In the dynamic technology sector, GoDaddy Inc. and StoneCo Ltd. stand out as influential players, each driving innovation in software infrastructure. GoDaddy focuses on empowering digital identities and online presence worldwide, while StoneCo excels in financial technology solutions tailored to Brazil’s vibrant e-commerce market. This comparison sheds light on their strategic approaches and market potential, helping you identify which company may be the smarter addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between GoDaddy Inc. and StoneCo Ltd. by providing an overview of these two companies and their main differences.

GoDaddy Inc. Overview

GoDaddy Inc. focuses on designing and developing cloud-based technology products, primarily serving small businesses and individuals. Its core offerings include domain name registration, website hosting, security products, and marketing tools to help customers establish and grow their online presence. Headquartered in Tempe, Arizona, GoDaddy operates internationally and emphasizes enabling digital identity and e-commerce capabilities.

StoneCo Ltd. Overview

StoneCo Ltd. provides financial technology solutions tailored to merchants and partners in Brazil, facilitating electronic commerce across in-store, online, and mobile channels. It distributes its products through proprietary hubs and a sales network, targeting primarily small and medium-sized businesses. Founded in 2000 and based in George Town, Cayman Islands, StoneCo serves over 1.7M clients and operates as a subsidiary of HR Holdings, LLC.

Key similarities and differences

Both GoDaddy and StoneCo operate within the technology sector, focusing on infrastructure software, but target different markets and customer bases; GoDaddy emphasizes web presence and e-commerce services globally, while StoneCo centers on fintech solutions in Brazil. They share similar employee scale, with GoDaddy employing 5.5K and StoneCo 7.2K staff. However, their business models diverge, with GoDaddy offering a broad suite of digital tools and hosting services, whereas StoneCo specializes in payment and commerce facilitation technology.

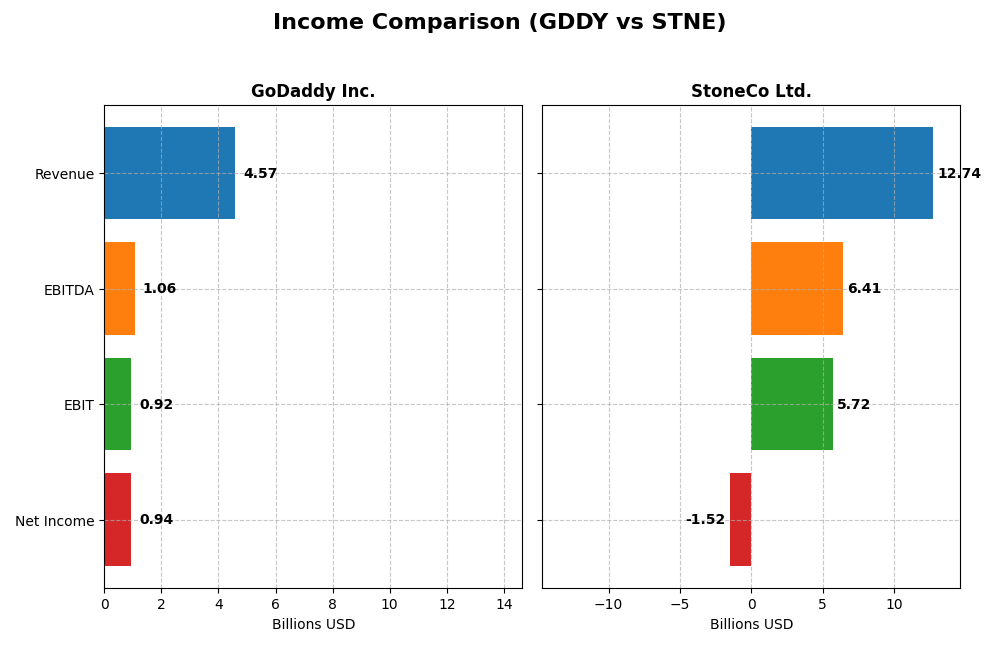

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for GoDaddy Inc. and StoneCo Ltd. for the fiscal year 2024, enabling a clear view of their financial performance.

| Metric | GoDaddy Inc. (GDDY) | StoneCo Ltd. (STNE) |

|---|---|---|

| Market Cap | 14.5B USD | 3.9B USD |

| Revenue | 4.57B USD | 12.7B BRL |

| EBITDA | 1.06B USD | 6.41B BRL |

| EBIT | 924M USD | 5.72B BRL |

| Net Income | 937M USD | -1.52B BRL |

| EPS | 6.63 USD | -5.02 BRL |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

GoDaddy Inc.

From 2020 to 2024, GoDaddy Inc. showed steady revenue growth of 37.9%, with net income increasing significantly by 289.2%. Gross and EBIT margins remained favorable, around 63.9% and 20.2% respectively. In 2024, revenue grew 7.5% but net margin declined by 36.6%, reflecting some pressure on profitability despite overall solid margin levels.

StoneCo Ltd.

StoneCo’s revenue surged 302.3% over 2020-2024, with a 12.1% increase in 2024 alone. Gross margin is strong at 73.4%, alongside a high EBIT margin of 44.9%. However, the company reported negative net margins of -11.9%, worsening net income by 277.4% over the period, and net margin fell sharply in 2024, indicating challenges in translating revenue growth to bottom-line profits.

Which one has the stronger fundamentals?

GoDaddy demonstrates more stable and consistently favorable margins, with positive net income growth and controlled interest expenses, supporting stronger profitability fundamentals. StoneCo shows impressive revenue growth and high operational margins but suffers from persistent net losses and negative net margin trends, raising concerns about its bottom-line sustainability despite top-line strength.

Financial Ratios Comparison

The table below presents key financial ratios for GoDaddy Inc. and StoneCo Ltd. based on the most recent fiscal year 2024 data, offering a clear view of their financial performance and stability.

| Ratios | GoDaddy Inc. (GDDY) | StoneCo Ltd. (STNE) |

|---|---|---|

| ROE | 135.4% | -12.9% |

| ROIC | 16.0% | 22.4% |

| P/E | 29.8 | -9.8 |

| P/B | 40.3 | 1.27 |

| Current Ratio | 0.72 | 1.37 |

| Quick Ratio | 0.72 | 1.37 |

| D/E (Debt-to-Equity) | 5.63 | 1.10 |

| Debt-to-Assets | 47.3% | 23.5% |

| Interest Coverage | 5.64 | 5.57 |

| Asset Turnover | 0.56 | 0.23 |

| Fixed Asset Turnover | 22.2 | 6.95 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

GoDaddy Inc.

GoDaddy exhibits strong profitability with a net margin of 20.49% and an exceptionally high ROE of 135.37%, indicating efficient equity use. However, liquidity ratios are weak, with a current ratio of 0.72 and a high debt-to-equity ratio of 5.63, signaling potential short-term risk. The company does not pay dividends, likely prioritizing reinvestment in growth and R&D.

StoneCo Ltd.

StoneCo shows mixed results: ROIC is favorable at 22.41%, but profitability ratios like net margin (-11.89%) and ROE (-12.87%) are negative, reflecting operational challenges. Liquidity is better than GoDaddy’s, with a current ratio of 1.37 and quick ratio also at 1.37. StoneCo does not pay dividends, suggesting focus on reinvestment and expansion amid ongoing losses.

Which one has the best ratios?

StoneCo has a slightly more favorable overall ratio profile, with half its ratios positive and better liquidity metrics. GoDaddy demonstrates stronger profitability and return measures but is hindered by weak liquidity and high leverage. Both companies have no dividend payouts, emphasizing growth strategies over shareholder returns.

Strategic Positioning

This section compares the strategic positioning of GoDaddy Inc. and StoneCo Ltd. based on market position, key segments, and exposure to technological disruption:

GoDaddy Inc.

- Large market cap of 14.5B USD, moderate beta, faces competition in cloud-based technology and hosting services.

- Focuses on cloud-based products: domain registration, hosting, marketing tools, business applications, and payment facilitation.

- Operates in established software infrastructure with incremental innovations in hosting, security, and e-commerce tools.

StoneCo Ltd.

- Smaller market cap of 3.9B USD, higher beta, competes in Brazilian fintech market with local sales model.

- Concentrates on financial technology solutions for merchants in Brazil, including in-store, online, and mobile commerce.

- Utilizes proprietary Stone Hubs and localized sales but exposed to fintech innovations and evolving payment technologies.

GoDaddy Inc. vs StoneCo Ltd. Positioning

GoDaddy pursues a diversified digital infrastructure strategy, spanning hosting, domains, and commerce applications, while StoneCo focuses narrowly on fintech solutions for Brazilian merchants. GoDaddy’s broad product range supports varied revenue streams; StoneCo’s local specialization targets regional market needs.

Which has the best competitive advantage?

Both companies demonstrate very favorable moats with growing ROIC trends indicating durable competitive advantages. StoneCo’s higher ROIC growth suggests a potentially stronger value creation despite its smaller scale compared to GoDaddy’s broader market presence.

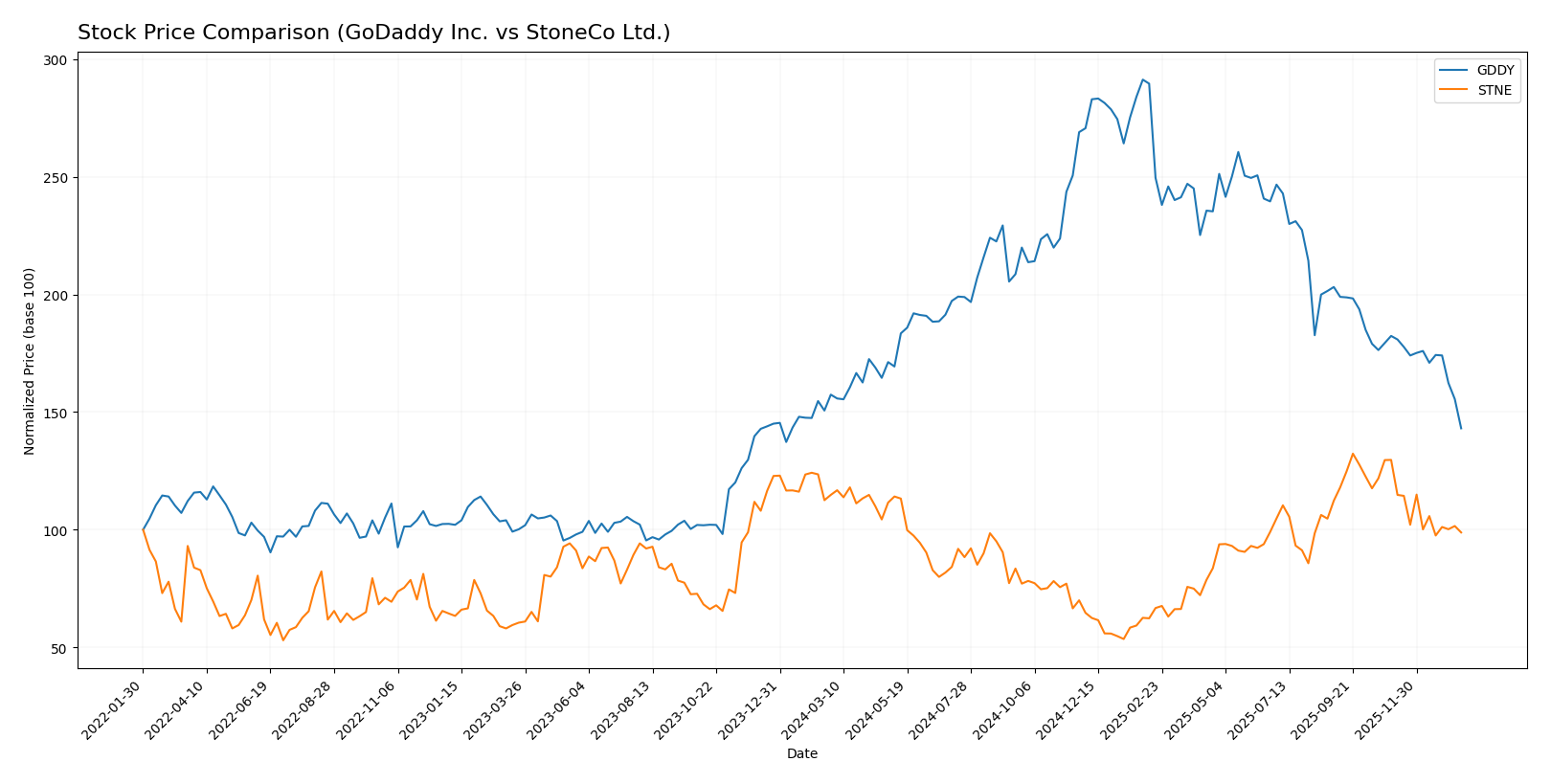

Stock Comparison

The stock price movements of GoDaddy Inc. and StoneCo Ltd. over the past 12 months reveal sustained bearish trends marked by deceleration and notable price declines, with recent periods showing intensified downward pressure and shifts in buyer-seller dynamics.

Trend Analysis

GoDaddy Inc. (GDDY) experienced a bearish trend over the past year with a -9.09% price change, decelerating downward momentum, and high volatility (27.35 std deviation). The stock reached a high of 212.65 and a low of 104.46.

StoneCo Ltd. (STNE) also showed a bearish trend over the same period with a -13.9% price change, deceleration in trend, and lower volatility (2.92 std deviation). Its highest and lowest prices were 19.4 and 7.85, respectively.

Comparing both, GoDaddy’s stock outperformed StoneCo’s with a smaller overall price decline, despite both showing bearish trends and deceleration over the past year.

Target Prices

Analysts present a mixed but generally positive target consensus for GoDaddy Inc. and StoneCo Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| GoDaddy Inc. | 182 | 70 | 143.33 |

| StoneCo Ltd. | 20 | 20 | 20 |

GoDaddy’s target consensus at 143.33 USD suggests upside potential compared to the current price of 104.46 USD, reflecting moderate optimism. StoneCo’s consensus at 20 USD is above its current price of 14.49 USD, indicating expected growth from analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for GoDaddy Inc. and StoneCo Ltd.:

Rating Comparison

GoDaddy Inc. Rating

- Rating: B+ indicating a very favorable overall status.

- Discounted Cash Flow Score: 5, very favorable valuation based on future cash flows.

- ROE Score: 5, very favorable efficiency in generating profit from equity.

- ROA Score: 4, favorable asset utilization to generate earnings.

- Debt To Equity Score: 1, very unfavorable due to higher financial risk.

- Overall Score: 3, moderate overall financial standing.

StoneCo Ltd. Rating

- Rating: C reflecting a very unfavorable overall status.

- Discounted Cash Flow Score: 3, moderate valuation based on future cash flows.

- ROE Score: 1, very unfavorable efficiency in profit generation from equity.

- ROA Score: 1, very unfavorable asset utilization for earnings.

- Debt To Equity Score: 1, very unfavorable indicating high financial risk.

- Overall Score: 2, moderate but below GoDaddy’s overall score.

Which one is the best rated?

Based on the provided data, GoDaddy Inc. is better rated than StoneCo Ltd., with higher scores in discounted cash flow, ROE, ROA, and an overall rating of B+ versus StoneCo’s C rating. Both share a very unfavorable debt-to-equity score.

Scores Comparison

Here is a comparison of the financial scores for GoDaddy Inc. and StoneCo Ltd.:

GoDaddy Scores

- Altman Z-Score: 1.53, indicating financial distress zone risk.

- Piotroski Score: 8, classified as very strong financial health.

StoneCo Scores

- Altman Z-Score: 1.02, also in the financial distress zone.

- Piotroski Score: 5, indicating average financial health.

Which company has the best scores?

GoDaddy shows a slightly higher Altman Z-Score but both are in distress zones. GoDaddy’s Piotroski Score is very strong compared to StoneCo’s average score, indicating better financial strength.

Grades Comparison

The grades from several reputable financial institutions for GoDaddy Inc. and StoneCo Ltd. are as follows:

GoDaddy Inc. Grades

This table summarizes recent grades from recognized grading companies for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | maintain | Neutral | 2026-01-08 |

| Jefferies | maintain | Hold | 2026-01-05 |

| B. Riley Securities | maintain | Buy | 2025-10-31 |

| Evercore ISI Group | maintain | In Line | 2025-10-31 |

| Benchmark | maintain | Buy | 2025-10-31 |

| JP Morgan | maintain | Overweight | 2025-10-31 |

| Citigroup | maintain | Buy | 2025-10-31 |

| UBS | maintain | Neutral | 2025-10-31 |

| Wells Fargo | maintain | Equal Weight | 2025-10-06 |

Overall, GoDaddy’s grades mostly range between Buy and Hold, with a stable outlook and no recent downgrades.

StoneCo Ltd. Grades

This table summarizes recent grades from recognized grading companies for StoneCo Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | maintain | Buy | 2025-10-14 |

| B of A Securities | maintain | Buy | 2025-09-09 |

| UBS | maintain | Buy | 2025-08-29 |

| JP Morgan | maintain | Overweight | 2025-07-16 |

| Barclays | maintain | Equal Weight | 2025-05-12 |

| Barclays | maintain | Equal Weight | 2025-04-23 |

| Citigroup | upgrade | Buy | 2025-04-22 |

| Barclays | maintain | Equal Weight | 2025-03-21 |

| Morgan Stanley | maintain | Underweight | 2025-03-21 |

| Goldman Sachs | maintain | Buy | 2025-02-06 |

StoneCo’s grades generally indicate a Buy consensus with some Equal Weight ratings and one Underweight rating from Morgan Stanley.

Which company has the best grades?

GoDaddy Inc. has a larger number of Buy ratings and fewer Hold or Neutral ratings compared to StoneCo Ltd., which shows more mixed ratings including Equal Weight and one Underweight. This suggests GoDaddy is viewed more favorably by analysts, potentially indicating stronger confidence or growth prospects that could impact investor sentiment.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for GoDaddy Inc. (GDDY) and StoneCo Ltd. (STNE) based on their latest financial and strategic data.

| Criterion | GoDaddy Inc. (GDDY) | StoneCo Ltd. (STNE) |

|---|---|---|

| Diversification | Strong product diversification with Core Platform and Applications & Commerce generating $2.92B and $1.65B respectively in 2024 | Focused primarily on digital payment solutions; less diversified in product lines |

| Profitability | High net margin at 20.49%; very favorable ROE of 135.37% and ROIC of 16.02% | Negative net margin (-11.89%) and ROE (-12.87%), but favorable ROIC at 22.41% |

| Innovation | Consistent revenue growth in business applications and platforms; favorable fixed asset turnover indicates efficient use of assets | High ROIC growth (371%), indicating strong innovation potential despite current losses |

| Global presence | Established global presence with diversified customer base | Mainly focused on Latin American markets, limiting global reach |

| Market Share | Large market share in domain registration and hosting | Growing market share in fintech payments but still emerging compared to global peers |

Key takeaways: GoDaddy demonstrates strong profitability, diversification, and a durable competitive advantage with growing returns on invested capital. StoneCo shows promising innovation and ROIC growth but struggles with profitability and has a more concentrated geographic presence, indicating higher risk but potential for future value creation.

Risk Analysis

Below is a comparative overview of key risks for GoDaddy Inc. and StoneCo Ltd. based on the most recent data from 2024:

| Metric | GoDaddy Inc. (GDDY) | StoneCo Ltd. (STNE) |

|---|---|---|

| Market Risk | Moderate (Beta 0.95) | High (Beta 1.84) |

| Debt level | High (D/E 5.63) | Moderate (D/E 1.10) |

| Regulatory Risk | Moderate (US tech sector) | High (Brazil fintech, regulatory changes) |

| Operational Risk | Moderate (Tech infrastructure) | Moderate (Fintech platform operations) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Low (US-based) | High (Brazil/Cayman Islands exposure) |

GoDaddy faces significant debt-related risks with a high debt-to-equity ratio and liquidity concerns (current ratio 0.72). StoneCo is more exposed to market volatility and geopolitical risks due to its Brazilian operations and higher beta, alongside regulatory uncertainty in fintech. Both companies have moderate operational risks, but StoneCo’s financial instability and geopolitical exposure are the most impactful concerns currently.

Which Stock to Choose?

GoDaddy Inc. (GDDY) exhibits favorable income growth with a 37.9% revenue increase over 2020-2024 and strong profitability, including a 20.5% net margin and 135.4% ROE. Debt levels are high with a debt-to-equity ratio of 5.63, and the company holds a very favorable B+ rating.

StoneCo Ltd. (STNE) shows strong revenue growth of 302.3% over the period but suffers from negative net margin (-11.9%) and ROE (-12.9%). Its debt profile is more conservative with a debt-to-assets ratio of 23.5%, and it has a very favorable C rating despite profitability challenges.

For investors prioritizing durable competitive advantage and profitability, GoDaddy’s very favorable rating and value-creating ROIC could appear more aligned with quality investing. Conversely, those focused on growth and lower leverage might find StoneCo’s improving ROIC and growth profile slightly favorable despite current profitability issues.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of GoDaddy Inc. and StoneCo Ltd. to enhance your investment decisions: