Investors seeking exposure to the industrial machinery sector often consider Illinois Tool Works Inc. (ITW) and Generac Holdings Inc. (GNRC), two prominent players with distinct market focuses. ITW excels in diversified industrial products and equipment, while Generac specializes in power generation and energy solutions. Both companies emphasize innovation but serve overlapping industrial markets. This article will help you identify which of these industry leaders presents the most compelling investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Illinois Tool Works Inc. and Generac Holdings Inc. by providing an overview of these two companies and their main differences.

Illinois Tool Works Inc. Overview

Illinois Tool Works Inc. is a diversified industrial manufacturer operating globally since 1912. It serves various markets including automotive OEM, food equipment, electronics, welding, polymers, construction, and specialty products. With a market cap of 74.7B USD, ITW focuses on delivering industrial products and equipment through direct sales and independent distributors, reflecting a broad product portfolio and well-established market presence.

Generac Holdings Inc. Overview

Generac Holdings Inc. designs and manufactures power generation and energy storage equipment, targeting residential, light commercial, and industrial markets worldwide. Founded in 1959, GNRC offers generators, outdoor power equipment, and clean energy solutions, supported by a network of dealers and retailers. With a market cap of 8.97B USD, it emphasizes power reliability and energy innovation, serving a more specialized niche within industrial machinery.

Key similarities and differences

Both companies operate in the industrial machinery sector and distribute products through dealers and direct channels. ITW has a broader product range across multiple industries, while Generac specializes in power generation and energy solutions. ITW’s business model is more diversified with seven segments, whereas Generac focuses on power-related equipment and aftermarket services, reflecting contrasting scopes and market strategies.

Income Statement Comparison

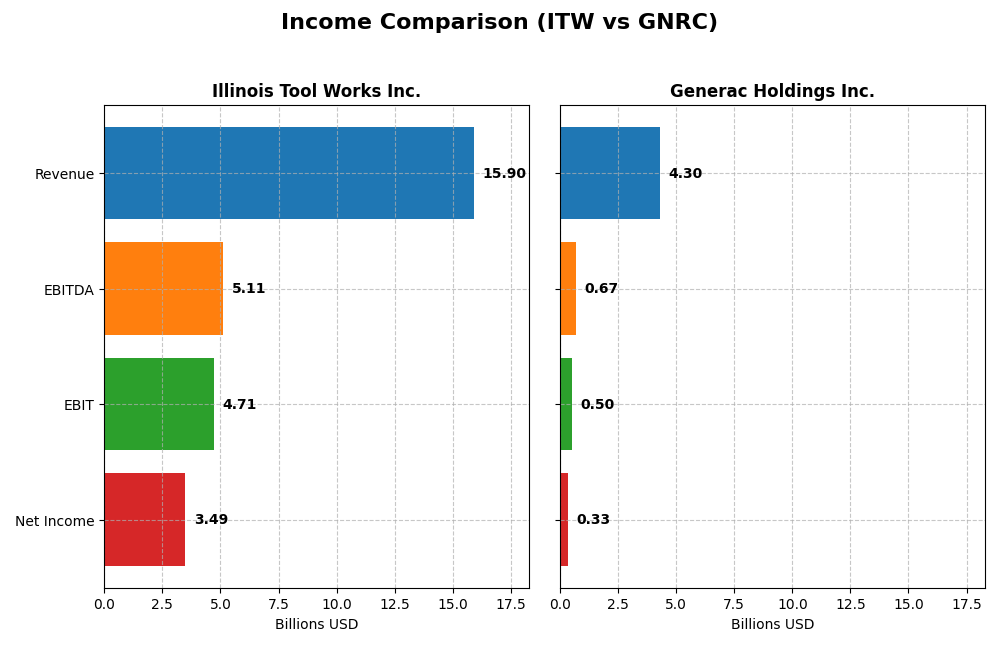

The table below compares key income statement metrics for Illinois Tool Works Inc. (ITW) and Generac Holdings Inc. (GNRC) for the fiscal year 2024.

| Metric | Illinois Tool Works Inc. (ITW) | Generac Holdings Inc. (GNRC) |

|---|---|---|

| Market Cap | 74.7B | 8.97B |

| Revenue | 15.9B | 4.30B |

| EBITDA | 5.11B | 671M |

| EBIT | 4.71B | 499M |

| Net Income | 3.49B | 325M |

| EPS | 11.75 | 5.46 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Illinois Tool Works Inc.

Illinois Tool Works (ITW) shows steady revenue growth of 26.44% over 2020-2024, with net income rising 65.39% in the same period. Margins are strong and improving, highlighted by a 21.94% net margin and 29.59% EBIT margin in 2024. The recent year saw a slight revenue decline (-1.3%) but favorable net margin and EPS growth, indicating operational efficiency.

Generac Holdings Inc.

Generac Holdings (GNRC) experienced robust revenue growth of 72.86% from 2020 to 2024 but a net income decline of 6.89%, reflecting margin pressures. Its 2024 gross margin was favorable at 38.77%, with a modest net margin of 7.57%. The latest year showed revenue growth of 6.79% alongside significant EPS and net margin improvements, despite operating expenses rising faster than revenue.

Which one has the stronger fundamentals?

Illinois Tool Works presents stronger fundamentals with consistent revenue and net income growth, superior margins, and a favorable overall income statement evaluation of 78.57% positive indicators. Generac, while showing solid revenue gains and recent margin improvements, faces challenges with negative net income growth and margin erosion over the full period, reflected in a lower favorable score of 64.29%.

Financial Ratios Comparison

The table below presents a comparison of key financial ratios for Illinois Tool Works Inc. (ITW) and Generac Holdings Inc. (GNRC) based on their most recent fiscal year data ending 2024.

| Ratios | Illinois Tool Works Inc. (ITW) | Generac Holdings Inc. (GNRC) |

|---|---|---|

| ROE | 105.2% | 13.0% |

| ROIC | 27.2% | 9.9% |

| P/E | 21.6 | 28.4 |

| P/B | 22.7 | 3.7 |

| Current Ratio | 1.36 | 1.97 |

| Quick Ratio | 0.99 | 0.97 |

| D/E (Debt to Equity) | 2.44 | 0.59 |

| Debt-to-Assets | 53.6% | 28.9% |

| Interest Coverage | 15.1 | 6.0 |

| Asset Turnover | 1.06 | 0.84 |

| Fixed Asset Turnover | 6.91 | 5.01 |

| Payout ratio | 48.6% | 0.08% |

| Dividend yield | 2.25% | 0.003% |

Interpretation of the Ratios

Illinois Tool Works Inc.

Illinois Tool Works shows strong profitability with a net margin of 21.94% and an impressive return on equity of 105.16%, indicating efficient capital use. However, its high price-to-book ratio of 22.69 and debt-to-assets at 53.61% raise concerns about valuation and leverage. The company pays a solid dividend, with a 2.25% yield supported by free cash flow, reflecting a slightly favorable overall ratio profile.

Generac Holdings Inc.

Generac exhibits moderate profitability metrics, with a net margin of 7.57% and return on equity of 13.04%, both rated neutral. Its capital structure is conservative, with a debt-to-assets ratio of 28.88% and a current ratio of 1.97, which is favorable. The company does not pay dividends, likely due to reinvestment priorities or growth focus, resulting in a neutral overall financial ratio assessment.

Which one has the best ratios?

Illinois Tool Works has a more favorable ratio profile overall, with half of its key ratios rated positively and strong profitability measures. Generac’s ratios are more mixed, with fewer favorable indicators and some valuation concerns. While ITW carries higher leverage, its dividend and return metrics provide a stronger signal compared to GNRC’s neutral stance.

Strategic Positioning

This section compares the strategic positioning of Illinois Tool Works Inc. (ITW) and Generac Holdings Inc. (GNRC), including market position, key segments, and exposure to technological disruption:

Illinois Tool Works Inc.

- Large market cap of 74.7B with diversified industrial machinery segments; faces moderate competitive pressure.

- Operates seven diverse segments including Automotive OEM, Food Equipment, Welding, and Polymers & Fluids driving multi-industry revenue streams.

- Exposure to technological disruption is moderate, with segments like Test & Measurement and Electronics integrating software and consumables.

Generac Holdings Inc.

- Smaller market cap of 8.97B, focused on power generation niche; experiences higher competitive pressure as a specialized player.

- Concentrated on power generation and energy storage products targeting residential, light commercial, and industrial markets.

- Faces technological disruption mainly from clean energy solutions and remote monitoring systems in power generation and storage sectors.

ITW vs GNRC Positioning

ITW’s diversified industrial approach spreads risk across multiple sectors, leveraging broad market exposure but with complex management needs. GNRC’s concentrated focus on power equipment offers specialization benefits but increases vulnerability to market and technology shifts within its niche.

Which has the best competitive advantage?

Based on MOAT evaluation, ITW demonstrates a very favorable competitive advantage with growing profitability and efficient capital use. GNRC shows a very unfavorable position, with declining returns and value destruction, indicating weaker competitive durability.

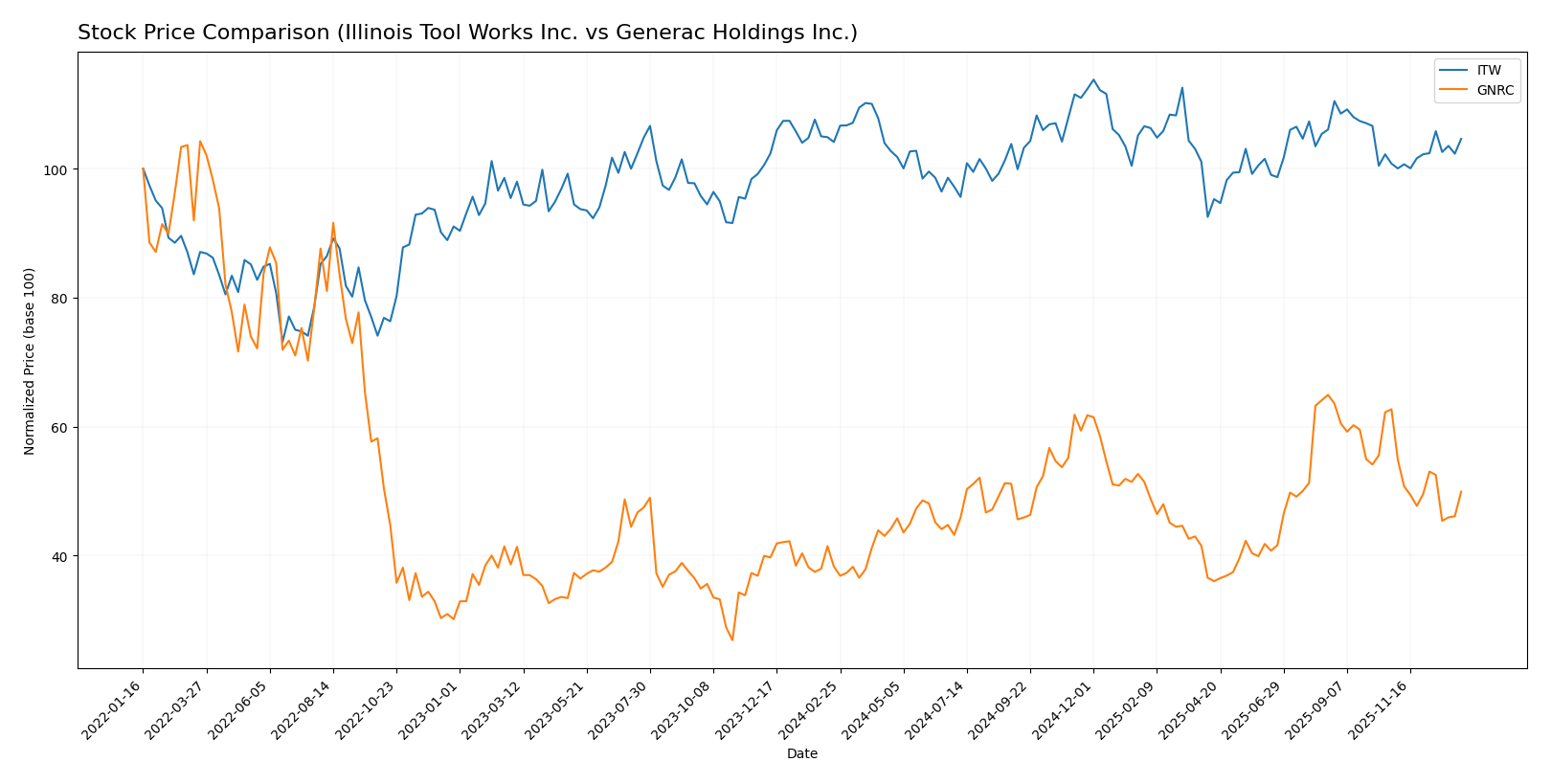

Stock Comparison

The stock price movements over the past year show distinct dynamics between Illinois Tool Works Inc. and Generac Holdings Inc., with notable shifts in trend direction and trading volume patterns.

Trend Analysis

Illinois Tool Works Inc. exhibited a bullish trend with a modest 0.47% price increase over the past 12 months, showing acceleration and a standard deviation of 10.66. Recent weeks continued this upward momentum with a 3.81% gain.

Generac Holdings Inc. displayed a strong bullish trend with a 30.27% price rise over the last year, though with deceleration and higher volatility (std deviation 22.61). However, recent months saw a bearish reversal, dropping 20.41%.

Comparing both, Generac Holdings delivered the highest annual market performance despite recent weakness, while Illinois Tool Works maintained steady but moderate gains with less volatility.

Target Prices

The current analyst consensus presents clear target price ranges for Illinois Tool Works Inc. and Generac Holdings Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Illinois Tool Works Inc. | 275 | 230 | 254 |

| Generac Holdings Inc. | 248 | 184 | 210 |

Analysts expect Illinois Tool Works to trade near its current price of 255, indicating limited upside potential. Generac’s consensus target of 210 suggests a significant upside from its current 153, reflecting more growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Illinois Tool Works Inc. (ITW) and Generac Holdings Inc. (GNRC):

Rating Comparison

ITW Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate valuation indication with a score of 3.

- ROE Score: Very favorable at 5, showing high efficiency in generating profit.

- ROA Score: Very favorable at 5, reflecting excellent asset utilization.

- Debt To Equity Score: Very unfavorable at 1, signaling high financial risk.

- Overall Score: Moderate at 3, summarizing the company’s financial standing.

GNRC Rating

- Rating: B, also considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate valuation indication with a score of 3.

- ROE Score: Favorable at 4, indicating good profitability from equity.

- ROA Score: Favorable at 4, indicating effective use of assets.

- Debt To Equity Score: Moderate at 2, showing better balance sheet strength.

- Overall Score: Moderate at 3, summarizing the company’s financial standing.

Which one is the best rated?

Both ITW and GNRC share the same overall rating (B) and overall score (3), with ITW scoring higher on ROE and ROA but much lower on debt-to-equity. GNRC shows a more balanced financial risk profile. Based strictly on these data, neither company is clearly better rated overall.

Scores Comparison

The comparison of Illinois Tool Works Inc. and Generac Holdings Inc. scores is as follows:

Illinois Tool Works Inc. Scores

- Altman Z-Score: 7.93 indicates a safe zone, low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Generac Holdings Inc. Scores

- Altman Z-Score: 3.73 indicates a safe zone, low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Which company has the best scores?

Illinois Tool Works Inc. has a higher Altman Z-Score than Generac Holdings Inc., suggesting greater financial stability. Both companies share the same Piotroski Score, reflecting equally strong financial health.

Grades Comparison

Here is the comparison of recent grades and ratings for Illinois Tool Works Inc. and Generac Holdings Inc.:

Illinois Tool Works Inc. Grades

The table below summarizes recent grades from reputable grading companies for Illinois Tool Works Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Underweight | 2026-01-07 |

| Goldman Sachs | Downgrade | Sell | 2025-12-16 |

| B of A Securities | Upgrade | Neutral | 2025-11-18 |

| Barclays | Maintain | Underweight | 2025-10-27 |

| Truist Securities | Maintain | Hold | 2025-10-27 |

| Wells Fargo | Maintain | Underweight | 2025-10-27 |

| Truist Securities | Maintain | Hold | 2025-10-08 |

| Barclays | Downgrade | Underweight | 2025-08-14 |

| Barclays | Maintain | Equal Weight | 2025-08-04 |

| UBS | Maintain | Neutral | 2025-07-31 |

The overall grading trend for Illinois Tool Works Inc. shows mostly hold to underweight ratings with some downgrades and a few neutral upgrades, indicating cautious sentiment among analysts.

Generac Holdings Inc. Grades

The table below summarizes recent grades from reputable grading companies for Generac Holdings Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | Upgrade | Outperform | 2026-01-09 |

| Citigroup | Upgrade | Buy | 2026-01-08 |

| B of A Securities | Maintain | Buy | 2026-01-07 |

| Wells Fargo | Upgrade | Overweight | 2025-12-19 |

| JP Morgan | Upgrade | Overweight | 2025-12-08 |

| Citigroup | Maintain | Neutral | 2025-11-03 |

| Barclays | Maintain | Equal Weight | 2025-10-31 |

| UBS | Maintain | Buy | 2025-10-30 |

| Canaccord Genuity | Maintain | Buy | 2025-10-30 |

| Citigroup | Maintain | Neutral | 2025-10-21 |

Generac Holdings Inc. grades show a strong upgrade trend toward buy and outperform ratings, reflecting positive analyst sentiment.

Which company has the best grades?

Generac Holdings Inc. has received significantly stronger grades, with multiple upgrades to buy and outperform, compared to Illinois Tool Works Inc.’s predominantly hold and underweight ratings. This suggests more favorable analyst confidence in Generac’s prospects, potentially influencing investor sentiment toward higher growth expectations.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses of Illinois Tool Works Inc. (ITW) and Generac Holdings Inc. (GNRC) based on recent financial performance, market position, and strategic factors.

| Criterion | Illinois Tool Works Inc. (ITW) | Generac Holdings Inc. (GNRC) |

|---|---|---|

| Diversification | Highly diversified across 7 strong segments; balanced revenue streams totaling around 17B USD in 2024 | Limited diversification; primarily focused on power generation products |

| Profitability | Strong profitability with net margin of 21.94%, ROIC 27.19%, and ROE 105.16% | Moderate profitability; net margin 7.57%, ROIC 9.89%, ROE 13.04% |

| Innovation | Consistent investment in test & measurement, electronics, and specialty products segments supports innovation | Innovation focused on power solutions but less broad-based |

| Global presence | Extensive global footprint across multiple industrial sectors | Primarily North America focused with growing international presence |

| Market Share | Leading positions in multiple industrial niches with durable competitive advantages | Growing market share but faces intense competition; value destruction indicates challenges |

Key takeaway: ITW demonstrates a durable competitive advantage with strong diversification, superior profitability, and a growing economic moat. GNRC shows moderate profitability but struggles with declining returns and value destruction, posing higher investment risks.

Risk Analysis

Below is a comparative table of key risk factors for Illinois Tool Works Inc. (ITW) and Generac Holdings Inc. (GNRC) based on the most recent 2024 data:

| Metric | Illinois Tool Works Inc. (ITW) | Generac Holdings Inc. (GNRC) |

|---|---|---|

| Market Risk | Beta 1.17 (moderate volatility) | Beta 1.83 (high volatility) |

| Debt level | High debt-to-equity (2.44, unfavorable) | Moderate debt-to-equity (0.59, neutral) |

| Regulatory Risk | Moderate, industrial sector compliance | Moderate, energy products regulation |

| Operational Risk | Diversified segments reduce risk | Concentrated in power generation |

| Environmental Risk | Moderate, exposure in manufacturing | Moderate, includes energy storage systems |

| Geopolitical Risk | Low, mostly US-based operations | Low, mostly US-based operations |

The most impactful risks are ITW’s high leverage increasing financial risk despite strong profitability, and GNRC’s elevated market volatility coupled with regulatory pressures in the energy sector. Both companies show strong financial health with safe Altman Z-Scores, but ITW’s debt level is a caution point for risk-averse investors.

Which Stock to Choose?

Illinois Tool Works Inc. (ITW) shows a favorable income evolution with strong growth in net income and EPS over 2020–2024. Financial ratios are slightly favorable, highlighting excellent profitability but some concerns in debt levels. Its very favorable moat and strong scores indicate durable value creation.

Generac Holdings Inc. (GNRC) presents a favorable income statement with revenue growth but mixed profitability trends and declining net margin over the period. Its financial ratios are neutral overall, supported by moderate debt and decent liquidity. The moat is very unfavorable, signaling value destruction and weakening returns.

Investors focused on quality and durable value may find ITW more favorable due to its robust profitability and strong moat. Conversely, those seeking potential growth with tolerance for volatility might view GNRC’s recent revenue expansion and decent liquidity as attractive despite its weaker moat and financial stability signals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Illinois Tool Works Inc. and Generac Holdings Inc. to enhance your investment decisions: