Investors seeking growth in the technology sector often evaluate companies that drive innovation in software infrastructure. Synopsys, Inc. (SNPS) specializes in electronic design automation and IP solutions, while GoDaddy Inc. (GDDY) focuses on cloud-based web services and digital presence tools. Both play pivotal roles in empowering businesses through technology, yet their market approaches differ significantly. This article will help you decide which company offers the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Synopsys, Inc. and GoDaddy Inc. by providing an overview of these two companies and their main differences.

Synopsys, Inc. Overview

Synopsys, Inc. is a leader in electronic design automation software, focusing on tools and IP products that aid in designing and testing integrated circuits. Its offerings include design implementation, verification, FPGA prototyping, and security testing solutions. Serving sectors like electronics, automotive, and finance, Synopsys is headquartered in Mountain View, California, with a workforce of 20,000 employees and a market cap near $98.8B.

GoDaddy Inc. Overview

GoDaddy Inc. develops cloud-based technology products centered on domain registration, website hosting, and online presence management. It targets small businesses and individuals by providing marketing tools, security offerings, managed hosting, and e-commerce solutions. Based in Tempe, Arizona, GoDaddy employs approximately 5,518 people and has a market capitalization of about $14.5B.

Key similarities and differences

Both Synopsys and GoDaddy operate in the technology sector under software infrastructure but serve distinct customer bases and markets. Synopsys focuses on complex electronic design automation and IP solutions for industrial and tech sectors, while GoDaddy specializes in cloud-based web services and digital identity for small businesses. Synopsys is significantly larger in scale and scope, whereas GoDaddy emphasizes end-user web services and marketing tools.

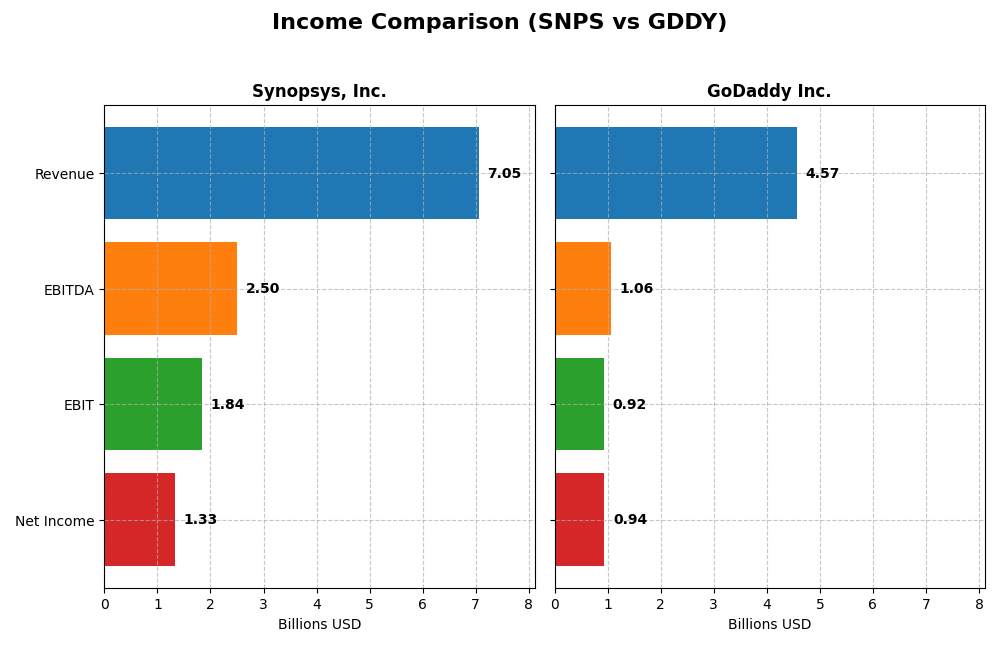

Income Statement Comparison

This table provides a side-by-side comparison of key income statement metrics for Synopsys, Inc. and GoDaddy Inc. for their most recent fiscal years.

| Metric | Synopsys, Inc. (SNPS) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Cap | 98.8B | 14.5B |

| Revenue | 7.05B | 4.57B |

| EBITDA | 2.50B | 1.06B |

| EBIT | 1.84B | 924M |

| Net Income | 1.33B | 937M |

| EPS | 8.13 | 6.63 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Synopsys, Inc.

Synopsys has shown consistent revenue growth from $4.2B in 2021 to $7.1B in 2025, with net income increasing overall from $757M to $1.33B despite a dip in 2025. Gross and EBIT margins remain favorable above 75% and 26%, respectively. In 2025, revenue growth slowed to 15.1%, while net margin and EPS declined, reflecting margin pressure despite higher operating income.

GoDaddy Inc.

GoDaddy’s revenue rose steadily from $3.3B in 2020 to $4.6B in 2024, with net income surging from a loss of $495M to $937M. Margins improved, with a gross margin of 63.9% and EBIT margin of 20.2% in 2024. The most recent year showed moderate revenue growth of 7.5% and a strong EBIT increase of 58.5%, although net margin and EPS contracted, indicating mixed profitability trends.

Which one has the stronger fundamentals?

Synopsys shows stronger revenue and net income growth over five years with very high gross and EBIT margins, but recent margin compression and EPS decline raise caution. GoDaddy exhibits impressive net income turnaround and margin expansion, with a higher proportion of favorable metrics and rapid EPS growth overall. Both companies present favorable fundamentals, with GoDaddy showing more recent operational leverage despite lower absolute scale.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Synopsys, Inc. (SNPS) and GoDaddy Inc. (GDDY), illustrating their profitability, liquidity, leverage, and efficiency metrics.

| Ratios | Synopsys, Inc. (SNPS) | GoDaddy Inc. (GDDY) |

|---|---|---|

| ROE | 4.72% | 135.37% |

| ROIC | 1.97% | 16.02% |

| P/E | 54.36 | 29.76 |

| P/B | 2.57 | 40.28 |

| Current Ratio | 1.62 | 0.72 |

| Quick Ratio | 1.52 | 0.72 |

| D/E (Debt-to-Equity) | 0.50 | 5.63 |

| Debt-to-Assets | 29.64% | 47.29% |

| Interest Coverage | 2.05 | 5.64 |

| Asset Turnover | 0.15 | 0.56 |

| Fixed Asset Turnover | 5.04 | 22.22 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Synopsys, Inc.

Synopsys shows a mixed ratio profile with favorable net margin at 18.96% and strong liquidity indicated by current and quick ratios above 1.5. However, its low return on equity (4.72%) and return on invested capital (1.97%) raise concerns, alongside a high price-to-earnings ratio of 54.36. The company does not pay dividends, likely focusing on reinvestment and growth.

GoDaddy Inc.

GoDaddy exhibits strong profitability ratios, including a net margin of 20.49%, ROE at 135.37%, and ROIC at 16.02%. It benefits from a low WACC of 7.42% and robust interest coverage. Yet, its balance sheet shows weaknesses: low current and quick ratios (0.72) and a high debt-to-equity ratio of 5.63. It similarly does not pay dividends, possibly prioritizing growth and acquisitions.

Which one has the best ratios?

Both companies have a neutral overall ratio evaluation with balanced favorable and unfavorable metrics. Synopsys displays stronger liquidity and moderate leverage but weaker profitability, while GoDaddy has excellent profitability but weaker liquidity and higher leverage. Neither company offers dividend returns, reflecting growth-focused financial strategies.

Strategic Positioning

This section compares the strategic positioning of Synopsys and GoDaddy, focusing on Market position, Key segments, and Exposure to technological disruption:

Synopsys, Inc.

- Leading EDA software provider facing competitive pressure in tech infrastructure.

- Diverse segments: digital design, verification, IP solutions, and security services.

- Exposed to technological shifts in semiconductor design and security testing.

GoDaddy Inc.

- Cloud-based technology leader with competitive pressure in domain and hosting services.

- Focused on domain registration, website hosting, marketing, and business applications.

- Exposure to cloud technology evolution and online marketing innovations.

Synopsys, Inc. vs GoDaddy Inc. Positioning

Synopsys pursues a diversified strategy across electronic design and IP services, offering broad tech solutions. GoDaddy concentrates on digital identity and web presence services, focusing on SMEs and individuals. Synopsys’ diversity may mitigate risk, while GoDaddy’s focus targets niche market needs explicitly.

Which has the best competitive advantage?

GoDaddy holds a very favorable moat with growing ROIC, indicating durable competitive advantage. Synopsys shows very unfavorable moat status with declining ROIC, reflecting challenges in sustaining value creation and profitability.

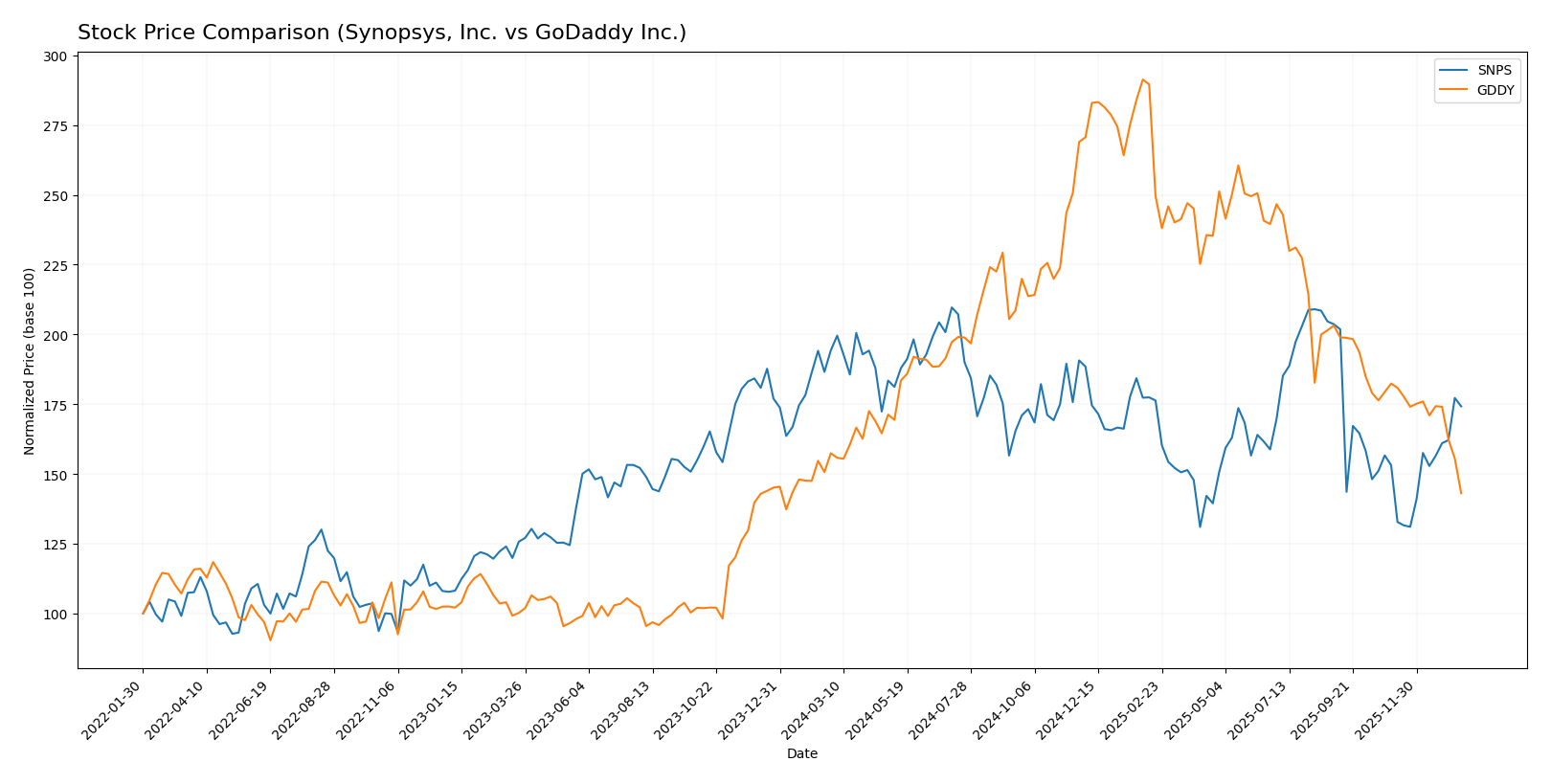

Stock Comparison

The stock price movements of Synopsys, Inc. and GoDaddy Inc. over the past 12 months reveal distinct bearish trends, with Synopsys showing recent acceleration and GoDaddy experiencing deceleration and increased selling pressure.

Trend Analysis

Synopsys, Inc. (SNPS) recorded a -10.31% price change over the past year, indicating a bearish trend with accelerating downward momentum. The stock fluctuated between $621.3 and $388.13, showing high volatility with a standard deviation of 58.85.

GoDaddy Inc. (GDDY) experienced a -9.09% price change over the same period, also bearish but with decelerating losses. Its price ranged from $212.65 to $104.46, with lower volatility reflected by a standard deviation of 27.35.

Comparing the two, Synopsys showed a larger negative price change but recent upward momentum, while GoDaddy’s trend is steadily declining. Overall, GoDaddy delivered a slightly better market performance despite both stocks trending down.

Target Prices

Analyst consensus indicates promising upside potential for both Synopsys, Inc. and GoDaddy Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Synopsys, Inc. | 600 | 425 | 530 |

| GoDaddy Inc. | 182 | 70 | 143.33 |

Synopsys shares trade near $516, slightly below the $530 consensus, suggesting modest upside. GoDaddy’s current price around $104 is well below the $143 consensus, indicating significant potential price appreciation according to analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Synopsys, Inc. (SNPS) and GoDaddy Inc. (GDDY):

Rating Comparison

SNPS Rating

- Rating: B- with a very favorable status

- Discounted Cash Flow Score: 3, moderate rating

- ROE Score: 3, moderate rating

- ROA Score: 3, moderate rating

- Debt To Equity Score: 2, moderate rating

- Overall Score: 3, moderate rating

GDDY Rating

- Rating: B+ with a very favorable status

- Discounted Cash Flow Score: 5, very favorable rating

- ROE Score: 5, very favorable rating

- ROA Score: 4, favorable rating

- Debt To Equity Score: 1, very unfavorable rating

- Overall Score: 3, moderate rating

Which one is the best rated?

Based strictly on the provided data, GDDY holds higher individual financial scores in discounted cash flow, ROE, and ROA, resulting in a better overall rating (B+) compared to SNPS’s B-. However, GDDY’s debt-to-equity score is weaker than SNPS’s.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Synopsys and GoDaddy:

Synopsys Scores

- Altman Z-Score: 3.54, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 4, average financial strength.

GoDaddy Scores

- Altman Z-Score: 1.53, in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 8, very strong financial strength.

Which company has the best scores?

Synopsys has a safer Altman Z-Score, suggesting lower bankruptcy risk, while GoDaddy shows a stronger Piotroski Score, indicating better financial strength. Each company leads in a different score category.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Synopsys, Inc. and GoDaddy Inc.:

Synopsys, Inc. Grades

The following table summarizes recent grade actions from key grading companies for Synopsys, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Morgan Stanley | Maintain | Overweight | 2025-12-12 |

| Rosenblatt | Maintain | Buy | 2025-12-11 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| Piper Sandler | Maintain | Overweight | 2025-12-11 |

| Needham | Maintain | Buy | 2025-12-11 |

| B of A Securities | Upgrade | Buy | 2025-12-11 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-11 |

| Rosenblatt | Upgrade | Buy | 2025-12-09 |

Synopsys shows a generally positive grade trend with multiple Buy and Overweight ratings and few downgrades, indicating confidence among analysts.

GoDaddy Inc. Grades

The table below presents recent grading company ratings for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

GoDaddy’s grades are more mixed, with a balance of Buy, Hold, Neutral, and Equal Weight recommendations, showing a more cautious analyst stance.

Which company has the best grades?

Synopsys, Inc. has received stronger grades overall, with multiple Buy and Overweight ratings and few neutral stances, suggesting greater analyst confidence. GoDaddy’s more varied grades may imply higher uncertainty, possibly affecting investor sentiment and risk assessment.

Strengths and Weaknesses

Below is a comparative overview of Synopsys, Inc. and GoDaddy Inc. based on key financial and strategic criteria as of 2026.

| Criterion | Synopsys, Inc. (SNPS) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Diversification | Moderate: Focused on software licenses and tech services, growing steadily | Strong: Diverse portfolio with core platform and commerce applications |

| Profitability | Moderate net margin (19%), but low ROIC (1.97%) and declining profitability; value destroying | High net margin (20.5%), robust ROIC (16%), and growing profitability; value creating |

| Innovation | Solid innovation in semiconductor software solutions, but profitability concerns | Consistent innovation in web services with scalable product lines |

| Global presence | Established global footprint in semiconductor industry | Broad global reach in online presence and commerce services |

| Market Share | Strong in semiconductor software licensing, but facing competitive pressures | Leading in domain registration and small business online services |

Key takeaways: GoDaddy demonstrates a durable competitive advantage with growing profitability and diversified offerings, making it a strong candidate for investment. Synopsys, while innovative, shows declining returns and value destruction, suggesting caution despite its market position.

Risk Analysis

Below is a comparison of key risks for Synopsys, Inc. (SNPS) and GoDaddy Inc. (GDDY) based on the most recent data from 2025 and 2024 respectively:

| Metric | Synopsys, Inc. (SNPS) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Risk | Beta 1.12 indicates moderate volatility; tech sector sensitive to innovation cycles | Beta 0.95 suggests slightly lower volatility; exposure to SMB market fluctuations |

| Debt level | Debt-to-Equity 0.5 (neutral); Debt-to-Assets 29.6% favorable, manageable leverage | Debt-to-Equity 5.63 (unfavorable); Debt-to-Assets 47.3% neutral, higher financial risk |

| Regulatory Risk | Moderate, due to technology IP and security compliance requirements | Moderate, with data privacy and e-commerce regulations impacting operations |

| Operational Risk | Moderate, complexity in semiconductor software and IP solutions | Moderate, reliance on cloud infrastructure and customer acquisition costs |

| Environmental Risk | Low, limited direct environmental impact | Low, mainly digital services with minimal environmental footprint |

| Geopolitical Risk | Moderate, global supply chain dependencies and US-China tech tensions | Moderate, international presence subject to trade and data sovereignty issues |

Synopsys faces moderate market and operational risks with a solid debt position, but its valuation ratios suggest caution. GoDaddy’s high debt level and lower liquidity ratios pose the greatest risk, despite strong profitability scores. Both companies face regulatory and geopolitical uncertainties that could impact growth.

Which Stock to Choose?

Synopsys, Inc. (SNPS) shows favorable income growth with a 67.79% revenue increase over five years and solid gross and EBIT margins. However, its profitability ratios like ROE (4.72%) and ROIC (1.97%) are unfavorable, with a high net debt to EBITDA ratio (4.36) and a very unfavorable MOAT rating indicating value destruction.

GoDaddy Inc. (GDDY) exhibits a balanced income evolution with a 37.88% revenue growth over five years and strong profitability metrics, including a high ROE (135.37%) and ROIC (16.02%). Despite a higher debt-to-equity ratio (5.63) and lower liquidity ratios, its MOAT rating is very favorable, signaling efficient capital use and value creation.

Investors focused on stable value creation and profitability might find GoDaddy’s strong MOAT and robust financial ratios appealing, while those emphasizing income growth with moderate financial risk could see Synopsys’s favorable income statement as attractive, albeit with caution due to its declining ROIC and higher leverage.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Synopsys, Inc. and GoDaddy Inc. to enhance your investment decisions: