MercadoLibre, Inc. (MELI) and Genuine Parts Company (GPC) are two established players in the specialty retail sector, yet they operate in distinct niches with overlapping market dynamics. MercadoLibre leads in Latin American e-commerce and fintech innovation, while Genuine Parts specializes in automotive and industrial replacement parts across multiple continents. This comparison explores their growth strategies and market resilience to help you identify the most promising investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between MercadoLibre and Genuine Parts Company by providing an overview of these two companies and their main differences.

MercadoLibre Overview

MercadoLibre, Inc. operates online commerce platforms in Latin America, focusing on e-commerce and financial technology solutions. It offers an automated marketplace, payment services via Mercado Pago, credit and investment products, logistics, classified listings, advertising, and digital storefronts. Founded in 1999 and headquartered in Montevideo, Uruguay, it is a leading specialty retail company with a market cap of $110B and employs over 84K people.

Genuine Parts Company Overview

Genuine Parts Company distributes automotive and industrial replacement parts primarily in the United States and other global markets. It serves repair shops, dealerships, fleet operators, and industrial customers through its Automotive Parts and Industrial Parts segments. Incorporated in 1928 and based in Atlanta, Georgia, it is a specialty retail company with a market cap of $17.9B and approximately 63K employees, offering value-added services such as equipment repairs and manufacturing.

Key similarities and differences

Both MercadoLibre and Genuine Parts Company operate in the specialty retail sector but focus on distinct markets and business models. MercadoLibre is a digital platform-based company centered on e-commerce and fintech in Latin America, while Genuine Parts Company is a traditional distributor of physical automotive and industrial parts with a broad international footprint. MercadoLibre emphasizes technology-driven services, whereas Genuine Parts relies on distribution networks and after-sales services.

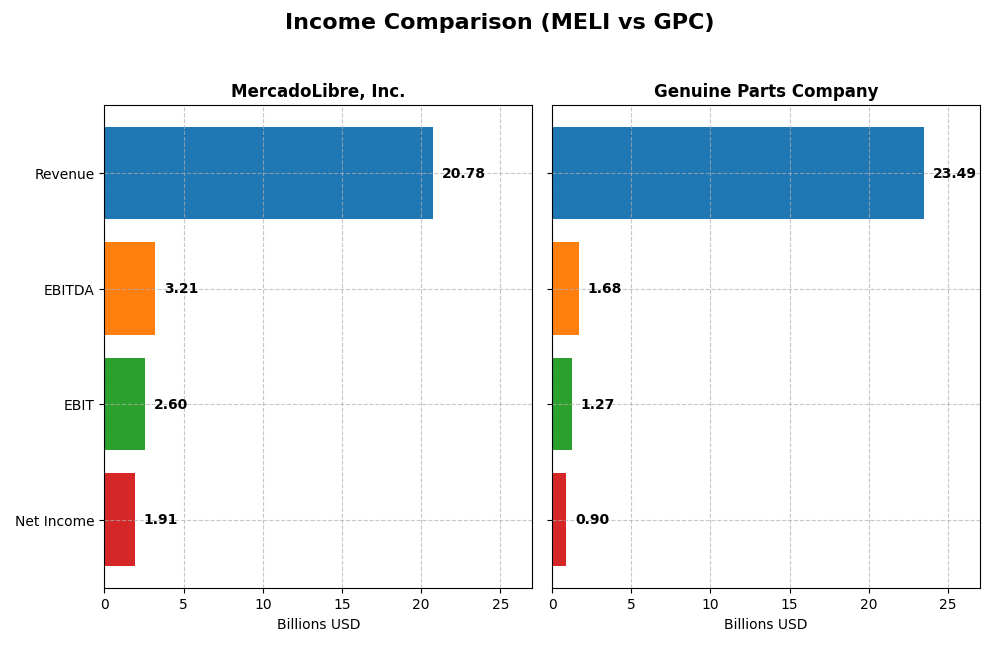

Income Statement Comparison

The table below compares key income statement metrics for MercadoLibre, Inc. and Genuine Parts Company for the fiscal year 2024.

| Metric | MercadoLibre, Inc. (MELI) | Genuine Parts Company (GPC) |

|---|---|---|

| Market Cap | 110.4B | 17.9B |

| Revenue | 20.8B | 23.5B |

| EBITDA | 3.2B | 1.7B |

| EBIT | 2.6B | 1.3B |

| Net Income | 1.9B | 904M |

| EPS | 37.69 | 6.49 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

MercadoLibre, Inc.

From 2020 to 2024, MercadoLibre exhibited strong growth in revenue, surging from $3.97B to $20.78B, with net income rising from a slight loss to $1.91B. Margins improved significantly, with a gross margin of 46.09% and net margin of 9.2% in 2024. The latest year showed robust expansion with revenue growth of 37.5% and net margin growth of 40.8%.

Genuine Parts Company

Genuine Parts saw moderate revenue growth from $16.54B in 2020 to $23.49B in 2024, and net income improved substantially from a loss to $904M. Margins remained relatively stable, with a gross margin of 36.29% and net margin of 3.85% in 2024, although EBIT margin was only 5.42%. The latest year reflected slowing growth, with revenue up 1.7% and net margin down 32.5%.

Which one has the stronger fundamentals?

MercadoLibre displays stronger fundamentals through higher and expanding margins, rapid revenue and net income growth, and favorable profitability metrics. Genuine Parts, while showing positive long-term income growth, struggles with margin compression and weaker recent yearly growth. Overall, MercadoLibre’s financials suggest a more dynamic performance across the period analyzed.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for MercadoLibre, Inc. (MELI) and Genuine Parts Company (GPC) based on the most recent fiscal year data available (2024).

| Ratios | MercadoLibre, Inc. (MELI) | Genuine Parts Company (GPC) |

|---|---|---|

| ROE | 43.9% | 20.8% |

| ROIC | 17.7% | 9.8% |

| P/E | 45.1 | 18.0 |

| P/B | 19.8 | 3.75 |

| Current Ratio | 1.21 | 1.16 |

| Quick Ratio | 1.20 | 0.51 |

| D/E (Debt-to-Equity) | 1.57 | 1.32 |

| Debt-to-Assets | 27.2% | 29.8% |

| Interest Coverage | 17.2 | 14.9 |

| Asset Turnover | 0.82 | 1.22 |

| Fixed Asset Turnover | 8.38 | 6.31 |

| Payout ratio | 0% | 61.4% |

| Dividend yield | 0% | 3.41% |

Interpretation of the Ratios

MercadoLibre, Inc.

MercadoLibre presents a mixed ratio profile with strong profitability indicators like a high ROE of 43.92% and ROIC of 17.73%, though its valuation multiples (PE at 45.11 and PB at 19.81) are unfavorable, suggesting a premium price. Liquidity and leverage metrics are mostly neutral to favorable, but the company carries a debt-to-equity ratio of 1.57, which is considered high. MercadoLibre does not pay dividends, likely reflecting its reinvestment strategy and focus on growth.

Genuine Parts Company

Genuine Parts shows a solid balance of ratios with a favorable ROE of 20.84% and a good asset turnover ratio of 1.22. However, its net margin is relatively weak at 3.85%, and the quick ratio is low at 0.51, indicating potential short-term liquidity concerns. The company pays a dividend yielding 3.41%, supported by a manageable payout relative to cash flow, suggesting a shareholder-friendly approach with steady returns.

Which one has the best ratios?

Both companies have slightly favorable overall ratio evaluations, but Genuine Parts scores better on liquidity and dividend yield, while MercadoLibre excels in profitability ratios like ROE and ROIC. MercadoLibre’s higher valuation multiples and leverage contrast with Genuine Parts’ more balanced financial structure. The choice depends on the investor’s focus between growth and income stability.

Strategic Positioning

This section compares the strategic positioning of MercadoLibre and Genuine Parts Company, including their market position, key segments, and exposure to disruption:

MercadoLibre, Inc. (MELI)

- Leading online commerce platform in Latin America facing high competitive pressure in e-commerce retail.

- Key segments include online marketplace commerce and fintech services driving growth and customer engagement.

- Faces technological disruption through fintech innovation and e-commerce logistics platforms.

Genuine Parts Company (GPC)

- Established distributor in automotive and industrial parts with moderate competitive pressure in aftermarket sectors.

- Key segments are automotive and industrial parts distribution, supported by value-added repair and logistics services.

- Exposed to disruption in automotive parts due to electric and hybrid vehicle trends, but industrial parts less impacted.

MELI vs GPC Positioning

MELI adopts a diversified digital commerce and fintech model focused on Latin America, benefiting from scalable online platforms. GPC concentrates on physical parts distribution with broad geographic reach, relying on industrial and automotive aftermarket demand. MELI’s growth is driven by technology, while GPC’s is tied to traditional supply chains.

Which has the best competitive advantage?

Both companies show a durable competitive advantage with growing ROIC above WACC. MELI’s higher ROIC spread and accelerating growth suggest a stronger economic moat compared to GPC’s stable but lower excess returns.

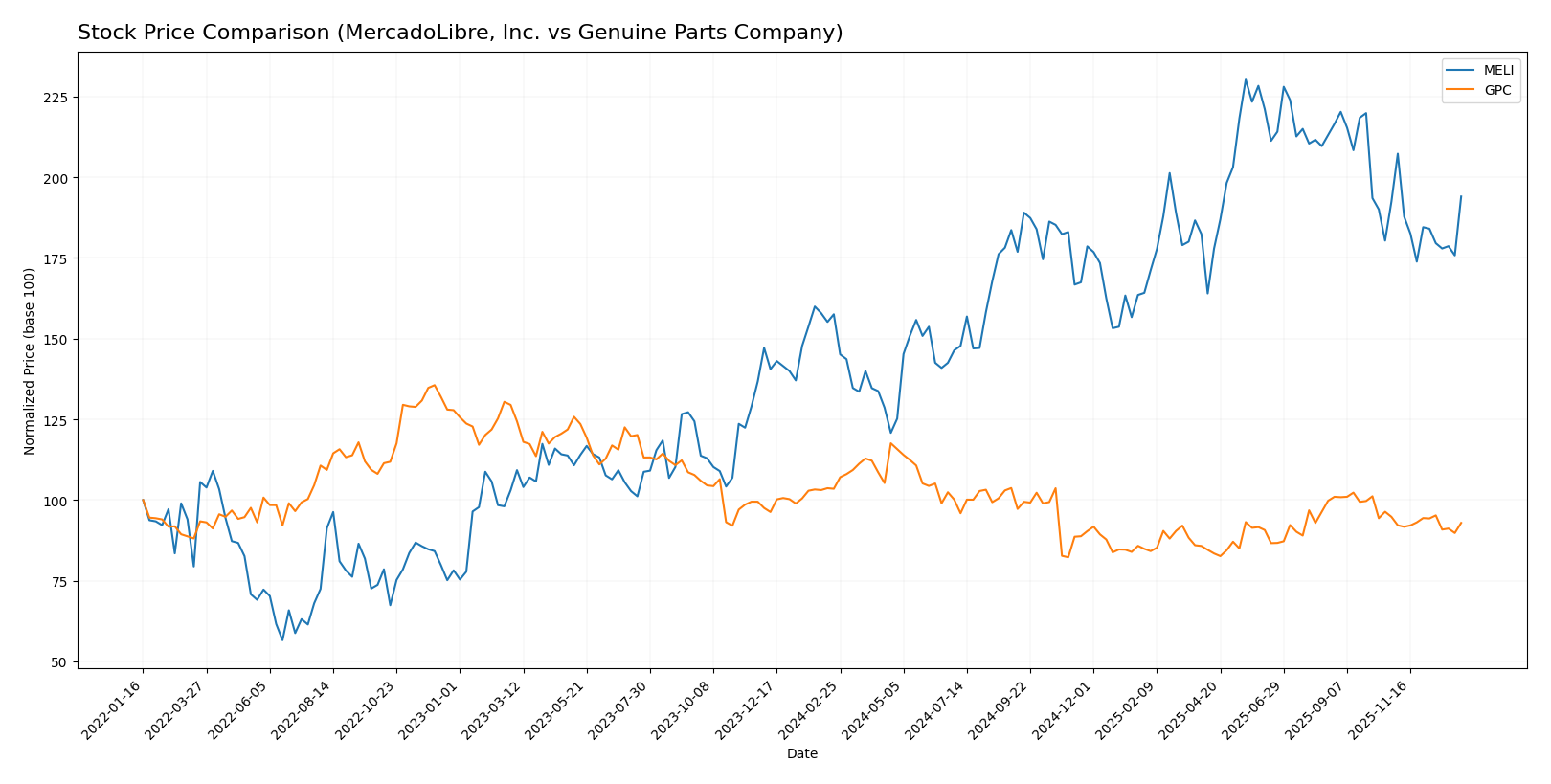

Stock Comparison

Over the past 12 months, MercadoLibre, Inc. (MELI) exhibited a strong bullish trend with a 23.16% price increase despite decelerating momentum, while Genuine Parts Company (GPC) faced a bearish trend with a 10.21% decline and accelerating downward pressure.

Trend Analysis

MercadoLibre, Inc. showed a 23.16% price rise over the past year, confirming a bullish trend with decelerating acceleration and significant volatility, hitting a high of 2584.92 and a low of 1356.43.

Genuine Parts Company experienced a 10.21% price drop over the same period, reflecting a bearish trend with accelerating decline and low volatility, reaching a high of 162.39 and a low of 113.61.

Comparatively, MercadoLibre outperformed Genuine Parts, delivering the highest market performance with a notable bullish trend versus GPC’s bearish trajectory.

Target Prices

Analysts present a positive consensus for MercadoLibre, Inc. and Genuine Parts Company with target prices above current market values.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MercadoLibre, Inc. | 2900 | 2700 | 2830 |

| Genuine Parts Company | 150 | 140 | 145.33 |

The target consensus for MercadoLibre at 2830 suggests upside potential from its current price of 2178.41 USD. Genuine Parts Company’s consensus target of 145.33 also indicates expected growth above its current 128.34 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MercadoLibre and Genuine Parts Company:

Rating Comparison

MercadoLibre Rating

- Rating: B-, considered very favorable overall.

- Discounted Cash Flow Score: Moderate at 3 out of 5.

- ROE Score: Very favorable with a high score of 5.

- ROA Score: Favorable with a score of 4.

- Debt To Equity Score: Very unfavorable at 1, indicating risk.

- Overall Score: Moderate at 3 out of 5.

Genuine Parts Company Rating

- Rating: B, also considered very favorable overall.

- Discounted Cash Flow Score: Favorable at 4 out of 5.

- ROE Score: Favorable at 4 out of 5.

- ROA Score: Moderate at 3 out of 5.

- Debt To Equity Score: Very unfavorable at 1 also.

- Overall Score: Moderate at 3 out of 5.

Which one is the best rated?

Genuine Parts Company holds a slightly better rating with a B compared to MercadoLibre’s B-. GPC scores higher in discounted cash flow and maintains favorable ROE and ROA, while both share similar overall and debt-to-equity scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for MercadoLibre and Genuine Parts Company:

MELI Scores

- Altman Z-Score: 3.46, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

GPC Scores

- Altman Z-Score: 2.44, indicating a grey zone with moderate bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

Which company has the best scores?

Based on the provided data, MELI shows a stronger Altman Z-Score in the safe zone, while GPC is in the grey zone. However, GPC has a higher Piotroski Score, suggesting somewhat better financial strength.

Grades Comparison

Here is a comparison of the recent grades assigned to MercadoLibre, Inc. and Genuine Parts Company by reputable grading firms:

MercadoLibre, Inc. Grades

The following table summarizes MercadoLibre’s most recent analyst grades from established institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | Maintain | Outperform | 2025-12-19 |

| BTIG | Maintain | Buy | 2025-12-04 |

| UBS | Maintain | Buy | 2025-11-24 |

| BTIG | Maintain | Buy | 2025-11-14 |

| JP Morgan | Maintain | Neutral | 2025-11-03 |

| Morgan Stanley | Maintain | Overweight | 2025-11-03 |

| Barclays | Maintain | Overweight | 2025-10-30 |

| Benchmark | Maintain | Buy | 2025-10-30 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-21 |

MercadoLibre’s grades predominantly range from Buy to Outperform, with no downgrades, reflecting a generally positive analyst sentiment.

Genuine Parts Company Grades

Below is a table detailing Genuine Parts Company’s recent analyst grades from verified sources:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Upgrade | Neutral | 2025-11-13 |

| JP Morgan | Maintain | Overweight | 2025-10-23 |

| Truist Securities | Maintain | Buy | 2025-10-22 |

| UBS | Maintain | Neutral | 2025-10-10 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-01 |

| Evercore ISI Group | Maintain | Outperform | 2025-08-26 |

| Loop Capital | Maintain | Buy | 2025-07-24 |

| JP Morgan | Maintain | Overweight | 2025-07-23 |

| Truist Securities | Maintain | Buy | 2025-07-23 |

| UBS | Maintain | Neutral | 2025-07-23 |

Genuine Parts Company’s grades vary more broadly from Neutral to Outperform, with a recent upgrade from Sell to Neutral, indicating mixed but stable analyst views.

Which company has the best grades?

MercadoLibre has consistently received stronger grades, mostly Buy and Outperform, while Genuine Parts Company shows a more mixed consensus, including several Neutral ratings. This suggests MercadoLibre is viewed more favorably by analysts, which may influence investor confidence and risk perception accordingly.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for MercadoLibre, Inc. (MELI) and Genuine Parts Company (GPC) based on the latest financial and operational data.

| Criterion | MercadoLibre, Inc. (MELI) | Genuine Parts Company (GPC) |

|---|---|---|

| Diversification | Strong diversification with significant revenue from both products ($2.14B) and services ($18.64B) mainly in commerce and fintech. | Focused on automotive ($14.77B) and industrial parts ($8.72B), less diversified but solid market segments. |

| Profitability | High ROIC at 17.7% and ROE at 43.9%, showing efficient capital use and strong profitability. Net margin neutral at 9.2%. | Moderate ROIC at 9.8%, ROE at 20.8%, net margin lower at 3.85%, indicating stable but less robust profitability. |

| Innovation | Considerable growth in ROIC over recent years, reflecting ongoing innovation and competitive edge. | Positive ROIC trend but at a slower pace; innovation appears more incremental in a mature industry. |

| Global presence | Large presence in Latin America with growing fintech and commerce platforms, expanding service offerings. | Primarily North American focus with well-established distribution networks, limited global expansion. |

| Market Share | Rapidly growing market share in e-commerce and fintech sectors, benefiting from digital transformation. | Strong market share in automotive parts distribution, with stable industrial segment presence. |

In summary, MELI excels in diversification, innovation, and profitability driven by digital commerce and fintech growth, while GPC shows steady performance with a focused portfolio in automotive and industrial parts, delivering stable returns in a mature market. Investors should weigh MELI’s growth potential against GPC’s stability and dividend yield.

Risk Analysis

Below is a comparative overview of key risks for MercadoLibre, Inc. (MELI) and Genuine Parts Company (GPC) based on the most recent 2024 data.

| Metric | MercadoLibre, Inc. (MELI) | Genuine Parts Company (GPC) |

|---|---|---|

| Market Risk | High beta (1.42) indicates elevated volatility in Latin American markets. | Moderate beta (0.75) suggests lower volatility exposure. |

| Debt level | Debt-to-equity ratio unfavorable at 1.57; significant leverage risk. | Debt-to-equity ratio also unfavorable at 1.32; moderate leverage concerns. |

| Regulatory Risk | Operating in multiple Latin American countries with evolving e-commerce and fintech regulations. | Exposure to automotive and industrial parts regulations in several countries including US and Europe. |

| Operational Risk | Complex logistics model with reliance on third-party carriers increases operational complexity. | Diverse supply chain across automotive and industrial sectors; risks from supply disruptions. |

| Environmental Risk | Moderate; logistics and warehousing impact environmental footprint. | Moderate; industrial parts distribution and services have environmental compliance requirements. |

| Geopolitical Risk | High; Latin America’s political and economic instability can affect operations. | Moderate; US-based with international presence, subject to trade policies and geopolitical tensions. |

Synthesis: The most impactful risks for MELI are market volatility and geopolitical instability in Latin America, combined with high leverage. For GPC, debt levels and supply chain disruptions represent notable risks, though it benefits from more stable markets. Investors should weigh MELI’s growth prospects against regional risks and GPC’s steadier but moderate operational challenges.

Which Stock to Choose?

MercadoLibre, Inc. (MELI) has demonstrated strong income growth with a 37.53% revenue increase in 2024 and a favorable net margin of 9.2%. Its profitability ratios, including a 43.92% ROE and 17.73% ROIC, are favorable, supported by moderate debt levels and a very favorable overall rating.

Genuine Parts Company (GPC) shows modest income growth of 1.71% in 2024 and a lower net margin of 3.85%, with a favorable ROE of 20.84% but neutral ROIC. GPC carries higher debt relative to EBITDA, yet its rating remains very favorable, with a solid dividend yield and balanced financial ratios.

For investors prioritizing growth and strong profitability, MELI might appear more attractive due to its robust income evolution and very favorable moat. Conversely, those seeking stability and dividend income could view GPC’s consistent performance and slightly favorable ratios as preferable. The choice may depend on individual risk tolerance and investment focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MercadoLibre, Inc. and Genuine Parts Company to enhance your investment decisions: