Thomson Reuters Corporation and Global Payments Inc. both operate within the specialty business services sector, yet they target distinct yet overlapping markets in information and payment technology solutions. Thomson Reuters excels in legal, tax, and news services, while Global Payments drives innovation in payment processing and financial software. Comparing their strategies and market positions reveals valuable insights for investors seeking growth and stability. Let’s explore which company presents the most compelling opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Thomson Reuters Corporation and Global Payments Inc. by providing an overview of these two companies and their main differences.

Thomson Reuters Corporation Overview

Thomson Reuters Corporation delivers business information services globally, operating in five segments including Legal Professionals, Corporates, Tax & Accounting Professionals, Reuters News, and Global Print. It focuses on providing research, workflow solutions, and content-enabled technology for legal, tax, and regulatory professionals. Headquartered in Toronto, Canada, the company serves law firms, governments, and media organizations with a market cap of 58B USD.

Global Payments Inc. Overview

Global Payments Inc. offers payment technology and software solutions across the Americas, Europe, and Asia-Pacific through three segments: Merchant Solutions, Issuer Solutions, and Business and Consumer Solutions. It provides authorization, settlement, software, and financial services targeting merchants, financial institutions, and underbanked consumers. Based in Atlanta, Georgia, GPN has a market cap of 19.5B USD and supports global payment processing.

Key similarities and differences

Both companies operate in the specialty business services industry and serve global markets with technology-driven solutions. Thomson Reuters emphasizes information services and workflow solutions for legal and tax professionals, while Global Payments focuses on payment processing and financial technology products. TRI’s business centers on content and analytics, whereas GPN specializes in payment authorization, settlement, and enterprise software, reflecting distinct but complementary niches within the industrials sector.

Income Statement Comparison

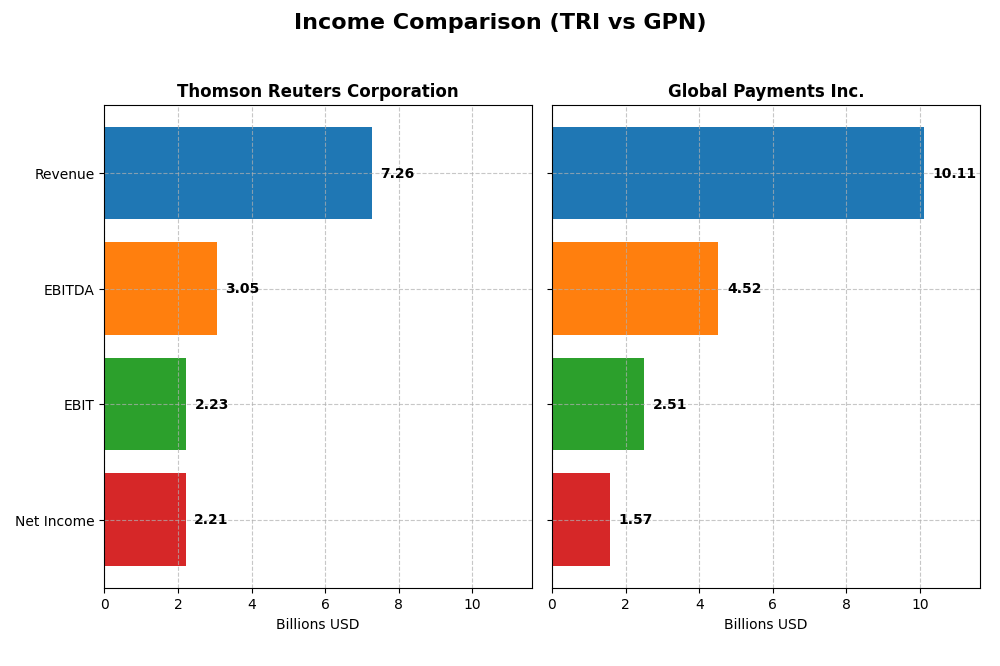

This table presents a side-by-side comparison of key income statement metrics for Thomson Reuters Corporation and Global Payments Inc. for the fiscal year 2024.

| Metric | Thomson Reuters Corporation (TRI) | Global Payments Inc. (GPN) |

|---|---|---|

| Market Cap | 58.2B | 19.5B |

| Revenue | 7.26B | 10.11B |

| EBITDA | 3.05B | 4.52B |

| EBIT | 2.23B | 2.51B |

| Net Income | 2.21B | 1.57B |

| EPS | 4.89 | 6.18 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Thomson Reuters Corporation

From 2020 to 2024, Thomson Reuters showed steady revenue growth, reaching $7.26B in 2024, with net income nearly doubling over the period. Margins remained strong, with a gross margin of 75.32% and a net margin of 30.45% in 2024. However, last year’s growth slowed, with net margin and EPS declining, signaling some pressure on profitability despite stable revenues.

Global Payments Inc.

Global Payments experienced consistent revenue increases, hitting $10.1B in 2024, accompanied by significant net income growth of 168.66% over five years. Margins improved notably, with a gross margin of 62.79% and net margin of 15.54% in 2024, and last year showed robust growth in EBIT and EPS. Operational expenses rose but were offset by strong profitability gains.

Which one has the stronger fundamentals?

Both companies report favorable income statements, but Global Payments demonstrates higher revenue and net income growth rates, alongside improving margins and EPS growth, indicating stronger momentum. Thomson Reuters maintains higher margins but faced recent margin contraction. Overall, Global Payments shows a more consistent and favorable growth trajectory in its financial fundamentals.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for Thomson Reuters Corporation (TRI) and Global Payments Inc. (GPN) based on their latest fiscal year data ending 2024.

| Ratios | Thomson Reuters Corporation (TRI) | Global Payments Inc. (GPN) |

|---|---|---|

| ROE | 18.4% | 7.0% |

| ROIC | 13.9% | 4.7% |

| P/E | 32.7 | 18.2 |

| P/B | 6.02 | 1.28 |

| Current Ratio | 1.02 | 0.97 |

| Quick Ratio | 1.01 | 0.97 |

| D/E (Debt-to-Equity) | 0.26 | 0.75 |

| Debt-to-Assets | 16.7% | 35.9% |

| Interest Coverage | 12.5 | 3.7 |

| Asset Turnover | 0.39 | 0.22 |

| Fixed Asset Turnover | 18.8 | 4.44 |

| Payout ratio | 40.9% | 16.1% |

| Dividend yield | 1.25% | 0.89% |

Interpretation of the Ratios

Thomson Reuters Corporation

Thomson Reuters shows strong profitability with a net margin of 30.45% and a favorable return on equity (18.41%) and invested capital (13.94%). The balance sheet appears solid with low debt-to-equity (0.26) and good interest coverage (13.23). However, high price-to-earnings (32.7) and price-to-book (6.02) ratios may concern valuation. Dividend yield is moderate at 1.25%, supported by stable payouts and buybacks funded by free cash flow.

Global Payments Inc.

Global Payments presents mixed results with a favorable net margin of 15.54% but weak returns on equity (7.05%) and invested capital (4.68%). The company’s liquidity ratios are slightly unfavorable (current ratio 0.97) and leverage is moderate (debt-to-equity 0.75). Its dividend yield is low at 0.89%, with potential risks given the less robust coverage by free cash flow. Asset turnover is weak, limiting efficiency.

Which one has the best ratios?

Thomson Reuters displays a stronger overall financial profile, with a majority of its ratios favorable, including profitability, leverage, and dividend metrics. Global Payments faces challenges in returns and liquidity, with a less favorable ratio distribution. Based on the available data, Thomson Reuters has the more robust set of financial ratios.

Strategic Positioning

This section compares the strategic positioning of Thomson Reuters Corporation and Global Payments Inc., focusing on market position, key segments, and exposure to technological disruption:

Thomson Reuters Corporation

- Established provider in specialty business services with stable market presence and low beta (0.306).

- Diversified segments: Legal, Corporates, Tax & Accounting, Reuters News, Global Print.

- Moderate exposure through digital transformation in legal and tax workflow software.

Global Payments Inc.

- Payment technology leader with moderate market size and higher beta (0.798).

- Focused on payment solutions: Merchant, Issuer, Business and Consumer segments.

- High exposure due to reliance on evolving payment technologies and software solutions.

Thomson Reuters Corporation vs Global Payments Inc. Positioning

Thomson Reuters pursues a diversified approach across legal, tax, and news services, offering stability but limited rapid growth. Global Payments concentrates on payment technologies with greater technological sensitivity, yielding higher growth potential but increased volatility.

Which has the best competitive advantage?

Thomson Reuters shows a very favorable MOAT with ROIC well above WACC and growing profitability, indicating a durable competitive advantage. Global Payments is slightly unfavorable, shedding value despite improving ROIC trends.

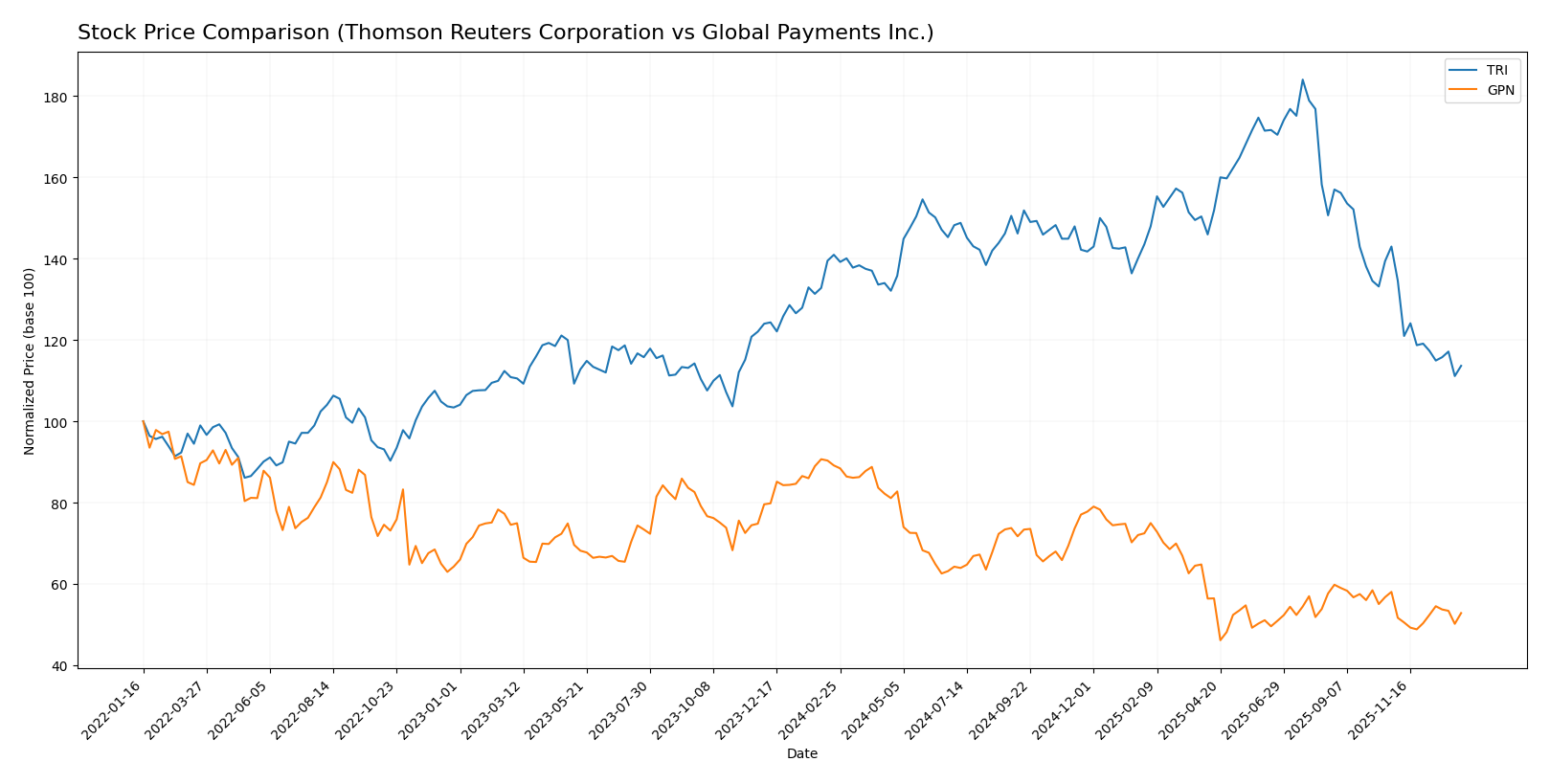

Stock Comparison

The stock price chart over the past 12 months reveals significant declines for both Thomson Reuters Corporation and Global Payments Inc., with notable bearish trends and distinct trading volumes influencing market dynamics.

Trend Analysis

Thomson Reuters Corporation (TRI) experienced a bearish trend over the past year with a -19.38% price change and decelerating downward momentum, ranging between $126.36 and $209.29, alongside high volatility (std. dev. 17.02).

Global Payments Inc. (GPN) showed a sharper bearish trend with a -40.74% price change over the same period, accelerating its decline from $134.19 to $69.46, also marked by significant volatility (std. dev. 17.04).

Comparing both, Thomson Reuters delivered a less severe decline and relatively more stable trend, outperforming Global Payments, which suffered the highest market value loss in the past year.

Target Prices

Analysts present a clear target price consensus for Thomson Reuters Corporation and Global Payments Inc., indicating potential upside from current levels.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Thomson Reuters Corporation | 212 | 165 | 187.33 |

| Global Payments Inc. | 105 | 93 | 100.33 |

The consensus target prices for Thomson Reuters and Global Payments exceed their current stock prices ($129.23 and $79.52 respectively), suggesting expected appreciation according to analyst estimates.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Thomson Reuters Corporation and Global Payments Inc.:

Rating Comparison

Thomson Reuters Corporation Rating

- Rating: B+ with a very favorable status reflecting solid fundamentals.

- Discounted Cash Flow Score: 4, favorable, suggesting reasonable valuation.

- ROE Score: 4, favorable, showing efficient profit generation from equity.

- ROA Score: 5, very favorable, demonstrating effective asset utilization.

- Debt To Equity Score: 3, moderate, indicating balanced financial risk.

- Overall Score: 3, moderate, summarizing steady financial health.

Global Payments Inc. Rating

- Rating: A- with a very favorable status indicating strong standing.

- Discounted Cash Flow Score: 5, very favorable, indicating undervaluation potential.

- ROE Score: 3, moderate, indicating average efficiency in profit generation.

- ROA Score: 3, moderate, reflecting average asset use effectiveness.

- Debt To Equity Score: 2, moderate, suggesting somewhat lower financial risk.

- Overall Score: 4, favorable, showing stronger overall financial performance.

Which one is the best rated?

Global Payments Inc. holds a better overall rating (A-) and a higher overall score (4) compared to Thomson Reuters Corporation’s B+ rating and score of 3. GPN’s stronger discounted cash flow score also supports its higher rating, despite TRI’s superior ROA score.

Scores Comparison

The scores comparison between Thomson Reuters Corporation and Global Payments Inc. highlights their financial health and bankruptcy risk:

Thomson Reuters Scores

- Altman Z-Score: 7.99, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Global Payments Scores

- Altman Z-Score: 0.98, indicating distress zone, high bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

Which company has the best scores?

Thomson Reuters shows a much stronger Altman Z-Score, indicating lower bankruptcy risk, while Global Payments scores higher on Piotroski, showing stronger financial health. The best scores depend on which metric investors prioritize.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Thomson Reuters Corporation and Global Payments Inc.:

Thomson Reuters Corporation Grades

The table below summarizes recent grades from reputable institutions for Thomson Reuters Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-12-17 |

| Scotiabank | maintain | Sector Outperform | 2025-11-05 |

| JP Morgan | maintain | Neutral | 2025-11-05 |

| Canaccord Genuity | upgrade | Buy | 2025-11-05 |

| CIBC | maintain | Outperform | 2025-10-29 |

| Goldman Sachs | upgrade | Buy | 2025-10-15 |

| Morgan Stanley | maintain | Equal Weight | 2025-09-11 |

| Wells Fargo | upgrade | Overweight | 2025-09-09 |

| TD Securities | upgrade | Buy | 2025-08-28 |

| CIBC | upgrade | Outperform | 2025-08-19 |

Overall, Thomson Reuters shows a positive trend with multiple upgrades to Buy, Outperform, and Overweight ratings, reflecting growing confidence among analysts.

Global Payments Inc. Grades

The table below summarizes recent grades from reputable institutions for Global Payments Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | maintain | Hold | 2025-11-13 |

| TD Cowen | maintain | Hold | 2025-11-05 |

| RBC Capital | maintain | Sector Perform | 2025-11-05 |

| Keybanc | downgrade | Sector Weight | 2025-10-22 |

| Evercore ISI Group | maintain | In Line | 2025-08-08 |

| Keybanc | maintain | Overweight | 2025-08-07 |

| UBS | maintain | Neutral | 2025-08-07 |

| JP Morgan | maintain | Neutral | 2025-08-07 |

| RBC Capital | maintain | Sector Perform | 2025-08-07 |

| Mizuho | upgrade | Outperform | 2025-07-25 |

Global Payments exhibits a more stable rating profile, with many Holds and Sector Perform ratings, and fewer upgrades or downgrades.

Which company has the best grades?

Thomson Reuters Corporation has received generally more positive and upwardly revised grades compared to Global Payments Inc., which mostly maintains Hold or Sector Perform ratings. This suggests stronger analyst confidence in Thomson Reuters, potentially impacting investor sentiment favorably.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Thomson Reuters Corporation (TRI) and Global Payments Inc. (GPN) based on the most recent data.

| Criterion | Thomson Reuters Corporation (TRI) | Global Payments Inc. (GPN) |

|---|---|---|

| Diversification | Focused on electronic software and services (~6.7B USD); limited print segment | Multiple segments: Merchant (~7.7B USD) and Issuer (~2.5B USD) solutions |

| Profitability | High net margin (30.45%), ROIC 13.94%, ROE 18.41% (favorable) | Moderate net margin (15.54%), lower ROIC (4.68%) and ROE (7.05%) |

| Innovation | Strong innovation demonstrated by growing ROIC and durable moat | Improving profitability with growing ROIC but still value-destructive overall |

| Global presence | Well-established global brand with extensive electronic services | Global reach in payment processing but lower liquidity ratios |

| Market Share | Strong market position in information services with high asset turnover | Significant market share in payment processing but weaker efficiency metrics |

Key takeaways: Thomson Reuters shows a durable competitive advantage with superior profitability and operational efficiency, making it a more favorable investment. Global Payments has growth potential but currently faces challenges in value creation and liquidity, requiring cautious risk management.

Risk Analysis

Below is a comparative table of key risks for Thomson Reuters Corporation (TRI) and Global Payments Inc. (GPN) based on the most recent 2024 data:

| Metric | Thomson Reuters Corporation (TRI) | Global Payments Inc. (GPN) |

|---|---|---|

| Market Risk | Low beta (0.31) indicates low volatility versus market | Moderate beta (0.80), higher sensitivity to market swings |

| Debt Level | Low debt-to-equity (0.26), strong interest coverage (13.23x) | Moderate debt-to-equity (0.75), moderate interest coverage (3.96x) |

| Regulatory Risk | Moderate, operates in multiple jurisdictions with compliance needs | High, financial services face strict regulation and compliance costs |

| Operational Risk | Moderate, diverse business segments with stable cash flows | Moderate to high, reliance on technology infrastructure and cybersecurity |

| Environmental Risk | Low, service-based company with limited environmental footprint | Low to moderate, limited direct environmental impact but reputational risk possible |

| Geopolitical Risk | Moderate, global operations expose it to geopolitical tensions | Moderate, global payment networks subject to geopolitical disruptions |

In summary, Thomson Reuters presents lower market and financial risk with solid liquidity and low leverage, making operational and regulatory risks more manageable. Global Payments faces higher market sensitivity and regulatory scrutiny, with financial leverage and operational dependence on tech systems as key vulnerabilities. Investors should watch GPN’s distress-level Altman Z-score indicating elevated bankruptcy risk despite a very strong Piotroski score, while TRI remains financially stable in the safe zone.

Which Stock to Choose?

Thomson Reuters Corporation (TRI) shows favorable income evolution with a 21.29% revenue growth over 2020-2024 and strong profitability indicators, including a 30.45% net margin and 18.41% ROE. Its debt levels are low with a debt-to-equity ratio of 0.26, and the company holds a very favorable B+ rating with a durable competitive advantage.

Global Payments Inc. (GPN) displays solid income growth at 36.13% revenue increase over five years and a 15.54% net margin, though profitability ratios such as ROE (7.05%) and ROIC (4.68%) are less favorable. It carries higher debt with a net debt-to-EBITDA of 3.27 and has an A- rating, reflecting moderate financial stability but with some risk factors.

Investors focused on quality and stable profitability may find Thomson Reuters’ favorable ratings and strong moat appealing, while those with a higher risk tolerance pursuing growth might see Global Payments’ improving income and rating as a potential opportunity, despite its elevated leverage and mixed profitability metrics.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Thomson Reuters Corporation and Global Payments Inc. to enhance your investment decisions: