GoDaddy Inc. and Wix.com Ltd. are two leading players in the software infrastructure industry, both specializing in cloud-based website creation and hosting solutions. While GoDaddy focuses on domain registration and comprehensive digital presence tools, Wix emphasizes user-friendly website design and integrated business applications. Their overlapping markets and innovative strategies make them natural competitors. In this article, I will analyze which company offers the most attractive investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between GoDaddy Inc. and Wix.com Ltd. by providing an overview of these two companies and their main differences.

GoDaddy Inc. Overview

GoDaddy Inc. focuses on cloud-based technology products, primarily serving small businesses and individuals by providing domain registration, website hosting, security, and marketing tools. The company offers a broad range of services such as managed hosting, online store capabilities, and business applications, positioning itself as a comprehensive digital identity and online presence provider. Headquartered in Tempe, Arizona, GoDaddy operates globally with a market cap of approximately 14.5B USD.

Wix.com Ltd. Overview

Wix.com Ltd. develops a cloud-based platform enabling users worldwide to create websites and web applications through drag-and-drop tools and AI-driven services. The company supports business growth with products like Wix Payments, marketing suites, and vertical-specific applications. Founded in 2006 and based in Tel Aviv, Israel, Wix serves millions of users with 6M premium subscriptions and holds a market capitalization near 4.5B USD.

Key similarities and differences

Both companies operate in the technology sector, providing cloud-based software infrastructure focused on website creation and online business facilitation. While GoDaddy emphasizes domain registration and a wider scope of hosting and security services, Wix concentrates on user-friendly website building with AI features and an extensive app marketplace. GoDaddy serves a broader range of customers including developers and domain investors, whereas Wix targets individual users and small business owners with customizable platforms.

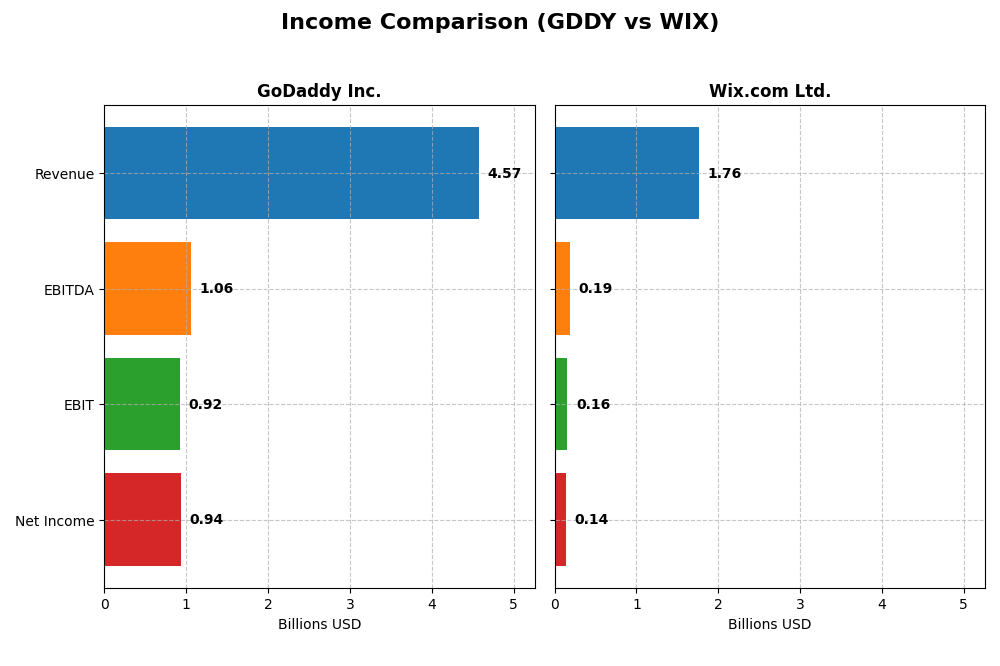

Income Statement Comparison

The table below compares key income statement metrics for GoDaddy Inc. and Wix.com Ltd. for the fiscal year 2024, highlighting their financial performance side by side.

| Metric | GoDaddy Inc. (GDDY) | Wix.com Ltd. (WIX) |

|---|---|---|

| Market Cap | 14.5B | 4.5B |

| Revenue | 4.57B | 1.76B |

| EBITDA | 1.06B | 186M |

| EBIT | 924M | 155M |

| Net Income | 937M | 138M |

| EPS | 6.63 | 2.49 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

GoDaddy Inc.

From 2020 to 2024, GoDaddy Inc. demonstrated solid revenue growth from $3.3B to $4.57B, with net income rising significantly from a loss of $495M to $937M. Margins showed strength, particularly gross margin at 63.88% and EBIT margin at 20.2% in 2024. The latest year saw revenue growth moderate to 7.5%, while net margin declined, indicating margin pressures despite rising operating income.

Wix.com Ltd.

Wix’s revenue expanded from $984M in 2020 to $1.76B in 2024, with net income swinging from a loss of $167M to a positive $138M. Gross margin was favorable at 67.93%, though EBIT margin was modest at 8.81%. In 2024, revenue growth accelerated to 12.74%, with strong improvements in net margin and EPS, reflecting operational leverage and profitability recovery after previous losses.

Which one has the stronger fundamentals?

Both companies show favorable income statement trends with growth and margin improvements. GoDaddy delivers higher absolute revenue and stronger EBIT margin, reflecting operational efficiency, but faced a net margin decline in the latest year. Wix exhibits faster revenue growth and margin recovery from losses, with consistent favorable margin growth. Overall, Wix shows more robust recent profitability momentum, while GoDaddy maintains stronger scale and margin levels.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for GoDaddy Inc. and Wix.com Ltd. based on their most recent fiscal year ended 2024.

| Ratios | GoDaddy Inc. (GDDY) | Wix.com Ltd. (WIX) |

|---|---|---|

| ROE | 1.35 | -1.76 |

| ROIC | 0.16 | 0.09 |

| P/E | 29.76 | 86.21 |

| P/B | 40.28 | -151.35 |

| Current Ratio | 0.72 | 0.84 |

| Quick Ratio | 0.72 | 0.84 |

| D/E (Debt-to-Equity) | 5.63 | -12.31 |

| Debt-to-Assets | 0.47 | 0.51 |

| Interest Coverage | 5.64 | 25.92 |

| Asset Turnover | 0.56 | 0.92 |

| Fixed Asset Turnover | 22.22 | 3.33 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

GoDaddy Inc.

GoDaddy shows strong profitability metrics with a net margin of 20.49% and an exceptionally high return on equity of 135.37%, indicating efficient use of equity capital. However, its valuation ratios such as P/E of 29.76 and P/B of 40.28 are unfavorable. Liquidity ratios are weak, with a current ratio of 0.72, and debt levels are high (D/E 5.63). GoDaddy does not pay dividends, consistent with its reinvestment and growth strategy.

Wix.com Ltd.

Wix displays moderate profitability with a net margin of 7.86% but suffers from a negative return on equity of -175.57%, reflecting potential operational challenges. Its P/E ratio is high at 86.21, signaling expensive valuation, though its negative D/E ratio suggests favorable leverage. Liquidity ratios are mixed, with a current ratio of 0.84. Wix also does not pay dividends, likely prioritizing reinvestment and innovation in a competitive market.

Which one has the best ratios?

GoDaddy’s ratios illustrate superior profitability and return measures compared to Wix, though it faces concerns with liquidity and valuation multiples. Wix’s financials show more mixed results, with weaker returns and valuation challenges but better debt profile. Overall, GoDaddy presents a more favorable ratio profile, while Wix’s metrics indicate slightly unfavorable conditions in 2024.

Strategic Positioning

This section compares the strategic positioning of GoDaddy Inc. and Wix.com Ltd. focusing on Market position, Key segments, and Exposure to technological disruption:

GoDaddy Inc.

- Market leader with a $14.5B market cap and broad US focus; faces moderate competitive pressure.

- Revenue driven by Core Platform ($2.9B) and Applications & Commerce ($1.65B), focusing on domains, hosting, and business tools.

- Exposure to cloud-based infrastructure and security tools; adapts with managed hosting and marketing products.

Wix.com Ltd.

- Smaller $4.5B market cap, global reach with higher beta, indicating greater volatility and competition.

- Concentrated on Creative Subscription ($1.26B) and Business Solutions ($496M), emphasizing website building platforms.

- Relies on cloud-based visual website development and AI-driven tools; continuous innovation in product suite.

GoDaddy Inc. vs Wix.com Ltd. Positioning

GoDaddy adopts a diversified approach with multiple revenue streams including domains, hosting, and business applications, providing broad market coverage. Wix is more concentrated on creative and business website solutions, focusing on user-friendly platforms and AI tools, which may limit diversification but enhance specialization.

Which has the best competitive advantage?

GoDaddy demonstrates a very favorable MOAT with an 8.6% ROIC above WACC and growing profitability, indicating a durable competitive advantage. Wix shows a slightly unfavorable MOAT, shedding value despite growing ROIC, suggesting less sustainable competitive advantage.

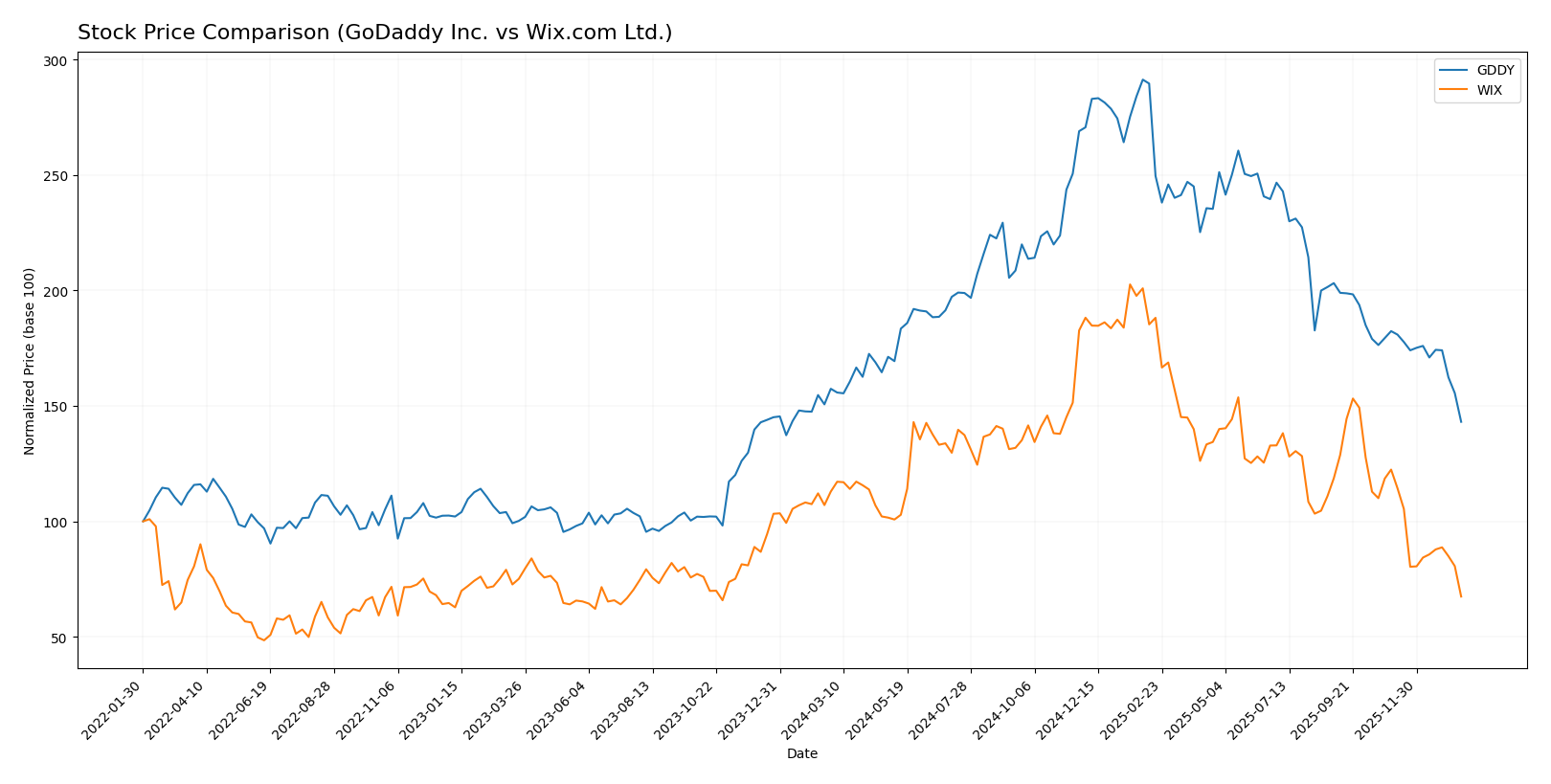

Stock Comparison

The stock price movements of GoDaddy Inc. and Wix.com Ltd. over the past year reveal significant bearish trends with notable deceleration and high volatility in trading dynamics.

Trend Analysis

GoDaddy Inc. experienced a 9.09% price decline over the last 12 months, indicating a bearish trend with decelerating downward momentum and significant volatility, ranging from a high of 212.65 to a low of 104.46.

Wix.com Ltd. showed a steeper 40.28% price drop over the same period, confirming a bearish trend with deceleration and even higher volatility, with prices fluctuating between 240.89 and 80.16.

Comparing both, Wix.com Ltd. exhibited a more pronounced bearish performance than GoDaddy Inc., delivering the lowest market returns during the analyzed period.

Target Prices

The current analyst consensus suggests promising upside potential for both GoDaddy Inc. and Wix.com Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| GoDaddy Inc. | 182 | 70 | 143.33 |

| Wix.com Ltd. | 210 | 70 | 160.27 |

Analysts expect GoDaddy’s stock to rise from its current price of $104.46 toward the consensus target of $143.33, indicating moderate growth potential. Wix’s consensus target of $160.27 significantly exceeds its current $80.16 price, reflecting a more bullish outlook.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for GoDaddy Inc. and Wix.com Ltd.:

Rating Comparison

GoDaddy Inc. Rating

- Rating: B+ indicating a very favorable assessment.

- Discounted Cash Flow Score: 5, very favorable valuation.

- ROE Score: 5, very favorable profitability from equity.

- ROA Score: 4, favorable asset utilization.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 3, moderate overall financial standing.

Wix.com Ltd. Rating

- Rating: C with a very favorable status noted.

- Discounted Cash Flow Score: 3, moderate valuation.

- ROE Score: 1, very unfavorable profitability from equity.

- ROA Score: 4, favorable asset utilization.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 2, moderate overall financial standing.

Which one is the best rated?

GoDaddy holds higher ratings in overall score, discounted cash flow, and return on equity, while both share the same unfavorable debt-to-equity score. Based strictly on provided data, GoDaddy is better rated overall.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for GoDaddy Inc. and Wix.com Ltd.:

GoDaddy Inc. Scores

- Altman Z-Score: 1.53, in distress zone indicating high bankruptcy risk.

- Piotroski Score: 8, very strong financial health rating.

Wix.com Ltd. Scores

- Altman Z-Score: 1.83, in grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 6, average financial health rating.

Which company has the best scores?

GoDaddy shows a higher Piotroski Score, reflecting stronger financial health, but a lower Altman Z-Score, indicating higher bankruptcy risk than Wix. Wix scores better on bankruptcy risk but lower on financial strength.

Grades Comparison

Here is a comparison of the most recent grades from reputable grading companies for GoDaddy Inc. and Wix.com Ltd.:

GoDaddy Inc. Grades

The following table summarizes the recent grades assigned by major financial institutions to GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

The consensus on GoDaddy Inc. is mixed with several “Buy” ratings alongside “Hold” and “Neutral” grades, indicating moderate optimism but some caution.

Wix.com Ltd. Grades

The following table shows recent grades from established financial firms for Wix.com Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-15 |

| Wells Fargo | Maintain | Overweight | 2025-12-19 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-11 |

| Wells Fargo | Maintain | Overweight | 2025-11-20 |

| Barclays | Maintain | Overweight | 2025-11-20 |

| Citizens | Maintain | Market Outperform | 2025-11-20 |

| Citigroup | Maintain | Buy | 2025-11-20 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-20 |

| Needham | Maintain | Buy | 2025-11-20 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-20 |

Wix.com Ltd. enjoys predominantly positive ratings, with multiple “Overweight,” “Outperform,” and “Buy” grades suggesting strong confidence from analysts.

Which company has the best grades?

Wix.com Ltd. has received consistently stronger grades than GoDaddy Inc., with more “Overweight,” “Outperform,” and “Buy” ratings. This may imply greater analyst confidence in Wix’s growth or stability, potentially affecting investor sentiment favorably compared to GoDaddy’s more mixed outlook.

Strengths and Weaknesses

Below is a comparative overview of the key strengths and weaknesses of GoDaddy Inc. (GDDY) and Wix.com Ltd. (WIX) based on their latest financial and strategic data.

| Criterion | GoDaddy Inc. (GDDY) | Wix.com Ltd. (WIX) |

|---|---|---|

| Diversification | Strong revenue mix with Core Platform ($2.92B) and Applications & Commerce ($1.65B) segments. | Revenue mainly from Creative Subscription ($1.26B) and Business Solutions ($496M), less diversified. |

| Profitability | High net margin of 20.49%, ROIC at 16.02%, favorable profitability metrics. | Moderate net margin of 7.86%, ROIC at 9.13%, profitability improving but still below ideal. |

| Innovation | Growing ROIC trend (+147%) signals efficient capital use and innovation. | Also shows growing ROIC trend (+159%), indicating increasing profitability potential. |

| Global presence | Large global footprint with broad product offering and strong market position. | Solid global presence but smaller scale and narrower market focus. |

| Market Share | Demonstrates durable competitive advantage with very favorable moat status. | Slightly unfavorable moat status; currently shedding value despite improving margins. |

Key takeaways: GoDaddy exhibits strong profitability, diversification, and a durable competitive moat, making it a more stable investment option. Wix, while showing growing profitability and innovation, remains less diversified and currently destroys value, warranting cautious consideration.

Risk Analysis

Below is a comparative table highlighting key risks for GoDaddy Inc. (GDDY) and Wix.com Ltd. (WIX) based on their latest available data from 2024.

| Metric | GoDaddy Inc. (GDDY) | Wix.com Ltd. (WIX) |

|---|---|---|

| Market Risk | Beta 0.95; moderate volatility | Beta 1.42; higher volatility |

| Debt level | Debt/Equity 5.63; high leverage | Debt/Equity -12.31; favorable (negative ratio suggests asset structure) |

| Regulatory Risk | Moderate, U.S. & international | Moderate, Israeli & international |

| Operational Risk | Medium; infrastructure focus | Medium; platform and app market |

| Environmental Risk | Low; tech sector exposure | Low; tech sector exposure |

| Geopolitical Risk | Low; U.S. base | Medium; Israel base with regional tensions |

The most impactful risks are GoDaddy’s high leverage (Debt/Equity 5.63) increasing financial risk and Wix’s higher market volatility (beta 1.42) combined with geopolitical exposure in a sensitive region. GoDaddy’s Altman Z-Score signals financial distress risk, while Wix is in a moderate grey zone. Investors should weigh leverage and regional risks carefully.

Which Stock to Choose?

GoDaddy Inc. (GDDY) shows a favorable income statement with strong revenue and net income growth over 2020-2024. Its financial ratios are mixed: excellent profitability and return metrics contrast with weaker liquidity and high debt. The company holds a very favorable B+ rating and demonstrates a durable competitive advantage with a very favorable moat evaluation.

Wix.com Ltd. (WIX) exhibits favorable income growth and improving profitability, though its return on equity remains negative. Financial ratios indicate some strengths but also concerns, including unfavorable debt-to-asset and price ratios. WIX holds a moderate C rating with a slightly unfavorable moat, signaling value destruction despite rising profitability.

Investors seeking companies with durable competitive advantages and strong profitability might find GoDaddy’s profile more aligned with quality investing. Conversely, those focused on revenue growth and potential turnaround opportunities could interpret Wix’s improving income trends as appealing, albeit with higher risk.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of GoDaddy Inc. and Wix.com Ltd. to enhance your investment decisions: