Home > Comparison > Industrials > IEX vs GNRC

The strategic rivalry between IDEX Corporation and Generac Holdings shapes the industrial machinery sector’s evolution. IDEX operates as a diversified industrial manufacturer specializing in fluid and metering technologies, health sciences, and fire safety equipment. In contrast, Generac focuses on power generation and energy storage solutions for residential and commercial markets. This analysis evaluates which company’s operational model offers a superior risk-adjusted return for investors navigating this competitive landscape.

Table of contents

Companies Overview

IDEX Corporation and Generac Holdings Inc. stand as key players in the industrial machinery sector, each commanding a significant market presence.

IDEX Corporation: Applied Solutions Powerhouse

IDEX Corporation excels as a diversified industrial machinery firm delivering applied solutions globally. Its core revenue stems from three segments: Fluid & Metering Technologies, Health & Science Technologies, and Fire & Safety/Diversified Products. In 2026, IDEX emphasizes innovation across precision fluidics, pumps, and safety equipment, targeting growth in life sciences and industrial markets.

Generac Holdings Inc.: Power Generation Specialist

Generac Holdings Inc. dominates as a leading power generation equipment manufacturer. It generates revenue through residential and commercial generators, energy storage systems, and portable power products. Its 2026 strategy reinforces expansion in clean energy solutions and remote monitoring technology, focusing on residential backup power and commercial energy infrastructure.

Strategic Collision: Similarities & Divergences

Both firms operate in industrial machinery but diverge sharply in approach. IDEX pursues a broad industrial portfolio with specialized fluid and safety tech, while Generac focuses on energy and power generation ecosystems. Their primary battleground is industrial infrastructure support, yet their investment profiles reflect distinct risk and growth dynamics tied to diversified innovation versus focused energy solutions.

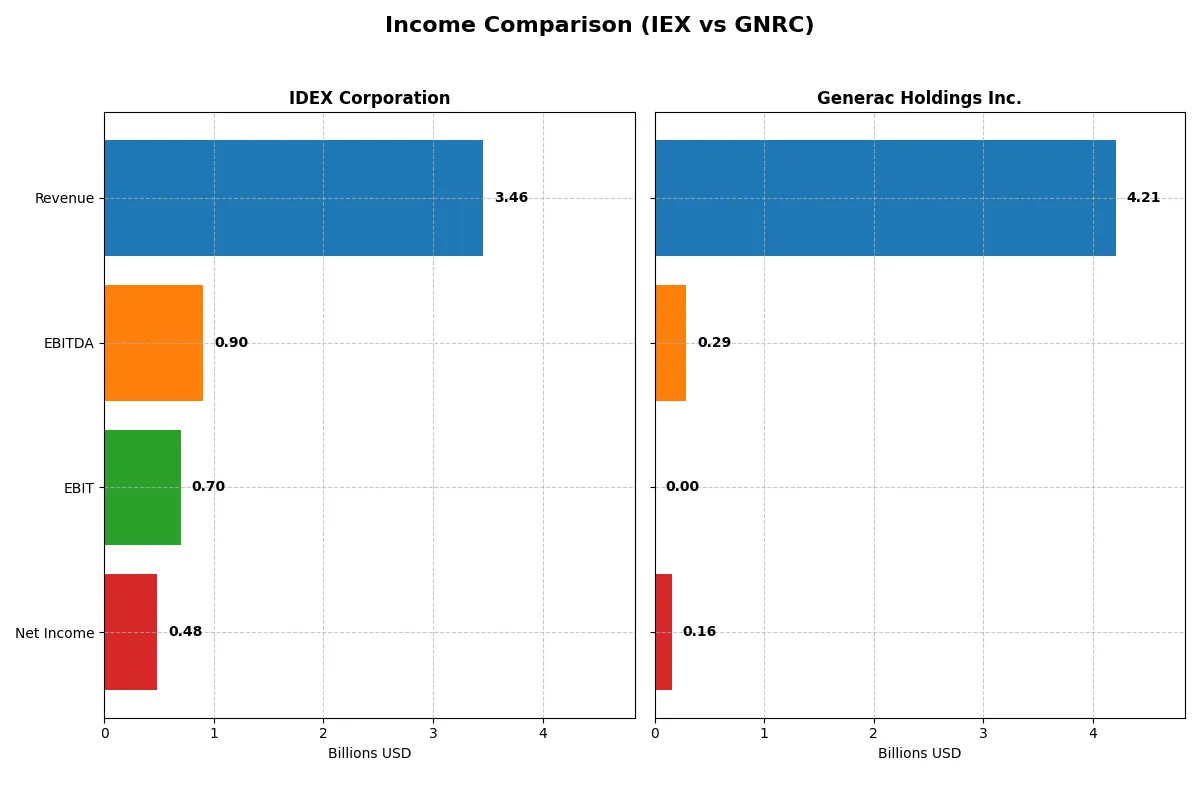

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | IDEX Corporation (IEX) | Generac Holdings Inc. (GNRC) |

|---|---|---|

| Revenue | 3.46B | 4.21B |

| Cost of Revenue | 1.92B | 2.60B |

| Operating Expenses | 819M | 1.32B |

| Gross Profit | 1.54B | 1.61B |

| EBITDA | 903M | 289M |

| EBIT | 697M | 0 |

| Interest Expense | 64M | -71M |

| Net Income | 483M | 160M |

| EPS | 6.41 | 2.73 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company converts revenue into profits most efficiently, exposing the true strength of their business models.

IDEX Corporation Analysis

IDEX Corporation steadily grows revenue, reaching 3.46B in 2025, with net income at 483M. Gross margin remains strong around 44.5%, and net margin holds a favorable 14%. Despite a slight dip in net margin growth last year, IDEX sustains efficient cost control and solid operating income momentum.

Generac Holdings Inc. Analysis

Generac’s revenue slipped slightly to 4.21B in 2025, with net income declining sharply to 160M. Its gross margin at 38.3% is decent, but net margin plummets to 3.8%. The company faces deteriorating profitability and negative EBIT growth, signaling operational challenges and margin pressure in the latest fiscal year.

Margin Strength vs. Profitability Struggles

IDEX outperforms Generac with higher margins and consistent net income growth over five years. Generac’s revenue scale is larger but undermined by collapsing profitability and worsening net margins. IDEX’s efficient margin profile makes it a fundamentally stronger earnings engine for investors seeking stability and quality profits.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | IDEX Corporation (IEX) | Generac Holdings Inc. (GNRC) |

|---|---|---|

| ROE | 12.0% | 0% |

| ROIC | 8.6% | 0% |

| P/E | 27.7 | 50.0 |

| P/B | 3.33 | 0 |

| Current Ratio | 2.86 | 0 |

| Quick Ratio | 2.02 | 0 |

| D/E | 0.45 | 0 |

| Debt-to-Assets | 26.3% | 0 |

| Interest Coverage | 11.2 | -4.1 |

| Asset Turnover | 0.50 | 0 |

| Fixed Asset Turnover | 7.39 | 0 |

| Payout ratio | 44.0% | 0.18% |

| Dividend yield | 1.59% | 0.004% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as the company’s DNA, exposing hidden risks and operational strengths crucial for investors’ decision-making.

IDEX Corporation

IDEX posts a solid 12% ROE and strong 13.98% net margin, signaling efficient profitability. Its P/E ratio stands at 27.73, suggesting a stretched valuation relative to earnings. IDEX maintains a 1.59% dividend yield, balancing shareholder returns with reinvestment to sustain growth and operational excellence.

Generac Holdings Inc.

Generac shows weak profitability with a 3.79% net margin and zero ROE, indicating operational challenges. Its P/E of 50.02 implies an expensive stock priced for growth despite poor returns. The absence of dividends reflects a focus on reinvestment, yet financial health ratios show notable weaknesses and risk factors.

Balanced Profitability vs. Risk Exposure

IDEX offers favorable profitability and financial stability despite a premium valuation. Generac’s stretched valuation and weak profitability raise red flags. For risk-averse investors, IDEX’s profile fits better; those seeking speculative growth face higher uncertainty with Generac.

Which one offers the Superior Shareholder Reward?

IDEX Corporation (IEX) pays a steady dividend with a 1.59% yield and a sustainable payout ratio near 44%. It pairs this with disciplined buybacks, optimizing capital allocation amid steady free cash flow of 8.2/share in 2025. Generac Holdings (GNRC) barely pays dividends, yielding near zero, and reinvests heavily in growth and acquisitions, supported by free cash flow of 7.5/share. GNRC’s buybacks are minimal, reflecting a growth-first stance but higher financial leverage and volatile margins. Historically, IEX’s balanced distribution strategy offers a more reliable and attractive total shareholder return profile in 2026, blending income with capital appreciation.

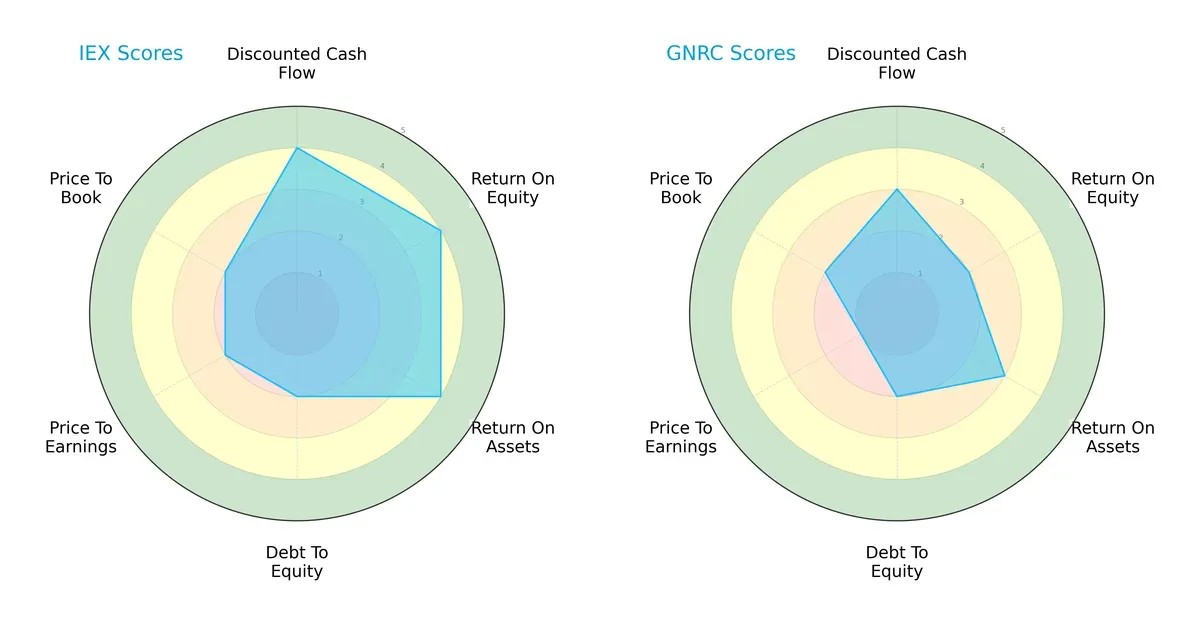

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of IDEX Corporation and Generac Holdings Inc., highlighting their financial strengths and weaknesses:

IDEX demonstrates a more balanced profile with strong DCF, ROE, and ROA scores at 4 each, signaling efficient capital allocation and asset use. Generac lags behind with moderate DCF (3) and ROA (3) and weaker ROE (2). Both struggle with debt management (score 2), but Generac’s valuation metrics (P/E 1, P/B 2) suggest it faces greater market skepticism. IDEX’s edge lies in operational efficiency, while Generac relies more on moderate asset returns.

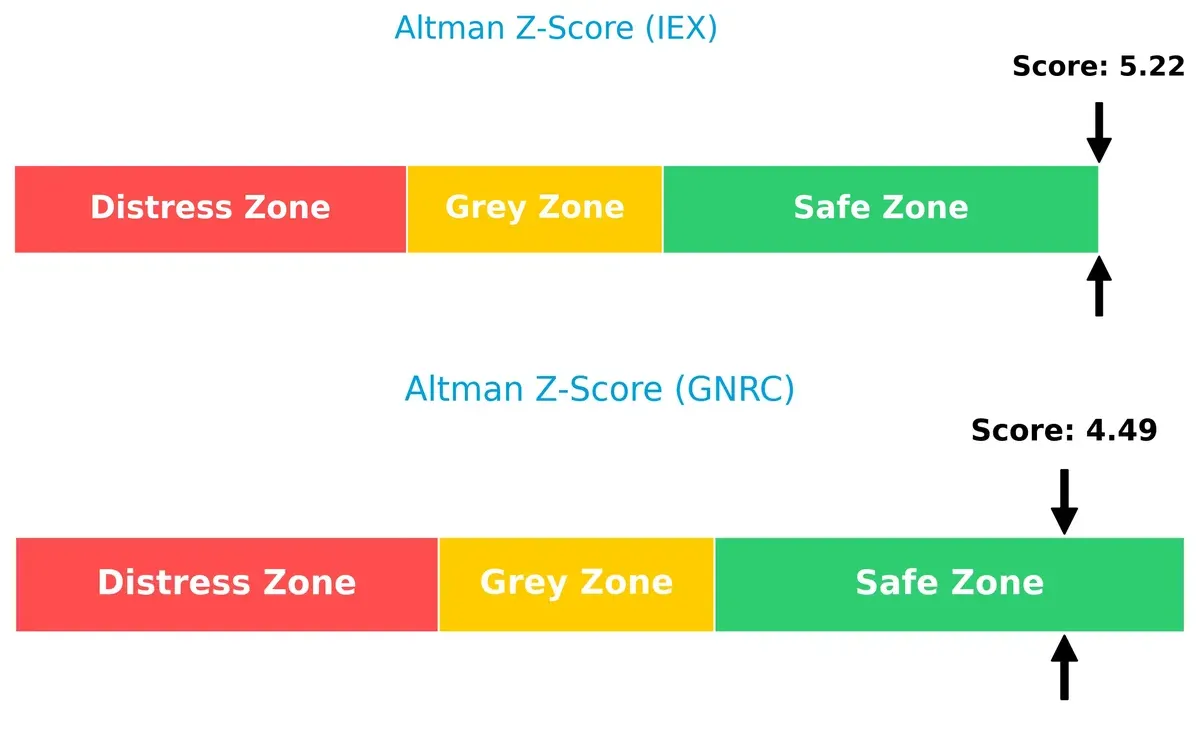

Bankruptcy Risk: Solvency Showdown

IDEX’s Altman Z-Score of 5.22 versus Generac’s 4.49 confirms both firms sit comfortably in the safe zone:

These scores imply strong solvency and low bankruptcy risk for both companies, but IDEX holds a clearer margin of safety. This positions IDEX as more resilient in potential economic downturns or sector volatility.

Financial Health: Quality of Operations

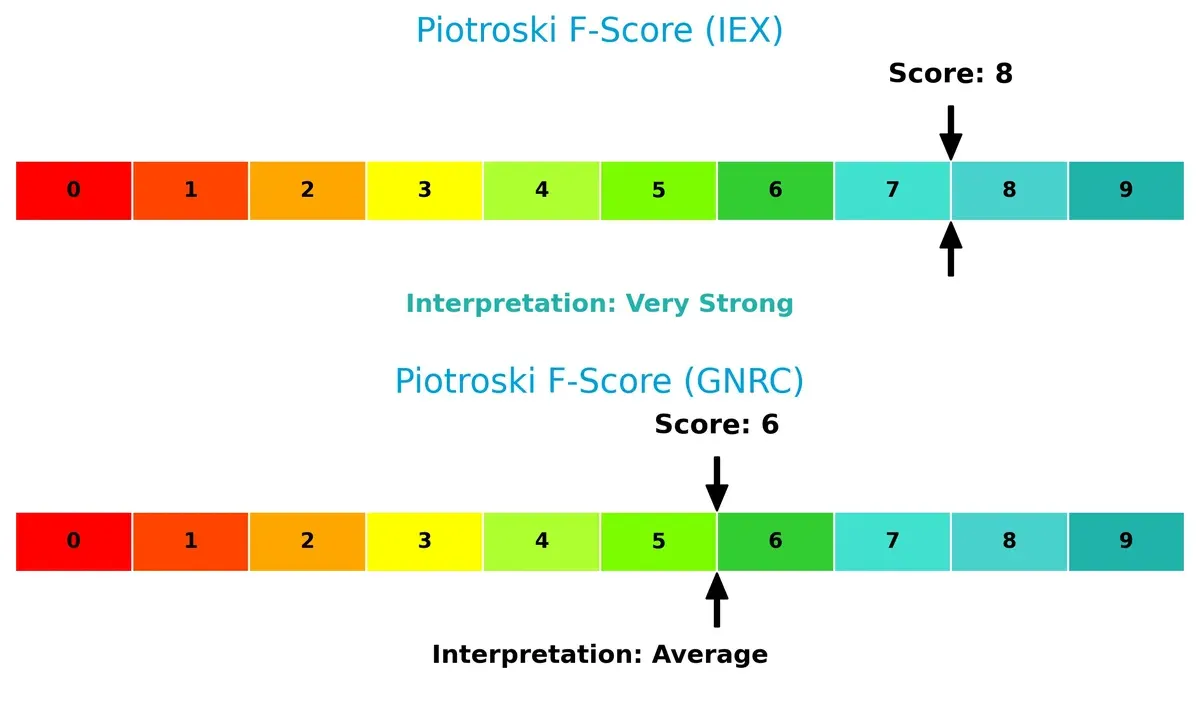

IDEX leads with a Piotroski F-Score of 8, while Generac scores a moderate 6:

IDEX’s high score signals robust profitability, liquidity, and operational efficiency. Generac’s average score suggests some red flags in internal metrics, warranting caution. I’ve observed that companies with scores below 7 often face challenges sustaining financial health in turbulent cycles.

How are the two companies positioned?

This section dissects the operational DNA of IDEX and Generac by comparing their revenue distribution by segment alongside internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage in today’s market.

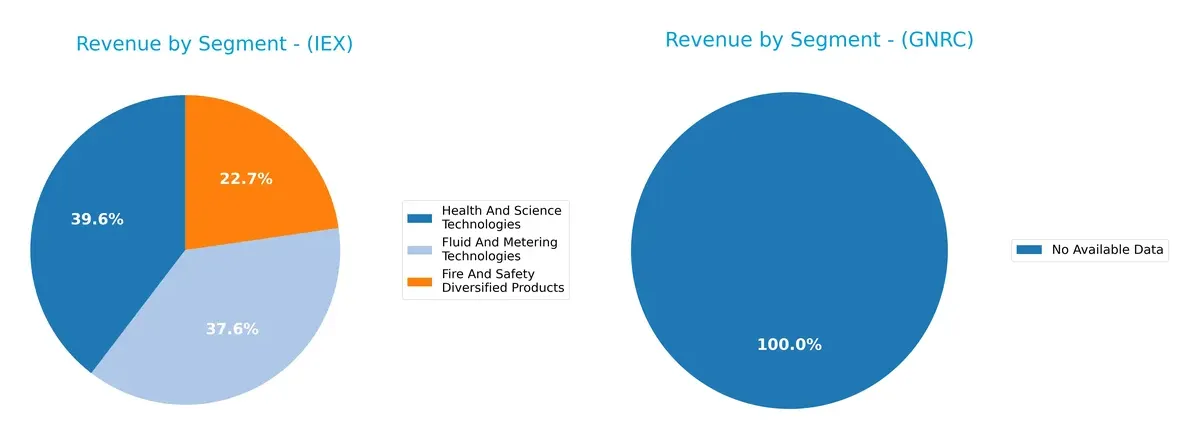

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how IDEX Corporation and Generac Holdings Inc. diversify their income streams and where their primary sector bets lie:

IDEX Corporation displays a well-balanced revenue mix across Health And Science Technologies ($1.3B), Fluid And Metering Technologies ($1.2B), and Fire And Safety Diversified Products ($744M). This diversification reduces concentration risk and supports ecosystem lock-in. In contrast, Generac lacks reported segment data, preventing direct comparison. IDEX’s approach anchors stability through broad industrial exposure, while Generac’s unknown segmentation raises caution for portfolio risk assessment.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of IDEX Corporation and Generac Holdings Inc.:

IDEX Corporation Strengths

- Diversified revenue streams across three technology segments

- Favorable net margin at 13.98%

- Strong liquidity with current ratio 2.86

- Low debt-to-assets ratio at 26.29%

- Favorable fixed asset turnover at 7.39

Generac Holdings Inc. Strengths

- Favorable price-to-book ratio

- Low debt levels indicated by debt-to-assets ratio

- Some financial leverage advantages from low debt

IDEX Corporation Weaknesses

- Unfavorable P/E ratio at 27.73

- Asset turnover at 0.5 considered low

- Neutral return on equity and invested capital

Generac Holdings Inc. Weaknesses

- Unfavorable net margin at 3.79%

- Zero returns on equity and invested capital

- Unfavorable P/E of 50.02 indicates high valuation

- Poor liquidity with zero current and quick ratios

- Negative interest coverage and no dividend yield

IDEX displays balanced profitability and sound financial health, supporting its diversified growth strategy. Generac faces significant profitability and liquidity challenges, signaling operational and financial risks impacting its stability.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield against profit erosion from relentless competition. Here’s how I see it for these two industrial machinery players:

IDEX Corporation: Diverse Industrial Solutions Moat

IDEX’s moat stems from its wide product portfolio and specialized fluidics technologies. This grants stable margins and high ROIC, though recent declines signal pressure. Expansion into biopharma and water treatment could deepen its moat in 2026.

Generac Holdings Inc.: Residential Power Generation Moat

Generac’s moat relies on brand dominance and scale in home standby generators, unlike IDEX’s industrial diversification. However, falling margins and shrinking profits weaken its competitive grip. Growth in clean energy storage offers a silver lining.

Industrial Diversification vs. Brand Dominance: Who Holds the Moat?

IDEX’s broader product base and historically higher ROIC give it a wider moat than Generac’s concentrated residential focus. I believe IDEX is better positioned to defend market share amid evolving industrial demands.

Which stock offers better returns?

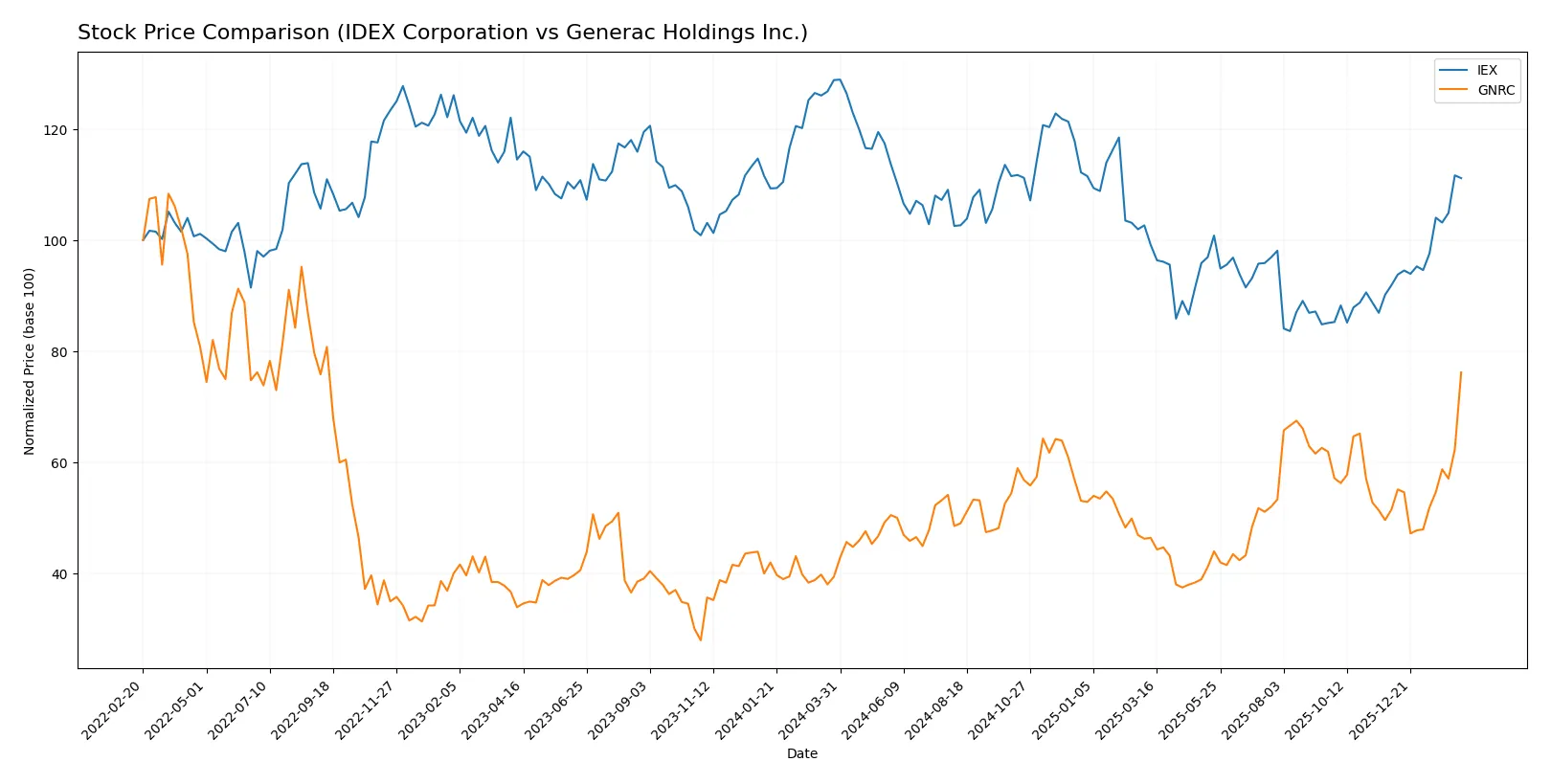

The past year shows contrasting price dynamics: IDEX Corporation endured a notable decline with late acceleration, while Generac Holdings surged sharply, sustaining strong upward momentum and buyer dominance.

Trend Comparison

IDEX Corporation’s stock fell 13.72% over the past 12 months, marking a bearish trend with accelerating downside and high volatility (22.27% std deviation). It reached a high of 244.02 and a low of 158.26.

Generac Holdings gained 93.64% over the same period, reflecting a bullish trend with accelerating gains and similar volatility (22.77% std deviation). Its price ranged between 110.25 and 224.45.

Comparing both, Generac Holdings clearly outperformed IDEX Corporation, delivering the highest market returns with sustained buyer strength and substantial price appreciation.

Target Prices

Analysts maintain optimistic target price ranges for both IDEX Corporation and Generac Holdings Inc., signaling confidence ahead.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| IDEX Corporation | 220 | 247 | 236.83 |

| Generac Holdings Inc. | 195 | 292 | 238.89 |

The target consensus for IDEX at 237 suggests roughly 12% upside from its current 210. Generac’s consensus near 239 implies a modest 6% gain versus its 224 price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

IDEX Corporation Grades

Here are recent institutional grades for IDEX Corporation from leading research firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Upgrade | Buy | 2026-02-06 |

| RBC Capital | Maintain | Outperform | 2026-02-05 |

| Citigroup | Maintain | Buy | 2026-02-05 |

| DA Davidson | Maintain | Neutral | 2026-02-05 |

| TD Cowen | Maintain | Buy | 2026-02-05 |

| Stifel | Maintain | Buy | 2026-01-23 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| RBC Capital | Maintain | Outperform | 2025-10-30 |

| Stifel | Maintain | Buy | 2025-10-20 |

| Oppenheimer | Maintain | Outperform | 2025-10-07 |

Generac Holdings Inc. Grades

Below are recent grades from reputable institutions for Generac Holdings Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-02-13 |

| Wells Fargo | Maintain | Overweight | 2026-02-12 |

| Guggenheim | Downgrade | Neutral | 2026-02-12 |

| Guggenheim | Maintain | Buy | 2026-02-10 |

| Barclays | Maintain | Equal Weight | 2026-01-20 |

| Canaccord Genuity | Maintain | Buy | 2026-01-13 |

| Baird | Upgrade | Outperform | 2026-01-09 |

| Citigroup | Upgrade | Buy | 2026-01-08 |

| B of A Securities | Maintain | Buy | 2026-01-07 |

| Wells Fargo | Upgrade | Overweight | 2025-12-19 |

Which company has the best grades?

IDEX Corporation holds consistently higher grades, with multiple “Buy” and “Outperform” ratings maintained or upgraded by top firms. Generac shows mixed ratings, including downgrades and “Equal Weight” stances. Investors might view IDEX as favored by analysts, suggesting stronger institutional conviction.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

IDEX Corporation

- Operates in diversified industrial machinery with strong segment variety, reducing market risk.

Generac Holdings Inc.

- Focuses on power generation equipment, facing intense competition and demand cyclicality.

2. Capital Structure & Debt

IDEX Corporation

- Maintains moderate debt-to-equity (0.45) and strong interest coverage (10.82), indicating financial stability.

Generac Holdings Inc.

- Shows zero reported debt but weak interest coverage and liquidity metrics, signaling potential financial strain.

3. Stock Volatility

IDEX Corporation

- Beta near 1 (0.98) suggests stock moves closely with market, moderate volatility.

Generac Holdings Inc.

- High beta (1.81) implies significant price swings, increasing investment risk.

4. Regulatory & Legal

IDEX Corporation

- Industrial machinery sector faces standard regulatory compliance risks, manageable with diversified segments.

Generac Holdings Inc.

- Energy equipment exposed to stricter environmental regulations and product safety standards, raising compliance costs.

5. Supply Chain & Operations

IDEX Corporation

- Global operations with multiple segments may mitigate supply chain disruptions.

Generac Holdings Inc.

- Reliance on specialized components and energy markets heightens vulnerability to supply chain shocks.

6. ESG & Climate Transition

IDEX Corporation

- Moderate ESG exposure; diversified segments allow gradual adaptation to climate regulations.

Generac Holdings Inc.

- Faces pressure to shift toward clean energy products, necessitating costly innovation investments.

7. Geopolitical Exposure

IDEX Corporation

- Primarily US-based with global sales; geopolitical risks moderate but manageable.

Generac Holdings Inc.

- US-centric with global supply dependencies; geopolitical tensions could disrupt operations and supply chains.

Which company shows a better risk-adjusted profile?

IDEX Corporation’s most impactful risk is its relatively high valuation multiples despite moderate profitability, which could pressure returns if growth slows. Generac’s dominant risk lies in its weak profitability and financial ratios, increasing distress potential amid market volatility. IDEX delivers a superior risk-adjusted profile, supported by strong liquidity, stable debt metrics, and a higher Altman Z-score (5.22 vs. 4.49), indicating greater financial resilience. Generac’s stock volatility and unfavorable earnings metrics heighten investment risk, while IDEX’s steady operational diversification cushions systemic shocks.

Final Verdict: Which stock to choose?

IDEX Corporation’s superpower lies in its robust financial discipline and operational efficiency, maintaining strong liquidity and prudent debt management. Its slight decline in profitability and ROIC signals a point of vigilance. I see IDEX fitting well in portfolios seeking steady, quality industrial exposure with moderate growth ambitions.

Generac Holdings commands a strategic moat through its recurring revenue streams in energy solutions and a clear bullish price momentum. Despite weaker profitability and financial ratios compared to IDEX, it offers higher growth potential with more volatility. This profile aligns with investors open to cyclical risks in exchange for growth upside.

If you prioritize resilient balance sheets and operational steadiness, IDEX outshines as the compelling choice due to its disciplined capital allocation and stable cash flows. However, if you seek aggressive growth and can tolerate greater earnings variability, Generac offers better upside potential fueled by its expanding market footprint. Each presents distinct scenarios tailored to divergent investor risk appetites.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of IDEX Corporation and Generac Holdings Inc. to enhance your investment decisions: