Choosing the right technology stock for your portfolio demands careful analysis, especially when comparing industry leaders with distinct approaches. Palantir Technologies Inc. and GoDaddy Inc. both operate in the software infrastructure sector but target different market needs—Palantir focuses on advanced data analytics and intelligence, while GoDaddy empowers digital presence through cloud-based products. This article will help you discern which company offers the most promising investment potential in 2026.

Table of contents

Companies Overview

I will begin the comparison between Palantir Technologies Inc. and GoDaddy Inc. by providing an overview of these two companies and their main differences.

Palantir Technologies Inc. Overview

Palantir Technologies Inc. specializes in building and deploying software platforms primarily for the intelligence community to support counterterrorism operations across the US, UK, and internationally. Its products, including Palantir Gotham and Foundry, enable users to analyze complex datasets and integrate data for operational use. Founded in 2003 and headquartered in Denver, Colorado, Palantir operates in the software infrastructure industry.

GoDaddy Inc. Overview

GoDaddy Inc. develops cloud-based technology products designed to help customers establish and manage their digital presence. Its offerings include domain registration, website hosting, security tools, marketing services, and business applications like Microsoft Office 365. Serving small businesses and individuals, GoDaddy was incorporated in 2014 and is headquartered in Tempe, Arizona, competing in the same software infrastructure sector.

Key similarities and differences

Both Palantir and GoDaddy operate within the software infrastructure industry in the US and provide technology solutions that empower organizations digitally. However, Palantir focuses on data analytics and intelligence software for government and enterprise clients, while GoDaddy targets small businesses and individual users with cloud-based web hosting, domain services, and marketing tools. Their customer bases and core product offerings highlight distinct market approaches.

Income Statement Comparison

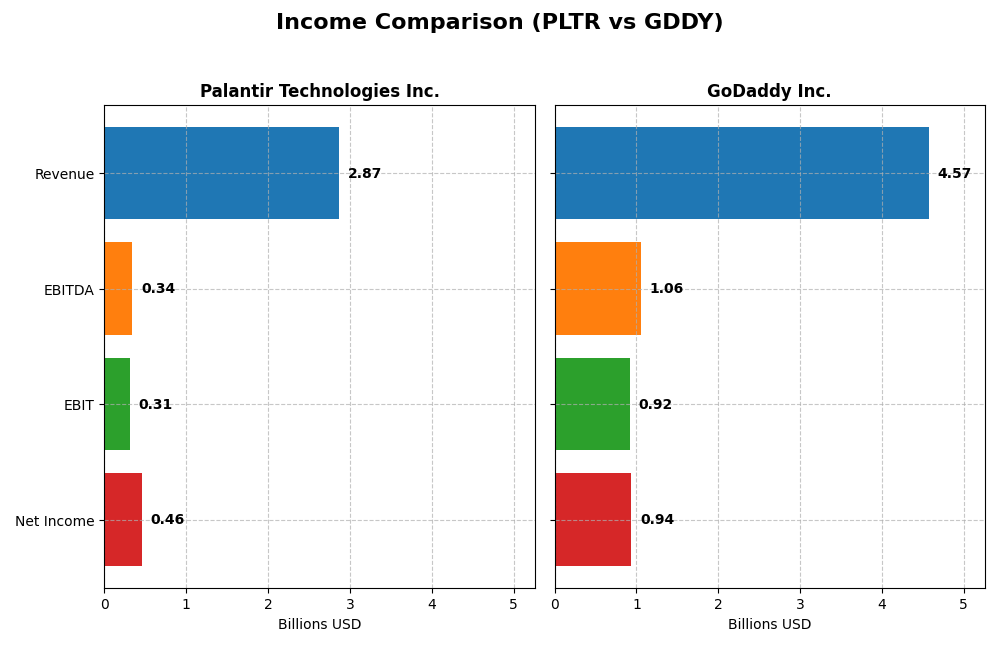

This table presents a side-by-side comparison of key income statement metrics for Palantir Technologies Inc. and GoDaddy Inc. for the fiscal year 2024, enabling a clear financial snapshot of both companies.

| Metric | Palantir Technologies Inc. | GoDaddy Inc. |

|---|---|---|

| Market Cap | 391B | 14.5B |

| Revenue | 2.87B | 4.57B |

| EBITDA | 342M | 1.06B |

| EBIT | 310M | 924M |

| Net Income | 462M | 937M |

| EPS | 0.21 | 6.63 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Palantir Technologies Inc.

Palantir’s revenue increased significantly from 1.09B in 2020 to 2.87B in 2024, while net income improved from a 1.17B loss in 2020 to a 462M profit in 2024. Margins showed marked improvement, with gross margin reaching 80.25% and net margin 16.13% in 2024. The latest year saw strong revenue growth of 28.8%, with a 158.7% surge in EBIT and a doubling of EPS, reflecting robust operational leverage.

GoDaddy Inc.

GoDaddy’s revenue grew steadily from 3.32B in 2020 to 4.57B in 2024, with net income rising from a 495M loss to a 937M profit. Margins remain solid, with a 63.9% gross margin and a 20.5% net margin in 2024, though net margin declined by 36.6% compared to the prior year. The company posted moderate revenue growth of 7.5% in 2024, alongside a 58.5% gain in EBIT, but EPS declined nearly 29%, signaling some pressure on profitability.

Which one has the stronger fundamentals?

Palantir demonstrates stronger margin expansion and higher growth rates in revenue, EBIT, and net income over the recent period, suggesting improving profitability and operational efficiency. GoDaddy shows steadier revenue growth and higher absolute net income but faces recent margin contraction and EPS decline. Both companies hold favorable income statement evaluations, yet Palantir’s rapid margin and earnings growth indicate more dynamic fundamental improvements.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Palantir Technologies Inc. and GoDaddy Inc., based on their latest fiscal year 2024 data.

| Ratios | Palantir Technologies Inc. (PLTR) | GoDaddy Inc. (GDDY) |

|---|---|---|

| ROE | 9.2% | 135.4% |

| ROIC | 5.5% | 16.0% |

| P/E | 368.2 | 29.8 |

| P/B | 34.0 | 40.3 |

| Current Ratio | 5.96 | 0.72 |

| Quick Ratio | 5.96 | 0.72 |

| D/E (Debt-to-Equity) | 4.8% | 563% |

| Debt-to-Assets | 3.8% | 47.3% |

| Interest Coverage | 0 (no interest coverage data) | 5.64 |

| Asset Turnover | 0.45 | 0.56 |

| Fixed Asset Turnover | 11.9 | 22.2 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Palantir Technologies Inc.

Palantir shows mixed ratio performance with a strong net margin at 16.13% but an unfavorable return on equity (9.24%) and high price-to-earnings (368.2) and price-to-book (34.01) ratios, indicating possible overvaluation. Its liquidity is strong with a high current ratio (5.96) and low debt levels, but asset turnover is weak. Palantir does not pay dividends, reflecting its reinvestment strategy in growth and R&D.

GoDaddy Inc.

GoDaddy exhibits favorable net margin (20.49%), exceptional return on equity (135.37%), and a solid return on invested capital (16.02%), signaling efficient capital use. However, liquidity is weak with a current ratio of 0.72 and a high debt-to-equity ratio (5.63). Despite positive earnings, GoDaddy does not pay dividends, likely prioritizing reinvestment and growth initiatives over shareholder payouts.

Which one has the best ratios?

GoDaddy presents a more favorable overall ratio profile with strong profitability and capital returns, despite weaker liquidity and higher leverage. Palantir’s mixed results and high valuation multiples suggest caution. Both companies do not pay dividends, focusing on growth, but GoDaddy’s superior returns and efficiency ratios give it a slight edge in financial health.

Strategic Positioning

This section compares the strategic positioning of Palantir Technologies Inc. and GoDaddy Inc., including market position, key segments, and exposure to technological disruption:

Palantir Technologies Inc.

- Large market cap of 390B, faces competitive pressure in software infrastructure

- Key segments: Government operating segment and commercial software platforms

- Operates with advanced AI and data analytics platforms, moderate exposure to disruption

GoDaddy Inc.

- Smaller market cap of 14B, competes in cloud-based technology products

- Key segments: Core platform and applications & commerce products

- Focus on cloud, hosting, and online presence products, moderate disruption risk

Palantir Technologies Inc. vs GoDaddy Inc. Positioning

Palantir focuses on data-driven software solutions mainly for government and commercial clients, while GoDaddy offers diversified cloud-based services targeting small businesses and individuals. Palantir’s specialization contrasts with GoDaddy’s broader product mix, affecting their market reach and growth drivers.

Which has the best competitive advantage?

GoDaddy shows a very favorable moat with ROIC well above WACC and growing profitability, indicating efficient capital use. Palantir’s moat is slightly unfavorable, shedding value despite improving ROIC trends.

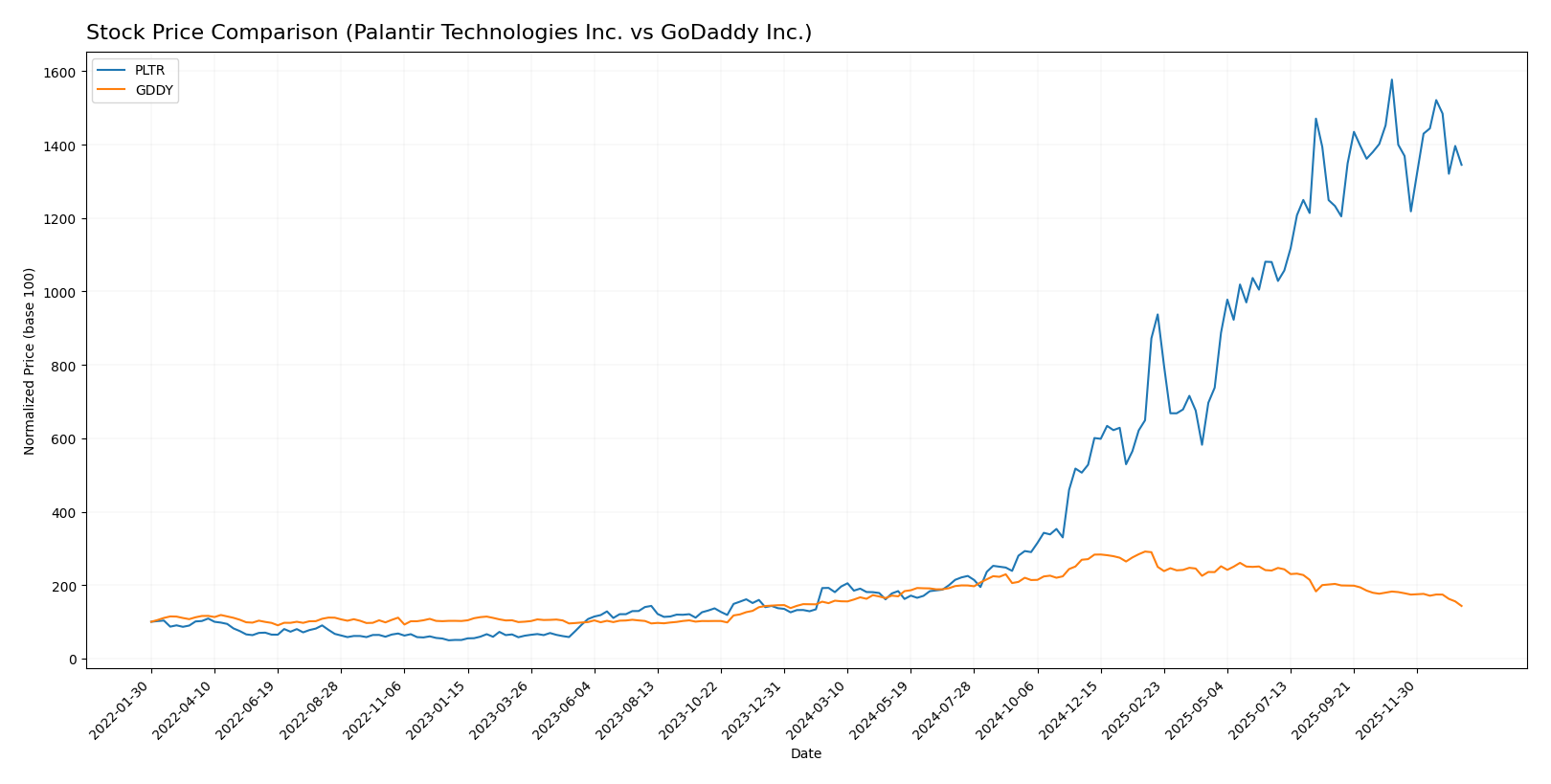

Stock Comparison

The stock price dynamics of Palantir Technologies Inc. (PLTR) and GoDaddy Inc. (GDDY) over the past 12 months reveal contrasting trajectories with significant price swings and evolving trading volumes impacting their market positioning.

Trend Analysis

Palantir Technologies Inc. exhibited a strong bullish trend over the past year with a 644.28% price increase, though the trend showed deceleration and a high volatility level with a 59.91 std deviation. Recently, PLTR’s trend reversed slightly, declining 14.72% from November 2025 to January 2026.

GoDaddy Inc. showed a bearish trend over the same 12-month span, with its stock price falling 9.09% and decelerating, amid moderate volatility (27.35 std deviation). The recent period saw an accelerated decline of 21.54% ending in January 2026.

Comparing both stocks, Palantir Technologies delivered substantially higher market performance despite recent pullbacks, whereas GoDaddy maintained a consistent bearish trend with a smaller overall drop.

Target Prices

Analysts show a bullish consensus for both Palantir Technologies Inc. and GoDaddy Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Palantir Technologies Inc. | 223 | 160 | 198.33 |

| GoDaddy Inc. | 182 | 70 | 143.33 |

Palantir’s consensus target price at 198.33 suggests upside potential from the current 170.96 USD, while GoDaddy’s 143.33 target also indicates room for growth above the 104.46 USD stock price.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Palantir Technologies Inc. and GoDaddy Inc.:

Rating Comparison

Palantir Rating

- Rating: B, considered very favorable overall

- Discounted Cash Flow Score: Moderate at 2

- ROE Score: Favorable at 4

- ROA Score: Very favorable at 5

- Debt To Equity Score: Favorable at 4

- Overall Score: Moderate at 3

GoDaddy Rating

- Rating: B+, also very favorable overall

- Discounted Cash Flow Score: Very favorable at 5

- ROE Score: Very favorable at 5

- ROA Score: Favorable at 4

- Debt To Equity Score: Very unfavorable at 1

- Overall Score: Moderate at 3

Which one is the best rated?

GoDaddy holds a slightly higher overall rating (B+) compared to Palantir’s B, driven by stronger discounted cash flow and ROE scores. However, Palantir shows better debt management and asset efficiency. Overall scores for both are moderate.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Palantir Technologies Inc. and GoDaddy Inc.:

PLTR Scores

- Altman Z-Score: Extremely high at 172.6, indicating a safe zone.

- Piotroski Score: Strong financial health with a score of 7.

GDDY Scores

- Altman Z-Score: Low at 1.53, placing the company in distress zone.

- Piotroski Score: Very strong financial health with a score of 8.

Which company has the best scores?

Based on the scores, PLTR shows an exceptionally high Altman Z-Score indicating very low bankruptcy risk, while GDDY has a better Piotroski Score signaling stronger financial health. Each leads in a different metric.

Grades Comparison

Here is a detailed comparison of the grading data for Palantir Technologies Inc. and GoDaddy Inc.:

Palantir Technologies Inc. Grades

The table below presents recent grade updates from reputable financial institutions for Palantir Technologies Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2026-01-12 |

| RBC Capital | Maintain | Underperform | 2025-11-04 |

| Baird | Maintain | Neutral | 2025-11-04 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-04 |

| Goldman Sachs | Maintain | Neutral | 2025-11-04 |

| Mizuho | Maintain | Neutral | 2025-11-04 |

| UBS | Maintain | Neutral | 2025-11-04 |

| Piper Sandler | Maintain | Overweight | 2025-11-04 |

| DA Davidson | Maintain | Neutral | 2025-11-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

Overall, Palantir’s grades predominantly remain neutral with a recent upgrade to Buy by Citigroup, indicating mixed analyst sentiment.

GoDaddy Inc. Grades

The table below presents recent grade updates from reputable financial institutions for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

GoDaddy’s grades show a stronger positive bias, with multiple buy ratings and consistent maintenance of these grades across firms.

Which company has the best grades?

GoDaddy Inc. holds the better overall grades, with a strong consensus of Buy and multiple buy ratings from key firms, compared to Palantir’s predominantly Neutral and Underperform grades. This contrast may influence investors’ perception of growth and risk profiles in their portfolios.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of Palantir Technologies Inc. (PLTR) and GoDaddy Inc. (GDDY) based on the most recent financial and operational data.

| Criterion | Palantir Technologies Inc. (PLTR) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Diversification | Moderate: Revenue split between Commercial (1.30B) and Government (1.57B) segments | High: Diverse revenue from Core Platform (2.92B) and Applications & Commerce (1.65B) |

| Profitability | Moderate net margin (16.13%), ROIC neutral (5.51%), but overall value destroying (ROIC < WACC) | Strong profitability with net margin 20.49%, ROIC 16.02%, creating value (ROIC > WACC) |

| Innovation | Growing ROIC trend suggests improving efficiency and innovation | Very favorable ROIC trend indicating strong innovation and competitive advantage |

| Global presence | Primarily US government and commercial sectors; less global diversification | Significant presence in global web services and e-commerce markets |

| Market Share | Niche market in data analytics and government contracts | Leading market share in domain registration and online presence services |

Key takeaways: GoDaddy stands out with strong profitability, diversification, and a durable competitive advantage, making it a solid value creator. Palantir shows growth potential with increasing ROIC but currently sheds value and remains more specialized, which entails higher investment risk.

Risk Analysis

The table below summarizes key risk metrics for Palantir Technologies Inc. (PLTR) and GoDaddy Inc. (GDDY) based on the most recent data from 2024:

| Metric | Palantir Technologies Inc. (PLTR) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Risk | High beta 1.545 indicates higher volatility | Moderate beta 0.948 indicates moderate volatility |

| Debt level | Very low debt-to-equity ratio 0.05 (favorable) | High debt-to-equity ratio 5.63 (unfavorable) |

| Regulatory Risk | Moderate, given exposure to government contracts and data privacy | Moderate, due to cloud service and data privacy regulations |

| Operational Risk | Moderate, reliant on advanced AI and data integration platforms | Moderate, dependent on hosting infrastructure and security |

| Environmental Risk | Low, technology sector with minimal direct environmental impact | Low, technology sector with minimal direct environmental impact |

| Geopolitical Risk | Moderate, international government contracts could be affected by policy shifts | Low to moderate, primarily US-focused but some international presence |

Palantir’s most impactful risks include market volatility and moderate regulatory challenges tied to government contracts. GoDaddy faces significant financial risk from its high debt level, despite favorable operational scores. Both companies have moderate operational and regulatory risks, but Palantir’s strong liquidity and low debt provide a cushion against financial distress.

Which Stock to Choose?

Palantir Technologies Inc. (PLTR) shows strong income growth with a 162% revenue increase since 2020 and a 16.13% net margin in 2024. Its financial ratios are slightly unfavorable overall, with a high P/E of 368 and a low ROE of 9.24%. Debt levels are low and well covered, rating the company as very favorable (B).

GoDaddy Inc. (GDDY) presents moderate income growth of 38% over five years and a 20.49% net margin in 2024. Its financial ratios are neutral overall, supported by a strong ROE of 135% but weaker liquidity and higher debt. The rating is very favorable (B+) despite some concerns on leverage.

For investors prioritizing a durable competitive advantage and efficient capital use, GoDaddy’s very favorable moat and improving profitability might appear more attractive. Conversely, Palantir’s rapid income growth and low debt could appeal to growth-oriented investors comfortable with some ratio weaknesses. The choice could depend on one’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Palantir Technologies Inc. and GoDaddy Inc. to enhance your investment decisions: