In today’s fast-evolving technology landscape, MongoDB, Inc. and GoDaddy Inc. stand out as influential players in the software infrastructure sector. MongoDB leads with its innovative database platforms, while GoDaddy dominates in cloud-based solutions for digital identity and web presence. Both companies target overlapping markets with distinct innovation strategies, making their comparison insightful. Join me as I analyze which company presents the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between MongoDB and GoDaddy by providing an overview of these two companies and their main differences.

MongoDB Overview

MongoDB, Inc. operates a general-purpose database platform globally, offering products such as MongoDB Enterprise Advanced for enterprises, MongoDB Atlas, a multi-cloud database-as-a-service, and a free Community Server. Founded in 2007 and headquartered in New York City, the company serves a wide range of clients with solutions for cloud, on-premise, and hybrid environments. MongoDB focuses on infrastructure software with a market cap of 32.5B USD.

GoDaddy Overview

GoDaddy Inc. designs and develops cloud-based technology products, primarily serving small businesses and individuals. Its offerings include domain registration, website hosting, security, marketing tools, and business applications like Microsoft Office 365. Incorporated in 2014 and based in Tempe, Arizona, GoDaddy operates in the technology sector with a market cap of 14.5B USD, emphasizing digital identity and online presence services.

Key similarities and differences

Both MongoDB and GoDaddy operate within the software infrastructure industry and target a diverse customer base. While MongoDB specializes in database platforms and cloud services, GoDaddy focuses on domain registration, website hosting, and marketing products. MongoDB’s product suite caters more to developers and enterprises, whereas GoDaddy primarily serves small businesses and individuals with a broader array of cloud-based tools. Their market caps and operational focuses distinctly set them apart.

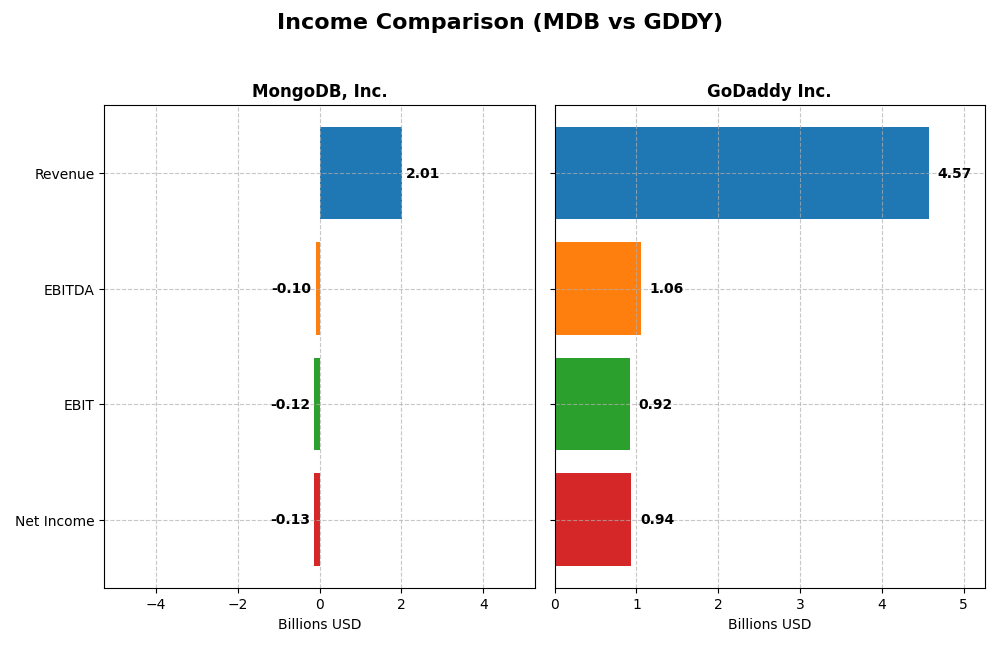

Income Statement Comparison

The table below provides a side-by-side comparison of key income statement metrics for MongoDB, Inc. and GoDaddy Inc. for their most recent fiscal years.

| Metric | MongoDB, Inc. (MDB) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Cap | 32.5B | 14.5B |

| Revenue | 2.01B | 4.57B |

| EBITDA | -97M | 1.06B |

| EBIT | -124M | 924M |

| Net Income | -129M | 937M |

| EPS | -1.73 | 6.63 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

MongoDB, Inc.

MongoDB’s revenue and net income have shown significant growth from 2021 to 2025, with revenues rising from $590M to over $2B. Gross margins remained strong around 73%, but the company consistently reported negative EBIT and net margins, though these losses have narrowed in the latest year. The 2025 fiscal year saw revenue growth of 19.2% and improved net margin by 38.7%, indicating operational progress despite ongoing losses.

GoDaddy Inc.

GoDaddy’s revenue increased steadily from $3.3B in 2020 to $4.57B in 2024, with net income rising substantially from a loss of $495M to a profit of $937M. Gross margin held favorably near 64%, and EBIT and net margins were positive and improving, though net margin declined somewhat last year. The latest year showed moderate revenue growth of 7.5% but a decrease in net margin and EPS, reflecting mixed performance signals.

Which one has the stronger fundamentals?

MongoDB exhibits robust revenue and profitability growth momentum despite negative margins, signaling operational scaling but ongoing losses. GoDaddy delivers consistent profits with strong margins and significant net income growth over five years, though recent margin and EPS declines raise caution. Both show favorable income statement trends, yet GoDaddy’s sustained profitability contrasts with MongoDB’s improving but still negative bottom line.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for MongoDB, Inc. (MDB) and GoDaddy Inc. (GDDY) based on their most recent fiscal year data.

| Ratios | MongoDB, Inc. (MDB) 2025 | GoDaddy Inc. (GDDY) 2024 |

|---|---|---|

| ROE | -4.64% | 135.37% |

| ROIC | -7.36% | 16.02% |

| P/E | -158 | 29.76 |

| P/B | 7.32 | 40.28 |

| Current Ratio | 5.20 | 0.72 |

| Quick Ratio | 5.20 | 0.72 |

| D/E | 0.013 | 5.63 |

| Debt-to-Assets | 1.06% | 47.29% |

| Interest Coverage | -26.7 | 5.64 |

| Asset Turnover | 0.58 | 0.56 |

| Fixed Asset Turnover | 24.78 | 22.22 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

MongoDB, Inc.

MongoDB shows a mixed ratio profile with significant weaknesses: negative net margin (-6.43%), return on equity (-4.64%), and return on invested capital (-7.36%) signal profitability challenges. Its high current ratio (5.2) is unusual and marked unfavorable, possibly indicating inefficient asset use. The company does not pay dividends, reflecting a reinvestment strategy likely tied to its growth and R&D focus.

GoDaddy Inc.

GoDaddy’s ratios suggest operational strength, with a strong net margin of 20.49%, excellent return on equity (135.37%), and favorable interest coverage (5.84). However, its price-to-book ratio at 40.28 and debt-to-equity of 5.63 raise concerns about valuation and leverage. Like MongoDB, GoDaddy does not pay dividends, likely prioritizing reinvestment for growth and acquisitions.

Which one has the best ratios?

GoDaddy presents a more favorable overall ratio profile, showing profitability and solid coverage ratios despite some leverage and valuation concerns. MongoDB exhibits more unfavorable metrics, especially in profitability and liquidity, contributing to its overall unfavorable ratios evaluation. Thus, GoDaddy holds a relatively stronger position based on the analyzed financial ratios.

Strategic Positioning

This section compares the strategic positioning of MongoDB, Inc. and GoDaddy Inc. in terms of market position, key segments, and exposure to technological disruption:

MongoDB, Inc.

- Operates in software infrastructure with a 32.5B market cap; faces competitive pressure in cloud databases.

- Focuses on general purpose database platforms, cloud services (MongoDB Atlas), and enterprise subscriptions.

- Positioned in evolving cloud database technology; moderate disruption risk from emerging data management innovations.

GoDaddy Inc.

- Software infrastructure firm with a 14.5B market cap; competes in cloud-based digital identity and hosting.

- Provides domain registration, website hosting, marketing tools, and business applications for SMBs.

- Engages in cloud technologies and online presence tools; exposed to rapid changes in web hosting and security.

MongoDB, Inc. vs GoDaddy Inc. Positioning

MongoDB concentrates on cloud database platforms with growing subscription revenues, while GoDaddy offers diversified cloud-based web presence and commerce products. MongoDB’s focus is narrower but specialized; GoDaddy serves broader SMB digital needs with varied offerings.

Which has the best competitive advantage?

GoDaddy demonstrates a durable competitive advantage with ROIC above WACC and strong growth, indicating efficient capital use. MongoDB is shedding value despite improving profitability, reflecting a weaker moat position.

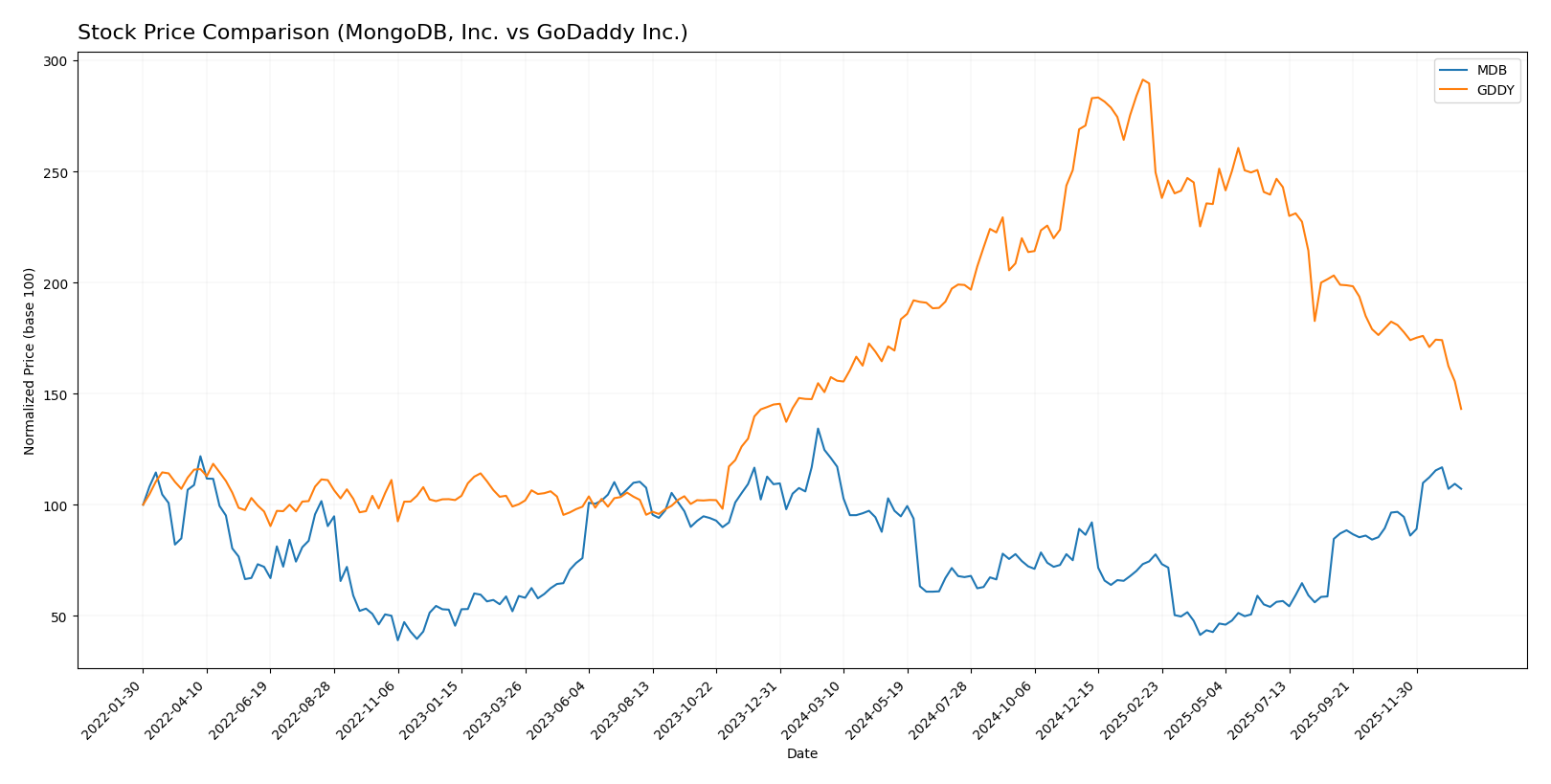

Stock Comparison

The stock price movements of MongoDB, Inc. and GoDaddy Inc. over the past year reveal contrasting bearish trends with differing acceleration patterns and recent volatility shifts.

Trend Analysis

MongoDB, Inc. (MDB) experienced an overall bearish trend with an 11.46% price decline over the past 12 months, characterized by accelerating downward momentum, a high price volatility (std deviation 72.49), and a recent positive reversal gaining 11.1%.

GoDaddy Inc. (GDDY) also showed a bearish trend with a 9.09% price decrease in the same 12-month span, but with decelerating losses and lower volatility (std deviation 27.35); its recent trend worsened with a 21.54% decline.

Comparing both stocks, MongoDB’s recent price recovery contrasts with GoDaddy’s intensified recent losses. Despite this, MongoDB’s total 12-month decline was larger, marking GoDaddy as the better-performing stock over the full period.

Target Prices

The current analyst consensus for target prices reflects a generally optimistic outlook for these technology infrastructure companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MongoDB, Inc. | 500 | 375 | 445.2 |

| GoDaddy Inc. | 182 | 70 | 143.33 |

Analysts expect MongoDB’s stock to appreciate moderately above its current price of $399.76, while GoDaddy’s consensus target suggests upside potential from its current $104.46, indicating positive growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MongoDB, Inc. and GoDaddy Inc.:

Rating Comparison

MDB Rating

- Rating: C, indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 2, reflecting moderate value.

- ROE Score: 1, showing very unfavorable profitability.

- ROA Score: 1, very unfavorable asset efficiency.

- Debt To Equity Score: 4, favorable financial stability.

- Overall Score: 2, moderate overall financial standing.

GDDY Rating

- Rating: B+, denoting a very favorable overall evaluation.

- Discounted Cash Flow Score: 5, considered very favorable.

- ROE Score: 5, indicating very favorable profitability.

- ROA Score: 4, favorable asset utilization.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

GoDaddy Inc. holds a higher rating (B+) and scores better on key profitability and valuation metrics, despite weaker debt-to-equity strength. MongoDB, Inc. shows moderate scores with strengths in debt management but weaker profitability measures.

Scores Comparison

Here is a comparison of the financial scores for MongoDB, Inc. and GoDaddy Inc.:

MDB Scores

- Altman Z-Score: 30.24, indicating a safe zone.

- Piotroski Score: 4, considered average financial strength.

GDDY Scores

- Altman Z-Score: 1.53, indicating a distress zone.

- Piotroski Score: 8, considered very strong financial strength.

Which company has the best scores?

MDB shows a very high Altman Z-Score, signaling strong financial stability, while GDDY has a much stronger Piotroski Score, indicating better financial health in profitability and efficiency. Each company excels in different score aspects.

Grades Comparison

Here is a comparison of the recent grades assigned to MongoDB, Inc. and GoDaddy Inc.:

MongoDB, Inc. Grades

The following table summarizes recent grades given by reputable grading companies for MongoDB, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

MongoDB’s grades consistently indicate strong buy or overweight ratings, showing a clear positive consensus.

GoDaddy Inc. Grades

The following table summarizes recent grades given by reputable grading companies for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

GoDaddy’s grades are more mixed, ranging from hold and neutral to buy and overweight, reflecting a balanced outlook.

Which company has the best grades?

MongoDB, Inc. has received consistently stronger buy and outperform ratings compared to GoDaddy Inc., which has a broader range including neutral and hold grades. This suggests MongoDB may be viewed more favorably by analysts, potentially implying stronger growth expectations or outlook stability for investors.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for MongoDB, Inc. (MDB) and GoDaddy Inc. (GDDY) based on their latest financial and strategic data.

| Criterion | MongoDB, Inc. (MDB) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from MongoDB Atlas and subscriptions; limited product variety beyond core database services. | High: Diverse segments including Core Platform, Applications, Commerce, Domains, and Hosting services. |

| Profitability | Low: Negative net margin (-6.43%), negative ROE (-4.64%), and negative ROIC (-7.36%), indicating current unprofitability. | Strong: Positive net margin (20.49%), very high ROE (135.37%), and healthy ROIC (16.02%), showing solid profitability. |

| Innovation | High: Rapid ROIC growth (~63%), driven by increasing adoption of cloud database services, though still value destructive overall. | High: Significant ROIC growth (~147%) with durable competitive advantage in web services and commerce platforms. |

| Global presence | Growing: Expanding cloud footprint but still focused on database solutions primarily in tech-centric markets. | Established: Wide global reach with strong brand recognition in domains and hosting internationally. |

| Market Share | Niche leader in modern database management systems with strong Atlas growth but limited broader IT market presence. | Leading player in domain registration and web hosting with substantial market share in SMB segments. |

Key takeaways: GoDaddy demonstrates strong profitability and diversification with a durable competitive advantage, making it a more stable investment. MongoDB shows impressive growth potential and innovation but is currently shedding value and lacks profitability, which entails higher risk. Investors should weigh growth prospects against the profitability gap.

Risk Analysis

Below is a comparative table summarizing key risks for MongoDB, Inc. (MDB) and GoDaddy Inc. (GDDY) based on the latest financial and operational data for 2025 and 2024 respectively:

| Metric | MongoDB, Inc. (MDB) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Risk | High beta (1.38) indicates higher volatility in tech infrastructure sector | Moderate beta (0.95), lower volatility but sensitive to small business trends |

| Debt level | Very low debt-to-equity (0.01), minimal financial leverage | High debt-to-equity (5.63), significant leverage risk |

| Regulatory Risk | Moderate; tech sector compliance and data privacy regulations apply | Moderate; domain registration and online payment compliance required |

| Operational Risk | Negative net margin (-6.43%), operational inefficiencies reflected in ROE and ROIC | Strong profitability (net margin 20.49%), operational risk lower |

| Environmental Risk | Low direct impact, standard corporate sustainability concerns | Low direct impact, similar sustainability profile |

| Geopolitical Risk | Moderate; global cloud infrastructure exposure | Moderate; international customer base sensitive to trade policies |

Synthesis: MongoDB faces high market volatility and operational challenges with negative profitability metrics but maintains very low debt, reducing financial distress risk. GoDaddy has strong profitability but carries high debt levels, increasing financial risk. Market and operational risks are most impactful for MongoDB, while debt and market risks dominate for GoDaddy.

Which Stock to Choose?

MongoDB, Inc. (MDB) shows a favorable income statement with strong revenue growth of 19.22% last year and 240% over five years. However, its profitability ratios are mostly unfavorable, with negative net margin (-6.43%) and return on equity (-4.64%). Debt levels are low, and the rating is very favorable, though the global financial ratios evaluation remains unfavorable.

GoDaddy Inc. (GDDY) presents a favorable income profile with a 7.5% revenue growth last year and 38% over five years. It has strong profitability metrics, including a 20.49% net margin and 135.37% return on equity. Debt is higher and less favorable, but the overall rating is very favorable and the global financial ratios evaluation is neutral.

For investors, GDDY’s very favorable rating and durable competitive advantage with growing ROIC may appeal to risk-tolerant and quality-focused profiles seeking profitability. MDB’s favorable income growth but unfavorable ratios and slight value destruction might attract growth-oriented investors willing to accept higher risk and volatility.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MongoDB, Inc. and GoDaddy Inc. to enhance your investment decisions: