In the fast-evolving semiconductor industry, GLOBALFOUNDRIES Inc. (GFS) and IPG Photonics Corporation (IPGP) stand out as innovative players with overlapping markets in technology and manufacturing. GFS specializes in integrated circuit fabrication, while IPGP focuses on advanced fiber laser technologies. Comparing these companies offers insights into different innovation strategies shaping tech futures. Join me as we explore which stock holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between GLOBALFOUNDRIES Inc. and IPG Photonics Corporation by providing an overview of these two companies and their main differences.

GLOBALFOUNDRIES Inc. Overview

GLOBALFOUNDRIES Inc. operates as a semiconductor foundry worldwide, manufacturing integrated circuits essential for various electronic devices. The company produces a wide range of semiconductor products, including microprocessors, mobile application processors, and power management units. Founded in 2009 and based in Malta, New York, GLOBALFOUNDRIES is a significant player in wafer fabrication services and semiconductor technologies.

IPG Photonics Corporation Overview

IPG Photonics Corporation develops, manufactures, and sells high-performance fiber lasers, amplifiers, and diode lasers used primarily in materials processing and communications. The company offers a diverse portfolio including hybrid fiber-solid state lasers and integrated laser systems. Founded in 1990 and headquartered in Marlborough, Massachusetts, IPG serves OEMs, system integrators, and end users worldwide.

Key similarities and differences

Both GLOBALFOUNDRIES and IPG Photonics operate in the semiconductor sector and serve global markets with advanced technology products. GLOBALFOUNDRIES focuses on semiconductor manufacturing and wafer fabrication, while IPG Photonics specializes in laser and amplifier systems. Their business models differ in product offerings—GLOBALFOUNDRIES emphasizes integrated circuits, whereas IPG concentrates on laser-based solutions for materials processing and communications.

Income Statement Comparison

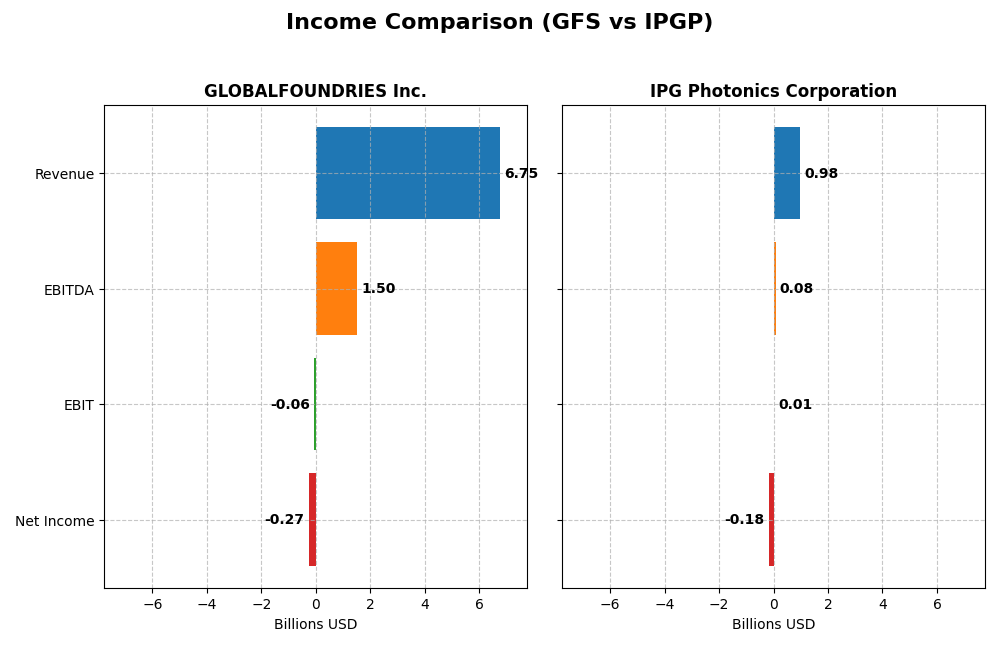

This table presents a side-by-side comparison of key income statement metrics for GLOBALFOUNDRIES Inc. (GFS) and IPG Photonics Corporation (IPGP) for the fiscal year 2024.

| Metric | GLOBALFOUNDRIES Inc. (GFS) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Market Cap | 23B | 3.4B |

| Revenue | 6.75B | 977M |

| EBITDA | 1.5B | 76M |

| EBIT | -64M | 14.5M |

| Net Income | -265M | -182M |

| EPS | -0.48 | -4.09 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

GLOBALFOUNDRIES Inc.

GLOBALFOUNDRIES showed revenue growth of 39.15% over 2020-2024 but a decline of 8.69% in the latest year. Net income grew overall by 80.37% but fell sharply in 2024, resulting in a negative net margin of -3.93%. Gross margins remained favorable at 24.46%, yet EBIT and net margins deteriorated in 2024, reflecting operational challenges.

IPG Photonics Corporation

IPG Photonics experienced a revenue decline of 18.62% over the five-year span and a 24.1% drop in 2024. Net income and margins worsened significantly, with net margin at -18.58% in 2024 and overall net income down 213.76%. While gross margin held at a solid 34.61%, EBIT margin was only slightly positive and recent profitability weakened markedly.

Which one has the stronger fundamentals?

Both companies face unfavorable overall income statement evaluations due to recent declines in revenue and profitability. GLOBALFOUNDRIES has shown more resilience with long-term revenue and net income growth and a decent gross margin. IPG Photonics struggles with sustained negative net income trends and sharper margin contractions, indicating comparatively weaker fundamentals based on provided income data.

Financial Ratios Comparison

Below is a comparative overview of key financial ratios for GLOBALFOUNDRIES Inc. (GFS) and IPG Photonics Corporation (IPGP) based on their most recent fiscal year, 2024.

| Ratios | GLOBALFOUNDRIES Inc. (GFS) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| ROE | -2.46% | -8.97% |

| ROIC | -1.47% | -9.97% |

| P/E | -89.54 | -17.76 |

| P/B | 2.20 | 1.59 |

| Current Ratio | 2.11 | 6.98 |

| Quick Ratio | 1.57 | 5.59 |

| D/E (Debt-to-Equity) | 0.22 | 0.009 |

| Debt-to-Assets | 13.8% | 0.78% |

| Interest Coverage | -1.48 | 0 |

| Asset Turnover | 0.40 | 0.43 |

| Fixed Asset Turnover | 0.82 | 1.66 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

GLOBALFOUNDRIES Inc.

GLOBALFOUNDRIES shows several unfavorable profitability ratios including negative net margin (-3.93%) and return on equity (-2.46%), indicating operational challenges. However, liquidity and leverage ratios are favorable, with a strong current ratio (2.11) and low debt-to-assets (13.81%). The company does not pay dividends, likely prioritizing reinvestment or growth given its negative earnings.

IPG Photonics Corporation

IPG Photonics presents weak profitability metrics with a negative net margin (-18.58%) and return on equity (-8.97%), reflecting profitability pressure. Liquidity shows mixed signals: a very high current ratio (6.98) but also a favorable quick ratio (5.59). The company does not distribute dividends, suggesting a focus on reinvestment or R&D to support its business strategy.

Which one has the best ratios?

Both companies have a similar proportion of favorable ratios (about 36%), but GLOBALFOUNDRIES faces a higher share of unfavorable ratios (57%) compared to IPG Photonics (43%). IPG Photonics’ slightly better balance of neutral and favorable ratios, especially in leverage and coverage, positions it with a marginally stronger overall ratio profile despite profitability concerns.

Strategic Positioning

This section compares the strategic positioning of GLOBALFOUNDRIES Inc. and IPG Photonics Corporation in terms of market position, key segments, and exposure to technological disruption:

GLOBALFOUNDRIES Inc.

- Operates worldwide as a semiconductor foundry facing strong competitive pressure in semiconductors.

- Key segments include wafer fabrication and engineering services, driven by integrated circuits for diverse electronics.

- Exposure to disruption linked to semiconductor fabrication technology advances and evolving device demands.

IPG Photonics Corporation

- Manufactures high-performance fiber lasers and amplifiers targeting specialized laser markets with moderate competition.

- Diverse laser product lines focused on materials processing, communications, and medical applications.

- Faces disruption risks from innovations in fiber laser technology and integrated communication systems.

GLOBALFOUNDRIES Inc. vs IPG Photonics Corporation Positioning

GLOBALFOUNDRIES shows a diversified semiconductor foundry focus with broad device fabrication, while IPG Photonics concentrates on fiber laser and amplifier technologies. GLOBALFOUNDRIES’ scale contrasts with IPG’s specialized product range, reflecting differing market and technology dependencies.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC. GLOBALFOUNDRIES has a slightly unfavorable moat with growing ROIC, whereas IPG Photonics faces a very unfavorable moat with declining profitability, indicating weaker competitive advantage.

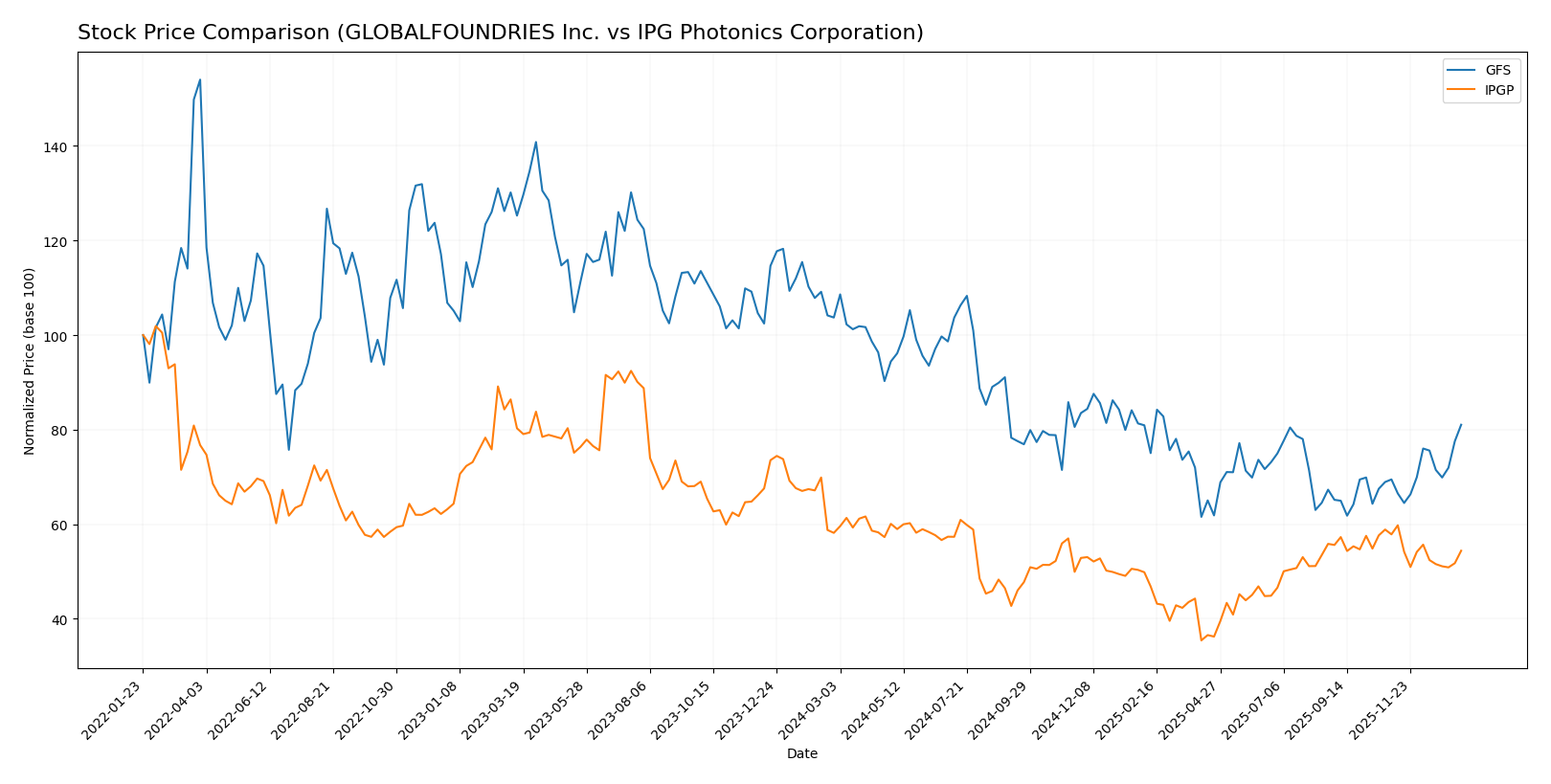

Stock Comparison

The stock price movements of GLOBALFOUNDRIES Inc. (GFS) and IPG Photonics Corporation (IPGP) over the past 12 months reveal distinct bearish trends, with GFS showing a sharper decline and recent accelerated recovery, while IPGP exhibits a moderated deceleration.

Trend Analysis

GLOBALFOUNDRIES Inc. experienced a -21.86% price decline over the past year, indicating a bearish trend with accelerating downward momentum. The stock ranged between 55.66 and 31.54, showing considerable volatility with a std deviation of 6.45.

IPG Photonics Corporation’s stock fell by -6.49% over the same period, also bearish but with decelerating decline. The price fluctuated between 90.69 and 52.12, demonstrating higher volatility at a std deviation of 9.27.

Comparing both, GFS had the steepest negative return but showed recent positive momentum, whereas IPGP’s decline was less severe but persistent; GFS’s recent rally contrasts with IPGP’s ongoing downward slope.

Target Prices

The current analyst consensus suggests modest upside potential for both GLOBALFOUNDRIES Inc. and IPG Photonics Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| GLOBALFOUNDRIES Inc. | 40 | 37 | 38.5 |

| IPG Photonics Corporation | 96 | 92 | 94 |

Analysts expect GLOBALFOUNDRIES shares to trade slightly below the current market price of 41.53 USD, indicating limited upside. IPG Photonics shows a target consensus significantly above the current price of 80.03 USD, suggesting potential for meaningful appreciation.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for GLOBALFOUNDRIES Inc. and IPG Photonics Corporation:

Rating Comparison

GLOBALFOUNDRIES Inc. Rating

- Rating: C+, considered very favorable

- Discounted Cash Flow Score: 3, moderate

- ROE Score: 1, very unfavorable

- ROA Score: 1, very unfavorable

- Debt To Equity Score: 3, moderate

- Overall Score: 2, moderate

IPG Photonics Corporation Rating

- Rating: B+, considered very favorable

- Discounted Cash Flow Score: 4, favorable

- ROE Score: 2, moderate

- ROA Score: 3, moderate

- Debt To Equity Score: 4, favorable

- Overall Score: 3, moderate

Which one is the best rated?

Based strictly on the provided data, IPG Photonics Corporation holds a higher overall rating (B+) and generally better financial scores, including discounted cash flow, return on assets, and debt to equity, compared to GLOBALFOUNDRIES Inc.’s C+ rating and lower scores.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score for GLOBALFOUNDRIES Inc. and IPG Photonics Corporation:

GFS Scores

- Altman Z-Score: 2.61, placing the company in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength and investment potential.

IPGP Scores

- Altman Z-Score: 9.65, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, showing strong financial health and better investment quality.

Which company has the best scores?

Based strictly on the provided scores, IPG Photonics Corporation exhibits a stronger financial position with a safer Altman Z-Score and a higher Piotroski Score compared to GLOBALFOUNDRIES Inc.

Grades Comparison

The following presents a comparison of recent grades assigned to GLOBALFOUNDRIES Inc. and IPG Photonics Corporation by reputable grading companies:

GLOBALFOUNDRIES Inc. Grades

This table shows recent grading updates from various financial institutions for GLOBALFOUNDRIES Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | Downgrade | Neutral | 2025-12-31 |

| B of A Securities | Maintain | Underperform | 2025-12-04 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-13 |

| JP Morgan | Maintain | Neutral | 2025-11-13 |

| Citigroup | Maintain | Neutral | 2025-11-13 |

| Wedbush | Maintain | Outperform | 2025-11-13 |

| B of A Securities | Downgrade | Underperform | 2025-10-13 |

| Deutsche Bank | Maintain | Buy | 2025-08-06 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-06 |

| Wedbush | Maintain | Outperform | 2025-08-06 |

Grades for GLOBALFOUNDRIES show a mix of “Neutral,” “Outperform,” and “Underperform” opinions, with recent downgrades from Wedbush and B of A Securities.

IPG Photonics Corporation Grades

The following table summarizes recent grading activity for IPG Photonics Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Stifel | Maintain | Buy | 2025-02-12 |

| Needham | Maintain | Hold | 2025-02-12 |

| Seaport Global | Downgrade | Neutral | 2024-08-01 |

| Stifel | Maintain | Buy | 2024-07-31 |

| Raymond James | Maintain | Strong Buy | 2024-07-31 |

IPG Photonics grades display a predominance of “Buy” and “Strong Buy” ratings, with some upgrades and a minority of “Sell” and “Neutral” opinions.

Which company has the best grades?

IPG Photonics has generally received stronger grades, including multiple “Strong Buy” and “Outperform” ratings, compared to GLOBALFOUNDRIES’ mixed “Neutral” and “Underperform” assessments. This difference could influence investor sentiment and portfolio decisions by reflecting higher confidence in IPG Photonics’ prospects.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of GLOBALFOUNDRIES Inc. (GFS) and IPG Photonics Corporation (IPGP) based on their recent financial performance, market position, and operational metrics.

| Criterion | GLOBALFOUNDRIES Inc. (GFS) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Diversification | Moderate: Focused on Water Fabrication (6.1B USD in 2024) and Engineering Services (652M USD) | Moderate: Diverse laser product range with high and low power lasers, amplifiers, and systems |

| Profitability | Weak: Negative net margin (-3.93%), ROIC -1.47%, shedding value but improving ROIC trend | Weak: More negative net margin (-18.58%), ROIC -9.97%, declining profitability |

| Innovation | Moderate: Growing ROIC indicates improving operational efficiency | Weak: Declining ROIC and profitability suggests challenges in innovation or market adaptation |

| Global presence | Strong: Large scale fabrication services with global clientele | Strong: Global leader in fiber lasers with broad industry applications |

| Market Share | Solid in semiconductor fabrication niche | Leading in fiber laser market but facing margin pressure |

Key takeaways: Both companies face profitability challenges with negative returns on capital. GLOBALFOUNDRIES shows signs of recovery with a growing ROIC trend, while IPG Photonics struggles with declining profitability. Investors should weigh GFS’s improving efficiency against IPGP’s market leadership but deteriorating margins.

Risk Analysis

Below is a comparative table highlighting key risk factors for GLOBALFOUNDRIES Inc. (GFS) and IPG Photonics Corporation (IPGP) based on the latest data from 2024–2026.

| Metric | GLOBALFOUNDRIES Inc. (GFS) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Market Risk | High beta at 1.485, volatile semiconductor sector | Moderate beta at 1.017, niche laser market |

| Debt Level | Moderate debt-to-equity ratio 0.22, manageable leverage | Very low debt-to-equity 0.01, strong balance sheet |

| Regulatory Risk | Moderate, semiconductor manufacturing subject to export controls | Moderate, laser tech may face export and safety regulations |

| Operational Risk | Negative profitability and ROIC, operational inefficiencies | Negative margins but stronger operational metrics than GFS |

| Environmental Risk | Moderate, typical for semiconductor fabs with chemical usage | Lower, laser manufacturing less environmentally intensive |

| Geopolitical Risk | Elevated, global supply chain tensions and US-China tech rivalry | Moderate, exposure to international markets but less supply chain dependence |

The most impactful risks are GFS’s operational inefficiencies and market volatility, with a beta near 1.5 indicating higher sensitivity to market swings. IPGP benefits from a stronger balance sheet and safer Altman Z-Score but faces challenges in profitability and a competitive niche market. Investors should closely monitor semiconductor sector cycles and geopolitical tensions affecting supply chains.

Which Stock to Choose?

GLOBALFOUNDRIES Inc. (GFS) shows a mixed income evolution with a recent decline but overall growth over 2020-2024. Its financial ratios are mostly unfavorable, including negative profitability and asset returns, yet it maintains low debt and a moderate rating of C+ indicating some financial stability. The company is shedding value but with a growing ROIC trend, suggesting improving profitability despite current challenges.

IPG Photonics Corporation (IPGP) has experienced consistent income deterioration over the period 2020-2024, reflected in unfavorable net margin and profitability ratios. While it benefits from very low debt and strong liquidity ratios, its overall financial ratios are slightly unfavorable, and it holds a better rating of B+ with a safe-zone Altman Z-score, despite a declining ROIC trend signaling weakening profitability.

Investors focused on improving profitability and moderate financial stability might view GFS as potentially attractive due to its growing ROIC trend despite value destruction, while those prioritizing financial safety and stronger ratings may find IPGP more aligned with conservative profiles, despite its declining profitability and unfavorable income growth.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of GLOBALFOUNDRIES Inc. and IPG Photonics Corporation to enhance your investment decisions: