In the rapidly evolving software infrastructure sector, Gen Digital Inc. and Rubrik, Inc. stand out as key players offering innovative cybersecurity and data protection solutions. Both companies serve critical needs across diverse markets, from individual consumers to large enterprises, making their strategies and growth prospects highly relevant for investors. In this analysis, I will help you determine which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Gen Digital Inc. and Rubrik, Inc. by providing an overview of these two companies and their main differences.

Gen Digital Overview

Gen Digital Inc. focuses on providing cyber safety solutions to consumers across multiple regions including the US, Europe, and Asia Pacific. Its product portfolio includes Norton 360 for malware protection, LifeLock identity theft services, VPN solutions, and privacy management tools. Founded in 1982 and based in Tempe, Arizona, Gen Digital operates in the software infrastructure industry with a market cap of around 16.1B USD and employs approximately 3,400 people.

Rubrik Overview

Rubrik, Inc. delivers data security solutions to both individuals and enterprises worldwide, emphasizing cloud data protection, cyber recovery, and threat analytics. Established in 2013 and headquartered in Palo Alto, California, Rubrik operates within the software infrastructure sector. The company serves diverse industries such as finance, healthcare, and education, with a market cap near 13.4B USD and a workforce of about 3,200 employees.

Key similarities and differences

Both companies operate in the software infrastructure industry with a focus on security solutions. Gen Digital concentrates on consumer cyber safety and identity protection, while Rubrik targets enterprise data protection and cyber recovery. Gen Digital’s operations are more consumer-centric with a longer market presence, whereas Rubrik focuses on business sectors with advanced data security services and has a more recent IPO. Their market caps and employee counts are similar, reflecting comparable scale.

Income Statement Comparison

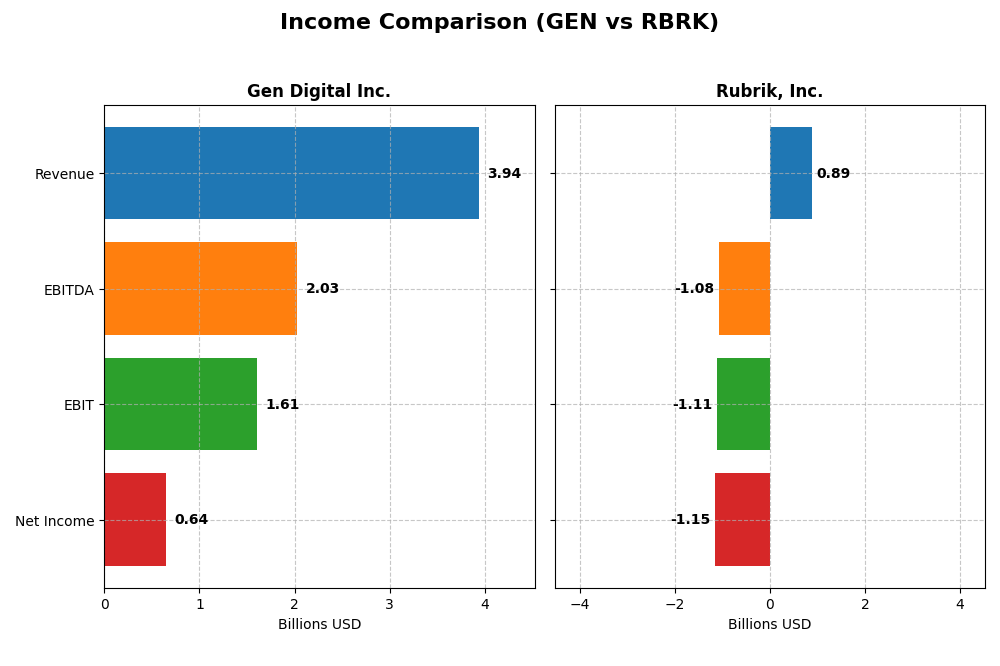

The table below presents a side-by-side comparison of key income statement metrics for Gen Digital Inc. and Rubrik, Inc. for the fiscal year 2025.

| Metric | Gen Digital Inc. | Rubrik, Inc. |

|---|---|---|

| Market Cap | 16.1B | 13.4B |

| Revenue | 3.94B | 887M |

| EBITDA | 2.03B | -1.08B |

| EBIT | 1.61B | -1.11B |

| Net Income | 643M | -1.15B |

| EPS | 1.04 | -7.48 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Gen Digital Inc.

Gen Digital Inc. showed steady revenue growth from 2.55B in 2021 to 3.94B in 2025, with net income rising from 554M to 643M in the same period. Gross and EBIT margins remained strong, with a slight dip in net margin over time. In 2025, revenue growth slowed moderately to 3.55%, but EBIT margin improved significantly, reflecting operational efficiency gains.

Rubrik, Inc.

Rubrik, Inc. experienced rapid revenue growth, jumping from 388M in 2021 to 887M in 2025, a 128.64% increase overall. However, net income remained deeply negative, with losses expanding from -213M to -1.15B. Gross margin was favorable at 70%, but EBIT and net margins stayed negative with deteriorating profitability, especially in the latest year where EBIT losses widened markedly.

Which one has the stronger fundamentals?

Gen Digital Inc. presents stronger fundamentals with consistent profitability, favorable gross and EBIT margins, and positive net income growth despite a slight net margin contraction. Rubrik, while growing revenue rapidly, struggles with persistent and worsening net losses and unfavorable EBIT and net margins. Thus, Gen Digital’s income statement reflects more stable and sustainable financial health.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Gen Digital Inc. (GEN) and Rubrik, Inc. (RBRK) based on the most recent fiscal year data available.

| Ratios | Gen Digital Inc. (GEN) FY 2025 | Rubrik, Inc. (RBRK) FY 2025 |

|---|---|---|

| ROE | 28.3% | 208.6% |

| ROIC | 7.8% | -234.8% |

| P/E | 25.4 | -9.8 |

| P/B | 7.19 | -20.4 |

| Current Ratio | 0.51 | 1.13 |

| Quick Ratio | 0.51 | 1.13 |

| D/E (Debt-to-Equity) | 3.66 | -0.63 |

| Debt-to-Assets | 53.7% | 24.7% |

| Interest Coverage | 2.79 | -27.5 |

| Asset Turnover | 0.25 | 0.62 |

| Fixed Asset Turnover | 36.1 | 16.7 |

| Payout Ratio | 48.7% | 0% |

| Dividend Yield | 1.92% | 0% |

Interpretation of the Ratios

Gen Digital Inc.

Gen Digital exhibits strong profitability with a favorable net margin of 16.34% and return on equity at 28.34%, though its valuation ratios like P/E and P/B are unfavorable, indicating possible overvaluation. The company faces liquidity concerns with a low current ratio of 0.51 and high debt levels (debt to equity 3.66). It pays a dividend with a 1.92% yield, supported moderately by free cash flow, but risks exist from its payout sustainability and leverage.

Rubrik, Inc.

Rubrik shows mixed financial health: despite a negative net margin of -130.26%, it reports a high return on equity of 208.55%, reflecting volatile profitability. Its liquidity and leverage ratios are generally favorable, with a current ratio above 1 and negative debt to equity, indicating net cash. Rubrik does not pay dividends, consistent with its negative earnings and reinvestment focus in R&D and growth initiatives.

Which one has the best ratios?

Rubrik’s ratios are globally more favorable at 57.14% compared to Gen Digital’s 28.57%, mainly due to better liquidity and leverage metrics. However, Rubrik’s profitability and interest coverage are weak, while Gen Digital shows stronger profit margins but suffers from liquidity and debt issues. Overall, Rubrik displays more favorable financial metrics despite operational challenges.

Strategic Positioning

This section compares the strategic positioning of Gen Digital Inc. and Rubrik, Inc. regarding Market position, Key segments, and Exposure to technological disruption:

Gen Digital Inc.

- Leading consumer cyber safety provider with global reach, facing moderate competition.

- Focuses on consumer cyber safety, identity theft protection, and privacy solutions.

- Exposure to evolving cyber threats; invests in integrated platforms and privacy tools.

Rubrik, Inc.

- Data security specialist targeting enterprise clients across diverse sectors, competing in cloud security.

- Concentrates on enterprise data protection, cloud, SaaS security, and cyber recovery services.

- Faces disruption risks from cloud and SaaS innovations; emphasizes advanced data threat analytics.

Gen Digital Inc. vs Rubrik, Inc. Positioning

Gen Digital adopts a diversified consumer-focused approach with broad geographic coverage, while Rubrik concentrates on enterprise data security across multiple industries. Gen Digital benefits from scale, whereas Rubrik targets specialized, high-value segments.

Which has the best competitive advantage?

Both companies show declining ROIC and are currently value destroyers with very unfavorable moats, indicating challenges in sustaining competitive advantages based on recent capital efficiency data.

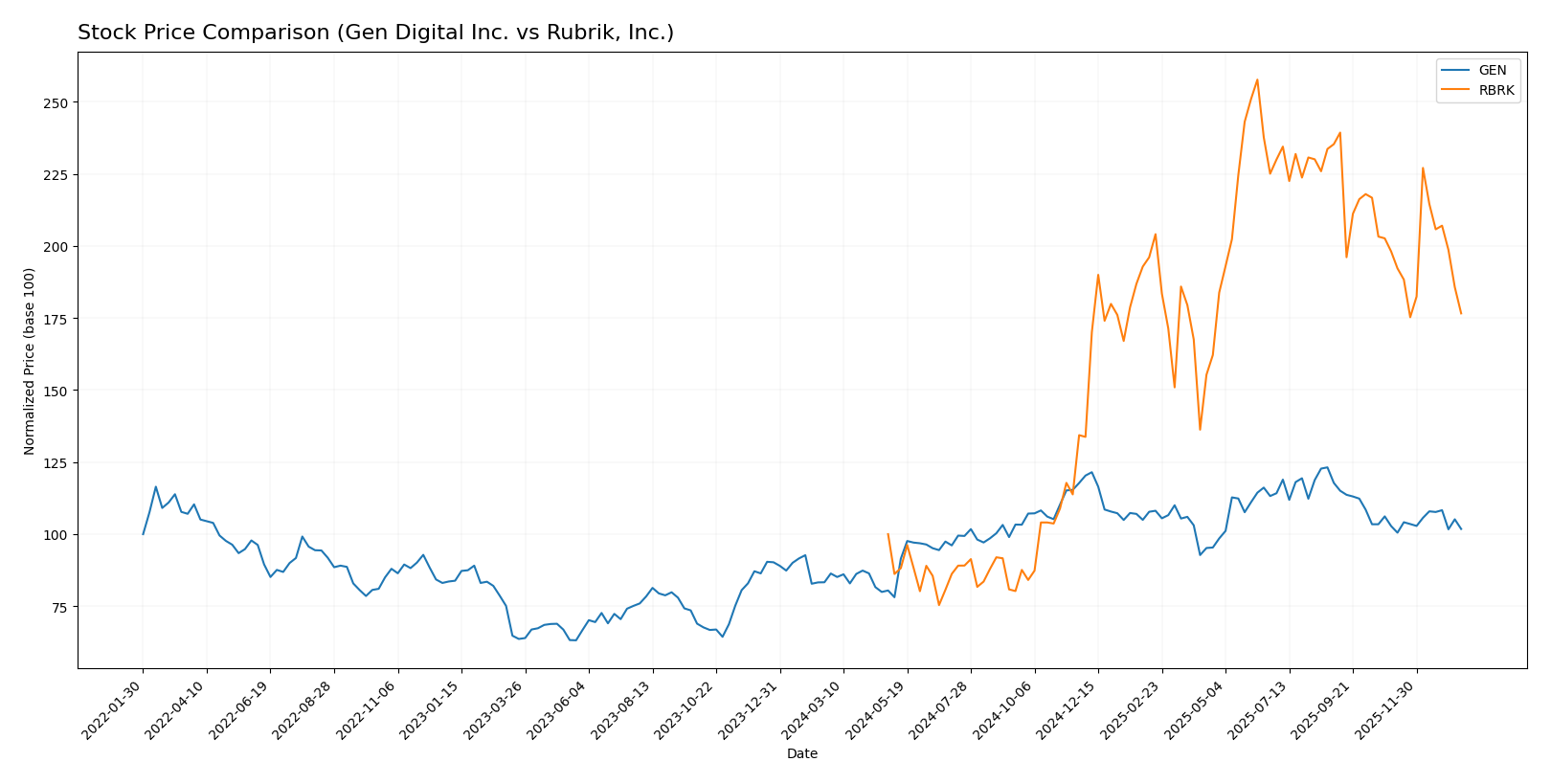

Stock Comparison

The stock price movements of Gen Digital Inc. and Rubrik, Inc. over the past 12 months show distinct bullish trends with notable deceleration and recent downward pressures in trading dynamics.

Trend Analysis

Gen Digital Inc. exhibited a 17.89% price increase over the past year, confirming a bullish trend with decelerating momentum. The stock ranged between 20.03 and 31.58, with low recent volatility and a minor negative price change of 0.99%.

Rubrik, Inc. showed a stronger 76.58% price gain over the same period, also bullish but decelerating. It experienced higher volatility with a wide price range from 28.65 to 97.91 and a recent sharper decline of 10.85%.

Comparing both, Rubrik, Inc. delivered the highest market performance with significantly larger gains despite increased volatility and recent downside pressure compared to Gen Digital Inc.

Target Prices

The current analyst consensus indicates moderate upside potential for both Gen Digital Inc. and Rubrik, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Gen Digital Inc. | 32 | 31 | 31.5 |

| Rubrik, Inc. | 113 | 105 | 109.33 |

Analysts expect Gen Digital’s price to rise from $26.1 to about $31.5, signaling a positive outlook. Rubrik’s consensus target at $109.33 suggests significant growth potential versus its current $67.1 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Gen Digital Inc. and Rubrik, Inc.:

Rating Comparison

Gen Digital Inc. Rating

- Rating: B, considered Very Favorable by analysts.

- Discounted Cash Flow Score: 5, indicating very favorable valuation.

- ROE Score: 5, showing very efficient profit generation from equity.

- ROA Score: 3, suggesting moderate asset utilization efficiency.

- Debt To Equity Score: 1, marking very unfavorable financial risk.

- Overall Score: 3, a moderate overall financial standing.

Rubrik, Inc. Rating

- Rating: C, also classified as Very Favorable.

- Discounted Cash Flow Score: 1, reflecting very unfavorable valuation.

- ROE Score: 5, equally very efficient in generating profits.

- ROA Score: 1, indicating very unfavorable asset utilization.

- Debt To Equity Score: 1, similarly very unfavorable financial risk.

- Overall Score: 2, a moderate but lower overall financial standing.

Which one is the best rated?

Gen Digital Inc. holds a higher rating (B vs. C) and a superior overall score (3 vs. 2) compared to Rubrik, Inc. Gen also performs better in discounted cash flow and ROA scores, indicating comparatively stronger financial metrics.

Scores Comparison

Here is a comparison of the financial health scores for Gen Digital Inc. and Rubrik, Inc.:

Gen Scores

- Altman Z-Score: 1.25, indicating financial distress.

- Piotroski Score: 6, classified as average financial strength.

RBRK Scores

- Altman Z-Score: 1.41, also indicating financial distress.

- Piotroski Score: 4, classified as average financial strength.

Which company has the best scores?

Both companies are in the Altman Z-Score distress zone, showing financial risk. Gen has a higher Piotroski Score (6 vs. 4), suggesting comparatively stronger financial health in that metric.

Grades Comparison

The grades for Gen Digital Inc. and Rubrik, Inc. from reputable grading companies are as follows:

Gen Digital Inc. Grades

Below is the recent grading summary from key financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2025-11-07 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-02 |

| Barclays | Maintain | Equal Weight | 2025-08-08 |

| Wells Fargo | Maintain | Overweight | 2025-08-08 |

| RBC Capital | Maintain | Sector Perform | 2025-08-08 |

| Barclays | Maintain | Equal Weight | 2025-07-14 |

| RBC Capital | Maintain | Sector Perform | 2025-05-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-04-16 |

| RBC Capital | Maintain | Sector Perform | 2025-01-31 |

Gen Digital Inc. has maintained a consistent range of grades mostly between Sector Perform and Equal Weight, with occasional Overweight and Outperform ratings.

Rubrik, Inc. Grades

Below is the recent grading summary from key financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

Rubrik, Inc. shows a strong positive trend with multiple Outperform and Overweight grades and no Hold or Sell ratings.

Which company has the best grades?

Rubrik, Inc. has received more consistently positive ratings, including several Outperform and Buy grades, indicating stronger analyst confidence compared to Gen Digital Inc.’s more moderate Sector Perform and Equal Weight grades. This contrast may influence investors seeking stocks with higher analyst enthusiasm.

Strengths and Weaknesses

Below is a comparative overview of the key strengths and weaknesses of Gen Digital Inc. (GEN) and Rubrik, Inc. (RBRK) based on the most recent financial and strategic data.

| Criterion | Gen Digital Inc. (GEN) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Diversification | Moderate: Focused on Cyber Safety and Identity Protection with some legacy products | Moderate: Primarily subscription-based with maintenance and other services |

| Profitability | Favorable net margin (16.34%), strong ROE (28.34%), but ROIC slightly below WACC (7.77% vs 7.82%) | Highly volatile: Negative net margin (-130.26%) and ROIC (-234.85%), but strong ROE (208.55%) |

| Innovation | Stable innovation in cybersecurity products, but declining ROIC trend signals challenges | Innovation present in cloud data management, but profitability concerns and declining ROIC |

| Global presence | Strong global footprint in cybersecurity markets | Growing presence, focused on subscription market, less global scale than GEN |

| Market Share | Significant in consumer security and identity fraud protection sectors | Niche player in cloud data management with growing subscription base |

Key takeaway: Both companies face challenges with declining ROIC and value destruction. Gen Digital shows more stable profitability and a broader product scope, while Rubrik exhibits higher growth potential but with higher risk due to profitability issues. Investors should weigh Gen Digital’s steady cash flow against Rubrik’s volatility and growth aspirations.

Risk Analysis

Below is a comparative table summarizing key risks for Gen Digital Inc. (GEN) and Rubrik, Inc. (RBRK) based on the most recent 2025 data:

| Metric | Gen Digital Inc. (GEN) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Market Risk | Beta 1.08 (moderate volatility) | Beta 0.28 (low volatility) |

| Debt level | High debt-to-equity 3.66 (unfavorable) | Low debt-to-equity -0.63 (favorable) |

| Regulatory Risk | Moderate, cybersecurity industry subject to evolving regulations | Moderate, data security compliance required |

| Operational Risk | Moderate, with average asset turnover 0.25 (unfavorable) | Moderate, asset turnover 0.62 (neutral) |

| Environmental Risk | Low, typical for software sector | Low, typical for software sector |

| Geopolitical Risk | Moderate, global operations in multiple regions | Moderate, US-based with international clients |

Gen Digital faces significant financial leverage risk with high debt levels and liquidity concerns, pushing it into a distress zone per Altman Z-Score (1.25). Rubrik shows better debt metrics but suffers from negative profitability and cash flow, also in distress territory (Z-score 1.41). Market volatility is higher for Gen Digital, while Rubrik’s operational risks stem from negative margins and interest coverage. Investors should weigh financial stability cautiously, prioritizing risk management given both firms’ distress signals.

Which Stock to Choose?

Gen Digital Inc. shows a generally favorable income evolution with stable net and EBIT margins and moderate revenue growth. Its profitability ratios like ROE are strong, but the company carries significant debt and has a slightly unfavorable liquidity position. The overall rating is very favorable.

Rubrik, Inc. has experienced strong revenue growth but suffers from negative net margin and declining profitability. It maintains a lower debt level and better liquidity ratios but shows unfavorable operational returns and a mixed rating with some very unfavorable financial metrics despite a very favorable overall rating.

Investors focused on consistent profitability and financial stability might find Gen Digital’s profile more favorable, while those with a tolerance for operational volatility and higher growth potential could see Rubrik as more attractive. Both companies have value destruction signals in their ROIC trends, suggesting caution.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Gen Digital Inc. and Rubrik, Inc. to enhance your investment decisions: