In the fast-evolving semiconductor industry, GLOBALFOUNDRIES Inc. (GFS) and indie Semiconductor, Inc. (INDI) stand out as key players with distinct market focuses. While GLOBALFOUNDRIES specializes in broad wafer fabrication and integrated circuits, indie Semiconductor targets automotive applications and advanced driver assistance systems. This comparison explores their innovation strategies and market positions to help you decide which company offers the most compelling investment opportunity. Let’s dive in to uncover the best fit for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between GLOBALFOUNDRIES Inc. and indie Semiconductor, Inc. by providing an overview of these two companies and their main differences.

GLOBALFOUNDRIES Overview

GLOBALFOUNDRIES Inc. operates as a semiconductor foundry worldwide, manufacturing integrated circuits that enable a variety of pervasive electronic devices. Its product range includes microprocessors, mobile application processors, network processors, and power management units. Founded in 2009 and headquartered in Malta, New York, the company serves mainstream wafer fabrication needs with advanced semiconductor technologies.

indie Semiconductor Overview

indie Semiconductor, Inc. focuses on automotive semiconductors and software solutions, supporting advanced driver assistance, connected cars, and electrification applications. It develops devices for parking assistance, infotainment, wireless charging, and telematics. Incorporated in 2007 and based in Aliso Viejo, California, indie serves specialized automotive markets with photonic components and high-speed electronics.

Key similarities and differences

Both companies operate in the semiconductor industry and trade on NASDAQ, yet GLOBALFOUNDRIES has a broader foundry business serving multiple device types, while indie Semiconductor targets automotive-specific applications and software. GLOBALFOUNDRIES is considerably larger with 13K employees and a market cap of 23B USD, compared to indie’s 920 employees and 857M USD market cap, indicating different scales and market focuses.

Income Statement Comparison

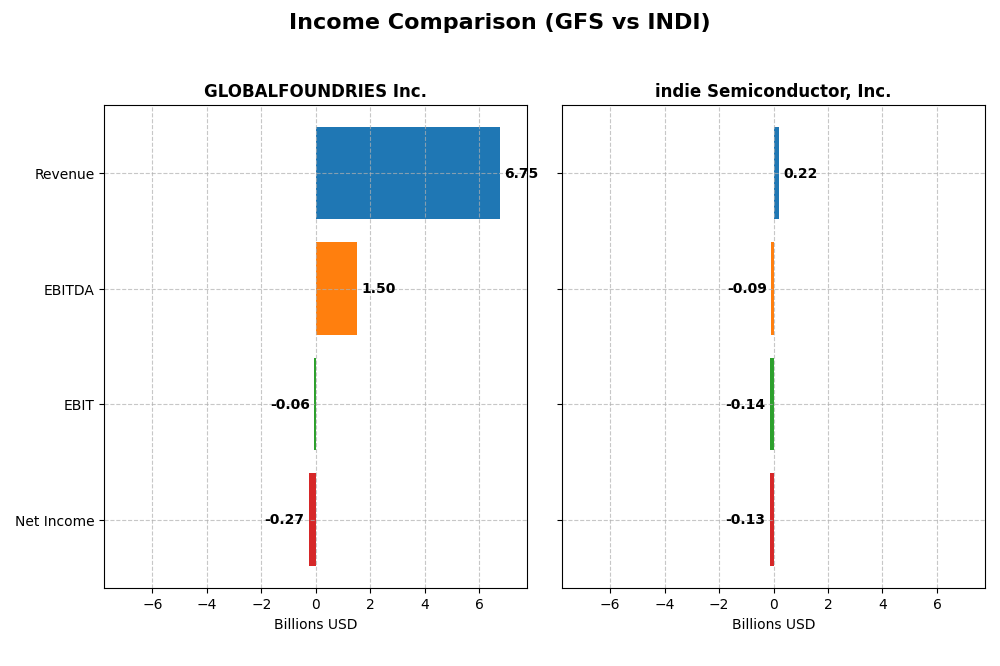

The table below compares the key income statement metrics of GLOBALFOUNDRIES Inc. (GFS) and indie Semiconductor, Inc. (INDI) for the fiscal year 2024.

| Metric | GLOBALFOUNDRIES Inc. (GFS) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Cap | 23B | 857M |

| Revenue | 6.75B | 217M |

| EBITDA | 1.50B | -94M |

| EBIT | -64M | -137M |

| Net Income | -265M | -133M |

| EPS | -0.48 | -0.76 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

GLOBALFOUNDRIES Inc.

GLOBALFOUNDRIES showed a 39.15% revenue growth from 2020 to 2024 but experienced an 8.69% decline in 2024 alone. Net income grew 80.37% overall but swung to a loss of $265M in 2024 from a $1.02B profit in 2023. Gross margin remained favorable at 24.46%, yet EBIT and net margins turned negative in 2024, indicating margin pressures and deteriorating profitability.

indie Semiconductor, Inc.

indie Semiconductor’s revenue expanded dramatically by 858.35% over five years but dipped 2.91% in 2024 to $217M. Gross margin improved significantly to 41.68%, yet the company sustained heavy losses with a net margin of -61.2% and an EBIT margin of -63.22%. Despite a 6.17% increase in EPS last year, net income declined by 36.01% over the period, reflecting ongoing profitability challenges.

Which one has the stronger fundamentals?

GLOBALFOUNDRIES benefits from higher absolute revenues and overall net income growth, with a more stable gross margin but recent profitability declines. indie Semiconductor exhibits impressive revenue growth and improving gross margins but suffers from deep net losses and volatile EBIT margins. Both face unfavorable net margins, with GLOBALFOUNDRIES showing a more pronounced recent deterioration, while indie Semiconductor’s fundamentals remain mixed.

Financial Ratios Comparison

The table below compares key financial ratios for GLOBALFOUNDRIES Inc. (GFS) and indie Semiconductor, Inc. (INDI) based on their most recent fiscal year data for 2024.

| Ratios | GLOBALFOUNDRIES Inc. (GFS) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| ROE | -2.46% | -31.73% |

| ROIC | -1.47% | -19.25% |

| P/E | -89.54 | -5.35 |

| P/B | 2.20 | 1.70 |

| Current Ratio | 2.11 | 4.82 |

| Quick Ratio | 1.57 | 4.23 |

| D/E | 0.22 | 0.95 |

| Debt-to-Assets | 13.81% | 42.34% |

| Interest Coverage | -1.48 | -18.37 |

| Asset Turnover | 0.40 | 0.23 |

| Fixed Asset Turnover | 0.82 | 4.30 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

GLOBALFOUNDRIES Inc.

GLOBALFOUNDRIES shows a mixed financial profile with notable weaknesses such as negative net margin (-3.93%) and return on equity (-2.46%), alongside unfavorable interest coverage (-0.44) and asset turnover (0.4). However, it maintains a solid liquidity position with a current ratio of 2.11 and low debt levels. The company does not pay dividends, possibly reflecting reinvestment priorities or operating challenges.

indie Semiconductor, Inc.

indie Semiconductor faces significant profitability challenges, with a steep negative net margin (-61.2%) and return on equity (-31.73%). The company exhibits strong liquidity with a quick ratio of 4.23 but suffers from poor interest coverage (-14.8). It also does not distribute dividends, likely due to ongoing heavy R&D investments and a growth-focused strategy.

Which one has the best ratios?

Both companies present predominantly unfavorable ratios, reflecting operational and profitability difficulties. GLOBALFOUNDRIES benefits from stronger liquidity and lower leverage, while indie Semiconductor shows more extreme profitability deficits despite solid quick liquidity and fixed asset turnover. Overall, GLOBALFOUNDRIES exhibits a somewhat more balanced ratio profile, but both warrant caution.

Strategic Positioning

This section compares the strategic positioning of GLOBALFOUNDRIES Inc. and indie Semiconductor, Inc., including market position, key segments, and exposure to technological disruption:

GLOBALFOUNDRIES Inc.

- Large semiconductor foundry with significant market presence and competitive pressure on NASDAQ Global Select.

- Main revenue from wafer fabrication (~6B USD), with additional engineering services; broad semiconductor product portfolio.

- Exposure to technological disruption linked to semiconductor fabrication advances and integration in various electronic devices.

indie Semiconductor, Inc.

- Smaller automotive semiconductor firm facing higher volatility and competitive pressure on NASDAQ Capital Market.

- Focused on automotive semiconductors and software for ADAS, connectivity, and electrification applications.

- Exposure focused on automotive tech innovations including photonics, wireless charging, and optical communication.

GLOBALFOUNDRIES Inc. vs indie Semiconductor, Inc. Positioning

GLOBALFOUNDRIES has a diversified semiconductor foundry business with a broad product base, while indie Semiconductor concentrates on automotive semiconductor solutions. GLOBALFOUNDRIES benefits from scale but faces intense industry competition; indie focuses on niche automotive tech but with smaller scale.

Which has the best competitive advantage?

Based on MOAT evaluation, GLOBALFOUNDRIES shows slightly unfavorable value creation with growing profitability, whereas indie Semiconductor faces very unfavorable value destruction and declining profitability, indicating GLOBALFOUNDRIES has a comparatively stronger competitive advantage.

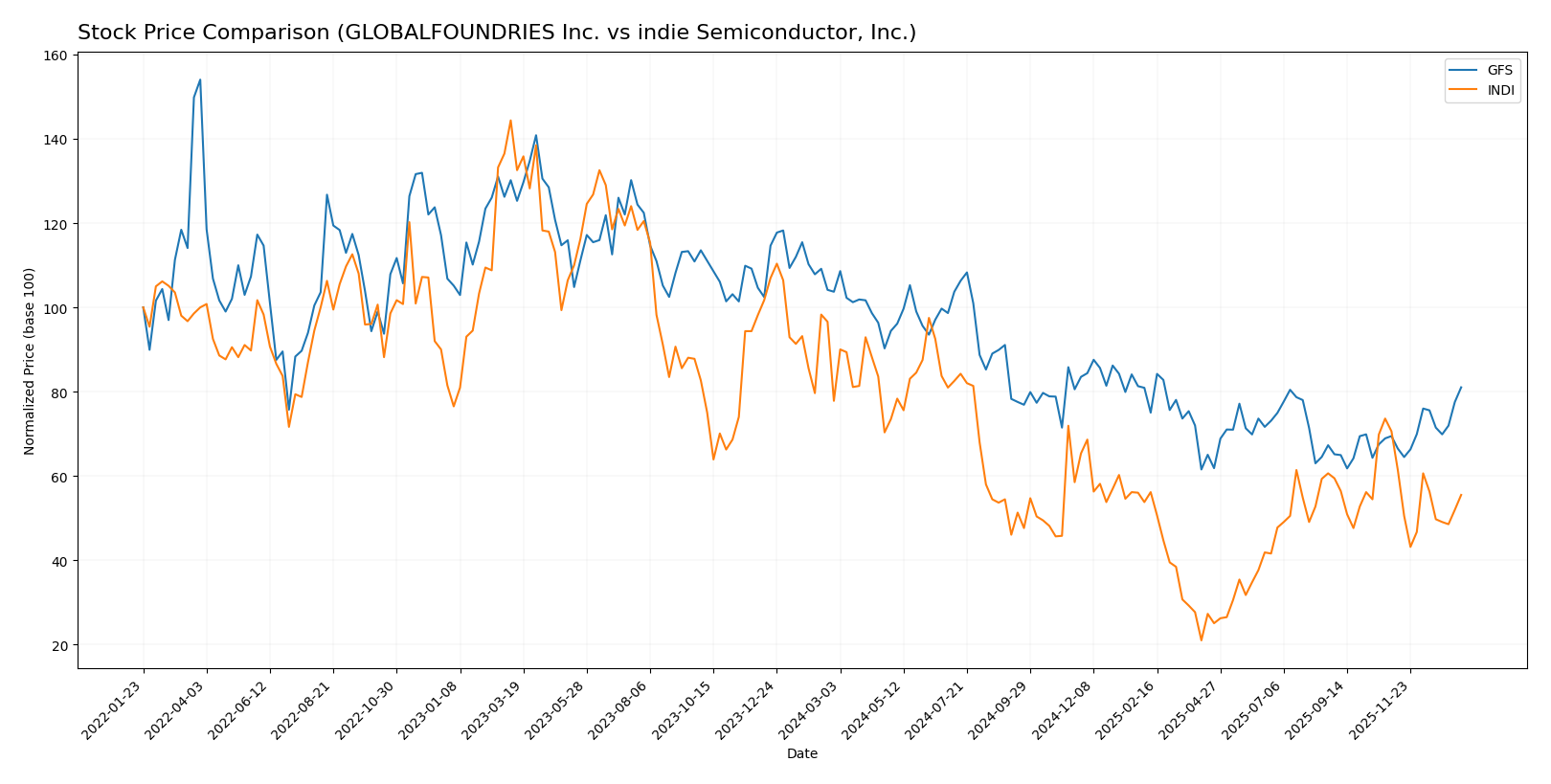

Stock Comparison

The stock price chart highlights significant bearish trends for both GLOBALFOUNDRIES Inc. and indie Semiconductor, Inc. over the past 12 months, with recent divergent price movements and evolving trading volumes shaping their trajectories.

Trend Analysis

GLOBALFOUNDRIES Inc. exhibited a bearish trend over the past year with a -21.86% price change, showing acceleration and elevated volatility (std dev 6.45). Its recent trend reversed positively with a 16.66% gain.

indie Semiconductor, Inc. also displayed a bearish trend over 12 months, declining -28.67% with deceleration and lower volatility (std dev 1.35). Recently, the downward trend persisted with a -21.38% drop.

Comparing both stocks, GLOBALFOUNDRIES Inc. delivered the highest market performance recently, reversing losses, whereas indie Semiconductor, Inc. continued to decline steadily.

Target Prices

The consensus target prices from recognized analysts indicate potential price ranges for these semiconductor companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| GLOBALFOUNDRIES Inc. | 40 | 37 | 38.5 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

Analysts expect GLOBALFOUNDRIES shares to trade slightly below the current price of $41.53, while indie Semiconductor’s target of $8 suggests significant upside from its current $4.23 level. Overall, the targets reflect cautious optimism with varied risk profiles.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for GLOBALFOUNDRIES Inc. and indie Semiconductor, Inc.:

Rating Comparison

GLOBALFOUNDRIES Inc. Rating

- Rating: C+, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate at 3.

- ROE Score: Very unfavorable at 1.

- ROA Score: Very unfavorable at 1.

- Debt To Equity Score: Moderate at 3.

- Overall Score: Moderate at 2.

indie Semiconductor, Inc. Rating

- Rating: C-, also considered very favorable.

- Discounted Cash Flow Score: Very unfavorable at 1.

- ROE Score: Very unfavorable at 1.

- ROA Score: Very unfavorable at 1.

- Debt To Equity Score: Very unfavorable at 1.

- Overall Score: Very unfavorable at 1.

Which one is the best rated?

Based strictly on the provided data, GLOBALFOUNDRIES Inc. is better rated overall, with a higher rating (C+) and moderate scores in discounted cash flow, debt to equity, and overall score, compared to indie Semiconductor’s uniformly very unfavorable scores.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score for GLOBALFOUNDRIES Inc. and indie Semiconductor, Inc.:

GFS Scores

- Altman Z-Score: 2.61, positioned in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 6, indicating average financial strength.

INDI Scores

- Altman Z-Score: 0.12, positioned in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 2, indicating very weak financial strength.

Which company has the best scores?

Based on the provided data, GLOBALFOUNDRIES Inc. has higher Altman Z and Piotroski scores, suggesting comparatively stronger financial health than indie Semiconductor, Inc.

Grades Comparison

Here is the detailed comparison of recent grades issued by reputable grading companies for the two companies:

GLOBALFOUNDRIES Inc. Grades

The following table summarizes recent grades from recognized financial institutions for GLOBALFOUNDRIES Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | Downgrade | Neutral | 2025-12-31 |

| B of A Securities | Maintain | Underperform | 2025-12-04 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-13 |

| JP Morgan | Maintain | Neutral | 2025-11-13 |

| Citigroup | Maintain | Neutral | 2025-11-13 |

| Wedbush | Maintain | Outperform | 2025-11-13 |

| B of A Securities | Downgrade | Underperform | 2025-10-13 |

| Deutsche Bank | Maintain | Buy | 2025-08-06 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-06 |

| Wedbush | Maintain | Outperform | 2025-08-06 |

GLOBALFOUNDRIES has mixed grades, with a recent downgrade to Neutral from Wedbush and multiple Underperform ratings from B of A Securities, offset by Outperform and Buy ratings from other firms.

indie Semiconductor, Inc. Grades

The following table summarizes recent grades from recognized financial institutions for indie Semiconductor, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

indie Semiconductor consistently holds Buy or Overweight ratings across multiple grading companies, with only one Neutral rating from UBS.

Which company has the best grades?

indie Semiconductor, Inc. has received predominantly Buy and Overweight grades, indicating stronger analyst confidence compared to GLOBALFOUNDRIES Inc., which has a more mixed outlook including Neutral and Underperform ratings. This divergence may influence investor perception of growth potential and risk exposure.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for GLOBALFOUNDRIES Inc. (GFS) and indie Semiconductor, Inc. (INDI) based on the most recent financial and operational data.

| Criterion | GLOBALFOUNDRIES Inc. (GFS) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Diversification | Moderate, primarily in Water Fabrication and Engineering services (6.7B USD total revenue) | Limited, focused on Product and Service segments (216M USD total revenue) |

| Profitability | Negative net margin (-3.93%), ROIC slightly negative but improving | Significantly negative net margin (-61.2%), declining ROIC |

| Innovation | Moderate, with steady ROIC growth indicating improving capital efficiency | Low, with declining ROIC and profitability |

| Global presence | Strong, large revenue base suggests broad market reach | Smaller scale, likely more niche or regional presence |

| Market Share | Solid in semiconductor fabrication services | Smaller player in semiconductor product market |

Key takeaways: GLOBALFOUNDRIES shows stronger diversification and improving profitability despite current losses, positioning it better for recovery. indie Semiconductor faces steep profitability challenges and declining efficiency, signaling higher risk for investors.

Risk Analysis

Below is a comparative risk assessment table for GLOBALFOUNDRIES Inc. (GFS) and indie Semiconductor, Inc. (INDI) based on their latest 2024 financial and operational data.

| Metric | GLOBALFOUNDRIES Inc. (GFS) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Risk | Beta 1.49 (moderate volatility) | Beta 2.54 (high volatility) |

| Debt level | Low debt-to-equity 0.22 (favorable) | High debt-to-equity 0.95 (neutral) |

| Regulatory Risk | Moderate (semiconductor industry, US-based) | Moderate (automotive semiconductor, US-based) |

| Operational Risk | Negative net margin (-3.93%), asset turnover low (0.4) | Very negative net margin (-61.2%), low asset turnover (0.23) |

| Environmental Risk | Industry pressure on sustainability, but no major issues reported | Similar industry concerns, no specific environmental red flags |

| Geopolitical Risk | Exposure to US-China tech tensions impacting supply chains | Similar exposure, with automotive sector sensitivities |

In synthesis, indie Semiconductor faces the most impactful risks, notably financial distress indicated by a very low Altman Z-score (0.12, distress zone) and weak profitability metrics, increasing bankruptcy risk. GLOBALFOUNDRIES shows moderate risks with better debt management and a more stable Altman Z-score (2.6, grey zone), but operational inefficiencies and negative returns remain concerns. Market volatility is higher for indie Semiconductor, suggesting greater share price swings. Caution is advised, prioritizing risk management when considering exposure to these stocks.

Which Stock to Choose?

GLOBALFOUNDRIES Inc. (GFS) shows a mixed financial picture with a declining income in 2024 but overall revenue and net income growth since 2020. Its financial ratios reveal more unfavorable than favorable metrics, with negative returns on equity and assets, yet it maintains a low debt burden and a strong current ratio. The company’s rating is moderate with a C+ grade, and its economic moat is slightly unfavorable, indicating value destruction but improving profitability.

indie Semiconductor, Inc. (INDI) experiences significant revenue growth over the medium term but faces steep net income declines and negative profitability ratios in 2024. Its financial ratios are mostly unfavorable, marked by poor returns and high net debt to EBITDA, despite a very high current ratio and some favorable asset turnover. The rating is lower with a C- grade, and its moat is very unfavorable, reflecting sustained value destruction and declining profitability.

For investors, the choice might depend on risk tolerance and investment goals: those prioritizing improving profitability and moderate financial stability may find GFS more appealing, while risk-tolerant investors focused on high growth potential but facing significant risks might look at INDI. The ratings and income evaluations suggest caution, as both companies show challenges in profitability and value creation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of GLOBALFOUNDRIES Inc. and indie Semiconductor, Inc. to enhance your investment decisions: