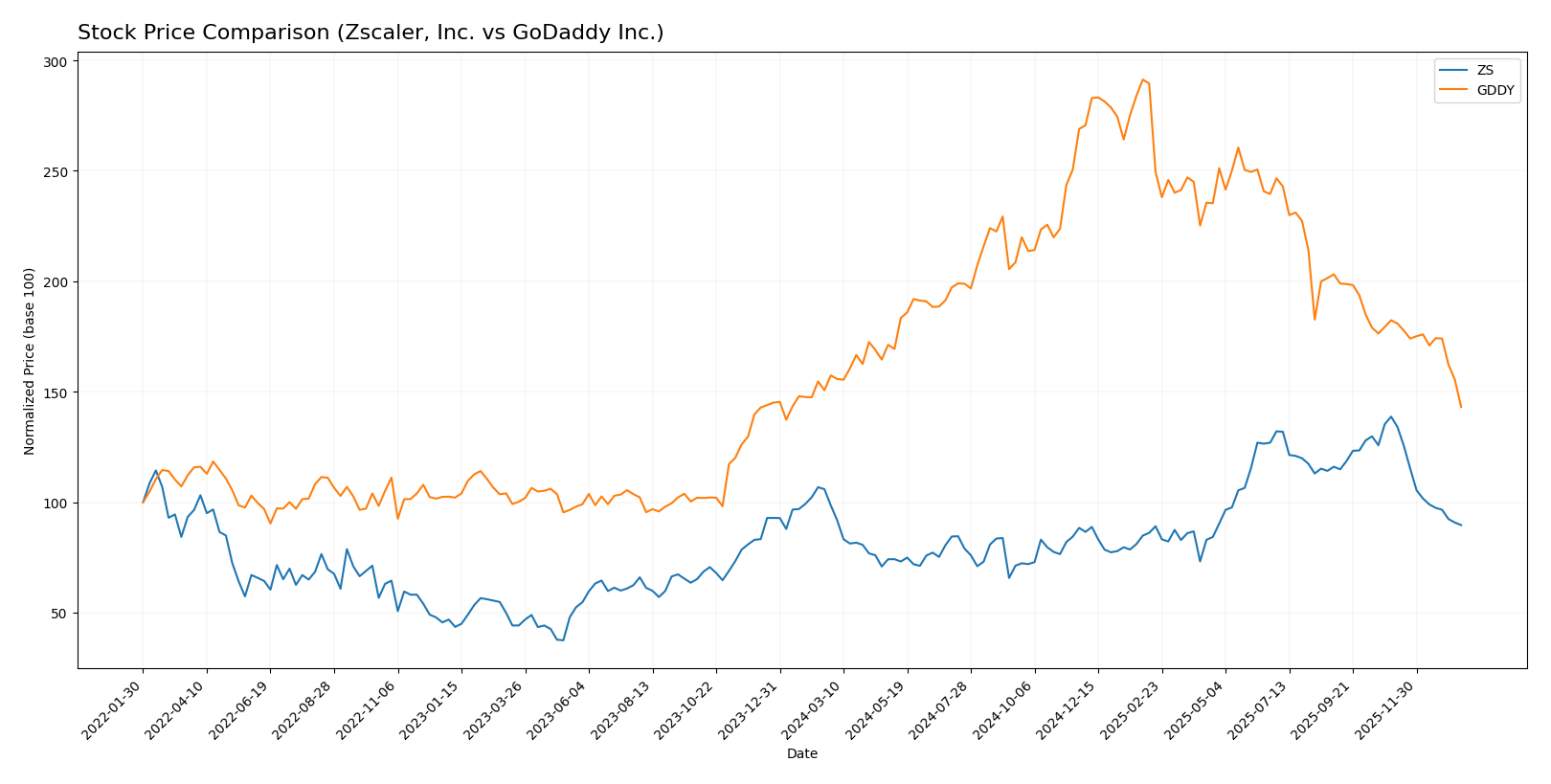

Stock Comparison

The stock prices of Zscaler, Inc. and GoDaddy Inc. have both experienced notable declines over the past year, with distinct trading volume trends and decelerating bearish momentum shaping their recent performance.

Trend Analysis

Zscaler, Inc. (ZS) shows a bearish trend over the past 12 months with a price decline of 9.03%. The trend is decelerating, with a high volatility level (std deviation 47.11), hitting a peak of 331.14 and a low of 156.78. Recent months reveal a sharper drop of 35.38%, indicating accelerated downside pressure.

GoDaddy Inc. (GDDY) also exhibits a bearish trend over the last year, with a 9.09% price decrease and deceleration in trend momentum. Volatility is moderate (std deviation 27.35), with prices ranging between 212.65 and 104.46. The recent trend shows a 21.54% decline, less steep than ZS but still significant.

Comparing both stocks, Zscaler has experienced a larger recent price drop and higher volatility, while GoDaddy’s decline is somewhat less severe. Over the full year, both delivered similar negative returns, with neither stock showing resilience in market performance.

Target Prices

Here is the current analyst target price consensus for selected technology infrastructure stocks.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Zscaler, Inc. | 360 | 260 | 311.41 |

| GoDaddy Inc. | 182 | 70 | 143.33 |

Analysts expect both Zscaler and GoDaddy shares to appreciate significantly from their current prices of $213.98 and $104.46, respectively, reflecting positive growth prospects in cloud security and web services.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial grades for Zscaler, Inc. and GoDaddy Inc.:

Rating Comparison

ZS Rating

- Rating: C-, classified as Very Favorable.

- Discounted Cash Flow Score: 4, Favorable.

- ROE Score: 1, Very Unfavorable.

- ROA Score: 1, Very Unfavorable.

- Debt To Equity Score: 1, Very Unfavorable.

- Overall Score: 1, Very Unfavorable.

GDDY Rating

- Rating: B+, classified as Very Favorable.

- Discounted Cash Flow Score: 5, Very Favorable.

- ROE Score: 5, Very Favorable.

- ROA Score: 4, Favorable.

- Debt To Equity Score: 1, Very Unfavorable.

- Overall Score: 3, Moderate.

Which one is the best rated?

Based strictly on the provided data, GoDaddy Inc. holds higher ratings and stronger scores in key profitability metrics such as ROE and ROA. Zscaler’s scores are mostly very unfavorable except for its discounted cash flow rating.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Zscaler, Inc. and GoDaddy Inc.:

ZS Scores

- Altman Z-Score: 4.89, in safe zone, indicating low bankruptcy risk.

- Piotroski Score: 3, very weak financial strength indication.

GDDY Scores

- Altman Z-Score: 1.53, in distress zone, indicating high bankruptcy risk.

- Piotroski Score: 8, very strong financial strength indication.

Which company has the best scores?

Based on the provided data, Zscaler has a much stronger Altman Z-Score indicating financial stability, while GoDaddy scores significantly higher on the Piotroski Score, reflecting strong financial health. Each company excels in different metrics.

Grades Comparison

Here is a comparison of the recent grades assigned to Zscaler, Inc. and GoDaddy Inc. by reputable grading firms:

Zscaler, Inc. Grades

This table summarizes recent analyst grades and actions for Zscaler, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Mizuho | Upgrade | Outperform | 2025-12-16 |

| Bernstein | Downgrade | Market Perform | 2025-12-01 |

| Citigroup | Maintain | Buy | 2025-12-01 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Baird | Maintain | Outperform | 2025-11-26 |

| BTIG | Maintain | Buy | 2025-11-26 |

Zscaler’s grades show a generally positive trend with several Buy and Outperform ratings maintained or upgraded, though there was a single downgrade to Market Perform.

GoDaddy Inc. Grades

This table summarizes recent analyst grades and actions for GoDaddy Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

GoDaddy’s analyst grades indicate a mixed but generally neutral to positive outlook, with many Hold, Neutral, and Equal Weight ratings, alongside some Buy and Overweight opinions.

Which company has the best grades?

Zscaler, Inc. has received stronger and more consistently positive grades with multiple Buy and Outperform ratings, while GoDaddy Inc.’s grades are more mixed and neutral. This suggests Zscaler is viewed more favorably by analysts, which may influence investor sentiment toward higher growth expectations and confidence in its prospects.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Zscaler, Inc. (ZS) and GoDaddy Inc. (GDDY) based on recent financial and operational data.

| Criterion | Zscaler, Inc. (ZS) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Diversification | Limited product range; mainly cybersecurity | More diversified with Core Platform and Applications & Commerce segments |

| Profitability | Negative net margin (-1.55%), ROIC -3.18% | Strong profitability; net margin 20.49%, ROIC 16.02% |

| Innovation | Growing ROIC trend suggests improving efficiency | Very favorable ROIC trend indicating durable innovation |

| Global presence | Strong presence in cloud security globally | Extensive global reach through domain and hosting services |

| Market Share | Niche leader in cloud security but smaller scale | Large market share in domains and web hosting |

Key takeaways: GoDaddy shows stronger profitability and diversification, supported by a very favorable economic moat and stable financial ratios. Zscaler, while currently shedding value with negative profitability metrics, demonstrates improving ROIC trends that may signal future growth potential but remains a riskier investment.

Risk Analysis

Below is a comparative table highlighting key risks for Zscaler, Inc. (ZS) and GoDaddy Inc. (GDDY) based on the most recent data from 2025 and 2024 respectively:

| Metric | Zscaler, Inc. (ZS) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Risk | Beta 1.02, moderate market volatility exposure | Beta 0.95, slightly less volatile |

| Debt Level | Debt-to-Equity 1.0 (neutral), Debt-to-Assets 28% (favorable) | Debt-to-Equity 5.63 (unfavorable), Debt-to-Assets 47% (neutral) |

| Regulatory Risk | Moderate, in cloud security sector with evolving compliance standards | Moderate, subject to data privacy and e-commerce regulations |

| Operational Risk | Negative net margin (-1.55%) and low ROE (-2.31%) indicate operational challenges | Positive net margin (20.5%) and high ROE (135%) suggest solid operations |

| Environmental Risk | Low direct environmental impact, typical for software industry | Low direct environmental impact, typical for software industry |

| Geopolitical Risk | US-based with global customers; potential exposure to international trade tensions | US-based with global reach; exposed to geopolitical factors affecting internet infrastructure |

In synthesis, GoDaddy faces higher debt and liquidity risks, reflected in its high debt-to-equity ratio and lower current ratio, which warrants caution despite strong profitability and financial scores. Zscaler shows operational weaknesses including negative profitability and returns but maintains a safer debt profile and a strong Altman Z-score indicating low bankruptcy risk. Market and regulatory risks remain moderately impactful for both, given their technology infrastructure focus in an evolving regulatory environment. Investors should weigh GoDaddy’s leverage risks against its strong earnings, while considering Zscaler’s operational losses but solid financial stability.

Which Stock to Choose?

Zscaler, Inc. (ZS) has shown strong income growth with a 297% revenue increase over five years, but suffers from negative profitability ratios including ROE at -2.31% and net margin at -1.55%. Its debt levels are moderate, supported by favorable liquidity ratios, yet the global financial ratio evaluation remains slightly unfavorable. The company’s rating is very favorable overall, though specific scores reveal weaknesses in profitability and valuation metrics.

GoDaddy Inc. (GDDY) displays stable income growth, with a 38% revenue increase over five years and a favorable net margin of 20.49%. Financial ratios indicate strong profitability, including a 135% ROE and a positive ROIC exceeding its WACC, signaling value creation. However, leverage is high with a debt-to-equity ratio of 5.63. The overall rating is very favorable, complemented by solid profitability and cash flow metrics despite some valuation concerns.

Considering both companies’ ratings and financials, Zscaler’s improving income and moderate debt might appeal to growth-oriented investors willing to accept short-term profitability challenges. Conversely, GoDaddy’s strong profitability and value creation could be more attractive to investors prioritizing financial stability and established earnings, despite higher leverage. The choice between these stocks could thus depend on an investor’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Zscaler, Inc. and GoDaddy Inc. to enhance your investment decisions: