In the ever-evolving technology sector, Palo Alto Networks, Inc. (PANW) and GoDaddy Inc. (GDDY) stand out as influential players in software infrastructure. While both operate in cybersecurity and cloud-based services, their market focus and innovation strategies differ, making this comparison insightful. As an investor, understanding these nuances is crucial. This article will help you identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Palo Alto Networks and GoDaddy by providing an overview of these two companies and their main differences.

Palo Alto Networks Overview

Palo Alto Networks, Inc. specializes in cybersecurity solutions, offering a broad range of products including firewall appliances, security management software, and subscription services for threat prevention and data loss prevention. The company targets medium to large enterprises, service providers, and government entities across various industries. Founded in 2005 and headquartered in Santa Clara, California, it is a major player in the software infrastructure sector with a market cap of approximately 128B USD.

GoDaddy Overview

GoDaddy Inc. focuses on cloud-based technology products, primarily serving small businesses and individuals by providing domain registration, website hosting, security tools, and digital marketing services. It also offers business applications and payment facilitation tools. Incorporated in 2014 and based in Tempe, Arizona, GoDaddy operates in the software infrastructure industry with a market capitalization near 14.5B USD and emphasizes enabling customers to establish and grow their digital presence.

Key similarities and differences

Both Palo Alto Networks and GoDaddy operate within the software infrastructure sector and provide cloud-related services, but their target markets differ significantly. Palo Alto Networks concentrates on cybersecurity solutions for larger enterprises and government clients, while GoDaddy targets small businesses and individuals with website and marketing tools. Additionally, Palo Alto Networks offers advanced security management, whereas GoDaddy focuses on domain services, hosting, and online business enablement.

Income Statement Comparison

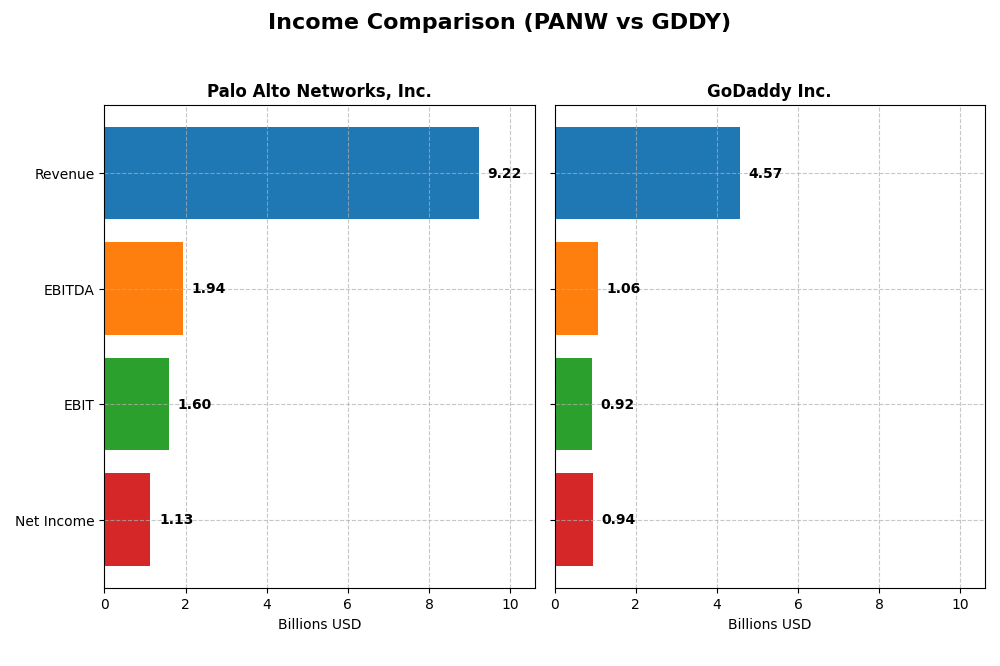

Below is the income statement comparison for Palo Alto Networks, Inc. and GoDaddy Inc. based on their most recent fiscal year data.

| Metric | Palo Alto Networks, Inc. | GoDaddy Inc. |

|---|---|---|

| Market Cap | 128.4B | 14.5B |

| Revenue | 9.22B | 4.57B |

| EBITDA | 1.94B | 1.06B |

| EBIT | 1.60B | 924M |

| Net Income | 1.13B | 937M |

| EPS | 1.71 | 6.63 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Palo Alto Networks, Inc.

Palo Alto Networks showed a strong revenue growth from 4.26B in 2021 to 9.22B in 2025, with net income swinging from a loss of 499M in 2021 to a positive 1.13B in 2025. Margins improved overall, with a favorable gross margin of 73.41% and EBIT margin of 17.32%. However, net margin and EPS declined in the most recent year, signaling some pressure despite solid top-line growth.

GoDaddy Inc.

GoDaddy’s revenue steadily rose from 3.32B in 2020 to 4.57B in 2024, while net income increased from a loss of 495M in 2020 to 937M in 2024. Margins remained stable with a favorable gross margin of 63.88% and a high net margin of 20.49%. The latest year showed moderate revenue growth of 7.5% and a significant EBIT increase, though net margin and EPS contracted notably.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement evaluations with strong revenue and net income growth over their respective periods. Palo Alto Networks leads with higher gross and EBIT margins but experienced recent declines in net margin and EPS. GoDaddy maintains higher net margin stability but slower revenue growth. Overall, Palo Alto shows more aggressive growth, while GoDaddy offers steadier margin performance.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Palo Alto Networks, Inc. and GoDaddy Inc. based on their latest reported fiscal years.

| Ratios | Palo Alto Networks, Inc. (2025) | GoDaddy Inc. (2024) |

|---|---|---|

| ROE | 14.5% | 135.4% |

| ROIC | 5.7% | 16.0% |

| P/E | 101.4 | 29.8 |

| P/B | 14.7 | 40.3 |

| Current Ratio | 0.89 | 0.72 |

| Quick Ratio | 0.89 | 0.72 |

| D/E (Debt to Equity) | 0.04 | 5.63 |

| Debt-to-Assets | 1.4% | 47.3% |

| Interest Coverage | 414.3 | 5.64 |

| Asset Turnover | 0.39 | 0.56 |

| Fixed Asset Turnover | 12.6 | 22.2 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Palo Alto Networks, Inc.

Palo Alto Networks shows a mix of strengths and weaknesses in its ratios. It benefits from a favorable net margin of 12.3% and strong interest coverage at 532.53, but its price-to-earnings ratio of 101.43 and price-to-book of 14.7 are unfavorable. The current ratio at 0.89 raises liquidity concerns. The company does not pay dividends, likely focusing on reinvestment and growth.

GoDaddy Inc.

GoDaddy’s net margin of 20.49% and return on equity of 135.37% are notably strong, supported by a favorable weighted average cost of capital at 7.42%. However, its debt-to-equity ratio of 5.63 and price-to-book ratio of 40.28 are unfavorable. Liquidity ratios are weak, with a current ratio of 0.72. The company also does not pay dividends, possibly prioritizing growth and R&D.

Which one has the best ratios?

Palo Alto Networks presents a slightly favorable overall ratio profile, balancing several robust metrics with some liquidity and valuation concerns. GoDaddy exhibits stronger profitability ratios but is burdened by higher leverage and weaker liquidity, resulting in a neutral overall evaluation. Both companies have strengths and risks reflected in their ratios.

Strategic Positioning

This section compares the strategic positioning of Palo Alto Networks, Inc. and GoDaddy Inc. based on market position, key segments, and exposure to technological disruption:

Palo Alto Networks, Inc.

- Leading cybersecurity provider with strong NASDAQ presence facing moderate competitive pressure.

- Revenue driven by subscriptions (5B), support (2.4B), and products (1.8B) in cybersecurity solutions.

- Exposure focused on evolving cybersecurity threats and cloud security innovations.

GoDaddy Inc.

- Established domain and hosting provider on NYSE with moderate competitive pressure.

- Revenue from core platform (2.9B) and applications & commerce (1.7B), focused on cloud and digital identity.

- Exposure tied to cloud technology evolution and online presence management tools.

Palo Alto Networks, Inc. vs GoDaddy Inc. Positioning

Palo Alto Networks adopts a diversified cybersecurity approach across multiple industries, leveraging subscriptions and support services. GoDaddy concentrates on cloud-based domain registration and hosting services, focusing on small businesses and individuals, with growth driven by platform and commerce applications.

Which has the best competitive advantage?

GoDaddy demonstrates a very favorable MOAT with a growing ROIC exceeding WACC, indicating durable competitive advantage and increasing profitability. Palo Alto Networks shows a slightly unfavorable MOAT, shedding value despite growing ROIC, suggesting weaker competitive strength.

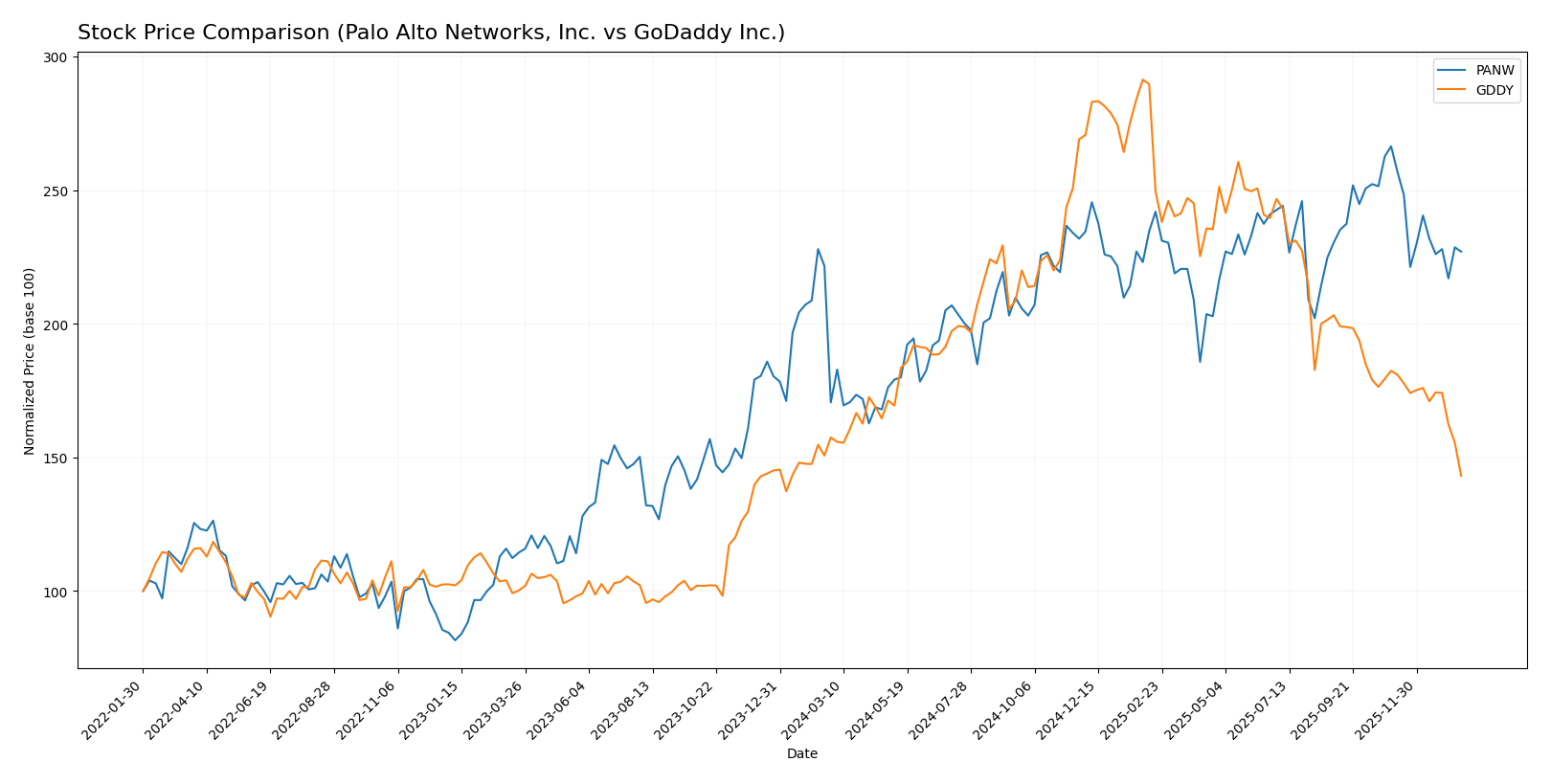

Stock Comparison

The stock price movements over the past 12 months reveal a bullish trend for Palo Alto Networks, Inc., contrasted with a bearish trend for GoDaddy Inc., highlighting distinct trading dynamics and volume shifts.

Trend Analysis

Palo Alto Networks, Inc. (PANW) showed a 33.05% price increase over the past year, indicating a bullish trend with deceleration and a high price of 220.24. Recent months reflect a -14.79% decline with increased selling pressure.

GoDaddy Inc. (GDDY) experienced a -9.09% price decrease over the last 12 months, confirming a bearish trend with deceleration, hitting a low of 104.46. The recent period shows further decline of -21.54%, with slight seller dominance.

Comparing the two, PANW outperformed GDDY markedly over the past year with a positive 33.05% gain versus GDDY’s negative 9.09% loss, delivering the highest market performance.

Target Prices

The consensus target prices for Palo Alto Networks, Inc. and GoDaddy Inc. reflect optimistic analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Palo Alto Networks, Inc. | 265 | 157 | 231.07 |

| GoDaddy Inc. | 182 | 70 | 143.33 |

Analysts expect Palo Alto Networks’ price to rise notably above its current 187.66 USD, while GoDaddy’s consensus target suggests significant upside potential from its current 104.46 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Palo Alto Networks, Inc. and GoDaddy Inc.:

Rating Comparison

Palo Alto Networks, Inc. Rating

- Rating: B, considered very favorable overall.

- Discounted Cash Flow Score: 4, indicating favorable value.

- ROE Score: 4, showing favorable profitability.

- ROA Score: 3, a moderate efficiency in asset use.

- Debt To Equity Score: 4, favorable financial stability.

- Overall Score: 3, moderate financial standing.

GoDaddy Inc. Rating

- Rating: B+, also very favorable overall.

- Discounted Cash Flow Score: 5, indicating very favorable value.

- ROE Score: 5, showing very favorable profitability.

- ROA Score: 4, a favorable asset utilization.

- Debt To Equity Score: 1, indicating very unfavorable financial risk.

- Overall Score: 3, also moderate financial standing.

Which one is the best rated?

GoDaddy holds a slightly higher rating (B+) than Palo Alto Networks (B) and scores better on DCF, ROE, and ROA, though it has a weaker debt-to-equity score. Overall, both have moderate overall scores.

Scores Comparison

The comparison of scores between Palo Alto Networks and GoDaddy helps assess their financial health and risk levels:

Palo Alto Networks Scores

- Altman Z-Score: 5.95, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength and value potential.

GoDaddy Scores

- Altman Z-Score: 1.53, indicating distress and higher bankruptcy risk.

- Piotroski Score: 8, reflecting very strong financial health and value potential.

Which company has the best scores?

Palo Alto Networks shows a stronger Altman Z-Score, placing it in a safe zone, while GoDaddy has a higher Piotroski Score indicating very strong financial health. Each company leads in a different score category.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Palo Alto Networks, Inc. and GoDaddy Inc.:

Palo Alto Networks, Inc. Grades

The following table summarizes recent grades from credible grading companies for Palo Alto Networks, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Guggenheim | Upgrade | Neutral | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-18 |

| Goldman Sachs | Maintain | Buy | 2025-11-21 |

| HSBC | Downgrade | Reduce | 2025-11-21 |

| Needham | Maintain | Buy | 2025-11-20 |

| WestPark Capital | Maintain | Hold | 2025-11-20 |

| Bernstein | Maintain | Outperform | 2025-11-20 |

| DA Davidson | Maintain | Buy | 2025-11-20 |

Overall, Palo Alto Networks displays a generally positive grade trend, with multiple buy and overweight ratings, although there is a recent downgrade to reduce from HSBC.

GoDaddy Inc. Grades

The following table shows recent grades from verified grading companies for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

GoDaddy’s grades are mostly stable, with a mix of buy, hold, and neutral ratings but fewer upgrades or downgrades recently.

Which company has the best grades?

Palo Alto Networks, Inc. has received generally stronger and more frequent buy and overweight ratings compared to GoDaddy Inc., which has more hold and neutral ratings. This suggests that analysts are more optimistic about Palo Alto Networks’ near-term prospects, potentially impacting investor confidence and portfolio allocation decisions.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Palo Alto Networks, Inc. (PANW) and GoDaddy Inc. (GDDY) based on the most recent data.

| Criterion | Palo Alto Networks, Inc. (PANW) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from subscriptions (4.97B in 2025) and support services, less from product sales. | Moderate to high: Diverse platform services with Core Platform (2.92B) and Applications & Commerce (1.65B) revenue streams in 2024. |

| Profitability | Moderate: Net margin 12.3%, ROIC 5.67% (slightly below WACC 7.37%), showing value destruction but improving ROIC trend. | High: Net margin 20.49%, ROIC 16.02% well above WACC 7.42%, indicating strong value creation and durable competitive advantage. |

| Innovation | Strong: High fixed asset turnover (12.56) and growing ROIC trend suggest effective capital use and innovation. | Moderate: Good fixed asset turnover (22.22) but some unfavorable leverage ratios; growth driven by platform expansion. |

| Global presence | Significant: Large subscription base suggests global reach in cybersecurity solutions. | Significant: Well-known global brand in web services and domains, supporting broad market presence. |

| Market Share | Strong in cybersecurity niche but faces intense competition; valuation multiples (PE 101.43, PB 14.7) appear stretched. | Leading in domain registration and SMB web services; valuation multiples (PE 29.76, PB 40.28) remain high but more reasonable than PANW. |

Key takeaways: GoDaddy demonstrates stronger profitability and value creation with a durable competitive advantage, while Palo Alto Networks shows improving profitability but currently destroys value relative to its cost of capital. Both companies have solid global presence and diversified revenue streams, but investors should weigh PANW’s stretched valuation and weaker liquidity ratios against GDDY’s higher leverage and mixed ratio profile.

Risk Analysis

Below is a comparative risk overview for Palo Alto Networks, Inc. (PANW) and GoDaddy Inc. (GDDY) based on the most recent available data for 2025 and 2024 respectively.

| Metric | Palo Alto Networks, Inc. (PANW) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Risk | Moderate (Beta 0.75, stable sector) | Moderate (Beta 0.95, volatile market) |

| Debt level | Low (Debt/Equity 0.04, very favorable) | High (Debt/Equity 5.63, unfavorable) |

| Regulatory Risk | Moderate (Cybersecurity sector scrutiny) | Moderate (Internet service regulations) |

| Operational Risk | Moderate (Complex cybersecurity solutions) | Moderate (Cloud hosting and service reliability) |

| Environmental Risk | Low (Technology sector, limited direct impact) | Low (Technology sector, limited direct impact) |

| Geopolitical Risk | Moderate (Global presence, US-based) | Moderate (Global customer base, US-based) |

The most significant risks are GoDaddy’s elevated debt level, which poses financial strain, and Palo Alto Networks’ high valuation multiples (P/E and P/B), which could increase market sensitivity. Both operate in moderately regulated tech sectors with operational and geopolitical risks to monitor carefully.

Which Stock to Choose?

Palo Alto Networks, Inc. (PANW) shows strong income growth with 116.67% revenue and 327.28% net income increase over 2021-2025. Its financial ratios are slightly favorable overall, with good profitability and low debt, supported by a very favorable B rating and a moderate Altman Z-Score of 5.95.

GoDaddy Inc. (GDDY) exhibits moderate revenue growth of 37.88% and 289.23% net income rise from 2020 to 2024. Its financial ratios are neutral overall, with high returns but higher debt levels, reflected in a very favorable B+ rating, though an Altman Z-Score of 1.53 indicates financial distress risk.

For investors prioritizing growth potential and improving profitability, PANW’s favorable income trends and solid financial health might appear more attractive. Conversely, those accepting higher leverage and seeking strong returns could find GDDY’s profile appealing, despite its financial risks and neutral ratio evaluation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Palo Alto Networks, Inc. and GoDaddy Inc. to enhance your investment decisions: