Generac Holdings Inc. and Nano Nuclear Energy Inc. both operate within the industrial machinery sector but focus on vastly different energy solutions. Generac specializes in power generation and energy storage systems with a broad market presence, while Nano Nuclear Energy pioneers innovative microreactor technology. Comparing these companies highlights contrasting approaches to energy innovation and market potential. Join me as we evaluate which presents a more compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Generac Holdings Inc. and Nano Nuclear Energy Inc by providing an overview of these two companies and their main differences.

Generac Holdings Inc. Overview

Generac Holdings Inc. designs, manufactures, and sells power generation equipment and energy storage systems for residential, commercial, and industrial markets worldwide. Founded in 1959 and headquartered in Waukesha, Wisconsin, the company offers a diverse product range including standby generators, portable generators, outdoor power equipment, and clean energy solutions under PWRcell and PWRview brands. Generac distributes through dealers, retailers, and e-commerce channels with a market cap of approximately 8.97B USD.

Nano Nuclear Energy Inc Overview

Nano Nuclear Energy Inc. is a microreactor technology company focused on developing solid-core and low-pressure coolant reactors, as well as a uranium fabrication facility to supply nuclear fuel. Founded in 2021 and based in New York City, NNE is a smaller player with only five employees and a market cap near 1.33B USD. The company also offers fuel transportation and nuclear consultation services and trades on NASDAQ Global Select.

Key similarities and differences

Both Generac and Nano Nuclear Energy operate in the industrial machinery sector within the US and offer energy-related technologies. However, Generac focuses broadly on power generation and energy storage products for various end users, while Nano Nuclear specializes in advanced nuclear microreactors and fuel fabrication. Generac’s business is well-established with a large workforce and extensive distribution, contrasting with Nano Nuclear’s early-stage development model and niche technological focus.

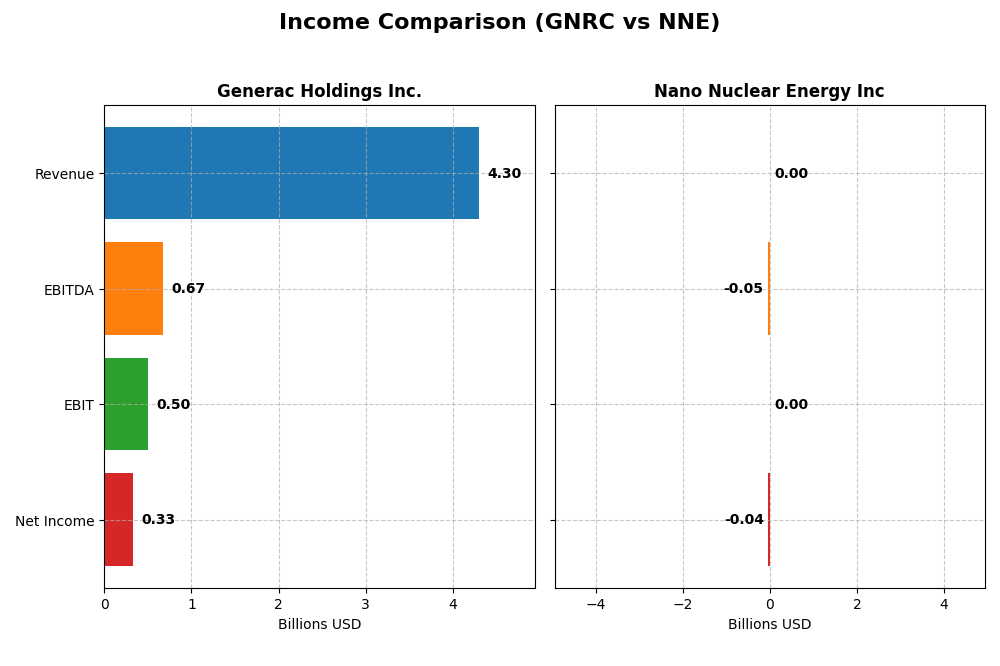

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Generac Holdings Inc. and Nano Nuclear Energy Inc. based on their most recent fiscal year data.

| Metric | Generac Holdings Inc. (GNRC) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| Market Cap | 8.97B | 1.33B |

| Revenue | 4.30B | 0 |

| EBITDA | 671M | -46.2M |

| EBIT | 499M | 0 |

| Net Income | 325M | -40.1M |

| EPS | 5.46 | -1.06 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Generac Holdings Inc.

Generac’s revenue showed a favorable overall growth of 72.9% from 2020 to 2024, reaching $4.3B in 2024. Net income, however, declined by 6.9% over the same period, with $325M reported in 2024. Margins remained generally strong, with a gross margin of 38.8% and net margin of 7.6%. The latest year saw improved profitability, with a 50% net margin increase and 6.8% revenue growth.

Nano Nuclear Energy Inc

Nano Nuclear Energy reported no revenue from 2022 through 2025, maintaining a gross margin of 0%. Net losses widened significantly, with net income at -$40M in 2025 and a negative net margin. While earnings per share showed some improvement in growth rate terms, overall the company’s income statement remains unfavorable due to the absence of revenue and persistent losses. Expenses remain high relative to revenue.

Which one has the stronger fundamentals?

Generac demonstrates stronger fundamentals, supported by consistent revenue growth and improving profitability margins in recent years. In contrast, Nano Nuclear Energy’s lack of revenue and ongoing net losses signal weaker fundamentals. Generac’s favorable margin trends and positive earnings growth contrast with Nano Nuclear’s unfavorable income statement metrics, indicating a more stable financial position for Generac.

Financial Ratios Comparison

The following table compares the most recent key financial ratios of Generac Holdings Inc. (GNRC) and Nano Nuclear Energy Inc (NNE) for the latest available fiscal years.

| Ratios | Generac Holdings Inc. (2024) | Nano Nuclear Energy Inc (2025) |

|---|---|---|

| ROE | 13.04% | -18.00% |

| ROIC | 9.89% | -20.51% |

| P/E | 28.39 | -0.04 |

| P/B | 3.70 | 0.007 |

| Current Ratio | 1.97 | 53.48 |

| Quick Ratio | 0.97 | 53.48 |

| D/E (Debt-to-Equity) | 0.59 | 0.01 |

| Debt-to-Assets | 28.88% | 1.22% |

| Interest Coverage | 5.98 | 0 |

| Asset Turnover | 0.84 | 0 |

| Fixed Asset Turnover | 5.01 | 0 |

| Payout Ratio | 0.08% | 0 |

| Dividend Yield | 0.003% | 0 |

Interpretation of the Ratios

Generac Holdings Inc.

Generac’s ratios present a mixed picture with a neutral global evaluation. The company shows favorable liquidity with a current ratio near 2 and sound debt management indicated by a debt-to-assets ratio under 30%. Profitability metrics such as ROE and ROIC are neutral, though valuation ratios like PE and PB appear unfavorable. Generac does not pay dividends, reflecting its reinvestment strategy in a capital-intensive sector.

Nano Nuclear Energy Inc.

Nano Nuclear Energy’s ratios mostly appear unfavorable, signaling financial challenges. Profitability is negative across key measures including ROE and ROIC, while liquidity ratios are distorted by an unusually high current ratio. Valuation multiples are favorable due to low price levels, but operational efficiency ratios are near zero. The company does not pay dividends, consistent with its development stage and focus on R&D.

Which one has the best ratios?

Considering the evaluations, Generac holds a more balanced and neutral ratio profile with strengths in liquidity and manageable leverage. In contrast, Nano Nuclear Energy’s ratios are predominantly unfavorable, reflecting early-stage operational losses and financial instability. Thus, Generac’s ratios are comparatively stronger based on available financial metrics.

Strategic Positioning

This section compares the strategic positioning of Generac Holdings Inc. and Nano Nuclear Energy Inc., including market position, key segments, and exposure to technological disruption:

Generac Holdings Inc.

- Established leader in power generation equipment facing typical industrial competition.

- Diverse product range including residential, commercial, industrial power systems and clean energy solutions.

- Moderate exposure through innovation in remote monitoring and clean energy storage products.

Nano Nuclear Energy Inc

- Emerging player in microreactor technology with niche market focus.

- Developing solid-core and low-pressure coolant reactors and uranium fuel fabrication.

- High exposure due to pioneering nuclear microreactor technology and fuel supply development.

Generac Holdings Inc. vs Nano Nuclear Energy Inc. Positioning

Generac presents a diversified approach with a broad product portfolio serving various power generation markets, while Nano Nuclear Energy focuses on a concentrated, innovative niche in nuclear microreactors and fuel technology, each with distinct market and technological challenges.

Which has the best competitive advantage?

Both companies are currently shedding value; however, Nano Nuclear Energy shows improving profitability trends, suggesting a slightly more favorable moat outlook despite ongoing value destruction compared to Generac’s declining returns.

Stock Comparison

The stock price performance of Generac Holdings Inc. (GNRC) and Nano Nuclear Energy Inc. (NNE) over the past 12 months reveals significant bullish trends, with both experiencing deceleration and recent downward pressure in their price movements.

Trend Analysis

Generac Holdings Inc. (GNRC) showed a bullish trend over the past 12 months with a 30.27% price increase, though the trend is decelerating; the recent period saw a 20.41% decline, indicating short-term bearish pressure. Nano Nuclear Energy Inc. (NNE) delivered a strong bullish trend with a 609.76% gain over the past year, also decelerating; however, it faced a sharper recent drop of 27.81%, signaling short-term weakness. Comparing both, NNE outperformed GNRC substantially in overall market performance, despite both showing recent price declines and deceleration in their bullish trends.

Target Prices

Analysts present a clear target consensus for Generac Holdings Inc. and Nano Nuclear Energy Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Generac Holdings Inc. | 248 | 184 | 210 |

| Nano Nuclear Energy Inc | 50 | 50 | 50 |

For Generac Holdings Inc., the consensus target price of 210 suggests a potential upside from the current 152.78 USD, indicating positive analyst sentiment. Nano Nuclear Energy Inc.’s target consensus at 50 is significantly higher than its current price of 32.01 USD, reflecting bullish expectations despite notable volatility.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Generac Holdings Inc. and Nano Nuclear Energy Inc.:

Rating Comparison

Generac Holdings Inc. Rating

- Rating: B, considered very favorable overall.

- Discounted Cash Flow Score: 3, moderate valuation signal.

- Return on Equity Score: 4, favorable profit efficiency.

- Return on Assets Score: 4, favorable asset utilization.

- Debt To Equity Score: 2, moderate financial risk.

- Overall Score: 3, moderate financial standing.

Nano Nuclear Energy Inc Rating

- Rating: C, also considered very favorable overall.

- Discounted Cash Flow Score: 2, moderate valuation signal.

- Return on Equity Score: 1, very unfavorable profit efficiency.

- Return on Assets Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 5, very favorable low financial risk.

- Overall Score: 2, moderate financial standing.

Which one is the best rated?

Generac Holdings Inc. holds a higher rating (B vs. C) with stronger profitability and asset use scores, while Nano Nuclear Energy Inc. shows better debt management but weaker operational efficiency. Overall, Generac has the more favorable rating based on these metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Generac Holdings Inc. and Nano Nuclear Energy Inc.:

GNRC Scores

- Altman Z-Score: 3.73, indicating a safe zone.

- Piotroski Score: 7, rated as strong financial health.

NNE Scores

- Altman Z-Score: 143.56, indicating a safe zone.

- Piotroski Score: 2, rated as very weak financial health.

Which company has the best scores?

Both companies are in the safe zone by Altman Z-Score, but GNRC has a significantly stronger Piotroski Score at 7 compared to NNE’s very weak score of 2, showing better overall financial health according to these metrics.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Generac Holdings Inc. and Nano Nuclear Energy Inc.:

Generac Holdings Inc. Grades

The table below summarizes recent analyst grades from reputable firms for Generac Holdings Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | Upgrade | Outperform | 2026-01-09 |

| Citigroup | Upgrade | Buy | 2026-01-08 |

| B of A Securities | Maintain | Buy | 2026-01-07 |

| Wells Fargo | Upgrade | Overweight | 2025-12-19 |

| JP Morgan | Upgrade | Overweight | 2025-12-08 |

| Citigroup | Maintain | Neutral | 2025-11-03 |

| Barclays | Maintain | Equal Weight | 2025-10-31 |

| UBS | Maintain | Buy | 2025-10-30 |

| Canaccord Genuity | Maintain | Buy | 2025-10-30 |

| Citigroup | Maintain | Neutral | 2025-10-21 |

Generac shows a strong positive trend with multiple upgrades and predominantly Buy or better ratings from major financial institutions.

Nano Nuclear Energy Inc. Grades

The table below summarizes recent analyst grades from reputable firms for Nano Nuclear Energy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-08-19 |

| Ladenburg Thalmann | Downgrade | Sell | 2025-08-18 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-15 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-01-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-27 |

| Benchmark | Maintain | Buy | 2024-11-07 |

| Benchmark | Maintain | Buy | 2024-07-15 |

| Benchmark | Maintain | Buy | 2024-06-25 |

Nano Nuclear Energy generally maintains Buy ratings, but the downgrade to Sell by Ladenburg Thalmann stands out as a notable caution.

Which company has the best grades?

Generac Holdings Inc. holds a stronger consensus with multiple upgrades and predominantly Buy or better grades, reflecting greater analyst confidence. Nano Nuclear Energy Inc. has mostly Buy ratings but includes a significant recent Sell downgrade, implying a more mixed outlook. This difference could influence investor sentiment and risk assessment.

Strengths and Weaknesses

Below is a comparative table outlining the key strengths and weaknesses of Generac Holdings Inc. (GNRC) and Nano Nuclear Energy Inc. (NNE) based on the latest financial and operational data.

| Criterion | Generac Holdings Inc. (GNRC) | Nano Nuclear Energy Inc. (NNE) |

|---|---|---|

| Diversification | Moderate; focused on power generation solutions | Limited; emerging nuclear energy technology focus |

| Profitability | Neutral net margin at 7.57%, ROIC at 9.89% | Unfavorable; negative net margin and ROIC |

| Innovation | Established in traditional energy solutions | Growing innovation potential with rising ROIC trend |

| Global presence | Established global footprint | Limited global presence, early-stage expansion |

| Market Share | Solid in power generation equipment | Small, niche market in nuclear energy |

Key takeaways: Generac offers stability with moderate profitability and established market presence but shows signs of value erosion. Nano Nuclear Energy, while currently unprofitable, demonstrates a promising upward trend in profitability and innovation, reflecting potential for future growth despite current risks.

Risk Analysis

Below is a comparative risk assessment for Generac Holdings Inc. (GNRC) and Nano Nuclear Energy Inc. (NNE) based on the most recent data available.

| Metric | Generac Holdings Inc. (GNRC) | Nano Nuclear Energy Inc. (NNE) |

|---|---|---|

| Market Risk | Moderate (Beta 1.83) | Very High (Beta 7.49) |

| Debt Level | Moderate (Debt/Equity 0.59) | Very Low (Debt/Equity 0.01) |

| Regulatory Risk | Moderate (Industrial sector) | High (Nuclear energy regulation) |

| Operational Risk | Moderate (Established ops) | High (Emerging technology) |

| Environmental Risk | Moderate (Energy products) | High (Nuclear safety concerns) |

| Geopolitical Risk | Moderate (US-based) | High (Nuclear geopolitics) |

The most impactful risks are the high market volatility and nuclear regulatory risks facing NNE, amplified by its emerging technology and weak profitability metrics in 2025. GNRC presents more balanced risks but faces unfavorable valuation ratios and moderate operational challenges in a competitive industrial machinery market. Investors should weigh NNE’s high growth potential against its regulatory and operational uncertainties, while GNRC offers more stability but limited upside due to valuation pressures.

Which Stock to Choose?

Generac Holdings Inc. (GNRC) exhibits a generally favorable income evolution with a 6.79% revenue growth in 2024 and solid profitability metrics, including a 7.57% net margin and 13.04% ROE. Its debt levels are moderate, supported by a 1.97 current ratio and favorable debt-to-assets at 28.88%. The company’s rating is very favorable (grade B), though its economic moat is very unfavorable due to declining ROIC below WACC.

Nano Nuclear Energy Inc. (NNE) shows unfavorable income statement metrics with zero gross and net margins and negative returns on equity (-18%) and invested capital (-20.5%). Its debt is minimal, with very low debt-to-assets (1.22%) and an exceptionally high current ratio (53.48). The rating is very favorable (grade C) despite an unfavorable global financial ratios evaluation and a slightly unfavorable economic moat with improving profitability.

For investors focused on stable profitability and moderate growth, GNRC may appear more favorable given its solid income statement and financial ratios despite a weak economic moat. Conversely, investors with a higher risk tolerance and growth orientation might view NNE’s improving profitability and low debt profile as a potential opportunity, despite its current unfavorable income and financial ratios. The ultimate choice could depend on the investor’s risk appetite and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Generac Holdings Inc. and Nano Nuclear Energy Inc to enhance your investment decisions: