In today’s fast-evolving technology landscape, choosing the right software infrastructure company is crucial for savvy investors. Gen Digital Inc. and UiPath Inc. both operate in this dynamic sector, with Gen Digital focusing on cybersecurity solutions and UiPath leading in robotic process automation. Their innovative approaches and market overlap make them compelling investment candidates. In this article, I will help you determine which company offers the most promising opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Gen Digital Inc. and UiPath Inc. by providing an overview of these two companies and their main differences.

Gen Digital Inc. Overview

Gen Digital Inc. operates in the software infrastructure industry, focusing on cyber safety solutions for consumers across multiple regions, including the US, Europe, and Asia Pacific. The company offers products such as Norton 360 and LifeLock for malware protection and identity theft prevention, along with privacy and security tools like VPN and Dark Web Monitoring. Founded in 1982 and based in Tempe, Arizona, Gen Digital serves a diverse global market with a workforce of about 3,400 employees.

UiPath Inc. Overview

UiPath Inc., headquartered in New York City, provides an automation platform specializing in robotic process automation (RPA) software primarily serving clients in the US, Romania, and Japan. The platform integrates AI with process mining and low-code tools to enable businesses to automate workflows efficiently. Founded in 2005, UiPath employs approximately 3,868 people and targets sectors such as banking, healthcare, and government with its end-to-end automation solutions.

Key similarities and differences

Both Gen Digital and UiPath operate in the technology sector within software infrastructure but serve distinct markets; Gen Digital focuses on consumer cyber safety, while UiPath targets enterprise automation. Each company provides subscription-based software solutions, yet their core offerings differ significantly—security and privacy versus robotic automation. Additionally, Gen Digital has a longer market presence since 1982, compared to UiPath’s more recent IPO in 2021, reflecting different growth trajectories and market maturity.

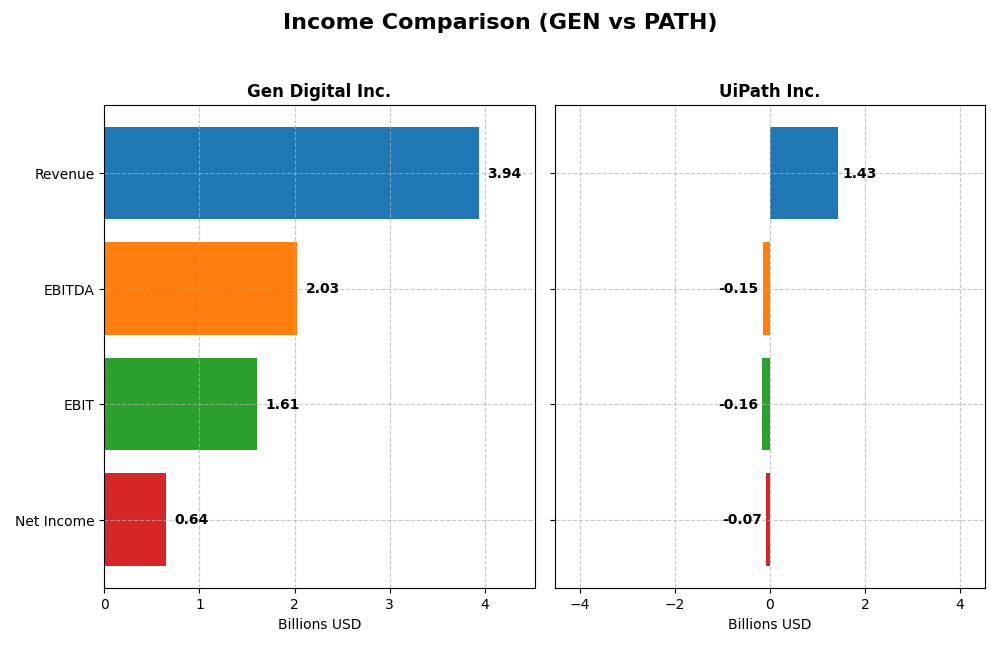

Income Statement Comparison

The table below presents a side-by-side comparison of the key income statement metrics for Gen Digital Inc. and UiPath Inc. for their most recent fiscal year.

| Metric | Gen Digital Inc. | UiPath Inc. |

|---|---|---|

| Market Cap | 16.1B | 7.7B |

| Revenue | 3.94B | 1.43B |

| EBITDA | 2.03B | -145M |

| EBIT | 1.61B | -163M |

| Net Income | 643M | -74M |

| EPS | 1.04 | -0.13 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Gen Digital Inc.

Gen Digital Inc. has shown consistent revenue growth from $2.55B in 2021 to $3.93B in 2025, with net income rising moderately from $554M to $643M over the period. Gross and EBIT margins remained strong, around 80% and 41% respectively, though interest expense is notably high at nearly 15%. The 2025 fiscal year saw modest revenue growth of 3.55% and a significant 44% EBIT increase, indicating improved operational efficiency.

UiPath Inc.

UiPath Inc. experienced rapid revenue growth from $608M in 2021 to $1.43B in 2025, with net losses narrowing from -$92M to -$74M. The company maintains high gross margins exceeding 82%, but EBIT and net margins remain negative, reflecting ongoing investments. The 2025 year marked a 9.3% revenue increase and positive net margin growth of nearly 25%, suggesting improving profitability trends despite persistent operating losses.

Which one has the stronger fundamentals?

Gen Digital presents stable profitability with favorable gross and net margins, supported by consistent net income growth and strong EBIT expansion, though burdened by high interest costs. UiPath shows faster revenue and net income growth with improving margins but remains unprofitable at the EBIT and net income levels. Both have favorable income evaluations, yet Gen’s established profitability contrasts with UiPath’s growth-at-losses profile.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Gen Digital Inc. (GEN) and UiPath Inc. (PATH) based on their most recent fiscal year data as of 2025.

| Ratios | Gen Digital Inc. (GEN) | UiPath Inc. (PATH) |

|---|---|---|

| ROE | 28.3% | -4.0% |

| ROIC | 7.8% | -7.4% |

| P/E | 25.4 | -108.0 |

| P/B | 7.19 | 4.31 |

| Current Ratio | 0.51 | 2.93 |

| Quick Ratio | 0.51 | 2.93 |

| D/E (Debt to Equity) | 3.66 | 0.04 |

| Debt-to-Assets | 53.7% | 2.7% |

| Interest Coverage | 2.79 | 0 |

| Asset Turnover | 0.25 | 0.50 |

| Fixed Asset Turnover | 36.1 | 14.4 |

| Payout ratio | 48.7% | 0% |

| Dividend yield | 1.9% | 0% |

Interpretation of the Ratios

Gen Digital Inc.

Gen Digital Inc. shows a mixed ratio profile with strong net margin (16.34%) and return on equity (28.34%), but faces challenges with a low current ratio (0.51) and high debt levels (debt to equity 3.66). The price-to-earnings (PE) and price-to-book (PB) ratios are high, suggesting valuation concerns. The company pays dividends with a modest 1.92% yield, indicating moderate shareholder returns without excessive payout risks.

UiPath Inc.

UiPath Inc. exhibits weak profitability ratios, including negative net margin (-5.15%) and return on equity (-3.99%), reflecting ongoing losses. Its liquidity is strong with a current ratio of 2.93, and leverage is low (debt to equity 0.04). The company does not pay dividends, consistent with its reinvestment focus during a growth phase, relying on cash flow to support operations and development.

Which one has the best ratios?

Both companies have a slightly unfavorable overall ratio evaluation due to weaknesses in key areas. Gen Digital benefits from profitability and dividend payments but struggles with liquidity and leverage. UiPath shows better liquidity and lower debt but suffers from negative profitability and no dividend returns. Neither company clearly dominates in ratio strength.

Strategic Positioning

This section compares the strategic positioning of Gen Digital Inc. and UiPath Inc., including their market position, key segments, and exposure to technological disruption:

Gen Digital Inc.

- Leading consumer cyber safety provider with global presence facing competitive software infrastructure market.

- Key segments include Cyber Safety, Identity and Fraud Protection, and Legacy products driving revenues.

- Exposed to evolving cyber threats but offers diverse solutions including VPN, Dark Web Monitoring, and Privacy tools.

UiPath Inc.

- Focused on robotic process automation with strong presence in US, Romania, Japan amid software infrastructure competition.

- Revenue driven by License sales, Subscription Services, and Professional Services in automation software.

- Faces technological disruption risks but leverages AI and low-code automation to innovate process automation.

Gen Digital Inc. vs UiPath Inc. Positioning

Gen Digital follows a diversified cyber safety and privacy strategy targeting consumers worldwide, while UiPath concentrates on RPA automation solutions for enterprises mainly in select regions. Gen Digital’s broad product suite contrasts with UiPath’s focused automation platform.

Which has the best competitive advantage?

Both companies currently shed value as ROIC is below WACC; however, UiPath shows improving profitability with a growing ROIC trend, while Gen Digital’s ROIC is declining, indicating weaker competitive advantage durability.

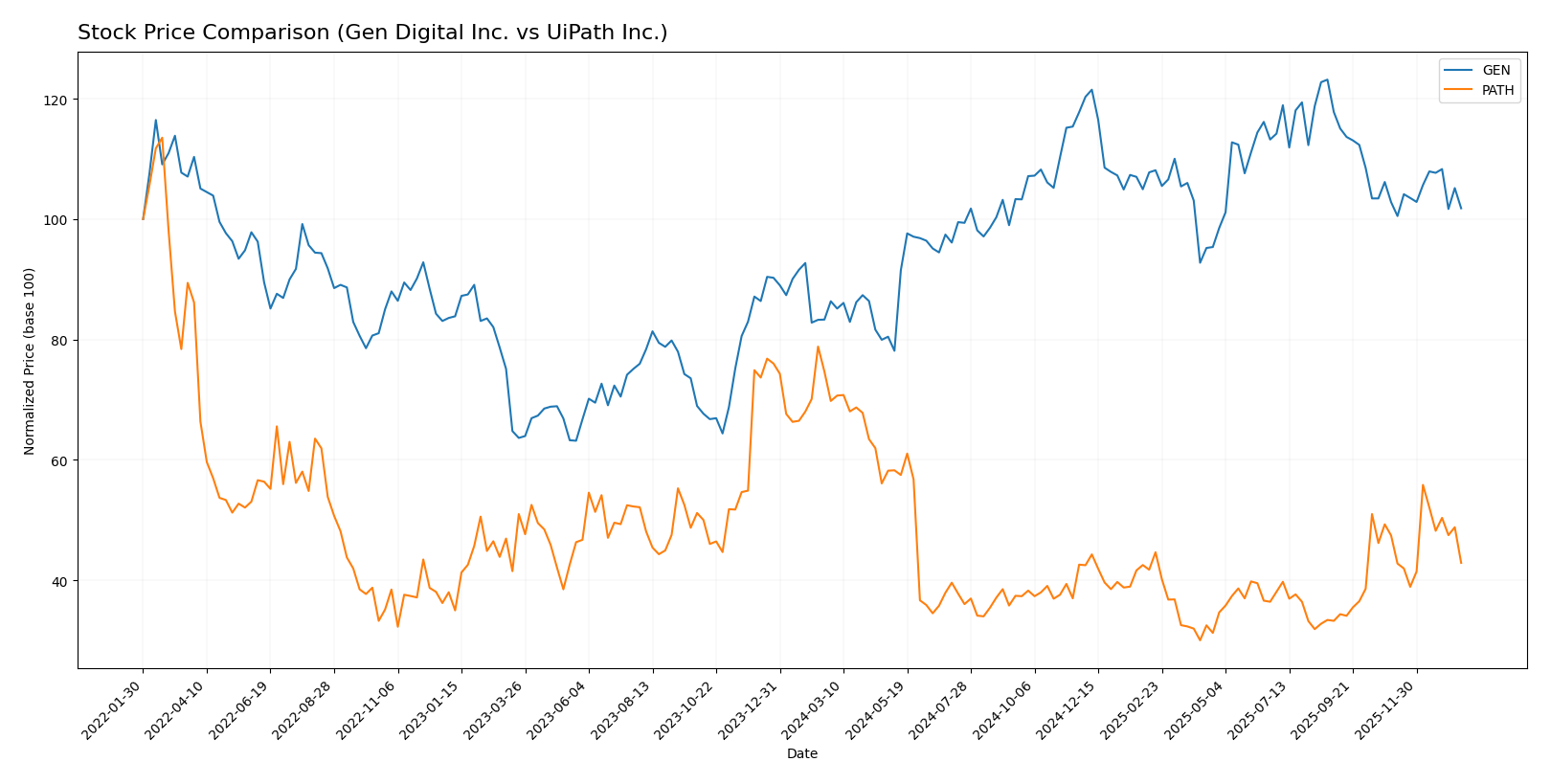

Stock Comparison

The stock price movements of Gen Digital Inc. and UiPath Inc. over the past 12 months reveal contrasting trading dynamics, with Gen Digital showing a bullish trend despite recent deceleration, while UiPath experiences an accelerating bearish trend amid high volatility.

Trend Analysis

Gen Digital Inc. posted a 17.89% price increase over the past year, indicating a bullish trend with decelerating momentum. The stock ranged from a low of 20.03 to a high of 31.58, with moderate volatility (2.59 std deviation).

UiPath Inc. recorded a -38.53% price decline over the same period, signaling a bearish trend with accelerating downward pressure. Its price fluctuated between 10.04 and 23.66, showing higher volatility (3.33 std deviation).

Comparing the two, Gen Digital delivered the highest market performance with a significant price gain, whereas UiPath faced substantial losses and stronger negative momentum.

Target Prices

Analysts present a clear consensus on the target prices for Gen Digital Inc. and UiPath Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Gen Digital Inc. | 32 | 31 | 31.5 |

| UiPath Inc. | 19 | 14 | 16.6 |

The consensus target prices suggest moderate upside potential for both stocks compared to current prices: Gen Digital at $26.1 and UiPath at $14.34, reflecting generally positive analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Gen Digital Inc. and UiPath Inc.:

Rating Comparison

Gen Digital Inc. Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: 5, indicating very favorable valuation.

- ROE Score: 5, a very favorable measure of profit generation efficiency.

- ROA Score: 3, moderate asset utilization.

- Debt To Equity Score: 1, very unfavorable, high financial risk.

- Overall Score: 3, moderate overall financial standing.

UiPath Inc. Rating

- Rating: B+, also considered very favorable.

- Discounted Cash Flow Score: 3, indicating moderate valuation.

- ROE Score: 4, a favorable but lower efficiency score.

- ROA Score: 4, favorable asset utilization.

- Debt To Equity Score: 4, favorable, lower financial risk.

- Overall Score: 3, same moderate overall standing.

Which one is the best rated?

UiPath Inc. holds a slightly better rating (B+) compared to Gen Digital Inc. (B) due to stronger debt management and better asset utilization, despite Gen having higher DCF and ROE scores.

Scores Comparison

The scores comparison between Gen Digital Inc. and UiPath Inc. highlights their financial risk and strength assessments:

Gen Scores

- Altman Z-Score: 1.25, in distress zone indicating high bankruptcy risk

- Piotroski Score: 6, average financial strength

PATH Scores

- Altman Z-Score: 5.27, in safe zone indicating low bankruptcy risk

- Piotroski Score: 7, strong financial strength

Which company has the best scores?

UiPath Inc. exhibits stronger financial health with a safe zone Altman Z-Score and a strong Piotroski Score. Gen Digital Inc. shows higher bankruptcy risk and average financial strength based solely on these scores.

Grades Comparison

Here is a comparison of the recent grades and ratings assigned to Gen Digital Inc. and UiPath Inc.:

Gen Digital Inc. Grades

The following table summarizes recent grades provided by reputable grading companies for Gen Digital Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | maintain | Sector Perform | 2025-11-07 |

| Evercore ISI Group | maintain | Outperform | 2025-11-07 |

| Morgan Stanley | maintain | Equal Weight | 2025-09-02 |

| Barclays | maintain | Equal Weight | 2025-08-08 |

| Wells Fargo | maintain | Overweight | 2025-08-08 |

| RBC Capital | maintain | Sector Perform | 2025-08-08 |

| Barclays | maintain | Equal Weight | 2025-07-14 |

| RBC Capital | maintain | Sector Perform | 2025-05-07 |

| Morgan Stanley | maintain | Equal Weight | 2025-04-16 |

| RBC Capital | maintain | Sector Perform | 2025-01-31 |

Gen Digital’s grades mainly range from Sector Perform to Outperform and Overweight, with most actions maintaining previous ratings, indicating a stable outlook.

UiPath Inc. Grades

The following table summarizes recent grades provided by reputable grading companies for UiPath Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Equal Weight | 2026-01-12 |

| RBC Capital | maintain | Sector Perform | 2026-01-05 |

| RBC Capital | maintain | Sector Perform | 2025-12-10 |

| Morgan Stanley | maintain | Equal Weight | 2025-12-09 |

| DA Davidson | maintain | Neutral | 2025-12-05 |

| Canaccord Genuity | maintain | Buy | 2025-12-04 |

| Mizuho | maintain | Neutral | 2025-12-04 |

| RBC Capital | maintain | Sector Perform | 2025-12-04 |

| Wells Fargo | maintain | Equal Weight | 2025-12-04 |

| Evercore ISI Group | maintain | In Line | 2025-12-04 |

UiPath’s grades mostly hover around Sector Perform, Equal Weight, and Neutral, with one Buy rating, all maintained, reflecting cautious stability.

Which company has the best grades?

Gen Digital Inc. has received generally more favorable grades, including Outperform and Overweight ratings, compared to UiPath Inc.’s mostly Neutral and Equal Weight grades. This difference may influence investors by signaling a relatively stronger growth or performance outlook for Gen Digital.

Strengths and Weaknesses

The table below compares key strengths and weaknesses of Gen Digital Inc. (GEN) and UiPath Inc. (PATH) based on recent financial and strategic data.

| Criterion | Gen Digital Inc. (GEN) | UiPath Inc. (PATH) |

|---|---|---|

| Diversification | Strong with Cyber Safety and Identity Protection segments generating $3.88B and $1.33B respectively | Moderate, focused on Licensing and Subscription Services totaling around $1.4B |

| Profitability | Positive net margin 16.34%, ROE 28.34%, but slightly unfavorable ROIC vs WACC (-0.05) | Negative net margin (-5.15%), negative ROE (-3.99%), ROIC below WACC (-16.27) |

| Innovation | Legacy segment shrinking, focus on Cyber Safety shows moderate innovation | Growing ROIC trend (+65%), investing in subscription and AI automation innovation |

| Global presence | Established global player in cybersecurity | Expanding global footprint with growing subscription base |

| Market Share | Significant in consumer security | Emerging market share in robotic process automation |

Key takeaway: Gen Digital offers solid profitability and diversification but struggles with value creation efficiency. UiPath shows improving innovation and ROIC trends but remains unprofitable with higher risks. Investors should weigh steady income against growth potential carefully.

Risk Analysis

Below is a comparison of key risk factors for Gen Digital Inc. (GEN) and UiPath Inc. (PATH) based on the most recent 2025 data:

| Metric | Gen Digital Inc. (GEN) | UiPath Inc. (PATH) |

|---|---|---|

| Market Risk | Beta 1.08 (moderate) | Beta 1.08 (moderate) |

| Debt level | High (D/E 3.66, 54% assets) | Low (D/E 0.04, 2.7% assets) |

| Regulatory Risk | Moderate (cybersecurity industry) | Moderate (automation software regulations) |

| Operational Risk | Moderate (global operations, cyber threats) | Moderate (complex RPA deployments) |

| Environmental Risk | Low (software sector) | Low (software sector) |

| Geopolitical Risk | Moderate (global footprint) | Moderate (US, Romania, Japan exposure) |

Gen Digital faces significant debt-related risk with a leverage ratio above 3.5, increasing financial vulnerability despite solid profitability. UiPath has better balance sheet strength and lower financial risk but posted negative margins in 2025, reflecting operational challenges. Market and regulatory risks remain moderate for both due to technology sector dynamics and global exposure. Investors should weigh Gen’s leverage risks against UiPath’s profitability hurdles.

Which Stock to Choose?

Gen Digital Inc. (GEN) shows steady income growth with favorable net and EBIT margins, a strong return on equity (28.34%), but carries significant debt (debt-to-equity 3.66) and a low current ratio (0.51). Its overall rating is very favorable (B), though some valuation ratios appear unfavorable.

UiPath Inc. (PATH) exhibits higher revenue growth and improving profitability trends but negative net margin (-5.15%) and return on equity (-3.99%). PATH maintains low debt levels and strong liquidity (current ratio 2.93), with a very favorable rating (B+) and a safer financial distress profile.

Considering ratings and financial evaluations, GEN’s stable profitability and strong returns contrast with PATH’s growth but negative profitability and value destruction. Growth-oriented investors might find PATH’s improving ROIC trend appealing, while those prioritizing financial stability and profitability could view GEN more favorably.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Gen Digital Inc. and UiPath Inc. to enhance your investment decisions: