In today’s fast-evolving technology sector, MongoDB, Inc. and Gen Digital Inc. stand out as influential players in software infrastructure. MongoDB specializes in database platforms powering cloud and hybrid environments, while Gen Digital focuses on cybersecurity solutions protecting consumers worldwide. Their overlapping roles in securing and managing digital information make this comparison compelling. Join me as we explore which company offers the most promising investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between MongoDB and Gen Digital by providing an overview of these two companies and their main differences.

MongoDB Overview

MongoDB, Inc. delivers a general-purpose database platform globally, targeting enterprise customers with its commercial MongoDB Enterprise Advanced and hosted MongoDB Atlas multi-cloud database-as-a-service. Founded in 2007 and based in New York City, it also offers a free Community Server and professional consulting services. MongoDB operates in the software infrastructure industry and employs 5,558 people, positioning itself as a key player in database management technology.

Gen Digital Overview

Gen Digital Inc. specializes in cyber safety solutions for consumers worldwide, offering Norton 360 and LifeLock identity theft protection, among other security products. Based in Tempe, Arizona, and founded in 1982, Gen Digital serves a broad international market with services including VPN, privacy monitoring, and online reputation management. The company has 3,400 employees and operates in the software infrastructure sector, focusing on cybersecurity and privacy solutions.

Key similarities and differences

Both companies operate within the software infrastructure industry, but MongoDB focuses on database platforms for enterprises, while Gen Digital concentrates on consumer cybersecurity products. MongoDB’s business model centers around providing database services via cloud and on-premise solutions, whereas Gen Digital offers subscription-based cyber safety and identity protection services. Their workforce sizes differ, with MongoDB employing significantly more staff, reflecting their distinct market segments and technology focuses.

Income Statement Comparison

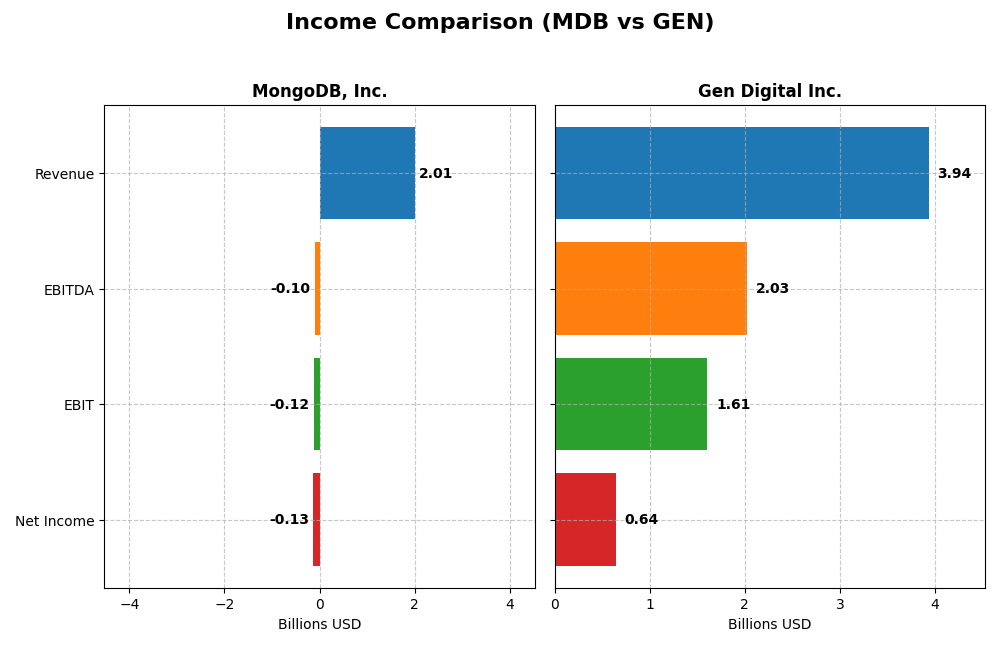

This table presents a side-by-side comparison of key income statement metrics for MongoDB, Inc. and Gen Digital Inc. for the fiscal year 2025, highlighting their financial performance.

| Metric | MongoDB, Inc. (MDB) | Gen Digital Inc. (GEN) |

|---|---|---|

| Market Cap | 32.5B | 16.1B |

| Revenue | 2.01B | 3.94B |

| EBITDA | -97M | 2.03B |

| EBIT | -124M | 1.61B |

| Net Income | -129M | 643M |

| EPS | -1.73 | 1.04 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

MongoDB, Inc.

MongoDB’s revenue and net income have grown significantly between 2021 and 2025, with revenue increasing by 240% and net income improving by 52%. Despite consistent negative net and EBIT margins, its gross margin remains strong and stable around 73%. In 2025, MongoDB’s revenue growth accelerated to 19%, with improved net margin and EPS growth, signaling operational progress despite ongoing losses.

Gen Digital Inc.

Gen Digital experienced steady revenue growth of 54% over the five-year span, with net income rising by 16%. The company maintains high gross and EBIT margins above 80% and 40%, respectively, and positive net margins around 16%. In 2025, growth slowed to about 3.5% in revenue and gross profit, while EBIT surged 44%, reflecting efficient cost management amid moderate net margin stability.

Which one has the stronger fundamentals?

MongoDB shows strong revenue and net income growth momentum, supported by stable gross margins, though profitability remains negative. Gen Digital benefits from high and consistent profitability margins, but revenue growth has slowed and net margin declined overall. While both have favorable income statement evaluations, Gen Digital’s positive net margins contrast with MongoDB’s losses, indicating different risk-return profiles in fundamentals.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for MongoDB, Inc. (MDB) and Gen Digital Inc. (GEN) based on their most recent fiscal year data.

| Ratios | MongoDB, Inc. (MDB) | Gen Digital Inc. (GEN) |

|---|---|---|

| ROE | -4.64% | 28.34% |

| ROIC | -7.36% | 7.77% |

| P/E | -157.88 | 25.36 |

| P/B | 7.32 | 7.19 |

| Current Ratio | 5.20 | 0.51 |

| Quick Ratio | 5.20 | 0.51 |

| D/E | 0.01 | 3.66 |

| Debt-to-Assets | 1.06% | 53.66% |

| Interest Coverage | -26.70 | 2.79 |

| Asset Turnover | 0.58 | 0.25 |

| Fixed Asset Turnover | 24.78 | 36.10 |

| Payout ratio | 0% | 48.68% |

| Dividend yield | 0% | 1.92% |

Interpretation of the Ratios

MongoDB, Inc.

MongoDB shows several unfavorable ratios including negative net margin (-6.43%), ROE (-4.64%), and ROIC (-7.36%), indicating profitability challenges. Its current ratio is strong at 5.2, but interest coverage is deeply negative, signaling financial strain. MongoDB does not pay dividends, reflecting its reinvestment strategy in growth and R&D, with no shareholder returns via dividends or buybacks.

Gen Digital Inc.

Gen Digital presents generally favorable profitability ratios such as a 16.34% net margin and 28.34% ROE, though its debt levels are high with a debt-to-assets ratio of 53.66% and D/E of 3.66, raising solvency concerns. The company pays a dividend yielding 1.92%, with a payout supported moderately by cash flow, suggesting balanced shareholder returns but some financial risk.

Which one has the best ratios?

Gen Digital holds an edge with stronger profitability and dividend payments, despite leverage concerns and weaker liquidity ratios. MongoDB struggles with losses and negative returns on capital, although it maintains liquidity. Overall, Gen Digital’s ratios appear slightly more favorable, while MongoDB’s are broadly unfavorable.

Strategic Positioning

This section compares the strategic positioning of MongoDB and Gen Digital, covering market position, key segments, and exposure to technological disruption:

MongoDB, Inc.

- Positioned as a specialized database platform facing competition in software infrastructure.

- Key segments include MongoDB Atlas cloud database, other subscriptions, and professional services.

- Exposure to technological disruption through cloud database innovation and hybrid deployment models.

Gen Digital Inc.

- Competes in cybersecurity with established consumer safety solutions and moderate competitive pressure.

- Key business drivers are consumer cyber safety products like Norton 360, identity protection, and VPN services.

- Faces disruption risks in cybersecurity, requiring constant innovation in privacy and threat protection solutions.

MongoDB, Inc. vs Gen Digital Inc. Positioning

MongoDB focuses on a concentrated cloud database platform business, benefiting from rapid growth in Atlas subscriptions but with narrower diversification. Gen Digital operates a more diversified cybersecurity portfolio across multiple geographies, balancing legacy and core consumer products but facing a broader threat landscape.

Which has the best competitive advantage?

Both companies are currently shedding value relative to their cost of capital. MongoDB shows a growing ROIC trend despite negative spread, while Gen Digital experiences both value destruction and declining profitability, indicating MongoDB holds a slightly stronger competitive advantage.

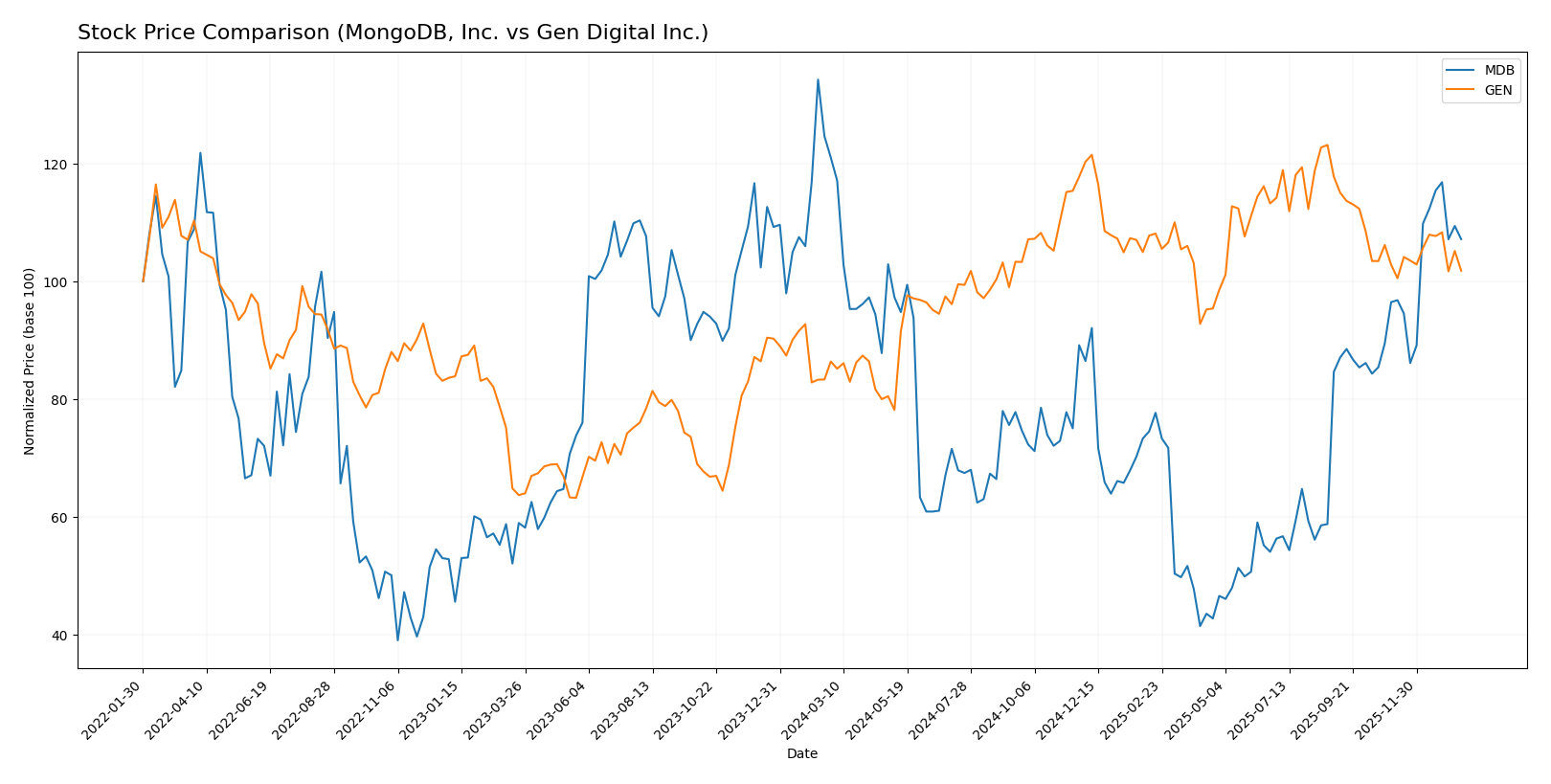

Stock Comparison

The stock prices of MongoDB, Inc. (MDB) and Gen Digital Inc. (GEN) have shown contrasting movements over the past 12 months, with MDB experiencing a notable bearish trend marked by acceleration, while GEN displayed a bullish trend with deceleration.

Trend Analysis

MongoDB, Inc. (MDB) recorded an overall price decline of -11.46% over the past year, indicating a bearish trend with accelerating downward momentum. The stock’s volatility was high, with a standard deviation of 72.49, reaching a high of 451.52 and a low of 154.39.

Gen Digital Inc. (GEN) posted a 17.89% price increase during the same period, reflecting a bullish trend but with deceleration. The stock showed low volatility, with a standard deviation of 2.59, hitting a high of 31.58 and a low of 20.03.

Comparing both, GEN outperformed MDB over the past year, delivering positive market performance while MDB experienced a significant decline, despite MDB’s recent short-term rebound.

Target Prices

Analyst consensus presents a clear target price range for MongoDB, Inc. and Gen Digital Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MongoDB, Inc. | 500 | 375 | 445.2 |

| Gen Digital Inc. | 32 | 31 | 31.5 |

The consensus target price for MongoDB at 445.2 is about 11% above its current price of 399.76, indicating moderate upside potential. Gen Digital’s consensus target of 31.5 suggests modest gains from its current 26.1 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MongoDB, Inc. and Gen Digital Inc.:

Rating Comparison

MongoDB, Inc. Rating

- Rating: C, considered very favorable overall.

- Discounted Cash Flow Score: 2, moderate valuation outlook.

- ROE Score: 1, very unfavorable efficiency in equity use.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 4, favorable balance sheet strength.

- Overall Score: 2, moderate overall financial standing.

Gen Digital Inc. Rating

- Rating: B, considered very favorable overall.

- Discounted Cash Flow Score: 5, very favorable valuation.

- ROE Score: 5, very favorable efficiency in equity use.

- ROA Score: 3, moderate asset utilization.

- Debt To Equity Score: 1, very unfavorable balance sheet risk.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Gen Digital Inc. holds higher ratings and stronger scores in discounted cash flow, ROE, and ROA, but has a weaker debt-to-equity score compared to MongoDB, which exhibits better debt management but weaker profitability metrics. Overall, Gen Digital is rated better strictly by these metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

MDB Scores

- Altman Z-Score: 30.24, in the safe zone, indicating low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

GEN Scores

- Altman Z-Score: 1.25, in the distress zone, indicating high bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

Which company has the best scores?

MDB has a significantly higher Altman Z-Score, placing it in the safe zone, compared to GEN’s distress zone score. GEN has a higher Piotroski Score, but both are categorized as average. Overall, MDB shows stronger bankruptcy safety based on the provided scores.

Grades Comparison

The following section compares the recent grades from reputable grading companies for MongoDB, Inc. and Gen Digital Inc.:

MongoDB, Inc. Grades

This table shows MongoDB’s latest grades from major financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

MongoDB consistently received Buy or Outperform ratings, reflecting strong confidence from analysts over recent months.

Gen Digital Inc. Grades

This table presents Gen Digital’s recent grades from recognized financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2025-11-07 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-02 |

| Barclays | Maintain | Equal Weight | 2025-08-08 |

| Wells Fargo | Maintain | Overweight | 2025-08-08 |

| RBC Capital | Maintain | Sector Perform | 2025-08-08 |

| Barclays | Maintain | Equal Weight | 2025-07-14 |

| RBC Capital | Maintain | Sector Perform | 2025-05-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-04-16 |

| RBC Capital | Maintain | Sector Perform | 2025-01-31 |

Gen Digital’s grades predominantly fall in the Sector Perform to Equal Weight range, with a few Outperform and Overweight ratings, indicating moderate analyst outlook.

Which company has the best grades?

MongoDB, Inc. has received more consistently positive grades, mostly Buy and Outperform, compared to Gen Digital’s more moderate Sector Perform and Equal Weight ratings. This suggests stronger analyst confidence in MongoDB, which may influence investors’ perceptions of growth potential and risk.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for MongoDB, Inc. (MDB) and Gen Digital Inc. (GEN) based on recent financial and strategic data.

| Criterion | MongoDB, Inc. (MDB) | Gen Digital Inc. (GEN) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from MongoDB Atlas (1.4B in 2025) and subscriptions; limited service revenue. | High: Strong focus on Cyber Safety (3.9B in 2025) plus legacy products, showing product range. |

| Profitability | Unfavorable: Negative net margin (-6.43%), ROIC -7.36%, and shedding value but improving ROIC trend. | Favorable: Positive net margin (16.34%), high ROE (28.34%), but ROIC slightly above WACC with declining trend. |

| Innovation | Strong: Significant revenue growth in cloud database services, showing innovation in tech. | Moderate: Core in cybersecurity with steady revenues but facing profitability pressure and declining ROIC. |

| Global presence | Growing cloud adoption globally, but smaller scale compared to GEN. | Established global cybersecurity presence with broad customer base. |

| Market Share | Niche leader in modern database solutions with growing adoption. | Strong market share in consumer and enterprise cybersecurity sectors, but facing competition challenges. |

Key takeaway: MongoDB shows promising innovation and revenue growth but struggles with profitability and value creation. Gen Digital demonstrates solid profitability and market reach but faces challenges in sustaining ROIC and managing debt levels. Investors should weigh growth potential against current financial health.

Risk Analysis

Below is a comparative table of key risks for MongoDB, Inc. (MDB) and Gen Digital Inc. (GEN) based on the most recent data from 2025.

| Metric | MongoDB, Inc. (MDB) | Gen Digital Inc. (GEN) |

|---|---|---|

| Market Risk | High beta (1.38) indicates above-average volatility | Moderate beta (1.08), slightly less volatile |

| Debt level | Very low debt-to-equity (0.01), minimal financial leverage | High debt-to-equity (3.66), significant leverage |

| Regulatory Risk | Moderate, typical for cloud-based software providers | Elevated due to consumer privacy and cybersecurity regulations |

| Operational Risk | Moderate, relies on cloud infrastructure and enterprise clients | Moderate, dependent on subscription model and technology updates |

| Environmental Risk | Low, primarily software business with limited physical footprint | Low, similar software focus with limited environmental impact |

| Geopolitical Risk | Moderate, global cloud presence exposes to regional instability | Moderate, international consumer base with data sovereignty concerns |

In synthesis, Gen Digital faces the most impactful risk from its high debt levels and regulatory scrutiny in cybersecurity, which could affect financial stability and compliance costs. MongoDB, while more leveraged towards market volatility, benefits from a very low debt burden and strong liquidity but must manage operational risks related to cloud service delivery. Both companies operate in a rapidly evolving regulatory landscape, demanding vigilance and adaptability.

Which Stock to Choose?

MongoDB, Inc. (MDB) shows strong income growth with a 19.22% revenue increase in 2025 and a favorable gross margin of 73.32%, but suffers from negative profitability ratios, elevated debt efficiency, and an unfavorable global financial ratio profile alongside a slightly unfavorable MOAT rating.

Gen Digital Inc. (GEN) has moderate income growth at 3.55% for 2025 and strong profitability with a 16.34% net margin and 28.34% ROE, though burdened by high debt levels and a slightly unfavorable overall financial ratio evaluation, combined with a very unfavorable MOAT rating due to declining profitability.

From a rating and financial perspective, GEN might appear more attractive for investors seeking profitability and stable income, whereas MDB may appeal to those valuing growth potential despite profitability challenges; risk-averse investors could interpret MDB’s favorable income trends cautiously given its financial ratio weaknesses and moderate rating.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MongoDB, Inc. and Gen Digital Inc. to enhance your investment decisions: