VeriSign, Inc. and GoDaddy Inc. are two leading players in the software infrastructure industry, both pivotal in managing domain name services and internet presence. VeriSign specializes in domain registry and internet security, while GoDaddy focuses on cloud-based tools and web hosting for small businesses. Their overlapping markets and distinct innovation strategies make them ideal candidates for comparison. This article will help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between VeriSign and GoDaddy by providing an overview of these two companies and their main differences.

VeriSign Overview

VeriSign, Inc. focuses on domain name registry services and internet infrastructure, ensuring the security and stability of internet navigation worldwide. It operates the authoritative registry for the .com and .net domains and manages root zone services and several root servers. VeriSign’s mission centers on maintaining resilient internet infrastructure, supporting global e-commerce since its incorporation in 1995.

GoDaddy Overview

GoDaddy Inc. develops cloud-based technology products to empower digital identity and online presence for small businesses and individuals. Its portfolio includes domain registration, website hosting, marketing tools, security products, and business applications like Microsoft Office 365. Founded in 2014, GoDaddy emphasizes comprehensive online solutions including e-commerce, payment facilitation, and social media management to help customers grow digitally.

Key similarities and differences

Both companies operate in the software infrastructure sector focusing on internet domain services but differ in scope and service breadth. VeriSign specializes in domain registry and internet infrastructure with a focus on security and stability at the core internet level. GoDaddy offers a broader suite of cloud-based products targeting website creation, hosting, marketing, and e-commerce, catering primarily to end-users and small businesses rather than infrastructure.

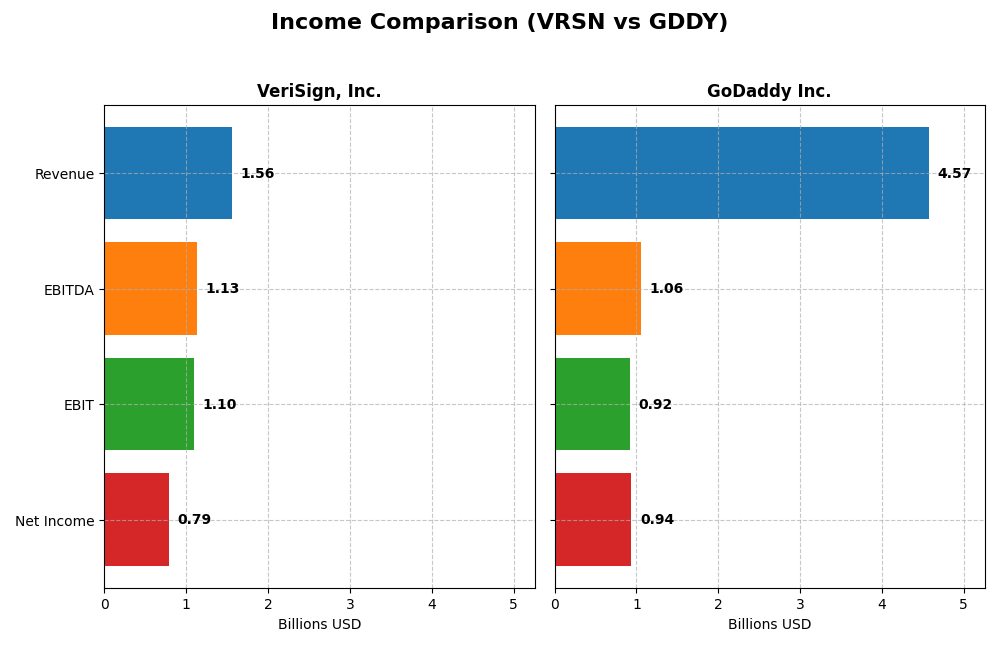

Income Statement Comparison

The table below summarizes the key income statement metrics for VeriSign, Inc. and GoDaddy Inc. for the fiscal year 2024, providing a clear comparison of their financial performance.

| Metric | VeriSign, Inc. (VRSN) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Cap | 23.1B | 14.5B |

| Revenue | 1.56B | 4.57B |

| EBITDA | 1.13B | 1.06B |

| EBIT | 1.10B | 924M |

| Net Income | 786M | 937M |

| EPS | 8.01 | 6.63 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

VeriSign, Inc.

VeriSign’s revenue increased steadily from $1.27B in 2020 to $1.56B in 2024, reflecting a favorable 23.11% growth over five years. Net income, however, declined slightly overall, down 3.58%, with a net margin contraction of 21.68%. In 2024, revenue grew modestly by 4.31%, gross profit improved, but net margin decreased, indicating some pressure on profitability despite stable operations.

GoDaddy Inc.

GoDaddy showed strong revenue growth from $3.32B in 2020 to $4.57B in 2024, a 37.88% increase, with net income rising impressively by 289.23% over the same period. Margins remained favorable, with a 20.49% net margin in 2024. Despite a 7.5% revenue growth in the latest year, net margin and EPS declined sharply, suggesting recent challenges in converting sales to profits efficiently.

Which one has the stronger fundamentals?

Both companies present favorable income statements, but GoDaddy displays stronger overall growth in revenue and net income with sustained margin improvements over the period. VeriSign maintains higher profitability margins but faces margin erosion and slight net income decline. GoDaddy’s recent earnings volatility contrasts with its long-term growth, while VeriSign shows steadier but slower growth and some margin pressure.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for VeriSign, Inc. (VRSN) and GoDaddy Inc. (GDDY) based on their most recent fiscal year data from 2024.

| Ratios | VeriSign, Inc. (VRSN) | GoDaddy Inc. (GDDY) |

|---|---|---|

| ROE | -40.1% | 135.4% |

| ROIC | 4.51% | 0.16% |

| P/E | 25.8 | 29.8 |

| P/B | -10.4 | 40.3 |

| Current Ratio | 0.43 | 0.72 |

| Quick Ratio | 0.43 | 0.72 |

| D/E | -0.92 | 5.63 |

| Debt-to-Assets | 128.1% | 47.3% |

| Interest Coverage | 14.1 | 5.64 |

| Asset Turnover | 1.11 | 0.56 |

| Fixed Asset Turnover | 6.66 | 22.22 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

VeriSign, Inc.

VeriSign’s ratios show strengths in net margin (50.45%) and return on invested capital (451.0%), indicating efficient profitability and capital use. However, unfavorable returns on equity (-40.13%) and liquidity ratios (current and quick ratios at 0.43) raise concerns about shareholder returns and short-term solvency. The company pays dividends with a last dividend of 3.08, but dividend yield is zero, suggesting limited shareholder distributions.

GoDaddy Inc.

GoDaddy presents a mixed ratio profile with favorable net margin (20.49%) and strong return on equity (135.37%). It has a high debt-to-equity ratio (5.63), indicating leverage risk, and liquidity ratios below 1, suggesting potential short-term funding challenges. GoDaddy does not pay dividends, reflecting its focus on reinvestment and growth, which aligns with its ongoing strategic priorities.

Which one has the best ratios?

VeriSign’s ratios are generally favorable with robust profitability and capital efficiency but show liquidity and equity return weaknesses. GoDaddy’s profile is more mixed, balancing strong equity returns against leverage and liquidity concerns. Overall, VeriSign has a more favorable ratio assessment, while GoDaddy’s ratios suggest neutrality due to offsetting strengths and weaknesses.

Strategic Positioning

This section compares the strategic positioning of VeriSign and GoDaddy, including Market position, Key segments, and Exposure to technological disruption:

VeriSign, Inc.

- Dominant domain registry for .com and .net, facing limited direct competition in internet infrastructure.

- Focused on domain registry services and internet infrastructure stability supporting global e-commerce.

- Operates critical internet root servers, ensuring high resilience; limited direct disruption threats noted.

GoDaddy Inc.

- Leading cloud-based technology provider offering domain registration, hosting, and a broad suite of digital services.

- Diversified across Core Platform and Applications & Commerce, serving small businesses and individuals globally.

- Provides evolving cloud hosting, security, marketing tools, and payment solutions, adapting to digital ecosystem shifts.

VeriSign vs GoDaddy Positioning

VeriSign concentrates on domain registry and internet infrastructure, offering stability but narrower market scope. GoDaddy pursues diversification with cloud services and business applications, providing broader revenue streams but facing more competitive segments.

Which has the best competitive advantage?

Both companies show very favorable moats with growing ROIC, but VeriSign’s dominance in domain registry and critical internet infrastructure suggests a stronger, more durable economic moat compared to GoDaddy’s diversified but competitive offerings.

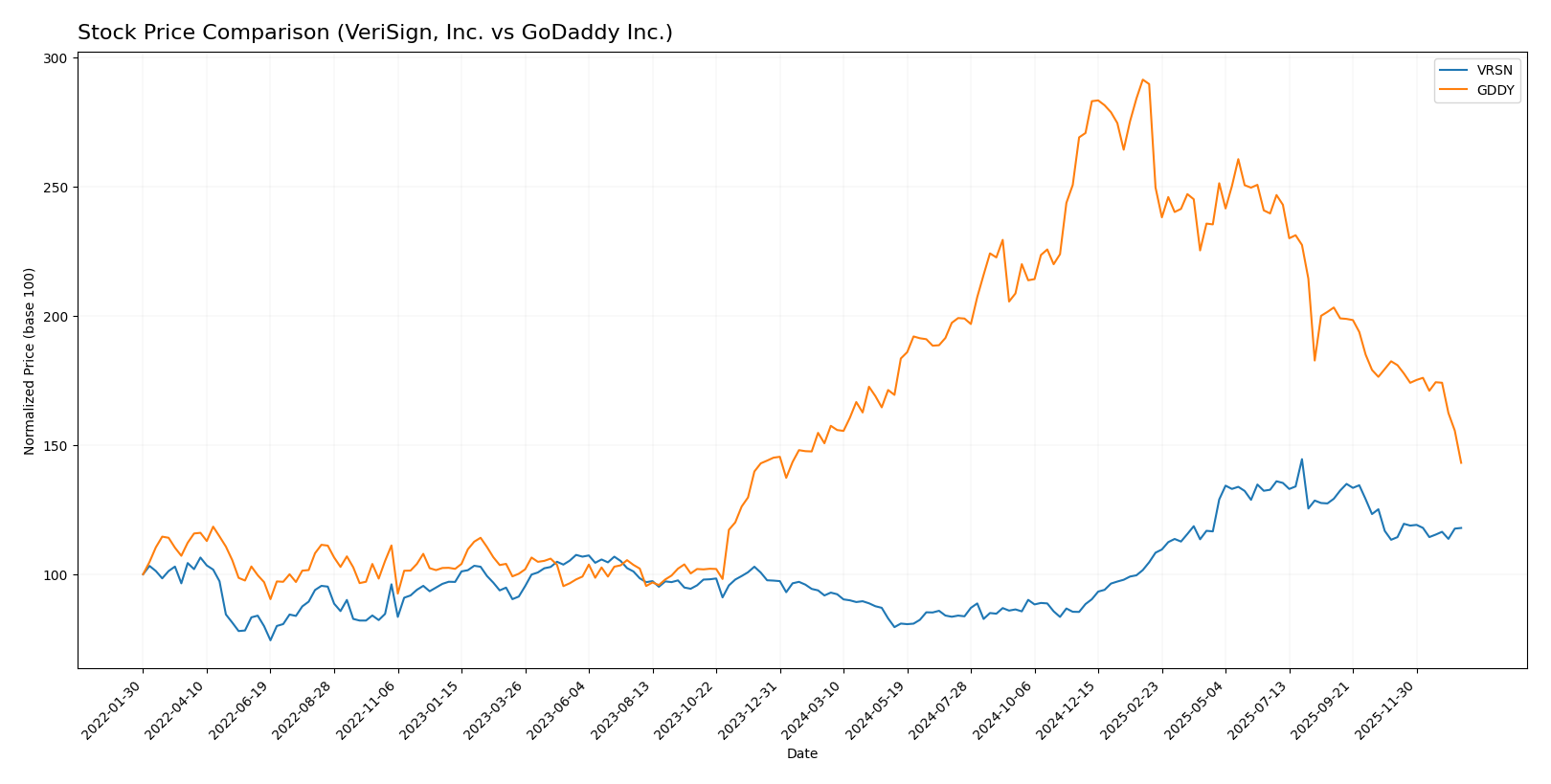

Stock Comparison

The stock price chart highlights robust gains for VeriSign, Inc. (VRSN) and notable declines for GoDaddy Inc. (GDDY) over the past 12 months, reflecting contrasting trading dynamics and market sentiment.

Trend Analysis

VeriSign, Inc. (VRSN) exhibited a bullish trend with a 26.92% price increase over the past year, despite deceleration in momentum. The stock showed high volatility with a standard deviation of 40.88, reaching a peak price of 305.79 and a low of 168.32.

GoDaddy Inc. (GDDY) experienced a bearish trend with a 9.09% price decline over the same period and decelerating downward momentum. The stock demonstrated moderate volatility with a standard deviation of 27.35 and traded between 104.46 and 212.65.

Comparing the two, VeriSign delivered the highest market performance with strong positive returns, whereas GoDaddy faced significant losses and weaker trading dynamics during the past year.

Target Prices

The current analyst consensus provides clear target price ranges for VeriSign, Inc. and GoDaddy Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| VeriSign, Inc. | 325 | 325 | 325 |

| GoDaddy Inc. | 182 | 70 | 143.33 |

Analysts expect VeriSign’s price to rise from 249.47 USD to 325 USD, indicating a strong upside. GoDaddy’s consensus target at 143.33 USD suggests moderate growth potential from its current 104.46 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for VeriSign, Inc. and GoDaddy Inc.:

Rating Comparison

VeriSign, Inc. Rating

- Rating: B- with a very favorable status

- Discounted Cash Flow Score: 4 (Favorable)

- ROE Score: 1 (Very Unfavorable)

- ROA Score: 5 (Very Favorable)

- Debt To Equity Score: 1 (Very Unfavorable)

- Overall Score: 2 (Moderate)

GoDaddy Inc. Rating

- Rating: B+ with a very favorable status

- Discounted Cash Flow Score: 5 (Very Favorable)

- ROE Score: 5 (Very Favorable)

- ROA Score: 4 (Favorable)

- Debt To Equity Score: 1 (Very Unfavorable)

- Overall Score: 3 (Moderate)

Which one is the best rated?

Based strictly on the provided data, GoDaddy Inc. holds a better rating (B+) and higher overall score (3) compared to VeriSign’s B- rating and overall score of 2. GoDaddy also scores better in ROE and DCF metrics.

Scores Comparison

The scores comparison between VeriSign, Inc. and GoDaddy Inc. is as follows:

VRSN Scores

- Altman Z-Score: -4.67, indicating financial distress risk.

- Piotroski Score: 8, reflecting very strong financial health.

GDDY Scores

- Altman Z-Score: 1.53, also indicating financial distress risk.

- Piotroski Score: 8, reflecting very strong financial health.

Which company has the best scores?

Both companies have identical Piotroski scores of 8, indicating very strong financial health. However, VeriSign’s Altman Z-Score is lower (-4.67) than GoDaddy’s (1.53), both in the distress zone, with VeriSign showing a higher bankruptcy risk.

Grades Comparison

The following presents the recent grading data for VeriSign, Inc. and GoDaddy Inc.:

VeriSign, Inc. Grades

This table summarizes the latest grades and actions from recognized grading companies for VeriSign, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Neutral | 2026-01-06 |

| Baird | maintain | Outperform | 2025-07-01 |

| Baird | maintain | Outperform | 2025-04-25 |

| Baird | maintain | Outperform | 2025-04-01 |

| Citigroup | maintain | Buy | 2025-02-04 |

| Citigroup | maintain | Buy | 2025-01-03 |

| Baird | upgrade | Outperform | 2024-12-09 |

| Baird | maintain | Neutral | 2024-06-27 |

| Baird | maintain | Neutral | 2024-04-26 |

| Citigroup | maintain | Buy | 2024-04-02 |

VeriSign’s grades mostly reflect a stable to positive outlook, with frequent “Outperform” and “Buy” ratings maintained over time.

GoDaddy Inc. Grades

This table presents the most recent grades and actions from established grading companies for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | maintain | Neutral | 2026-01-08 |

| Jefferies | maintain | Hold | 2026-01-05 |

| B. Riley Securities | maintain | Buy | 2025-10-31 |

| Evercore ISI Group | maintain | In Line | 2025-10-31 |

| Benchmark | maintain | Buy | 2025-10-31 |

| JP Morgan | maintain | Overweight | 2025-10-31 |

| Citigroup | maintain | Buy | 2025-10-31 |

| UBS | maintain | Neutral | 2025-10-31 |

| Wells Fargo | maintain | Equal Weight | 2025-10-06 |

GoDaddy’s grades span a range from “Hold” and “Neutral” to several “Buy” ratings, indicating a mixed but generally positive consensus.

Which company has the best grades?

Both VeriSign and GoDaddy hold a consensus “Buy” rating, but GoDaddy shows a wider distribution with more “Buy” and “Strong Buy” votes, while VeriSign’s grades tend to cluster around “Outperform” and “Buy.” This suggests GoDaddy may have broader analyst support, potentially affecting investor confidence and perceived growth opportunities differently for each stock.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for VeriSign, Inc. (VRSN) and GoDaddy Inc. (GDDY), based on their latest financial and strategic data.

| Criterion | VeriSign, Inc. (VRSN) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Diversification | Focused on domain name registry, limited diversification | Broader product range: Core Platform and Applications & Commerce segments |

| Profitability | Very high net margin (50.45%), strong ROIC (451%) but negative ROE (-40.13%) | Good net margin (20.49%), strong ROE (135.37%) and positive ROIC (16.02%) |

| Innovation | High profitability indicates efficient capital use, but limited product expansion | Growing revenues in applications and commerce suggest innovation and expansion |

| Global presence | Strong global domain registry presence | Global presence through diversified hosting and domain services |

| Market Share | Dominant in domain registry market with durable moat | Significant market share in hosting and domains, expanding commerce solutions |

Key takeaways: VeriSign excels in profitability and has a durable competitive advantage in domain registry but shows limited diversification. GoDaddy offers a more diversified business model with solid growth in multiple segments, though its profitability metrics are lower but improving. Both companies demonstrate growing ROIC, supporting their sustainable competitive positions.

Risk Analysis

Below is a comparative table highlighting key risk factors for VeriSign, Inc. (VRSN) and GoDaddy Inc. (GDDY) for the year 2024.

| Metric | VeriSign, Inc. (VRSN) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Risk | Beta 0.77 (moderate volatility) | Beta 0.95 (higher volatility) |

| Debt level | Debt to Assets 128% (high leverage) | Debt to Assets 47% (moderate leverage) |

| Regulatory Risk | Moderate; domain registry subject to internet governance policies | Moderate; hosting and payment services face compliance scrutiny |

| Operational Risk | Low; stable root zone maintainer, limited employees (929) | Moderate; larger workforce (5,518) and complex service offerings |

| Environmental Risk | Low; primarily digital infrastructure | Low; mainly digital services, limited physical footprint |

| Geopolitical Risk | Moderate; US-based with global domain influence | Moderate; US-based but international customer base |

The most impactful risks are VeriSign’s high debt level and moderate regulatory exposure, which could affect financial flexibility and operational stability. GoDaddy’s higher market volatility and operational complexity pose notable risks but are balanced by a stronger equity position. Both companies face moderate regulatory and geopolitical risks due to their critical internet infrastructure roles.

Which Stock to Choose?

VeriSign, Inc. (VRSN) shows a generally favorable income evolution with strong gross and EBIT margins around 88% and 70%, respectively, despite a slight net margin decline. Its financial ratios are mostly positive, notably a high ROIC of 451% versus WACC of 7.19%, signaling value creation. However, it carries notable debt concerns and a negative return on equity, reflected in a moderate overall rating of B-.

GoDaddy Inc. (GDDY) demonstrates favorable income growth and profitability improvements, with net margin at 20.5% and strong EPS growth over the period. Financial ratios reflect solid ROE above 135% and positive ROIC growth, although debt levels and leverage ratios remain elevated. Its rating is slightly higher at B+, with a moderate overall score highlighting both strengths and risks.

For investors focusing on durable competitive advantages and value creation, VeriSign’s robust ROIC and favorable income margins might appear attractive, particularly for those tolerant of leverage concerns. Conversely, growth-oriented investors might find GoDaddy’s strong equity returns and income growth more aligned with their strategy, despite its higher debt. Thus, the choice could depend on the investor’s risk tolerance and preference for growth versus capital efficiency.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of VeriSign, Inc. and GoDaddy Inc. to enhance your investment decisions: