Oracle Corporation and GoDaddy Inc. are two prominent players in the software infrastructure industry, each shaping the digital landscape through their innovative cloud-based solutions. Oracle, with its vast enterprise software and cloud services, contrasts with GoDaddy’s focus on empowering small businesses with web hosting and domain services. This article will analyze their strategies and market positions to help you decide which company presents a more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Oracle and GoDaddy by providing an overview of these two companies and their main differences.

Oracle Overview

Oracle Corporation focuses on delivering software and cloud solutions to enterprise IT environments worldwide. Its offerings include cloud applications like enterprise resource planning, supply chain management, and human capital management, alongside infrastructure technologies such as the Oracle Database and Java. Founded in 1977, Oracle is a major player in technology with a market cap of $549B and employs 159K people globally.

GoDaddy Overview

GoDaddy Inc. specializes in cloud-based technology products aimed at individuals and small businesses. It provides domain registration, website hosting, security tools, and marketing services to help customers establish and grow their online presence. Founded in 2014, GoDaddy’s market cap stands at $14.5B, with a workforce of about 5.5K employees, positioning it as a significant provider in digital identity and online business solutions.

Key similarities and differences

Both Oracle and GoDaddy operate in the technology sector, specifically within software infrastructure, with active trading on the NYSE. Oracle targets large enterprises with comprehensive cloud and infrastructure products, while GoDaddy focuses on small businesses and individuals with domain and hosting services. Oracle’s scale and breadth of offerings contrast with GoDaddy’s specialized approach to digital presence and e-commerce solutions.

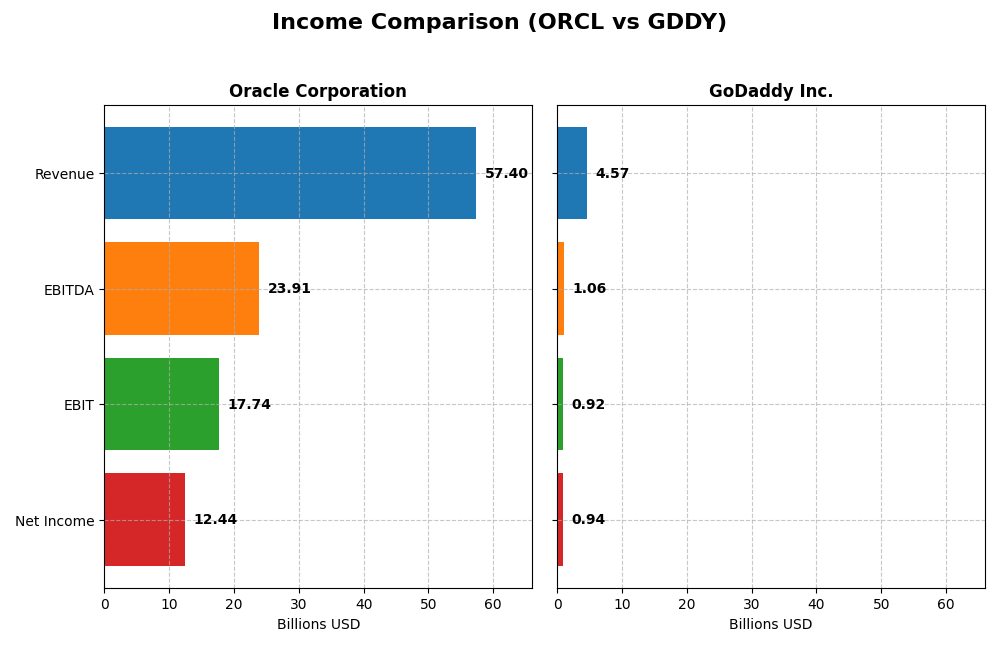

Income Statement Comparison

The following table compares the key income statement metrics for Oracle Corporation and GoDaddy Inc. for their most recent fiscal years, providing a clear view of their financial performance.

| Metric | Oracle Corporation | GoDaddy Inc. |

|---|---|---|

| Market Cap | 549B | 14.5B |

| Revenue | 57.4B | 4.57B |

| EBITDA | 23.9B | 1.06B |

| EBIT | 17.7B | 924M |

| Net Income | 12.4B | 937M |

| EPS | 4.46 | 6.63 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Oracle Corporation

Oracle’s revenue showed steady growth from $40.5B in 2021 to $57.4B in 2025, with net income rising from $13.7B in 2021 to $12.4B in 2025, though net income declined overall. Margins remain strong, with a gross margin above 70% and net margin around 21.7% in 2025. The latest year saw favorable revenue and EBIT growth, indicating improving operational efficiency despite a slight net income contraction over the full period.

GoDaddy Inc.

GoDaddy’s revenue grew from $3.3B in 2020 to $4.6B in 2024, with net income increasing substantially from a loss of $495M in 2020 to nearly $937M in 2024. Margins are healthy, with a gross margin of 63.9% and net margin at 20.5% in 2024. The most recent year showed moderate revenue growth and significant EBIT improvement, although net margin and EPS declined, reflecting some profitability pressures.

Which one has the stronger fundamentals?

Oracle displays higher absolute revenue and stable, favorable margins with consistent operational improvements, though net income growth has been unfavorable overall. GoDaddy exhibits impressive net income growth and margin expansion over the longer period but faces recent margin and EPS pressure. Both have favorable global income statement evaluations, with GoDaddy slightly ahead in growth metrics.

Financial Ratios Comparison

The table below presents the key financial ratios for Oracle Corporation and GoDaddy Inc. based on their most recent fiscal year data, providing a snapshot of profitability, liquidity, leverage, efficiency, and shareholder returns.

| Ratios | Oracle Corporation (2025) | GoDaddy Inc. (2024) |

|---|---|---|

| ROE | 60.8% | 135.4% |

| ROIC | 10.9% | 16.0% |

| P/E | 37.1 | 29.8 |

| P/B | 22.6 | 40.3 |

| Current Ratio | 0.75 | 0.72 |

| Quick Ratio | 0.75 | 0.72 |

| D/E (Debt-to-Equity) | 5.09 | 5.63 |

| Debt-to-Assets | 61.8% | 47.3% |

| Interest Coverage | 4.94 | 5.64 |

| Asset Turnover | 0.34 | 0.56 |

| Fixed Asset Turnover | 1.32 | 22.22 |

| Payout ratio | 38.1% | 0% |

| Dividend yield | 1.03% | 0% |

Interpretation of the Ratios

Oracle Corporation

Oracle shows strong profitability with a favorable net margin of 21.68% and an impressive return on equity at 60.84%. However, several leverage and liquidity ratios are unfavorable, including a high debt-to-equity ratio of 5.09 and a current ratio below 1 at 0.75, indicating potential short-term liquidity concerns. Oracle pays a stable dividend with a moderate yield of 1.03%, supported by cash flow, though payout sustainability should be monitored given some cash flow challenges.

GoDaddy Inc.

GoDaddy demonstrates favorable profitability and efficiency ratios, including a net margin of 20.49% and an exceptional return on equity of 135.37%. The company maintains a neutral leverage profile with a debt-to-assets ratio of 47.29% and a current ratio of 0.72, signaling some liquidity pressure. GoDaddy does not pay dividends, likely reflecting a focus on reinvestment and growth, typical for a company prioritizing expansion and R&D.

Which one has the best ratios?

GoDaddy presents a more balanced ratio profile with higher percentages of favorable metrics (42.86%) and a neutral overall rating, compared to Oracle’s predominantly unfavorable profile (57.14% unfavorable). Oracle’s strong profitability is offset by weaker liquidity and leverage ratios, while GoDaddy’s stronger returns and manageable leverage suggest a comparatively healthier financial position based on these ratios.

Strategic Positioning

This section compares the strategic positioning of Oracle Corporation and GoDaddy Inc., focusing on Market position, Key segments, and Exposure to technological disruption:

Oracle Corporation

- Large market cap of 549B with strong competitive pressure in enterprise IT software infrastructure.

- Diversified revenue from cloud and license (49B), hardware (2.9B), and services (5.2B) segments.

- Exposure to disruption through cloud software, autonomous databases, IoT, digital assistants, and blockchain.

GoDaddy Inc.

- Smaller market cap of 14.5B, focused on cloud-based technology for small businesses and individuals.

- Concentrated on core platform (2.9B) and applications and commerce (1.7B) mainly in domain and hosting services.

- Exposure through cloud hosting, website building tools, security products, and digital marketing services.

Oracle vs GoDaddy Positioning

Oracle pursues a diversified strategy across cloud, hardware, and services with a broad industry focus, offering resilience but facing intense competition. GoDaddy targets a concentrated niche in small business digital presence, enabling focused innovation but limited scale.

Which has the best competitive advantage?

GoDaddy shows a very favorable economic moat with growing ROIC and value creation, indicating a durable competitive advantage. Oracle’s slightly unfavorable moat and declining ROIC suggest challenges in sustaining profitability and competitive edge.

Stock Comparison

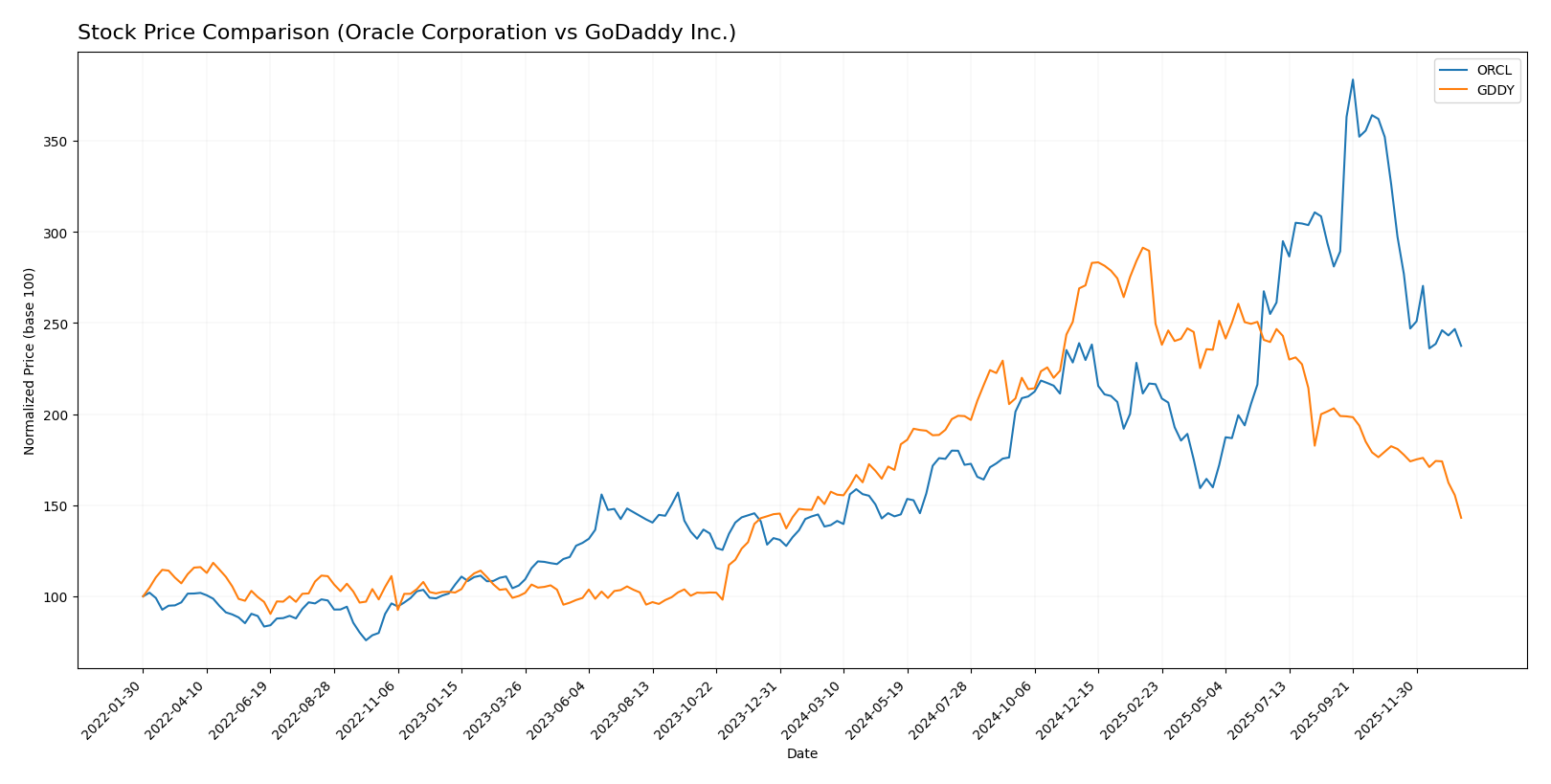

The stock price charts of Oracle Corporation and GoDaddy Inc. over the past year reveal distinct trading dynamics, with Oracle showing a strong overall price increase despite recent declines, while GoDaddy exhibits a consistent downward trend with moderate volatility.

Trend Analysis

Oracle Corporation’s stock price increased by 70.69% over the past 12 months, indicating a bullish trend with decelerating momentum. The price ranged from a low of 111.95 to a high of 308.66, with a recent 27.23% decline signaling short-term weakness.

GoDaddy Inc. experienced a 9.09% decrease in stock price over the same period, reflecting a bearish trend with deceleration. The price fluctuated between 104.46 and 212.65, with recent declines of 21.54% and lower volatility compared to Oracle.

Comparing both stocks, Oracle delivered the highest market performance over the past year, showing strong gains despite recent pullbacks, while GoDaddy’s trend remained negative with smaller price fluctuations.

Target Prices

Analysts present a clear consensus on target prices for Oracle Corporation and GoDaddy Inc., reflecting their growth potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Oracle Corporation | 400 | 175 | 314.08 |

| GoDaddy Inc. | 182 | 70 | 143.33 |

Oracle’s consensus target price is significantly above its current price of 191.09, suggesting potential upside, while GoDaddy’s target consensus also exceeds its current price of 104.46, indicating positive analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Oracle Corporation and GoDaddy Inc.:

Rating Comparison

Oracle Corporation Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate at 3, indicating average valuation based on cash flow projections.

- ROE Score: Very favorable at 5, reflecting efficient profit generation from equity.

- ROA Score: Favorable at 4, showing good asset utilization.

- Debt To Equity Score: Very unfavorable at 1, signaling high financial risk.

- Overall Score: Moderate at 3, suggesting average overall financial standing.

GoDaddy Inc. Rating

- Rating: B+, also considered very favorable by analysts.

- Discounted Cash Flow Score: Very favorable at 5, showing strong cash flow valuation.

- ROE Score: Very favorable at 5, indicating strong equity profit efficiency.

- ROA Score: Favorable at 4, indicating efficient use of assets.

- Debt To Equity Score: Very unfavorable at 1, indicating similar high financial risk.

- Overall Score: Moderate at 3, reflecting comparable overall financial health.

Which one is the best rated?

GoDaddy holds a slightly better rating of B+ compared to Oracle’s B. GoDaddy’s discounted cash flow score is significantly higher, while other scores like ROE, ROA, debt-to-equity, and overall score remain identical, making GoDaddy the better rated based solely on these metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Oracle Corporation and GoDaddy Inc.:

Oracle Corporation Scores

- Altman Z-Score: 2.43, in the grey zone indicating moderate risk

- Piotroski Score: 5, average financial strength

GoDaddy Inc. Scores

- Altman Z-Score: 1.53, in the distress zone indicating high risk

- Piotroski Score: 8, very strong financial strength

Which company has the best scores?

GoDaddy shows a higher Piotroski Score of 8 versus Oracle’s 5, indicating stronger financial health. However, Oracle’s Altman Z-Score is better at 2.43 compared to GoDaddy’s 1.53, suggesting lower bankruptcy risk for Oracle.

Grades Comparison

I present below the grades issued by recognized financial institutions for Oracle Corporation and GoDaddy Inc.:

Oracle Corporation Grades

The table below summarizes recent grades from notable financial analysts for Oracle Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-05 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-12-12 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| UBS | Maintain | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-11 |

| JP Morgan | Maintain | Neutral | 2025-12-11 |

| DA Davidson | Maintain | Neutral | 2025-12-11 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-11 |

Oracle’s grades predominantly indicate a positive outlook, with multiple Buy and Overweight ratings alongside several Neutral assessments.

GoDaddy Inc. Grades

The following table details recent grades from established grading firms for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

GoDaddy’s ratings are mixed, with several Buy ratings balanced by Neutral, Hold, and Equal Weight recommendations.

Which company has the best grades?

Oracle Corporation has received a stronger consensus with multiple Buy and Overweight ratings, suggesting a generally more favorable analyst outlook than GoDaddy Inc., whose ratings show more balance between Buy and Hold/Neutral. This broader positivity for Oracle may influence investor confidence differently than GoDaddy’s more cautious valuations.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of Oracle Corporation and GoDaddy Inc. based on recent financial and operational data.

| Criterion | Oracle Corporation (ORCL) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Diversification | Strong with Cloud & License (49.2B), Services (5.2B), Hardware (2.9B) | Focused on Core Platform (2.9B) and Applications & Commerce (1.7B) segments |

| Profitability | High net margin (21.7%) and ROE (60.8%), but declining ROIC trend | Solid net margin (20.5%) with very high ROE (135.4%) and growing ROIC |

| Innovation | Moderate; slight decline in ROIC indicates challenges in sustaining competitive edge | High; very favorable ROIC trend reflecting durable competitive advantage |

| Global presence | Extensive global footprint as a major enterprise software provider | Strong presence in domain registration and hosting markets, mostly US-centric |

| Market Share | Large in enterprise software and cloud services | Significant in domain registration and web hosting sectors |

Key takeaways: Oracle’s broad diversification and strong profitability are offset by a declining return on invested capital, signaling caution. In contrast, GoDaddy shows robust growth, superior profitability trends, and a durable competitive advantage, but with a narrower business scope. Investors should weigh Oracle’s scale against GoDaddy’s growth momentum.

Risk Analysis

Below is a comparative table of key risks for Oracle Corporation and GoDaddy Inc. based on the most recent data from 2025 and 2024, respectively.

| Metric | Oracle Corporation (ORCL) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Risk | Beta 1.65 indicates higher volatility and sensitivity to market swings. | Beta 0.95 suggests moderate market risk with lower volatility. |

| Debt level | High debt-to-equity ratio (5.09) and debt-to-assets at 61.8%, signaling significant leverage. | Debt-to-equity ratio at 5.63, with debt-to-assets moderate at 47.3%, indicating considerable leverage as well. |

| Regulatory Risk | Moderate, due to global operations and data regulations affecting cloud services. | Moderate, with exposure to data privacy and cybersecurity regulations. |

| Operational Risk | Large scale with 159K employees and complex cloud infrastructure, risk of implementation issues. | Smaller scale (5.5K employees) but reliant on uptime and security of hosting services. |

| Environmental Risk | Moderate, given hardware business and energy consumption in data centers. | Lower, primarily digital services with limited direct environmental footprint. |

| Geopolitical Risk | Moderate, global presence exposes to trade tensions and regulatory differences. | Moderate, mainly US-focused but some international exposure. |

The most impactful and likely risks are the high debt levels for both companies, which could strain financial flexibility amid market volatility. Oracle’s higher beta indicates greater market sensitivity, while GoDaddy’s Altman Z-score places it in distress zone, signaling higher bankruptcy risk compared to Oracle’s grey zone status. Investors should monitor leverage and market conditions closely.

Which Stock to Choose?

Oracle Corporation (ORCL) shows favorable income growth with an 8.38% revenue increase in 2025 and strong profitability metrics, including a 21.68% net margin and 60.84% ROE. However, its financial ratios reveal several weaknesses, such as a high debt-to-equity ratio of 5.09 and low liquidity ratios, resulting in a generally unfavorable ratios assessment. The company’s rating is very favorable (B), but its economic moat evaluation is slightly unfavorable due to declining ROIC below WACC.

GoDaddy Inc. (GDDY) demonstrates solid income statement performance with mostly favorable growth metrics, including a 37.88% revenue increase over the period and strong ROE of 135.37%. Its financial ratios are more balanced, with 42.86% favorable and 42.86% unfavorable, yielding a neutral global ratios opinion. The company has a very favorable rating (B+) and a very favorable moat status, supported by growing ROIC well above WACC.

For investors, the choice might depend on their risk tolerance and investment approach: those prioritizing durable competitive advantage and improving profitability may find GoDaddy’s metrics more attractive, while investors focusing on established profitability with some financial leverage might see Oracle as a viable option. Both stocks present distinct profiles in income growth and financial health that could appeal differently depending on investment goals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Oracle Corporation and GoDaddy Inc. to enhance your investment decisions: